- Home

- »

- Advanced Interior Materials

- »

-

Gallium Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Gallium Market Size, Share & Trends Report]()

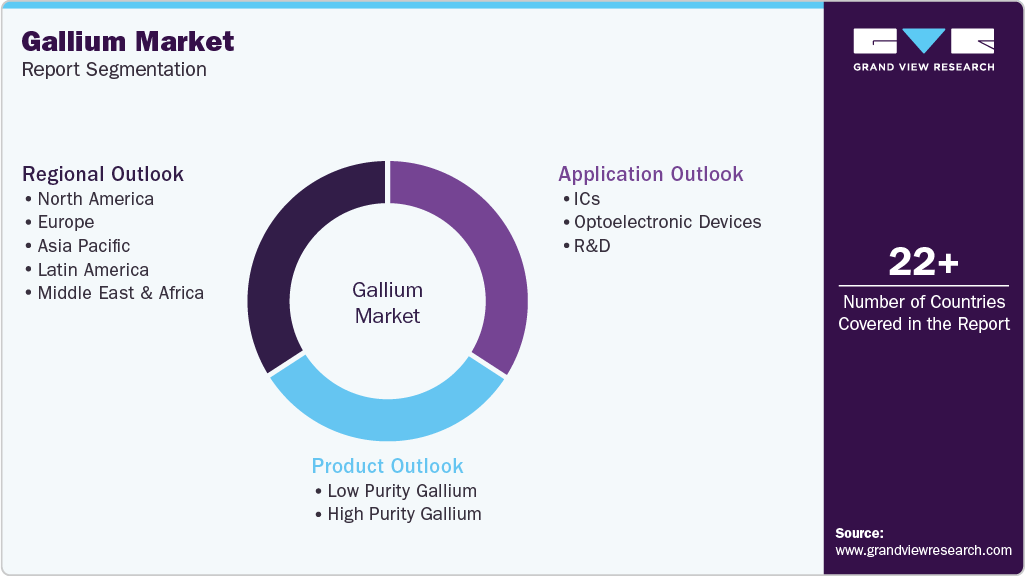

Gallium Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Low Purity, High Purity), By Application (ICs, Optoelectronics), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-443-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Gallium Market Summary

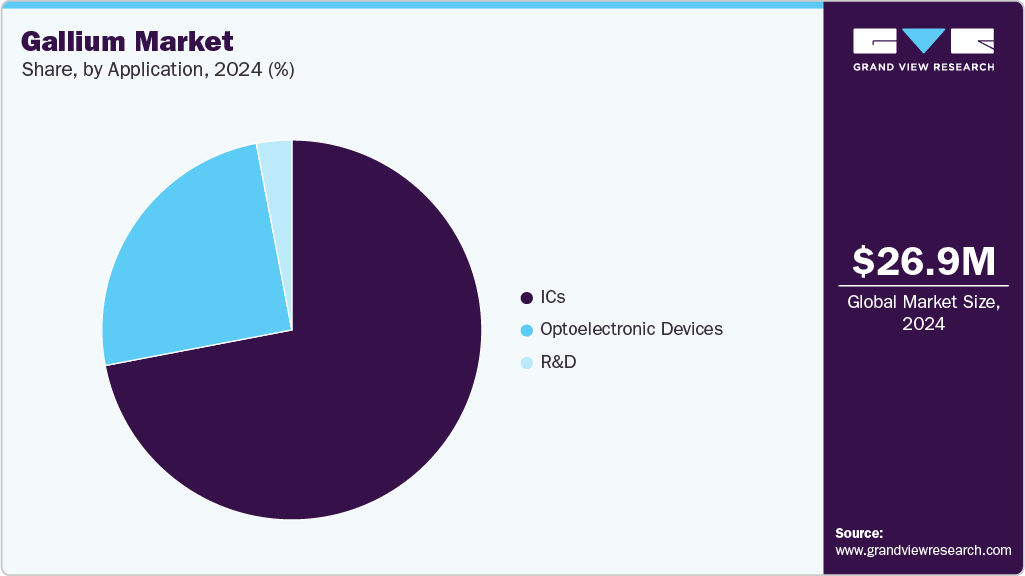

The global gallium market size was estimated at USD 26.9 million in 2024 and is projected to reach USD 49.9 million by 2033, growing at a CAGR of 7.1% from 2025 to 2033. The growing usage of gallium (Ga)-based products is anticipated to increase, owing to the rapid growth in popularity of electronic devices such as mobile phones and laptops, television transmission, light-emitting diodes (LEDs), lighting applications, wireless infrastructure, power electronics, and satellite markets.

