- Home

- »

- Plastics, Polymers & Resins

- »

-

Europe Plastic Compounding Market Size Report, 2030GVR Report cover

![Europe Plastic Compounding Market Size, Share & Trends Report]()

Europe Plastic Compounding Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Polyethylene, PET, Polypropylene), By Application (Automotive, Construction, Electrical & Electronics, Packaging), By Country, And Segment Forecasts

- Report ID: GVR-2-68038-800-8

- Number of Report Pages: 133

- Format: PDF

- Historical Range: 2019 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

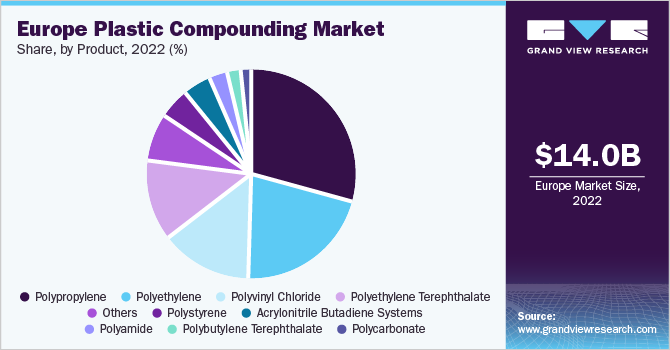

The Europe plastic compounding market size was valued at USD 14.04 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.4% from 2023 to 2030. The market is driven by increasing applications in automotive and consumer appliance manufacturing. Polyurethane is most widely used as a foam cushioning material in seats and insulation panels in automotive manufacturing. Plastic compounding is an important process that determines the final product quality and various characteristics or attributes of the end product. In compounding, different materials are assorted, melted, and then granulated. The granules are processed into a finished or semi-finished part, which is durable and flexible.

Molding or extruding methods are employed for the processing of granules. The final product and its quality are based on the blend of materials used in the initial stage. Its use in Europe is regulated by stringent rules and guidelines regarding plastic waste disposal by European Union (EU). The local governments are also developing initiatives for recycling PET and PE.

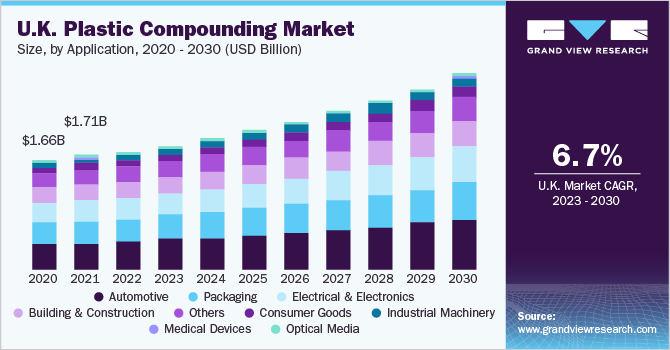

The U.K., led by the automotive industry, is the second-largest market in Europe. The building & construction industry also holds a significant market share of around 14.0% in terms of revenue in the U.K. The country’s construction industry is aided by recently sanctioned government budgets, coupled with foreign investments in the region to re-engineer the sector.

As per the government, the U.K. is estimated to showcase up to 200,000 new houses under the HS2 housing project. The building and construction industry demands plastic compounds for various end-uses such as manufacturing ducts and pipes, floor and wall coverings, linings and fitted furniture, and insulations.

Increasing automotive production and subsequent rise in plastic consumption in automotive component fabrication as a result of regulatory policies are expected to drive the market in Europe over the forecast period. Polyamide (PA) compounds, particularly PA6 and PA66, are being widely used in automotive applications that comprise pedal boxes engine covers, radiator tanks, and several other components.

European manufacturers are experiencing more difficulties due to the high costs of natural gas and electricity. Gas prices in the region remain around 2.5 times higher than those in the U.S. The region requires a significant amount of oil imports to meet its local demand, which is adding to the final product cost. High prices of power raise the cost of manufacturing of all chemicals, but a few see a particularly significant increase downstream.

Application Insights

The automotive segment accounted for more than 25.0% share of the overall revenue of Europe in 2022. Increasing the integration of electronics into automobiles, coupled with rising demand for wearable devices among youth, is driving demand for plastic compounds in the region. The automotive industry has witnessed rising sales of passenger cars and light commercial vehicles. Polypropylene compounds are used to reduce the overall vehicle weight and increase fuel economy. Plastic compounds are also used extensively in the interiors of automobiles, further driving demand.

The construction industry in Europe has depicted significant growth post-2020 and is driven by economic recovery and a steady rise in per capita disposable income. Plastic compounds are widely used for dome lights, glazing, and sound walls. Its impact strength, moldability, and availability in optically transparent grades have been instrumental in penetrating construction applications.

PVC is the most preferred material in the construction industry and has successfully replaced traditional materials such as metal, wood, clay, and concrete. It is used in constructing components such as window frames, pipes, and roofing foils owing to its cheap cost and high resistance. Government initiatives to reduce real estate prices and recover housing permits add to the economic stability of the region. These initiatives have largely benefited the construction industry, thereby fuelling the Europe plastic compounding market.

