- Home

- »

- Advanced Interior Materials

- »

-

Ferrosilicon Market Size, Share And Growth Report, 2030GVR Report cover

![Ferrosilicon Market Size, Share & Trends Report]()

Ferrosilicon Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Deoxidizer, Inoculants), By End-use (Carbon & Other Alloy Steel, Stainless Steel, Electric Steel, Cast Iron), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-791-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ferrosilicon Market Summary

The global ferrosilicon market size was estimated at USD 11.50 billion in 2023 and is projected to reach USD 13.67 billion by 2030, growing at a CAGR of 2.5% from 2024 to 2030. The market growth is anticipated to be driven by the rising use of ferrosilicon as a deoxidizer in the steel industry and as an inoculant in cast iron.

Key Market Trends & Insights

- Asia Pacific held the largest revenue share of over 66.0% in 2023.

- The Japan ferrosilicon market held a revenue share of about 8.0% of the Asia Pacific market in 2023.

- On the basis of end-use, the carbon & other alloy steel segment accounted for about 43.0% revenue share of the market in 2023.

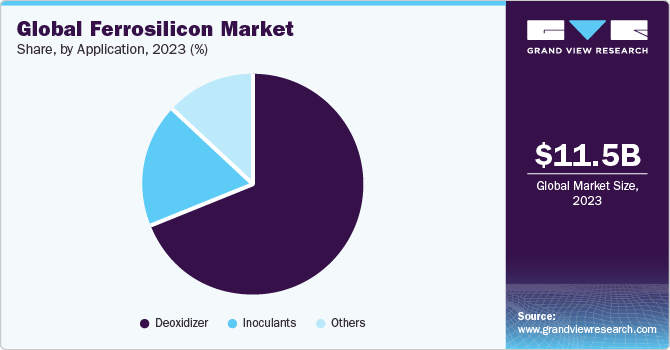

- On the basis of application, the deoxidizer segment dominated the market in 2023 with a revenue share of more than 69.0%

Market Size & Forecast

- 2023 Market Size: USD 11.50 Billion

- 2030 Projected Market Size: USD 13.67 Billion

- CAGR (2023-2030): 2.5%

- Asia Pacific: Largest Market in 2021

Growing demand for steel is encouraging M&A activity and capacity increases. The U.S. is one of the largest steel producers in the world. Its production was recorded at 80.7 million tons in 2023, 0.2% up from 2022; the production, however, is still lower than in 2021. However, investment in public projects witnessed a boost from the end of 2022 and throughout 2023 owing to the Infrastructure and Jobs Act. This government policy has allocated USD 550 billion for improving the infrastructure of roads, airports, ports, and freight rails.The growing investments in infrastructure have increased competition in the industry, compelling market players to indulge in mergers & acquisitions and capacity expansions. For instance, in December 2023, Nippon Steel Corporation announced that it would acquire U.S. Steel for a transaction value of USD 14.9 billion. This deal is anticipated to enhance the former’s environmental sustainability plans, and also become a world-class steel maker with a strong global presence.

Furthermore, growth in the electric vehicles (EVs) industry is benefitting market growth. For instance, in January 2022, General Motors announced its decision to invest USD 4 billion in its Orion Assembly Plant in Michigan, U.S., to enable the production of electric pickups. In March 2022, Suzuki Motor Corporation decided to invest USD 1,320.2 million in its manufacturing plant in Gujarat, India. It is also planned to produce 125,000 EVs by 2025.

Market Concentration & Characteristics

Market growth stage is medium and the pace of growth is accelerating. The ferrosilicon market is characterized by a relatively lower degree of innovation since a standard technology is followed for the production process, as well as in end-user industries. There is more R&D and investment in the steel-making process, and Industry 4.0 is a popularly evolving and emerging concept.

The market is also characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to new manufacturing and application technologies, become more environmentally sustainable, mitigate risk, enhance capital outlay, and improve market share. High competition amongst producers has led to the adoption of strategic initiatives such as capacity expansions and M&A activities to expand their share of the industry.

