- Home

- »

- Power Generation & Storage

- »

-

Electric Vehicle Battery Recycling Market Size ReportGVR Report cover

![Electric Vehicle Battery Recycling Market Size, Share & Trends Report]()

Electric Vehicle Battery Recycling Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Lithium-ion, Lead Acid, Others), By Source (End of life, Production Scrap), By Vehicle Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-081-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Vehicle Battery Recycling Market Summary

The global electric vehicle battery recycling market size was valued at USD 0.23 billion in 2022 and is projected to reach USD 10.45 billion by 2030, growing at a CAGR of 61.7% from 2023 to 2030. The market for electric vehicle (EV) battery recycling is advancing due to the increasing demand from EV manufacturers and government bodies to recycle the waste generated by the automotive industry.

Key Market Trends & Insights

- North America accounted for the second-largest revenue share.

- Asia Pacific accounted for the largest revenue share of 40.37% in the market for EV battery recycling in 2022.

- By type, lithium-ion accounted for the largest share of 58.36% in the type segment in 2022.

- By vehicle type, passenger cars accounted for the dominant share of 80.90% in 2022.

- By source, the production scrap segment accounted for the largest revenue share of 71.36% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 0.23 Billion

- 2030 Projected Market Size: USD 10.45 Billion

- CAGR (2023-2030): 61.7%

- Asia Pacific: Largest market in 2022

Batteries have become one of the major components of electric vehicles as they replace the traditional internal combustion engine fuel tank. Batteries used in electric vehicles have a limited life span that ranges from 5 to 15 years and must be replaced after their operational life ends. The price of raw material components is increasing as the electric vehicle production increases. This has prompted market players to invest in battery recycling technology to increase the number of rare metals recovered, such as platinum and vanadium. Increasing raw material prices have made recycling financially competitive in the market. Governments around the world are implementing new policies to promote recycling and reduce the overall carbon emissions caused by electric vehicles.

Market players are investing in recycling facilities and increasing the amount of recycled raw material in their manufacturing process. Regulatory bodies in many countries have been implementing regulations mandating that a certain portion of the manufactured battery is derived from recycled material. This is expected to boost the market growth, as companies start to invest in battery recycling infrastructure over the forecast period.

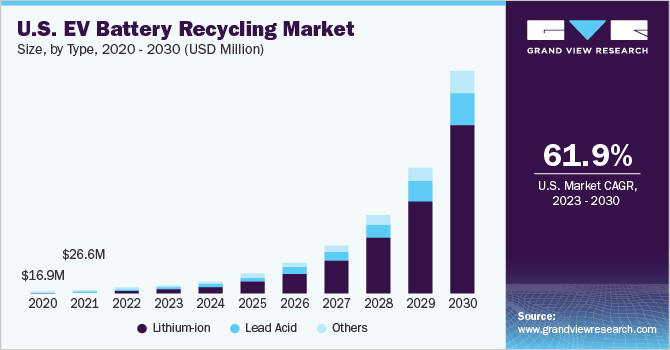

The increasing sales of electric vehicles in the U.S. owing to the formulation of supportive federal policies such as the Responsible Battery Recycling Act of 2022, California, as well as the presence of leading market players are expected to drive the demand for lithium-ion batteries in the country over the forecast period. The Responsible Battery Recycling Act of 2022, California instructs each battery retailer in the state to have a system for the collection of used rechargeable batteries for recycling and reusing purposes, as well as for their disposal.

The U.S. has emerged as a growing market for the recycling of EV lithium-ion batteries, owing to the presence of large lithium-ion recycling facilities in the country. For instance, in October 2022, Li-cycle Corp. inaugurated its new lithium-ion recycling facility with a 120,000-square feet warehousing space. This facility can process 10,000 tons of battery material obtained from electric vehicles annually. The company possesses the capacity to recycle 60,000 electric vehicle batteries across North America.

In September 2022, General Motors and LG announced a joint venture worth USD 2.5 billion to develop battery manufacturing facilities in Ohio, Tennessee, and Michigan, to be financed by the U.S. Energy Department. The increase in the establishment of battery recycling facilities in the country and the surge in the number of joint ventures among electric vehicle and battery manufacturers in the U.S. are expected to fuel the demand for battery recycling activities in the country in the coming years.

