- Home

- »

- Plastics, Polymers & Resins

- »

-

Foam Market Size, Share & Growth, Industry Report, 2033GVR Report cover

![Foam Market Size, Share & Trends Report]()

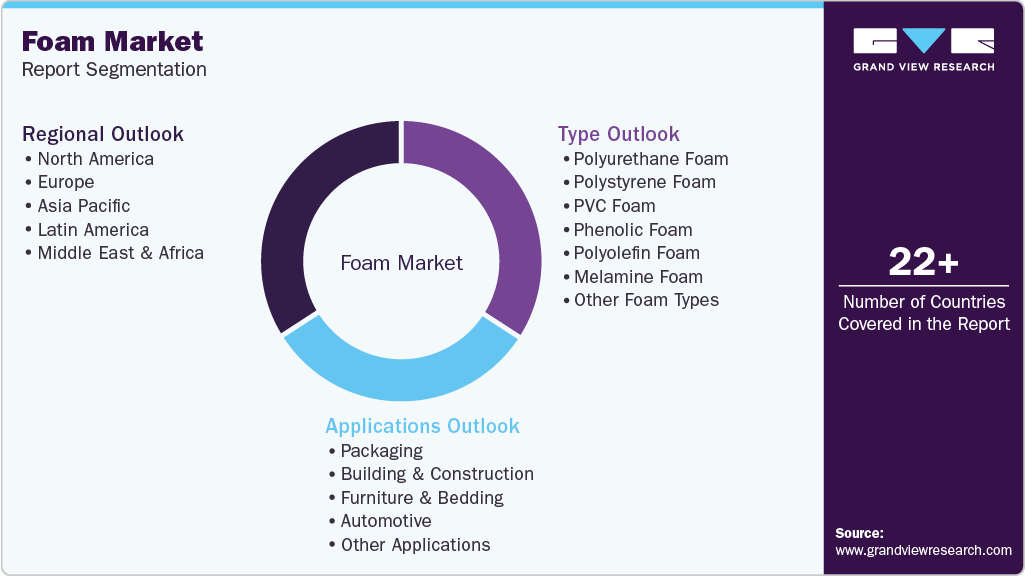

Foam Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (PU Foam, PS Foam, PVC Foam, Phenolic Foam, Polyolefin Foam, Melamine Foam), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-666-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Foam Market Summary

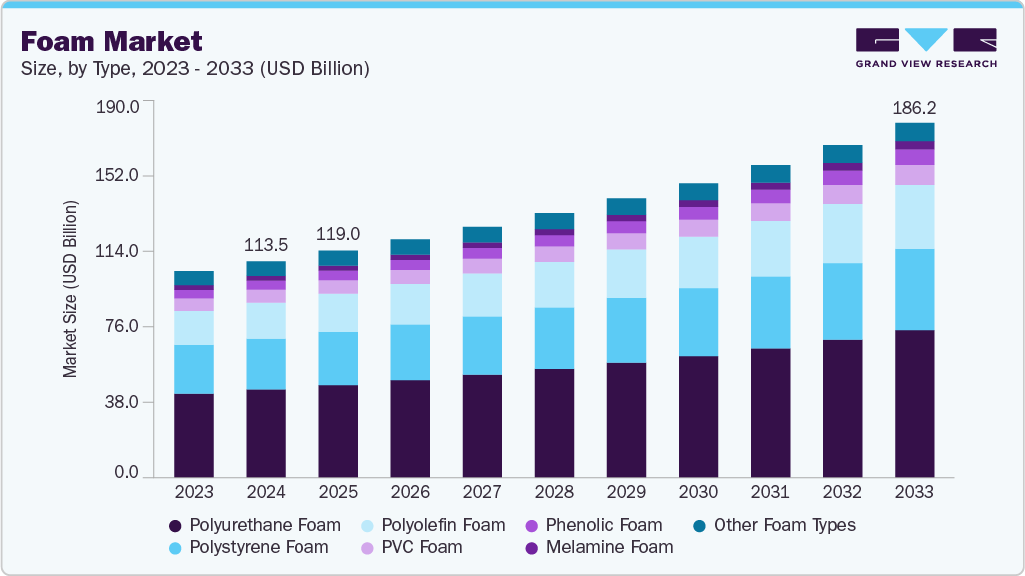

The global foam market size was estimated at USD 119.02 billion in 2025 and is projected to reach USD 186.16 billion by 2033, growing at a CAGR of 5.9% from 2026 to 2033. The growing demand from the packaging, building & construction, furniture & bedding, and automotive industries is driving the demand for foam globally.

