- Home

- »

- Next Generation Technologies

- »

-

Facility Management Services Market, Industry Report, 2033GVR Report cover

![Facility Management Services Market Size, Share & Trends Report]()

Facility Management Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Offering Type (Outsourced, In-house), By Service Type (Hard Services, Soft Services), By Organization Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-628-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Facility Management Services Market Summary

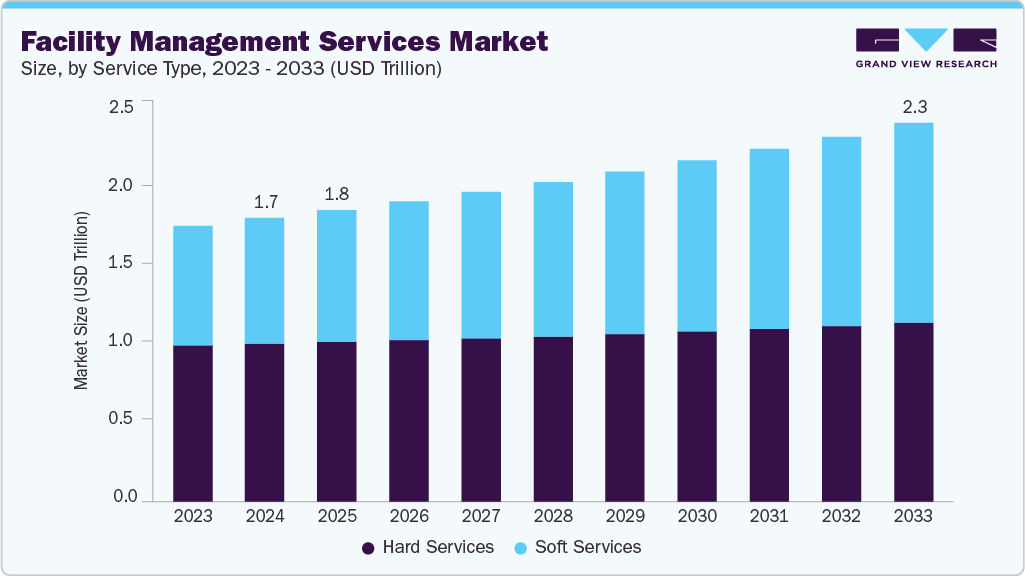

The global facility management services market size was valued at USD 1.75 trillion in 2024 and is projected to reach USD 2.33 trillion by 2033, growing at a compound annual growth rate (CAGR) of 3.3% from 2025 to 2033. The market is growing rapidly, driven by a surge in demand for integrated, tech-enabled solutions that enhance operational efficiency, workplace safety, and sustainability.

Key Market Trends & Insights

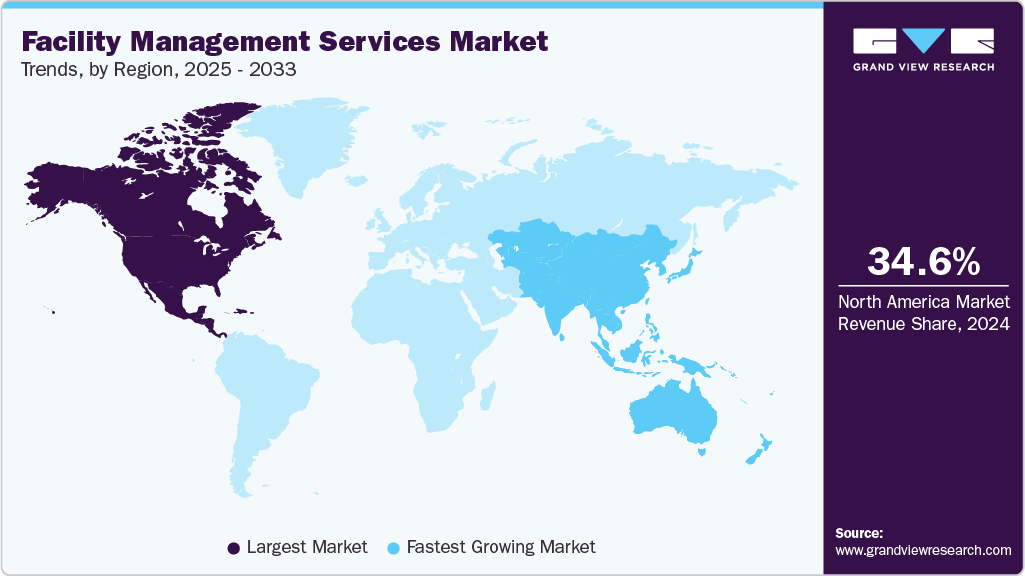

- North America dominated the global Facility management services market with the largest revenue share of 34.6% in 2024.

