- Home

- »

- Plastics, Polymers & Resins

- »

-

Expanded Polypropylene Foam Market Size Report, 2033GVR Report cover

![Expanded Polypropylene Foam Market Size, Share & Trends Report]()

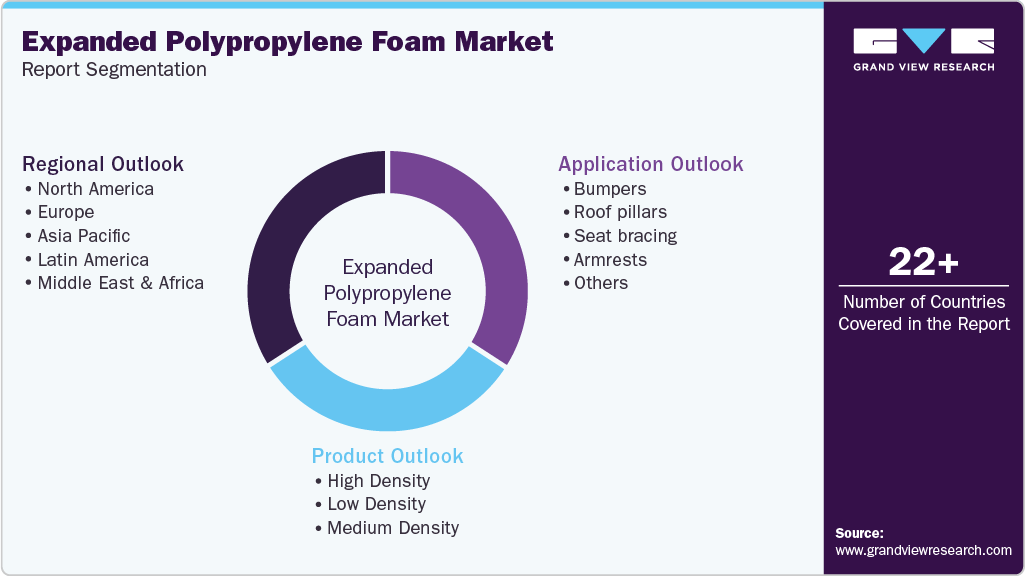

Expanded Polypropylene Foam Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (High Density, Low Density, Medium Density), By Application (Bumpers, Roof Pillars, Seat Bracing, Armrests), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-931-9

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

EPP Foam Market Summary

The global expanded polypropylene foam market size was estimated at USD 1.15 billion in 2024 and is projected to reach USD 2.55 billion by 2033, growing at a CAGR of 9.15% from 2025 to 2033. This growth is attributed to the product's usage in wide applications, including packaging, consumer goods, building and construction, and others.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, China is expected to register the highest CAGR from 2025 to 2030.

- In terms of product, high-density segment is expected to grow at a considerable CAGR of 9.34% from 2025 to 2033.

- In terms of application, bumpers segment is expected to grow at a considerable CAGR of 9.39% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 1.15 Billion

- 2033 Projected Market Size: USD 2.55 Billion

- CAGR (2025-2033): 9.15%

- Asia Pacific: Largest market in 2024

Expanded Polypropylene Foam shows a strong preference for high impact resistance for delicate goods like computer equipment and circuit boards in non-food packaging applications. Owing to consumers' increasing attention to their physical health, the usage of expanded polypropylene foam in toys and sporting products is anticipated to increase.Numerous breakthroughs and technological advancements have been made as a result of the U.S. automobile industry's shift in focus toward electricity-powered and fuel-efficient vehicles, which has led to an increase in consumer demand for high-end electric vehicles. The widespread usage of high-performance materials for auto parts as a result of the rising demand for fuel-efficient vehicles has encouraged the use of chemically stable EPP foam rather than the alternatives that are now available.

