- Home

- »

- Medical Devices

- »

-

Europe Bioanalytical Testing Services Market, Industry Report, 2030GVR Report cover

![Europe Bioanalytical Testing Services Market Size, Share & Trends Report]()

Europe Bioanalytical Testing Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Molecule (Small Molecule, Large Molecule), By Test (In-vivo, In-vitro, PK, PD), By Workflow, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-288-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The Europe bioanalytical testing services market size was estimated at USD 1.3 billion in 2023 and is anticipated to grow at a CAGR of 8.9% from 2024 to 2030. The industry has been advancing at a fast pace on account of the increasing demand for the analytical testing of biologics and biosimilars. The growing incidence of chronic disorders such as cancer, inflammatory bowel diseases, and rheumatoid arthritis has highlighted the need for biologics. However, the expensive nature of biologics has led drug manufacturers and medical stakeholders to shift their focus toward biosimilars. As a result, advancements in the R&D of biosimilars in recent years is expected to heighten the demand for a range of bioanalytical testing services such as compatibility studies and protein analysis of biosimilars, product release testing, and stability testing.

The European market for bioanalytical testing services accounted for 28.9% of the global revenue share in 2023. The presence of advanced bioanalytical testing service facilities in the region has led to noticeable improvements in areas such as clinical research and drug development, driving market expansion. These services comprise a vital aspect of the analysis of pharmaceutical compounds such as biologics and small molecules, with leading providers offering methods such as immunoassays, chromatography, and biomarker analysis.

Europe is a leading region in terms of drug development, making it a significant opportunity for companies involved in offering bioanalytical testing services to establish their operational base. The increasing focus on understanding drug performance, as well as ensuring its approval and commercialization, is a major driver for this market. Additionally, the rising importance of personalized patient care and medicine has further highlighted the necessity for these solutions in European economies.

In these fields, precision dosing can be achieved by customizing drug dosage as per individual patient needs and depending upon their pharmacokinetic profiles. This helps in improving therapeutic outcomes while also ensuring minimal chances of adverse reactions. Additionally, the continued monitoring required to ensure the maintenance of the efficacy and safety of a drug even after its commercial release drives the demand for bioanalytical testing.

Molecule Insights

The small molecule segment accounted for the largest market share of 57.0% in 2023. The consistent advancements made in the space of small molecules in recent years, along with unmet medical requirements, are anticipated to boost the segment’s expansion in the coming years. The role of small molecules, for example, chemical probes, has been crucial in understanding disease biology in the biomedical research space. The majority of companies offering testing services in the region have developed their proprietary bioanalytical techniques that have been validated for analyzing small-molecule drugs in plasma/serum, blood, tissue, urine, and feces.

The large molecule segment is anticipated to advance at a comparatively faster CAGR of 9.5% during the forecast period. Large molecules, which are protein-based drugs, are as heavy as 150,000 g/mol, or 150 kDa, and bind to specific cell receptors associated with the disease process. Common bioanalytical studies for large molecules include Liquid Chromatography-Mass Spectrometry (LC-MS) and immunoassays, among others. Immunoassay studies include Pharmacokinetic (PK) studies and Antidrug Antibodies (ADA) studies.

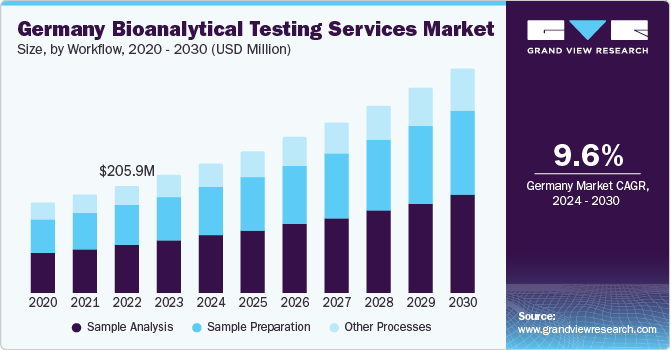

Workflow Insights

The sample analysis workflow segment held the largest revenue share of 45.7% in 2023. The increasing importance of this workflow process to determine the concentration of chemical elements or compounds is a notable factor driving segment growth. For the purpose of sample analysis, various procedures are being utilized, ranging from simple weighing techniques to complex approaches that incorporate the use of specialized instruments. Sample analysis is a critical aspect in the stages of medication research and marketing, leading to its substantial share in the market.

