- Home

- »

- Beauty & Personal Care

- »

-

Foot Care Products Market Size, Industry Report, 2033GVR Report cover

![Foot Care Products Market Size, Share, & Trend Report]()

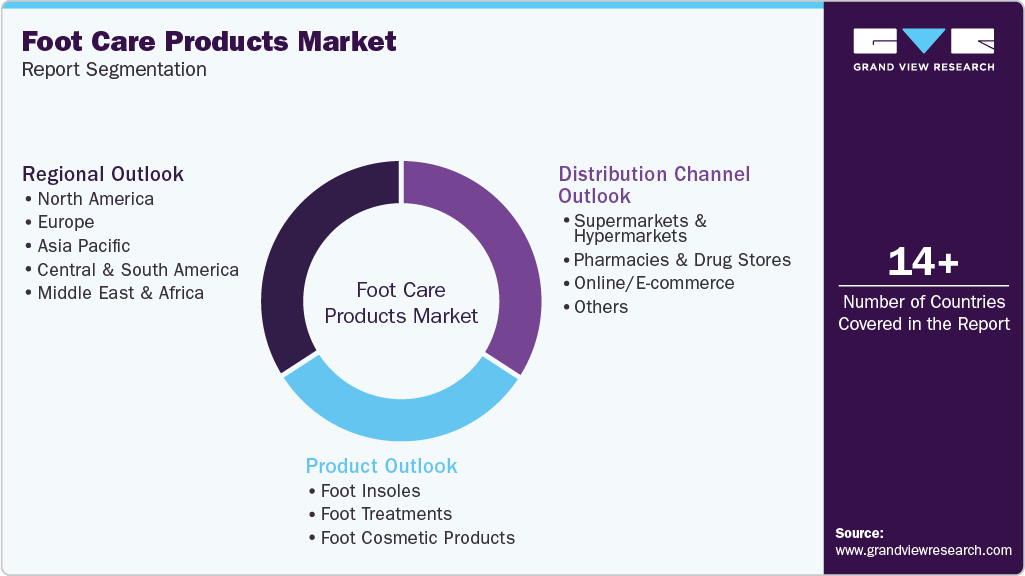

Foot Care Products Market (2026 - 2033) Size, Share, & Trend Analysis Report By Product (Foot Insoles, Foot Treatments, Foot Cosmetic Products), By Distribution Channel (Supermarkets & Hypermarkets, Pharmacies & Drug Stores, Online/E-commerce), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-148-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Foot Care Products Market Summary

