- Home

- »

- Next Generation Technologies

- »

-

Everything As A Service Market Size And Share Report, 2030GVR Report cover

![Everything As A Service Market Size, Share & Trends Report]()

Everything As A Service Market (2025 - 2030) Size, Share & Trends Analysis Report By Offering (Solution, Services), By Type (IaaS, PaaS), By Organization Size, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-993-5

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Everything As A Service Market Summary

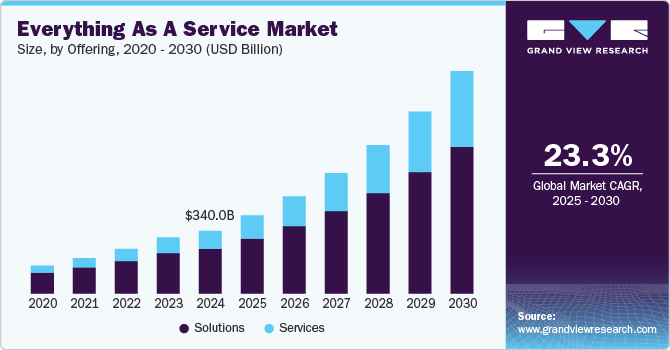

The global everything as a service market size was valued at USD 340.0 billion in 2024 and is projected to reach USD 1,208.51 billion by 2030, growing at a CAGR of 23.3% from 2025 to 2030. The emergence of the XaaS model has gained traction with the growing prominence of innovative products and services, insight-driven strategies, and digitally powered technology architecture.

Key Market Trends & Insights

- North America everything-as-a-service market (XaaS) dominated the global market with a revenue share of 33.6% in 2024.

- In January 2020, temenos announced the rollout of front-to-back banking software as a service for the U.S. market.

- In terms of offering, the solution segment is the dominant segment in the market, with a revenue share of 71.16% in 2024.

- In terms of organization size, the large enterprises segment dominated the market in 2024, with the largest revenue share.

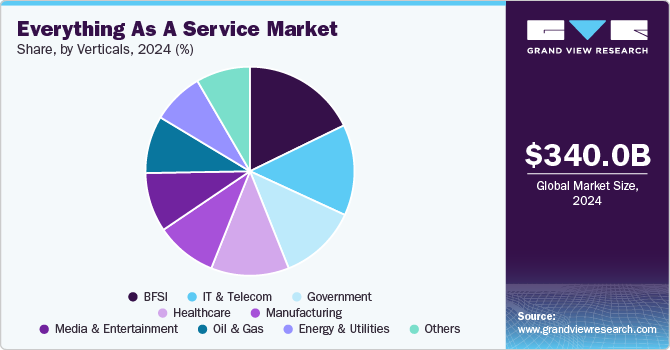

- In terms of verticals, the BFSI segment has dominated the market in 2024 with the largest revenue share.

Market Size & Forecast

- 2024 Market Size: USD 340.0 Billion

- 2030 Projected Market Size: USD 1,208.51 Billion

- CAGR (2025-2030): 23.3%

- North America: Largest market in 2024

The trend for the subscription-based model has encouraged XaaS vendors to reduce costs and streamline operations. Stakeholders expect media and entertainment, healthcare, BFSI, oil and gas, and IT and telecom to exhibit an increased inclination for XaaS models.

XaaS shows how enterprises and organizations embrace the as-a-service model and tap into growth opportunities. Anything as a service alludes to the delivery of products, services, physical assets, and equipment made available to use by paying on a usage basis. The trend for “as a service” and the rising prominence of cloud computing and remote access have augured well for leading companies gearing to boost their portfolios. A host of cloud computing models, such as PaaS (Solution as a Service), SaaS (Software as a Service), DRaaS (Disaster Recovery as a Service), IaaS (Infrastructure as a Service), and NaaS (Network as a Service) among others, has gained ground across emerging and advanced economies. For instance, security as a service has received an impetus to include encryption, anti-virus software, and authentication. End-users will likely bank on XaaS for scalability, advanced security, and cost savings.

