- Home

- »

- Animal Feed and Feed Additives

- »

-

Feed Premixes Market Size & Share, Industry Report, 2030GVR Report cover

![Feed Premixes Market Size, Share & Trends Report]()

Feed Premixes Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Premixes, Basemixes, Concentrates), By Species (Pet, Poultry, Ruminant, Swine, Aquaculture, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-166-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Feed Premixes Market Summary

The global feed premixes market size was valued at USD 95.85 billion in 2024 and is projected to reach USD 158.58 billion by 2030, growing at a CAGR of 10.1% from 2025 to 2030. The growing demand for high-value nutrition, along with increased awareness towards animal health and nutrition, is driving the animal feed premixes industry.

Key Market Trends & Insights

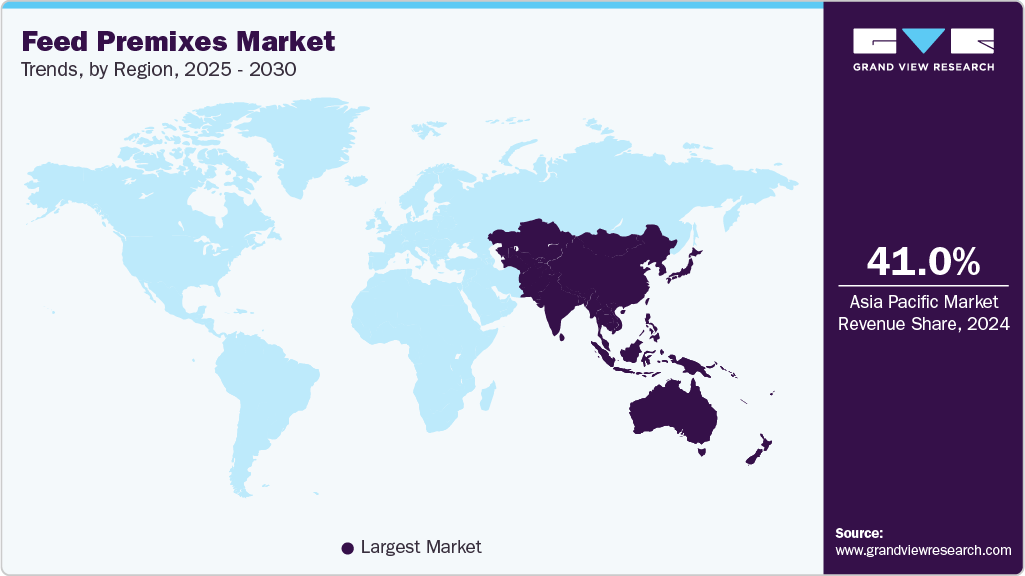

- The Asia Pacific region accounted for the largest revenue share of 41.0% in 2024.

- The U.S. feed premix market is experiencing steady growth, driven by several key factors.

- By type, the concentrate segment dominated the feed premixes market with a market share of 87.4% in 2024.

- By species, the poultry segment dominated the feed premixes market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 95.85 Billion

- 2030 Projected Market Size: USD 158.58 Billion

- CAGR (2025-2030): 10.1%

- Asia Pacific: Largest market in 2024

Further, technological advancements in the field of animal nutrition and supplements have also led to the introduction of niche and sophisticated premix products in the market. Feed premixes are carefully formulated combinations enriched with essential nutrients, including amino acids, vitamins, and other additives, aimed at improving the nutritional quality of animal feed. These premixes are essential in providing livestock with a balanced diet. They are available in different forms, including powders, granules, or liquids, and they offer exceptional flexibility in their use across different feeding systems and different animal species.In Western countries, there is a heightened awareness towards pet health, accompanied by higher spending on pet food products, including premixes. Major pet food manufacturers, including Nestlé Purina PetCare and Mars Petcare, have contributed to the widespread adoption of food premixes worldwide. Another significant contributing factor is the consistently growing rate of pet ownership in the Western region. For instance, according to an article published by the Forbes Advisor, in 2024, 66% of the U.S. households, equating to 86.9 million homes, have at least one pet. This has significantly boosted the demand for high-grade pet food and premixes across the country.

Growing demand from developing countries in South America and the Asia-Pacific region has also encouraged major companies to establish production facilities in these areas. For example, Brazil, with one of the largest cattle numbers in the world, is expected to become a major hub for companies manufacturing feed premixes, catering to the country's strong demand. Furthermore, with more than 25% of the global milk production, India has been ranked first over the past couple of decades. Consistently growing mil production capacity is creating significant growth opportunities for the feed premixes industry in the country and region. All such factors are contributing to the growth of the market in emerging regions.

