- Home

- »

- Advanced Interior Materials

- »

-

Fire-resistant Glass Market Size Report, 2021-2028GVR Report cover

![Fire-resistant Glass Market Size, Share & Trends Report]()

Fire-resistant Glass Market (2021 - 2028) Size, Share & Trends Analysis Report By Product (Ceramic, Tempered, Wired), By Application (Building & Construction, Marine), By Region (North America, APAC), And Segment Forecasts

- Report ID: GVR-1-68038-112-2

- Number of Report Pages: 87

- Format: PDF

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fire-resistant Glass Market Summary

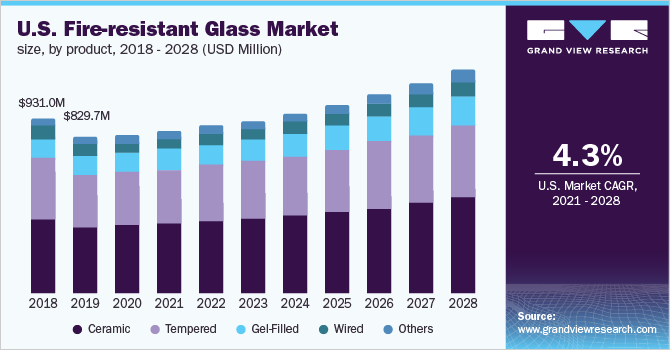

The global fire-resistant glass market size was valued at USD 4.25 billion in 2020 and is projected to reach USD 5.92 billion by 2027, growing at a CAGR of 4.3% from 2021 to 2027. The rising number of fire accidents coupled with expansion in the construction industry is anticipated to augment the market growth over the forecast period.

Key Market Trends & Insights

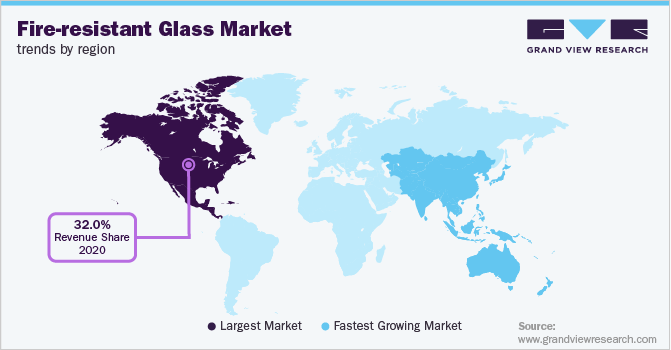

- North America held the largest revenue share of over 32% in 2020.

- Asia Pacific is anticipated to register the fastest growth rate over the forecast period.

- By product, the ceramic segment accounted for a revenue share of more than 40% in 2020.

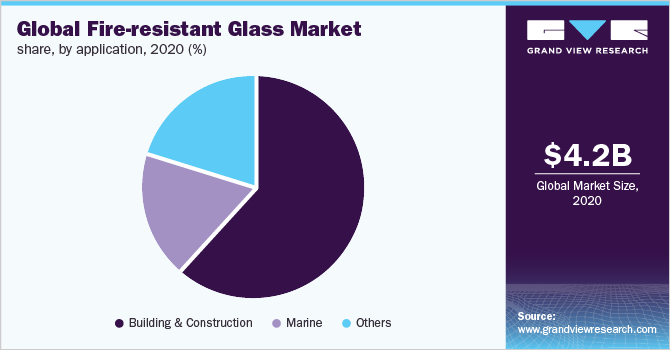

- By application, the building & construction segment accounted for the largest revenue share of more than 61.0% in 2020.

Market Size & Forecast

- 2020 Market Size: USD 4.25 Billion

- 2027 Projected Market Size: USD 5.92 Billion

- CAGR (2021-2027): 4.3%

- North America: Largest market in 2020

- Asia Pacific: Fastest growing market

Rising instances of fire mishaps have prompted increased spending by the national governments globally to improve the fire safety of buildings, including residential and commercial. In addition, the growing demand for urban housing projects and high-rise buildings owing to the shift of population toward urban economic centers has led to the development of various residential projects with suitable fire safety standards. These factors are anticipated to drive the market over the forecast period.

