- Home

- »

- Consumer F&B

- »

-

GCC Dietary Supplements Market Size, Industry Report 2030GVR Report cover

![GCC Dietary Supplements Market Size, Share, & Trends Report]()

GCC Dietary Supplements Market (2025 - 2030) Size, Share, & Trends Analysis Report By Ingredients (Vitamins, Botanicals, Minerals), By Form, By Type, By Application, By End Use, By Distribution Channel, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-702-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

GCC Dietary Supplements Market Summary

The GCC dietary supplements market size was estimated at USD 1.72 billion in 2024 and is projected to reach USD 3.19 billion by 2030, growing at a CAGR of 10.7% from 2025 to 2030. Rising health awareness and preventive healthcare, increasing consumer focus on maintaining balanced health and preventing lifestyle diseases such as obesity, diabetes, and cardiovascular conditions, significantly drive demand for dietary supplements.

Key Market Trends & Insights

- Saudi Arabia held a significant share in the GCC dietary supplements market in 2024.

- By ingredients, vitamins accounted for 31.3% in 2024.

- By ingredients, the proteins and amino acids segment accounted for 14.1% over the forecast period.

- By form, tablet supplements accounted for the largest revenue share of 31.4% in 2024.

- By end use, dietary supplements for adults dominated the dietary supplements market, with a share of 62.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.72 Billion

- 2030 Projected Market Size: USD 3.19 Billion

- CAGR (2025-2030): 10.7%

In addition, vitamin D and calcium deficiencies are common due to indoor lifestyles. These conditions are driving the consumption of targeted supplements that help manage weight, improve metabolic health, and restore nutritional balance.Increasing disposable income and affluence across the GCC region are key drivers of growth in the GCC dietary supplements industry. With a young, tech-savvy population and growing awareness of health trends, spending on vitamins, protein supplements, and functional foods is becoming more common among locals and expatriates.

Furthermore, rapid urbanization and increasingly busy lifestyles drive demand for the GCC dietary supplements market. As more people move to cities and adopt fast-paced routines, they often face time constraints, irregular meals, and higher stress levels. This shift pushes consumers to find convenient ways to maintain their health, leading to greater interest in supplements supporting energy, immunity, digestion, and overall wellness. On-the-go formats such as capsules, gummies, and ready-to-mix powders are especially popular among working professionals, students, and urban families seeking quick, effective health solutions.

Consumer Insights

Consumers in the GCC dietary supplement market are becoming increasingly health-conscious and informed, with a strong preference for products that support preventive health, beauty, and fitness goals. There is growing demand for multivitamins, vitamin D, omega-3, collagen, and probiotics, driven by awareness of common deficiencies and lifestyle-related issues. Younger, tech-savvy consumers often research products online and prefer trusted international brands, but there is also rising interest in halal-certified, clean-label, and natural supplements. Convenience matters; gummies, sachets, and capsules are favored over traditional tablets, especially among younger adults and women. Many consumers now associate supplements with illness and maintaining energy, boosting immunity, improving appearance, and supporting an active lifestyle.

Rising disposable income, especially among younger professionals and women, allows more people to invest in personal wellness products. Urban lifestyles and time constraints encourage people to seek fast, convenient health solutions that fit into busy routines. The influence of social media, fitness culture, and wellness influencers has normalized supplement use as part of everyday self-care.

Ingredient Insights

The vitamin segment dominated the market with the largest share of 31.3% in 2024, due to widespread micronutrient deficiencies, particularly in vitamin D, caused by limited sun exposure, cultural clothing norms, and diets low in fresh produce. According to a study conducted by NIH, in Saudi Arabia, nearly half of students (49.5%) and employees (44%) suffer from vitamin D deficiency, with key risk factors including poor diet, low supplement use, obesity, and living in the Eastern region, especially among females and lower-income groups. Many consumers use multivitamins and specific vitamin supplements to support immunity, bone health, and overall wellness.

