- Home

- »

- Automotive & Transportation

- »

-

Forklift Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Forklift Market Size, Share & Trends Report]()

Forklift Market Size, Share & Trends Analysis Report By Class (Class 1, Class 2, Class 3, Class 4/5), By Power Source (ICE, Electric), By Load Capacity (Below 5 Ton, 5-15 Ton), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-754-4

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Forklift Market Size & Trends

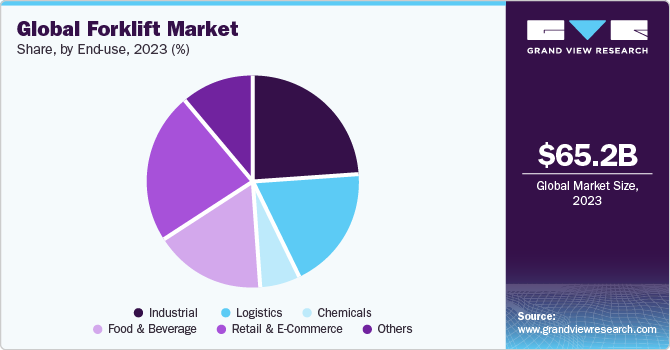

The global forklift market size was valued at USD 65.16 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 13.5% from 2024 to 2030. The world is witnessing a significant increase in construction activities, highlighted by the expansion of road networks, the improvement of airports and seaports, and the modernization of rail systems. In the 2023-2024 annual budget of the Victoria state government in Australia, around AUD 9.3 billion (USD 6.18 billion) was projected to be allocated toward infrastructure and energy investments. This budget presents substantial prospects for the construction industry within the state.

The growing emphasis on sustainability and the rising environmental concerns have propelled the need for eco-friendly alternatives and triggered a paradigm shift from gas-fired or diesel-fired forklifts to electric forklifts. Governments across several countries are pursuing various initiatives to achieve a net-zero economy. For instance, in May 2023, the Federal Economic Development Agency for Southern Ontario announced an investment of USD 3.6 million in Stromcore Energy Inc., a forklift battery manufacturer, to add advanced manufacturing equipment and launch new products to promote a green economy. The company planned to introduce two energy-efficient products, namely Electric Cart, a zero-emission electric forklift designed in collaboration with Amazon.com, Inc., and Turbo Bank, an advanced AI-powered charger with enhanced efficiency. By assisting companies such as Stromcore Energy Inc., the government of Ontario is supporting green technology and manufacturing.

Efficient movement of goods and equipment is essential for developing and improving airports and seaports. Forklifts ensure seamless loading and unloading of cargo onto planes and ships, facilitating timely delivery of supplies and equipment for ongoing infrastructure projects. For instance, in June 2023, in New South Wales, NSW ports introduced a forty-year master plan for sustainable growth. The plan anticipates that population growth may triple the existing container trade at Port Botany and increase the volume of motor vehicles as well as machinery via Port Kembla.

In addition, the demand for construction materials would increase over the coming four decades to meet housing & infrastructure demand, while the shift to renewable energy would drive cargo trade projects, such as offshore and onshore wind farm components. Forklifts are well-suited for navigating the bustling environments of airports and seaports, effectively organizing, and distributing goods within these important transportation hubs.

However, raw materials such as steel, lead, and copper, and other products, such as rubber, are used to manufacture forklifts. These raw materials are sourced from different countries, and the supply of these materials is mainly vulnerable to fluctuations in the commodity markets and exchange rates. Such fluctuations may have negative effects on the supply chain and pose a challenge for the original equipment manufacturer operating in the market.

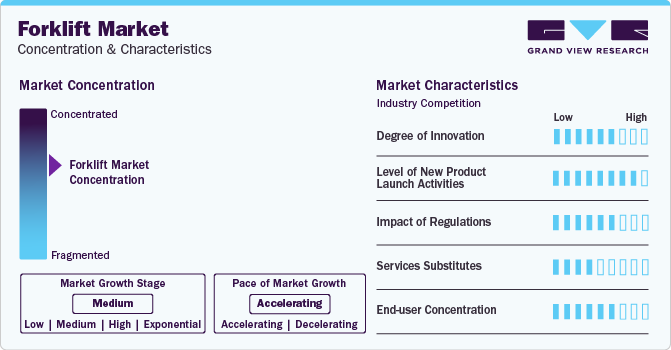

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The market is characterized by a high degree of innovation. The advent of autonomous vehicle technology in material handling is expected to open new avenues for market growth. Adopting autonomous forklifts ensures operators' safety and helps maintain a safe work environment.