The havoc wrecked by the COVID-19 pandemic fostered the need for a work-from-home model, boosting companies' demand for the XaaS delivery model. Besides, an upsurge in cyber incidents during the outbreak prompted companies to adopt anything as a service. The prevalence of COVID-related phishing campaigns and scams led to distributed denial of service (DDoS) attacks and ransomware. For instance, in April 2020, the OECD reported that cybercriminals mirrored Johns Hopkins University's interactive dashboard tracking coronavirus infections to spread password-stealing malware.

The pandemic triggered the need for XaaS as companies strived to become agile and augment investments in the cloud. Service-based technologies are poised to gain a foothold to contain costs, create new business processes, and enhance workforce efficiency. Moreover, the pandemic alluded to the significance of subscription models. The pandemic triggered the need for XaaS as companies strived to become agile and augment investments in the cloud. Service-based technologies are poised to gain a foothold to contain costs, create new business processes, and enhance workforce efficiency. Moreover, organizations have started using cloud-based services such as common as a services tool for video conferencing, project management, and different messaging applications. Industry players are poised to explore opportunities in XaaS models to boost customer centricity and gain a competitive edge.

Offering Insights

The solution segment is the dominant segment in the market, with a revenue share of 71.16% in 2024. Stakeholders expect XaaS solutions to remain dominant with the growing popularity of IoT Intelligent Apps, customer experience (CX), and enterprise performance management (EPM). Moreover, the trend for pay-per-use, pay-as-you-go, and pay-per-view solutions will also bode well for industry growth. These solutions will likely provide flexibility and scalability to bolster their operations and IT capabilities. Industry leaders are likely to count on XaaS on the heels of IT solution virtualization, such as network functionalities and data centers.

Furthermore, XaaS solutions are also sought to help verticals access network resources and advanced services. These products and services will help companies embrace cutting-edge technologies. With reduced CAPEX, everything as a service will remain instrumental in boosting business operations.

The services segment is anticipated to register a significant CAGR over the forecast period. The trend is mainly due to the rising footfall of cloud-based services, including video conferencing. Cloud-based video conferencing services have gained ground following the increasing footprint of tablets, smartphones, plug-and-play meeting room kits, and multi-media desk phones. Moreover, XaaS services have an impetus to foster flexibility, streamline IT operations, and access to advanced technologies. Companies are likely to adopt the model to boost cost savings amidst a surge in digital transformation.

Type Insights

The SaaS segment has dominated the market in 2024, registering a significant revenue share. The segment is expected to grow due to the increasing adoption of SaaS Solutions by the IT and telecommunication industries. Furthermore, with cloud computing gaining ground, industry participants expect Infrastructure-as-a-Service (IaaS) to provide lucrative opportunities over the next few years. Along with small and mid-size businesses, governments will likely exhibit increased traction for IaaS for strong elasticity, broad network access, on-demand self-service, and scalability. Furthermore, IaaS providers rely on edge solutions and the cloud to keep up with the demand for portability and data sovereignty requirements. With several companies planning to do away with the majority of their data centers, cloud-based IaaS is likely to gain considerable impetus in the ensuing period.

Stakeholders anticipate the Disaster recovery as a Service (DRaaS) segment to witness a robust CAGR during the assessment period. This trend is mainly attributed to an increased need for disaster recovery planning in the wake of pervasive cyberattacks, power outages, and natural disasters. Disaster recovery services could be cost-effective as organizations pay for what they use. Disaster recovery models have gained significant traction following the popularity of managed DRaaS and self-service DRaaS. For instance, managed DRaaS has garnered popularity as third parties take full responsibility for disaster recovery. Meanwhile, self-service DRaaS has become highly sought-after as the least expensive option as businesses host their infrastructure backup in a remote location.

Organization Size Insights

The large enterprises segment dominated the market in 2024, with the largest revenue share. Large enterprises are expected to bank on XaaS models to expedite innovation, reduce the cost of ownership, and reinforce flexibility. Anything as a Service has further received an uptick to expand its customer base, streamline remote-based operations, shift resources to higher-value projects, and propel operational efficiency. The model is poised to offer new revenue streams and provide customer-centric solutions. Prominently, leading organizations, such as Microsoft and Amazon, have furthered their investments in the business model. Amidst shifting customer expectations, businesses are expected to bank on the anything-as-a-service business model to streamline access to advanced technology and enable CXOs and management to emphasize RoI and other entrepreneurial opportunities.

