- Home

- »

- Healthcare IT

- »

-

Gene Therapy Platform Market Size, Industry Report, 2030GVR Report cover

![Gene Therapy Platform Market Size, Share & Trends Report]()

Gene Therapy Platform Market (2025 - 2030) Size, Share & Trends Analysis Report By Platform Type (Viral Vector Platforms, Non-Viral Vector Platforms), By Therapeutic Application, By Delivery Mode, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-589-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Gene Therapy Platform Market Size & Trends

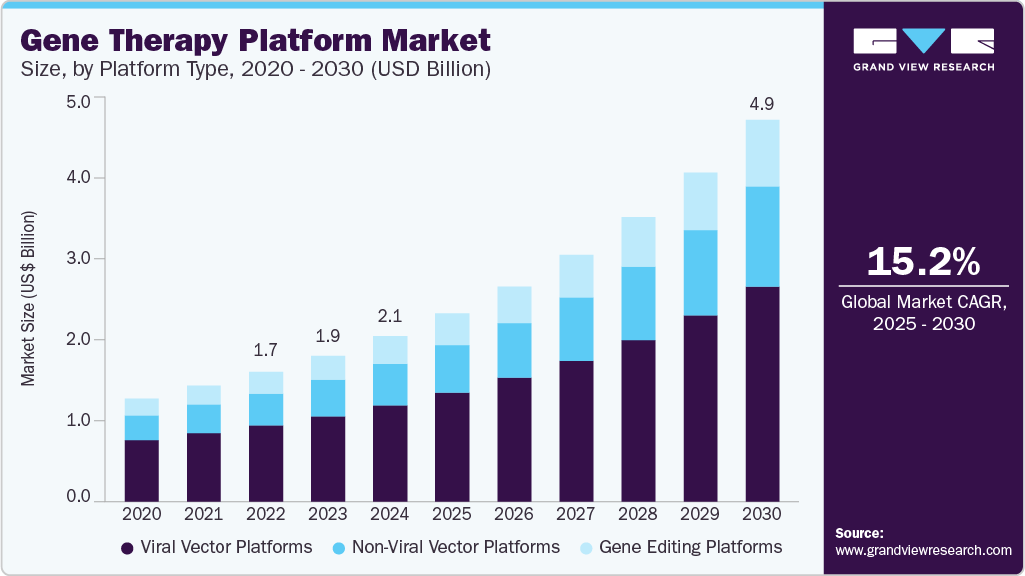

The global gene therapy platform market size was estimated at USD 2.14 billion in 2024 and is projected to grow at a CAGR of 15.2% from 2025 to 2030. The growth is driven by several key drivers, including rapid technological advancements, increasing prevalence of genetic and chronic diseases, growing investments and funding in biopharmaceutical research, and supportive regulatory frameworks facilitating faster approvals.

Key Highlights:

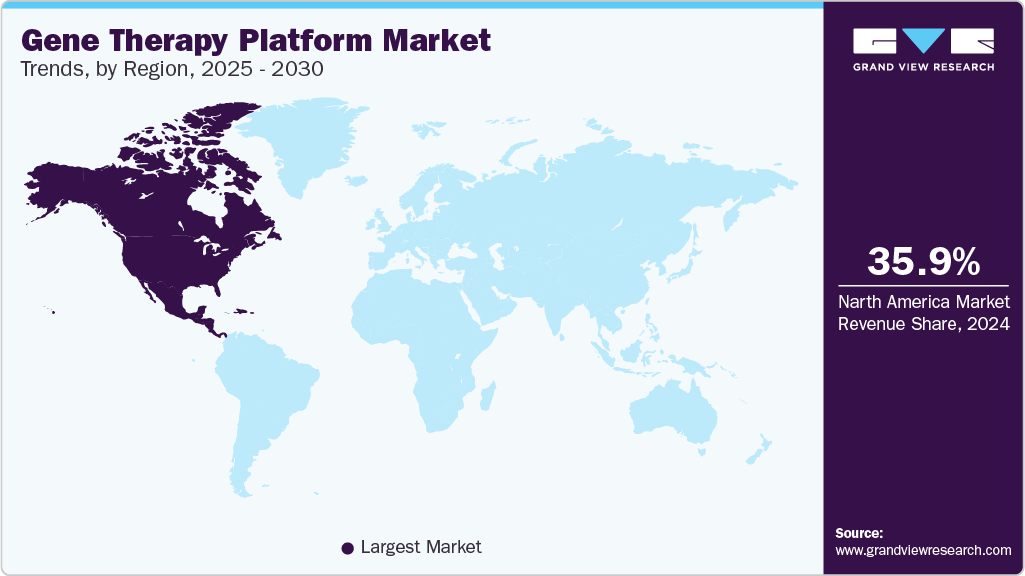

- North America dominated the global gene therapy platform market and accounted for the largest share of 35.96% in 2024.

- The gene therapy platform market in the U.S. is experiencing rapid advancements in gene therapy

- By platform type, the viral vector platforms segment dominated the market with the largest revenue share of 58.12% in 2024

- By application, the oncology segment held the largest revenue share in 2024

- By delivery method, the in vivo gene therapy segment held the largest revenue share in the 2024 market

Innovations in viral vector technologies, gene editing tools including CRISPR, integration of AI and automation in manufacturing are enhancing therapy precision and production efficiency. For instance, in March 2023, Catalent is enhancing its UpTempo AAV platform to speed up the development of gene therapies.

The increasing number of FDA approvals for gene therapies targeting rare and genetic diseases has validated the clinical potential of these platforms, encouraging investment and R&D. For instance, in December 2023[, CRISPR-based therapies, like Exagamglogene autotemcel (Casgevy), received FDA approval for sickle cell disease and beta-thalassemia, marking a significant milestone in gene therapy. These breakthroughs are pushing the field forward, enabling more efficient technology for various genetic disorders.

The rising prevalence of genetic disorders and chronic diseases worldwide, is fueling demand for gene therapies that target disease at the molecular level. Conditions such as cystic fibrosis, hemophilia, spinal muscular atrophy, and various cancers are increasingly treated with gene therapy approaches that offer potentially curative outcomes. The World Health Organization (WHO) in 2024 projected a sharp increase in cancer cases globally, with over 35 million new cases expected by 2050, up 77% from 2022. This growing patient pool creates urgent demand for advanced treatments, driving investment and innovation in gene therapy technologies to address unmet medical needs.

Moreover, regulatory support for innovative therapies is driving market growth. Regulatory agencies, including the FDA and the European Medicines Agency (EMA), have streamlined approval processes for gene therapies, recognizing their transformative potential. In addition, regulatory incentives such as fast-track designations and orphan drug status further support the development of gene therapies. These measures help reduce development timelines and encourage the introduction of new treatments to address unmet medical needs.

The COVID-19 pandemic significantly impacted the market, disrupting clinical trials, manufacturing, and supply chains. The increased demand for raw materials for COVID-19 vaccine production caused shortages, affecting the availability of essential components for gene therapy manufacturing. Despite these challenges, the pandemic also spurred innovation, with some gene therapy developers adapting their efforts toward COVID-19-related therapeutics and vaccines, highlighting the resilience and potential of the gene therapy sector.

Case Study & Insights:

Case Study: “Infant with rare, incurable disease is first to successfully receive personalized gene therapy treatment”

Published in May 2025

Background:

The National Institutes of Health (NIH)-supported research team has developed and successfully delivered a personalized gene editing therapy to treat an infant diagnosed with carbamoyl phosphate synthetase 1 (CPS1) deficiency, a rare and incurable genetic disorder characterized by the liver’s inability to break down toxic ammonia. This accumulation can cause severe brain and liver damage, with limited treatment options involving a low-protein diet and eventual liver transplant, during which patients remain at high risk of organ failure and fatal complications.