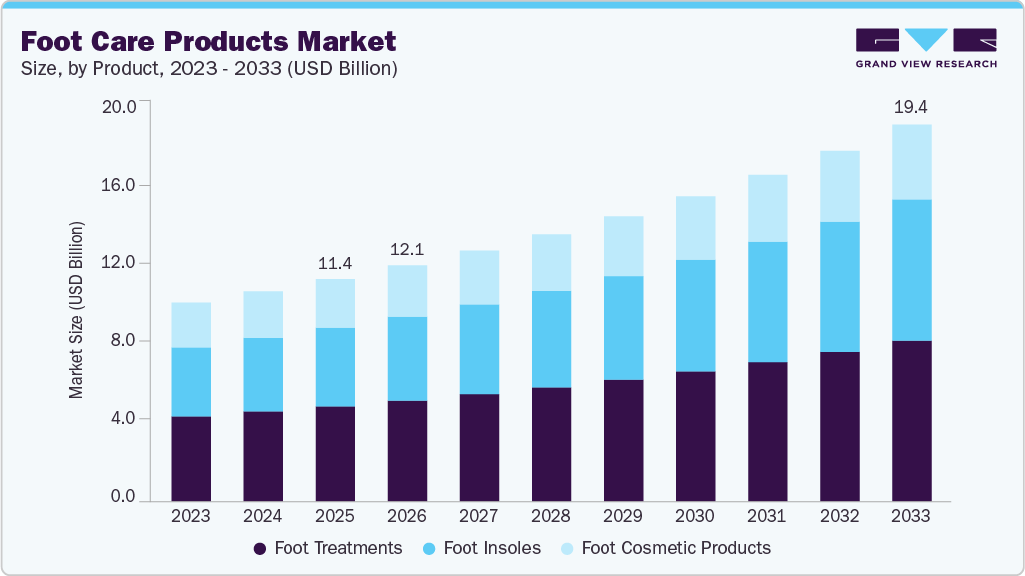

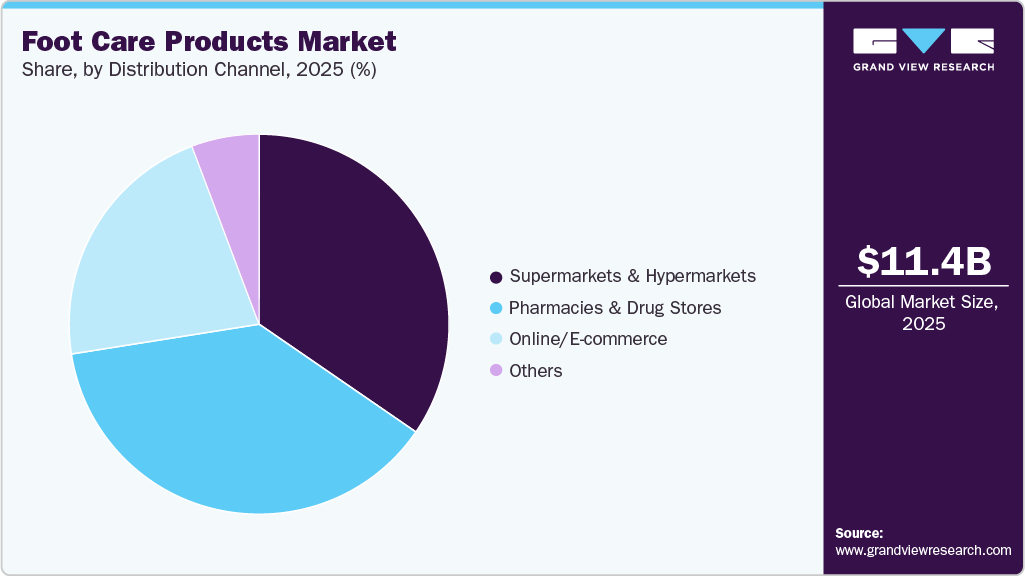

The global foot care products market size was estimated at USD 11.46 billion in 2025 and is expected to reach USD 19.41 billion by 2033, growing at a CAGR of 6.8% from 2026 to 2033. Consumers are increasingly recognising that foot health is a critical element of overall wellness, not just a cosmetic or comfort issue.