Key Market Trends & Insights

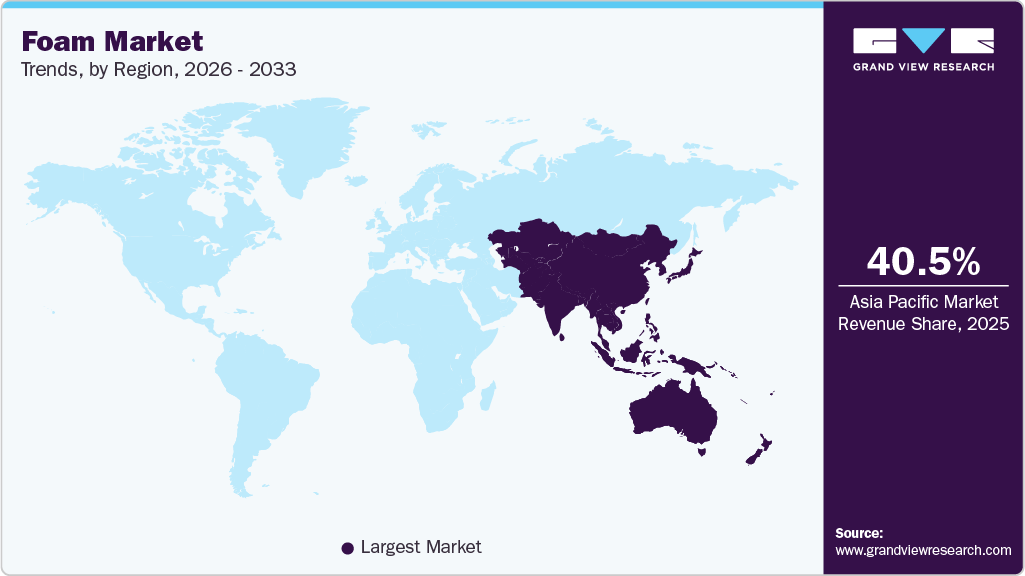

- Asia Pacific dominated the foam market with the largest revenue share of 40.53% in 2025.

- The foam market in Europe is expected to grow at a substantial CAGR of 5.9% from 2026 to 2033.

- By type, the polyolefin foam segment is expected to grow at the fastest CAGR of 6.7% from 2026 to 2033 in terms of revenue.

- By applications, the packaging segment is expected to grow at the fastest CAGR of 6.2% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 119.02 Billion

- 2033 Projected Market Size: USD 186.16 Billion

- CAGR (2026-2033): 5.9%

- Asia Pacific: Largest market in 2025

The foam market is expected to experience substantial growth, owing to booming e-commerce, leading to an increase in foam usage in packaging. The foam market is expected to experience steady growth, driven by increasing demand in key sectors such as packaging, automotive, construction, and healthcare. The lightweight nature, thermal insulation properties, and cushioning capabilities of foam materials are crucial for enhancing energy efficiency in buildings, improving fuel economy in vehicles, and ensuring product safety during transportation. The transition to recyclable and bio-based options is accelerating due to heightened regulatory demands and sustainability objectives, especially in developed countries.

Furthermore, rapid urbanization, investments in infrastructure, and the expansion of cold chain logistics in emerging markets are driving a wider adoption of foams. As industries focus on performance, safety, and sustainability, consistent market growth is projected for the upcoming years.

Drivers, Opportunities & Restraints

The foam industry is projected to experience continuous growth, fueled by the increasing demand from sectors such as packaging, construction, automotive, and healthcare. Its lightweight, thermal insulation, and shock-absorbing characteristics render it crucial for energy-efficient structures, reducing vehicle weight, and providing protective packaging options. The rising application of foams in medical products, mattresses, and cold chain logistics further bolsters market growth, particularly with the expansion of healthcare facilities in developing areas.