Challenges:

The main challenge was safely correcting the specific gene mutation in the infant’s liver cells quickly enough to prevent irreversible damage. Traditional treatments are slow and risky, and no prior personalized gene-editing therapies have been administered to human patients. The team needed a precise, repeatable, and safe method to edit the non-reproductive cells without affecting the patient’s germline, ensuring changes were confined to the individual.

Solutions:

The solution used a CRISPR-based gene-editing platform customized to target the infant’s liver cells. The therapy was initially administered in a low dose, followed by a higher dose, allowing careful safety and efficacy monitoring. Early signs of success included the infant’s ability to tolerate more protein in the diet and reduced reliance on ammonia-lowering medications. The child tolerated common illnesses without severe complications, indicating improved metabolic stability.

Conclusion:

In conclusion, this pioneering case marks the first successful use of personalized CRISPR gene therapy in a human patient, demonstrating the potential of rapid, tailored gene-editing treatments for rare genetic diseases. The approach promises a new era of precision medicine, offering hope for hundreds of other rare conditions where early, individualized intervention can be life-changing. The research sets a foundation for expanding this platform to treat a broad range of genetic disorders efficiently and safely.

Market Concentration & Characteristics

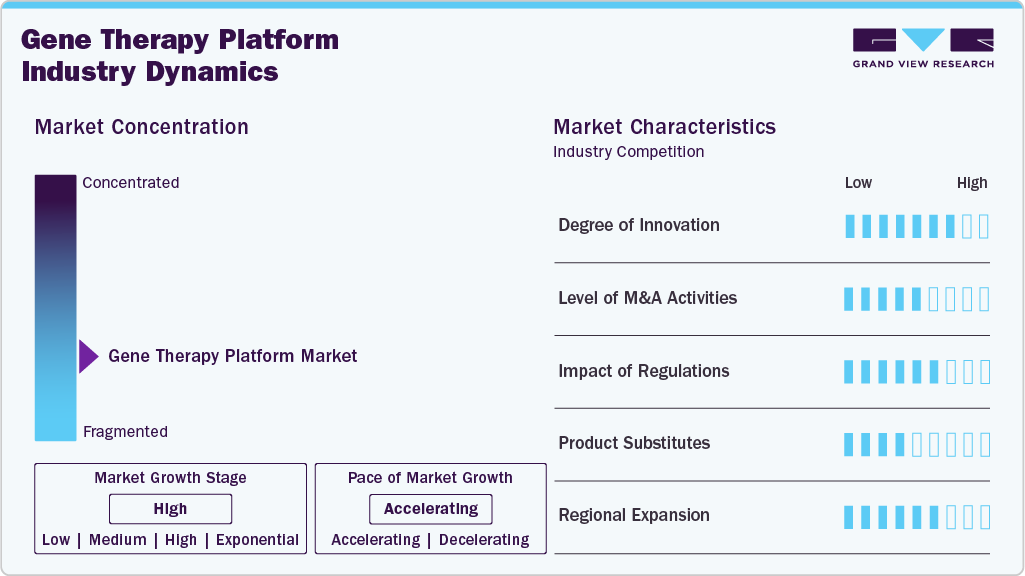

The degree of innovation in the market is high, as the field is witnessing rapid advancements in gene editing technologies and viral vectors. For instance, in November 2024, iotaSciences will debut its Single-Cell Cloning Platform XT at Cell 2024 in London, enhancing the original platform with advanced fluid-shaping technology. It targets cell biology and gene therapy researchers, focusing on stem cell handling and gene editing. This improvement supports the development of more targeted and effective gene therapies, accelerates the discovery of new treatments, and enhances the overall reliability of gene-editing techniques, leading to faster clinical advancements and more successful therapeutic outcomes.