The market is also subject to a fair amount of regulatory scrutiny. Regulatory bodies such as the Environmental Protection Agency (EPA) provide guidelines for the health and safety of workers during the production process, as well as minimum quality parameters for effective steel making.

Products such as silico manganese can be used to increase the manganese content in steel, and hence substitute ferrosilicon during the steel production process. The production of ferrosilicon is an energy-intensive process, as compared to its substitutes. Hence, where silico manganese is readily available, it is used during steel making. Where the power cost is relatively economical and stable, ferrosilicon is preferred.

End-user concentration is a significant factor in the ferrosilicon market, since it primarily caters to the steel industry. Hence, its market growth is solely dependent upon the performance of steel. All producing nations will consume ferrosilicon to varying degrees. Many regional markets are completely import dependent, due to the absence of raw material. The presence of ferrosilicon producers in vicinity to steel production facilities is advantageous to control logistics cost.

End-Use Insights

The carbon & other alloy steel segment accounted for about 43.0% revenue share of the market in 2023. Ferrosilicon is an important raw material in the production process of steel, where it is used as a deoxidizer and alloy agent. Ferrosilicon powder can release a large amount of heat when burned at high temperatures, hence, it is also used as a heat-producing agent for making capped steel.

The cast iron segment is anticipated to register the highest CAGR, in terms of revenue, over the forecast period. Cast iron is less expensive, easier to handle during the melting and casting process, unlike steel. Ferrosilicon is used as an inoculant in the cast iron industry to prevent the formation of iron carbide, resulting from the rapid cooling of thin sections of castings. Growing investment in cast iron is anticipated to benefit product demand.

Stainless steel is another vital end-use segment of the market. Ferrosilicon is used in the product to improve its aesthetics, wear, and corrosion resistance. Hence growing stainless steel production is propelling segment growth. For instance, in January 2023, North American Stainless (NSS) announced that it would increase its production capacity by 200,000 tons with an investment of USD 244 million to cater to the growing demand from the domestic market.

Application Insights

The deoxidizer segment dominated the market in 2023 with a revenue share of more than 69.0%, and this trend is expected to continue over the forecast period. Ferrosilicon is widely used as a deoxidizer in the steel industry. The deoxidization process blocks the heat and prevents the loss of carbon from the molten steel, thereby ensuring its quality.

Inoculants are anticipated to register the highest growth rate, in terms of revenue, over the forecast period. Ferrosilicon is used as an inoculant in the cast iron industry and growing demand for cast iron cookware is anticipated to drive the market further. For instance, in September 2023, Stove Kraft, the Indian manufacturer of the Pigeon brand of cast iron cookware announced that it would be setting up the country’s first fully automated foundry with an investment of INR 55 crore (~USD 6.6 million) for the production of cast iron cookware.

Ferrosilicon is also used during the Pidgeon process for high-purity magnesium refining. Growing demand for magnesium products from different industries is propelling its production, thus benefiting market growth. For instance, in March 2023, Western Magnesium Corporation announced that it would commission a new plant with a capacity of 25,000 tons, to produce magnesium products, in Nevada, U.S.

Regional Insights

The ferrosilicon market in North America is expected to grow at a significant CAGR over the forecast period, with the U.S. being a major regional market. With the rising demand for stainless steel in the end-use industries, the demand for ferrosilicon for stainless production is expected to grow over the forecast period. The presence of steel manufacturing companies including Nucor Corp., United States AK Steel, ArcelorMittal USA, and Steel Dynamics Inc. (STLD) is expected to be another key factor for ferrosilicon demand in North America.

U.S. Ferrosilicon Market Trends

The U.S. Ferrosilicon market’s growthis driven by the rising use of ferrosilicon as a deoxidizer in the steel manufacturing industry. Furthermore, the major boom in the construction and electric vehicle (EV) sectors has driven the demand for high-grade electrical steel, which is manufactured using ferrosilicon.