Type Insights

Lithium-ion accounted for the largest share of 58.36% in the type segment in 2022, owing to the increasing use of these batteries in electric vehicles due to their high thermal and chemical stability. This factor is anticipated to further drive their demand for EV battery recycling in the coming years. Furthermore, Chinese vendors have been using this battery in electric vehicles, owing to its properties and the easy availability of raw materials for its production in China. These factors will boost the growth of lithium-ion battery recycling over the forecast period.

Based on type, the market for EV battery recycling has been segmented into lithium-ion, lead acid, and others. Lead-acid batteries are classified as flooded and valve-regulated. These batteries are utilized for ignition in electric vehicles. Growth in the electric vehicle industry is expected to foster the requirement for lead-acid recycled batteries. The others segment includes nickel-cadmium and nickel-metal hydride, which are widely used in electric and hybrid vehicles. The growth of the electric vehicle industry is expected to fuel the demand for EV battery recycling in the coming years.

Vehicle Type Insights

Passenger cars accounted for the dominant share of 80.90% in 2022 on account of the growing demand and investment in the manufacturing of electric passenger cars.Several government-sponsored initiatives, including tax breaks, grants, and other non-financial advantages such as access to carpool lanes, are anticipated to significantly increase the demand for electric passenger cars, which will advance the market for EV battery recycling over the forecast period.

Based on the vehicle type, the market for EV battery recycling has been segmented into passenger cars, buses, vans, and others. The buses segment accounted for the second-largest share in 2022, owing to the adoption of electric vehicle technology in public transportation in several countries globally.According to the International Energy Agency (IEA), as of 2022, China dominates the electric buses market.

Other nations, including the UK, the US, India, Japan, South Korea, and some European economies, are striving to increase the proportion of electric buses in their public transportation fleets. In the years to come, demand for electric buses is anticipated to increase significantly due to ever-increasing environmental regulations. The market for electric buses and battery recycling is anticipated to grow rapidly during the forecast period.

Source Insights

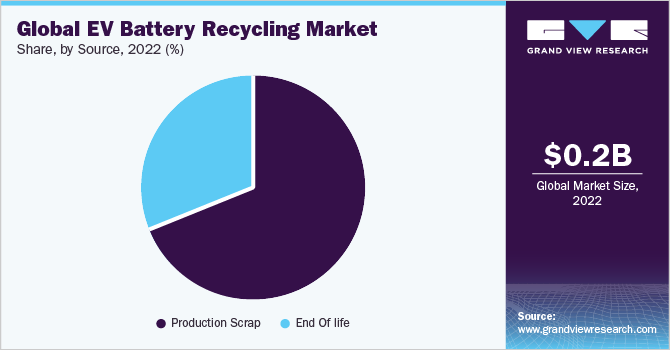

The production scrap segment accounted for the largest revenue share of 71.36% in 2022, owing to the growing transition to EV manufacturing in countries such as the U.S., China, and the UK. Most of the battery material that is still suitable for recycling comes from cells in consumer electronics products, like those found in laptops and other home appliances, as well as cell manufacturing scrap produced by defective batteries that fail quality control.

Based on source, the EV battery recycling market can be segmented into end-of-life and production scrap. The end-of-life segment is expected to grow at a stagnant rate, owing to the low rate of recycling in this area. Numerous factors contribute to this, including the storage or hoarding of batteries, their disposal without recycling, or their reuse in other applications.

Regional Insights

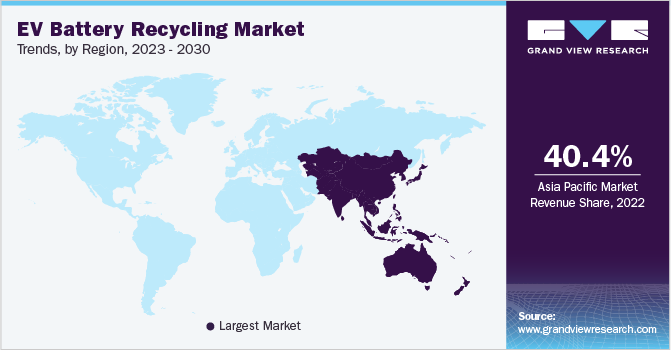

Asia Pacific accounted for the largest revenue share of 40.37% in the market for EV battery recycling in 2022.Asia Pacific is likely to witness notable market growth for recycled lithium-ion batteries over the forecast period. India and China are expected to witness substantial progress, owing to rapid developments related to the production & recycling of lithium-ion batteries and the growth of the industry.