Product Insights

The polypropylene segment led the market and accounted for more than 29.0% share of the European revenue in 2022. European market owing to their application in core manufacturing sectors such as automotive, construction, and electrical and electronics. Rapid growth in the regional automotive industry is the primary factor behind the growing demand for polypropylene compounds. Widespread acceptance of these products can be attributed to their cost-effectiveness, good chemical resistance, excellent mechanical properties, and moldability.

PET is the most commonly used product in Europe as well as globally and has been witnessing a rapidly increasing demand. These compounds are used across automotive, packaging, textiles, and other industries. Its rising demand has led various leading companies to develop methods to recycle PET, thus addressing issues pertaining to its disposal. The development of bio-based PET is expected to provide a much-needed solution for internal substitution.

Country Insights

Germany dominated the market and accounted for over 26.0% share of the European revenue in 2022. Germany has a thriving plastics industry and has set international standards for its manufacturing methods. The country has several production facilities and a well-developed industrial sector; it also houses one of the biggest automotive manufacturing hubs in Europe. The construction, automotive, packaging, and mechanical engineering sectors in Germany are focused on developing new and innovative products.

Regional growth is driven by the widespread usage of plastic compounds in the industrial machinery, construction, and automotive industries. Europe has also scrutinized the grades and types of plastic compounds being used across end-use industries. Hence, compounders in the region are investing heavily to capture potential markets and replace heavier materials. Metal components such as machinery panels, covers, and hoods are being substituted with strong and durable plastic materials. Such replacements are prominent in the packaging industry as well. Packaging is an emerging industry for plastic compounders in Europe and reflects a total of 50.0% of all products being packaged in plastic containers or boxes.

Key Companies & Market Share Insights

Industry participants are majorly focusing on the development of new technologies for recycling plastics while maintaining crucial European standards. Formulators in the region have also been enhancing their product portfolio and focusing majorly on recycled plastics to comply with regulations laid down by governments of various countries and other concerned regulatory bodies. Furthermore, companies are focusing on the usage of organic feedstock in order to create bio-based plastics as a sustainable solution.

For instance, in April 2023, DSM Engineering Materials (DEM) and Lanxess High-Performance Materials (HPM) formed a joint venture with Advent International to form a new company name Envalior, in which the holding of DSM, and Lanxess would be 40% and Advent 60%. Furthermore, Envalior will offer customers a unique portfolio of leading recycled product brands and bio-based materials, combined with materials expertise and deep application with a strong footprint in Asia, Europe, and the US. Some of the prominent players in the Europe plastic compounding market include:

-

BASF SE

-

The Dow Chemical Company

-

SABIC

-

LyondellBasell Industries, N.V.

-

Dyneon GmbH

-

Asahi Kasei Plastics

-

Covestro (Bayer Material Science)

-

Eurostar Engineering Plastics

-

Lanxess

-

Solvay

-

Avient Corporation

-

Ensinger

-

Akkro Plastic

-

Technocompound

-

RTP Company

-

PCW GmbH

-

RIA-POLYMERS GMBH

-

Ravago

-

Washington Penn Plastics Company

-

Celanese Corporation

- Borealis

Europe Plastic Compounding Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 14.69 billion

Revenue forecast in 2030

USD 22.68 billion

Growth rate

CAGR of 6.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2019 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD billion, volume in kilotons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company profiles, competitive landscape, growth factors, and trends

Segments covered

Product, application, country

Region scope

Europe

Country scope

Austria; U.K.; France; Germany; Switzerland; Czech Republic; Hungary

Key companies profiled

BASF SE; SABIC; Dow, Inc.; Hanwha Azdel Inc.; Lear Corporation; Owens Corning; Magna International, Inc.; Momentive Performance Materials, Inc.; DuPont de Nemours, Inc.; Covestro AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Plastic Compounding Market Report Segmentation

This report forecasts revenue and volume growth at regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2019 to 2030. For this study, Grand View Research has segmented the Europe plastic compounding market report based on product, application, and country:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Automotive

-

Construction

-

Electrical & Electronics

-

Packaging

-

Consumer Goods

-

Industrial Machinery

-

Medical Devices

-

Optical Media

-

Appliances

-

Others

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Thermoplastic Vulcanizates (TPV)

-

Thermoplastic Polyolefins (TPO)

-

Polyvinyl Chloride (PVC)

-

Polystyrene (PS)

-

Polyethylene Terephthalate (PET)

-

Polybutylene Terephthalate (PBT)

-

Polyamide (PA)

-

Polycarbonate (PC)

-

Acrylonitrile Butadiene Systems (ABS)

-

Others

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Austria

-

U.K.

-

France

-

Germany

-

Switzerland

-

Czech Republic

-

Hungary

-

Frequently Asked Questions About This Report

b. The Europe plastic compounding market size was estimated at USD 14.04 billion in 2022 and is expected to reach USD 14.69 billion in 2023.

b. The Europe plastic compounding market is expected to grow at a compound annual growth rate of 6.4% from 2023 to 2030 to reach USD 22.68 billion by 2030.

b. Automotive dominated the application segment of the Europe plastic compounding market with a revenue share of over 25.0% in 2022. This is attributable to rising sales of passenger cars and light commercial vehicles in the region.

b. Some key players operating in the Europe plastic compounding market include BASF SE, Dow Chemical Co., SABIC, LyondellBasell Industries, and Covestro.

b. Key factors that are driving the market growth include increasing integration of electronics into automobiles coupled with rising demand for wearable devices among youth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.