- Home

- »

- Advanced Interior Materials

- »

-

Flat-roof Fasteners Market Size, Share, Industry Report 2033GVR Report cover

![Flat-roof Fasteners Market Size, Share & Trends Report]()

Flat-roof Fasteners Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Mechanically Fixed, Glued, Ballasted), By Roofing Membrane (Single-ply Membranes, Two-ply Bitumen), By End-use, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-644-1

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flat-roof Fasteners Market Summary

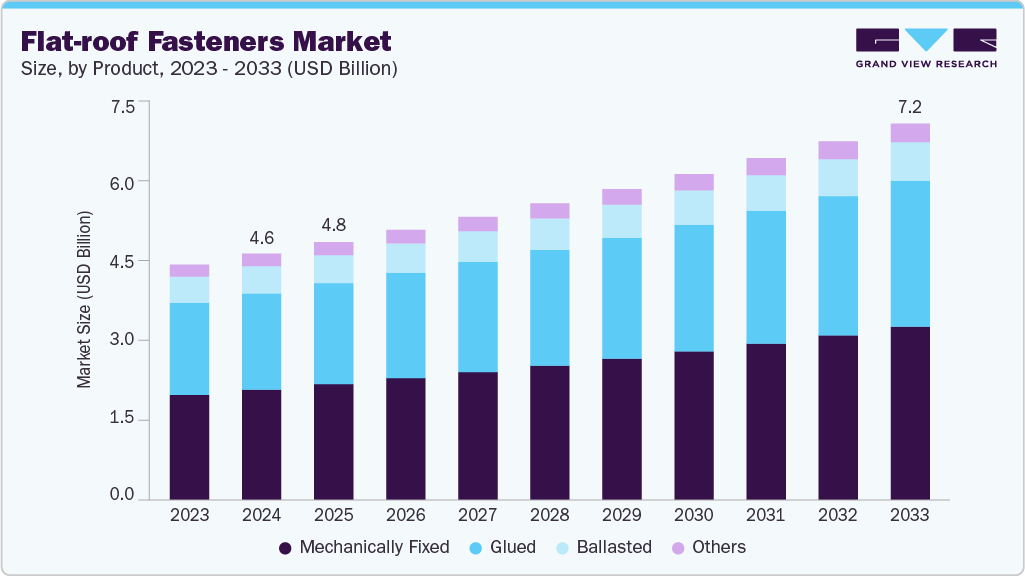

The global flat-roof fasteners market size was estimated at USD 4.56 billion in 2024 and is projected to reach USD 7.16 billion by 2033, growing at a CAGR of 5.2% from 2025 to 2033. This growth can be attributed to the rising adoption of flat roofing systems in commercial, industrial, and residential buildings.

Key Market Trends & Insights

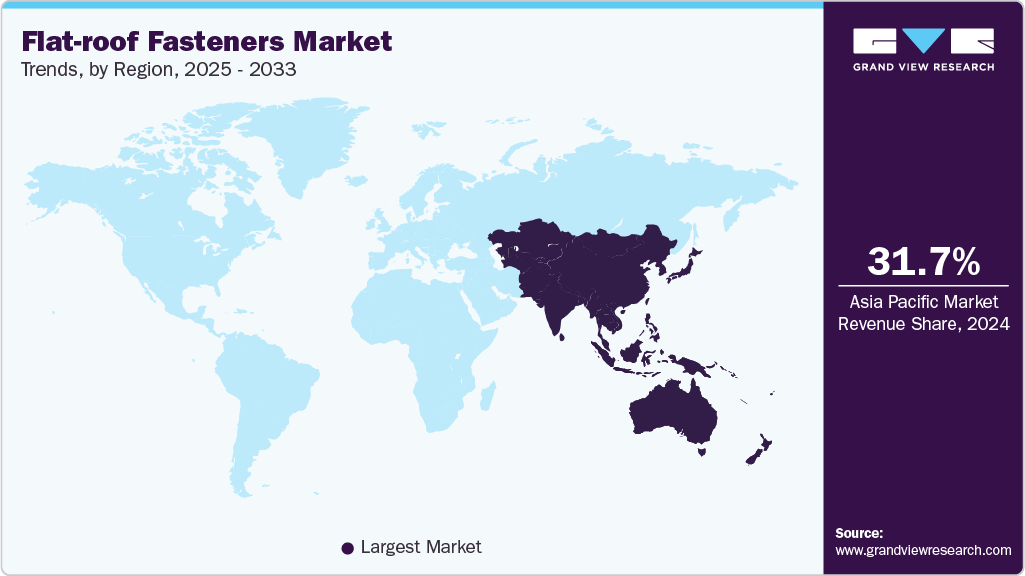

- Asia Pacific dominated the flat roof fasteners market with the largest revenue share of 31.7% in 2024.