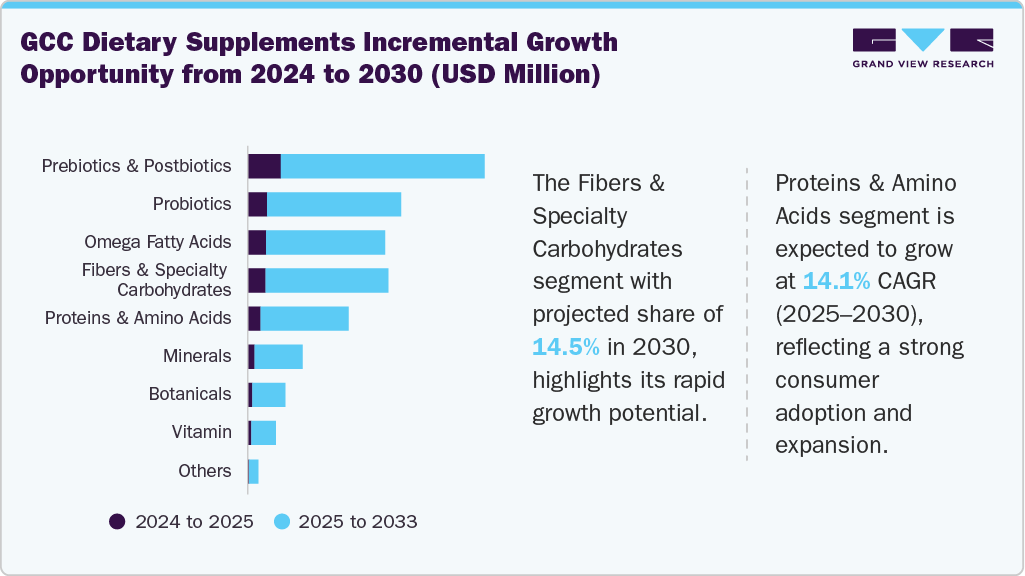

The proteins and amino acids segment is projected to be the fastest-growing segment with a CAGR of 14.1% from 2025 to 2030. The market is driven by increasing health and fitness awareness, supported by government-led wellness initiatives such as Saudi Vision 2030. Consumers are increasingly seeking functional nutrition for muscle recovery, weight management, and energy support, particularly in urban areas where gyms and fitness centers are expanding. The market is also shifting toward plant-based and clean-label protein sources, driven by health and environmental concerns. In October 2024, Eurovo Group participated in the Dubai Muscle Show for the third time, showcasing its ProUp egg white-based protein range as part of its growing commitment to the Gulf region’s booming health and wellness market.

Form Insights

The tablet segment held the largest revenue share in 2024 due to its dosage accuracy, convenience, and long shelf life. Tablets are preferred for their portability and single-serving ease, which makes them ideal for busy consumers. Pharmacies and supermarkets stock tablets more frequently than other formats, reinforcing consumer familiarity and trust. Packaging in blister or foil-sealed strips further preserves stability, making tablets the default choice for formulators and consumers.

The gummies segment is anticipated to grow at the fastest CAGR over the forecast period. Consumer preference for convenience and taste is expected to drive the demand for the product in the GCC dietary supplement industry. Gummies are more palatable and enjoyable than tablets or capsules, especially for children, young adults, and seniors who may struggle with swallowing pills. In addition, rising awareness of men's health issues such as sexual health, hair loss, and stress is increasing the demand for the product.