Key Market Trends & Insights

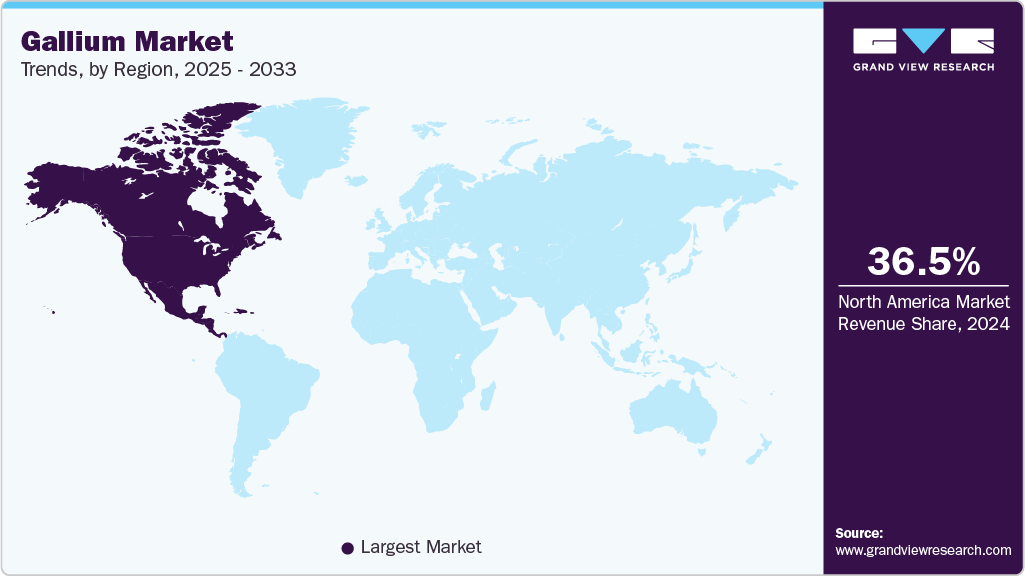

- North America dominated the gallium market with a revenue share of 36.5% in 2024.

- In the U.S., high defense spending plays a crucial role in propelling the growth of the gallium industry.

- By product, the high purity gallium segment dominated the market with a revenue share of over 64.0% in 2024.

- By application, the ICs segment dominated the market with a revenue share of over 72.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 26.9 Million

- 2033 Projected Market Size: USD 49.9 Million

- CAGR (2025-2033): 7.1%

- North America: Largest market in 2024

The growth of the gallium industry is anticipated to be driven mainly by Ga usage in integrated circuits (ICs). The digital revolution that has marked recent years, the expansion of the telecommunications industry, increasing innovations in automotive electronics, and the Internet of Things (IoT) are anticipated to drive IC demand.

Drivers, Opportunities & Restraints

The global gallium market is experiencing growth primarily driven by the critical application of gallium in integrated circuits (ICs) and optoelectronic devices. Gallium is extensively used as a semiconductor material in ICs, which form the backbone of modern electronics. Additionally, it plays a pivotal role in optoelectronics, particularly in producing LEDs, laser diodes, and high-efficiency solar cells. These components are vital for fiber optic communication, 5G infrastructure, high-speed data transmission systems, and aerospace electronics. With the continued global push toward digital transformation and electrification, the demand for gallium-based materials will remain strong over the coming years.

Significant opportunities are emerging in the market due to the expansion of bauxite mining and alumina refining projects, which are key sources of gallium as a byproduct. Several large-scale projects across Africa and Asia are poised to enhance the availability of gallium in global markets. For instance, the Koumbia Bauxite Project in Guinea (USD 1 billion), the Bauxite Hills Mine in Queensland (USD 30 million), and the Dakcheung Bauxite-Alumina Complex in Laos (USD 1 billion) are expected to contribute to increased gallium recovery. These significant developments offer an opportunity to diversify the global supply base and reduce dependence on China, which currently dominates the gallium production landscape.

However, the market faces significant restraints, primarily due to the concentrated nature of global production. China continues to control a substantial share of gallium output and has, in the past, used export restrictions to influence global supply and pricing. Even as new sources come online, China's ability to flood the market with cheap gallium can depress international prices, undermining the economic viability of producers in other regions. This manipulation creates a volatile pricing environment and discourages long-term investment outside China. As a result, despite positive demand trends, the market for gallium remains vulnerable to geopolitical risks and strategic supply disruptions.

Product Insights

The high-purity gallium market segment accounted for the largest revenue share, approximately 64.0% in 2024, owing to its critical role in advanced electronic applications. High-purity gallium, often a refined metal, typically contains a minimum purity level ranging from 99.999% (5N) to 99.99999% (7N). This grade of gallium is essential for producing compound semiconductors such as gallium arsenide (GaAs) and gallium nitride (GaN), which are used in the manufacturing of a wide array of high-performance electronic devices.

