- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Food Premix Market Size And Share, Industry Report, 2030GVR Report cover

![Food Premix Market Size, Share & Trends Report]()

Food Premix Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Vitamin, Minerals, Hydrocolloids), By Form (Powder, Liquid), By Application (Dietary Supplements, Beverages, Dairy Products), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-587-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Food Premix Market Summary

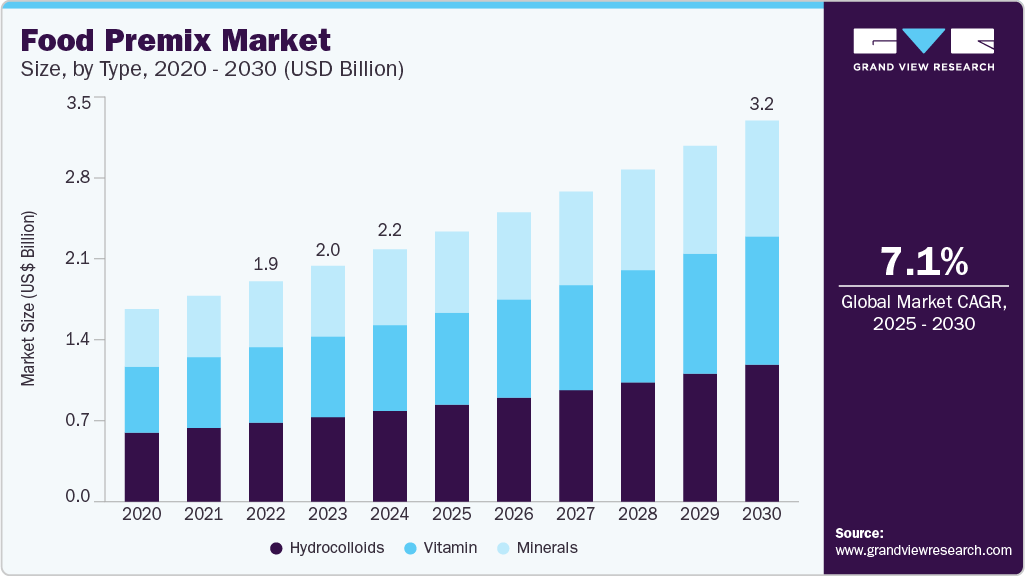

The global food premix market size was 2.2 billion at USD value in 2024 and is projected to reach USD 3247.5 million by 2030, growing at a CAGR of 7.1% from 2025 to 2030. The food premix market is experiencing robust growth, driven primarily by shifting consumer preferences toward convenience and health.

Key Market Trends & Insights

- The North America food premix market was valued at USD 738.7 million in 2024.

- The U.S. food premix market is expected to exceed USD 900 million by 2030.

- By type, vitamin premix market segment is expected to reach USD 1050 million by 2030.

