- Home

- »

- Next Generation Technologies

- »

-

Gear Motor Market Size And Share, Industry Report, 2033GVR Report cover

![Gear Motor Market Size, Share & Trends Report]()

Gear Motor Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Helical Gear Motor, Planetary Gear Motor, Helical-Bevel Gear Motor), By Rated Power, By Torque (Up to 10,000 Nm, Above 10,000 Nm), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-395-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Gear Motor Market Summary

The global gear motor market size was estimated at USD 25.63 billion in 2024 and is projected to reach USD 46.16 billion by 2033, growing at a CAGR of 6.9% from 2025 to 2033. This market expansion is driven by the growing adoption of gear motors in robotics, conveyor systems, and packaging machinery to enhance operational reliability, coupled with advancements in compact, high-torque motor designs and integrated control technologies.

Key Market Trends & Insights

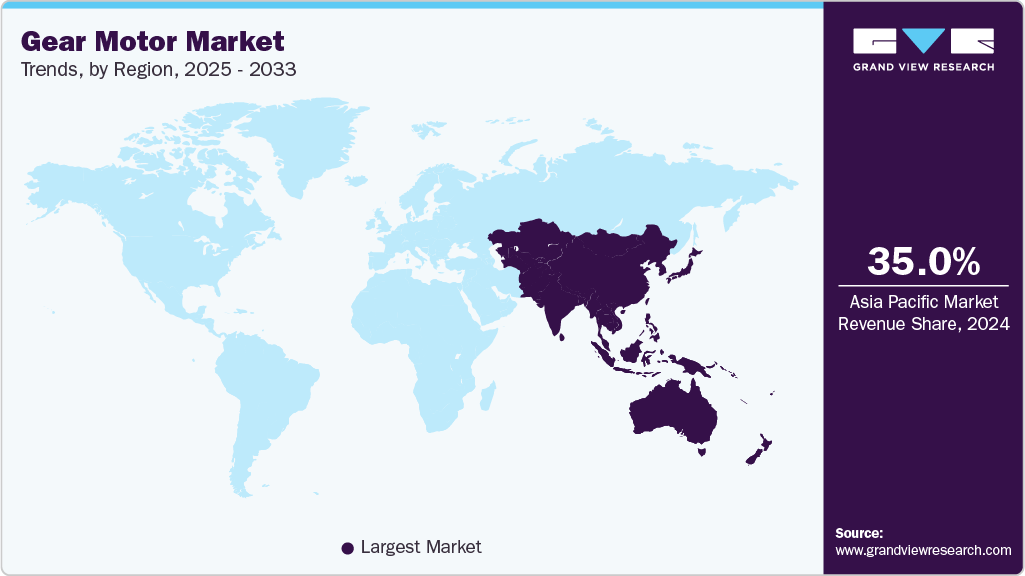

- Asia Pacific dominated the global gear motor market with the largest revenue share of over 35% in 2024.

- The gear motor market in China led the Asia Pacific market and held the largest revenue share in 2024.

- By type, the helical gear motor segment led the market and held the largest revenue share of over 46% in 2024.

