- Home

- »

- Biotechnology

- »

-

Europe Microfluidics Market Size, Industry Report, 2030GVR Report cover

![Europe Microfluidics Market Size, Share & Trends Report]()

Europe Microfluidics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Microfluidic Components, Microfluidic-based Devices), By Technology (Lab-on-a-chip, Organ-on-a-chip), By Material Type (Silicon, Glass), By Application, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-539-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Microfluidics Market Size & Trends

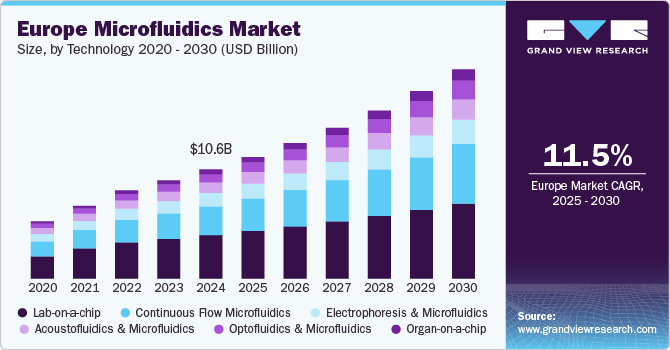

The Europe microfluidics market size was estimated at USD 10.64 billion in 2024 and is expected to grow at a CAGR of 11.5% from 2025 to 2030. Rising demand for point-of-care diagnostics, advancements in lab-on-a-chip technology, and increasing applications in the pharmaceutical and biotechnology sectors drive market growth. Supportive government initiatives, growing healthcare R&D, and the need for high-throughput screening further fuel market expansion.

The COVID-19 pandemic accelerated growth in the European microfluidics market by driving demand for rapid, cost-effective diagnostic solutions. Microfluidic-based point-of-care testing became essential for detecting infections quickly, reducing reliance on centralized laboratories. The urgent need for high-throughput screening and multiplexed assays spurred innovations in lab-on-a-chip technology. Additionally, increased investments in healthcare R&D and government funding for diagnostic advancements fueled market expansion. Pharmaceutical companies leveraged microfluidics for drug discovery and vaccine development, enhancing efficiency in research workflows. The pandemic also highlighted the importance of decentralized and portable diagnostic systems, encouraging further adoption across hospitals, clinics, and research labs.

Moreover, advancements in lab-on-a-chip technology streamlined diagnostic processes, enhancing speed, accuracy, and efficiency while minimizing sample requirements. Integration with AI and automation optimized real-time data analysis and remote monitoring, driving operational efficiencies. This surge in demand for rapid, scalable diagnostic solutions fueled long-term investment and adoption of microfluidics across healthcare, biotech, and pharmaceutical sectors, reinforcing its market growth trajectory.

Furthermore, the growing penetration of microfluidics in the diagnostics market is revolutionizing point-of-care testing, molecular diagnostics, and personalized medicine. Its ability to deliver rapid, cost-effective, and high-throughput analysis drives increased adoption by healthcare providers, diagnostic labs, and biotech firms. The demand for decentralized testing solutions, especially in infectious disease detection and chronic disease monitoring, accelerates market growth. Additionally, advancements in automation and miniaturization enhance efficiency, scalability, and accuracy, making microfluidic technologies a strategic investment for businesses looking to optimize healthcare delivery. As regulatory approvals and funding initiatives support innovation, microfluidics is set to play a pivotal role in shaping the future of diagnostics.

Microfluidics Fabrication in Europe: Cost and Implementation Challenges

Microfluidics research and development in Europe has gained significant momentum, with various fabrication techniques being employed across universities and research institutions. The cost and technical complexity of these methods greatly influence their adoption. Simple and cost-effective techniques such as etched tape, glass coverslips, and Pasta/PDMS methods are commonly used for introductory-level applications due to their low resolution and minimal capital investment. However, these approaches often pose limitations in precision and require longer processing times, which can be a barrier in fast-paced research environments. On the other hand, 3D printing has emerged as a promising method due to its ability to create microchannels with relatively high resolution. However, it remains expensive and requires careful design considerations. The high costs associated with paper-based microfluidics using inkjet printing further restrict its accessibility, making it viable mainly in well-funded research labs.

