- Home

- »

- Alcohol & Tobacco

- »

-

Europe Rum Market Size And Share, Industry Report, 2030GVR Report cover

![Europe Rum Market Size, Share & Trends Report]()

Europe Rum Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Dark & Golden Rum, White Rum, Flavored & Spiced Rum), By Distribution Channel (Off-Trade, On-Trade), By Country (Germany, UK, France, Russia, Italy), And Segment Forecasts

- Report ID: GVR-4-68040-583-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Rum Market Size & Trends

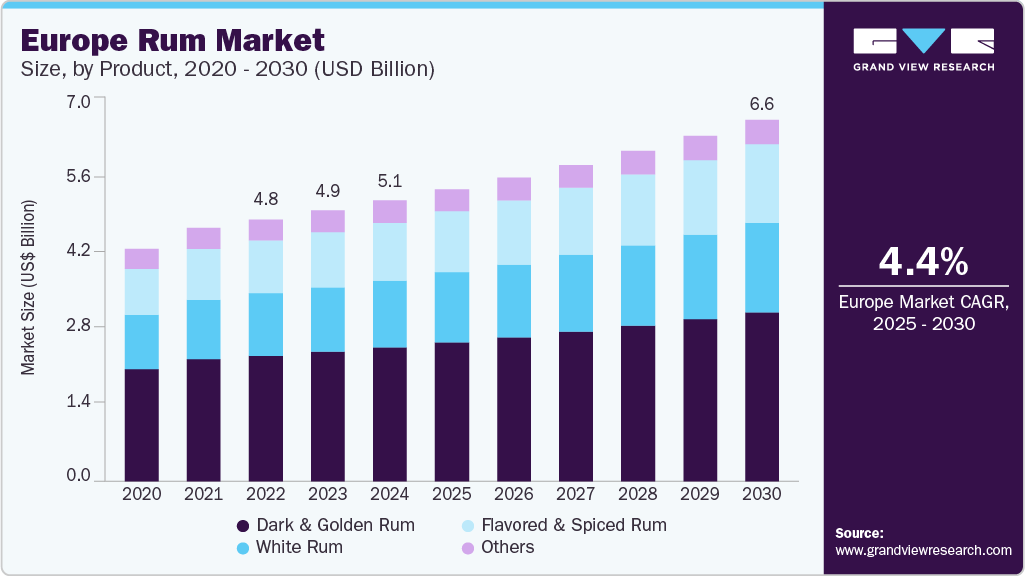

The Europe rum market size was estimated at USD 5.12 billion in 2024 and is expected to grow at a CAGR of 4.4% from 2025 to 2030. The market is driven by evolving consumer preferences toward premium and craft spirits, increased interest in cocktail culture, and a broader acceptance of dark and flavored rums among younger demographics. Rising disposable incomes, tourism recovery, and the influence of Caribbean culture and exotic branding have further contributed to demand, especially in Western European countries like the UK, Germany, and France. Additionally, innovation in product offerings-such as spiced, aged, and organic rums-has attracted a broader consumer base and supported retail expansion across both on-trade and off-trade channels.