- The facility management services market in the U.S. led the North America market and held the largest revenue share in 2024.

- By offering type, outsourced segment led the market and held the largest revenue share of 61.5% in 2024.

- By organization size, large enterprises segment held the dominant position in the market and accounted for the leading revenue share of 66.5% in 2024.

- By end use, construction & real estate segment is expected to grow at the fastest CAGR of 5.8% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 1.75 Trillion

- 2033 Projected Market Size: USD 2.33 Trillion

- CAGR (2025-2033): 3.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As businesses and industries integrate digital technologies into their physical environments, the demand for smarter and more efficient facility operations is accelerating. Organizations are prioritizing cost-effective, predictive, and data-driven facility management solutions to enhance performance and occupant experience. The widespread adoption of IoT, automation, and AI is enabling real-time monitoring, preventive maintenance, and resource optimization. There is also a strong push toward integrated service models and sustainable practices aligned with ESG goals. These evolving needs and innovations are driving significant growth in the facility management services industry.

The growing demand for smart building technologies is transforming facility management across industries such as corporate, healthcare, and education. Organizations are investing in IoT sensors, AI-driven analytics, and automation systems to enable real-time monitoring and predictive maintenance of their assets. These technologies help reduce operational costs, improve energy efficiency, and enhance occupant comfort and safety. Cloud-based platforms are increasingly being integrated to support seamless data management and operational control. Furthermore, regulatory emphasis on sustainability is driving the adoption of energy-efficient solutions. These combined factors are expected to substantially boost the growth of the facility management services industry over the forecast period.

The growing demand for enhanced workplace experience and employee well-being is redefining the role of facility management. Organizations are incorporating wellness programs, flexible space designs, and technology-enabled amenities to foster productivity and engagement. The shift to hybrid and remote work models is increasing the need for adaptable and health-conscious facility solutions. Facility management providers are leveraging smart access systems, indoor air quality monitoring, and mobile engagement tools to improve user satisfaction. As talent retention emerges as a significant challenge, companies are making substantial investments in enhancing workplace environments. This shift in focus is expected to propel ongoing growth in the facility management services sector.

Offering Type Insights

The outsourced segment led the market and accounted for 61.5% of the global revenue in 2024. The increasing demand for cost-effective and specialized expertise is driving growth in the outsourced facility management services segment. Organizations are increasingly turning to third-party providers to manage non-core functions, enabling them to focus on strategic priorities and enhance operational efficiency. This trend is further accelerated by the adoption of integrated service models and bundled contracts, which streamline processes and improve service quality. Additionally, rising pressure to meet sustainability goals and comply with regulatory standards is prompting firms to rely on outsourcing partners with domain-specific capabilities and technology-driven solutions.

The in-house segment is predicted to register a significant CAGR of 1.2% from 2025-2033, primarily driven by the need for enhanced control, service consistency, and compliance. The in-house facility management services segment is witnessing steady growth. Organizations in sensitive sectors such as healthcare, education, and government increasingly prefer internal teams to ensure stricter oversight and tailored service delivery. This approach enables quicker decision-making, better alignment with institutional goals, and improved accountability. Moreover, the adoption of digital tools and automation is making it more feasible for in-house teams to manage complex facilities efficiently without relying on outsourced providers.

Service Type Insights

The hard services segment accounted for the largest market revenue share in 2024, owing to the increasing emphasis on infrastructure efficiency, regulatory compliance, and safety, the hard services segment in facility management is gaining significant traction. Organizations are prioritizing the upkeep of critical systems such as HVAC, MEP, fire safety, and water management to ensure operational continuity and occupant well-being. The rise of smart building solutions and IoT-enabled maintenance enables predictive servicing, reduces downtime, and lowers lifecycle costs. Furthermore, sustainability goals are pushing demand for energy-optimized systems, driving innovation and investment in advanced hard service capabilities.

The soft services segment is predicted to foresee significant growth in the forecast period. The increasing demand for enhanced workplace hygiene, employee well-being, and operational support is driving growth in the soft services segment of facility management. Organizations are emphasizing on services such as cleaning, catering, security, and front-office management to create safe, efficient, and welcoming environments. This trend is further fueled by the shift toward hybrid work models, which require flexible and responsive service delivery. Moreover, the adoption of smart technologies is optimizing soft service operations, enabling real-time monitoring, automation, and improved service quality.