SMEs are projected to grow at the fastest CAGR over the forecast period, mainly due to the growing footfall of cloud computing services. Small businesses are exploring opportunities in the XaaS model to streamline businesses and enhance cost efficiency. For instance, on-demand or subscription models have gained ground in minimizing costs, helping SMEs boost their cash flow. Moreover, SMEs will likely use the model to access digital services and applications through cloud computing. With the high penetration of IoT and AI, XaaS models will continue to add fillip to the industry growth.

Verticals Insights

The BFSI segment has dominated the market in 2024 with the largest revenue share. The BFSI sector is poised to boost the adoption of XaaS against the backdrop of the prominent trend for cloud computing. Moreover, banks are likely to keep up with the demand from organizations for financial advice and real-time information flow. In essence, cloud-based banking, including Paas and SaaS architectures, has received impetus across developing and developed countries.

The insurance sector has also exhibited traction for anything as a service to leverage advances in IoT, machine learning, and big data. With a surge in efficiency in payouts and claims through automation, insurers could modernize legacy technology and foster the adoption of cloud-based approaches. Moreover, the need for automation will make policy changes, quotes, and renewals easier and faster, aging well for the industry's growth.

The healthcare sector has emerged as a viable proposition following the penetration of patient-centric and data-driven medical treatment. Prominently, the onset of the COVID-19 outbreak furthered the trend for mobile-powered cloud-based systems, streamlining virtual screening and remote connection between doctors and patients. The pandemic spurred the shift from traditional IT to the XaaS model, driving Everything as a Service Market value over the next few years. Specifically, the rising footfall of IoT has leveraged health monitoring, online consultation, and doorstep medical services. For instance, in March 2022, Microsoft announced the expansion of healthcare cloud strategies with advanced capabilities and new solutions that will continue to boost clinical experiences and patient engagement.

Regional Insights

The North America everything-as-a-service market (XaaS) dominated the global market with a revenue share of 33.6% in 2024. The well-established players and start-ups have furthered their portfolios in the U.S. and Canada against the backdrop of technological advancements across vertical sectors. For instance, in January 2020, Temenos announced the rollout of front-to-back banking software as a service for the U.S. market. Besides, bullish adoption of smart devices and bring-your-own-device (BYOD) trends have augured well for North American market growth. Stakeholders have also exhibited an increased inclination for the security-as-a-service (SECaaS) Solution. The growth trajectory is mainly due to an uptick in cyberattacks and the subsequent need for encryption, authentication, and anti-virus software.

Asia Pacific Everything As A Service Market Trends

The everything-as-a-service market in Asia Pacific is slated to provide promising growth potential in the wake of the rising footprint of the IT and telecom, energy and utilities, and media and entertainment sectors. An uptick in IT solutions, including data security and data centers, has encouraged leading companies to solidify their positions in the regional market. Besides, the expanding penetration of Solution-as-a-service and infrastructure-as-a-service will complement the demands of IT professionals and business users across the Asia Pacific. With cloud spending gaining footfall across China and India, organizations are likely to bank on XaaS to boost innovations and leverage technologies.

Key Everything As A Service Company Insights

The market is characterized by strong competition, with a few major worldwide competitors owning a significant market share. The major focus is developing new products and collaborating among the key players.

-

Amazon Web Services (AWS), a subsidiary of Amazon.com, is a comprehensive cloud computing platform that offers a wide range of services designed to provide businesses with scalable and flexible solutions. Launched in 2006, AWS has grown to become a leader in cloud services, catering to millions of customers, from startups to large enterprises and government organizations. AWS offers a robust portfolio of services, including computing power, storage options, and database management, all delivered through a pay-as-you-go pricing model. Its offerings encompass Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS), allowing organizations to access computing resources on demand without the need for significant upfront investment in hardware.