The market's M&A activities are medium. Companies are acquiring smaller biotech firms to expand their gene therapy pipelines and enhance their technological capabilities. For instance, in January 2024, Kyowa Kirin finalized its acquisition of Orchard Therapeutics, a global provider of gene therapy for rare diseases. This acquisition enhanced Kyowa Kirin’s capabilities in developing advanced gene therapies in rare genetic disorders and increased its access to Orchard's innovative gene-editing technologies.

“This platform offers significant potential to deliver more innovative treatments and breakthrough therapies and aligns with our purpose to deliver lifechanging value for people living with rare and complex diseases.”

- Masashi Miyamoto, Ph.D., Representative Director, President and CEO of Kyowa Kirin.

Regulations significantly shape the market by ensuring safety, efficacy, and ethical standards. The FDA's draft guidance on the Platform Technology Designation Program, released in May 2024, significantly impacts the gene therapy platform market by introducing a pathway that allows companies with an approved gene therapy platform, such as a viral vector or gene editing system, to leverage existing data for new products using the same platform. This regulatory framework aims to streamline development and manufacturing processes by reducing redundant nonclinical studies and facilitating faster FDA reviews, accelerating time to market for subsequent gene therapies built on well-characterized platforms.

Product substitutes for the market include traditional pharmaceuticals, such as small-molecule drugs and biologics, which manage symptoms or disease progression without altering genetic material. RNA-based therapies such as siRNA, mRNA, and antisense oligonucleotides provide alternatives by modulating gene expression. Protein replacement therapies, genome editing technologies, base and prime editing, and CRISPR-based tools such as Retron Library Recombineering (RLR) Platform, Cas-CLOVER Nucleases are used outside of viral vector platforms also act as substitutes, providing less invasive or more targeted alternatives to gene therapy, depending on the treated condition.

Companies are increasingly investing in scalable gene therapy platforms that enable the efficient development and manufacturing of personalized treatments. For instance, in April 2024, AGC Biologics introduced a new division specifically for Cell and Gene Technologies. This division will enhance AGC Biologics' capabilities and assist developers by providing additional capacity, scientific expertise, and highly skilled operators in cell and gene contract development and manufacturing (CDMO). These platforms combine advanced gene editing, vector development, and cell engineering tools to create tailored therapies for specific genetic conditions. As demand rises, the expansion focuses on enhancing cost-efficiency, regulatory adherence, and treating a wider range of diseases, including cancers.

Platform Type Insights

The viral vector platforms segment dominated the market with the largest revenue share of 58.12% in 2024 due to their high transduction efficiency, ability to deliver genetic material to specific cells, and capacity for long-term expression. Technological advancements drive the widespread adoption of viral vectors in clinical applications, including oncology, genetic disorders, and infectious diseases. For instance, in May 2023, AGC Biologics launched its BravoAAV and ProntoLVV viral vector platforms, combining three decades of expertise in AAV and LVV development. These platforms enable fast, efficient GMP production and release, reducing development timelines to nine months for clinical and commercial use.

“The launch of these two platforms is the latest in a series of enhancement aimed at deliberately growing our cell and gene therapy services to support developers from early phases through clinical and commercial stage manufacturing. By offering a new templated approach for viral vector production, BravoAAV and ProntoLVV will support companies bringing these life changing treatments by helping to accelerate project timelines, reach clinical and commercial milestones, and deliver effective therapies to patients as quickly as possible.”

- Patricio Massera, CEO, AGC Biologics.

The gene editing platforms segment is anticipated to grow at the fastest CAGR during the forecast period, driven by advancements in precision technologies, including CRISPR/Cas9, TALENs, and prime editing. For instance, in November 2022, Ionis partnered with Metagenomi to incorporate gene editing into its extensive technology platform, further advancing these tools for targeted genetic modifications. These innovations offer potential cures for genetic disorders, cancers, and infectious diseases, with CRISPR-based therapies, such as those for sickle cell disease, already gaining regulatory approvals.

