- Home

- »

- Advanced Interior Materials

- »

-

Permanent Magnets Market Size & Share Report, 2030GVR Report cover

![Permanent Magnets Market Size, Share & Trends Report]()

Permanent Magnets Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Ferrite, NdFeB), By Application (Consumer Goods & Electronics, Energy), By Region (Europe, Asia Pacific), And Segment Forecasts

- Report ID: 978-1-68038-058-3

- Number of Report Pages: 117

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Permanent Magnets Market Summary

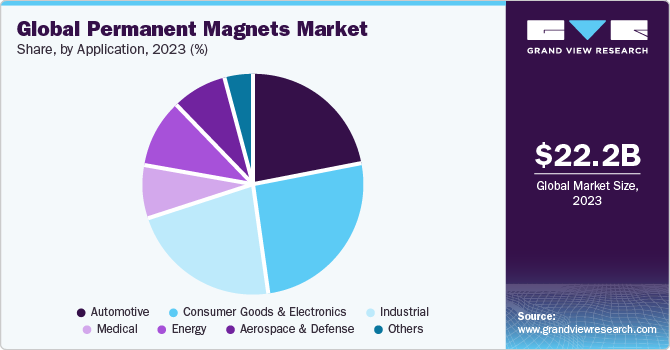

The global permanent magnets market size was estimated at USD 22.18 billion in 2023 and is projected to reach USD 39.71 billion by 2030, growing at a CAGR of 8.7% from 2024 to 2030. The rising prominence of renewable energy sources, such as wind and solar, is anticipated to positively aid the market growth over the forecast period.

Key Market Trends & Insights

- Asia Pacific accounted for the largest revenue share of nearly 75.0% in 2023.

- By material, the ferrite material segment dominated the market in 2023 and accounted for the largest revenue share of about 36.0%.

- By application, the consumer goods & electronics accounted for the largest revenue share of about 26.0% and emerged as the leading application segment in 2023.

Market Size & Forecast

- 2023 Market Size: USD 22.18 Billion

- 2030 Projected Market Size: USD 39.71 Billion

- CAGR (2024-2030): 8.7%

- Asia Pacific: Largest market in 2023

At present, permanent magnets are used in wind turbine generators for increasing their efficiency. Rare earth magnets, such as Neodymium Ferrite Boron (NdFeB), are being predominantly used in wind turbines owing to benefits, such as increased reliability and reduction in maintenance costs.

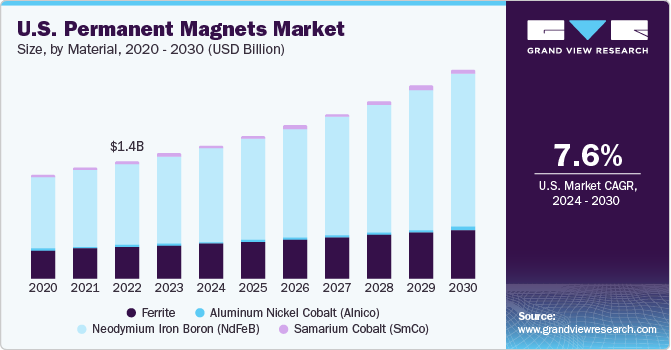

The permanent magnet market in U.S. is expected to grow at a higher rate than its ferrite counterpart over the forecast period owing to its wide usage in high-end applications like robotics, wearable devices, electric vehicles, and wind power. Since the economic meltdown of 2008-09, the automotive industry in the U.S. has grown steadily. The country has been witnessing a significant rise in the adoption of plug-in electric cars, primarily driven by the advanced products offered by key players, such as Tesla, Chevy, Nissan, Ford, Audi, and BMW, among others. In early 2018, Tesla became one of several electric carmakers to use motors with neodymium magnets.