Key Market Trends & Insights

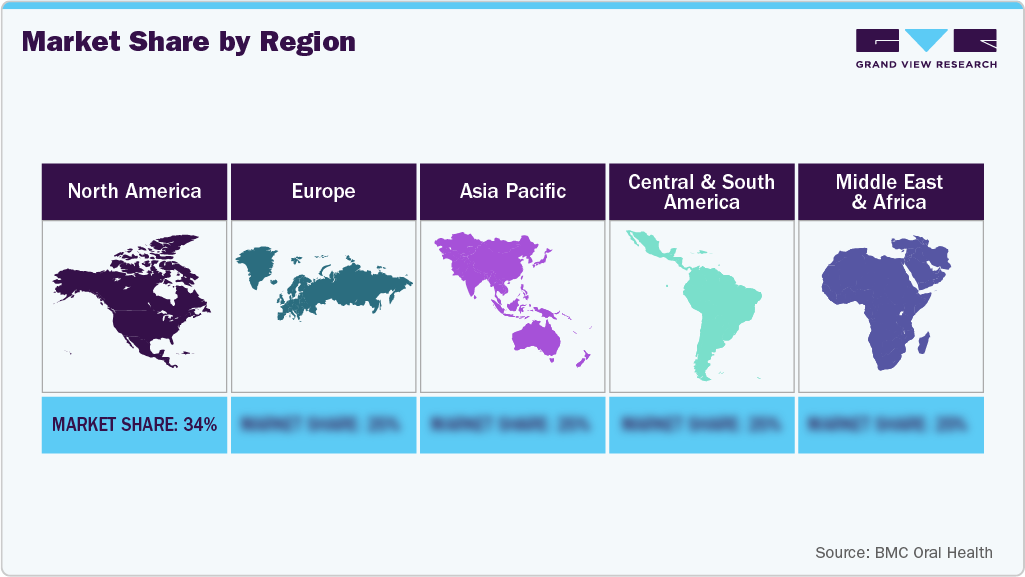

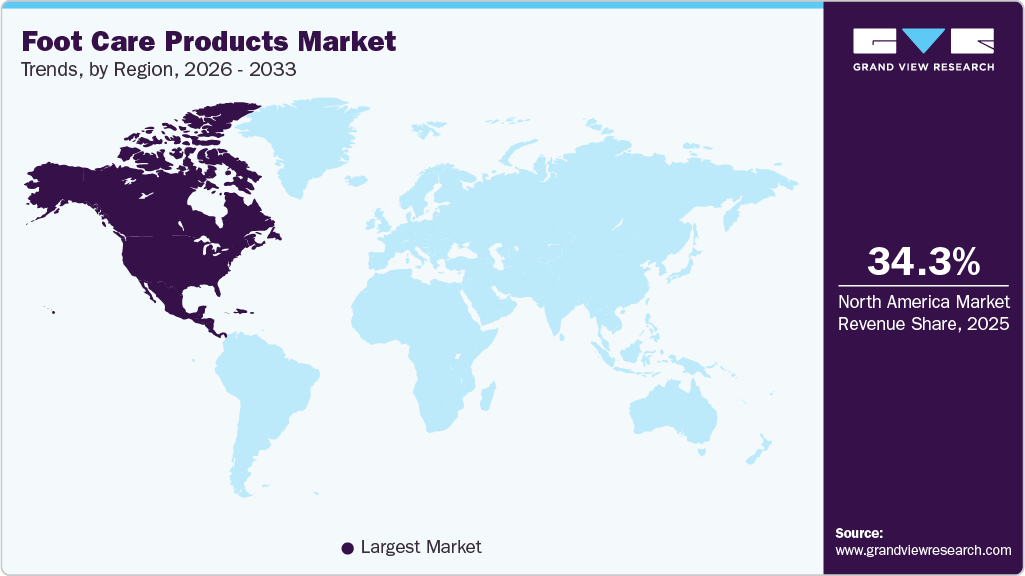

- The North America foot care products market accounted for a share of 34.3% in 2025.

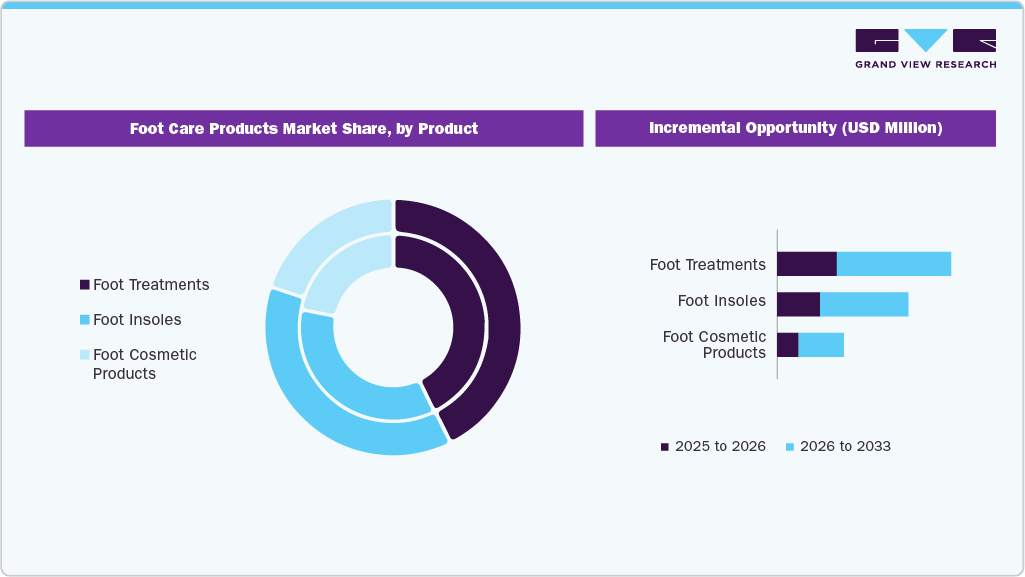

- By product, foot treatments led the market and accounted for a share of 42.8% in 2025.

- By distribution channel, the pharmacies & drugstore segment led the market and accounted for a share of 37.9% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 11.46 Billion

- 2033 Projected Market Size: USD 19.41 Billion

- CAGR (2026-2033): 6.8%

- North America: Largest market in 2025

Every human being walks about 115,000 miles during his or her average lifetime, and 30% of people face foot problems at some point in their lives. The American Academy of Orthopaedic Surgeons (AAOS) reports that around 43.1 million residents in the U.S. suffer from foot problems, which nearly equals 1 in every 6 people. These issues range from minor ailments like blisters and ingrown toenails to more serious conditions, and can be caused by factors such as ill-fitting shoes, injuries, or underlying diseases.The foot care products market has been significantly impacted by the rise in sports and athletic activities, which has increased consumer demand for customized insoles that enhance performance and comfort, while also reducing the risk of injury. The popularity and participation in sports and fitness activities have significantly increased over the past few decades. According to the Sports & Fitness Industry Association (SFIA), in 2024, the team sports category shows that there were roughly 8 million more team sports participants in 2023 than in 2022, an 11% increase.

People of all ages participate in various sports, ranging from leisure activities like cycling and running to team sports and endurance events. This has significantly driven the demand for sports footwear, which provides various advantages, including injury prevention, shock absorption, stability, and support. Moreover, key players operating in the market are also launching new sports footwear that incorporates such advantages.

For instance, in November 2024, Insollz launched a new orthotic insole designed for plantar fasciitis, heel pain, flat feet, and overpronation. It features a “dynamic fin design” for continuous support and claims to rival custom orthotics despite being a stock product.