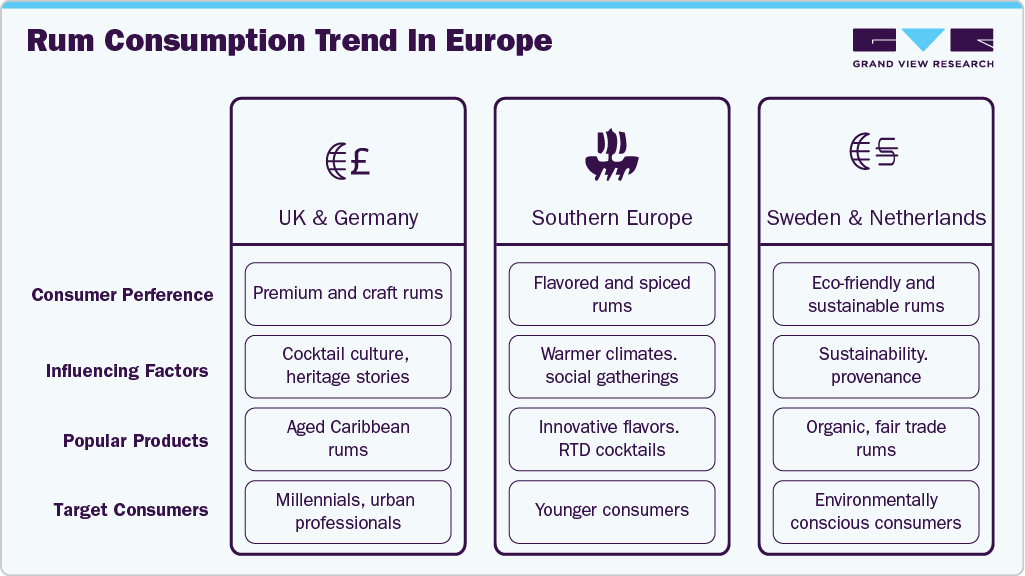

The market growth is largely fueled by shifting consumer tastes toward premiumization and craft spirits. More consumers are seeking high-quality, authentic experiences, which has boosted demand for aged and small-batch rums. For example, brands like Ron Zacapa and Mount Gay have gained popularity by offering distinctive aged rums that appeal to connoisseurs and casual drinkers alike. This trend is especially strong in countries like the UK and Germany, where cocktail culture and artisanal beverages have become mainstream, encouraging bars and retailers to expand their rum selections.

Furthermore, younger generations are increasingly drawn to flavored and spiced rums, expanding the market beyond traditional drinkers. This demographic is more adventurous and willing to experiment with innovative products, such as Bacardi’s flavored rums or Captain Morgan’s spiced varieties, which have successfully attracted new consumers through creative marketing and social media engagement. The rise of cocktail bars and mixology also supports this trend, as bartenders incorporate rum into popular cocktails like mojitos and piña coladas, making it a staple in European nightlife and casual drinking occasions.

Moreover, external factors such as the revival of tourism post-pandemic and growing interest in Caribbean culture have reinforced rum’s appeal. European travelers returning from Caribbean destinations often bring back a taste for authentic rum, while festivals and cultural events celebrating Caribbean heritage further boost local demand. Retail channels have also evolved, with supermarkets and online platforms increasingly stocking a wider variety of rum products, including organic and sustainably produced options. This diversification in product availability and consumer reach is helping to sustain the market’s steady growth across Europe.

Consumer Insights

Product Insights

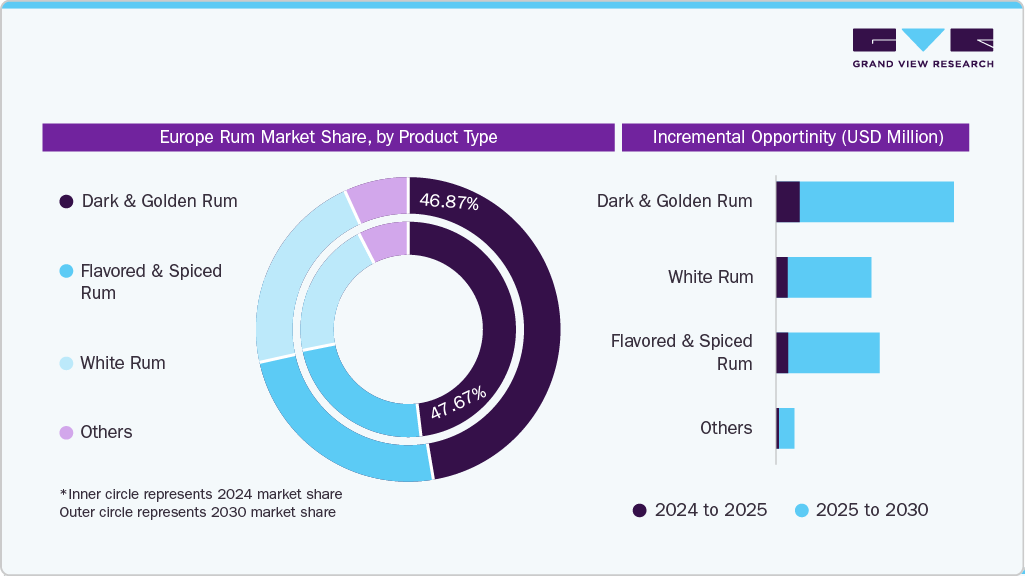

Dark and golden rum accounted for a 47.67% revenue share in 2024, due to its association with premium, complex, and aged spirits favored by more discerning consumers. These rums offer deeper, richer flavor profiles, often linked to craftsmanship and tradition, which appeal to enthusiasts and connoisseurs in mature markets like the UK and Germany. Premium brands like Ron Zacapa, Mount Gay, and Diplomatico are highly regarded for their aged offerings, and their success reflects the growing consumer preference for sipping rums and sophisticated drinking experiences, which supports the large market share of dark and golden rum in Europe.