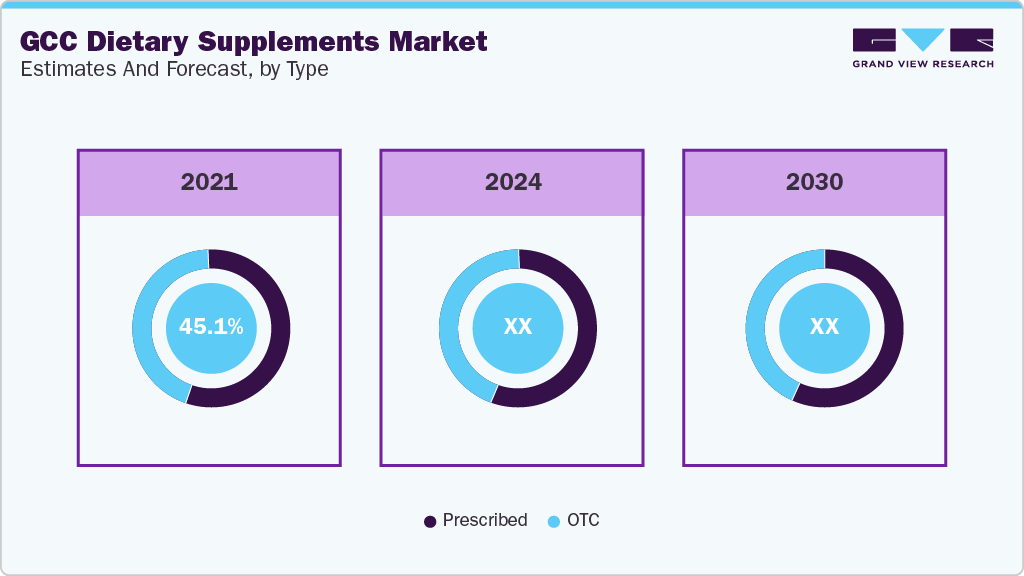

Type Insights

The prescribed segment dominated the market in 2024 and is expected to grow at the fastest CAGR during the forecast period. The dominance of the prescribed dietary supplement segment in the GCC region is driven by several key factors, including a strong healthcare infrastructure, high prevalence of lifestyle-related diseases such as diabetes and obesity, and widespread micronutrient deficiencies, particularly in vitamin D and iron. Cultural trust in medical professionals encourages consumers to rely on prescriptions for supplements rather than over-the-counter options. In addition, government-led health initiatives promoting preventive care, an aging population with rising health needs, and increased awareness of maternal and child nutrition contribute to higher demand for doctor-recommended supplements.

The OTC segment is expected to grow at a significant CAGR during the forecast period, due to rising health awareness, increased interest in self-care, and the popularity of fitness and wellness trends, especially among younger consumers. Easy access to OTC products through pharmacies, supermarkets, and online platforms supports convenience-driven purchasing, which is expected to drive the demand for the segment in the GCC dietary supplement industry. Consumers increasingly use vitamins, minerals, protein, and herbal supplements to support immunity, beauty, and energy without needing a prescription. Marketing campaigns, influencer endorsements, and availability of global brands have further boosted OTC supplement consumption, especially in urban areas of the UAE and Saudi Arabia.

Application Insights

The immunity segment held the largest share in 2024, as the demand for dietary supplements to support immunity is driven by heightened health awareness, especially in the aftermath of the COVID-19 pandemic. Consumers increasingly seek preventive health measures, leading to greater use of vitamins C and D, zinc, and herbal supplements.

Frequent travel, exposure to air-conditioned environments, and urban pollution weaken immunity, prompting individuals to seek daily immune support. Regional healthcare authorities and wellness campaigns have promoted immunity-boosting strategies. The widespread availability of OTC immune supplements in pharmacies, supermarkets, and e-commerce platforms has further fueled this trend.

The prenatal health segment is anticipated to grow fastest from 2025 to 2030. The market is driven by rising disposable incomes and increased access to private healthcare, which has led more expectant mothers to prioritize premium prenatal nutrition, including liquid and soft gel dietary supplements. The growing number of antenatal consultations and regular screenings has resulted in earlier detection of nutritional deficiencies, prompting preventive supplementation. Cultural emphasis on maternal and infant well-being, supported by family and community influence, also drives consistent supplement use.

End Use Insights

The adult segment dominated the market with the largest share in 2024, increasing prevalence of lifestyle-related diseases such as obesity, diabetes, hypertension, and vitamin D deficiency, prompting a greater reliance on supplements for disease prevention and wellness. Adults are actively seeking solutions for energy, immunity, mental wellness, and healthy aging. Busy urban lifestyles, dietary gaps, and tech-enabled access to customized supplements. In addition, a large expat population and the demand for halal-certified and culturally tailored products contribute to sustained adult segment growth across the region.