Organization Size Insights

The large enterprises segment accounted for the largest market revenue share in 2024. The increasing demand for scalable, integrated, and cost-efficient facility management solutions is driving the segment growth. These organizations often operate across multiple locations and require standardized service delivery, regulatory compliance, and strategic asset management. As a result, they are investing in advanced FM technologies such as CAFM, IoT-enabled monitoring, and predictive maintenance to streamline operations. Additionally, large enterprises are increasingly partnering with global FM providers to leverage bundled services, reduce overheads, and enhance overall workplace experience.

The small & medium enterprises segment is predicted to foresee significant growth in the forecast period, owing to the rise of digital transformation and remote work models, SMEs are leveraging technology-driven facility management tools to enhance operational visibility and reduce manual oversight. Cloud-based CMMS platforms, mobile apps, and sensor-enabled systems allow small businesses to manage assets, maintenance schedules, and vendor coordination more efficiently. This has significantly reduced dependency on large-scale infrastructure and enabled data-driven decision-making. The result is improved uptime, reduced facility costs, and a more agile business environment for SMEs.

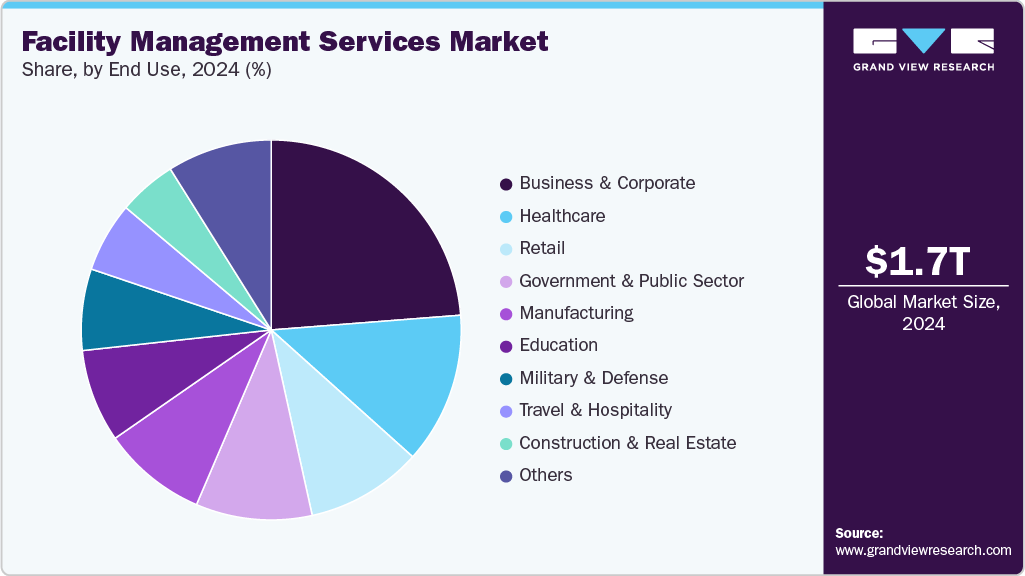

End Use Insights

The business & corporate segment accounted for the largest market revenue share in 2024, driven by rising pressure to achieve sustainability and ESG compliance, businesses are embedding green practices into their facility management strategies. Organizations are investing in energy-efficient systems, sustainable materials, and waste-reduction initiatives to meet environmental goals. Facility management providers are increasingly being selected based on their ability to deliver measurable impact in these areas. This trend is positioning FM partners as key enablers of corporate sustainability agendas.

The construction & real estate segment is projected to grow significantly over the forecast period, owing to rising expectations for tenant experience and asset performance, real estate developers are leveraging advanced facility management services to deliver premium, tech-enabled environments. From smart building systems and automated maintenance to concierge and digital support platforms, FM is central to delivering value in both residential and commercial spaces. This has led to stronger collaboration between developers and FM firms to create service-rich, responsive, and secure environments. The trend underscores FM's growing role in enhancing occupancy, retention, and real estate value.

Regional Insights

North America facility management services market dominated and accounted for 34.6% share in 2024,primarily driven by stringent government regulations focused on energy efficiency and carbon reduction, companies are adopting greener facility management solutions. The push for sustainable practices is encouraging the deployment of renewable energy sources and waste management programs in commercial and industrial buildings. Additionally, the rise of remote and hybrid work models requires flexible space management and advanced technology adoption. This regulatory and operational environment is accelerating the modernization of facility management services across the region.