White rum is expected to grow at a CAGR of 5.4% from 2025 to 2030, primarily owing to its versatility and appeal among younger, casual drinkers. Its lighter, smoother profile makes it ideal for popular cocktails like Mojitos and Piña Coladas, favorites in Europe’s expanding cocktail culture. Brands such as Bacardi and Havana Club have boosted white rum’s popularity by launching flavored variants and ready-to-drink options, catering to consumers seeking convenient, refreshing alcoholic beverages that fit social and outdoor occasions, especially in southern European countries and urban centers.

In April 2025, Caribbean rum brand The Duppy Share launched in Denmark through a new partnership with beverage distribution platform Bemakers. Its portfolio features Duppy Share Aged-a blend of three-year-old Jamaican rum and five-year-old Barbadian rum-a pineapple-infused spiced rum, and a 100% Jamaican white rum created in collaboration with London-born rapper, songwriter, and actor Kane ‘Kano’ Robinson.

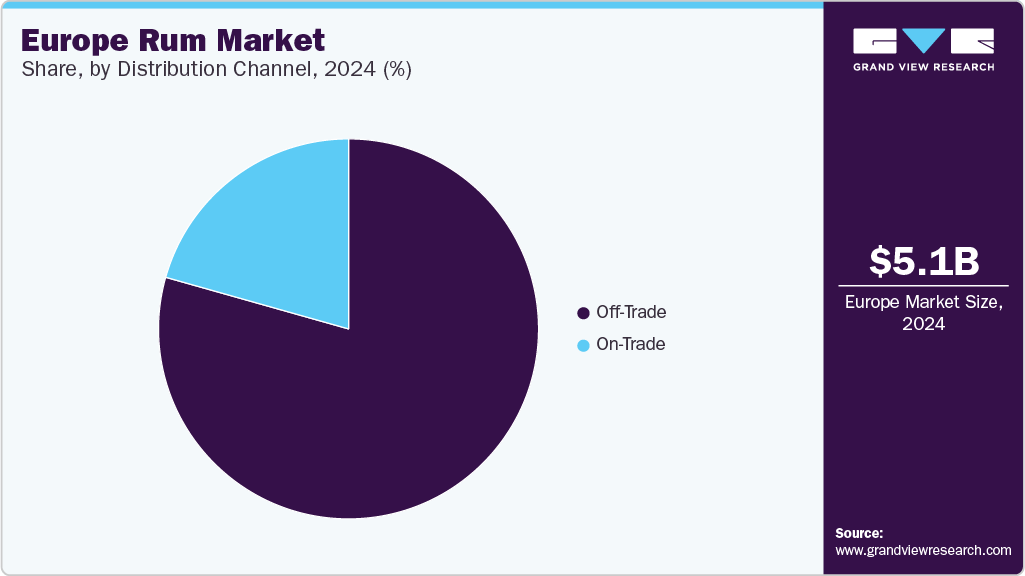

Distribution Channel Insights

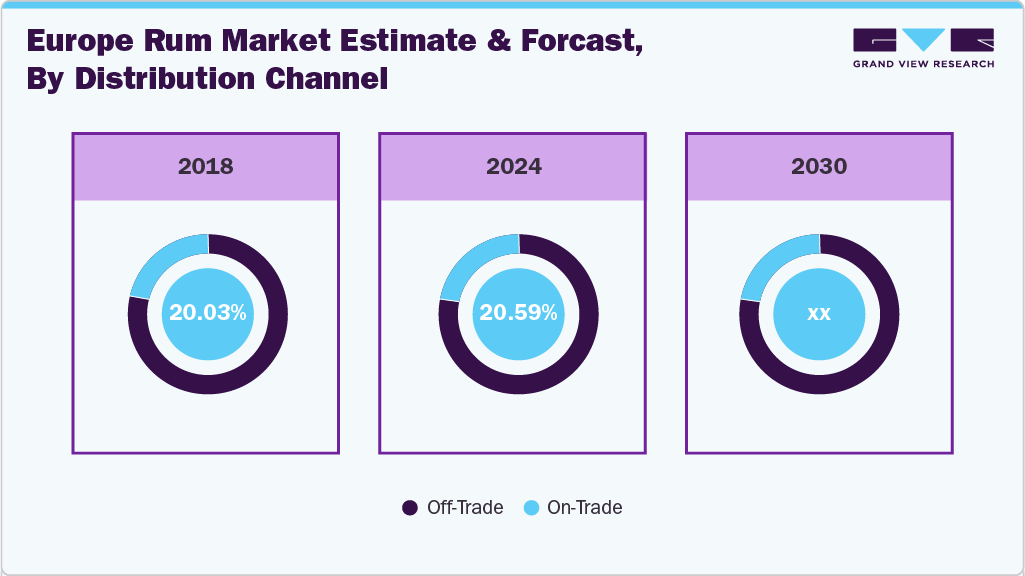

Sales of rum through the off-trade channel accounted for a share of 79.41% in 2024. European consumers prefer the convenience, cost savings, and wider variety available through supermarkets, liquor stores, and online shops. The rise of at-home drinking occasions, boosted by pandemic habits, means many people buy rum to enjoy casually or in private settings. Additionally, off-trade channels often offer promotions and bulk-buy options that appeal to budget-conscious shoppers across Europe.

Rum sales through the on-trade distribution channel are projected to grow at a CAGR of 4.9% from 2025 to 2030 due to the recovery and expansion of bars, restaurants, and nightlife scenes across major European cities. As cocktail culture flourishes, consumers seek out premium and craft rums in social and experiential settings. The resurgence of events, tasting sessions, and rum-focused bars in places like London, Paris, and Berlin is driving more demand for on-premise consumption, making the on-trade channel an increasingly important growth area.