However, due to fewer permanent motor magnet manufacturers in the country, it imported 4 million pounds of automotive parts from China, with the bulk of them being electric motors. The escalating trade war with China is likely to represent a significant challenge for the U.S., as it threatens to cut off its supply of rare earth and associated products to the U.S. To reduce its reliance on raw material sourcing of rare earth materials, the government has taken various steps including funding mining projects under the Defense Production Act. Such initiatives are likely to strengthen the raw material supply for the domestic industry in the U.S.

As per IMF, the GDP growth of North America for 2023 is anticipated to be 1.6%. The growth can be attributed to the U.S. economy, which witnessed growth in Q2 2023 despite high rates and inflation. The U.S. GDP grew by 2.4% (seasonally adjusted) for the April–June 2023 period due to government purchases, consumer spending, and investments in business & inventory. On account of the massive fiscal packages offered by the U.S. government to uphold industrial production, the domestic market for permanent magnets witnessed gradual growth in 2023.

Market Concentration & Characteristics

Market growth stage is high, and pace of the growth is accelerating. The industry is anticipated to witness growth owing to the increasing demand for sustainable energy sources such as wind power, and the exponential growth in the electric vehicle (EV) markets.

The permanent magnets market is fragmented and is characterized by regional concentration of players in certain parts of the world. On account of the presence of large-scale rare earth metal deposits in China, numerous small, medium, and large-scale manufacturers are located in its close vicinity.

The market is characterized by a high degree of innovation to optimize the production process in an environmentally sustainable manner, and to manage residue and waste. Manufacturers have been focusing on developing and innovating new products with higher efficiency to cater to high-end performance industries, such as defense, aerospace, and automation.

The market is expected to observe low level of merger and acquisition (M&A) activity owing to the stringent regulatory process and approvals required for mining licenses and residue management. Since the approval process is long, and the player concentration is high, M&A every year is observed to be lower than that of other industries.

The market is also subject to stringent regulatory scrutiny. Various regulatory authorities such as European Union restrict the production and use of permanent magnets in the region. End user concentration is a significant factor in the market, since there are several industries that consume permanent magnets, such as automotive, consumer goods, industrial and medical. The performance of each end use industry is influenced by macro-economic trends and seasonal variations in each industry.

Material Insights

The ferrite material segment dominated the market in 2023 and accounted for the largest revenue share of about 36.0%. Ferrite magnets are primarily used in motor applications. Over 65% of the total volume of ferrite magnets are utilized in motor applications, with consumption in automotive motors, appliance motors, HVAC motors, and industrial & commercial motors estimated roughly at 19%, 14%, 12%, and 11%, respectively, in 2022. Furthermore, they are also utilized in loudspeakers, separation equipment, Magnetic Resonance Imaging (MRI), relays & switches, and holding & lifting applications. Neodymium Iron Boron (NdFeB) is projected to emerge as the second-largest material segment with the fastest CAGR, in terms of volume as well as the revenue over the forecast period.

Over the past five years, the application scope of NdFeB magnets has broadened considerably. Apart from its traditional applications, the product is now witnessing significant penetration in the motors of electric and hybrid electric vehicles, wind power generators, air conditioning compressors & fans, and energy storage systems. Alnico is the name for an alloy composed of aluminum, nickel, and cobalt. Permanent magnets based on alnico were considered to be the strongest magnets before rare earth magnets, such as NdFeB, were discovered in the 1970s. According to Magnet Applications, Inc., the average Energy Density (BHmax) exhibited by the alnico magnet is 7 MGOe, which is higher than that of ferrite magnets but considerably lower than Neodymium-Iron-Boron (NdFeB) magnets.

Application Insights

Consumer goods & electronics accounted for the largest revenue share of about 26.0% and emerged as the leading application segment in 2023. In the electronics industry, the product is used in air conditioning compressors & fans, recorders, computer cables, DVDs, cameras, watches, earbuds, loudspeakers, microphones, mobile phones, voice coil motors, printers, fax stepper motors, printer machine rollers, hard disk drives (HDDs), and portable power tool motors among others. Growth in the production of the aforementioned product categories is estimated to directly support the market growth for permanent magnets.