As per the U.S. Fire Administration (USFA), in 2019, there were 1,291,500 fire incidents in the country, which caused 3,704 deaths, 16,600 injuries, and a loss of USD 14.8 billion. This has led to the growing awareness pertaining to the installation of fire safety products in buildings, which is anticipated to boost fire-resistant glass consumption in the country in the coming years. Moreover, the rising spending capability of consumers along with increasing instances of fire mishaps in the past few years are anticipated to drive the market over the forecast period. Growing demand from automotive aftermarket and increasing military spending also contribute to the market growth.

The market witnessed a decline in 2020 on account of the COVID-19 pandemic. All market players in the industry value chain were impacted because of the pandemic. The crisis has posed new challenges, which include fluctuations in raw material prices, unemployment, minimal production, mandatory shutdowns in manufacturing, and disruptions in logistics, which hampered the market growth during the crisis. The market scenario started recovering in the second half of 2020. All factories, logistics centers, supply chains, and project sites were shut until May-June 2020. Post which, companies started ramping up their operations. The industries are putting in extra efforts to recover from their losses incurred in 2020.

Fire-resistant Glass Market Trends

Fire-resistant glasses are used in the construction sector in areas such as windows, glazing, and doors, owing to their unique features such as limiting the spread of smoke, heat, and fire; this is the major factor boosting the demand for the market. In 2021, the average monthly spending on new private construction was estimated at around USD 1,245 billion in the United States.

In the automotive market, fire-resistant glass shows a wide application in roof and side window panels. Increasing demand for safe and reliable vehicles has forced manufacturers to utilize fire-resistant glass in their vehicles. According to the International Organization of Motor Vehicle Manufacturers, sales of vehicles increased by 4.9% from 2020 to 2021.

Strict regulations imposed by government bodies for the manufacturing of fire-resistant glass, along with the rising cost of material required for glass manufacturing, are likely to act as a restraint on the market growth. On the other hand, the increased government spending on the defense sector is likely to create opportunities for the growth of the fire-resistant glass industry.

Product Insights

The ceramic segment accounted for a revenue share of more than 40% in 2020. The high share can be attributed to the growing preference for insulated glass units in residential and commercial construction, which provide fire ratings ranging from 20 minutes to 3 hours and can withstand the thermal shock of water from fire hoses and water sprinklers. Thus, advantageous characteristics of ceramic glass are expected to augment segment growth over the forecast period.

Tempered glass is witnessing an increase in global demand due to the wide scope of application in fire doors, which are meant to provide fire protection. In this glass, a special coating is applied on the outer layer to reflect some heat and therefore reduce the amount of heat transferred through the glass. Thus, huge investments to upscale residential and commercial projects, are likely to drive the demand for fire-resistant glass.

The gel-filled segment is estimated to grow at a CAGR of 4.7%, in terms of revenue, during the forecast period. Gel-filled glass consists of two or more layers of glass, where the space between the glass is filled with a translucent gel that reacts to a certain temperature. Regulatory support aimed at promoting the use of passive fire products boosts the usage of gel-filled fire-resistance glass. This trend is expected to increase the scope of gel-based lightweight fire-resistant glass in combination with passive fire protection over the forecast period.

Application Insights

The building & construction application segment accounted for the largest revenue share of more than 61.0% in 2020 of the global market. Architectural glass is extensively used in the building & construction sector on account of its high strength and toughness. Growing emphasis by regulatory bodies on improving fire safety standards in buildings and adherence to building codes are other factors driving the segment.

In marine applications where vessels face strong waves, winds, noise, and extreme temperature conditions, especially offshore vessels, are prone to a higher risk of fire explosion accidents caused by equipment or structure failures. As a result, rising safety concerns pertaining to the sinking of vessel containers in the event of a fire breakout boost the incorporation of fire-resistant glass solutions in the marine segment.

The others segment comprises automotive, aerospace, military & defense, and other applications. The growing focus on the incorporation of safety glass in vehicles is anticipated to propel the product demand in the automotive industry as it abides all strict flammability and structural airworthiness requirements for aviation applications in windows, cabin dividers, and glass screens.

Regional Insights

North America held the largest revenue share of over 32% in 2020 and is projected to grow at a steady CAGR during the forecast period. Factors driving the regional market include a rise in investments in infrastructure projects, growing spending capability of consumers, and increasing focus by government and regulatory bodies on improving the overall fire safety standards of buildings and commercial apartments.