Country Insights

Germany Rum Market Trends

The rum market in Germany accounted for 24.97% revenue share of the market and held a revenue of USD 1.28 billion in 2024. This strong position is driven by well-established cocktail culture and high demand for premium and craft rums among German consumers, who appreciate both traditional Caribbean brands like Mount Gay and innovative European craft labels. Germany’s mature on-trade scene, combined with widespread off-trade availability, supports diverse consumption occasions, from casual home drinking to sophisticated bar experiences.

In April 2025, the Mauritian rum brand Star & Key expanded its presence by entering the German market for the first time through a distribution agreement with Eggerssohn. This deal facilitates the availability of Star & Key rum in Germany.

UK Rum Market Trends

The UK rum market is anticipated to witness a CAGR of 5.1% from 2025 to 2030, fueled by a vibrant nightlife and bar culture that embraces rum-based cocktails and new product innovations. Younger consumers in the UK are increasingly exploring flavored and spiced rums, and there’s a growing interest in sustainable and craft spirits. Brands such as Diplomatico and Havana Club are popular. At the same time, the rise of rum festivals, cocktail competitions, and experiential events further drives awareness and demand, positioning the UK as a fast-growing market within Europe.

For instance, in November 2024, Caribbean-inspired rum brand Ten To One, co-owned by Trinidadian Entrepreneur Marc Farrell and R&B artist Ciara, expanded its market presence by launching in the UK through distributors Amathus and Master of Malt [1]. The UK portfolio features 700ml bottles of Ten To One Extra Proof White Rum, Aged Dark Rum, and the Five Origins Select blend.