High-density EPP foam products find numerous applications in car interiors, including NVH reduction, acoustic insulation, passenger safety, energy absorption, and comfort, owing to the improved chemical especially mechanical properties of the material. The growing U.S automotive industry is expected to drive the demand for EPP foam over the forecast period.

The demand for expanded polypropylene foam in consumer goods is expected to witness significant growth over the forecast period, attributed to the growing demand for consumer electronics and household appliances in the country. In addition, the presence of key electronics manufacturers such as Apple Inc., Samsung, and IBM, among others, strengthens the demand for consumer electronics, which, in turn, is expected to drive the growth of the consumer goods industry.

Market Concentration & Characteristics

The growth stage of the EPP foam market is medium, and the pace is accelerating. The market exhibits fragmentation, with key players dominating the industry landscape. Major companies JSP, BASF SE, KANEKA CORPORATION, DS Smith, FURUKAWA ELECTRIC CO., LTD., Hanwha Group, Sonoco Products Company, Knauf Industries, Izoblok, DONGSHIN INDUSTRY INCORPORATED, Clark Foam Products Corporation, Paracoat Products Ltd., Molan-Pino South Africa, Signode Industrial Group LLC, Armacel, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and materials to meet evolving industry demands.

The EPP foam market faces increasing competition from alternative materials such as expanded polyethylene (EPE), expanded polystyrene (EPS), and polyurethane foams. These substitutes often offer comparable cushioning and insulation properties at lower costs, making them attractive for price-sensitive applications in the packaging and construction sectors. Additionally, materials like EPS are more widely available and have established recycling infrastructures, further challenging EPP's market share. The versatility and cost-effectiveness of these alternatives necessitate continuous innovation and value proposition enhancement within the EPP foam industry to maintain its competitive edge.

Regulatory frameworks are influencing the EPP foam market, particularly concerning environmental and safety standards. Governments worldwide are implementing stricter regulations on plastic usage and waste management, compelling manufacturers to adopt more sustainable practices. For instance, the European Union's directives on packaging and waste have prompted a shift towards recyclable and eco-friendly materials, impacting the production and application of EPP foams. Csompliance with such regulations requires significant investment in research and development to innovate and align products with evolving legal requirements, thereby affecting market dynamics.

Application Insights

Bumpers dominated the market and accounted for more than 42.64% of the total share, in terms of revenue, in 2024 due to the increasing utilization of EPP foam in automotive end-use. The growing demand for high-impact resistant packaging solutions for automobile interior and exterior equipment is likely to have a positive impact on the market growth.

EPP foams are used to provide a smooth and long-lasting finish, along with high resistance to chemical and UV exposure. The high resistance nature of EPP foam has led to the increased usage of EPP foam products in the construction industry for the production of various parts such as roof pillars, ceilings, and others.

Population growth and demographics that are conducive to manufacturing are two factors that are anticipated to drive the global market for EPP foam in the building sector. Products made using ABS are corrosion resistant and more durable than expanded polystyrene (EPS), and it is therefore used to manufacture food containers and other materials. These advantageous properties are anticipated to augment demand for EPP foam in various applications, including bumpers, seat bracing, roof pillars, armrests, and others.