- The flat roof fasteners market in China is expected to grow at a significant CAGR over the forecast period.

- By product, the mechanically fixed segment is expected to grow at the fastest CAGR of 5.6% over the forecast period.

- By roofing membrane, the single-ply membrane segment is expected to grow at the fastest CAGR of 5.5% over the forecast period.

- By end use, the industrial & manufacturing segment is expected to grow at the fastest CAGR of 5.6% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 4.56 Billion

- 2033 Projected Market Size: USD 7.16 Billion

- CAGR (2025-2033): 5.2%

- Asia Pacific: Largest market in 2024

Flat roofs offer benefits such as cost-effective construction, easier installation of HVAC systems, and the potential for green roofing or solar panel integration. This trend is particularly strong in urban environments where space optimization is critical. Advancements in construction materials and techniques are driving demand for specialized fasteners that can withstand extreme weather conditions and ensure long-term structural integrity. Governments and developers also focus on sustainable and energy-efficient building practices, often involving flat roofing solutions with high-performance membranes requiring compatible fastening systems.

Prominent players in the flat roof fasteners market increasingly focus on direct-to-customer models through online platforms to streamline distribution and enhance profitability. By bypassing traditional intermediaries, manufacturers can better control pricing, reduce lead times, and improve customer engagement. These online channels also enable real-time tracking of customer preferences and market trends, allowing companies to adapt their product offerings accordingly. This strategic shift boosts profit margins and strengthens manufacturers’ responsiveness to evolving industry demands and end user requirements.

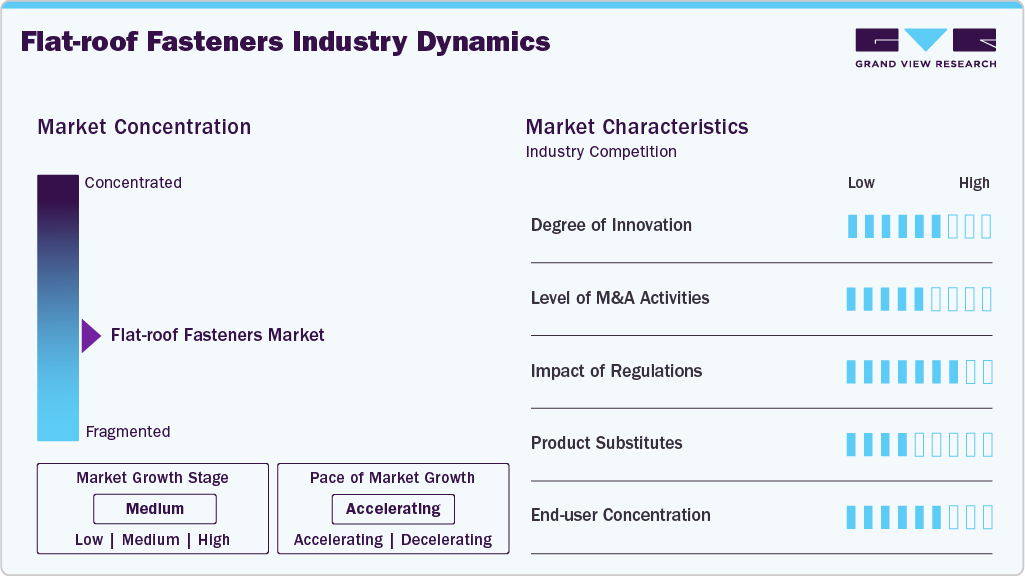

Market Concentration & Characteristics

The flat roof fasteners market is moderately fragmented, with a mix of global players and regional manufacturers competing across different geographies. Established companies such as SFS Group, 3M, and Bossard Group hold significant market shares due to their broad product portfolios, technological expertise, and well-established distribution networks. However, numerous smaller and specialized players catering to niche applications or local markets keep the market competitive. The moderate concentration level also allows room for innovation and pricing flexibility, giving buyers various options depending on their project needs.

