- Home

- »

- Advanced Interior Materials

- »

-

Europe Pavement Reinforcement Materials Market, Industry Report, 2030GVR Report cover

![Europe Pavement Reinforcement Materials Market Size, Share & Trends Report]()

Europe Pavement Reinforcement Materials Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Carbon Fiber, Glass Fiber, Steel Rebar), By Country (Germany, UK), And Segment Forecasts

- Report ID: GVR-4-68040-299-2

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

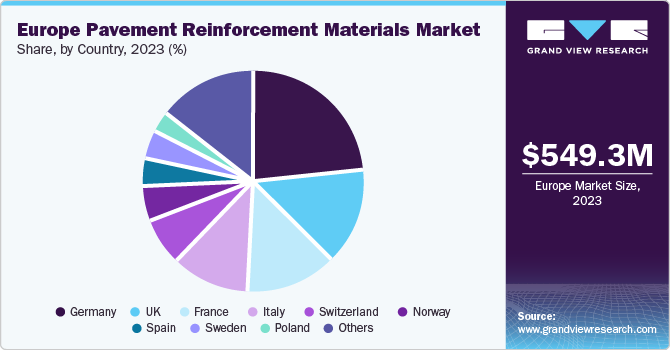

The Europe pavement reinforcement materials market size was estimated at USD 549.3 million in 2023 and is projected to grow at a CAGR of 8.3% from 2024 to 2030. The market is driven by several factors, such as increasing investment in infrastructure development projects. In June 2022, The European Union announced an investment of EURO 5.4 billion (USD 5.69 billion) to support infrastructure projects. This initiative encompasses the enhancement of road networks and shipping routes, consequently driving the demand for pavement materials.

The substantial investment revitalizes infrastructure and stimulates economic growth, aligning with the EU's broader strategy to promote sustainable development and resilience. This strategic investment underscores the EU's commitment to advancing infrastructure development while addressing the challenges posed by the pandemic and promoting a greener, more resilient future for Europe.

Growing awareness of the benefits of pavement reinforcement, such as improved durability and reduction in maintenance cost, is driving adoption among infrastructure developers. Rising focus on eco-friendly construction practices and the increasing need to address challenges posed by heavy traffic loads and harsh weather conditions. As a result, there is a growing demand for advanced reinforcement solutions that can enhance structural integrity.

Stringent government regulations aimed at enhancing the quality of roads and pavements are further driving the market as they necessitate the use of reinforcement technologies. The European Union heavily invested in road infrastructure developments, such as transferring high-speed traffic from rural roads to trunk routes.

The rising focus on sustainable and eco-friendly construction practices is prompting the adoption of innovative pavement reinforcement materials that offer environmental benefits, contributing to market growth. In January 2022, Terram launched the improved Bodpave 40, a paving system that gave an opportunity for the usage of 100% recycled plastic in ground reinforcement infrastructure. These pavers deliver a 50% reduction in CO2 footprint and are used in cycle paths and emergency access routes. This helped in the reduction of installation time by 25% and also improved connection strength by 250%.

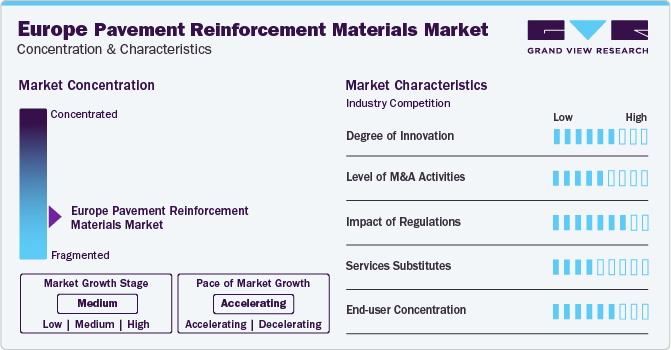

Market Concentration & Characteristics

The Europe pavement reinforcement materials industry is significantly fragmented, the growth stage is medium, and the pace is accelerating. Major urban centers and transportation hubs experience higher concentrations of pavement infrastructure due to heavy traffic loads and greater economic activity. Countries with extensive highway infrastructure such as Germany, France, and UK often have well established pavement markets characterized by mix of government funded projects and private sector investment.