The ferrosilicon market in Canada is expected to grow over the forecast period. It is akey market for ferrosilicon in North America owing to the wide steel production base in the country.Canada has around 20 steel manufacturing facilities across 5 provinces, which employ over 22,000 populations. These factors are expected to positively impact the industry growth.

Asia Pacific Ferrosilicon Market Trends

Asia Pacific held the largest revenue share of over 66.0% in 2023. High potential for infrastructural developments coupled with continuous investment in the automobile industry is propelling steel production, thereby augmenting the growth of the ferrosilicon market. According to the World Steel Association, China, India, and Japan were the top three crude steel producers in the world in 2023. The region is witnessing various investments in steel capacity expansions in different countries, which is anticipated to benefit market growth in the region over the forecast period.

The Japan ferrosilicon market held a revenue share of about 8.0% of the Asia Pacific market in 2023. Despite a consistent drop in crude steel production, the demand for ferrosilicon as an inoculant in iron casting is expected to be a key driver for the market’s growth. The presence of several foundries in the country, including Tomotetsu Kogyo Co., Ltd., Ota Chuzosho Co., Ltd., Koyochuzo Co., Ltd., and Shimamura Industry Co., Ltd., is expected to have a positive impact on the product demand over the forecast period.

The ferrosilicon market in South Korea is expected to be a key marketplace owing to rising steel production in the country. It is a major steel producer in the world. It reported a 1.3% increase on a y-o-y basis in 2023. Growing production of crude steel in the country, coupled with investments in solar energy, is providing lucrative growth opportunities for the market to flourish further.

Europe Ferrosilicon Market Trends

The ferrosilicon market in Europe is highly capital-intensive due to fixed costs such as the recruitment of skilled workers and expensive machinery. The regional companies have a positive track record in research and substantial investments. The establishment of a supportive regulatory framework by the governments is fostering technological solutions including waste heat recovery for hot water, steam, or electricity production, capturing carbon byproducts, and production of carbonates, algae, and hydrogen, and use of biomass or charcoal as reductant. In addition, the regional players are subject to comply with EU Emissions Trading System (EU ETS) to achieve climate-neutral economy by 2050.

The growth of ferrosilicon market in Germany is driven by the rising consumption of steel in the construction and automotive industries. This is expected to further propel market growth over the forecast period. Another key driver is the rising demand for ferrosilicon in the metal manufacturing industry in the form of ferroalloys. The country is also a major exporter of ferrosilicon.

The Turkey ferrosilicon market is expected to continue to grow in the coming years. The country's government has set a target of increasing steel production to 30 million tons annually by 2023. This will lead to an increase in the demand for ferrosilicon. The country is a major producer of semiconductors, and the demand for semiconductors is expected to grow in the coming years.

Central & South America Ferrosilicon Market Trends

The ferrosilicon market in Central & South America is projected to witness significant growth during the forecast period. This is attributed to the booming steel industry and ongoing infrastructure development in emerging economies of Columbia and Brazil.

The Brazil ferrosilicon market is estimated to grow at a significant CAGR over the forecast period. Emerging automotive and steel manufacturing industries are creating demand for ferrosilicon in Brazil.

Middle East & Africa Ferrosilicon Market Trends

The ferrosilicon market in Middle East & Africa observed price fluctuations during the COVID-19 pandemic and the market is gradually recovering. The increasing ferrosilicon demand for eco-friendly, cost-effective hydropower industries is projected to create market growth opportunities during the forecast period.

The Gulf Corporation Council (GCC) ferrosilicon market is expected to witness steady growth over the forecast period, due to rising ferrosilicon demand as an inoculant and deoxidizer in several end-use industries including carbon & alloy steel, cast iron, and stainless steel.

Key Ferrosilicon Company Insights

Some of the key players operating in the market include Elkem ASA, Eurasian Resources Group (ERG), and Ferroglobe.

-

Elkem ASA develops products of silicone, silicon, carbon, and foundry alloys. It produces STD 75, STD 50 ferrosilicon and ferrosilicon briquettes in Iceland. In addition, it produces a range of other ferrosilicon compositions that provide optimum results for high-performance steel grades.