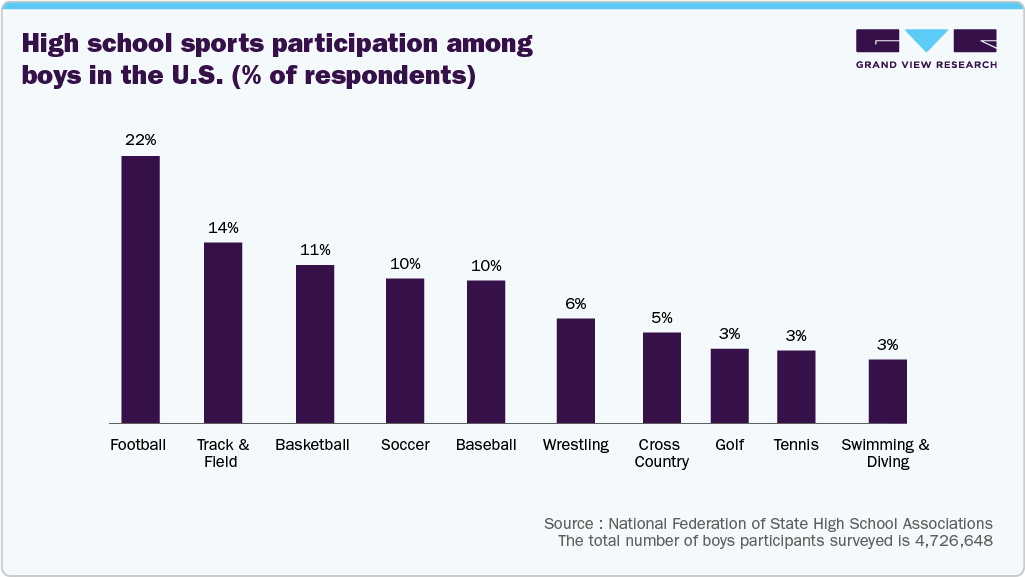

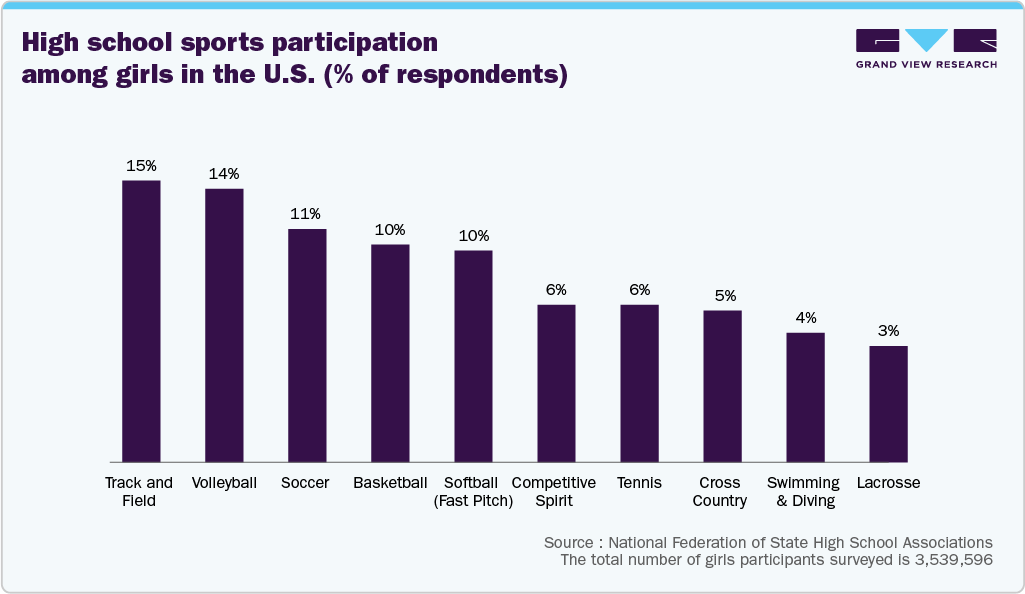

In addition, growing parental awareness of enrolling their children in various sports at schools and professional clubs drives the demand for sports and athletic footwear, as well as shoe insoles. Schools are among the prominent institutions that adapt to the changing sports arena and encourage both boys and girls to focus on overall development.

The National Federation of State High School Associations (NFHS High School Athletics Participation Survey) indicated that 8,266,244 participants were involved in high school sports in 2024-25, up 203,942 from the previous year and topping the previous record of 8,062,302 set in 2023-24. The total includes 4,726,648 boys and 3,539,596 girls, both record highs, according to figures obtained from the 51 NFHS member state associations, which include the District of Columbia.

Furthermore, sports activities can place immense stress on the feet, ankles, and lower limbs. Proper support and alignment are essential for maintaining stability and reducing the risk of overpronation or underpronation during dynamic movements. Shoe insoles with arch support and biomechanical features help athletes maintain proper foot alignment and reduce the risk of overuse injuries, thus driving the growth of shoe insoles in the foot care products market.

