- Home

- »

- Advanced Interior Materials

- »

-

Ferrite Magnet Market Size And Share, Industry Report 2033GVR Report cover

![Ferrite Magnet Market Size, Share & Trends Report]()

Ferrite Magnet Market (2025 - 2033) Size, Share & Trends Analysis Report, By Application (Automotive, Consumer Goods & Electronics, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-826-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ferrite Magnet Market Summary

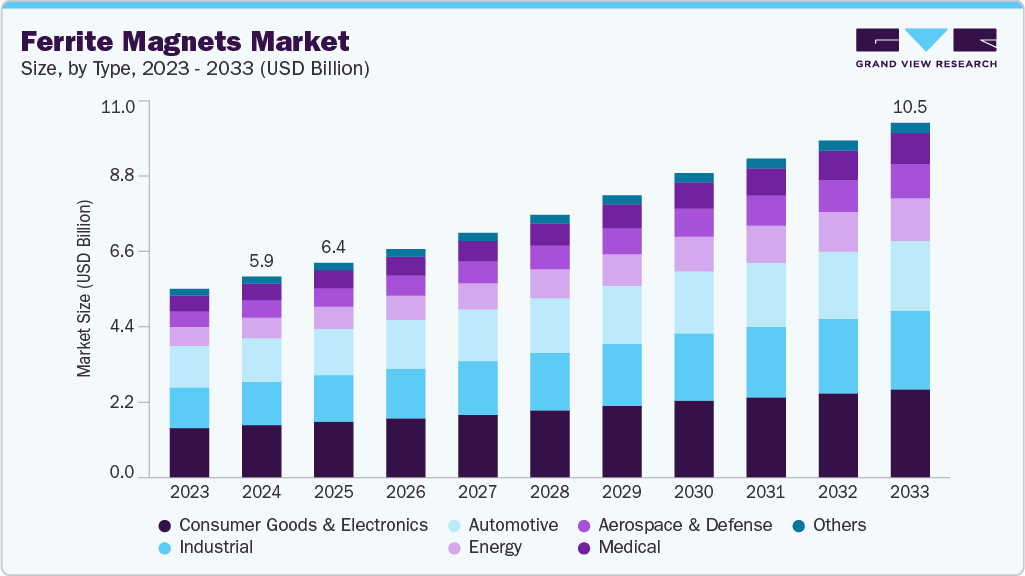

The global ferrite magnet market size was estimated at USD 5.96 billion in 2024 and is projected to reach USD 10.52 billion by 2033, growing at a CAGR of 6.5% from 2025 to 2033. The increasing demand for cost-effective, high-performance permanent magnets across automotive, consumer electronics, and industrial machinery applications is a significant factor driving market growth.

Key Market Trends & Insights

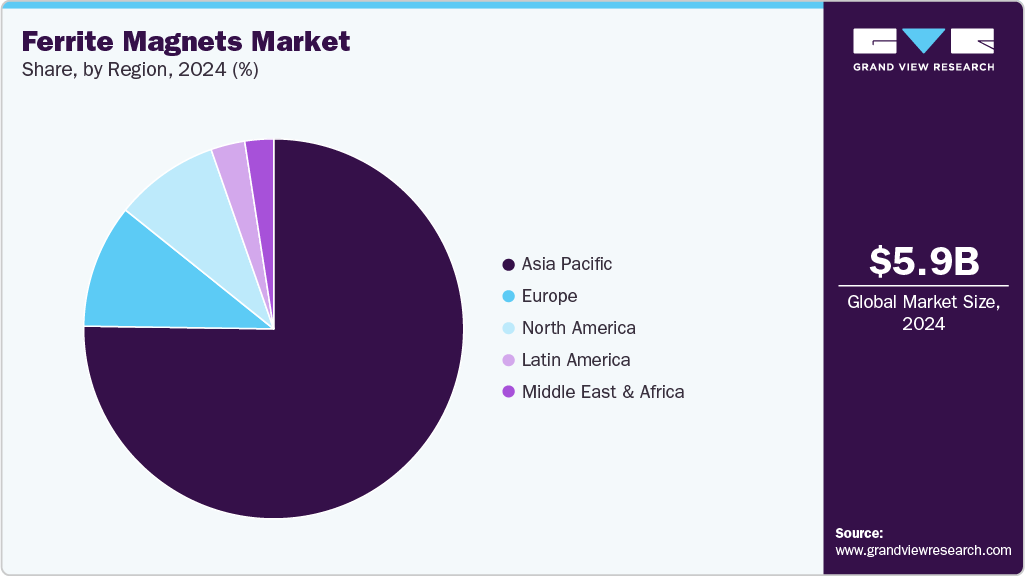

- Asia Pacific dominated the ferrite magnets market with a revenue share of over 75.23% in 2024.