"Gene editing has the potential to transform chronic therapies into potentially curative treatments for patients who currently have limited options."

- Brian C. Thomas, Ph.D., chief executive officer and founder of Metagenomi.

Application Insights

The oncology segment held the largest revenue share in 2024 due to the increasing demand for targeted, personalized cancer treatments. Key drivers include advancements in CAR-T cell therapy, CRISPR gene editing, and other gene modification technologies that allow for more effective treatments. In addition, the segment continues to expand with innovations in gene therapy. For instance, in September 2024, Vironexis Biotherapeutics received FDA clearance for the first clinical trial of an AAV-delivered cancer immunotherapy, marking a significant step forward in targeted, in vivo cancer treatment.

“Our novel technology builds on the power of T-cell immunotherapy while overcoming key shortcomings and challenges of existing approaches such as CAR-T and bispecific antibodies. We believe we have the opportunity to dramatically improve upon the safety, efficacy and durability of these drug classes, while streamlining manufacturing and significantly lessening the burden of treatment for patients. Our focus on execution has yielded an expansive pipeline and a clinic-ready lead program in just three years. We’re working as quickly as possible to transform the future of cancer treatments for patients.”

- Samit Varma, co-founder and CEO of Vironexis.

The hematological disorders segment is expected to grow at the fastest CAGR for the forecast period, driven by significant advancements in gene editing technologies and increasing clinical approvals. For instance, in June 2023, BioMarin's Roctavian, a gene therapy for severe hemophilia A, received FDA approval. This therapy offers patients the potential for long-term clotting factor production with a single infusion. This success highlights the potential of gene therapy platforms to address complex blood disorders including hemophilia, driving investment in platform technologies such as gene editing, viral vector delivery systems, and personalized medicine approaches.

Delivery Method Insights

The in vivo gene therapy segment held the largest revenue share in the 2024 market due to its ability to deliver genetic material directly into a patient's body, enabling targeted treatment of complex diseases. This method reduces the need for cell extraction and reinfusion, streamlining the therapeutic process. Key drivers include advancements in viral vector technologies, such as AAV and lentiviral vectors, and growing success in treating inherited disorders such as spinal muscular atrophy and hemophilia. For instance, in May 2025, Stylus Medicine was established to advance precision in vivo genetic therapies and maximize the potential of CAR-T treatments. Its platform aims to improve the accuracy and scalability of gene integration, which speeds up the creation of lasting cures and enhances the effectiveness of in vivo gene therapy technologies.

The ex vivo gene therapy segment is expected to grow at the fastest CAGR over forecast period, due to its ability to precisely modify cells outside the body before reintroducing them, ensuring controlled and targeted treatment. Key drivers include advancements in gene-editing technologies such as CRISPR, increasing demand for personalized therapies, and improved cell culture and expansion techniques. This approach particularly effectively treats blood disorders, cancers, and immune-related diseases. In addition, according to an article published in January 2025, CAR-T cell therapy involves removing T-cells from the patient, genetically altering them to target cancer antigens, expanding them outside the body, and then reinfusing the modified cells into the patient. This process follows the ex vivo gene therapy approach, where cells are changed and expanded outside the body before being returned to the patient for treatment.