Table 1 : Overview of fabrication techniques, associated costs, and limitations

Fabrication Technique

Listed Resolution

Technical Limitations

Approximate Capital Cost (EUR)

Approximate Reagent/

Supply Cost (EUR)

Time to Fabricate Device

Etched tape and glass cover slips

~1 mm

Low resolution, and limited applications

8.46

0.42

1 hour

Pasta/PDMS

~1 mm

Low resolution

16.92

4.23

1 day

3D printing

10 µm

Limited channel shapes

1,861.20

21.15

2 days

Paper microfluidics (inkjet printing)

5 µm

Some expensive equipment and materials

25,380.00

0.08

5 hours

Xurography

25 µm

Requires alignment of layers by hand

338.40

0.85

2 hours

Photolithography

15 nm

Expensive and significant training

4,653.00

42.30

1 week

Source: Biomedical Engineering Society, Primary Research, Grand View Research

In contrast, more advanced fabrication techniques such as xurography and photolithography, though widely used in Europe, present significant challenges in terms of precision and scalability. Xurography, despite its affordability, suffers from low yield due to manual layer alignment, making it less l The barriers to implementing these methods in educational environments further highlight the need for cost-effective and scalable alternatives. European institutions are thus investing in optimizing fabrication techniques, seeking to balance affordability, precision, and accessibility to push the frontiers of microfluidics research and development.

Future Trends in Microfluidics Fabrication in Europe

The future of microfluidics fabrication in Europe is set to be shaped by advancements in automation, precision engineering, and the development of novel materials. Emerging fabrication techniques will increasingly incorporate artificial intelligence (AI) and machine learning (ML) to optimize designs and improve efficiency. Integrating microfluidics with nanotechnology is also expected to enhance the resolution and functionality of devices, allowing for more complex and high-performance applications. Additionally, 3D printing and digital manufacturing are becoming more refined, enabling faster prototyping and mass production at reduced costs. These developments will significantly impact industries such as healthcare, environmental monitoring, and pharmaceuticals, where miniaturized fluidic systems are becoming essential.

Sustainability is another key focus area in microfluidics fabrication. Researchers in Europe are exploring biodegradable and recyclable materials as alternatives to conventional polymers, aligning with global efforts to reduce plastic waste. Furthermore, advancements in lab-on-a-chip technology will drive innovation in diagnostics and personalized medicine, making point-of-care testing more efficient and accessible. Collaborative efforts between academia, industry, and regulatory bodies will play a crucial role in standardizing fabrication processes and ensuring the scalability of microfluidic devices. With continuous investment in research and supportive regulatory frameworks, Europe is well-positioned to lead the next wave of microfluidics innovation.

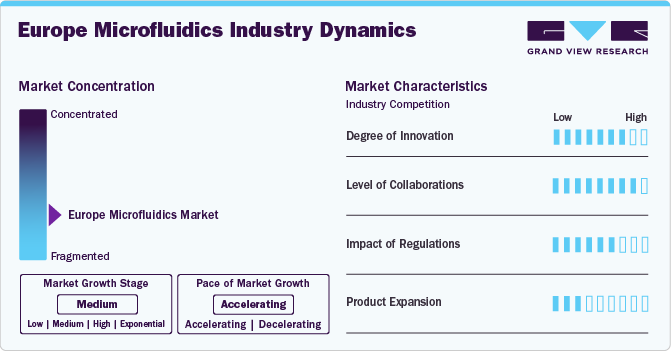

Market Concentration & Characteristics

Innovation in the European microfluidics industry is accelerating, driven by advancements in lab-on-a-chip technology, AI integration, and automation. Growing demand for rapid diagnostics, personalized medicine, and high-throughput screening attracts investments, while regulatory support and increasing R&D funding further propel market expansion.

The European microfluidics industry is experiencing exponential collaboration among industry players, driven by innovation, research funding, and technological advancements. Strategic partnerships between academia, startups, and major companies are accelerating the development of cost-effective, high-precision microfluidic devices, fostering growth in healthcare, diagnostics, and lab-on-a-chip technologies across the region. For instance, in December 2024, Quantum-Si expanded its collaboration with SkyWater Technology to develop new consumables for protein sequencing, aiming to enhance accuracy and throughput in proteomics research.

