- Home

- »

- Next Generation Technologies

- »

-

Gas Sensor Market Size & Share, Industry Report, 2033GVR Report cover

![Gas Sensor Market Size, Share & Trends Report]()

Gas Sensor Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Oxygen/Lambda Sensor, Carbon Dioxide Sensor), By Type (Wired, Wireless), By Technology, By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-083-5

- Number of Report Pages: 147

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Gas Sensor Market Summary

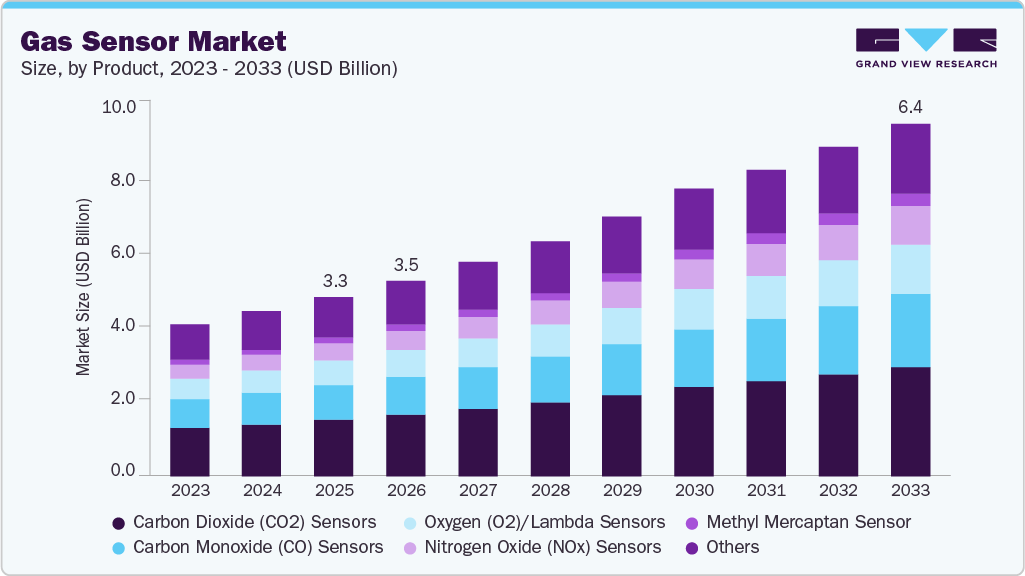

The global gas sensor market size was estimated at USD 3.26 billion in 2025 and is projected to reach USD 6.39 billion by 2033, growing at a CAGR of 8.8% from 2026 to 2033. The major factor driving the growth of the gas sensor industry is the development of wireless capabilities and miniaturization, coupled with improvements in communication technologies that enable their integration into various devices and machines to detect toxic gases at a safe distance.