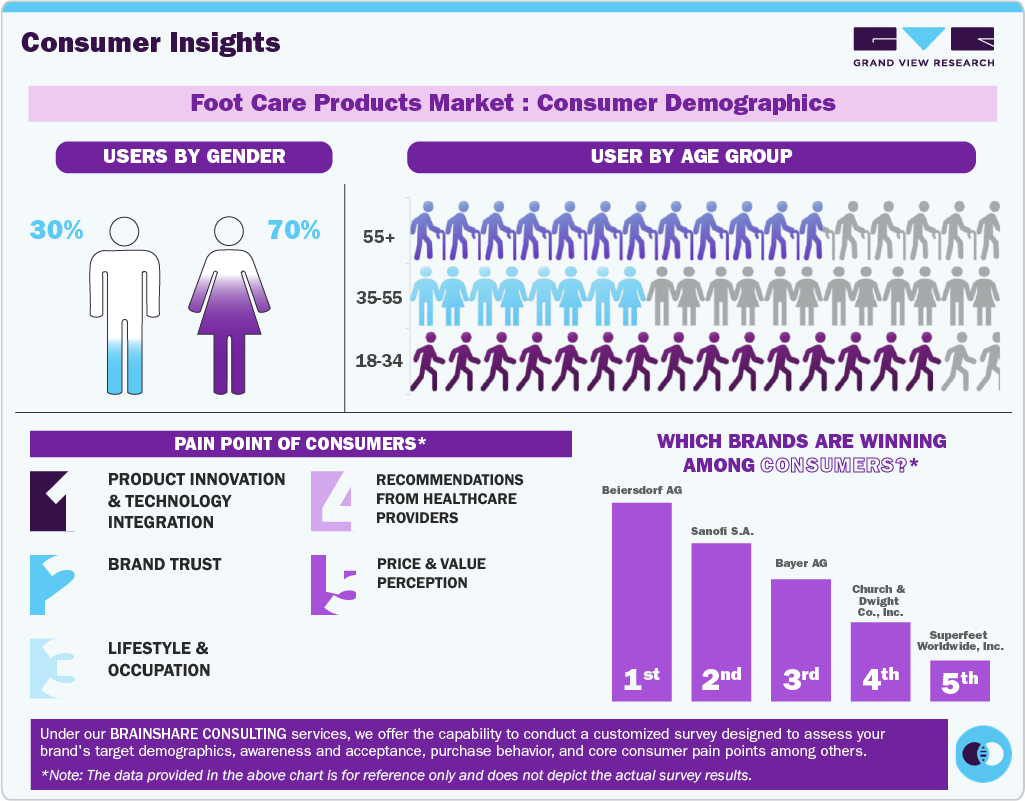

Consumer Insights

Foot cosmetics have been positioned as part of broader self-care and “beauty from head to toe” routines; demand has been stimulated by social media (viral foot-peel videos), seasonal needs (sandal season), and ingredient narratives (natural oils, AHAs/BHAs for exfoliation, moisturizing ceramides). Consumers are split between quick-fix, high-visible-impact treatments (exfoliating foot peels and bootie masks that produce dramatic peeling) and gentler, maintenance-first products (intensive foot creams, overnight masks).

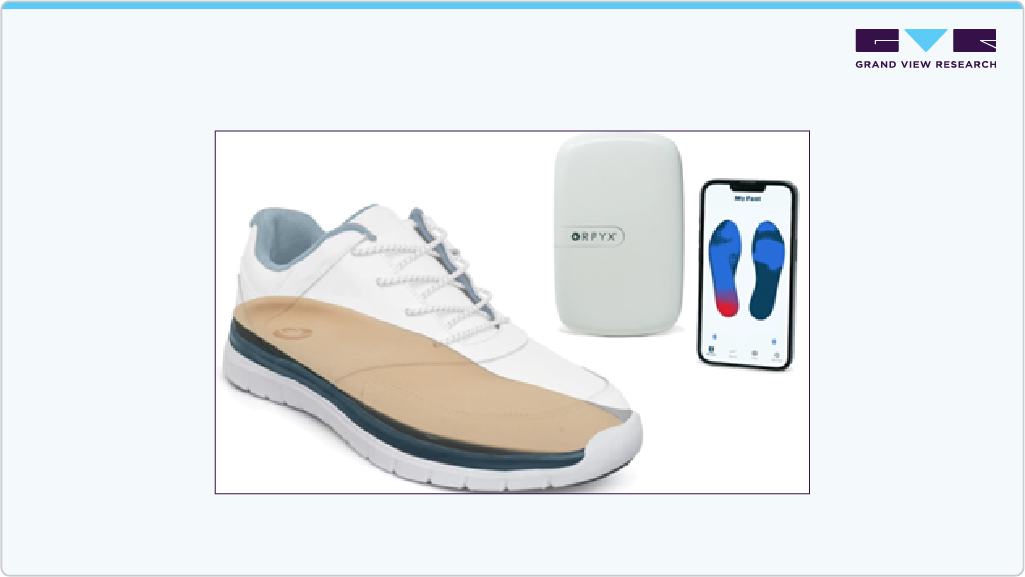

Smart insoles and wearable technology are key technological trends in the foot care products market. The development of smart insoles has resulted from the integration of sensors and electronics into shoe insoles. These insoles can monitor a number of parameters, including temperature, pressure distribution, step count, and gait analysis.