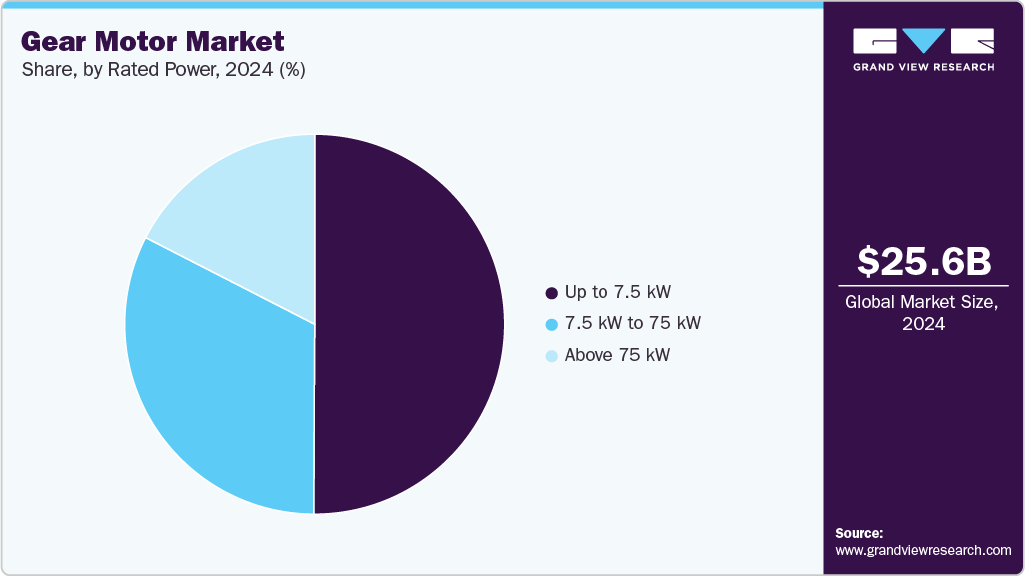

- By rated power, the up to 7.5 kW segment led the market, with the largest revenue share of over 50% in 2024.

- By end use, the industrial machinery segment led the market, with the largest revenue share of over 33% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 25.63 Billion

- 2033 Projected Market Size: USD 46.16 Billion

- CAGR (2025-2033): 6.9%

- Asia Pacific: Largest market in 2024

The increasing integration of automation, precision motion systems, and energy-efficient technologies drives the growth of the gear motor industry. The move toward smart factories is accelerating the deployment of high-torque, compact gear motors equipped with intelligent control units, supporting seamless robotic handling, conveyor automation, and material-flow optimization. The incorporation of IoT-enabled monitoring, vibration analysis, and predictive maintenance platforms allows real-time fault detection and performance optimization, minimizing downtime in continuous production environments.Energy efficiency is becoming a key driver of growth in the gear motor market as industries face mounting pressure to reduce energy consumption and comply with stringent environmental regulations. The modern gear motor industry is engineered to deliver high torque with minimal power loss, enabling manufacturers, logistics hubs, and processing plants to optimize operational costs while aligning with global sustainability mandates. This shift toward energy-efficient drive solutions is strengthening the adoption of advanced gear motors across both continuous and intermittent duty applications.

In addition, the integration of IoT and smart monitoring technologies is further transforming gear motor functionality, enabling real-time visibility into core performance parameters such as temperature, vibration, and load. These intelligent, connected units collect actionable data that supports predictive maintenance, minimizing downtime, preventing unplanned failures, and extending equipment lifespan. As industries accelerate their transition toward digitalized production environments, smart gear motors are becoming essential components of automated, sensor-driven industrial ecosystems.

Moreover, technological advancements in material science are reshaping product design and operational capability. The growing use of high-strength, lightweight materials such as carbon composites, advanced polymers, and thermally stable alloys is enhancing durability, improving torque density, and enabling compact configurations suitable for high-precision tasks. These innovations are expanding the applicability of gear motors across demanding sectors such as robotics, automotive manufacturing, food processing, and heavy machinery.

Furthermore, the rapid automation of manufacturing and intralogistics systems, where gear motors play a critical role in enabling precise motion control and continuous-duty performance. Growing deployment of advanced conveyor systems, automated storage and retrieval units, and robotics platforms is accelerating demand for compact, high-torque gear motors. Moreover, expanding investments in renewable energy infrastructure are increasing the need for durable gear motors. This broad industrial transition toward automation, efficiency, and sustainable power generation continues to reinforce strong growth momentum for the gear motor market.

Type Insights

The helical gear motor segment accounted for the largest market share of over 46% in 2024, owing to its ability to deliver exceptionally smooth, efficient, and low-vibration performance, as well as strong demand across precision-driven industrial operations. The adoption of advanced automated production lines and energy-efficient machinery is accelerating the need for motion-control solutions. Increasing investments in smart factories and digitally monitored equipment further boost the segment.

The planetary gear motor segment is expected to witness the fastest CAGR of 7.6% from 2025 to 2033, driven by a clear shift in the market toward compact, high-performance motion systems. Industries are increasingly adopting solutions that deliver higher torque density, improved efficiency, and minimal backlash, making planetary designs the preferred choice over conventional gear systems. This trend is further reinforced by growing use in robotics, automation, EVs, and precision systems, where demand for compact, high-load, and reliable motors is rapidly increasing.