GaAs-based integrated circuits (ICs), which have gained significant traction recently, are preferred in specialized applications such as satellite communications, supercomputers, and defense electronics. These circuits offer distinct advantages over traditional silicon-based ICs, including faster data transmission, higher resistance to radiation, and the ability to operate at elevated temperatures, making them suitable for harsh and high-performance environments.

Low-purity gallium, with a minimum purity level of 99.99% (4N), primarily serves as a feedstock for refining into high-purity material. It is typically recovered through primary extraction processes and recycling scraps derived from end-of-life ICs and optoelectronic components. This lower-grade variant is more abundant and less expensive, with China accounting for most global production. While it is a cost-effective option for specific industrial uses, the refined, high-purity form is in greater demand due to its critical role in next-generation technologies and other specialized, high-value applications.

Application Insights

The optoelectronic devices segment is projected to register the fastest CAGR of 7.5% over the forecast period, driven by their expanding role across various high-growth industries. These specialized semiconductor components enable the conversion of light energy into electrical energy and vice versa. They are integral to multiple applications in military systems, telecommunications, medical devices, and automated access control. Common examples include LEDs, solar cells, and photodiodes. Due to the indirect bandgap of silicon, which results in poor optical absorption and emission, it is not ideally suited for such applications. This limitation has paved the way for gallium-based compounds like gallium arsenide (GaAs) and gallium nitride (GaN), which are widely adopted in optoelectronics for their superior optical properties-a trend expected to persist over the forecast period.

Integrated circuits (ICs) represent another key application segment in the gallium industry, contributing a substantial revenue share in 2024. Gallium offers high electrical conductivity and thermal stability, making it an ideal material for manufacturing high-speed, high-performance ICs and transistors. These components are used extensively in defense electronics, advanced computing systems, and telecommunications equipment. Compared to traditional silicon-based ICs, gallium-based alternatives deliver faster switching speeds, improved heat resistance, and lower electrical resistance, enhancing overall system performance.

Continued investment in R&D further supports the adoption of it in emerging electronic technologies. For instance, in May 2022, Singapore-based Gallium Semiconductor inaugurated a new R&D center in Nijmegen, the Netherlands, focusing on advancing radio frequency (RF) GaN technology innovations for 5G mobile communications. The center focuses on product development, device design, and customer-specific engineering solutions to serve the growing European market. Such initiatives underscore the strategic importance of gallium in enabling next-generation communication infrastructure and high-performance electronics.

Regional Insights

The North America gallium market is expected to witness steady growth over the forecast period, primarily driven by the demand in the United States. The region’s expansion is underpinned by the increasing use of gallium-based integrated circuits (ICs) in defense electronics and telecommunication systems. As national security and advanced communications remain top priorities, the U.S. will likely continue investing in next-generation semiconductor technologies, positioning gallium as a critical material in military-grade and high-frequency applications.

U.S. Gallium Market Trends

In the U.S., high defense spending plays a crucial role in propelling the growth of the gallium industry. The growing demand for cutting-edge electronics used in defense and aerospace sectors contributes to increased gallium-based compounds like GaAs and GaN consumption. Moreover, the U.S. Department of Energy’s Solid-State Lighting Plan, which aims for a 73.7% market share of LED-based solid-state lighting by 2030, is expected to boost gallium demand significantly. LEDs rely heavily on GaN-based technologies, reinforcing the importance of gallium in achieving national energy efficiency and technological goals.

Asia Pacific Gallium Market Trends

The Asia Pacific gallium industry accounted for the highest demand in 2024, owing to strong manufacturing capabilities and sustained investment in electronics. Countries like China, Japan, South Korea, and Taiwan are central in producing ICs and optoelectronic devices, benefiting from large-scale contract manufacturing and robust R&D activity. China demonstrated consistent growth due to increased usage of gallium in power electronics, 5G infrastructure, and defense-related applications. Regional emphasis on technological self-sufficiency and expansion in semiconductor fabrication will likely elevate gallium consumption across the region.

Europe Gallium Market Trends

Europe is expected to witness healthy growth in the gallium industry, supported by the increasing IC production and expanding R&D investments in semiconductors and optoelectronic technologies. Countries like Germany, France, and the Netherlands are promoting high-performance materials for energy-efficient and defense applications. Strategic initiatives to reduce dependency on imported semiconductor materials and boost domestic capabilities, especially in response to global supply chain concerns, encourage regional adoption of gallium-based compounds. Additionally, investments in next-generation wireless and photonics technologies will likely sustain the upward trajectory of gallium demand in the region.

Key Gallium Company Insights

Some of the key players operating in the market include American Elements, Neo, NICHIA, and Reade.