The threat of substitutes in the flat roof fasteners market is relatively low, as fasteners are essential in ensuring structural integrity and weatherproofing of roofing systems. While adhesive-based solutions and integrated roofing membranes are gaining traction due to their clean finish and reduced thermal bridging, they are generally suited for specific applications and require controlled installation conditions. Mechanical fasteners remain the preferred choice in large-scale and variable climate projects due to their reliability and ease of use. As a result, although some alternatives exist, they do not significantly threaten traditional fastening systems in most mainstream construction scenarios.

Product Insights

The mechanically fixed segment held the highest revenue market share of 44.8% in 2024 due to its proven reliability, cost-effectiveness, and ease of installation across a wide range of substrates. Mechanical fastening provides strong resistance against wind uplift and ensures long-term structural stability, making it a preferred choice in new and re-roofing projects. It also allows quicker on-site application without specific temperature or surface conditions, making it ideal for large-scale commercial and industrial installations.

The glued segment is expected to grow at the fastest CAGR of 5.1% over the forecast period. This is due to its aesthetic appeal, lightweight application, and compatibility with modern roofing membranes. Adhesive-based fastening eliminates the need for penetrations, reducing the risk of leaks and improving thermal performance. This method is increasingly adopted in regions with stringent energy efficiency and insulation regulations. As sustainable building practices gain traction and technological advancements enhance adhesive performance, the glued segment is gaining momentum, particularly in residential and high-end commercial applications.

Roofing Membrane Insights

The single-ply membrane segment held the highest revenue market share of 45.5% in 2024 due to its lightweight properties, ease of installation, and cost-efficiency. Membranes such as TPO, PVC, and EPDM offer excellent weather resistance, UV stability, and flexibility, making them a popular choice for commercial and industrial flat roofs. Their compatibility with mechanical fastening systems and reduced labor requirements have made single-ply membranes a go-to solution for large-scale roofing projects, especially where speed and budget are key considerations.

The two-ply bitumen segment is expected to grow at the fastest CAGR of 5.1% over the forecast period. This is due to its superior durability, waterproofing capability, and enhanced resistance to punctures and harsh weather conditions. As construction projects increasingly focus on longevity and resilience, particularly in regions prone to extreme climates, two-ply bitumen systems are gaining popularity. The growing demand for roofing systems with higher load-bearing capacity and longer lifespans, coupled with advancements in modified bitumen technology, is driving adoption in retrofit and new build applications.

Distribution Channel Insights

The direct distribution channel segment held the highest revenue market share of 67.8% in 2024, as major manufacturers increasingly focus on selling directly to contractors, builders, and end users. This approach helps companies streamline their supply chain, reduce dependency on intermediaries, and improve profit margins. Direct channels also allow for better control over pricing, enhanced customer service, and quicker feedback loops, enabling manufacturers to respond more efficiently to market trends and customer needs. As a result, many leading players have established their own sales networks or online platforms to strengthen their direct-to-customer engagement.

The indirect distribution channel segment is expected to grow significantly at a CAGR of 5.0% over the forecast period, particularly in emerging markets where access to a wide network of local dealers and distributors remains crucial. These intermediaries offer regional expertise, logistics support, and well-established relationships with small and mid-sized contractors who prefer purchasing through familiar channels. As the construction industry expands in remote and developing areas, manufacturers increasingly partner with indirect distributors to tap into new customer bases, enhance market reach, and ensure product availability across diverse geographies.