The automotive segment is projected to observe a steady growth rate, in terms of revenue, over the forecast period. According to Arnold Magnetic Technologies, there are roughly 100 permanent magnet devices in a typical car. Although ferrite is favored by the majority of car manufacturers, the shifting paradigm of consumer demand for lightweight vehicles has fueled the need for small and high-performance magnetic products. Thus, advancement toward vehicle energy efficiency is projected to positively support the segment growth over the predicted timeline. The industrial application segment held the third-largest share, in terms of revenue, in 2023.

The need among oil & gas industry players to enhance the usage of energy-intensive technological processes like electronic submersible pumps and reduce power consumption represents a lucrative opportunity for the market vendors of the permanent magnet. As compared to asynchronous submersible electric motors, which are used for driving electrical submersible pumps, permanent magnet motors (PMM) have a number of characteristics that make them economically attractive for the oil & gas industry. Medical is projected to be among the fastest-growing application segments for the market over the predicted timeline. The product demand in the medical sector is primarily driven by its increasing use in devices, such as MRI, body scanners, and heart pacemakers.

Regional Insights

Asia Pacific accounted for the largest revenue share of nearly 75.0% in 2023. The region is a manufacturing hub of the world. Automotive and electronic productions are critical components of the region’s manufacturing activities. China, Japan, and South Korea have become hot centers for manufacturing computer hardware devices including hard disks, computer chips, and microprocessors. This has contributed to the rising demand for permanent magnets, which are being extensively consumed by electronics and hardware manufacturers. Europe is anticipated to emerge as the second-largest regional market by 2030, although the region witnessed a sharp decline in 2020. This is because industrial production in Europe has observed slower growth in the past few years due to the overall economic slowdown and due to political uncertainties, such as Brexit.

The economic growth in FY 2020 was further impacted by the lockdown caused by the COVID-19 pandemic. North America accounted for a significant revenue share in 2023. The COVID-19 pandemic drastically affected the market supply in the North America region. According to the International Monetary Fund, the GDP of North America declined by at least 7% in 2020. This indicates the decline in the manufacturing output of end-use industries, such as automotive & transportation, electrical & electronics, and aerospace & defense. Middle East & Africa witnessed a decline in terms of revenue, in 2023. The GDP of MEA contracted by roughly 4.2% in 2020. The key countries of the region, especially gulf countries, started to feel pressure as the deflation continue to rise.

Key Companies & Market Share Insights

Some of the key players operating in the market include Hitachi Metals Ltd., Shin-Etsu Chemical Co., Ltd. and Ningbo Yunsheng Co., Ltd.

-

Hitachi Metals Ltd. operates through three business segments, namely automotive related products, electronics-related products, and infrastructure related products. It offers a wide range of products including cutting tools, molding materials, chassis, exhaust components, magnets & motor related products, LCD displays & semiconductors, medical equipment, aircraft components, piping equipment, industrial equipment, and rubber.

-

Shin-Etsu Chemical Co., Ltd. operates through various business segments, namely PVC, silicones, specialty chemicals, semiconductor silicon, electronics & functional materials, and processing/trading businesses.

-

Ningbo Yunsheng Co., Ltd. develops and manufactures sintered and bonded NdFeB, AlNiCo, and SmCo magnets; magnetic assemblies; and electric motor products. The company is engaged in the research and management of servomotors, compact spinning devices, automobile motors, serinette, smart technology products & supplies, and neodymium magnets.

-

Earth-Panda Advance Magnetic Material Co., Ltd., and Ninggang Permanent Magnetic Materials Co., Ltd., are some of the emerging market participants.

-

Earth-Panda Advance Magnetic Material Co., Ltd. manufactures permanent and flexible magnets including ceramic and ferrite. Its product portfolio includes extruded magnet strips, rubber magnet sheets/rolls, magnetic products, electric motor seals, magnetic tapes, refrigerator seals, magnetic gifts, magnetic darts, bathroom seal, magnetic toys, magnetic belts, and office automation & stationary magnets.