-

American Elements is a leading supplier of engineered and advanced materials, specializing in producing and distributing high‑purity metals,including gallium, germanium, and antimony. The company offers a comprehensive portfolio of products, including alloys, oxides, chlorides, nitrates, nanoparticles, thin-film coatings, and sputtering targets. It serves diverse high-tech sectors such as semiconductors, optoelectronics, and aerospace

-

Neo is a vertically integrated specialty materials company offering critical metals, including gallium, hafnium, niobium, and tantalum, as well as permanent magnets. Its operations span recycling electronic scrap to produce high-purity gallium, chemical and oxide processing, environmental catalyst manufacturing, and the production of rare-earth magnets. The company targets downstream, high-margin niche markets including defense, EV, and clean energy applications.

-

NICHIA is a renowned Japanese chemical and electronics manufacturer known for pioneering gallium nitride (GaN) LED and laser diode technologies. The firm produces phosphors, LEDs across the visible spectrum, and laser diodes in displays, lighting, automotive, and industrial applications. NICHIA’s work contributed to the development of blue LEDs, a breakthrough recognized by the 2014 Nobel Prize in Physics.

-

Reade is a global distributor of specialty chemical solids, including high‑purity metals, oxides, and compounds. In the gallium space, Reade supplies gallium metal and gallium oxide powders to the semiconductors, aerospace, and electronics sectors. Its strength lies in distributing advanced materials across research, industrial, and technical markets.

Key Gallium Companies:

The following are the leading companies in the gallium market. These companies collectively hold the largest market share and dictate industry trends.

- American Elements

- China JinMuan Nonferrous Metal Group Co., Ltd.

- Dowa Electronics Materials Co., Ltd.

- NEO Performance Materials

- NICHIA Corporation

- Noah Chemicals Corporation

- Reade Advanced Materials

- Umicore

- Vital Materials Co., Ltd.

- Zhuzhou Smelter Group Co., Ltd. (ZSG)

Recent Developments

-

In December 2024, American Elements announced a significant expansion of its production facilities in Salt Lake City, aiming to scale up the output of gallium, germanium, and antimony in various forms, including alloys, oxides, chlorides, nitrates, nanoparticles, and thin-film coating materials. This expansion was driven by the growing demand for high-purity materials amid tightening global supply, especially after China's export restrictions on gallium and germanium. The company positioned itself as a strategic U.S. supplier capable of mitigating export risks and ensuring uninterrupted access for domestic and international clients.

-

Neo reported several key milestones throughout 2024, reflecting strong financial performance and strategic realignment. In Q2 2024, the company achieved an Adjusted EBITDA of USD 24.2 million, and by Q3, had signed a long-term contract with a Tier-1 European automaker, covering ~35% capacity of its new European magnet plant. In August 2024, Neo divested its Oklahoma gallium trichloride facility, part of a portfolio streamlining effort. The company further announced plans to exit certain rare-earth separation facilities in China to focus on downstream, high-value operations.

-

In early 2025, European officials, including the European Commission’s executive vice president, highlighted a planned gallium extraction facility in Greece operated by Metlen Energy & Metals, part of a USD 24.6 billion EU strategy to secure critical minerals. The plant, tapping domestic bauxite refinement, will produce up to 50 tons annually starting in 2027. Though operations began later, project planning and EU alignment occurred throughout 2024.

Gallium Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 28.7 million

Revenue forecast in 2033

USD 49.9 million

Growth rate

CAGR of 7.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in tons, revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East, Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Russia; Turkey; China; India; Japan; South Korea; Brazil

Key companies profiled

American Elements; China JinMuan Nonferrous Metal Group Co., Ltd.; Dowa Electronics Materials Co., Ltd.; NEO Performance Materials; NICHIA Corporation; Noah Chemicals Corporation; Reade Advanced Materials; Umicore; Vital Materials Co., Ltd.; Zhuzhou Smelter Group Co., Ltd. (ZSG)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gallium Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global gallium market report based on product, application, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

Low Purity Gallium

-

High Purity Gallium

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

ICs

-

Optoelectronic Devices

-

R&D

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Turkey

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global gallium market size was estimated at USD 26.9 million in 2024 and is expected to reach USD 28.7 million in 2025.

b. The global gallium market is expected to grow at a compound annual growth rate of 7.1% from 2025 to 2033 to reach USD 49.9 million by 2033.

b. By product, high-purity gallium accounted for the largest revenue share, approximately 64.0% in 2024, primarily owing to its extensive use in the production of semiconductors, optoelectronic devices, and compounds.

b. Some of the key players in the global gallium market are American Elements, China JinMuan Nonferrous Metal Group Co., Ltd., Dowa Electronics Materials Co., Ltd., NEO Performance Materials, NICHIA Corporation, Noah Chemicals Corporation, Reade Advanced Materials, Umicore, Vital Materials Co., Ltd., Zhuzhou Smelter Group Co., Ltd. (ZSG).

b. The global gallium market is experiencing growth driven primarily by its critical applications in integrated circuits (ICs) and optoelectronic devices. Gallium is extensively used as a semiconductor material in ICs, which form the backbone of modern electronics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.