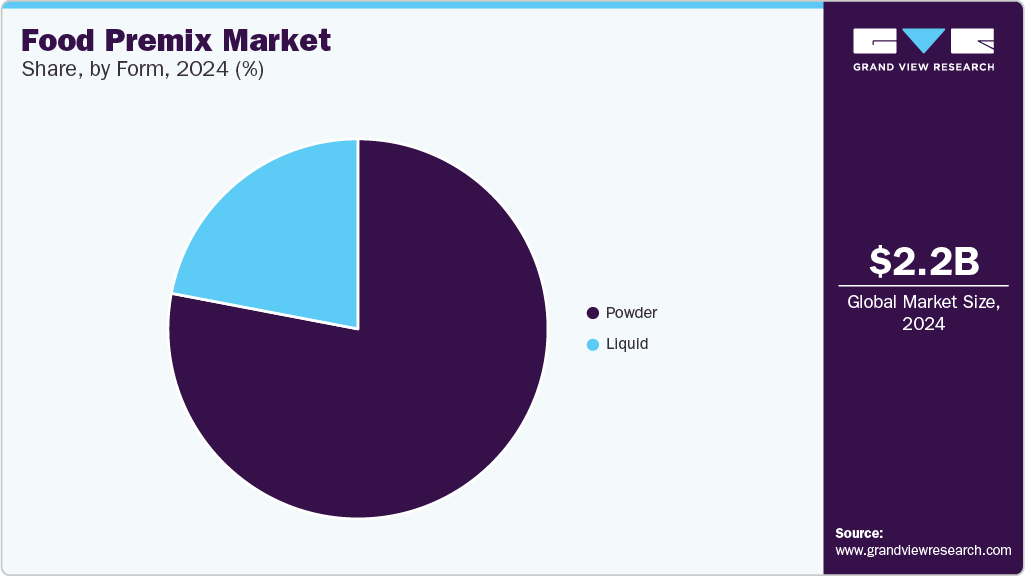

- By form, powder food premix segment is expected to account for USD 1667 million in 2024.

- By application, dietary supplements were the most extensive application for food premix and are expected to account for over 35% of the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.2 Billion

- 2030 Projected Market Size: USD 3247.5 Million

- CAGR (2025-2030): 7.1%

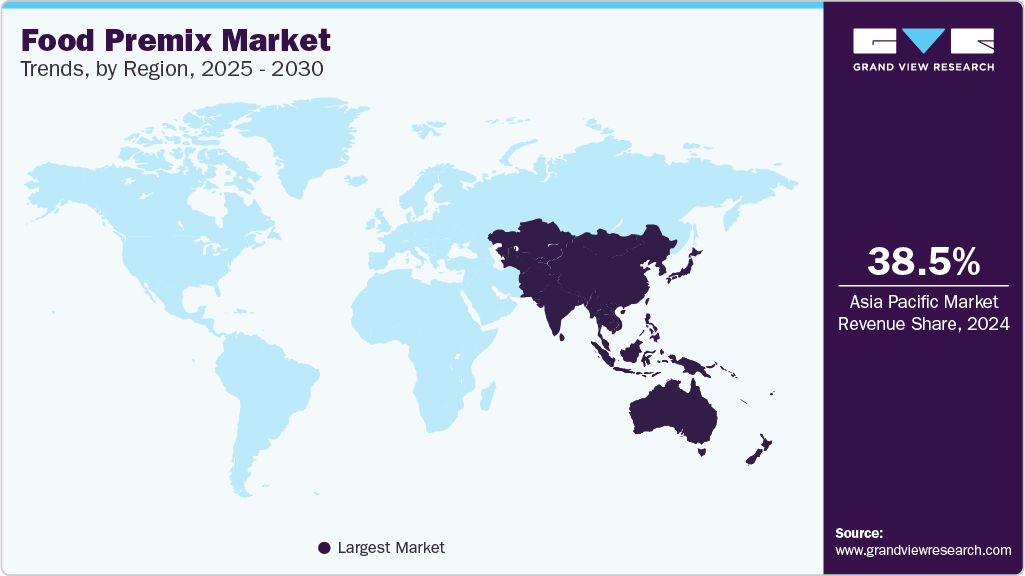

- Asia Pacific: Largest market in 2024

As modern lifestyles become increasingly fast-paced, consumers have less time for elaborate meal preparation, leading to a surge in demand for easy-to-use, ready-to-cook, and ready-to-eat food options. Food premixes offer a practical solution by simplifying cooking processes while ensuring consistent taste and nutritional value, making them highly attractive to busy urban populations. A significant factor fueling this market is the growing awareness of nutrition and the importance of a balanced diet. Consumers are more conscious of their health and are actively seeking products that help address specific nutritional deficiencies. Food premixes, often fortified with essential vitamins, minerals, amino acids, and other nutrients, are being used to enhance the nutritional profile of everyday foods, beverages, and supplements. This trend is particularly evident in the rise of fortified and functional foods, which are increasingly preferred for their perceived health benefits.

