- Home

- »

- Medical Devices

- »

-

Europe Diabetes Care Devices Market, Industry Report 2030GVR Report cover

![Europe Diabetes Care Devices Market Size, Share & Trends Report]()

Europe Diabetes Care Devices Market Size, Share & Trends Analysis Report By Product (BGM Devices, Insulin Delivery Devices), By Distribution Channel, By End-use, By Country, And Segment Forecast, 2024 - 2030

- Report ID: GVR-3-68038-967-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

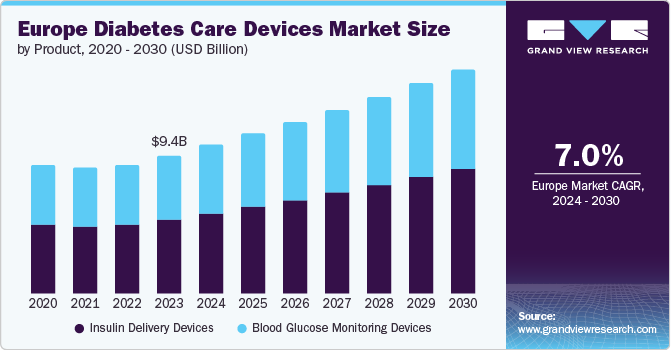

The Europe diabetes care devices market size was valued at USD 9.36 billion in 2023 and is projected to grow at a CAGR of 7.0% from 2024 to 2030. The industry is driven by rising obesity rates, rising prevalence of diabetes, and rising level of physical inactivity. Equipment for monitoring diabetes consists of ketone meters, blood glucose meters, continuous glucose meters, insulin pumps, smart insulin pens, and software for managing diabetes. Glucose monitoring devices assist patients in managing and regulating their glucose levels, enhancing their overall well-being.

The European diabetes care device market is driven by the increasing prevalence of diabetes, which is resulting in a high burden of expenditure on healthcare systems. The International Diabetes Federation reports that Europe has the highest prevalence of type 1 diabetes among children and adolescents, with 31,000 new cases annually, further emphasizing the need for effective diabetes management solutions. This highlights the need for effective diabetes management solutions that can help patients control their blood sugar levels and reduce the financial strain on healthcare systems.

Advances in technology have led to the development of innovative diabetes care devices, including insulin delivery systems that offer safer and more precise treatment options. Medtronic's introduction of its smart insulin pen with integrated features is a prime example of this trend. These devices are designed to monitor and track blood glucose levels throughout the day, providing patients with valuable insights to make informed decisions about their treatment.

The growing adoption of continuous glucose monitoring (CGM) systems is another key driver of the European diabetes care device market. CGM devices track blood glucose levels continuously, providing patients with real-time data to manage their condition more effectively. This technology has been shown to improve glycemic control, reduce hypoglycemic events, and enhance patient quality of life. As the prevalence of diabetes continues to rise, the demand for these devices is expected to increase, driving growth in the European diabetes care device market.

Product Insights

Insulin delivery devices dominated the market and accounted for a share of 54.2% in 2023. The growing prevalence of obesity in Europe, driven by unhealthy lifestyle choices, is fueling a surge in diabetes cases, subsequently driving demand for insulin delivery devices. Key growth drivers include increased healthcare spending, innovative medical devices, and enhanced awareness about diabetes. Insulin delivery devices encompass pens, pumps, syringes, and jet injectors.

Blood glucose monitoring (BGM) devices are expected to register significant growth over the forecast period, registering a CAGR of 6.5%. The escalating prevalence of diabetes in Europe is driving demand for blood glucose monitoring (BGM) devices. As a chronic condition affecting blood sugar regulation, diabetes requires effective management. Sub-segments include self-monitoring devices and continuous glucose monitoring devices, with heightened awareness among consumers fueling a surge in demand for BGM devices.

Distribution Channel Insights

Hospital pharmacies dominated the market and accounted for a share of 54.1% in 2023. Hospital pharmacies in the region collaborate with doctors to provide medication expertise and handle complex diabetes cases requiring advanced monitoring or delivery devices, such as insulin pumps or CGMs, which are often not available at retail pharmacies. Strict regulations govern hospital pharmacies.

Retail pharmacies are expected to register the fastest CAGR of 8.0% during the forecast period. Retail pharmacies offer a convenient and accessible location for patients to acquire diabetes care devices, featuring dedicated sections with a range of products including blood glucose meters, test strips, insulin pens, and CGMs. Easy access and streamlined insurance claims processing simplify the purchase process, encouraging patients to initiate and maintain self-management routines.