The industry is influenced by stringent regulations and standards set by national governments and the European Union regarding pavement quality, safety, and environmental impact. Compliance with these regulations drives innovation. There is a continuous push for innovation in pavement materials and construction techniques to improve durability, sustainability, and performance.

Both public infrastructure projects and private sector investments influence the industry. Service substitutes such as alternative transport modes like public transit or cycling infrastructure can affect the demand for pavement solutions, particularly in urban areas.

Government agencies heavily invest in public infrastructure projects. Private sector entities such as real estate developers contribute to market demand through investments in private roadways, parking lots, and industrial pavements.

Product Insights

Carbon fiber held the highest market share of 47.0% in 2023. The growing demand for high-performance pavements in transportation infrastructure projects fuels the adoption of carbon fiber reinforcement. With increasing traffic volumes, heavier loads, and higher vehicle speeds, there is a need for pavements capable of withstanding heavy traffic loads while maintaining optimal performance and safety standards. Carbon fiber reinforcement enhances the structural stability and load-bearing capacity of pavements, reducing the risk of premature cracking, rutting, and deformation. As transportation agencies seek to improve the durability and reliability of their road networks, the integration of carbon fiber reinforcement becomes essential for achieving long-term pavement performance and minimizing maintenance costs.

Glass fiber is anticipated to grow at the fastest CAGR during the forecast period.The growing demand for sustainable and energy-efficient infrastructure drives the adoption of glass fiber reinforcement in pavement construction. Glass fiber-reinforced pavements offer excellent thermal properties, reducing the urban heat island effect and contributing to energy conservation. By incorporating glass fiber into pavement designs, cities, and municipalities can create more sustainable and resilient urban environments while mitigating the impacts of climate change. Additionally, the recyclability of glass fiber materials aligns with circular economy principles, further enhancing the sustainability credentials of pavement reinforcement projects.

Country Insights

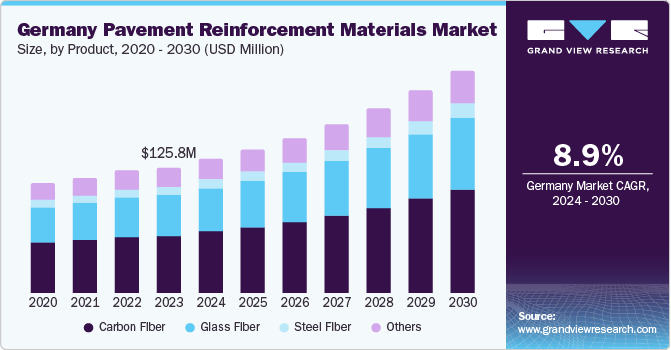

Germany held the largest market share of 22.9% in 2023. The increasing importance of multimodal transportation and sustainable mobility solutions drives demand for pavement reinforcement technologies that accommodate diverse modes of transport. Germany, like many European countries, promotes alternatives to traditional car-centric transportation, such as cycling, walking, and public transit. Pavements reinforced with materials such as porous asphalt or permeable pavers support these alternative modes of transport while reducing stormwater runoff and enhancing urban green infrastructure. As Germany invests in creating more walkable, bike-friendly cities and improving public transit accessibility, the demand for pavement reinforcement solutions tailored to these needs is expected to grow.

The France market holds significant importance due to the country's extensive transportation network and ongoing infrastructure projects to enhance road safety and efficiency. With a strong focus on modernizing highways, bridges, and urban roads, France's investments create opportunities for pavement reinforcement suppliers to provide tailored, high-performance solutions that align with the country's specific needs. The emphasis on improving infrastructure supports economic growth and underscores France's commitment to sustainable development and resilience.

Key Europe Pavement Reinforcement Materials Company Insights

Some of the key companies operating in the Europe pavement reinforcement materials market are NAUE GmbH & Co. KG and EUROVIA among others.