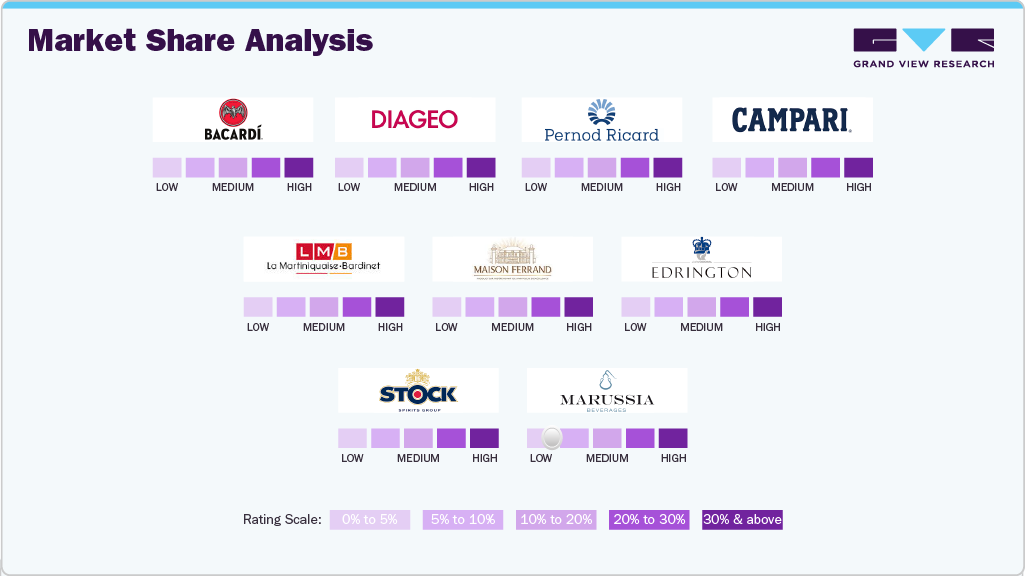

Key Europe Rum Company Insights

The European rum market is highly competitive and diverse, featuring a mix of dominant global brands alongside a flourishing community of regional and craft distillers. International heavyweights such as Bacardi, Captain Morgan, and Havana Club enjoy broad recognition and extensive distribution across Europe, supported by strong marketing efforts and long-standing consumer loyalty. However, Europe’s unique landscape also nurtures a growing number of local craft producers, such as Compagnie des Indes from France, Slyrs from Germany, and Doorly’s from the UK, who emphasize heritage, artisanal production methods, and innovative flavor profiles. These smaller distilleries are tapping into Europe’s increasing consumer demand for authenticity, premiumization, and provenance, distinguishing themselves from mass-market products.

Understanding the competitive landscape in Europe is critical for both defending existing market positions and pursuing new growth avenues. Brands that invest in expanding omnichannel distribution especially integrating traditional retail, specialty stores, and online platforms-while introducing unique product innovations such as cask-finished rums or region-specific blends are more likely to gain a competitive advantage. Strategic collaborations, limited editions, and engagement with Europe’s vibrant cocktail culture also play a pivotal role in capturing consumer interest. In this dynamic environment, success depends on a brand’s ability to balance broad market reach with distinctiveness and to respond rapidly to regional preferences and emerging trends across the continent.

Key Europe Rum Companies:

- Bacardi Limited

- Diageo plc

- Pernod Ricard

- Campari Group

- La Martiniquaise-Bardinet

- Maison Ferrand

- Edrington Group

- Stock Spirits Group

- Marussia Beverages

Recent Developments

-

In April 2025, BACARDÍ, launched passionfruit-flavored rum across European markets. This new product, BACARDÍ Passionfruit, combines the brand's signature white rum with bold passionfruit flavor, offering a sweet, tangy, and vibrant taste experience.

-

In March 2025, Wray & Nephew launched Wray’s 43, a new UK-exclusive white Jamaican rum with an ABV of 43%, designed to cater to the growing demand for flavorful, easy-to-mix spirits. This limited edition rum is a blend of unaged Jamaican white rums, featuring notes of rich fruits, charred pineapple, and molasses.

Europe Rum Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.31 billion

Revenue forecast in 2030

USD 6.58 billion

Growth rate

CAGR of 4.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, country

Country scope

Germany; UK; France; Russia; Italy

Key companies profiled

Bacardi Limited; Diageo plc; Pernod Ricard; Campari Group; La Martiniquaise-Bardinet; Maison Ferrand; Edrington Group; Stock Spirits Group; Marussia Beverages; Spiribam

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Rum Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe rum market report based on product, distribution channel, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dark & Golden Rum

-

White Rum

-

Flavored & Spiced Rum

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Off-Trade

-

On-Trade

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

UK

-

France

-

Russia

-

Italy

-

Frequently Asked Questions About This Report

b. The Europe rum market size was estimated at USD 5.12 billion in 2024 and is expected to reach USD 5.32 billion in 2025.

b. The Europe rum market is expected to grow at a compound annual growth rate (CAGR) of 4.4% from 2025 to 2030 to reach USD 6.58 billion by 2030.

b. Germany dominated the rum market with a share of 24.97% in 2024, driven by the mature on-trade scene, combined with widespread off-trade availability, supporting diverse consumption occasions, from casual home drinking to sophisticated bar experiences.

b. Some key players operating in the Europe rum market include Bacardi Limited; Diageo plc; Pernod Ricard; Campari Group; La Martiniquaise-Bardinet; Maison Ferrand; Edrington Group; Stock Spirits Group; Marussia Beverages; and Spiribam.

b. The market is driven by evolving consumer preferences toward premium and craft spirits, increased interest in cocktail culture, and a broader acceptance of dark and flavored rums among younger demographics. Rising disposable incomes, tourism recovery, and the influence of Caribbean culture and exotic branding have further contributed to demand, especially in Western European countries like the UK, Germany, and France.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.