Government initiatives and global health organizations are also crucial in promoting food fortification. Programs aimed at reducing micronutrient deficiencies, such as anemia and vitamin deficiencies, have led to the widespread adoption of fortified premixes in staple foods. The World Health Organization’s targets for improving maternal and child nutrition through large-scale fortification further underscore the importance of premixes in public health strategies, prompting manufacturers to innovate and expand their fortified product offerings.

The food industry’s shift toward clean-label, organic, and plant-based products is another key driver. Consumers demand transparency in food ingredients and are willing to pay premiums for products with added health benefits, such as protein-fortified or immunity-boosting foods. This has encouraged manufacturers to develop advanced premix formulations that cater to these evolving preferences, including customized and nutrient-rich blends for specific health needs.

Technological advancements and improved food enrichment methods have made it easier for manufacturers to incorporate premixes into various products. Premixes, available in powder, liquid, and other forms, are versatile and can be used in bakery, dairy, beverages, snacks, and even animal feed. This adaptability, combined with the rise of e-commerce and broader distribution channels, has made food premixes more accessible to consumers and manufacturers worldwide.

Rapid urbanization and rising disposable incomes in emerging markets, particularly in Asia-Pacific, are accelerating the adoption of food premixes. The expanding middle class and changing dietary habits in countries such as China and India are driving demand for fortified and functional foods, making these regions significant contributors to global market growth. As a result, the food premix market is expected to continue its upward trajectory, with innovation and health consciousness at its core.

Type Insights

Vitamin premix market is expected to reach USD 1050 million by 2030. Vitamin premixes are carefully formulated blends of essential vitamins designed to fortify foods and beverages, ensuring that consumers meet their daily micronutrient requirements. The growth of vitamin premixes is primarily attributed to rising health consciousness and the global push to combat micronutrient deficiencies, particularly in developing regions. Governments and health organizations, such as the World Health Organization, actively promote food fortification programs to address public health challenges such as anemia and vitamin A deficiency. This has led to the widespread use of vitamin premixes in staple foods, infant nutrition, dietary supplements, and ready-to-eat products.

Moreover, consumers are increasingly seeking foods with added health benefits, such as immunity-boosting or energy-enhancing properties, which has further propelled demand for vitamin-fortified products. Manufacturers are responding by developing innovative, customized vitamin premixes tailored to specific demographic needs, such as children, athletes, or the elderly, and incorporating them into a wide range of food and beverage applications.

Mineral premixes combine essential minerals, such as calcium, iron, zinc, and magnesium, into a single, easy-to-use blend. The market for mineral premixes is expanding as consumers and food producers recognize the importance of minerals in preventing conditions like anemia and osteoporosis. The rise in chronic health issues related to mineral deficiencies and the growing popularity of functional foods and beverages has spurred manufacturers to fortify their products with mineral premixes. Regulatory support for mandatory fortification in certain staple foods and the scalability and consistency offered by premix solutions are additional factors driving this segment’s growth. Mineral premixes are now commonly found in bakery products, dairy, infant formula, and nutritional supplements, helping ensure that populations receive adequate mineral intake in their daily diets.

Hydrocolloid (colloidal) premixes are specialized blends of hydrocolloids, such as xanthan gum, carrageenan, pectin, guar gum, and others, that are used to modify texture, stabilize, thicken, and emulsify food products. The growth of hydrocolloid premixes is closely linked to the surge in processed and convenience foods, as these ingredients play a crucial role in enhancing texture, shelf life, and product stability. Hydrocolloids are indispensable in dairy products, bakery items, beverages, sauces, and plant-based alternatives, where they prevent separation, improve mouthfeel, and maintain consistency. The clean-label movement and demand for plant-based, gluten-free, and low-fat products have further boosted the use of hydrocolloid premixes, as they enable manufacturers to create foods with appealing sensory qualities while meeting specific dietary needs. Advances in hydrocolloid technology, such as encapsulation and novel blends, allow for even greater customization, supporting the development of functional foods with added health benefits like fiber enrichment, fat replacement, and glycemic control.