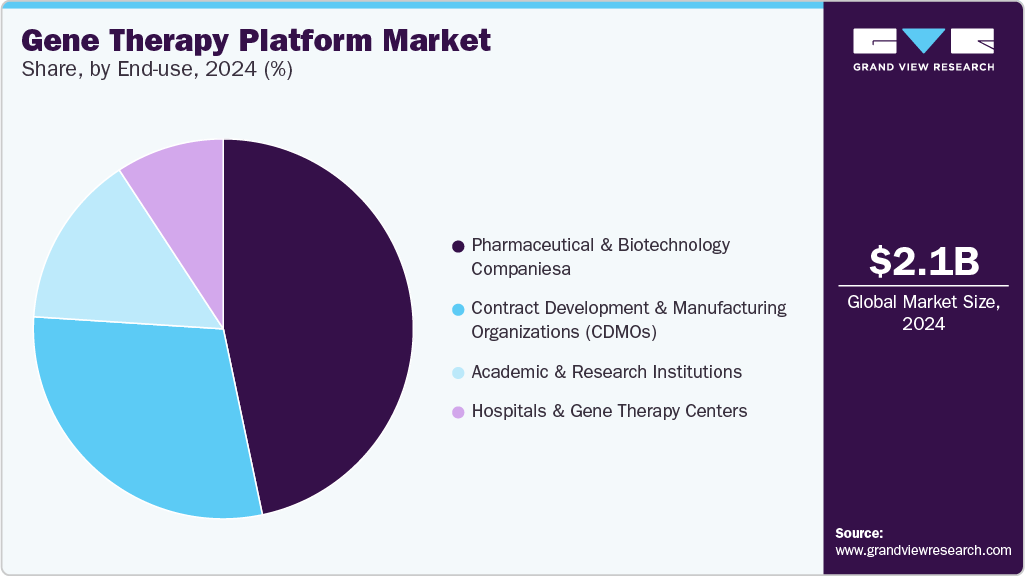

End Use Insights

The pharmaceutical and biotechnology companies segment held the largest revenue share in 2024, due to their significant investments in R&D, advanced manufacturing capabilities, and vital clinical pipelines. Pharmaceutical and biotech companies are investing heavily in advanced vector engineering technologies to enhance gene therapies' efficacy, specificity, and safety. For instance, in October 2024, Roche will use Dyno Therapeutics' engineered AAV capsid platform to develop advanced gene therapies for unspecified neurological diseases. This collaboration could generate over $1 billion in revenue for Dyno.

“Our previous collaboration with Dyno Therapeutics gives us great confidence to increase our investment in therapeutic gene delivery, to support our neurological disease portfolio. We are very pleased to take our partnership with Dyno Therapeutics to the next level.”

- Boris L. Zaïtra, head of Roche Corporate Business Development

The Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs) segment is expected to grow at the fastest CAGR in the gene therapy platform market, driven by several key factors. The increasing number of gene therapy candidates progressing through clinical trials significantly raised the demand for specialized services offered by CROs and CDMOs. These organizations provide essential expertise in process development, regulatory compliance, and scalable manufacturing, enabling biotech firms to navigate the complexities of gene therapy development efficiently. In addition, integrating AI in manufacturing processes optimizes production efficiency and scalability, driving market growth.

Regional Insights

North America gene therapy platform market dominated the global gene therapy platform market and accounted for the largest share of 35.96% in 2024. The region continues to dominate global gene therapy advancements, with a flourishing biotech ecosystem driving the development of advanced technologies such as viral vectors and CRISPR gene editing. For instance, in May 2025, Andelyn Biosciences used its AAV Curator Platform to rapidly develop and deliver a viral vector gene therapy for a baby with ultra-rare NEDAMSS, completing production in just 10 months, highlighting gene therapy’s growing role as an accessible treatment option.

U.S. Gene Therapy Platform Market Trends

The gene therapy platform market in the U.S. is experiencing rapid advancements in gene therapy, driven by the increasing prevalence of chronic genetic diseases and a growing pipeline of therapies. Government agencies such as the FDA continue to support the field by fast-tracking approvals for gene therapies, facilitating an environment conducive to rapid innovation. In addition, advanced gene editing technologies, including CRISPR, enable precise targeting of genetic abnormalities, while regulatory incentives from the FDA encourage innovation and faster commercialization.