-

Cisco Systems, Inc. is a global technology leader specializing in networking, cybersecurity, and collaboration solutions. Founded in 1984 and headquartered in San Jose, California, Cisco has played a pivotal role in shaping the Internet and enterprise networking landscape. The company offers a broad range of products and services designed to help organizations connect, secure, and automate their operations. Its core offerings include routers, switches, and software-defined networking solutions that facilitate reliable connectivity. Cisco also provides robust cybersecurity solutions, ensuring that organizations can protect their networks and data from evolving threats.

Key Everything As A Service Companies:

The following are the leading companies in the everything as a service market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services

- Alibaba Group

- Avaya

- Cisco Systems Inc

- Dell

- IBM

- Microsoft

- Oracle Corporation

- Rackspace

- VMware

Recent Developments

-

In September 2024, Avaya, a global provider in Enterprise CX, announced the launch of the Avaya Experience Solution (AXP) Public Cloud. Avaya’s robust and comprehensive CX Solution, trusted by large enterprises worldwide, enables customers to retain their core capabilities while pursuing flexible innovation paths through on-premises, private cloud, public cloud, or hybrid deployment models. The introduction of AXP Public Cloud in India marks the complete local availability of Avaya’s unified CX Solution.

-

In September 2024, Rackspace Technology, a prominent provider of hybrid, multicloud, and AI technology services, announced the launch of the Rackspace Rapid Migration Offer (RRMO), aimed at streamlining data center migrations to Amazon Web Services (AWS). The RRMO delivers all the essential resources an organization needs to speed up its transition to the cloud.

Everything As A Service Market Report Scope

Report Attribute

Details

Market Size Value in 2025

USD 424.73 billion

Revenue Forecast in 2030

USD 1,208.51 billion

Growth Rate

CAGR of 23.3% from 2025 to 2030

Base Year for Estimation

2023

Historical data

2018 to 2023

Forecast period

2025 to 2030

Report updated

October 2024

Quantitative Units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, and growth factors and trends

Segments Covered

Offering, type, organization size, vertical, region

Regional scope

North America, Europe, Asia Pacific, South America, Middle East & Africa

Country scope

U.S., UK, Germany, France, China, India, Japan, Brazil, Mexico

Key Companies Profiled

Microsoft, Amazon Web Services, Google, IBM, Alibaba Group, Dell, Cisco Systems Inc., Avaya, Rackspace, VMware, Oracle Corporation

Customization Scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or changes to the country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Everything As A Service Market Report Segmentation

This report offers a deep-dive analysis of industry dynamics, including revenue growth forecasts at the global, regional, and country levels. The latest industry trends in each segment from 2018 to 2030 provide a proactive strategic approach to tap into the global market. For this study, Grand View Research has segmented the global Everything as a Service Market based on offerings, type, organization size, vertical, and region.

-

Offerings Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solutions

-

Services

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

IaaS

-

PaaS

-

SaaS

-

CaaS

-

DaaS

-

SECaaS

-

DRaaS

-

Others

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large enterprises

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

IT and Telecom

-

Media and Entertainment

-

Government

-

Healthcare

-

Manufacturing

-

Oil and Gas

-

Energy and Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include the rising adoption of subscription-based pricing model to augment growth and increased demand for improved business operation and to enhance operational efficiency drives the market growth

b. The global everything as a service market size was estimated at USD 340.00 billion in 2024 and is expected to reach USD 424.73.billion in 2025

b. The global everything as a service market is expected to grow at a compound annual growth rate of 23.3% from 2025 to 2030 to reach USD 1,208.5 billion by 2030.

b. North America dominated the XaaS market with a share of around 33.6% in 2024. This is attributable due to the well-established players and start-ups have furthered their portfolios in the U.S. and Canada against the backdrop of technological advancements across end-use sectors.

b. Some key players operating in the everything as a service market include Microsoft, Amazon Web Services, Google, IBM, Alibaba Group, Dell, Cisco Systems Inc., Avaya, Rackspace, VMware, Oracle Corporation

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.