The market is also characterized by a high level of new product launch activity by the market players. This is due to several factors, including launching innovative and advanced products in the market and to maintain strong brand position in the market.

Having realized that inadequate forklift driver training can potentially lead to workplace injuries and property damage, regulatory organizations, such as the Occupational Safety & Health Administration (OSHA), have made it mandatory for operators to pursue relevant training programs to ensure a safer work environment.

The threat of substitutes is likely to fluctuate from high to moderate owing to the availability of alternative material handling methods such as conveyor systems and automated guided systems. The systems are safer, more convenient, and require less space to accommodate. Moreover, battery-powered tugs are safer than forklifts.

End-use industries, including construction, automotive, aerospace & defense, and warehouse & logistics, play a vital role in the forklift value chain. Their involvement begins with identifying their specific operational needs and requirements, directly influencing the demand for forklifts. End users are responsible for properly utilizing, maintaining, and servicing forklifts throughout their lifespan, ensuring optimal performance and durability.

Class Insights

Class 3 segment led the market and accounted for 43.1% in 2023. Class 3 segment includes electric motorized hand trucks. These are hand-controlled forklifts, where the operator steers the forklift with a tiller from the front of the vehicle. Hand trucks are often controlled by a handle at the back of the truck, with a hand control used to steer as the driver rides or walks it to the destination. These forklifts are frequently used for moving items requiring low raises and can effortlessly transfer goods throughout the warehouse floor without requiring the product to be placed on a high shelf or rack.

The class 1 segment is expected to witness considerable growth over the forecast period. The high demand for electric rider trucks across end-use areas such as retail stores, factories, the food service industry, and chemical factories is expected to support the segment growth. These forklifts generally have fewer moving parts, thereby reducing maintenance requirements and overall expenses. The ease of maneuverability and quiet operations make class 1 forklifts suitable for diverse work environments, from warehouses to manufacturing facilities, where noise levels and space constraints are significant considerations.

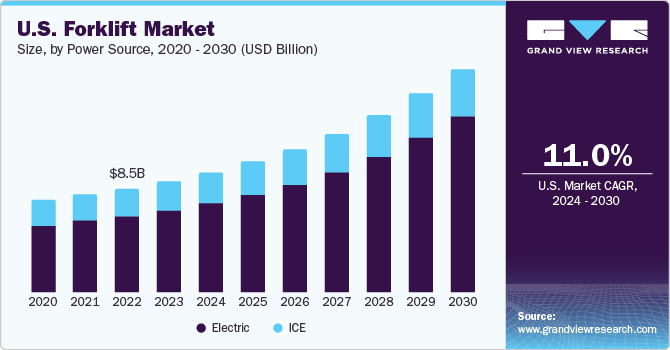

Power Source Insights

The electric segment accounted for the largest market revenue share in 2023. Electricity is an eco-friendly alternative to gasoline and diesel-powered forklifts. Rising environmental concerns and depleting fossil fuel resources are driving the need for sustainable, efficient, and durable forklifts, which can also ensure a healthier, emission-free environment for employees. Advances in battery technology and the strong emphasis on ensuring a healthier working environment for employees are expected to play a potent role in driving the growth of the segment over the forecast period.

Several vendors are developing new electric forklift models as part of their efforts to expand their respective portfolios of material handling solutions. For instance, in May 2023, AB Volvo Penta, an industrial engine manufacturer, announced a partnership with FTMH Fantuzzi Team Material Handling Spa, a heavy equipment manufacturer, to develop electric forklifts. The partnership envisaged developing an electric forklift with weighing capacity up to 52 tons.

Load Capacity Insights

The 5-15 ton segment led the market in 2023. Forklifts with capacities between 5 tons and 15 tons are commonly used for handling a wide range of materials, including pallets, steel, and bricks. They can be considered highly efficient equipment for mechanized loading and short-distance transportation. They can be used both indoors or outdoors and can be fired by natural gas, liquid propane, or gasoline. These forklift trucks are usually sit-down models and happen to be the most common types of forklifts used to lift and position heavy objects promptly and with precision. This versatility is expected to create lucrative opportunities for the growth of the segment.

The below 5 segment is expected to register the highest growth rate over the forecast period. These compact forklifts are highly versatile, allowing businesses to handle various load sizes efficiently. These compact forklifts facilitate the safe and easy movement of products across limited floor space. Manufacturing, warehousing, material handling, logistics, and freight handling are some of the application fields of these forklifts. Furthermore, when used to transport risky cargo in small warehouse spaces, these forklifts also protect the workforce.