Rated Power Insights

The up to 7.5 kW segment accounted for the largest market share in 2024, owing to the adoption of lower-power gear motors that offer reliable torque with reduced energy consumption. The shift toward space-saving equipment designs further strengthens demand, as gear motors in this range integrate easily into compact production setups. Growing deployment of digitally monitored low-maintenance industrial machinery additionally supports this segment’s uptake within the gear motor industry.

The above 75 kW segment is expected to witness the fastest CAGR from 2025 to 2033. The rising adoption of high-power gear motors capable of delivering exceptional torque for heavy industrial operations. Increasing automation across large-scale manufacturing, mining, and processing facilities is accelerating the need for robust drive systems that can withstand continuous, high-load conditions. Increasing emphasis on operational efficiency and reduced downtime continues to support the rapid expansion of the segment within the gear motor market.

Torque Insights

The up to 10,000 Nm segment accounted for the largest market share in 2024, primarily due to its widespread standardization and seamless compatibility with various industrial systems. This segment benefits from extensive market penetration and suppliers offering readily available models. The industries prioritize reliable torque solutions that support scalable and cost-effective operations, thereby the segment remains a widely adopted segment in the gear motor industry.

The above 10,000 Nm segment is expected to witness the fastest CAGR from 2025 to 2033, driven by a growing industry shift toward high-torque systems that support heavier loads, enhanced precision, and improved efficiency across advanced automation, robotics, and industrial machinery. This push for more powerful and durable torque solutions is emerging as a key trend as end users prioritize performance optimization and higher operational throughput.

End Use Insights

The industrial machinery segment accounted for the largest market share in 2024, primarily due to its extensive reliance on gear motors to power critical mechanical functions within production environments. The growing integration of automated controls, digital monitoring systems, and smart performance-optimization tools is accelerating the adoption. Rising investments in high-efficiency conveyors, mixers, pumps, and precision-driven equipment further strengthen the need for continuous-duty operation. These factors highlight the segment's dominant position within the gear motor market.

The aerospace & defense segment is expected to witness the fastest CAGR from 2025 to 2033, driven by the rising demand for high-precision, mission-critical gear motors that support advanced aerospace and defense operations. These industries require exceptionally accurate and reliable motion systems for aircraft control mechanisms, missile guidance platforms, satellite positioning units, and other high-stakes applications where operational failure is not an option. This focus on precision engineering positions the segment as one of the fastest-growing within the gear motor industry.

Regional Insights

The Asia-Pacific gear motor market dominated the market with a share of over 35% in 2024, driven by rapid industrialization, massive expansion of manufacturing plants, and the rising shift toward automated material handling solutions. Increasing investments in smart factories, energy-efficient machinery, and high-torque gear motor systems are boosting demand. The region’s strong growth in electronics manufacturing, e-commerce warehousing, and renewable energy projects further accelerates the gear motor industry market.

Gear motor market in Japan is gaining traction due to the modernization of precision manufacturing facilities, the expanding adoption of robotics, and the increasing reliance on compact, high-accuracy gear motors for semiconductor, automotive, and packaging applications. Government-supported smart manufacturing programs and the country’s leading position in advanced mechatronics are driving the deployment of intelligent, sensor-integrated gear motor units across factories.

The China gear motor market is rapidly expanding. The market is driven by large-scale factory automation, electric vehicle production, and continuous upgrades in conveyor, machining, and material handling systems. Government initiatives promoting intelligent manufacturing and the adoption of high-efficiency motors are accelerating the shift toward digitally connected, high-torque gear motors. Strategic collaboration between domestic motor manufacturers and global automation companies are further advancing technological innovation and increasing market penetration across industrial clusters.

North America Gear Motor Market Trends

Gear motor market in North America significantly dominated the respective global market, with a revenue share of over 25% in 2024, driven by the strong adoption of industrial automation, the expansion of advanced manufacturing facilities, and the high integration of smart motor technologies. The region’s emphasis on energy-efficient motion control systems supported by strict DOE and EPA efficiency standards is accelerating the transition toward IE3 and IE4-rated gear motors. Growing investments in predictive maintenance platforms, IIoT-enabled motor controls, and digital monitoring solutions continue to strengthen market growth across both industrial and commercial sectors.