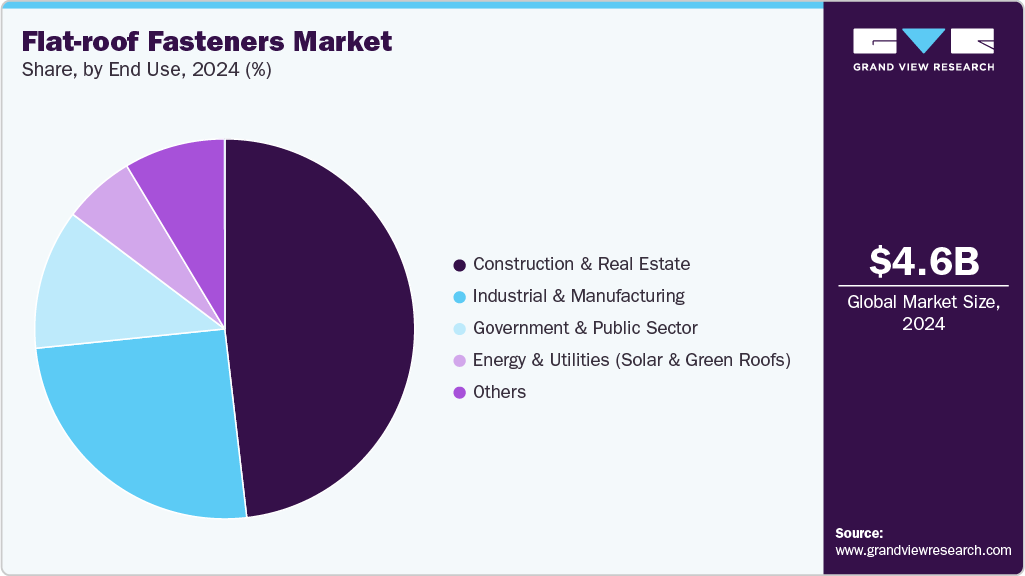

End-use Insights

The construction & real estate end use segment held the highest revenue market share of 48.1% in 2024. This is due to the widespread use of flat-roofing systems in commercial buildings, residential complexes, and institutional infrastructure. These sectors prioritize cost-effective, space-efficient roofing solutions, making flat roofs ideal. With increasing urbanization and a steady rise in real estate development projects globally, especially in metro and tier-2 cities, demand for reliable and durable flatroof fasteners has remained consistently strong in this segment.

The industrial and manufacturing segment is expected to grow significantly at a CAGR of 5.6% over the forecast period, driven by the expansion of industrial facilities, warehouses, and logistics centers. These structures often require large flat roofing surfaces for operational efficiency and infrastructure optimization. As manufacturing activity scales up across developing economies and global supply chains evolve, the need for robust, weather-resistant roofing systems is rising. This pushes demand for high-performance fasteners to ensure long-term durability and structural integrity under demanding industrial conditions.

Regional Insights

North America holds a significant share in the flat roof fasteners market, backed by mature construction practices and a high rate of re-roofing and renovation projects. The region favors single-ply roofing systems in commercial and industrial buildings, increasing the use of mechanically fastened solutions. Sustainability regulations, energy efficiency targets, and the adoption of solar-ready flat roofs are also driving the market. Technological advancements and a focus on premium, weather-resistant materials are further shaping regional product development.

U.S. Flat-roof Fasteners Market Trends

The U.S. flat-roof fasteners market is characterized by consistent demand for flat roof fasteners, particularly in the commercial real estate and warehousing sectors. The growth of e-commerce has led to a surge in large-scale distribution centers, many of which utilize flat-roofing. Additionally, increasing investment in infrastructure revitalization and federal incentives for energy-efficient buildings fuel demand. The U.S. also strongly prefers mechanical fastening systems due to their proven reliability and ease of application in varying climate conditions.

Asia Pacific Flat-roof Fasteners Market Trends

Asia Pacific dominated the market and accounted for the largest revenue share of about 31.7% in 2024, driven by rapid urbanization, a booming construction sector, and large-scale infrastructure development across countries like China, India, and Southeast Asian nations. The region is witnessing a surge in commercial and industrial building projects, and many prefer flatroofing systems for their cost-efficiency and space optimization. Moreover, government initiatives focused on smart cities, affordable housing, and industrial corridors fuel construction activities, directly boosting the demand for flatroof fasteners.

China is a key contributor to the flatroof fasteners market, driven by its massive construction output and rapid urbanization. Government-backed infrastructure projects, rising commercial real estate development, and industrial expansion continue to push demand for flatroofing systems. The growing trend of green buildings and solar panel installations on flatroofs further supports fastener demand. Additionally, the country’s strong manufacturing base enables large-scale production of fasteners at competitive prices, making it both a leading consumer and supplier in the global market.

Europe Flat-roof Fasteners Market Trends

Europe’s flat roof fasteners market is shaped by stringent environmental regulations and the rising adoption of energy-efficient building practices. Countries across the region are investing in green construction, where flat roofs are often used for solar installations or green roofing systems. This has led to increased demand for durable and weather-resistant fasteners. Renovation of aging infrastructure and government subsidies for energy-saving construction also contribute to steady market growth, especially in Western Europe.

The Germany flat-roof fasteners market stands out within Europe due to its strong emphasis on sustainable architecture and high-quality construction standards. The country is a leader in green buildings, passive house developments, and solar-integrated roofing-all of which commonly use flat roofing systems. Demand for technically advanced and long-lasting fasteners is high, with local manufacturers focusing on precision-engineered, environmentally compliant products. Public and private sector investments in infrastructure and energy-efficient retrofitting further boost market activity.