Electric Battery Type Insights

The lead-acid segment held the largest revenue share of 66.77% in 2023. Lead-acid batteries can be considered a reliable energy source due to their ability to provide a high-power surge. Hence, they are popularly used in electric forklifts. Electric forklifts call for high current output to perform heavy lifting and maneuvering tasks. Lead-acid batteries can deliver the necessary power output, making them well-suited for these applications without confronting any significant voltage drops or power fluctuations.

Li-ion battery segment is expected to register the highest growth rate over the forecast period. Growing environmental concerns are prompting businesses to seek eco-friendly solutions to reduce their carbon footprint. Lithium-ion batteries offer a cleaner alternative to conventional lead-acid batteries, which feature toxic chemicals, such as lead and sulfuric acid. By adopting lithium-ion technology in electric forklifts, vendors are demonstrating their commitment to sustainability by abiding with the increasingly stringent environmental regulations, which bodes well for the growth of the segment.

End-use Insights

The industrial segment held the largest revenue share of 24.06% in 2023. Forklifts are extensively used for undertaking material handling and warehousing tasks in industrial environments. In manufacturing plants, forklifts play a crucial role in moving raw materials, intermediate products, and finished goods within production lines. Their ability to handle heavy loads and navigate tight spaces helps ensure a smooth material flow, reducing production bottlenecks and enhancing operational efficiency.

The retail & e-commerce segment has experienced a significant transformation in recent years, driven by changing consumer preferences and the rise of online shopping. The retail & e-commerce industry has been evolving significantly over the past few years, driven by changing consumer preferences and the growing preference for online shopping. In this dynamic landscape, forklifts have become integral to the industry, offering tailored applications to support efficient material handling and logistics operations. Forklifts play a vital role in streamlining warehouse operations and ensuring seamless movement of goods from order receipt to storage and order fulfillment. Their compact design and precise control enable agile maneuvering in tight spaces, optimizing space utilization and expediting inventory management.

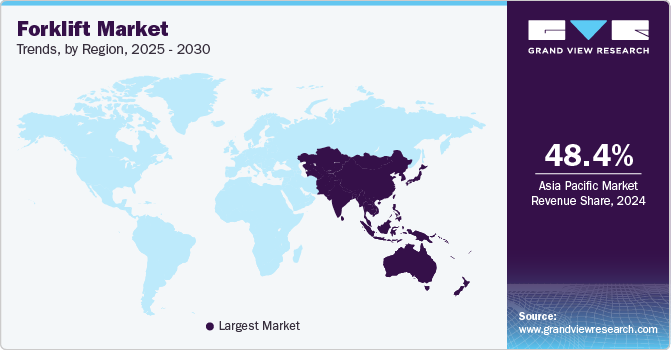

Regional Insights

Asia Pacific dominated the forklift market and accounted for 47.6% share in 2023. The Asia Pacific region is home to several prominent forklift manufacturers, such as Doosan Corporation and Hangcha Forklift, fostering technological innovations and driving industry competitiveness. As companies continuously develop advanced electric forklift models with enhanced performance and features, end-use industries upgrade their fleets to remain competitive and efficient. As the market evolves, collaborations among governments, manufacturers, and businesses are expected to play a pivotal role in driving further advancements and widespread adoption of forklifts in Asia.

In Europe, the market is expected to register a considerable growth rate over the forecast period. The forklift industry in Europe is expected to witness significant growth over the forecast period owing to the increasing demand for sustainable supply-chain solutions, the rising global awareness of climate change, and the need for sustainable practices. The concept of a sustainable supply chain has gained significant momentum in Europe, with various businesses focusing on reducing their carbon footprint and promoting eco-friendly practices throughout their operations.

Key Companies & Market Share Insights

Some of the key players operating in the market include Toyota Motor Corporation (Toyota Material Handling); KION Group AG; Jungheinrich AG; Crown Equipment Corporation; and Mitsubishi Logisnext Co., Ltd.

-

Mitsubishi Logisnext Co., Ltd is engaged in developing, designing, and selling engine and electric-powered forklifts, local area networks, electric vehicles, automated warehouses, monorails, transportation robots, and other logistics equipment. The company has a strong market presence in North America, Europe, Asia & Oceania, and China. For the company Asia is the most potential market for future growth.

-

Jungheinrich AG is an intralogistics solutions provider offering a wide product portfolio comprising material handling equipment, digital solutions, automated systems, and related services, including rental services and aftermarket services. The company provides its customers with tailor-made solutions from a single source to help them expand their intralogistics services The company has developed an automated intralogistics workflow using various automated warehouse equipment, mobile robots, and software.

-

Combilift, BYD, Hangcha Forklift, UniCarriers Corporation, and Maximal Forklift are some of the emerging market participants in the forklift market.