- The ferrite magnets market in China is the unquestioned leader in the due to its enormous ceramic-magnet manufacturing infrastructure and vertically integrated supply chain for iron-oxide-based materials.

- In 2024, the consumer goods & electronics segment held the largest share, over 26.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.96 Billion

- 2033 Projected Market Size: USD 10.52 Billion

- CAGR (2025-2033): 6.5%

- Asia Pacific: Largest market in 2024

Ferrite magnets continue to gain preference due to their strong magnetic properties, excellent corrosion resistance, and lower production costs compared to rare-earth magnets, making them well-suited for mass-production environments.Sustainability has emerged as a significant catalyst for the growth of the ferrite magnets industry, as industries increasingly shift toward environmentally responsible materials. Unlike rare-earth magnets, which rely on resource-intensive mining and processing, ferrite magnets are produced using abundant raw materials such as iron oxide and strontium carbonate, resulting in a lower environmental impact and reduced supply-chain risks. Their long service life, corrosion resistance, and recyclability further strengthen their appeal in applications where durability and circular economy principles are prioritized. As governments and corporations intensify efforts to decarbonize industrial operations and improve energy efficiency, ferrite magnets are steadily becoming a preferred alternative for high-volume applications in electric motors, appliances, and power tools.

On the technology front, ongoing advancements in material science and manufacturing techniques are significantly enhancing the performance potential of ferrite magnets. Innovations in powder metallurgy, grain boundary optimization, and sintering processes have led to higher magnetic anisotropy and improved heat resistance, enabling ferrite magnets to penetrate more demanding applications that were previously dominated by neodymium-based magnets. The integration of automation and digital monitoring in production lines is also improving dimensional precision and consistency, reducing defect rates and enabling mass customization for OEMs. With rapid progress in electric drivetrain engineering, robotics, and innovative consumer devices, technology-driven improvements are expected to expand the application scope of ferrite magnets over the next decade.

Drivers, Opportunities & Restraints

Strong manufacturing-side advancements and stable material economics are driving the ferrite magnets industry. In 2025, researchers demonstrated that applying the first-order reversal curve (FORC) technique enhances characterization of ferrite magnetic properties, enabling tighter quality control and improving industrial reliability. In the same year, a study on hexaferrite-type materials reaffirmed that strontium ferrite remains the largest magnet category by volume globally, supported by its low material cost, high corrosion resistance, and long operating life. In addition, rising vulnerabilities in global rare-earth supply chains have prompted OEMs to diversify into materials that are abundant and geopolitically secure, thereby reinforcing demand for ferrites in automotive components, appliances, and industrial motors.

Recent technological developments have created meaningful headroom for performance improvements in ferrite magnets. In 2025, research teams successfully developed a cold-sintering process for strontium ferrite, achieving extremely high densification while reducing energy consumption during production, indicating potential for cheaper and more environmentally efficient mass manufacturing. At the same time, export restrictions and geopolitical tensions surrounding rare-earth materials have compelled manufacturers of motors, electronics, and EV components to accelerate evaluation of rare-earth-free alternatives, giving ferrite magnets renewed consideration in product redesign. These factors collectively open opportunities for ferrite magnets to enter higher-value application segments that were historically dominated by neodymium-based solutions.

Despite progress, ferrite magnets still face limitations that constrain their competitiveness. A 2025 engineering analysis on permanent-magnet motors for light electric vehicles found that ferrite magnets deliver significantly lower magnetic flux and energy products than rare-earth magnets, making them unsuitable for many compact or high-power-density motor platforms. Although new manufacturing processes, such as cold sintering, are promising, they are still at the R&D or pilot adoption stage, meaning industrial scaling and cost competitiveness have not yet been fully realized. In addition, beyond direct competition from rare-earth magnets, the growing industry pivot toward magnet-free motor architectures, such as synchronous reluctance motors in the EV sector, poses a structural risk because it reduces total demand for permanent magnets, including ferrites.

Application Insights & Trends

The consumer goods & electronics segment led the market with the largest revenue share of 26.2% in 2024, as continues to hold the leading position, surpassing all other areas of demand. Its dominance is supported by the widespread integration of ferrite materials into everyday electronic products ranging from personal gadgets and audio systems to household appliances and IT peripherals. This space benefits from the high-volume nature of electronics manufacturing, rapid product refresh cycles, and strong consumption patterns across both developed and emerging markets. In addition, manufacturers favor ferrites for their cost-effectiveness, magnetic stability, and suitability for large-scale production, which helps this segment retain its leadership even as other sectors gradually expand.