Key Market Trends & Insights

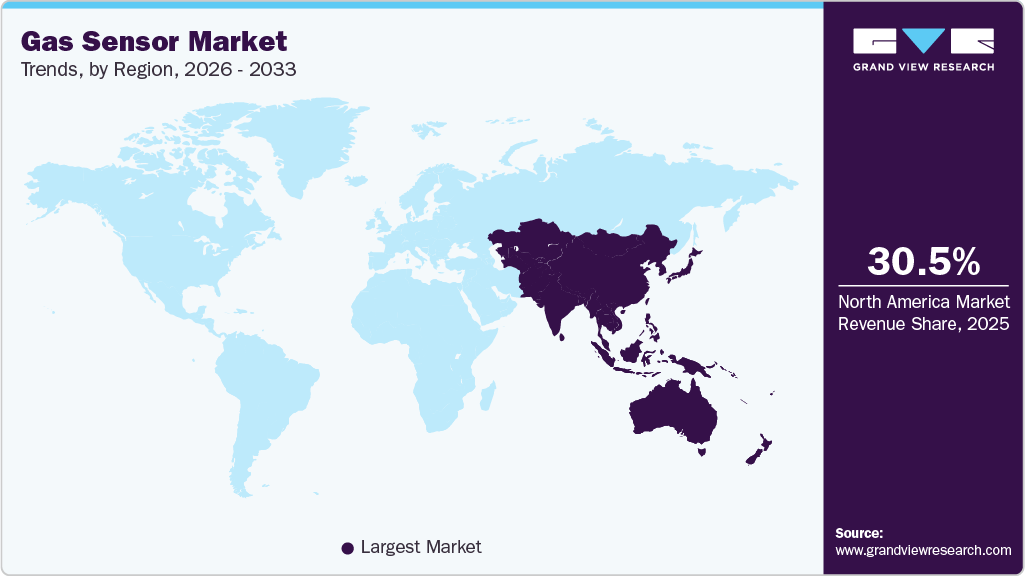

- Asia Pacific dominated the gas sensor market with the largest revenue share of 30.5% in 2025.

- The gas sensor market in India is expected to grow at a notable growth rate during the forecast period.

- By product, the carbon dioxide (CO2) sensors segment led the market with the largest revenue share of 31.6% in 2025.

- By type, the wired segment accounted for the largest market revenue share in 2025.

- By technology, the electrochemical segment accounted for the largest market revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 3.26 Billion

- 2033 Projected Market Size: USD 6.39 Billion

- CAGR (2026-2033): 8.8%

- Asia Pacific: Largest market in 2025

Gas sensors are used to constantly control and monitor gas emissions from various industrial processes, ranging from domestic and industrial. In addition, the rising demand to control the harmful emissions from critical industries also bodes well for the growth of the market. One of the most significant trends in the gas sensor industry is the widespread integration of sensors with the internet of things (IoT) and wireless technologies.IoT-enabled gas sensors enable real-time data transmission, remote monitoring, and cloud connectivity, thereby enhancing operational efficiency and facilitating predictive maintenance across various industrial, environmental, and smart infrastructure applications. This connectivity is transforming traditional gas detection systems into networked platforms that deliver actionable insights, reduce downtime, and enhance safety in facilities such as factories, refineries, and smart cities.

The growing awareness of the adverse effects of air pollution on public health and the environment is driving the increased adoption of gas sensors in air quality monitoring systems worldwide. Governments and regulatory authorities are implementing stricter emissions norms and air quality regulations, compelling industries and municipalities to enhance their monitoring capabilities. As a result, sectors such as municipal air monitoring, industrial emissions management, and building automation are increasingly deploying advanced gas sensing solutions. This regulatory focus, combined with sustainability initiatives, is accelerating the use of sensors to detect CO₂, NOx, methane, and other harmful pollutants in both indoor and outdoor environments.

Numerous industries, including the chemical, oil & gas, and power sectors, utilize gas sensors to detect the presence of various combustible and toxic gases. A significant number of gases, including carbon monoxide, carbon dioxide, hydrocarbons, and ammonia, are released into the air by these industries. An excess of emissions of these gases can have adverse effects on human health. Moreover, methane is widely used for power generation. Methane is a greenhouse gas that is highly inflammable and forms explosive mixes in the air if the methane leaks are not detected properly. Hence, new sensor technologies are being developed, such as substance-specific electrochemical sensors and Non-Dispersive Infrared (NDIR) sensors, which are used to detect methane and other gases in industries.

Miniaturization has been a breakthrough, driving the expansion of gas sensors into consumer electronics and portable safety equipment. Miniaturization driven by MEMS and nanotechnology is enabling gas sensors to shrink in size while improving performance. Smaller, low-power sensors can now be integrated into portable devices, wearables, and even smart consumer electronics, allowing continuous personal exposure tracking and environmental monitoring on the go. This shift broadens the applications of gas sensors beyond traditional industrial environments into health tech, consumer air quality gadgets, and smart wearable devices.