-

NAUE GmbH & Co. KG specializes in the development, manufacture, and distribution of geosynthetics. NAUE is a leading full-service provider of geosynthetic solutions, boasting a global presence through its subsidiaries and offices worldwide. The company offers a diverse portfolio encompassing various geosynthetic products, including geogrids, geomembranes, geotextiles, composites, drainage mats, geosynthetic clay liners (GCLs), and more.

-

EUROVIA, a subsidiary of Vinci SA, is a prominent construction contractor offering diverse construction solutions tailored for transport infrastructure and urban development. The company's core services encompass infrastructure maintenance, consulting, and design coordination, reflecting its commitment to ensuring the longevity and efficiency of transportation networks. Eurovia specializes in constructing and maintaining road and rail infrastructure, airport platforms, road equipment installation, and industrial and business sites. The company's strategic focus on innovation and sustainability underscores its dedication to delivering high-quality construction solutions that align with evolving industry standards and client needs.

Key Europe Pavement Reinforcement Materials Companies:

- ACO Eurobar

- Bonar Geosynthetics

- Concrete Canvas Ltd

- EUROVIA

- Huesker

- MACCAFERRI ENVIRONMENTAL SOLUTIONS PVT. LTD.

- Naue GmbH & Co. KG

- TENAX SPA

- Tensar

- Terram

Recent Developments

-

In September 2023, Concrete Canvas Ltd launched its latest innovation, CCX, which is designed to prevent erosion and reduce seepage loss in canal infrastructure. CCX will provide long-term durability and increase the operational life and overall functionality of canal infrastructure. Their products are the first GCCMs (Geosynthetic Cementitious Composite Mats) to meet international standards.

-

In May 2022, ACO Eurobar, a manufacturer of continuous iron casting, announced a merger with ACO Guss GmbH. The merger aimed to increase efficiency and simplify the casting process. The brand name will remain the same, and ACO Eurobar will work for ACO Guss GmbH in the continuous casting process.

Europe Pavement Reinforcement Materials Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 938.5 million

Growth rate

CAGR of 8.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, country

Country scope

Germany, UK, France, Italy, Spain, Denmark, Belgium, Netherlands, Poland, Switzerland, Austria, Sweden, Portugal, Norway, Ireland

Key companies profiled

ACO Eurobar; Bonar Geosynthetics; Concrete Canvas Ltd; Eurovia; Huesker; MACCAFERRI ENVIRONMENTAL SOLUTIONS PVT. LTD.; Naue GmbH & Co. KG; TENAX SPA; Tensar; Terram

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Pavement Reinforcement Materials Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe pavement reinforcement materials market report based on product and country.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Carbon Fiber

-

Glass Fiber

-

Steel Rebar

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Belgium

-

Netherlands

-

Poland

-

Switzerland

-

Austria

-

Sweden

-

Portugal

-

Norway

-

Ireland

-

Frequently Asked Questions About This Report

b. The Europe pavement reinforcement materials market size was estimated at USD 549.3 million in 2023 and is expected to reach USD 582.3 billion in 2024

b. The Europe pavement reinforcement materials market is expected to grow at a compound annual growth rate of 8.3% from 2024 to 2030 to reach USD 938.5 million by 2030

b. Germany held the largest market share of 22.9% in 2023. The increasing importance of multimodal transportation and sustainable mobility solutions drives demand for pavement reinforcement technologies that accommodate diverse modes of transport.

b. Some key players operating in the Europe pavement reinforcement materials market include ACO Eurobar, Bonar Geosynthetics, Concrete Canvas Ltd, Eurovia, Huesker, MACCAFERRI ENVIRONMENTAL SOLUTIONS PVT. LTD., Naue GmbH & Co. KG, TENAX SPA, Tensar, Terram

b. Factors such as growing demand for sustainable and resilient pavement solutions and increasing demand for multimodal transportation and the rehabilitation of aging infrastructure are driving the market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.