Smart insole data can be used for health-related analysis, performance improvement, and monitoring of physical activity. A variety of insole systems that are sensitive to pressure but not shear have previously been created for laboratory research reasons and to monitor foot pressure in everyday life situations. Tekscan, Inc. and XSENSOR Technology Corporation are two major manufacturers of these systems, among others.

On August 7, 2025, Orpyx Medical Technologies Inc., a leader in sensor-based remote monitoring, today announced the launch of its next-generation sensory insole program, a proactive, scalable solution to prevent the most costly and preventable consequences of diabetes. The Orpyx Sensory Insoles are embedded with proprietary sensors that continuously track plantar pressure, foot temperature, step count, and wear time, physiological indicators that signal early deterioration in foot health. Designed for effortless patient use, the insoles function for up to six months without charging and sync with an intuitive mobile app and home hub that uploads data directly and securely to the Orpyx cloud.

A key trend observed in shoe insoles manufacturing is 3D printing. The footwear sector, especially shoe insoles, has greatly benefited from advances in 3D printing technology. Manufacturers are using 3D printing to produce insoles that are specifically fitted to each person's foot form and gait. This personalization improves comfort and support while also addressing particular foot-related problems. There is a significant prevalence of flat foot and high arch issues.

Aside from injuries (acute or chronic), diabetes, rheumatoid arthritis, or Achilles tendon injury, these foot problems are typically congenital or hereditary. These collapsed arches frequently affect the joints and bones of the ankle and complex, causing pain and discomfort. It was discovered that using a 3D-printed footbed enhanced people's comfort levels and foot functionality. 3D printing provides high customization of insoles, resulting in precise correction of foot biomechanics, which has led to increased adoption of 3D printing for shoe insole manufacturing.

Covestro AG, in collaboration with orthopedic service provider GeBioM Group, is extending support to orthopedic shoemakers by facilitating the production of customized insoles through 3D printing. The process involves utilizing Covestro's thermoplastic polyurethane, specifically Addigy FPU 79A, to create these personalized insoles. This partnership aims to enhance the manufacturing of orthopedic insoles, leveraging the benefits of 3D printing and advanced materials to deliver tailored solutions for individual foot needs.

Additionally, manufacturers are focusing on lightweight materials for insoles, with an emphasis on overall shoe weight and performance. Lightweight insoles enhance mobility, lessen fatigue, and match the style of contemporary footwear. Moreover, to provide customers with orthopedic support, manufacturers of shoe insoles are increasingly embracing biomechanical concepts.

Product Insights

Foot treatments held the largest share of the foot care market, accounting for 42.8% in 2025. As the population ages, an increasing number of people are experiencing foot-related issues, such as pain and reduced mobility, thereby increasing the need for treatment and care. The rise in chronic diseases, such as diabetes, has further increased demand for specialized foot care to prevent serious complications. Additionally, active lifestyles and increased participation in sports are leading consumers to seek preventive and recovery-oriented solutions. Awareness about the importance of foot health is also growing, encouraging people to practice regular care. Rising incomes and urbanization are enabling more people to invest in quality foot treatments and wellness services.

Foot insoles are anticipated to witness a CAGR of 7.6% from 2026 to 2033. The foot care products market is primarily driven by the rising prevalence of foot-related disorders, including plantar fasciitis, flat feet, diabetic ulcers, and arthritis. With aging populations and increasingly sedentary lifestyles, more consumers experience chronic pain or discomfort that prompts them to seek supportive solutions.

Additionally, rising obesity levels contribute to excess strain on feet, further accelerating demand for orthopedic and therapeutic insoles. For instance, Dr. Scholl’s, a leading U.S. brand, offers medically tested insoles designed to relieve plantar pain and improve posture, making clinical-grade foot care easily accessible to everyday consumers.

Distribution Channel Insights

Sales of foot care products through pharmacies & drugstores held the largest share, accounting for 37.9% of the market in 2025. Foot problems, such as cracked heels, corns, fungal infections, or athlete’s foot, are considered health-related issues, prompting shoppers to seek professional advice or reliable medical-grade products. Pharmacies typically stock dermatologist-recommended creams, antifungal ointments, and medicated foot sprays, which boost consumer confidence in product efficacy and safety.

Additionally, pharmacies provide easy access and consistent product availability, particularly in local neighborhoods and hospitals. Their convenient locations and focus on health and wellness make them a preferred choice for consumers seeking quick relief or maintenance care. While supermarkets cater more to cosmetic and wellness-oriented foot care, pharmacies dominate the medical and problem-solving segment, reflecting a functional and health-driven purchasing behavior.

Sales of foot care through online/e-commerce are anticipated to witness a CAGR of 8.2% from 2026 to 2033. Online shopping allows consumers to browse a wide range of products, including foot creams, exfoliating masks, and callus removers, at any time and from anywhere. This is especially appealing to busy or tech-savvy consumers who value home delivery, easy reordering, and cashless payment options.