Asia Pacific is anticipated to register the fastest growth rate over the forecast period. Rising construction activities in the region, along with increasing instances of fire accidents, are likely to boost product consumption, especially in the emerging economies. For instance, as per the International Trade Administration, the U.S. Department of Commerce, China emerged as the largest construction market and accounted for revenue worth USD 440.0million in 2020.

Europe held the second-largest revenue share in 2020. Advanced manufacturing facilities of automobiles, growing investments in developing new products, and expansion of operation are the prominent factors attributed to the growth of the market. For instance, in August 2020, DellnerBubenzer Group had expanded its new operation in the U.K. Company, DellnerRomag Ltd., which focuses on manufacturing and supply of specialist glass and glazing products. Middle East & Africa is anticipated to expand at a CAGR of 4.0% over the forecast period. Rising product demand due to the growing number of residential and commercial infrastructure projects in the MEA region is estimated to drive the regional market.

Key Companies & Market Share Insights

The key players focus on merger & acquisition, regional expansion, and high profit-margin segments. For instance, in November 2020, AGC Glass acquired Etex’s. In November 2019, Pyroguard, a leading manufacturer of fire-rated safety glass, expanded its presence in India. Companies are aiming for survivability and resilience to hold financial stability in the post-COVID-19 scenario. In the wake of the COVID-19 crisis, the product demand slumped significantly owing to the temporary shutdown of construction activities. Moreover, the whole supply chain got disrupted, which hampered the market dynamics. Hence, companies are looking forward to revised business models to cater to the growing demand during the projected period.

Recent Developments

-

In May 2022, Saint-Gobain entered into an acquisition agreement with Portuguese companies Falper and Fibroplac, in alignment with the company’s “Grow & Impact” strategy. This strategy has shown great results in the Portuguese market

-

In May 2022, AGC Inc. announced production capacity expansion plans for its new company, AGC Vinythai Public Company Limited, located in Thailand. The total investment anticipated for this expansion is estimated to be more than 100 billion yen

-

In October 2021, The NSG Group and Cohda Design Limited (UK) entered into a collaboration to develop a glass that can conduct electricity. This advancement in the glass industry will reduce the dependency on wires for electricity transfer to operate devices

-

In August 2021, Pyroguard relocated its UK facility to a new site for business expansion and growth purposes. The new site is three times larger in size as compared to the previous site and is estimated to measure over 62,000 sq. feet

Some of the prominent players in the global fire-resistant glass market include:

-

Saint-Gobain

-

AGC, Inc.

-

GlasTrösch

-

Nippon Sheet Glass Co., Ltd.

-

POLFLAM sp. z o.o.

-

Shandong Hengbao Fireproof Glass Factory Co., Ltd.

-

Diamond Glass

-

Pyroguard

-

Safti First

-

Schott AG

Fire-resistant Glass Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 4.35 billion

Revenue forecast in 2028

USD 5.92 billion

Growth rate

CAGR of 4.3% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Russia; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

Saint-Gobain; AGC Inc.; GlasTrösch; Nippon Sheet Glass Co., Ltd.; POLFLAM sp. z o.o.; Shandong Hengbao Fireproof Glass Factory Co., Ltd.; Diamond Glass; Pyroguard; Safti First; Schott AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Fire-resistant Glass Market SegmentationThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017to 2028. For the purpose of this study, Grand View Research has segmented the global fire-resistant glass market report on the basis of product, application, and region.

-

Product Outlook (Revenue, USD Million, 2017 - 2028)

-

Wired

-

Ceramic

-

Gel-filled

-

Tempered

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2028)

-

Building & Construction

-

Marine

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Russia

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The fire-resistant glass market size was estimated at USD 4.25 billion in 2020 and is expected to reach USD 4.35 billion in 2021.

b. The fire-resistant glass market is expected to grow at a compound annual growth rate of 4.3% from 2021 to 2028 to reach USD 5.92 Million by 2028.

b. Ceramic segment dominated the fire-resistant glass market with a volumetric share of over 40.0% in 2020, owing to advantageous characteristics of ceramic glass over other types.

b. Some of the key players operating in the fire-resistant glass market include Saint-Gobain, AGC Inc., Glas Trösch, Nippon Sheet Glass Co., Ltd., POLFLAM sp. z o.o., Shandong Hengbao Fireproof Glass Factory Co., Ltd., Diamond Glass, Pyroguard, SAFTI FIRST, and SCHOTT AG, among other players.

b. The key factor driving the fire-resistant glass market is rising instances of fire mishaps and growth in the construction industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.