-

Hangcha Forklift is a manufacturer and distributor of material handling equipment. The company serves industries and industry verticals, such as retail, warehousing, food, pharmaceuticals, logistics, and automotive, along with ports & terminals. The company maintains a product portfolio of pallet trucks, stackers, reach trucks, order pickers, and forklifts.

-

Maximal Forklift is engaged in designing and manufacturing of material handling equipment. The company owns robot welding equipment, forklifts performance test lines, assembly lines, and coating lines, among others. The company’s current product range covers four series of forklifts, including 13.5-32.0T heavy duty forklift, 1.8-5.0T rough terrain forklift, 1.5-compact12T industrial forklift, and warehouse equipment.

Key Forklift Companies:

- Anhui Heli Co., Ltd.

- Clark Material Handing Company, (Clark Equipment Company)

- Crown Equipment Corporation

- Doosan Corporation

- Hangcha Forklift

- Hyster-Yale Materials Handling, Inc.(Hyster-Yale Group, Inc.)

- Jungheinrich AG

- KION Group AG

- Komatsu Ltd.

- Mitsubishi Logisnext Co., Ltd.

- Toyota Motor Corporation (Toyota Material Handling)

Recent Developments

-

In August 2023, Jungheinrich AG acquired Magazino, an automated solution provider. The acquisition helped the former company to strengthen position in autonomous mobile robots and related software.

-

In September 2023, Hangcha Forklift launched a high-voltage Lithium Battery based electric rough terrain forklift. The forklift ranges from 2.5-3.5 ton and features as reduced noise, zero-emission, and fast charging time.

-

In May 2023, Toyota Material Handling announced the launch of three new forklift models. The new forklifts have features such as standard power steering, industrial tow tractor, automatic parking brake, side-entry end rider, and center rider stacker. These features offer the user enhanced performance, efficiency, and a comfortable operating environment in the cabin. The models fall between the 6,000-8,000 lbs. weight classes and are ideal for order picking and cross-warehouse transportation.

-

In January 2023, Crown Equipment Corporation announced the launch of an electric counterbalance forklift. The C-B series features electric forklifts equipped with 80-volt motors. The forklifts have applications-oriented ergonomics such as a full suspension adjustable seat, intuitive control system, compact mast, and overhead guard. These features provide enhanced safety and productivity and reduce operator strain and fatigue.

Forklift Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 72.59 billion

Revenue forecast in 2030

USD 154.99 billion

Growth rate

CAGR of 13.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD million/billion, Volume in Units, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Class, power source, load capacity, electric battery type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; U.A.E.; Saudi Arabia; South Africa

Key companies profiled

Anhui Heli Co., Ltd.; CLARK; Crown Equipment Corporation; Doosan Corporation; Hangcha; Hyster-Yale Materials Handling, Inc.; Jungheinrich AG; KION Group AG; Komatsu Ltd.; Mitsubishi Logisnext Co., Ltd.; Toyota Material Handling

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Forklift Market Report Segmentation

The report forecasts revenue growth at global, regional, and at country level and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global forklift market report on the basis of class, power source, load capacity, electric battery type, end use and region.

-

Class Outlook (Volume Units; Revenue, USD Million, 2018 - 2030)

-

Class 1

-

Class 2

-

Class 3

-

Class 4/5

-

-

Power Source Outlook (Volume Units; Revenue, USD Million, 2018 - 2030)

-

ICE

-

Electric

-

-

Load Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 5 Ton

-

5-15 Ton

-

Above 16 Ton

-

-

Electric Battery Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Li-ion

-

Lead Acid

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Logistics

-

Chemical

-

Food & Beverage

-

Retail & E-Commerce

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global forklift market is expected to be estimated at USD 65.16 billion in 2023 and is expected to reach USD 72.59 billion in 2024.

b. The global forklift market is expected to grow at a compound annual growth rate of 13.5% from 2024 to 2030 in terms of revenue to reach USD 154.99 billion by 2030.

b. Asia Pacific dominated the forklift market and accounted for 47.6% share in 2023. The Asia Pacific region is home to several prominent forklift manufacturers, such as Doosan Corporation and Hangcha Forklift, fostering technological innovations and driving industry competitiveness.

b. Some key players operating in the forklift market include Anhui Forklift Truck Group Co., Ltd.; CLARK; Crown Equipment Corp.; Doosan Industrial Vehicle; Hangcha Group Co., Ltd.; Hyster-Yale Materials Handling, Inc.; Toyota Industries Corporation

b. Key factors driving the forklift market growth include development in the automotive industry; growth of warehousing and logistics; industrialization in emerging markets such as Latin America.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."