-

Eurasian Resources Group (ERG) is a diversified natural resources group based in Kazakhstan. It has a portfolio of production assets and development projects in almost 20 countries. Its ferroalloy plant produces ferrosilicon and ferrosilicomanganese in the Aksu plant.

-

Ferroglobe is headquartered in London and is a producer of silicon metal with a global presence in 25 locations. It has 18 electro-metallurgy production centers and more than 50 furnaces worldwide.

VBC Ferro Alloys Limited and Russian Ferro-Alloys Inc. are some of the emerging participants in the ferrosilicon market.

-

VBC Ferro Alloys Limited owns quartz mines, a metallurgical coke plant, and a fuel supply agreement with coal mines to ensure uninterrupted raw material supply. It is based in Telangana, India. It exports ferroalloys to the global markets.

-

FFA International, also known as Russian Ferro-Alloys Inc. is headquartered in Schaffhausen, Switzerland. It supplies ferrochrome, ferrosilicon, microsilica and other ferroalloy products mainly catering to Europe and the Western world.

Key Ferrosilicon Companies:

The following are the leading companies in the ferrosilicon market. These companies collectively hold the largest market share and dictate industry trends.

- Elkem ASA

- Eurasian Resources Group

- FINNFJORD AS

- Ferroglobe

- OM Holdings Ltd.

- Russian Ferro-Alloys Inc.

- SINOGU CHINA

- VBC Ferro Alloys Limited

Recent Developments

-

In July 2023, Green Ferro Alloy announced its plans to build Oman’s first silicon metal plant, which would serve as feedstock to the global ferrosilicon industry.

-

In February 2023, OM Holdings Ltd’s (OMH) ferroalloy smelting plant in Samalaju Industrial Park, Indonesia announced that it will construct additional ferrosilicon lines in its plants to develop high-grade products.

-

In August 2022, Arab Alloys, a producer of ferroalloys, established an industrial complex for the production of ferroalloys in the Suez Canal Economic Zone, southern Ain Sokhna, Egypt. The complex covers an area of 40,000 square meters. The company aims to manufacture silico manganese as well as 48,000 tons of ferrosilicon in the complex.

Ferrosilicon Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.75 billion

Revenue forecast in 2030

USD 13.67 billion

Growth rate

CAGR of 2.5% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

April 2024

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Russia; Turkey; China; Japan; India; Brazil; GCC

Key companies profiled

Elkem ASA; Eurasian Resources Group; Finnfjord AS; FENGERDA GROUP; Ferroglobe; OM Holdings Ltd.; Russian Ferro-Alloys Inc.; SINOGU CHINA; VBC Ferro Alloys Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ferrosilicon Market Report Segmentation

This report forecasts revenue and volume growth at country & regional levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ferrosilicon market report based on application, end-use, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Deoxidizer

-

Inoculants

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Carbon & Other Alloy Steel

-

Stainless Steel

-

Electric Steel

-

Cast Iron

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Russia

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

GCC

-

-

Frequently Asked Questions About This Report

b. The global ferrosilicon market size was estimated at USD 11.50 billion in 2023 and is expected to reach USD 11.75 billion in 2024.

b. The global ferrosilicon market is expected to grow at a compound annual growth rate of 2.5% from 2024 to 2030 to reach USD 13.67 billion by 2030.

b. Based on the application, deoxidizer accounted for the largest revenue share of more than 69.0% in 2023 of the overall market. Rising steel production is anticipated to drive the segment growth over the forecast period.

b. The key players operating in the ferrosilicon market include Elkem ASA, Eurasian Resources Group, Ferroglobe, IMFA, OM Holdings Ltd., SINOGU CHINA, and Russia Ferro-Alloys Inc., among others.

b. The rising use of ferrosilicon as a deoxidizer in steel production and as an inoculant in the cast iron industry are the major growth drivers for the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.