U.S. Facility Management Services Market Trends

The U.S. facility management services market dominated the market with a share of over 77% in 2024.The increasing demand for outsourced facility management services is reshaping the U.S. market landscape as companies seek cost efficiencies and expert resource access. Multi-site enterprises benefit from standardized contracts and consolidated vendor relationships, improving service delivery and accountability. The rapid growth of sectors such as healthcare and retail is further boosting demand for specialized facility management solutions. This outsourcing trend is expected to remain a key market driver in the coming years.

Europe Facility Management Services Market Trends

Europe facility management services market is expected to grow at a CAGR of 2.2% from 2025 to 2033, owing to evolving workplace dynamics and flexible working patterns, there is a rising need for adaptive facility services in Europe. Facility managers are implementing modular space designs and digital booking systems to accommodate hybrid work environments. The focus on employee well-being is also driving investments in indoor environment quality and ergonomic workplace solutions. These factors collectively stimulate demand for innovative facility management offerings across the region.

Germany facility management services market is expected to grow at a significant rate in the coming years, driven by the growing demand for energy-efficient and sustainable buildings. Germany’s market is expanding steadily due to the increasing investments in green building certifications and smart infrastructure are pushing service providers are being pushed to adopt innovative FM solutions. The country also benefits from strong public-private collaboration in modernizing public facility assets.

The facility management services market in the UK is expected to grow at a significant rate in the coming years, primarily driven by the increasing outsourcing of non-core operations by corporate clients. The UK market is evolving with a strong focus on integrated service models. There is a growing preference for bundled services, especially among large enterprises and government bodies. Additionally, ESG compliance and workplace wellness are becoming central themes in FM contracts.

Asia Pacific Facility Management Services Trends

Asia Pacific facility management services market is anticipated to register the fastest CAGR of over 5.5% from 2025 to 2033. The increasing demand for sustainability and energy-efficient building solutions is gaining momentum in Asia Pacific, especially in manufacturing and hospitality sectors. Facility managers are adopting green certifications and energy monitoring systems to comply with regional environmental policies and customer expectations. Rising awareness of health and safety standards of post-pandemic further encourages the integration of advanced air filtration and cleaning services. These drivers are accelerating the adoption of modern facility management practices across the region.

China facility management services market is Owing to rapid urbanization and the massive growth in commercial real estate; China’s facility management services market is experiencing significant growth. The rise of smart cities and government-led infrastructure initiatives has created strong demand for technology-driven FM solutions. Furthermore, local and multinational companies are increasingly seeking professionalized services to meet international operational standards.

The facility management services market in Japan is rapidly driven by an aging infrastructure base and a declining workforce. Thereby, Japan is focusing on automation and robotics in facility management. The market is shifting toward predictive maintenance, AI-based monitoring, and energy management to improve operational efficiency. Demand is also growing in healthcare and elderly care facilities, prompting FM firms to offer specialized solutions.

Key Facility Management Services Company Insights

Some of the key players operating in the market include Aramark Corporation and CBRE Group Inc., and among others.

-

AramarkCorporation is a global leader in food services, facilities management, and uniform services, operating across industries like education, healthcare, and business. In the facility management space, it specializes in operational efficiency, janitorial services, and workplace experience solutions. The company is known for integrating hospitality-driven approaches into day-to-day facilities services, enhancing employee and customer satisfaction.

-

CBRE Group Inc. is one of the world’s largest commercial real estate services firms, offering integrated facilities management services globally. The company specializes in hard and soft FM services, energy optimization, and workplace strategy for large enterprises. CBRE combines technology with deep property management expertise to help clients reduce operating costs and improve building performance.

SILA Group and EFS Facilities Services Group are some of the emerging market participants in the facility management services market.

-

SILA Group is an India-based facility management company that provides integrated services across real estate, infrastructure, and corporate sectors. It focuses on smart FM solutions using IoT and analytics, especially in cleaning, security, and technical maintenance. SILA stands out for its agility and tech-enabled approach tailored for fast-growing markets in Asia.

-

EFS Facilities Services Group is a UAE-headquartered facilities management firm operating across the Middle East, Africa, South Asia, and Turkey. The company specializes in end-to-end integrated FM solutions including MEP, energy management, and specialized cleaning for corporate, retail, and government clients. EFS is gaining traction for its quality standards, regional customization, and multi-sector experience.

Key Facility Management Services Companies:

The following are the leading companies in the facility management services market. These companies collectively hold the largest market share and dictate industry trends.