New opportunities are likely to arise due to the increasing emphasis on sustainability and circular economic practices. The advancement of recyclable and bio-based foam substitutes is becoming more prevalent, particularly in Europe and North America. Furthermore, the growth of e-commerce, infrastructure expansion, and the manufacturing of electric vehicles are creating fresh prospects for foam uses, especially in thermal insulation, impact resistance, and lightweight materials.

The market is expected to face restraints due to the growing environmental worries associated with foam waste and its recyclability, as well as escalating regulatory demands concerning certain blowing agents and raw materials. Fluctuating raw material prices and disruptions in the supply chain might also affect production costs and availability. In addition, competition from substitute materials and stringent compliance requirements could restrict acceptance in particular end-use sectors.

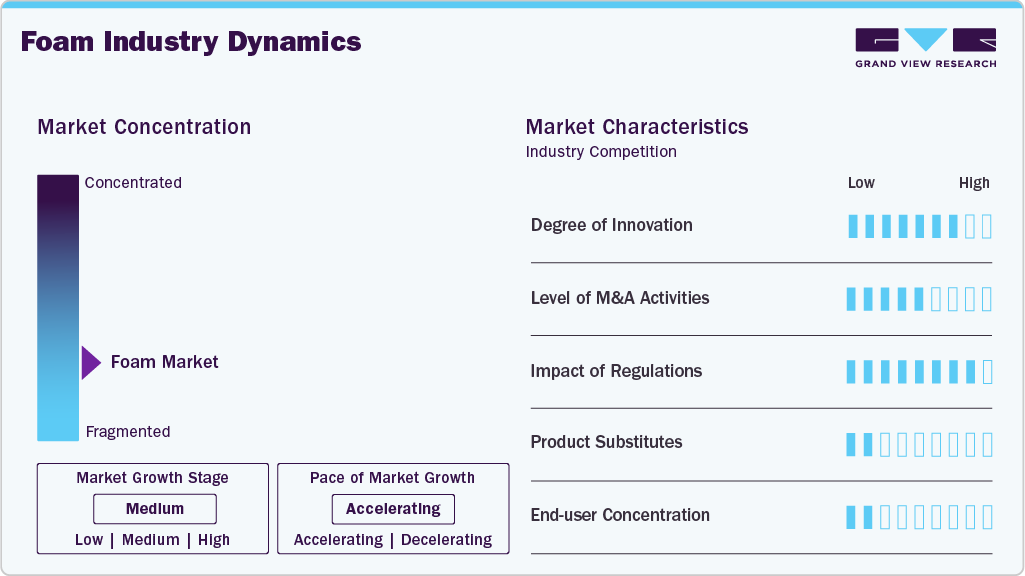

Market Concentration & Characteristics

The foam market is currently in a medium growth stage, with an accelerating pace, driven by increasing applications in various sectors such as construction, automotive, packaging, and healthcare. Although the market is fragmented, major players wield considerable power over the competitive environment. Leading firms like Arkema Group, Armacell International S.A., BASF SE, Borealis AG, SABIC, Japan Polypropylene Corporation, Braskem, and Exxon Mobil Corporation are crucial in influencing market dynamics. These companies foster innovation through the creation of advanced formulations, eco-friendly materials, and high-performance foam products to meet changing regulatory requirements and evolving customer expectations in global markets.

The foam market is being shaped by mergers and acquisitions, as major companies acquire niche firms to broaden their geographic presence, enhance their product offerings, and fortify their supply chains. These activities are fostering innovation in sustainable foam solutions in response to increasing regulatory demands. Regulatory frameworks, particularly in Europe and North America, are affecting the selection of materials, encouraging manufacturers to embrace alternatives that are low-emission, recyclable, and non-toxic. The costs associated with compliance and the evolution of standards are prompting investments in cleaner technologies and reformulated products.