The other segment is anticipated to grow at the fastest CAGR during the forecast period. The segment is expanding but comparatively smaller portion of ferrite magnet demand, driven by applications outside the mainstream industrial and consumer spectrum. This category includes toys, smart wearables, fitness equipment, packaging mechanisms, musical instruments, and emerging IoT-enabled lifestyle products that increasingly rely on compact magnetic components for motion, attachment, locking, and sensing functionalities. Growth is supported by designers and product developers who prefer ferrites for their safety, corrosion resistance, and stable magnetic properties, which do not depend on high-cost rare earth metals. As inventive product categories continue to scale, especially in interactive consumer entertainment, smart home accessories, and hobbyist DIY equipment, the contribution of this segment is gradually strengthening, adding new layers of long-tail demand to the ferrite magnets industry.

Regional Insights

The ferrite magnets market in North America is driven by the rising demand for electric drivetrain components, HVAC motors, and renewable energy hardware. Automotive suppliers and appliance manufacturers are increasingly exploring ferrite magnets as a cost-efficient option to reduce reliance on rare-earth materials, especially as EV platforms expand. The region has also seen growing investment in localized magnetic-component manufacturing to strengthen supply chain resilience, which is encouraging the greater adoption of ferrites in motors, pumps, loudspeakers, and industrial automation equipment.

U.S. Ferrite Magnet Market Trends

The ferrite magnets market in the U.S. remains the largest consumer in North America due to the scale of its automotive, home appliance, and consumer electronics industries. Demand has been robust from manufacturers of small motors, compressors, ventilation systems, and audio components, where high magnetic performance is not the primary requirement, but durability, temperature stability, and cost efficiency are. In addition, federal initiatives encouraging the reshoring of component manufacturing and reducing dependence on imported rare-earth materials have increased OEM interest in ferrite-based magnet solutions.

Asia Pacific Ferrite Magnet Market Trends

Asia Pacific dominated the global ferrite magnet market with the largest revenue share of 75.23% in 2024, due to its vast electronics, home appliance, and automotive manufacturing base. The region benefits from large-scale ceramic material processing, an extensive supply of iron-oxide raw materials, and a high demand for cost-efficient magnets across mass-market products. Ferrite magnets are widely used in motors for refrigerators, washing machines, fans, air conditioners, speakers, water pumps, and EV auxiliary systems, all sectors that have been rapidly expanding across the Asia Pacific over the last few years, ensuring strong and steady demand.

The ferrite magnet market in China is the unquestioned leader in the due to its enormous ceramic-magnet manufacturing infrastructure and vertically integrated supply chain for iron-oxide-based materials. The country produces ferrite magnets across the entire value chain, from raw material calcination to anisotropic sintered ferrite assemblies for motors and electronics, enabling unmatched scale and very low unit manufacturing costs. China’s leadership is reinforced by its role as the global center of home-appliance and consumer-electronics production, both of which are major users of ferrite magnets.

Europe Ferrite Magnet Market Trends

The ferrite magnets market in Europe demand is increasing gradually as industries seek cleaner, more cost-efficient, and sustainable material alternatives for motors and energy-efficient appliances. The region’s industrial-automation and machinery manufacturers have continued to integrate ferrite magnets into pumps, conveyors, and HVAC systems, where corrosion resistance and thermal stability are favored over maximum magnetic strength. At the same time, EV suppliers and Tier 1 automotive component manufacturers are evaluating ferrites for specific motor platforms to reduce their exposure to volatile rare-earth supply chains.

Key Ferrite Magnet Company Insights

Some of the key players operating in the market include TDK Corporation, Arnold Magnetic Technologies, Proterial, Ltd., and others.

-

TDK Corporation, founded in 1935 in Japan, operates as a leading global manufacturer of electronic components and magnetic materials, including ferrite magnets and cores. The company supplies ferrite magnets for automotive, consumer electronics, industrial, and energy applications, focusing on cost-effective, thermally stable, and corrosion-resistant solutions. TDK leverages advanced ceramic processing, precision manufacturing, and rigorous quality control systems to deliver reliable magnetic components for high-volume and specialized applications worldwide.