Form Insights

Powder food premix was the most popular product form and is expected to account for USD 1667 million in 2024. This dominance is attributed to several factors: powder premixes offer superior homogeneity, are easier to handle and transport, and have lower production and logistical costs than liquid forms. In addition, powders provide enhanced stability and longer shelf life, making them ideal for large-scale manufacturing and storage. Their versatility allows them to be easily incorporated into various products, including bakery, dairy, supplements, and fortified foods. The ability to deliver precise nutrient dosing and maintain product quality over time further cements the popularity of powder premixes among food manufacturers and consumers alike.

Liquid food premixes, while holding a smaller share of the market, are experiencing faster growth in recent years. Their appeal lies in their ease of integration into beverage production and other liquid-based food applications, offering consistent and specification-oriented quality without the need for additional dissolving or filtering equipment. Liquid premixes provide homogeneous blends with virtually no segregation and high microbiological stability. They can also help improve viscosity, mouthfeel, and product stability in finished products. They are especially favored in the beverage industry, where they enhance drinks' sensory attributes and shelf life. The segment’s growth is driven by increasing demand for ready-to-drink and functional beverages, as well as the trend toward convenient, specification-driven food solutions.

Application Insights

Dietary supplements were the most extensive application for food premix and are expected to account for over 35% of the market in 2024. Dietary supplements represent the leading application for food premixes, driven by a global shift toward preventive healthcare and wellness. Consumers increasingly seek to address specific nutritional deficiencies, boost immunity, and support overall health through supplements, which often rely on precisely formulated premixes of vitamins, minerals, amino acids, and herbal extracts. The rising prevalence of chronic health conditions such as obesity, diabetes, and cardiovascular diseases, along with an aging population that requires targeted nutrition, has significantly fueled demand for dietary supplements. In addition, growing consumer confidence in supplement efficacy, effective marketing, and the trend toward clean-label, organic, and plant-based formulations have further expanded the market. Manufacturers are responding with customized, innovative products tailored to diverse health needs, making dietary supplements a dynamic and resilient segment for food premix applications.

Demand for premixes is surging in the beverages sector due to the increasing popularity of convenience and ready-to-drink products. Busy lifestyles and urbanization have led consumers to prefer beverages that are quick to prepare yet offer functional benefits, such as energy, hydration, or added nutrition. The fastest-growing beverage segment is functional and wellness-based drinks, including protein shakes, energy drinks, fortified teas, and coffees, which appeal to health-conscious consumers seeking products with added vitamins, minerals, and natural ingredients. The beverage premix market is further propelled by innovative product development, convenient packaging, long shelf life, and the growing working population, especially in rapidly urbanizing regions like Asia-Pacific. As consumers increasingly prioritize health and convenience, beverage premixes are expected to maintain robust growth.

Regional Insights

The North America food premix market was valued at USD 738.7 million in 2024. The growth of the food and feed premix market in North America is primarily driven by high demand for micronutrient-enriched food products, which is a response to the prevalence of chronic disorders such as diabetes, cancer, and osteoporosis. Consumers in the region are increasingly seeking innovative and healthy food options, leading to a surge in demand for dietary supplements and fortified foods. The area also benefits from a well-established food processing industry and the presence of leading food premix producers, which further accelerates market expansion. In the feed premix sector, North America’s robust livestock and poultry industries are major contributors, as rising meat and egg consumption necessitate high-quality feed premixes to ensure optimal animal health and productivity. Technological advancements in feed manufacturing, nutrition optimization, and regulatory support for food safety and fortification also play significant roles in sustaining market growth.