E-commerce platforms also offer a wide variety of products, reviews, and comparisons, enabling informed decision-making. Consumers can read feedback, view ratings, and compare prices across brands before making a purchase, which helps build trust and confidence in new or lesser-known foot care brands. Online-exclusive offers, discounts, and subscription models further encourage repeat purchases and loyalty among digital shoppers.

Regional Insights

The North America foot care products market accounted for a share of 34.3% in 2025. The North American foot care products market is increasingly shaped by growing consumer awareness of foot aesthetics, hygiene, and confidence, alongside medical foot health. There’s a clear shift toward cosmetic and self-care-oriented foot products, including exfoliating peels, antifungal treatments, nail repair serums, moisturizing creams, and odor-control sprays. This trend reflects consumers’ desire for well-groomed, camera-ready feet, supported by the rise of social media beauty culture and personal care routines that extend beyond facial skincare. Additionally, the pedicure and at-home spa segment is expanding, as more people seek affordable and convenient ways to enhance the appearance of their feet.

U.S. Foot Care Products Market Trends

The U.S. foot care products market is expected to grow at a CAGR of 5.5% from 2026 to 2033, driven by increasing numbers of people suffering from foot‑related issues (from diabetes, aging, and active lifestyles) and a surge in preventive personal care routines. At the same time, rising participation in sports/fitness, long hours on one’s feet, and greater demand for comfort and wellness boost sales of foot creams, insoles, lotions, and specialized care products.

Europe Foot Care Products Market Trends

The foot care products industry in Europe is expected to grow at a CAGR of 6.3% from 2026 to 2033. Foot care is no longer viewed solely as a remedy for foot problems, but rather as an integral part of overall self-care and wellness routines. European consumers are increasingly investing in foot creams, scrubs, and masks that offer relaxation and rejuvenation benefits, mirroring the growing trend in skincare. Products like The Body Shop’s Peppermint Intensive Foot Rescue and L’Oréal Paris Shea Butter Foot Cream cater to this demand by combining hydration with spa-like sensory appeal. The rise of home pedicure kits and aromatherapy-based foot products also reflects this growing trend in self-care.

Asia Pacific Foot Care Products Market Trends

The Asia Pacific foot care products industry accounted for a 22.1% share in 2025. In the Asia-Pacific region, growing health consciousness and self-care awareness have expanded the focus from general skincare to specific areas, such as foot health. Consumers are becoming increasingly aware of issues such as cracked heels, calluses, fungal infections, and diabetic foot conditions. The surge in preventive health habits, partly influenced by the post-pandemic wellness movement, has encouraged individuals to adopt regular foot-care routines that go beyond salon pedicures. In addition, the prevalence of diabetes across India, China, and Southeast Asia has led to increased demand for therapeutic and medicated foot-care formulations..

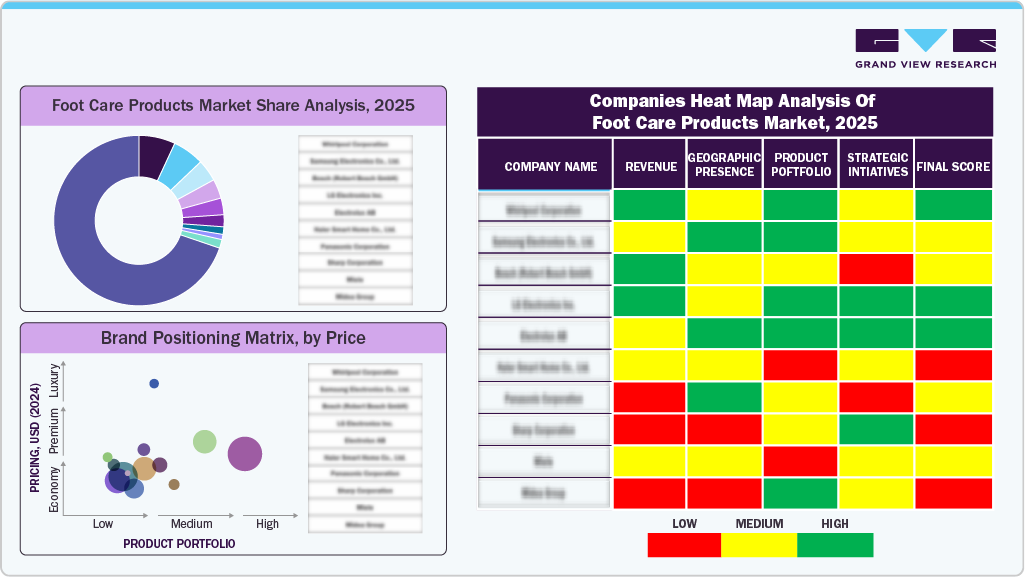

Key Foot Care Products Company Insights

The foot care products industry remains highly competitive, with brands strengthening their presence across both online and offline retail channels. Companies are increasingly investing in advanced dermatological formulations, skin-repair technologies, and targeted delivery systems to improve product efficacy, absorption, and compatibility with diverse consumer needs. Rising awareness of foot health, driven by growing incidences of diabetes-related foot conditions, lifestyle changes, and demand for preventive personal care, is further propelling market growth.