-

Arnold Magnetic Technologies, established in 1923 in the United States, functions as a diversified supplier of permanent magnets, soft magnetic materials, and precision assemblies. The company produces ferrite magnets used in automotive, industrial, medical, and aerospace systems, offering both standard and custom-designed solutions. Arnold integrates automated manufacturing, advanced material science, and assembly expertise to provide high-performance magnets and assemblies for industrial and technological applications globally.

-

Proterial Ltd., headquartered in Japan, specializes in the production of permanent magnets, ferrite materials, and related magnetic components for industrial, automotive, and consumer electronics markets. The company delivers high-quality ferrite magnets optimized for performance, durability, and cost efficiency. Proterial employs state-of-the-art sintering techniques, precision engineering, and strict quality management to support large-scale manufacturing and specialized applications across Asia, Europe, and North America.

Key Ferrite Magnet Companies:

The following are the leading companies in the ferrite magnet market. These companies collectively hold the largest market share and dictate industry trends.

- Arnold Magnetic Technologies

- Electron Energy Corporation (EEC)

- Magengine Co., Ltd.

- Ningbo Yunsheng Co., Ltd.

- Proterial Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Sinosteel New Materials

- TDK Corporation

- Tianshui Hengtong Group

- XHMAG

Recent Developments

-

In March 2025, TDK Corporation announced the expansion of its ferrite magnet production line at its Japan facility to meet growing demand from the automotive and consumer electronics sectors. The upgrade features advanced sintering equipment and automated quality inspection systems, designed to enhance magnetic consistency and reduce production cycle times. The company highlighted that the expansion would improve its ability to supply high-volume orders while maintaining stable product performance for temperature-sensitive and high-reliability applications.

-

In January 2025, Arnold Magnetic Technologies unveiled a new precision ferrite assembly line at its U.S. headquarters aimed at increasing output for industrial automation and medical device markets. The project incorporates real-time monitoring and robotic handling systems to maintain dimensional accuracy and reduce defect rates. Arnold stated that the new line will strengthen operational flexibility and accelerate delivery times for large-scale industrial and custom magnet orders.

-

In February 2025, Proterial Ltd completed the modernization of its ferrite magnet manufacturing process at its Japanese plant to enhance energy efficiency and reduce environmental impact. The upgrade features optimized kiln controls, advanced material handling, and automated inspection tools to ensure consistent magnetic properties. Proterial indicated that the improvements will support rising global demand, particularly for automotive motors and electronics components, while maintaining compliance with evolving sustainability standards.

Ferrite Magnet Market Report Scope

Report Attribute

Details

Market Definition

The market size represents the apparent demand value of ferrite magnets in different applications.

Market size value in 2025

USD 6.36 billion

Revenue forecast in 2033

USD 10.52 billion

Growth rate

CAGR of 6.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Russia; China; India; Japan; Australia; Brazil; South Africa; Iran

Key companies profiled

Arnold Magnetic Technologies; Electron Energy Corporation (EEC); Magengine Co., Ltd.; Ningbo Yunsheng Co., Ltd.; Proterial, Ltd.; Shin-Etsu Chemical Co., Ltd.; Sinosteel New Materials; TDK Corporation; Tianshui Hengtong Group; XHMAG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ferrite Magnet Market Report Segmentation

This report forecasts global, country, and regional revenue growth and analyzes the latest trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global ferrite magnet market report based on the application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Consumer Goods & Electronics

-

Industrial

-

Medical

-

Energy

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Iran

-

-

Frequently Asked Questions About This Report

b. The global ferrite magnets market size was estimated at USD 5.96 billion in 2024 and is expected to reach USD 6.36 billion in 2025.

b. The global ferrite magnets market is expected to grow at a compound annual growth rate of 6.5% from 2025 to 2033, reaching USD 10.52 billion by 2033.

b. In 2024, the consumer goods & electronics segment held the largest share, over 26.0% of the ferrite magnets market.

b. Some of the key vendors in the global ferrite magnets market include Arnold Magnetic Technologies, Electron Energy Corporation (EEC), Magengine Co., Ltd., Ningbo Yunsheng Co., Ltd., Proterial, Ltd., Shin-Etsu Chemical Co., Ltd., Sinosteel New Materials, TDK Corporation, Tianshui Hengtong Group, XHMAG, and others.

b. The global ferrite magnets market is driven by a combination of performance, cost efficiency, and expanding end-use innovations. Manufacturers across various industries, including electronics, automotive, energy, and industrial systems, increasingly rely on ferrite magnets due to their superior thermal stability, excellent corrosion resistance, and high durability in harsh operating environments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.