Market Concentration & Characteristics

The feed premixes market growth is high, and the pace of market growth is accelerating. The feed premixes market exhibits a moderate to high degree of innovation. While core formulations are well-established, ongoing advancements in functional additives such as probiotics, enzymes, and immune enhancers continue to enhance product performance. The growing demand for antibiotic-free, organic, and sustainable animal nutrition has also spurred the development of new, eco-friendly blends. Additionally, the integration of digital tools and precision nutrition technologies is reshaping how premixes are formulated and delivered.

The feed premixes market is witnessing a moderate to high level of M&A activity, driven by industry consolidation and the strategic ambitions of key players. Leading companies such as ADM and Cargill are actively acquiring regional and specialty firms to expand their geographic presence and diversify product offerings, including recent deals such as ADM's takeover of Trouw Nutrition Indonesia. In addition to mergers, partnerships and joint ventures are increasingly used to enter new markets and scale operations. This dynamic reflects a broader push for inorganic growth to remain competitive in a rapidly evolving market.

The impact of regulations on the feed premixes market is high. The industry is highly influenced by regulatory frameworks that shape product development, formulation, and distribution. Strict guidelines on feed safety, additive usage, and quality control, especially in regions like Europe (EFSA) and North America (FDA), drive compliance-focused innovation. Bans on antibiotic growth promoters have also accelerated the shift toward natural and functional ingredients. Moreover, growing emphasis on sustainability, traceability, and animal welfare continues to raise regulatory expectations, making compliance a critical factor for market success.

Type Insights

The concentrate segment dominated the feed premixes market with a market share of 87.4% in 2024 and is expected to maintain its dominance over the forecast period. With the continuous expansion of the livestock and aquaculture sectors, farmers are seeking concentrated sources of protein, energy, vitamins, and minerals to optimize feed formulations. Rising feed costs and the need for cost-effective nutrition solutions also encourage the use of concentrates to enhance feed efficiency. Technological improvements in concentration formulations also provide better digestibility and targeted nutrition for different animal species. All such factors contribute to the large market share in the overall feed premixes industry.

The premixes segment is projected to experience the fastest CAGR during the forecast period, driven by the need for nutrient-dense feed components that improve animal growth and productivity. The rising global demand for animal protein requires efficient and nutritious feed solutions. Growing awareness of animal health and nutrition, along with stringent regulatory standards, ensures consistent quality and safety in feed formulations. Fluctuating raw material costs promote the use of premixes to optimize feed efficiency, while advancements in premix technology improve nutrient availability tailored to specific animals. Furthermore, the growth of intensive farming practices and increasing adoption in developing regions further drives the demand for premixes.

Species Insights

The poultry segment dominated the feed premixes market with the largest revenue share in 2024. The poultry industry consists of eggs, broilers, pullets, and breeders, which are among the largest consumers of feed premixes globally. The sharp rise in demand for poultry meat in developing countries has driven growth in poultry livestock numbers. Some of the growth contributing factors include the consumers’ shift towards healthier meat alternatives, low cost, easy availability, and broad acceptance across different groups, which have boosted the demand for feed premixes for the poultry segment.

The swine segment is expected to grow with a significant CAGR over the forecast period. Due to the prevalence of fatal diseases among swine, the swine segment strongly emphasizes disease prevention and antibiotic reduction. This has resulted in the use of specialized additives in livestock feed, delivered through premixes, to ensure effective administration and improved animal health. According to the First USDA estimates, global swine farming is expected to reach 115.1 million tons. This is expected to boost the demand for feed premixes for swine farming.

Regional Insights

North America Premixes Market Trends

North America holds a significant position in the global market, fueled by a large pet-owning population and considerable investment in animal nutrition. In 2024, pet industry spending in the U.S. rose to USD 150.6 billion, an increase from USD 147 billion in 2023. This expenditure covers a range of categories, including pet food, veterinary services, grooming, and other related products and services. Besides, growth in the dairy industry in the U.S., Canada, and Mexico has further encouraged the demand for feed premixes for higher milk yields.

U.S. Feed Premixes Market Trends

The U.S. feed premix market is experiencing steady growth, driven by several key factors. The rising demand for premium quality meat, especially poultry, plays a major role in driving the market, given that feed expenses make up a large share of overall production costs. Advancements in feed formulation technologies, such as the incorporation of probiotics and natural additives, are enhancing feed efficiency and sustainability. Additionally, the growing emphasis on animal health and nutrition, coupled with stringent regulatory standards, is propelling the demand for balanced and fortified feed solutions.

Europe Feed Premixes Market Trends

Europe’s feed premixes market is experiencing steady growth, driven by rising demand for meat, dairy, and aquaculture products. Farm modernization and the need for precise nutrition are reinforced by strict EU regulations on feed quality and safety, encouraging the adoption of specialized premix solutions. Growing consumer preference for natural, organic, and antibiotic-free animal products is also fueling the shift toward sustainable, eco-friendly formulations. Investments in R&D, especially in functional additives like probiotics and enzymes, are enhancing animal health and productivity. Moreover, digital technologies and precision feeding are being increasingly implemented to boost efficiency and support environmental goals.