Latin America Flat-roof Fasteners Market Trends

Latin America's flat roof fasteners market is experiencing gradual growth, driven by urban development and increasing industrial construction in countries like Brazil and Mexico. While sloped roofing is still common in residential applications, commercial and industrial sectors are adopting flat roofing systems for cost and space efficiency. Economic recovery in key countries and foreign investment in real estate and logistics create new opportunities for fastener suppliers. However, market penetration is still in the early stages compared to more developed regions.

Middle East & Africa Flat-roof Fasteners Market Trends

The Middle East & Africa region is showing promising growth in the flat roof fasteners market, fueled by large-scale construction projects, particularly in the Gulf Cooperation Council (GCC) countries. Flat roofs are widely used in the region due to climatic suitability and architectural preferences. Key demand drivers include mega infrastructure and commercial developments in countries like the UAE, Saudi Arabia, and South Africa. As the region diversifies beyond oil-dependent economies, increased focus on sustainable and smart building projects is expected to further support market expansion.

Key Flat-roof Fasteners Company Insights

The flat roof fasteners market consists of key players such as SFS Group U.S., Inc., MSA, Grainger Canada, Alimak Group, 3M, MISUMI Corporation, Prince Fastener, Leeden Sdn Bhd, Bossard Group, and Stronghold Asia. These companies actively focus on strategies such as product innovation, strategic partnerships, and expanding their regional presence to strengthen their market foothold. Emphasis is also placed on enhancing supply chain efficiency and developing advanced fastening solutions tailored to evolving construction demands.

Moreover, leading players are pursuing mergers and acquisitions to broaden their product offerings and penetrate new geographical markets. For instance, in April 2024, Sika launched a new pressure-sensitive acrylic adhesive designed for roofing installation applications, reinforcing its position in the roof fasteners market. This advanced adhesive technology enables quick, secure bonding without additional mechanical fasteners or curing time, significantly reducing installation and labor costs. Its strong initial tack and long-term durability make it ideal for roofing materials, including membranes and insulation boards.

Key Flat-roof Fasteners Companies:

The following are the leading companies in the flat-roof fasteners market. These companies collectively hold the largest market share and dictate industry trends.

- SFS Group U.S., Inc.

- MSA

- Grainger Canada

- Alimak Group

- 3M

- MISUMI Corporation

- Prince Fastener

- Leeden Sdn Bhd

- Bossard Group

- Stronghold Asia

Flat-roof Fasteners Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.78 billion

Revenue forecast in 2033

USD 7.16 billion

Growth rate

CAGR of 5.2% from 2025 to 2033

Base year for estimation

2024

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, roofing membranes, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; South Korea; Brazil; UAE

Key companies profiled

SFS Group U.S., Inc.; MSA; Grainger Canada; Alimak Group; 3M; MISUMI Corporation; Prince Fastener; Leeden Sdn Bhd; Bossard Group; Stronghold Asia

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flat-roof Fasteners Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global flat roof fasteners market report based on product, roofing membranes, end-use, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Mechanically fixed

-

Glued

-

Ballasted

-

Others

-

-

Roofing Membrane Outlook (Revenue, USD Million, 2021 - 2033)

-

Single-ply Membranes

-

Two-Ply Bitumen

-

Other Composite Systems

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Construction & Real Estate

-

Energy & Utilities (Solar and Green Roofs)

-

Industrial & Manufacturing

-

Government & Public Sector

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Direct

-

Indirect

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global flat-roof fasteners market size was estimated at USD 4.56 billion in 2024 and is expected to reach USD 4.78 billion in 2025.

b. The global flat-roof fasteners market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2033 to reach USD 7.16 billion by 2033.

b. The mechanically fixed segment of the market accounted for the largest revenue share of 44.8% in 2024, due to its strong wind resistance, ease of installation, and suitability for a wide range of roofing materials and climates.

b. Some of the key players operating in the flat-roof fasteners market include SFS Group U.S., Inc., MSA, Grainger Canada, Alimak Group, 3M, MISUMI Corporation, Prince Fastener, Leeden Sdn Bhd, Bossard Group, Stronghold Asia.

b. Some of the key players operating in the flat-roof fasteners market include SFS Group U.S., Inc., MSA, Grainger Canada, Alimak Group, 3M, MISUMI Corporation, Prince Fastener, Leeden Sdn Bhd, Bossard Group, Stronghold Asia.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.