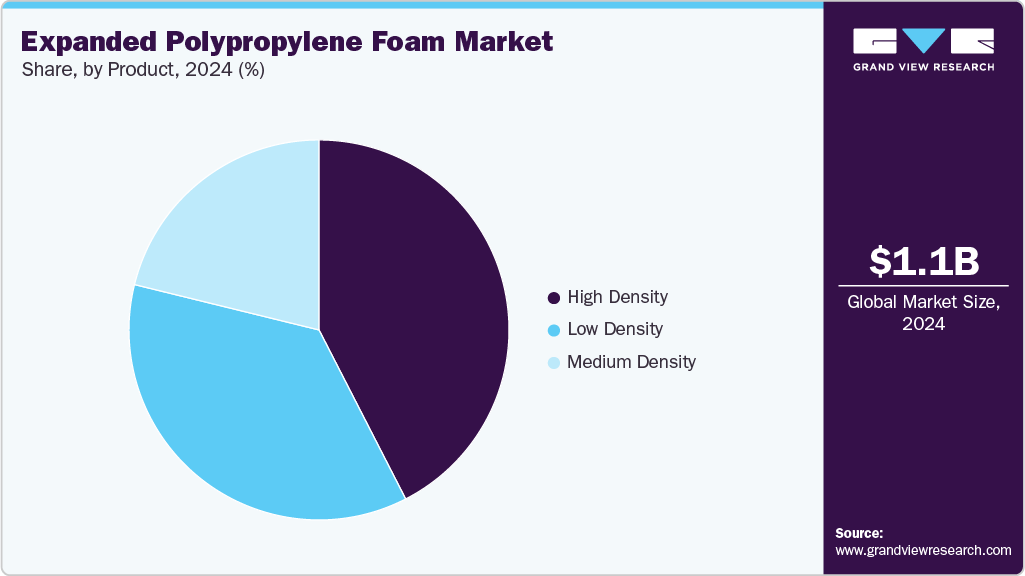

Product Insights

High-density dominated the product segment and accounted for more than 42.46% of the total share, in terms of revenue, in 2024. High density expanded polypropylene foams are used for energy management systems like bumpers, side tails and safety parts of vehicles. They are also used in industrial packaging applications due to their strength against impacts. With the increasing consumption of lightweight and premium products, the demand for high-density Expanded Polypropylene Foam is expected to rise over the forecast period.

Additionally, rising demand for electric and hybrid cars at a global level is likely to propel the use of light and chemically stable materials for auto components. Rising disposable income and changing lifestyle, in countries such as India, China, and Indonesia, are factors contributing to the increased production of automobiles, which is likely to have a positive impact on the growth of the automotive industry. The aforementioned factors are expected to drive the high-density EPP foam segment in the region over the forecast period.

Region Insights

North America expanded polypropylene foam market accounted for a revenue share of 29.44% in 2024, owing to growing end-user industries in the U.S. and Canada. Numerous breakthroughs and technological advancements have been made as a result of the U.S. automobile industry's shift in focus toward fuel-efficient vehicles and electricity-powered vehicles, which has led to an increase in consumer demand for high-end electric vehicles. The widespread usage of high-performance materials for auto parts as a result of the rising demand for fuel-efficient vehicles has encouraged the use of chemically stable EPP foam rather than the alternatives that are now available.

U.S. Expanded Polypropylene Foam Market Trends

The expanded polypropylene foam market in the U.S. is driven by the automotive sector's transition toward lightweighting initiatives to meet Corporate Average Fuel Economy (CAFE) standards and lower vehicle emissions. EPP foam is increasingly favored by domestic OEMs for its high energy absorption and structural strength in bumpers, headrests, and door panels. Additionally, the resurgence of electric vehicle (EV) production, supported by incentives from the Inflation Reduction Act, is accelerating the adoption of EPP foams in battery protection and thermal insulation applications. With rising e-commerce packaging needs and consumer demand for sustainable, recyclable materials, EPP foam is gaining strategic importance across industries.

Asia Pacific Expanded Polypropylene Foam Market Trends

The expanded polypropylene foam market in Asia Pacific dominated the global EPP foam market in 2024 and accounted for more than 41.06% of the overall revenue share. Consumer goods and electronics manufacturing industries in China, India, and Japan are experiencing rapid growth owing to rapid industrialization, availability of raw materials, and easy availability of labor. These factors are expected to propel the demand for EPP foam over the forecast period.

China expanded polypropylene foam market is driven by the consumer goods segment. China has witnessed tremendous growth in the sales of TV sets owing to rising viewership. In addition, the Chinese government has been pushing for digitalization, which will assist in the development of the TV industry as a whole. The growing demand for household electronics such as refrigerators, televisions, and microwave ovens is likely to augment the market growth of EPP foam in this region.