Asia Pacific Gene Therapy Platform Market Trends

The gene therapy platform market in Asia Pacific is experiencing rapid growth driven by increasing investments from countries such as China, India, and Japan in gene therapy research and clinical trials. Governments and private sectors prioritize rare genetic disorders and precision medicine, driving demand for personalized gene therapies tailored to diverse genetic profiles. Regulatory frameworks are evolving to support faster approvals and commercialization, while the region is becoming a hub for advanced manufacturing technologies, including viral vector production and CRISPR-based editing, which help reduce treatment costs.

The gene therapy platform market in China is experiencing rapid growth, driven by advancements in biotechnology infrastructure, regulatory support, and clinical trial activity. In November 2023[, Chinese startups leverage AI to advance adeno-associated virus (AAV) gene therapy development. Porton Advanced, a biotechnology company, partnered with BioMap, an AI firm specializing in life sciences, to enhance AAV vector design. BioMap's xTrimo platform, a large protein-centric language model, will be utilized to develop models that improve AAV assembly efficiency and distribution. This collaboration aims to overcome challenges in creating tissue-specific AAV capsids, a critical aspect of targeted gene therapies. By integrating AI with AAV technology, the partnership seeks to accelerate the development of gene therapies and expand their clinical applications.

Europe Gene Therapy Platform Market Trends

The gene therapy platform market in Europe is driven by innovative research and the region's expanding focus on personalized medicine and genetically based therapies. European governments and institutions are investing in biotech, particularly in the UK, Germany, and France, where gene therapy delivery technologies are integrated into research programs targeting diseases such as cancer, cardiovascular disorders, and rare genetic conditions. Regulatory support from the European Medicines Agency (EMA) has enabled the commercialization of gene therapies.

The UK gene therapy platform market is characterized by rapid growth driven by substantial venture capital investment and a robust biotech ecosystem. The UK captures over 55% of European venture capital funding in life sciences, underscoring its leadership in cell and gene therapy (CGT) innovation. Key trends include increased focus on advanced therapies such as CAR-T, genome editing tools like CRISPR, and strategic collaborations and manufacturing capacity expansions. The sector also benefits from a strong pipeline of platform technologies to optimize scalability and automation in cell and gene therapy manufacturing. For instance, in May 2024, Ori Biotech unveiled its IRO Platform at the Annual International Society for Cell & Gene Therapy Conference, marking a significant step forward in manufacturing innovation.

Latin America Gene Therapy Platform Market Trends

The gene therapy platform market in Latin America is driven by increasing healthcare demands, especially in Brazil and Argentina. Brazil, in particular, is showing potential in gene therapy due to its large population base and improving healthcare infrastructure. Regional governments recognized the potential of gene therapy and are supporting its development. For instance, in March 2024, Fiocruz and Caring Cross have partnered to produce CAR-T cell and stem cell gene therapies locally in Brazil, aimed at treating infectious, oncology, and genetic diseases, including leukemia, lymphoma, and HIV. The collaboration emphasizes affordable treatments, fostering local manufacturing, and using platform technologies for CAR-T production.

“By sharing our knowledge and expertise, this collaboration will establish local manufacturing capabilities for our innovative CAR-T cell manufacturing platform. When integrated with local point-of-care manufacturing, this approach enables us to drastically cut production expenditures and enable access to these therapies at a fraction of the cost compared to the U.S. and Europe. We are hopeful this collaboration will not only make these treatments more affordable but also serve as a global model for improving access to advanced medical therapies.”

- Boro Dropulić, Ph.D., Executive Director of Caring Cross.

Middle East & Africa Gene Therapy Platform Market Trends

The gene therapy platform market in the Middle East and Africa (MEA) is experiencing notable growth, particularly in regions such as the UAE and South Africa, where healthcare systems are rapidly improving. Regional factors such as local biotech investments, regulatory frameworks, and disease prevalence influence the growth, which is driven by collaborations and developments within or targeting that region. For instance, in June 2024, the Department of Health - Abu Dhabi (DoH) signed a Memorandum of Understanding with Opus Genetics to accelerate the development of gene therapies for rare inherited retinal diseases (IRD), focusing on patient-centered treatments in the UAE. This partnership stimulates growth in the region's gene therapy platform market by encouraging the integration of advanced gene therapy techniques, such as viral vectors and CRISPR technologies, into clinical practice.