The sample preparation segment is anticipated to advance at a CAGR of 9.3% from 2024 to 2030. This segment includes processes such as protein precipitation, liquid-liquid extraction, and solid phase extraction. Protein Precipitation (PPT) is an extensively used technique to prepare biological fluid samples for Liquid Chromatography (LC)/Mass Spectrometry (MS) research. Liquid-liquid Extraction (LLE) is generally used for regulated bioanalysis; this method can generate high analyte recoveries and can clean extract, while also being considered an economical option for end-users. Solid phase extraction is a notable sample preparation technology that uses chromatographic packing material, solid particles (usually in a cartridge device) to separate different components present in the sample. It is widely used for solid-based sample preparation in bioanalysis. Proper sample preparation helps minimize matrix risks, and assay variability, and thus provides cleaner samples, thus enhancing the bioanalysis process.

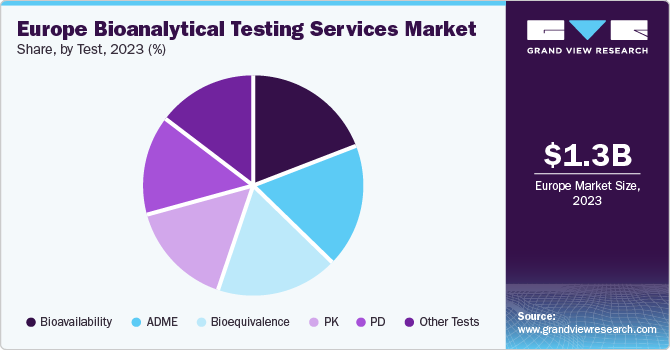

Test Insights

The Absorption, Distribution, Metabolism, and Excretion (ADME) segment accounted for a substantial revenue share in the market in 2023. These are pharmacokinetic (PK) processes that define how the body reacts to a drug. ADME studies are completed during drug discovery & preclinical phases for optimizing drug properties, supporting candidate selection, and designing the clinical phase.ADME data can be collected at different phases during the drug development process. Therapeutic developers may use chemical alterations to drug candidates to optimize ADME qualities during discovery and lead optimization. In vitro and in vivo studies give crucial information needed to meet regulatory expectations and allow drug developers to make informed decisions, as the medicine progresses through preclinical research & clinical phases.

The bioequivalence segment is anticipated to expand at the fastest CAGR from 2024 to 2030 due to the growing production and consumption rate of generics & biosimilars in the region. For instance, Eurofins Scientific, a French company, offers a comprehensive range of bioequivalence analysis to sponsors in biopharmaceutical and pharmaceutical companies across the globe. The company’s bioequivalence analyses supports study design, preclinical & clinical studies, GLP/GCLP compliance, in-house method development (LC/MS/MS) & validation, PK parameters calculation (WinNonlin), bioequivalence assessments, CDISC standards, and biosimilars.

Country Insights

Germany Bioanalytical Testing Services Market Trends

Germany emerged with the leading revenue share in the bioanalytical testing service industry of Europe in 2023. The country is anticipated to play a significant role due to the rising demand for outsourcing services from major companies such as Novartis, Sanofi, Roche, GlaxoSmithKline, and AstraZeneca. Germany’s growing requirement for improved product design, consulting, product maintenance, and related services is expected to be a crucial factor driving market expansion. Advancements in technology & quality clinical resources, along with positive government support and initiatives for clinical research activities, have accelerated the growth of the country’s bioanalytical testing service segment.

France Bioanalytical Testing Services Market Trends

France is expected to witness a substantial growth rate in the regional market during the projection period. The economy boasts an efficient healthcare & reimbursement system and a large patient pool, making it a preferred location for outsourcing clinical trials. In addition, the expansion of facilities by key players, such as SGS, in the bioanalytical testing services sector in France is likely to increase demand for bioanalytical testing services. This expansion positions companies to effectively address the increasing demand for bioanalytical testing services required to support the development of various drugs, including small molecules, peptides, biotherapeutics, and cell & gene therapies.

Key Europe Bioanalytical Testing Services Company Insights

Some of the leading names involved in the European market for bioanalytical testing services include SGS SA, ICON plc, IQVIA, Eurofins, and Syneos Health. These organizations compete with each other and other regional companies to generate higher revenues and boost their contribution.