The infant segment is projected to be the fastest-growing segment over the forecast period, rising birth rates in countries such as Saudi Arabia and the UAE, coupled with increasing parental awareness of early childhood nutrition, are expected to drive the demand for the products in the GCC dietary supplement industry. Governments across the region are actively promoting maternal and child health through national health campaigns and fortified nutrition programs. A growing demand for immune-boosting, brain development, and vitamin D supplements, especially in tablet, drop, and gummy forms, is also driving the market's growth. Arla Foods, a leading international dairy cooperative, launched its Baby&Me Organic range in Saudi Arabia in response to rising regional demand for organic infant and maternal nutrition products. The product line includes Mom Formula for pregnant women, infant milk formulas, multi-grain porridges for babies four months and older, and fruit and vegetable pouches for those six months and above.

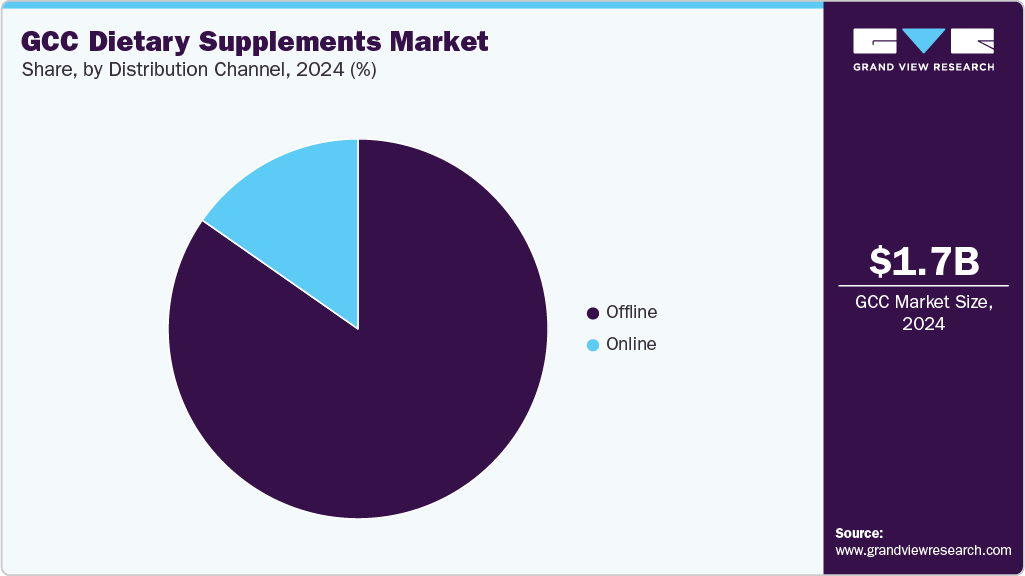

Distribution Channel Insights

The offline distribution channels led the market with the largest share in 2024, due to the strong consumer preference for in-person consultations and trust in licensed pharmacies, clinics, and health stores. Shoppers often rely on pharmacists and healthcare professionals for personalized advice before purchasing supplements, especially for specific health needs such as prenatal care, bone health, or chronic conditions. Cultural factors also play a role, as many consumers favor face-to-face interactions over online transactions. In September 2024, Aster DM Healthcare announced its expansion into Saudi Arabia through a joint venture with Al Hokair Holding Group, aiming to open over 250 Pharmacy outlets within five years.

Online distribution channel segment is projected to be the fastest-growing segment over the forecast period. The online segment for GCC dietary supplements industry is expanding rapidly, supported by platforms such as Aster Online, Nahdi Online, iHerb, Amazon UAE, and Life Pharmacy. These platforms offer consumers a wide range of vitamins, minerals, herbal products, and sports nutrition supplements with the convenience of home delivery and secure payment options.

Country Insights

Saudi Arabia Dietary Supplements Market Trends

Saudi Arabia held a significant share in the GCC dietary supplements market in 2024, due to rising health awareness, lifestyle changes, and increasing focus on preventive care. Consumers are becoming more proactive about managing their health, shifting toward boosting immunity, improving energy, and addressing nutrient deficiencies, especially after the COVID-19 pandemic. Urbanization, changing diets, and rising cases of lifestyle-related conditions such as obesity, diabetes, and cardiovascular diseases are further driving the market. Furthermore, increasing disposable income enables more consumers to invest in dietary supplements as part of their health regimen, driving the growth of the market.