- Ninggang Permanent Magnetic Materials Co., Ltd. was established in 2003 and is headquartered in Ningbo, China. It provides sintered SmCo materials, rubber magnets, plastic injection magnets, bonded NdFeB magnets, alnico, and ferrite magnets. The company has advanced producing technology, excellent test means, and strict quality guaranteed system to supply permanent magnets in various shapes.

Key Permanent Magnets Companies:

- Adams Magnetic Products Co.

- Earth-Panda Advance Magnetic Material Co., Ltd.

- Arnold Magnetic Technologies

- Daido Steel Co., Ltd.

- Eclipse Magnetics Ltd.

- Electron Energy Corp.

- Goudsmit Magnetics Group

- Hangzhou Permanent Magnet Group

- Magnequench International, LLC

- Ningbo Yunsheng Co., Ltd.

- Ninggang Permanent Magnetic Materials Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- TDK Corporation

- Thomas & Skinner, Inc.

- Vacuumschmelze GMBH & Co. Kg

- Ugimag Korea Co., Ltd.

- SsangYong Materials Corp.

- Pacific Metals Co., Ltd.

Recent Developments

-

In October 2023, Ara Partners, a private equity firm acquired Vacuumschmelze (VAC), a German permanent magnets producer, from its equity investor Apollo. This will strengthen the duo’s rare earths value chain, and help the former to pursue its strategic growth opportunity of supplying permanent magnets to key industries such as electric vehicles (EV).

-

In January 2023, VAC signed an agreement with U.S. automaker General Motors to build a permanent magnets manufacturing plant in North America to manufacture, using locally sourced raw materials. The product would be used in the manufacture of electric motors supplied to GM automobiles.

Permanent Magnets Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 22.18 billion

Revenue forecast in 2030

USD 39.71 billion

Growth Rate

CAGR of 8.7% from 2024 to 2030

Market size volume in 2023

1,177.6 kilotons

Volume forecast in 2030

1,767.8 kilotons

Growth Rate

CAGR of 6.0% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Volume in Kilotons, Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Russia; UK; France; Italy; China; India; South Korea; Indonesia; Japan; Brazil; Argentina

Key companies profiled

Adams Magnetic Products Co.; Earth-Panda Advance Magnetic Material Co., Ltd.; Arnold Magnetic Technologies; Daido Steel Co., Ltd.; and Eclipse Magnetics Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Permanent Magnets Market Report Segmentation

This report forecasts revenue and volume growth at country & regional levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global permanent magnets market report on the basis of material, application, and region.

-

Material Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Ferrite

-

Neodymium Iron Boron (NdFeB)

-

Aluminum Nickel Cobalt (Alnico)

-

Samarium Cobalt (SmCo)

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Automotive

-

Consumer goods & electronics

-

Industrial

-

Aerospace & Defense

-

Energy

-

Medical

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global permanent magnets market size was estimated at USD 20.58 billion in 2022 and is expected to reach USD 22.18 billion in 2023.

b. The global permanent magnets market is expected to grow at a compound annual growth rate of 8.6% from 2023 to 2033 to reach USD 39.71 billion by 2030.

b. Consumer goods & electronics segment dominated the permanent magnets market with a volume share of 27.0% in 2022, owing to its extensive use demand in manufacturing of speakers, headphones, and other electronic accessories.

b. Some of the key players operating in the permanent magnets market are Adams, Hitachi Group, Shin-Etsu, Daido Steel Co., Ltd., Eclipse Magnetsics Ltd, Goudsmit Magnetsics Group, Electron Energy Corporation, Magnequench International, LLC, and Hangzhou Permanent Magnets Group.

b. The key factors that are driving the permanent magnets market include rising demand for electronic accessories or gadgets and increasing focus towards wind energy generation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.