Technical limitations associated with gas sensors continue to restrain market growth, particularly in demanding operating environments. The sensitivity of the catalytic bead technology-based sensor is very high towards airborne contaminants, and excessive exposure may lead to a decrease in the lifespan of the sensor. In addition, electrochemical sensors can be affected by interfering gases, which may trigger false alarms. Although these sensors are designed to detect and measure only specific target gases, the presence of other substances may still lead to inaccurate readings. Such errors can pose significant operational challenges in industrial or commercial settings.

Product Insights

The carbon dioxide (CO2) sensors segment led the market with the largest revenue share of 31.6% in 2025.Heightened awareness of indoor air quality and its impact on health is propelling the adoption of CO2 sensors in residential, commercial, and industrial settings. As sustainability gains momentum, regulations and initiatives addressing greenhouse gas emissions are encouraging the integration of CO2 sensors in various applications to monitor and manage carbon footprints. Advances in sensor technology have led to the development of more cost-effective, compact, and energy-efficient CO2 sensors, making them accessible for broader deployment.

The nitrogen oxide (NOx) sensors segment is expected to grow at the fastest CAGR over the forecast period. The segment growth is being significantly driven by the tightening of emission regulations aimed at controlling vehicle exhaust and industrial air pollution, particularly in Europe, North America, and parts of Asia. Regulatory standards such as Euro 6/7 and similar frameworks have compelled automakers to implement advanced exhaust after treatment technologies, including selective catalytic reduction (SCR), which depend on precise NOx sensors for real-time emissions monitoring and compliance. In addition, the growing use of diesel and lean-burn gasoline engines in commercial vehicles and off-highway equipment is further driving demand for high-accuracy NOx sensors, which help enhance engine efficiency while meeting stringent emission standards.

Type Insights

The wired segment accounted for the largest market revenue share in 2025. The wired gas sensors offer several benefits, including low maintenance, compact size, lower cost, and higher accuracy. In many situations, wired sensors are among the most reliable systems. They directly link the sensor to the device receiving the input, making them suitable for use in hazardous environments such as mines, oil rigs, and nuclear power plants. In addition, the growing adoption of wired gas sensors in residential applications is a key factor driving the segment's growth.

The wireless segment is expected to grow at the fastest CAGR of 9.2% during the forecast period. The benefits provided by wireless gas sensors, such as high scalability and flexibility, cost-effectiveness, and ease of portability, are expected to drive the growth of the segment. Wireless sensors can be used in a wide range of industries, including petrochemical, manufacturing, and oil & gas. In the oil & gas sector, these sensors enable continuous remote monitoring of gases. They can be operated from the base stations, thus reducing the chances of leakage and explosion of hazardous gases.

Technology Insights

The electrochemical segment accounted for the largest market revenue share in 2025. This growth is primarily attributed to the low power consumption, enhanced safety, and high specificity for target gases. Its ability to detect toxic gases through efficient electrochemical reactions makes it especially valuable in hazardous environments, such as mining. These advantages are expected to drive continued adoption across industries seeking reliable and precise gas monitoring solutions.

The infrared segment is expected to grow at the fastest CAGR during the forecast period. Infrared gas sensors detect various gases, including methane, carbon monoxide, and Volatile Organic Compounds (VOCs) such as acetylene, benzene, butane, and others. These gas sensors are also used in monitoring oxygen levels in ventilators and incubators. The growth of the segment can also be attributed to the rising levels of pollution across the globe.

End Use Insights

The industrial segment led the market with the largest revenue share of 19.27% in 2025. Gas sensors are widely used in the industrial sector due to stringent regulations related to workplace safety. The increasing priority for the safety of workers in industrial settings is expected to boost the demand for gas sensors over the forecast period. Safety and regulatory compliance are paramount in industrial settings, prompting the increased adoption of gas sensors.