Asia Pacific Feed Premixes Market Trends

The Asia Pacific region accounted for the largest revenue share of 41.0% in 2024. The large livestock population in countries including China, India, Bangladesh, and others in the region primarily drives this growth. Additionally, the area is home to some of the top animal feed producers, with China leading the way, and countries such as Japan, Indonesia, and Thailand also possessing strong feed manufacturing capacities. According to Alltech's 2024 Agri-Food Outlook, Asia-Pacific led global feed production growth in 2023, increasing by 6.54 million metric tons (MMT) to a total of 475.33 MMT, marking a 1.4% rise. This growth was primarily driven by the ruminant sectors, which offset setbacks in the aquaculture sector. All such factors are contributing to the high market share of the region in the global feed premixes industry.

China Feed Premixes Market Trends

China's feed premixes market is rapidly expanding, driven by rising demand for animal protein, especially from pork, poultry, and dairy sectors. Government initiatives promoting modern, efficient, and sustainable farming practices have further boosted the adoption of high-performance premix solutions. Technological advancements in feed formulation, combined with consumer shifts toward natural and antibiotic-free products, are also propelling growth. Additionally, global feed ingredient price volatility has encouraged producers to optimize formulations for cost-efficiency. As a result, China remains a key growth engine in the Asia-Pacific premix market.

Key Feed Premixes Company Insights

Some of the key companies in the feed premixes market include Cargill Inc., ADM, DLG, ForFramers, Danish Agro, and others. Organizations have been tactically implementing various expansion plans, including mergers and acquisitions, strengthening of online presence, production enhancement, and new product launches to gain a competitive advantage.

-

Cargill Inc. provides products and services across agriculture, food, animal nutrition, bioindustrials, and risk management. Key business segments include grain trading, meat and poultry processing, animal feed and nutrition, and food ingredients. Cargill plays a critical role in the global food supply chain, connecting farmers with markets and delivering solutions focused on sustainability, efficiency, and food security.

-

Archer Daniels Midland Company (ADM) is a leading global player in the feed premix market, offering a comprehensive range of nutritional solutions for livestock, poultry, and aquaculture. The company operates a vast network of facilities worldwide, including state-of-the-art premix plants in key regions such as North America, Europe, and Asia.

Key Feed Premixes Companies:

The following are the leading companies in the feed premixes market. These companies collectively hold the largest market share and dictate industry trends.

- Cargill, Inc.

- ADM

- DLG

- ForFramers

- Danish Agro

- BASF SE

- Land O'Lakes Inc.

- Godrej Agrovet Limited

- dsm-firmenich

- InVivo Group

Recent Developments

-

In November 2024, Cargill launched TruPet, a highly concentrated postbiotic ingredient aimed at enhancing gut health and immunity in pets. Honored with the Pet Food Innovation Award at Fi Europe 2024, TruPet provides benefits such as better digestive health and stronger immune function. It maintains its effectiveness through advanced pet food processing techniques such as extrusion and retort.

-

In August 2024, ForFarmers acquired Piast, a Polish feed producer, enhanced its presence in the growing Polish market. Additionally, the company announced the intended acquisition of Van Triest Veevoeders, a Dutch company specializing in co-products, aiming to strengthen its position in sustainable feed solutions.

-

In December 2023, ADM acquired PT Trouw Nutrition Indonesia, a leading premix manufacturer and a subsidiary of Nutreco. This acquisition includes two state-of-the-art premix production facilities located in Pasuruan (Surabaya) and Cibitung (Jakarta), along with associated laboratories, warehouses, and offices across Indonesia. This move aims to bolster ADM's production capabilities, enabling the company to meet the rising demand for protein and expand its product portfolio in the Southeast Asian market.

Feed Premixes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 98.17 billion

Revenue forecast in 2030

USD 158.58 billion

Growth rate

CAGR of 10.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2025 to 2030

Report coverage

Volume, Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, species, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina, Saudi Arabia, South Africa.

Key companies profiled

Cargill, Inc.; ADM; DLG; ForFramers; Danish Agro; BASF SE; Land O'Lakes Inc.; Godrej Agrovet Limited; dsm-firmenich; InVivo Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Feed Premixes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global feed premixes market report based on type, species, and region.

-

Type Outlook (Volume, Kiloton, Revenue, USD Million, 2018 - 2030)

-

Premixes

-

Basemixes

-

Concentrates

-

-

Species Outlook (Volume, Kiloton, Revenue, USD Million, 2018 - 2030)

-

Pet

-

Poultry

-

Ruminant

-

Swine

-

Aquaculture

-

Others

-

-

Regional Outlook (Volume, Kiloton, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.