U.S. Food Premix Market Trends

The U.S. food premix market is expected to exceed USD 900 million by 2030 and grow at a CAGR of 6.8% from 2025 to 2030. Due to several factors, the U.S. stands out as a dominant force in the food premix market. The country has a large-scale food processing industry and a strong demand for dietary supplements, both propelling market growth. The rising incidence of chronic diseases and consumer interest in fortified, functional foods have led to increased use of premixes in a variety of applications, including infant nutrition, beverages, and over-the-counter pharmaceuticals. The U.S. is also a leading producer and consumer of meat, which drives the need for efficient livestock farming practices and specialized feed premixes to enhance animal health and productivity. Regulatory frameworks that support food fortification and the availability of customized premix solutions from top manufacturers further bolster the market. In addition, the widespread practice of fortifying staple foods such as wheat and corn with vitamins and minerals ensures that food premixes remain integral to the American diet.

Asia Pacific Food Premix Market Trends

The Asia Pacific food premix market is expected to grow at a CAGR of 7.6% from 2025 to 2030. Asia Pacific is experiencing rapid growth in the food premix market, fueled by rising health awareness, increasing prevalence of micronutrient deficiencies, and a growing demand for fortified foods and beverages. The region faces significant public health challenges, such as high rates of anemia and diabetes, prompting consumers to seek fortified products as proactive solutions for better nutrition and wellness. Urbanization and rising disposable incomes, particularly in countries such as China, India, Japan, and South Korea, are driving consumers to spend more on health-promoting and functional foods. Government initiatives promoting nutritional supplementation and food fortification, along with the expansion of the food and beverage manufacturing sector, further stimulate market growth. The trend toward plant-based and clean-label products, combined with advances in food technology and product innovation, is also contributing to the robust expansion of the food premix market in Asia Pacific.

Key Food Premix Company Insights

The global food premix market is highly competitive and characterized by the presence of both established multinational corporations and a growing number of regional and specialized players. Key industry leaders include Koninklijke DSM N.V., Cargill Incorporated, Archer Daniels Midland Company, BASF SE, Corbion N.V., Glanbia plc, SternVitamin GmbH & Co. KG, Barentz International BV, Jubilant Life Sciences Limited, Lycored Ltd., Watson Inc., Fenchem Biotek Ltd., and Hexagon Nutrition Pvt. Ltd., among others. These companies compete based on product innovation, quality, customization, and global reach.

Key Food Premix Companies:

The following are the leading companies in the food premix market. These companies collectively hold the largest market share and dictate industry trends.

- Archer Daniels Midland Company

- DSM

- Cargill Incorporated

- BASF SE

- Corbion N.V.

- Glanbia plc

- Associated British Foods plc (AB Agri Ltd)

- Barentz International

- Prinova Group LLC

- Hexagon Nutrition Pvt. Ltd.

- SternVitamin GmbH & Co. KG

- Farbest-Tallman Foods Corporation

- Jubilant Life Sciences

- Watson Inc

Food Premix Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2302.7 million

Revenue forecast in 2030

USD 3247.5 million

Growth rate (Revenue)

CAGR of 7.1% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, form, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, UAE

Key companies profiled

Archer Daniels Midland Company; DSM; Cargill Incorporated; BASF SE; Corbion N.V.; Glanbia plc; Associated British Foods plc (AB Agri Ltd); Barentz International; Prinova Group LLC; Fenchem Biotek Ltd.; Hexagon Nutrition Pvt. Ltd.; SternVitamin GmbH & Co. KG; Farbest-Tallman Foods Corporation; Jubilant Life Sciences; Watson Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