U.S. Gear Motor Market Trends

The U.S. gear motor market dominated in 2024, driven by the aggressive adoption of automation technologies, the expansion of high-precision manufacturing, and large-scale upgrades in material handling and processing systems. Federal initiatives promoting energy-efficient industrial equipment and smart factory development are accelerating the shift toward intelligent gear motor systems. Growth in sectors such as pharmaceuticals, packaging, food processing, and warehouse automation is further driving demand for gear motors across the country.

Europe Gear Motor Market Trends

The Europe gear motor market is expected to grow at the highest CAGR of over 7% from 2025 to 2033. The market growth is driven by stringent EU energy efficiency mandates, the rapid adoption of Industry 4.0 technologies, and a strong focus on decarbonization across industrial operations. The European Commission’s EcoDesign Directive and efficiency regulations are accelerating the adoption of premium-efficiency gear motors across manufacturing, chemicals, and logistics sectors. The region’s leadership in smart material handling systems, robotics engineering, and precision machinery is further boosting demand for high-performance, digitally connected gear motor solutions.

The UK gear motor market is expected to grow significantly in the coming years, driven by the modernization of industrial equipment, rising investments in automated warehousing, and government-supported net-zero industrial initiatives. Manufacturers are increasingly shifting toward energy-optimized gear motors integrated with IoT-based analytics to reduce operational costs and improve system reliability. The strong adoption of conveyor automation, packaging machinery upgrades, and advanced process control systems is expected to strengthen the country’s gear motor demand.

Gear motor market in Germany is driven by the country’s world-leading engineering ecosystem, extensive deployment of high-precision machinery, and strong government backing for industrial digitalization. German manufacturers are rapidly integrating smart gear motor systems with AI-enabled monitoring tools, enhancing operational accuracy and predictive maintenance capabilities. Robust demand from automotive manufacturing, robotics, and industrial automation, supported by Industrie 4.0 initiatives, continues to position Germany as one of Europe’s strongest gear motor markets.

Key Gear Motor Company Insights

Some of the key players operating in the market are SEW-EURODRIVE and Siemens AG, among others.

-

SEW-EURODRIVE provides comprehensive drive technology and gear motor solutions engineered for high-reliability industrial motion applications. The company’s portfolio includes helical, bevel, worm, and parallel-shaft gearmotors, modular geared motor systems, and integrated inverter-drive units designed for conveyors, intralogistics, and heavy machinery. SEW-EURODRIVE pairs rugged mechanical designs with digital services and system integration tools, enabling customers to reduce downtime and optimize lifecycle costs. Its global service network and extensive OEM partnerships position it as a top, full-spectrum player in the gear motor industry.

-

Siemens AG delivers high-performance geared drives and motor-drive systems targeted at heavy industry, manufacturing automation, and process control sectors. Siemens’ offerings span premium-efficiency motors, geared motor assemblies, and drive electronics that integrate seamlessly into PLCs, industrial networks, and digital-twin environments. The company emphasizes energy efficiency (IE3/IE4 classes), digital connectivity (IIoT/Edge integration), and system-level optimization, helping large industrial customers meet sustainability targets while improving throughput and predictive maintenance capabilities. Siemens’ breadth of automation expertise and global footprint make it one of the market’s leading strategic suppliers.

WEG Gear Systems GmbH and Portescap are some of the emerging market participants in the gear motor market.

-

WEG Gear Systems GmbH is expanding its presence with a growing range of compact, high-torque gear motors and geared drive solutions tailored for energy-efficient industrial applications. Combining WEG’s motor manufacturing scale with targeted gearbox engineering, the company focuses on modularity, thermal robustness, and compatibility with modern drive electronics. WEG is also accelerating product localization and service capabilities in key growth regions, positioning it as an emerging competitor in the global gear motor market.

-

Portescap specializes in miniature and specialty motor solutions that address niche motion requirements across robotics, medical devices, and precision automation segments. Portescap’s emphasis on bespoke micro-gearmotors, high-speed brushless designs, and miniaturized gearbox integration enables OEMs to achieve high power density and precision in space-constrained systems. Driven by increasing demand for compact automation solutions and precision actuation, Portescap is strengthening its position as a specialized manufacturer of gear motors.