- SGS SA is a Swiss organization that provides clinical research services, quality assurance, inspection, testing, and certification services around the world. Under clinical research services, it offers clinical development consultancy, pharmacovigilance & drug safety services, and early-phase clinical services (patent & clinical trials, and bioequivalence & bioavailability studies). It also provides verification & certification services to ensure that its customer’s products are in line with international standards, outsourcing, consulting, and data analytic services.

Key Europe Bioanalytical Testing Services Companies:

- Cerba HealthCare

- Charles River Laboratories

- Eurofins Scientific

- ICON plc

- Intertek Group plc

- IQVIA Inc.

- Labcorp Drug Development

- SGS Société Générale de Surveillance SA

- Syneos Health

- Thermo Fisher Scientific Inc. (PPD, Inc.)

Recent Developments

-

In May 2024, BBI Solutions OEM Limited and BioAgilytix announced a partnership agreement, wherein the former’s capability of producing quality custom antibody reagents for various testing applications would be integrated with the bioanalytical testing services of BioAgilytix. This development is expected to aid pharma and biopharma customers in accelerating the development of their innovative therapies

-

In January 2024, Frontage Laboratories, via its subsidiary Frontage Europe S.r.l., announced that it had acquired the Bioanalytical and Drug Metabolism & Pharmacokinetics business units of Accelera, an Italy-based CRO. Accelera is a part of NMS Group S.p.A., which provides discovery & preclinical studies as well as clinical bioanalysis to pharma & biotech companies and academic institutions, along with other stakeholders in the healthcare space

-

In September 2023, Cerba HealthCare, a France-based medical diagnosis company, announced the acquisition of CIRION BIOPHARMA RESEARCH INC., which is well-known for its integrated bioanalytical and global central laboratory services. The company’s bioanalytical capabilities include extensive specialization in the development of Biosimilars & Biologics, including PK, PD, and Immunogenicity testing

Europe Bioanalytical Testing Services Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 2.3 billion

Growth rate

CAGR of 8.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Molecule, test, workflow, country

Country scope

U.K.; Germany; France; Italy; Spain; Netherlands; Switzerland; Sweden; Denmark; Norway

Key companies profiled

Cerba HealthCare; Charles River Laboratories; Eurofins Scientific; ICON plc; Intertek Group plc; IQVIA Inc.; Labcorp Drug Development; SGS Société Générale de Surveillance SA; Syneos Health; Thermo Fisher Scientific Inc. (PPD, Inc.)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Bioanalytical Testing Services Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe bioanalytical testing services market report based on molecule, test, workflow, and country:

-

Molecule Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Molecule

-

Large Molecule

-

LC-MS Studies

-

Immunoassays

-

PK

-

ADA

-

Others

-

-

Others

-

-

Test Outlook (Revenue, USD Million, 2018 - 2030)

-

ADME

-

In-Vivo

-

In-Vitro

-

-

PK

-

PD

-

Bioavailability

-

Bioequivalence

-

Others

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Sample Preparation

-

Protein Precipitation

-

Liquid-Liquid Extraction

-

Solid Phase Extraction

-

-

Sample Analysis

-

Hyphenated Technique

-

Chromatographic Technique

-

Electrophoresis

-

Ligand Binding Assay

-

Mass Spectrometry

-

Nuclear Magnetic Resonance

-

-

Other Workflow Processes

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Netherlands

-

Switzerland

-

Frequently Asked Questions About This Report

b. The Europe bioanalytical testing services market size was valued at USD 1.3 billion in 2023.

b. The Europe bioanalytical testing services market is anticipated to advance at a compound annual growth rate (CAGR) of 8.9% from 2024 to 2030 to reach USD 2.3 billion by 2030.

b. The sample analysis workflow segment held the largest revenue share of 45.7% in 2023. This workflow process's increasing importance in determining the concentration of chemical elements or compounds is a notable factor driving segment growth.

b. Some of the leading names involved in the European market for bioanalytical testing services include SGS SA, ICON plc, IQVIA, Eurofins, and Syneos Health.

b. The growing incidence of chronic disorders such as cancer, inflammatory bowel diseases, and rheumatoid arthritis has highlighted the need for biologics. The increasing rate of advancements in the R&D of biosimilars in recent years is expected to heighten the demand for a range of bioanalytical testing services, such as compatibility studies and protein analysis of biosimilars, product release testing, and stability testing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.