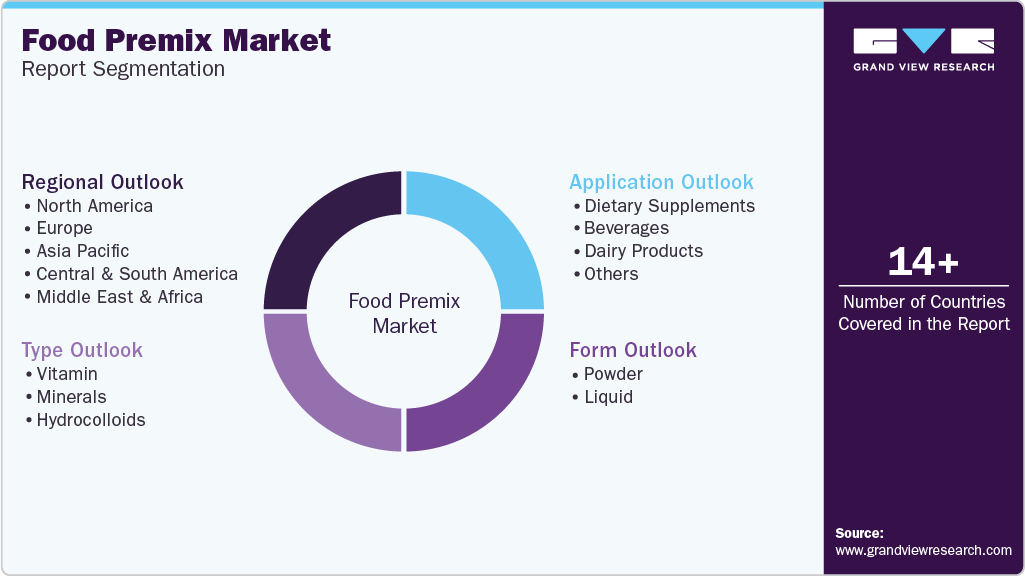

Global Food Premix Market Report Segmentation

This report forecasts revenue growth globally, regionally, and country-wide and analyzes the latest industry trends and opportunities in each sub-segment from 2018 to 2030. Grand View Research has segmented the global food premix market report by material type, form, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin

-

Minerals

-

Hydrocolloids

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder

-

Liquid

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Dietary Supplements

-

Beverages

-

Dairy Products

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global food premix market was valued at USD 2,150 million in 2024 and is expected to reach USD 2302.7 million in 2025.

b. The global food premix market is expected to grow at a CAGR of 7.1% from 2025 to 2030 to reach USD 3247.5 million by 2030.

b. Vitamin premix market is expected to reach USD 1050 million by 2030. Vitamin premixes are carefully formulated blends of essential vitamins designed to fortify foods and beverages, ensuring that consumers meet their daily micronutrient requirements. The growth of vitamin premixes is primarily attributed to rising health consciousness and the global push to combat micronutrient deficiencies, particularly in developing regions. Governments and health organizations, such as the World Health Organization, actively promote food fortification programs to address public health challenges like anemia and vitamin A deficiency. This has led to the widespread use of vitamin premixes in staple foods, infant nutrition, dietary supplements, and ready-to-eat products. Moreover, consumers are increasingly seeking foods with added health benefits, such as immunity-boosting or energy-enhancing properties, which has further propelled demand for vitamin-fortified products.

b. Some of the key players operating in the market include Archer Daniels Midland Company; DSM; Cargill Incorporated; BASF SE; Corbion N.V.; Glanbia plc; Associated British Foods plc (AB Agri Ltd); Barentz International; Prinova Group LLC; Fenchem Biotek Ltd.; Hexagon Nutrition Pvt. Ltd.; SternVitamin GmbH & Co. KG; Farbest-Tallman Foods Corporation; Jubilant Life Sciences; Watson Inc

b. The food premix market is experiencing robust growth, driven primarily by shifting consumer preferences toward convenience and health. As modern lifestyles become increasingly fast-paced, consumers have less time for elaborate meal preparation, leading to a surge in demand for easy-to-use, ready-to-cook, and ready-to-eat food options. Food premixes offer a practical solution by simplifying cooking processes while ensuring consistent taste and nutritional value, making them highly attractive to busy urban populations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.