Additionally, the shift toward natural, hypoallergenic, and sustainably sourced ingredients along with innovations in therapeutic creams, exfoliating treatments, and orthotic support solutionsncontinues to underpin strong, long-term expansion in the foot care products market.

Key Foot Care Products Companies:

The following are the leading companies in the foot care products market. These companies collectively hold the largest market share and dictate industry trends.

- O’Keeffe

- AHAVA, Inc.

- Beiersdorf AG

- Bayer AG

- Church & Dwight Co., Inc.

- GlaxoSmithKline plc

- Sanofi S.A.

- GEHWOL (Eduard Gerlach GmbH)

- PowerStep

- Tynor Orthotics Pvt. Ltd.

- Spenco Medical Corporation

- Sidas

- Superfeet Worldwide, Inc.

- CURREX

- Algeo Limited

Recent Developments

-

In November 2025, SINTX Technologies, a leader in advanced ceramic biomedical applications, announced the launch of OsseoSculpt, an innovative biologic intended to complement its FDA-cleared SINAPTIC Foot & Ankle Osteotomy Wedge System. OsseoSculpt provides a nanocrystalline HCA surface and biomimetic pore architecture that enhances bone healing by serving as an osteoconductive scaffold.

-

In October 2025, Superfeet launched the Run Pacer Elite, a new performance insole designed specifically for runners, featuring innovative technology that includes a Carbitex flexible carbon fiber plate and SuperRev foam produced through a supercritical process. This combination delivers 39% more responsiveness than traditional insoles, offering enhanced propulsion, adaptability, and comfort whether running fast or at an easy pace.

-

In October 2025, Zimmer Biomet, alongside its subsidiary Paragon 28, launched two new advanced products, the Gorilla Pilon Fusion Plating System and the Phantom TTC Trauma Nail, to address complex foot and ankle trauma, specifically targeting challenging pilon fractures and hindfoot injuries. Zimmer Biomet introduced the Gorilla Pilon Fusion Plating System and Phantom TTC Trauma Nail to enhance surgical options for complex foot and ankle trauma. The new plating system enables stable dual-column fixation and fusion in a single procedure for severe or malunited tibial pilon fractures. With these launches, Zimmer Biomet aims to offer U.S. foot and ankle specialists innovative tools for patient populations with historically limited surgical solutions.

-

In August 2025, Orpyx Medical Technologies launched a next-generation sensory insole system aimed at preventing diabetes-related foot complications by integrating wearable technology with personalized, behavioral coaching. These insoles continuously monitor plantar pressure, foot temperature, step count, and wear time, transmitting real-time data to healthcare providers via a home hub, thus enabling early intervention before complications arise.

Foot Care Products Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 12.15 billion

Revenue Forecast in 2033

USD 19.41 billion

Growth rate

CAGR of 6.8% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Distribution Channel, and Region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; Argentina; South Africa; UAE; Saudi Arabia

Key companies profiled

O’Keeffe; AHAVA Inc.; Beiersdorf AG; Bayer AG; Church & Dwight Co. Inc.; GlaxoSmithKline plc; Sanofi S.A.; GEHWOL (Eduard Gerlach GmbH); PowerStep; Tynor Orthotics Pvt. Ltd.; Spenco Medical Corporation; Sidas; Superfeet Worldwide Inc.; CURREX; Algeo Limited

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Foot Care Products Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the foot care products market by product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Foot Insoles

-

Athletic/Performance Insoles

-

Gel Insoles

-

Foam Insoles

-

Orthotic Insoles

-

Others

-

-

Foot Treatments

-

Blister Care

-

Corn Treatments

-

Others

-

-

Foot Cosmetic Products

-

Foot Creams

-

Foot Moisturizers

-

Foot Files

-

Foot Balms

-

Foot Masks

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Supermarkets & Hypermarkets

-

Pharmacies & Drug Stores

-

Online/E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global foot care products market was estimated at USD 11.46 billion in 2025 and is expected to reach USD 12.15 billion in 2026.

b. The global foot care products market is expected to grow at a compound annual growth rate of 6.8% from 2026 to 2033 to reach USD 38.25 billion by 2033.

b. Foot treatments held the largest share in the foot care market, accounting for a share of 42.8% in 2025. As the population ages, an increasing number of people are experiencing foot-related issues, such as pain and reduced mobility, thereby increasing the need for treatment and care. The rise in chronic diseases, such as diabetes, has further increased demand for specialized foot care to prevent serious complications.

b. Some of the key players operating in the foot care products market include O’Keeffe, AHAVA Inc., Beiersdorf AG, Bayer AG, Church & Dwight Co. Inc., GlaxoSmithKline plc, Sanofi S.A. and others

b. Key factors that are driving the foot care products market growth include a surge in participation in sports and fitness activities and manufacturing and technological innovations in foot insoles

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.