Regulatory frameworks significantly influence the Europe microfluidics industry. Stringent CE marking requirements, MDR regulations, and regulatory approvals impact market entry, while supportive policies and funding initiatives drive innovation, fostering growth in diagnostics, pharmaceuticals, and biomedical research.

The Europe microfluidics industry is seeing significant growth and product expansion due to several key factors. These include increasing demand for point-of-care diagnostics, advancements in lab-on-a-chip technology, and rising investments in healthcare R&D. Regulatory support, automation integration, and expanding applications in pharmaceuticals and biotechnology further drive market expansion.

Product Insights

The microfluidic components segment held the largest revenue share in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. This growth is driven by increasing demand for precision fluid control in diagnostics, drug delivery, and biomedical research. Advancements in valves, pump, and sensor technologies enhanced performance, fueling adoption across healthcare and pharmaceutical industries. Growing investment in lab-on-a-chip systems and point-of-care testing further boosted segment growth, as miniaturization and automation improved efficiency. Additionally, regulatory approvals and expanding applications in genomics and proteomics contributed to the segment’s dominance in the European microfluidics industry.

Microfluidic-based devices are expected to grow at a significant CAGR over the forecast period in the product segment. This growth is driven by the increasing adoption of point-of-care diagnostics, drug discovery, and personalized medicine. Advancements in lab-on-a-chip technology, automation, and AI integration enhance efficiency and scalability, fueling demand. Additionally, rising investments in healthcare R&D, growing applications in genomics and proteomics, and the need for high-throughput screening further accelerate market expansion. Regulatory support and the shift toward decentralized healthcare solutions also contribute to the segment’s rapid growth.

Technology Insights

The lab-on-a-chip segment held the largest revenue share of 39.85% in 2024. This growth is driven by increasing demand for miniaturized, high-throughput diagnostic solutions in healthcare and biotechnology. Lab-on-a-chip technology enables rapid, cost-effective, and precise analysis, making it essential for point-of-care testing, drug discovery, and personalized medicine. Advancements in microfabrication, automation, and AI integration have further enhanced its efficiency and scalability. Additionally, growing investments in R&D, regulatory support for innovative diagnostic solutions, and the rising need for decentralized healthcare have fueled the segment’s expansion in the European microfluidics market.

Organ-on-a-chip is expected to grow at the fastest CAGR over the forecast period in the product segment. This growth is driven by increasing demand for more accurate and efficient alternatives to traditional drug testing and animal models. Technology enables realistic simulation of human organ functions, accelerating drug discovery and personalized medicine. Rising investments in biotechnology and pharmaceutical R&D, along with advancements in microfluidics and 3D cell culture, further fuel adoption. Additionally, regulatory support for reducing animal testing and the push for precision medicine contribute to the rapid expansion of the organ-on-a-chip market in Europe.

Material Type Insights

The PDMS segment held the largest revenue share of 35.29% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. The segment growth is driven by PDMS’s biocompatibility, flexibility, and cost-effectiveness, making it ideal for microfluidic device fabrication. Its optical transparency and gas permeability enhance applications in lab-on-a-chip, organ-on-a-chip, and point-of-care diagnostics. Additionally, advancements in microfabrication techniques and increasing adoption in biomedical research, drug discovery, and personalized medicine further boost demand. Regulatory support and growing investment in microfluidics-based healthcare solutions also contribute to the segment’s rapid expansion.

Polymer is expected to grow at a significant CAGR over the forecast period in the product segment. This growth is driven by its cost-effectiveness, ease of fabrication, and scalability for mass production in microfluidic applications. Polymers offer excellent chemical resistance, biocompatibility, and design flexibility, making them ideal for lab-on-a-chip, organ-on-a-chip, and diagnostic devices. Increasing adoption in healthcare, biotechnology, and pharmaceutical sectors, along with advancements in polymer-based microfabrication techniques, further fuel demand. Additionally, growing investments in R&D and the shift toward disposable, single-use microfluidic devices contribute to the segment’s strong growth trajectory.