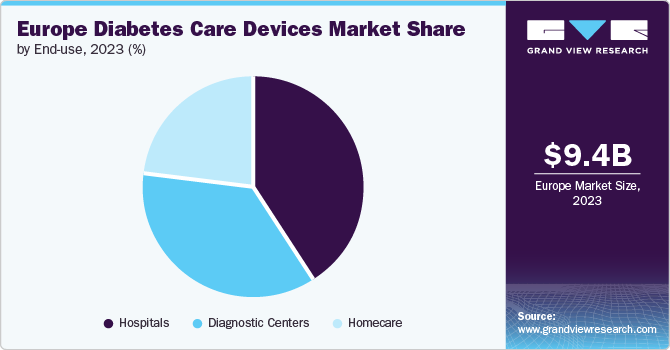

End-use Insights

Hospitals accounted for the largest market revenue share of 40.8% in 2023. As critical hubs for diabetes therapy initiation, hospitals often employ advanced technologies such as CGM and insulin pumps to create personalized management plans. Device data informs doctor-prescribed medication and insulin regimens, driving demand for these devices. Regulatory bodies, such as France's HAS, issue guidelines promoting CGM adoption in hospitalized diabetic patients, increasing hospital demand for these devices.

Diagnostic centers is projected to grow at the fastest CAGR of 7.6% over the forecast period. Diagnostics centers play a crucial role in confirming diagnoses and collecting data, while ongoing device management and prescription typically fall under specialists or primary care physicians. By establishing referral pathways with endocrinologists, diagnostics centers can seamlessly connect patients to comprehensive care. For instance, the Thriva app in the UK enables at-home testing and facilitates referrals to specialists for personalized device prescriptions.

Country Insights

Europe diabetes care device market is poised for substantial growth driven by rising cases of diabetes attributed to unhealthy lifestyles, including poor diets and sedentary habits. The continent's aging population also increases the risk of type 2 diabetes. The UK's NHS launched a campaign to raise awareness about type 2 diabetes risk factors and promote early detection, potentially leading to increased hospital diagnoses and subsequent demand for treatment devices. This trend is expected to create a significant opportunity for device manufacturers and healthcare providers.

Germany Diabetes Care Device Market Trends

Germany diabetes care device market is expected to grow rapidly in the coming years due to diabetes poses a major health issue and is a significant obstacle for healthcare systems across Germany. The occurrence of diagnosed type 1 & 2 diabetes is quite elevated in the adult population of Germany, with a significant number of individuals still undiagnosed. Because of a growing number of elderly people and unhealthy habits, the incidence of type 2 diabetes is projected to rise gradually in the coming years.

Key Europe Diabetes Care Devices Company Insights

Some key companies operating in Europe diabetes care device market include Medtronic plc; Abbott Laboratories; F. Hoffmann-La Roche Ltd.; Bayer AG; LifeScan IP Holdings, LLC. As awareness of diabetes management increases, government support and competitive pressures drive companies to innovate and capture market share in this dynamic sector, characterized by fierce competition and opportunities for growth.

-

LifeScan, Inc. is a manufacturer of diagnostic devices, offering a comprehensive portfolio of products that cater to the global market. The company’s product range includes glucose meters, test strips, lancing devices, hospital monitoring systems, and linearity test kits, enabling patients and healthcare professionals to manage diabetes effectively.

-

Insulet Corporation is a medical device company that designs, manufactures, and commercializes the Omnipod insulin infusion system for individuals with insulin-dependent diabetes.

Key Europe Diabetes Care Devices Companies:

- Medtronic plc

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd.

- Bayer AG

- LifeScan IP Holdings, LLC

- B. Braun Melsungen AG

- Dexcom, Inc.

- Insulet Corporation

- Ypsomed Holding AG

- Companion Medical, Inc.

- Sanofi S.A.

- Valeritas Holdings, Inc.

- Novo Nordisk A/S

- Arkray, Inc.

Recent Developments

-

In February 2024, DexCom, Inc. launched the Dexcom ONE+ CGM system, initially available in Spain, Belgium, and Poland. The new sensor replaced the older ONE sensor in some countries, resulting from user and healthcare professional feedback.

-

In May 2023, LifeScan IP Holdings, LLC published a study in Diabetes Therapy, analyzing real-life data from a Bluetooth-enabled blood glucose meter and mobile app, examining long-term results over 180 days, providing valuable insights for individuals with diabetes.

Europe Diabetes Care Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.05 billion

Revenue forecast in 2030

USD 15.11 billion

Growth rate

CAGR of 7.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, end-use, country

Regional scope

Europe

Country scope

Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway

Key companies profiled

Medtronic; Abbott ; F.Hoffmann-La-Ltd.; Bayer AG; LifeScan IP Holdings, LLC; B. Braun SE; Dexcom Inc.; Insulet Corporation; Ypsomed Holdings; Companion Medical; Sanofi; Valeritas Holding Inc.; Novo Nordisk; Arkray, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Diabetes Care Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe diabetes care device market report based on product, distribution channel, end-use, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood Glucose Monitoring Devices

-

Self-monitoring Devices

-

Blood Glucose Meter

-

Testing Strips

-

Lancets

-

-

Continuous Glucose Monitoring Devices

-

Sensors

-

Transmitter

-

Receiver

-

-

-

Insulin Delivery Devices

-

Pens

-

Pumps

-

Syringes

-

Jet Injector

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Diabetes Clinics/ Centers

-

Online Pharmacies

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Centers

-

Homecare

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."