The market experiences a moderate level of competition from alternative materials such as fiberglass, rigid plastics, and natural fibers in the insulation and packaging sectors; however, foams maintain a solid standing because of their lightweight, thermal insulation, and cushioning characteristics. There is significant concentration among end users, particularly within the construction and automotive industries, where large OEMs and contractors largely influence procurement decisions. This concentration impacts product development and demand volume, rendering the market vulnerable to industry cycles and trends in customer specifications.

Type Insights

Polyurethane (PU) Foam dominated the Foam Market across the Type segmentation in terms of revenue, accounting for a market share of 40.90% in 2025. The polyurethane foam market is projected to experience consistent growth due to its extensive application in the construction, automotive, furniture, and packaging sectors. Its outstanding properties for insulation, cushioning, and structure make it suitable for energy-efficient buildings, reducing noise, and creating lightweight components for vehicles. A significant factor contributing to this growth is the increasing demand for thermal insulation in both residential and commercial construction, especially in North America, Europe, and certain regions of Asia.

Moreover, the growth of the e-commerce industry is driving the requirement for protective packaging solutions, while the transition towards electric vehicles is boosting the need for lightweight and durable materials. With sustainability becoming more significant, advancements in bio-based and low-VOC polyurethane forms are anticipated to aid in the market's development.

The polystyrene foam market is projected to experience steady growth over the forecast period at a CAGR of 5.6%, bolstered by its robust demand in the packaging, construction, and consumer goods sectors. Its lightweight nature, insulating qualities, and resistance to moisture make it an optimal choice for protective packaging, food containers, and building insulation. In the construction industry, expanded polystyrene (EPS) is commonly utilized for thermal insulation in walls, roofs, and foundations, especially in areas with strict energy efficiency regulations.

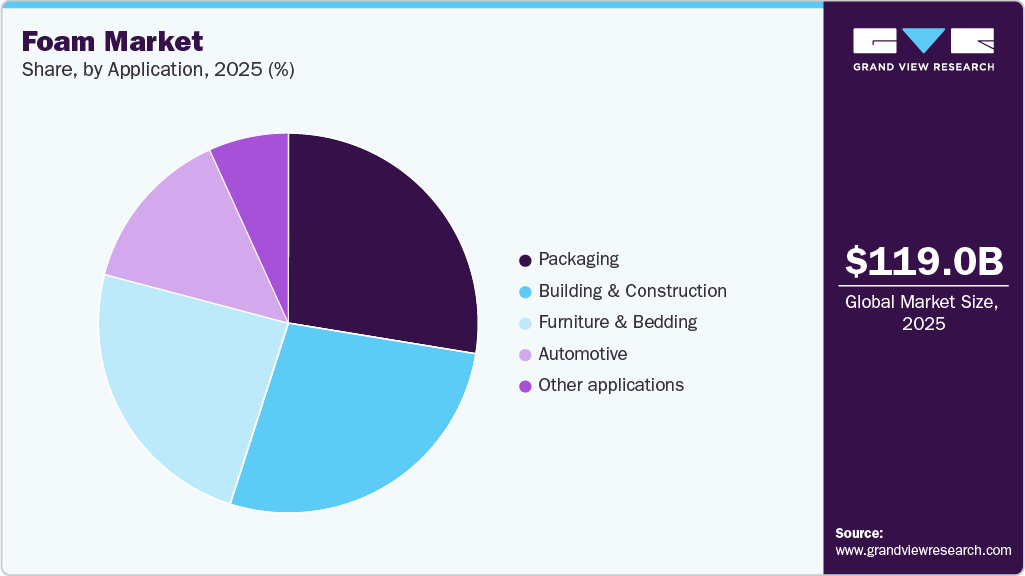

Application Insights

The packaging led the foam market across the application segmentation in terms of revenue, accounting for a market share of 27.59% in 2025. This growth is fueled by the rapid development of e-commerce, advancements in cold chain logistics, and an increasing need for protective and thermal insulation products. Foam materials like EPS and PE provide excellent shock absorption, a lightweight design, and moisture resistance, making them suitable for food containers, appliance packaging, and temperature-sensitive items. The rising emphasis on cost-effectiveness and recyclability is also driving innovation in sustainable foam-based packaging.