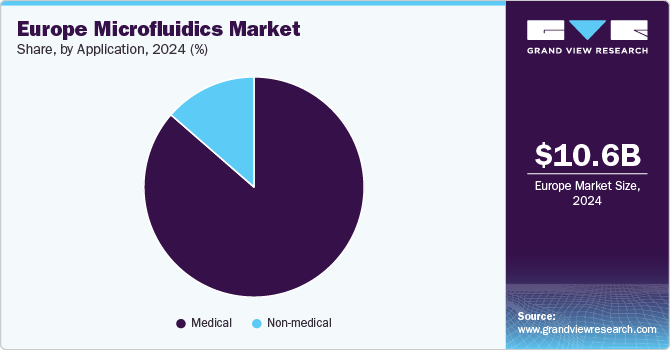

Application Insights

The medical segment held the largest market share in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. This is due to the increasing adoption of microfluidic technologies in diagnostics, drug delivery, and personalized medicine. The demand for rapid, cost-effective point-of-care testing and lab-on-a-chip solutions is driving market expansion. Additionally, advancements in organ-on-a-chip and high-throughput screening for drug discovery are fueling growth. Rising healthcare R&D investments, regulatory support, and the shift toward decentralized healthcare solutions further contribute to the segment’s strong growth trajectory in the European microfluidics market.

As an application, non-medical are expected to witness significant CAGR over the forecast period due to the expanding use of microfluidics in industries such as environmental testing, food safety, and chemical analysis. Growing demand for high-throughput screening, miniaturized analytical devices, and cost-effective lab automation solutions is driving adoption. Additionally, advancements in material science, automation, and AI integration are enhancing efficiency in research and industrial applications. Increasing investments in biotechnology, agricultural testing, and forensic science further fuel the segment’s growth, positioning microfluidics as a key enabler in various non-medical sectors.

Regional Insights

The microfluidics market in Europe is expected to grow exponentially due to advancements in biomedical research, increasing demand for lab-on-a-chip devices, and rising investments in healthcare innovation. Government initiatives like Horizon Europe are driving R&D, while breakthroughs in 3D printing and digital manufacturing are making fabrication more cost-effective. The expansion of point-of-care diagnostics, coupled with a growing focus on sustainability and biodegradable materials in leading countries like Germany and UK are further propelling market growth.

Germany Microfluidics Market Trends

The mcrofluidics market in Germany is anticipated to grow substantially over the forecast period, attributed to strong government funding for research, a well-established biotechnology sector, and increasing demand for lab-on-a-chip technologies. Advancements in precision engineering, 3D printing, and automation are enhancing fabrication efficiency and scalability. Additionally, collaborations between academic institutions, industry leaders, and healthcare providers are driving innovation in diagnostics, pharmaceuticals, and personalized medicine, further propelling market growth.

UK Microfluidics Market Trends

The microfluidics market in the UK is expected to grow significantly due to rising investments in healthcare innovation, increasing demand for point-of-care diagnostics, and advancements in lab-on-a-chip technologies. Government support, including funding from research programs, is accelerating R&D efforts. Additionally, innovations in 3D printing and sustainable materials enhance fabrication efficiency and scalability.

France Microfluidics Market Trends

Microfluidics market in France is anticipated to grow steadily over the forecast period, attributed to increasing investments in biomedical research, expanding applications in diagnostics and drug development, and strong government support for innovation. Advancements in microfabrication techniques, including 3D printing and photolithography, are enhancing production efficiency. Additionally, collaborations between research institutions, startups, and industry leaders are driving technological advancements and commercialization.

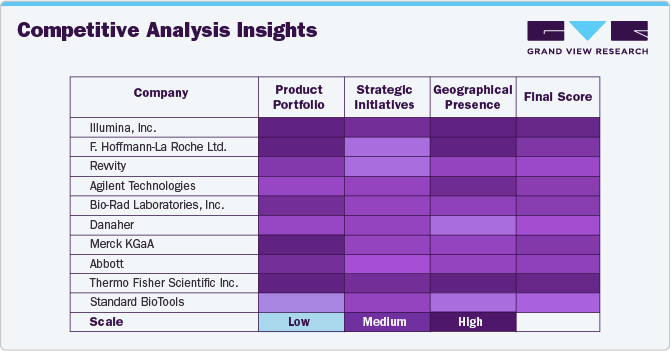

Key Europe Microfluidics Company Insights

Numerous players operate in the market, adopting strategies like product innovation, partnerships, and collaborations to strengthen their market presence. Companies focus on launching advanced microfluidic solutions, expanding R&D investments, and forming strategic alliances to enhance competitiveness and meet the growing demand across healthcare, biotechnology, and industrial applications.