The environmental segment is expected to witness at the fastest CAGR over the forecast period. The implementation of government-led environmental initiatives, particularly in developing economies, has significantly increased the demand for gas sensor solutions in this end-use segment. A supportive regulatory framework aimed at reducing environmental pollution is expected to remain a key growth driver for the market over the next eight years. Rising global concerns regarding air and water quality, along with stronger commitments to address climate change, are further accelerating the adoption of gas sensors across a wide range of environmental monitoring applications.

Regional Insights

The gas sensor market in North America is expected to grow at a notable CAGR during the forecast period. The rise of smart home technologies and the integration of Internet of Things (IoT) devices in the U.S. and Canada have expanded the application of gas sensors in residential settings, enhancing indoor air quality monitoring.

U.S. Gas Sensor Market Trends

The gas sensor market in U.S. accounted for the largest market revenue share in North America in 2025.A significant driver is the stringent environmental regulations enforced by agencies like the U.S. Environmental Protection Agency (EPA), which necessitate the adoption of gas sensors across various sectors to monitor and control emissions in the automotive industry. The shift towards electric and hybrid vehicles has increased the demand for gas sensors to ensure safety and compliance with emission standards.

Asia Pacific Gas Sensor Market Trends

Asia Pacific dominated the global gas sensor market with the largest revenue share of 30.5% in 2025 and is anticipated to grow at the fastest CAGR during the forecast period. Increasing awareness about the impact of air pollutants on human health across countries in the Asia Pacific, such as India and China, is driving the demand for gas sensors for air quality monitoring. Continued urbanization in the region is also contributing to the rising demand for gas sensors. Moreover, the governments in the Asia Pacific regions are investing heavily in smart city projects, thus creating significant potential for smart sensor devices. Such factors bode well for regional market growth.

The gas sensor market in India is expected to grow at a notable growth rate during the forecast period. The Indian market is experiencing significant growth owing to the country's expanding infrastructure development, construction projects, and industrial expansion.

The China gas sensor market held a significant market share in Asia Pacific in 2025. The gas sensor industry in China is undergoing rapid transformation, driven by the country’s intensified focus on industrial safety, environmental protection, and smart technologies. One of the primary drivers behind this growth is China’s aggressive industrial expansion, which necessitates robust safety protocols and compliance measures in manufacturing, petrochemical, and mining sectors.

Europe Gas Sensor Market Trends

The gas sensor market in Europe is expected to register at a moderate CAGR from 2026 to 2033. Stringent norms related to the emissions of gases and the subsequent need for emissions monitoring are expected to drive the regional market growth. In Europe, the safety requirements require all the vehicle OEMs to include the gas sensor technologies in their offers. As the rules to curb the pollution levels are becoming more rigorous, the popularity of gas sensors in the automotive sector to decrease pollution is expected to increase over the coming years. In addition, several regional market players are developing advanced gas sensors, which are ultimately propelling the market’s growth.

The UK gas sensor market is expected to grow at a rapid CAGR during the forecast period. One of the key drivers is the country's strong emphasis on environmental sustainability, particularly in urban centers where air pollution monitoring has become a top priority. The rise of smart homes and buildings equipped with integrated air monitoring systems is also fostering demand for compact and energy-efficient gas sensors. In addition, the shift toward hydrogen and alternative fuels in the energy and transportation sectors has introduced new safety and monitoring requirements, further expanding sensor applications.

The gas sensor market in Germany held a substantial market share in Europe in 2025. Companies such as Siemens and Dräger have made significant strides by introducing advanced gas sensor solutions tailored to the evolving needs of the German market. The increasing emphasis on workplace safety and environmental compliance is driving the demand for gas sensors across industries.

Key Gas Sensor Company Insights

Some of the key companies in the gas sensor industry include ABB Ltd., Alphasense (a subsidiary of AMETEK, Inc.), and Honeywell International Inc., among others. Market players are pursuing various strategies, such as mergers & acquisitions, new product launches, and strategic partnerships, among others, to expand their market presence.

Market players are also investing aggressively in R&D to enhance their product offerings. The benefits associated with wireless devices are prompting market players to provide wireless gas sensors mainly.