In addition, in July 2022, LG Energy Solution and Huayou Cobalt announced their plans to set up a new joint venture for battery waste recycling in China. This is anticipated to boost the companies’ presence in the country as sustainable market players in the future. These trends are likely to have a positive impact on market growth over the coming years.

North America accounted for the second-largest revenue share, owing to the increasing sales of electric vehicles and consumer electronics in countries such as the U.S., Canada, and Mexico. Rising demand for electric vehicles owing to increasing consumer awareness about the benefits of reducing carbon emissions is expected to fuel the growth of the regional market.

Moreover, the decline in demand for lead-acid batteries owing to the implementation of regulations formulated by the U.S. Environmental Protection Agency (EPA) to prevent lead contamination of the environment, coupled with the implementation of regulations related to safe storing, disposal, and recycling of lead-acid batteries, has driven the demand for carrying out EV battery recycling activities in North America.

Manufacturers of EVs are also shifting the production mechanism towards the usage of eco-friendly materials. For instance, Ford uses bio-based and recycled materials to manufacture the external body parts of electric vehicles. On the other hand, Nissan has adopted environment-friendly materials such as old car parts, water bottles, plastic bags, and home appliances to manufacture the interior and exterior body parts of electric vehicles. The increasing use of recycled products in the automotive industry is likely to fuel the demand for EV battery recycling over the forecast period.

Key Companies & Market Share Insights

The market for EV battery recycling is highly competitive, owing to the involvement of market players in business expansion activities through collaborations and partnerships across the value chain. For instance, in January 2023, Lohum entered a strategic partnership with Mercedes Benz to recover and recycle used batteries from e-rickshaws in India. Some prominent players in the global electric vehicle battery recycling market include:

-

Battery Solutions LLC

-

Gopher Resource LLC

-

Ecobat Logistics

-

Terrapure BR Ltd.

-

East Penn Manufacturing Company

-

Retriev Technologies

-

COM2 Recycling Solutions

-

Call2Recycle

-

Exide Technologies

-

Gravita India Ltd.

Electric Vehicle Battery Recycling Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 0.36 billion

Revenue forecast in 2030

USD 10.45 billion

Growth rate

CAGR of 61.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion, volume in kilotons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, source, vehicle type, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; South Korea; India; Australia; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Battery Solutions LLC; Gopher Resource LLC; Ecobat Logistics; Terrapure BR Ltd.; East Penn Manufacturing Company; Retriev Technologies; COM2 Recycling Solutions; Call2Recycle; Exide Technologies; Gravita India Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Vehicle battery recycling Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global electric vehicle (EV) battery recycling market report based on type, source, vehicle type, and region:

-

Type Outlook (Revenue, USD Billion; Volume, Kilotons, 2018 - 2030)

-

Lithium-ion

-

Lead Acid

-

Others

-

-

Source Outlook (Revenue, USD Billion; Volume, Kilotons, 2018 - 2030)

-

End of life

-

Production Scrap

-

-

Vehicle Type Outlook (Revenue, USD Billion; Volume, Kilotons, 2018 - 2030)

-

Passenger Cars

-

Buses

-

Vans

-

Others

-

-

Regional Outlook (Revenue, USD Billion; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global electric vehicle (EV) battery recycling market size was estimated at USD 0.23 billion in 2022 and is expected to reach USD 0.36 billion in 2023.

b. The global electric vehicle (EV) battery recycling Market is expected to grow at a compound annual growth rate of 61.7% from 2023 to 2030 to reach USD 10.45 billion by 2030.

b. Asia Pacific dominated the EV battery recycling Market with a revenue share of 40.37% in 2022. This is attributable to increasing demand from major emerging economies such as China and India.

b. Some key players operating in the EV battery recycling Market include Battery solutions LLC, Gopher Resource LLC, Ecobat Logistics, Terrapure BR Ltd., East Penn Manufacturing Company, Retriev Technologies LLC, COM2 Recycling Solutions ,Call2Recycle, Exide Technologies, Gravita India Ltd., Glencore, Sunforge LLC.

b. Key factors that are driving the market growth include the increasing use of lithium-ion batteries in electric vehicles owing to their high thermal and chemical stability is projected to drive their demand for EV battery recycling in the coming years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.