Key Gear Motor Companies:

The following are the leading companies in the gear motor market. These companies collectively hold the largest Market share and dictate industry trends.

- Eaton

- Siemens AG

- ABB

- SEW-EURODRIVE

- WEG Gear Systems GmbH

- Johnson Electric Holdings Limited

- Emerson Electric Co.

- Bauer Gear Motor GmbH

- Sumitomo Heavy Industries, Ltd.

- Regal Rexnord Corporation

- Portescap

- ORIENTAL MOTOR USA CORP

Recent Developments

-

In September 2025, ABB increased investment in ultra-premium efficiency motors (IE5 range) and expanded LV motor capacity, directly supporting the availability of high-efficiency gearmotor systems for industrial automation and energy-intensive applications. These expansions reinforce ABB’s leadership in supplying sustainable, high-performance gear motor technologies worldwide.

-

In July 2025, ORIENTAL MOTOR USA CORP expanded its gear motor portfolio with new 750 W brushless motors and PN planetary geared types for the AZ series, enabling higher torque, compact automation, and improved efficiency for OEM machinery. These additions strengthen Oriental Motor’s position in the compact, factory-automation-focused gear motors industry.

-

In April 2025, Eaton launched an EV-oriented powertrain component lineup, including the EV Truetrac differential showcased at Auto Shanghai 2025, reinforcing Eaton’s continued role in electrified drivetrains and precision gear systems for emerging mobility applications. This advancement strengthens Eaton’s competitive position in next-generation gear motor integration across electric vehicle (EV) platforms.

Gear Motor Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 27.04 billion

Revenue forecast in 2033

USD 46.16 billion

Growth rate

CAGR of 6.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD Million/Billion and CAGR from 2025 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, rated power, torque, end use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

Eaton; Siemens AG; ABB; SEW-EURODRIVE; WEG Gear Systems GmbH; Johnson Electric Holdings Limited; Emerson Electric Co.; Bauer Gear Motor GmbH; Sumitomo Heavy Industries Ltd.; Regal Rexnord Corporation; Portescap; ORIENTAL MOTOR USA CORP

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Gear Motor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the gear motor market report based on type, rated power, torque, end use, and region:

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Helical Gear Motor

-

Planetary Gear Motor

-

Helical-Bevel Gear Motor

-

Worm Gear Motor

-

Others

-

-

Rated Power Outlook (Revenue, USD Billion, 2021 - 2033)

-

Up to 7.5 kW

-

7.5 kW to 75 kW

-

Above 75 kW

-

-

Torque Outlook (Revenue, USD Billion, 2021 - 2033)

-

Up to 10,000 Nm

-

Above 10,000 Nm

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Industrial Machinery

-

Automotive

-

Aerospace & Defense

-

Consumer Electronics

-

Agriculture

-

Energy & Power

-

Marine

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global gear motor market was estimated at USD 25.63 billion in 2024 and is expected to reach USD 27.04 billion in 2025.

b. The global gear motor market is expected to grow at a compound annual growth rate of 6.9% from 2025 to 2033 and to reach USD 46.16 billion by 2033.

b. The Asia Pacific gear motor market accounted for the largest market share of over 35% in 2024, primarily driven by rapid industrialization, massive expansion of manufacturing plants, and the rising shift toward automated material handling solutions. Increasing investments in smart factories, energy-efficient machinery, and high-torque gear motor systems are boosting demand. The region’s strong growth in electronics manufacturing, e-commerce warehousing, and renewable energy projects further accelerates the gear motor industry market.

b. The key players in the gear motor market are Eaton, Siemens AG, ABB, SEW-EURODRIVE, WEG Gear Systems GmbH, Johnson Electric Holdings Limited, Emerson Electric Co., Bauer Gear Motor GmbH, Sumitomo Heavy Industries, Ltd., Regal Rexnord Corporation, Portescap, ORIENTAL MOTOR USA CORP.

b. Key drivers of the gear motor market include the growing adoption of gear motors in robotics, conveyor systems, and packaging machinery to enhance operational reliability, coupled with advancements in compact, high-torque motor designs and integrated control technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.