UAE Dietary Supplements Market Trends

UAE is expected to grow at a significant CAGR over the forecast period. Government initiatives such as the National Strategy for Wellbeing 2031 and the Dubai Fitness Challenge have encouraged preventive health and fitness-focused lifestyles, increasing supplement adoption, which is expected to drive the growth of the GCC dietary supplements industry. In addition, residents with high disposable income, especially in cities such as Dubai and Abu Dhabi, have strong purchasing power and a willingness to invest in premium health and wellness products, including personalized and organic supplements.

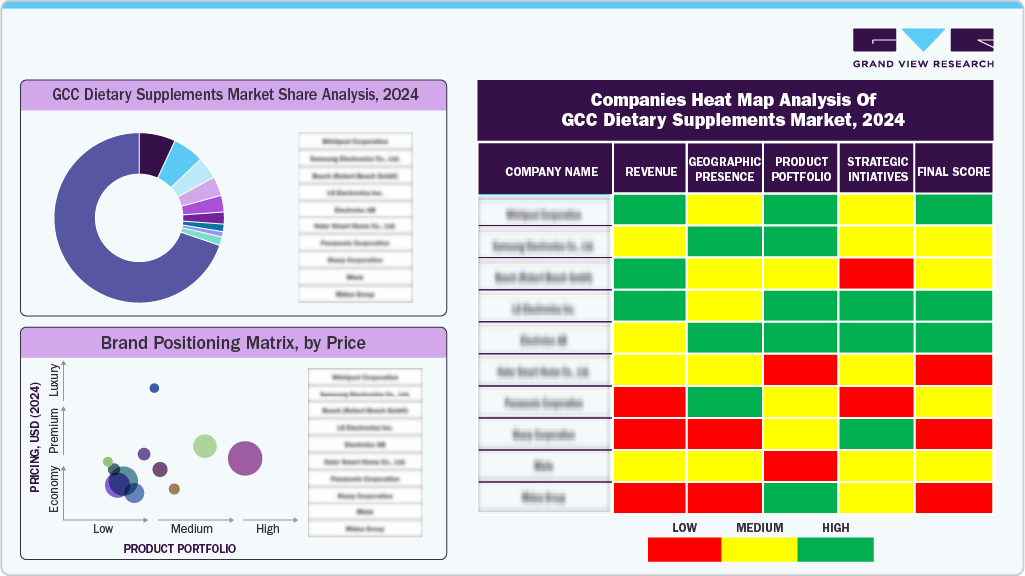

Key GCC Dietary Supplements Company Insights

Some key companies operating in the market include Julnar Healthcare, Yalla Nutrition FZ LLC, ADM, Herbalife Inc., Abbott., and Nestlé.

-

Herbalife. Offers a range of science-backed products, including protein shakes, dietary supplements, and personal care items. Herbalife operates through a direct-selling model and serves customers in over 90 countries. With a focus on weight management, targeted nutrition, and fitness, Herbalife aims to improve health outcomes through its community-based approach and independent distributors.

Key GCC Dietary Supplements Companies:

- Julnar Healthcare

- Yalla Nutrition FZ LLC

- ADM

- Herbalife Inc.

- Abbott

- Nestlé

Recent Developments

-

In February 2025, iPRO officially launched its healthy hydration drinks in Saudi Arabia through a strategic partnership with Al Rabie Saudi Foods Company, enabling distribution across over 21,000 sales points through Al Rabie.

GCC Dietary Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.92 billion

Revenue forecast in 2030

USD 3.19 billion

Growth rate

CAGR of 10.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Ingredients, form, type, application, end use, distribution channel, country

Country scope

Saudi Arabia, UAE, Bahrain, Kuwait, Oman and Qatar

Key companies profiled

Julnar Healthcare, Yalla Nutrition FZ LLC, ADM, Herbalife Inc., Abbott, Nestlé

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

GCC Dietary Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the GCC dietary supplements market report based on ingredients, form, type, application, end use, distribution channel, and country:

-

Ingredients Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (Selenium, Chromium, Copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Prescribed

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

-

-

Geriatric

-

Children

-

Infants

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others (Direct to Consumer, MLM)

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

GCC

-

Saudi Arabia

-

United Arab Emirates

-

Bahrain

-

Kuwait

-

Oman

-

Qatar

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.