-

ABB Ltd. is a multinational corporation headquartered in Zurich, Switzerland, specializing in electrification and automation technologies. The company operates through four main business areas: Electrification, Motion, Process Automation, and Robotics & Discrete Automation. ABB's offerings include products and services such as electric vehicle chargers, industrial robots, control systems, and digital solutions, all of which are available under the ABB Ability platform.

-

Honeywell International Inc. is a global conglomerate known for its gas sensors and diverse technologies and solution offerings. The company provides advanced gas sensing and detection solutions to various industries.

Key Gas Sensor Companies:

The following are the leading companies in the gas sensor market. These companies collectively hold the largest market share and dictate industry trends.

- Alphasense (AMETEK, Inc.)

- Honeywell International Inc.

- Process Sensing Technologies

- Figaro Engineering Inc.

- MEMBRAPOR AG

- Nemoto & Co. Ltd.

- GfG Gesellschaft für Gerätebau mbH

- Robert Bosch GmbH

- ABB Ltd

- Siemens AG

Recent Developments

-

In May 2025, Honeywell announced the launch of the Hydrogen Leak Detector (HLD) series, a new gas sensing solution designed to detect microscopic hydrogen leaks in real time using advanced thermal conductivity detection technology. The HLD sensors can be integrated into industrial equipment, power generators, and vehicles to enhance safety in hydrogen-powered systems and prevent leak-related hazards.

-

In February 2025, Process Sensing Technologies launched the QMA601 Moisture in CO₂ Analyzer, a quartz crystal microbalance-based gas analysis solution designed for CO₂ capture, transport, and sequestration projects. The analyzer provides high-accuracy, traceable moisture measurement at ppm levels, supporting process safety, infrastructure protection, and regulatory compliance in industrial and environmental applications.

Gas Sensor Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 3.55 billion

Revenue forecast in 2033

USD 6.39 billion

Growth rate

CAGR of 8.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, technology, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Alphasense (AMETEK, Inc.); Honeywell International Inc.; Process Sensing Technologies; Figaro Engineering Inc.; MEMBRAPOR AG; Nemoto & Co. Ltd.; GfG - Gesellschaft für Gerätebau mbH; Robert Bosch GmbH; ABB Ltd; Siemens AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gas Sensor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global gas sensor market report based on product, type, technology, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Oxygen/Lambda Sensor

-

Carbon Dioxide Sensor

-

Carbon Monoxide Sensor

-

NOx Sensor

-

Methyl Mercaptan Sensor

-

Others

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Wireless

-

Wired

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Electrochemical

-

Semiconductor

-

Solid State/MOS

-

Photo-Ionization Detector (PID)

-

Catalytic

-

Infrared (IR)

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Medical

-

Building Automation & Domestic Appliances

-

Environmental

-

Petrochemical

-

Automotive

-

Industrial

-

Agriculture

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global gas sensor market size was estimated at USD 3.26 billion in 2025 and is expected to reach USD 3.55 billion in 2026.

b. The global gas sensor market is expected to grow at a compound annual growth rate of 8.8% from 2026 to 2033 to reach USD 6.39 billion by 2033.

b. Asia Pacific dominated the gas sensor industry and accounted for a share of 30.5% in 2025. Increasing awareness about the impact of air pollutants on human health across the countries in the Asia Pacific, such as India and China, is driving the demand for gas sensors for air quality monitoring.

b. Some key players operating in the gas sensor market include Alphasense (AMETEK, Inc.), Honeywell International Inc., Process Sensing Technologies, Figaro Engineering Inc., MEMBRAPOR AG, Nemoto & Co. Ltd., GfG - Gesellschaft für Gerätebau mbH, Robert Bosch GmbH, ABB Ltd, Siemens AG.

b. Key factors driving the gas sensor market growth include the increased extensive application of gas sensors in process and manufacturing industries for detecting various toxic, including hydrogen sulfide and nitrogen dioxide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.