Key Europe Microfluidics Companies:

- Illumina, Inc.

- F. Hoffmann-La Roche Ltd.

- Revvity

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Danaher

- Merck KGaA

- Abbott

- Thermo Fisher Scientific

- Standard BioTools

Competitive Analysis Insights

The competitive landscape of the European microfluidics market is intense, with most companies demonstrating strong capabilities across product portfolio, strategic initiatives, and geographic presence, as shown in the table below. Illumina, Inc. and Thermo Fisher Scientific, Inc. achieve higher ratings across all three dimensions due to their diversified strengths, while Standard BioTools receives lower ratings due to its limited distribution reach and product offerings.

Recent Developments

-

In March 2025, Microlight3D partnered with Eden Tech to deliver high-precision microfluidic design solutions for healthcare, diagnostics, and research applications. This collaboration combines Microlight3D’s Smart Print UV technology with Eden Tech’s FLUI’DEVICE platform to expedite the prototyping of microfluidic devices.

-

In December 2024, Syensqo partnered with Emulseo to enhance microfluidic applications in the healthcare sector. This collaboration aims to leverage Syensqo's Galden PFPE to improve the performance of microfluidic systems, benefiting areas like cancer detection and vaccine development.

-

In July 2024, Illumina Inc. acquired Fluent BioSciences to enhance its single-cell analysis capabilities. Fluent's technology eliminates the need for complex, expensive instrumentation and microfluidic consumables, aligning with Illumina's goal of developing the sequencing ecosystem and supporting multi-fluid solutions like single-cell analysis.

Europe Microfluidics Market Report Scope

Report Attribute

Details

Revenue forecast in 2025

USD 11.85 billion

Revenue forecast in 2030

USD 20.39 billion

Growth rate

CAGR of 11.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, material type, application, country

Country scope

UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway

Key companies profiled

Illumina, Inc.; F. Hoffmann-La Roche Ltd.; Revvity; Agilent Technologies, Inc.; Bio-Rad Laboratories, Inc.; Danaher; Merck KGaA; Abbott; Thermo Fisher Scientific; Standard BioTools

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Europe Microfluidics Market Report Segmentation

This report forecasts revenue growth and analyzes the latest trends in each of the sub-segments from 2018 to 2030. Grand View Research has segmented the Europe microfluidics market based on product, technology, material type, application, and country.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Microfluidic-based Devices

-

Microfluidic Components

-

Chips

-

Micro-pumps

-

Sensors

-

Others

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Lab-on-a-chip

-

Organ-on-a-chip

-

Continuous flow microfluidics

-

Optofluidics and microfluidics

-

Acoustofluidics and microfluidics

-

Electrophoresis and microfluidics

-

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Silicon

-

Glass

-

Polymer

-

PDMS

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical

-

Pharmaceuticals

-

Medical Devices

-

In-vitro Diagnostics

-

Others

-

-

Non-medical

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Frequently Asked Questions About This Report

b. The Europe microfluidics market size was estimated at USD 10.64 billion in 2024 and is expected to reach USD 11.85 billion in 2025.

b. The Europe microfluidics market is expected to grow at a compound annual growth rate of 11.5% from 2025 to 2030 to reach USD 20.39 billion by 2030.

b. Lab-on-a-chip segment dominated the Europe microfluidics market with a share of 39.85% in 2024. This is attributable to the rising demand for faster, more efficient, and portable chip technologies for conducting laboratory experiments in diagnostics and drug discovery domains.

b. Some key players operating in the Europe microfluidics market include Illumina, Inc., F. Hoffmann-La Roche Ltd., Revvity, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Danaher, Merck KGaA, Abbott, Thermo Fisher Scientific, Standard BioTools

b. Key factors that are driving the market growth include the rising demand for point-of-care diagnostics, advancements in lab-on-a-chip technology, and increasing applications in the pharmaceutical and biotechnology sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.