- Aramark Corporation

- CBRE Group Inc.

- Jones Lang LaSalle Incorporated (JLL)

- Compass Group

- SAP SE

- SILA Group.

- EFS Facilities Services Group

- EMCOR Group, Inc.

- ISS Facility Services (ISS AS)

- Sodexo SA.

Recent Developments

-

In April 2025, ServiceChannel launched a new Partner Ecosystem designed to enhance the facility management services industry by streamlining procurement and service delivery for multi-site clients. The ecosystem features a carefully vetted network of strategic partners providing solutions in remote monitoring (IoT), field service management, asset collection, consulting, payments, and technology implementation. This initiative underscores ServiceChannel’s commitment to driving operational efficiency and fostering innovation within facilities management.

-

In February 2025, Shore Capital Partners announced a partnership with TCG Services, LLC, an asset-lite facility management provider based in El Dorado, Kansas. This collaboration aims to accelerate TCG’s growth by investing in its team, technology, and infrastructure while expanding service lines and vendor partnerships, leveraging Shore’s capital and operational expertise. Both parties are committed to maintaining TCG’s strong customer-centric culture and market reputation, with plans to drive organic growth and strategic acquisitions to solidify TCG’s position as a leading vendor-managed facility management company.

-

In January 2025, Ocus Group partnered with CBRE to manage facility operations for Ocus Medley, a flagship mixed-use development on Gurugram’s Dwarka Expressway. Spanning 4.14 acres and comprising premium offices, retail, multiplex, food courts, and entertainment zones, the project is strategically located near IGI Airport and NH-48. This collaboration aims to elevate service quality and operational efficiency, positioning the development as a world-class business and lifestyle destination.

-

In November 2024, ScottOMAN joined forces with India’s Beyond Squarefeet to launch Mall-IQ, a mall-management venture in Oman focused on retail real estate. The partnership leverages ScottOMAN’s local expertise and Beyond Squarefeet’s international consultancy experience to deliver advanced asset management, operational efficiency, and customized solutions for Omani retail properties. Mall-IQ addresses growing demand in Oman’s retail sector by enhancing tenant experience, enabling data-driven optimization, and supporting sustainable asset growth.

Facility Management Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.80 trillion

Revenue forecast in 2033

USD 2.33 trillion

Growth rate

CAGR of 3.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering type, service type, organization size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Aramark Corporation; CBRE Group Inc.; Jones Lang LaSalle Incorporated (JLL); Compass Group; SAP SE; SILA Group; EFS Facilities Services Group; EMCOR Group Inc.; ISS Facility Services (ISS AS); Sodexo SA.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Facility Management Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global facility management services market report based on offering type, service type, organization size, end use, and region.

-

Offering Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Outsourced

-

In-house

-

-

Service Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hard Services

-

MEP Services

-

HVAC Services

-

Fire Safety Systems

-

Water Management Systems

-

Energy Management Systems

-

Others

-

-

Soft Services

-

Office Support and Security Services

-

Cleaning Services

-

Catering Services

-

Other

-

-

-

Organization Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Business & Corporate

-

Healthcare

-

Retail

-

Education

-

Travel & Hospitality

-

Construction & Real Estate

-

Government & Public Sector

-

Manufacturing

-

Military & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global facility management services market size was estimated at USD 1.75 trillion in 2024 and is expected to reach USD 1.80 trillion in 2025.

b. The global facility management services market is expected to grow at a compound annual growth rate of 3.3% from 2025 to 2033 to reach USD 2.33 trillion by 2033

b. North America dominated the facility management services market with a share of 34.6% in 2024, primarily driven by stringent government regulations focused on energy efficiency and carbon reduction. Companies are adopting greener facility management solutions. The push for sustainable practices is encouraging the deployment of renewable energy sources and waste management programs in commercial and industrial buildings.

b. Some key players operating in the facility management services market include primarily driven by stringent government regulations focused on energy efficiency and carbon reduction, companies are adopting greener facility management solutions. The push for sustainable practices is encouraging the deployment of renewable energy sources and waste management programs in commercial and industrial buildings. Aramark Corporation, CBRE Group Inc., Jones Lang LaSalle Incorporated (JLL), Compass Group, SAP SE, SILA Group, EFS Facilities Services Group, EMCOR Group, Inc., ISS Facility Services (ISS AS), and Sodexo SA.

b. Key factors that are driving the market growth include rising demand for energy-efficient and sustainable building solutions, increasing adoption of integrated facility management services, and rapid urbanization coupled with infrastructure development.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.