Building & construction is projected to grow at a significant CAGR of 6.0% throughout the forecast period. The building & construction industry is projected to significantly influence the growth of the foam market, driven by an increasing need for lightweight and energy-efficient insulation materials. Various types of foams, including polyurethane, polystyrene, and phenolic, are commonly utilized for thermal insulation in walls, roofs, and foundations, leading to enhanced energy efficiency in both residential and commercial structures. The rising implementation of green building regulations and more stringent energy standards, especially in regions like Europe, North America, and certain areas of Asia Pacific, is promoting the utilization of high-performance insulation foams.

The swift pace of urban development, investment in infrastructure, and renovation projects in developing countries further bolsters the demand for resilient, moisture-resistant, and economically viable foam solutions in the construction sector.

The automotive sector is projected to experience significant growth fueled by the increasing need for lightweight, energy-absorbing, and noise-dampening materials. Foams are commonly utilized in seats, headliners, door panels, and under-the-hood components to improve comfort, safety, and fuel efficiency. The transition to electric and hybrid vehicles is also boosting the demand for foams for thermal insulation and lightweight applications. Moreover, higher safety regulations and consumer demand for enhanced interior comfort are prompting OEMs to implement advanced foam solutions across various vehicle platforms.

Regional Insights

Asia Pacific held the largest share of 40.53% in terms of revenue of the foam market in 2025. The foam market in the Asia Pacific region is anticipated to see significant growth, fueled by swift industrialization, urban expansion, and infrastructure advancements in nations such as China, India, Indonesia, and Vietnam. The increase in construction activities, coupled with a rising need for energy-efficient insulation materials, is elevating foam usage within both residential and commercial buildings. Additionally, the area's extensive automotive manufacturing sector and the expanding consumer electronics market are further driving the demand for foam in interior components, packaging, and thermal management applications.

China Foam Market Trends

China's foam industry is projected to experience swift expansion, fueled by extensive urban development, heightened construction efforts, and a flourishing automotive sector. Investments from the government in infrastructure, along with a growing appetite for consumer products, are also propelling the use of foam materials in the construction, transportation, and packaging industries.

North America Foam Market Trends

The foam market in North America is anticipated to experience a CAGR of 5.6%, fueled by strong demand in the construction, automotive, and packaging industries. Increasing regulations focused on energy efficiency are promoting the use of insulation foams in both residential and commercial properties. Furthermore, the robust e-commerce and cold chain logistics sectors in the region are further driving the need for protective and thermal packaging solutions.

The U.S. foam market is anticipated to grow due to continuous infrastructure improvements, stricter building regulations, and an increase in electric vehicle manufacturing. The rising consumer preference for comfort, safety, and lightweight materials in vehicles and furniture further promotes the use of advanced foam solutions in various end-use sectors.

Europe Foam Market Trends

Stringent energy efficiency regulations, the rise of green building initiatives, and a robust emphasis on the circular economy are likely to benefit the European foam market. There is a growing demand for recyclable, low-emission foam materials, especially in applications like insulation, automotive interiors, and eco-friendly packaging.

Key Foam Market Company Insights

The foam market is intensely competitive, with several key players influencing the sector through innovation and strategic growth initiatives. Leading companies like Arkema Group, Armacell International S.A., BASF SE, Borealis AG, SABIC, Japan Polypropylene Corporation, Braskem, and Exxon Mobil Corporation are pivotal in fostering product development and market expansion.

These firms are making substantial investments in research and development to enhance material performance, sustainability, and the versatility of applications across industries such as construction, automotive, packaging, and consumer goods. The competitive environment is also characterized by strategic partnerships, capacity expansions, and the launch of recyclable and low-emission foam products to align with changing regulatory and customer needs.

Key Foam Companies:

The following are the leading companies in the foam market. These companies collectively hold the largest market share and dictate industry trends.

- Arkema Group

- Armacell International S.A.

- BASF SE

- Borealis AG

- SABIC

- Japan Polypropylene Corporation

- Braskem

- Exxon Mobil Corporation

- LyondellBasell Industries Holdings B.V.

- Huntsman Corporation

- Evonik Industries AG

- Covestro AG

- Fritz Nauer AG (acquired by Recticel NV)

- Koepp Schaum GmbH

- JSP Corporation

- Polymer Technologies, Inc.