Europe Expanded Polypropylene Foam Market Trends

The expanded polypropylene foam market in Europe is expected to witness significant growth over the forecast period, owing to the presence of automotive giants such as MAN Trucks, Daimler AG, Volkswagen AG, and BMW AG. In addition, the rapidly emerging consumer goods industry in major economies such as Germany, France, Spain, and Russia is expected to propel the demand for expanded polypropylene foam over the analysis period.

Key Expanded Polypropylene Foam Companies Insights

Key players operating in the expanded polypropylene foam market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Expanded Polypropylene Foam Companies:

The following are the leading companies in the expanded polypropylene foam market. These companies collectively hold the largest market share and dictate industry trends.

- JSP

- BASF SE

- KANEKA CORPORATION

- DS Smith

- FURUKAWA ELECTRIC CO., LTD.

- Hanwha Group

- Sonoco Products Company

- Knauf Industries

- Izoblok

- DONGSHIN INDUSTRY INCORPORATED

- Clark Foam Products Corporation

- Paracoat Products Ltd.

- Molan-Pino South Africa

- Signode Industrial Group LLC

- Armacel

Recent Developments

-

In October 2024, Engineered Foam Products Ltd, a leading UK manufacturer of expanded foam, acquired Springvale EPS Ltd, the UK's largest expanded polystyrene (EPS) block moulder. This acquisition created the largest manufacturer of EPS and expanded polypropylene (EPP) in the UK, strengthening Engineered Foam Products' position in the construction and insulation markets.

-

In November 2024, BASF divested its Neopolen Expanded Polypropylene Foam business to Knauf Industries GmbH, a European specialist in molded EPP components. The deal included BASF’s production facility in Schwarzheide, Germany, along with products, intellectual property, customer and supplier contracts, and trademark rights.

Expanded Polypropylene Foam Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.26 billion

Revenue forecast in 2033

USD 2.55 billion

Growth rate

CAGR of 9.15% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia Brazil; Argentina; GCC; South Africa

Key companies profiled

JSP; BASF SE; KANEKA CORPORATION; DS Smith; FURUKAWA ELECTRIC CO., LTD.; Hanwha Group; Sonoco Products Company; Knauf Industries; Izoblok; DONGSHIN INDUSTRY INCORPORATED; Clark Foam Products Corporation; Paracoat Products Ltd.; Molan-Pino South Africa; Signode Industrial Group LLC; Armacel

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Expanded Polypropylene Foam Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2025 to 2033. For this study, Grand View Research has segmented the global expanded polypropylene foam market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

High Density

-

Low Density

-

Medium Density

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Bumpers

-

Roof pillars

-

Seat bracing

-

Armrests

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC Countries

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global Expanded Polypropylene Foam market size was estimated at USD 1.15 billion in 2024 and is expected to reach USD 1.27 billion in 2025.

b. The global Expanded Polypropylene Foam market is expected to grow at a compound annual growth rate of 9.15% from 2025 to 2033 to reach USD 2.55 billion by 2033.

b. High-density dominated the product segment in the global expanded polypropylene foam market and accounted for more than 42.46% of the total market share, in terms of revenue, in 2024.

b. Bumpers application dominated the global Expanded Polypropylene Foam market and accounted for more than 42.64% of the total market share, in terms of revenue, in 2024 on account of increasing utilization of EPP foam in automotive end-use.

b. Asia Pacific dominated the EPP foam market in 2024 and accounted for more than 41.06% of the overall market revenue share.

b. Some key players operating in the Expanded Polypropylene Foam market include Expanded Polypropylene Foam market include JSP, BASF SE, KANEKA CORPORATION, DS Smith, FURUKAWA ELECTRIC CO., LTD., Hanwha Group, Sonoco Products Company, Knauf Industries, Izoblok, and DONGSHIN INDUSTRY INCORPORATED.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.