- Recticel NV

- Rogers Corporation

- SEKISUI ALVEO AG

- Synthos S.A.

- DuPont de Nemours, Inc.

- Trelleborg AB

- Zotefoams plc

- Woodbridge Foam Corporation

- Sealed Air Corporation

Recent Developments

-

In May 2025, T.A.S. Corporation partnered with Formosa to launch the TECO Flexshield PU Foam, a product specially developed for heavy industrial environments. The foam featured high resistance to acid and chemicals, making it suitable for protecting against acid fumes in industrial settings. This innovation aimed to enhance safety and durability in harsh chemical conditions, supporting T.A.S.'s commitment to advanced, high-quality insulation solutions.

-

In February 2025, Carlisle Companies Incorporated completed its acquisition of ThermaFoam, a Texas-based manufacturer of expanded polystyrene insulation products, in early 2025. ThermaFoam, headquartered near Dallas/Fort Worth, serves commercial, residential, and infrastructure construction markets.

Foam Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 125.03 billion

Revenue forecast in 2033

USD 186.16 billion

Growth rate

CAGR of 5.9% from 2026 to 2033

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, applications, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; South Korea, Australia Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Arkema Group; Armacell International S.A.; BASF SE; Borealis AG; SABIC; Japan Polypropylene Corporation; Braskem; Exxon Mobil Corporation; LyondellBasell Industries Holdings B.V.; Huntsman Corporation; Evonik Industries AG; Covestro AG; Fritz Nauer AG (acquired by Recticel NV); Koepp Schaum GmbH; JSP Corporation; Polymer Technologies, Inc.; Recticel NV; Rogers Corporation; SEKISUI ALVEO AG; Synthos S.A.; DuPont de Nemours, Inc.; Trelleborg AB; Zotefoams plc; Woodbridge Foam Corporation; Sealed Air Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Foam Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global foam market report on the basis of type, applications, and region:

-

Type Outlook (Revenue, USD Million; Volume, Kilotons; 2021 - 2033)

-

Polyurethane Foam

-

Polystyrene Foam

-

PVC Foam

-

Phenolic Foam

-

Polyolefin Foam

-

Polyethylene Foam

-

Polypropylene Foam

-

-

Melamine Foam

-

Other Foam Types

-

-

Applications Outlook (Revenue, USD Million; Volume, Kilotons; 2021 - 2033)

-

Packaging

-

Food & Beverage packaging

-

Industrial protective packaging

-

Consumer Electronics Packaging

-

E-Commerce Mailers & Shipping

-

Pharmaceuticals & healthcare packaging

-

-

Building & Construction

-

Insulation boards (walls, roofs, floors)

-

Soundproofing/acoustic panels

-

HVAC duct insulation

-

Sealants & gap fillers

-

Waterproofing membranes

-

-

Furniture & Bedding

-

Mattresses

-

Upholstered furniture cushions

-

Office chairs

-

Foam toppers & pads

-

-

Automotive

-

Seating foam

-

Interior trim & headliners

-

Acoustic insulation

-

Bumper & crash pads

-

Air filters & HVAC foams

-

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global foam market size was estimated at USD 119.02 billion in 2025 and is expected to reach USD 125.03 billion in 2026.

b. The global foam market is projected to grow at a compound annual growth rate (CAGR) of 5.9% from 2026 to 2033, reaching a value of USD 186.16 billion by 2033.

b. Polyurethane (PU) Foam dominated the Foam Market across the Type segmentation in terms of revenue, accounting for a market share of 40.90% in 2025. The polyurethane foam market is projected to experience consistent growth due to its extensive application in the construction, automotive, furniture, and packaging sectors.

b. Some key players operating in the Foam market include Arkema Group, Armacell International S.A., BASF SE, Borealis AG, SABIC, Japan Polypropylene Corporation, Braskem, and Exxon Mobil Corporation.

b. The growing demand from the packaging, building & construction, furniture & bedding, and automotive industries is driving the demand for foam globally. The foam market is expected to experience substantial growth, owing to the booming e-commerce, leading to an increase in foam usage in packaging.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.