Key Gene Therapy Platform Company Insights

Major companies are focusing on M&A, strategic partnerships, expansions with technology providers, and product development. For instance, in October 2024, Terumo Blood and Cell Technologies (Terumo BCT) expanded its presence in Latin America to assist cell and gene therapy companies in Colombia, Brazil, and Mexico by providing automated manufacturing solutions. This expansion supports local developers and manufacturers in streamlining complex cell and gene therapy workflows, which is crucial for increasing patient access to these therapies in a region heavily reliant on government healthcare systems.

Key Gene Therapy Platform Companies:

The following are the leading companies in the gene therapy platform market. These companies collectively hold the largest market share and dictate industry trends.

- Lonza

- BioIT

- Autolomous Ltd

- Hypertrust Patient Data Care (Part of Accenture)

- IBM

- L7 Informatics, Inc.

- TrakCel

- IDBS

- Novartis

- SAP SE

- DEEP GENOMICS

- ElevateBio

- Sarepta Therapeutics, Inc.

- CRISPR Therapeutics

- Precision BioSciences

- AstraZeneca

- Andelyn Biosciences

- Renova Therapeutics

Recent Developments

-

In March 2025, AstraZeneca acquired the Belgian biotech company EsoBiotec for up to $1 billion. The acquisition will focus on advancing in vivo cell therapies, leveraging EsoBiotec’s Engineered NanoBody Lentiviral (ENaBL) platform.

“We are excited about the acquisition of EsoBiotec and the opportunity to rapidly advance their promising in vivo platform. We believe it has the potential to transform cell therapy and will enable us to scale these innovative treatments so that many more patients around the world can access them.”

- Susan Galbraith, Executive Vice President, Oncology Haematology R&D, AstraZeneca.

-

In February 2025, Andelyn Biosciences enhances gene therapy innovation by expanding its AAV Curator platform. The agreement grants Andelyn the right to use Stanton Lab CNS capsids for conducting research and development services on behalf of its clients developing gene therapies.

-

In December 2024, MRC established its inaugural two Centres of Research Excellence, aimed at creating advanced therapeutics for diseases that are currently untreatable. The MRC CoREs bring together top academic and industry expertise to accelerate translational research and clinical application of advanced therapeutics, thereby fostering innovation, infrastructure development, and regulatory progress that directly benefits and expands the gene therapy platform sector.

“The MRC CoREs are a new way of funding bold and ambitious science that seeks to advance our ability to understand diseases, diagnose them at an early stage, intervene with new treatments and prevent diseases of the future. They will focus on bringing together the brightest scientists to tackle diseases of major medical importance, so that they will really change the landscape and improve the health of the nation.”

- Professor Patrick Chinnery, Executive Chair of MRC

-

In June 2024, Renova Therapeutics announced the potential expansion of its gene therapy platform to address diabetes, heart failure, and related conditions.

"Despite the many therapies we now have for diabetes, we still see too many patients with inadequate blood sugar control and frequent complications of diabetes. Gene therapy is clearly one of the most promising new approaches to reducing the impact of diabetes."

- Dr. David Horwitz (MD, PhD, MBA), member of Renova's Scientific Advisory Board.

Gene Therapy Platform Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.43 billion

Revenue forecast in 2030

USD 4.93 billion

Growth rate

CAGR of 15.2% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Platform type, application, delivery method, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; China; India; Australia; South Korea; Singapore; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Lonza; BioIT; Autolomous Ltd; Hypertrust Patient Data Care (Part of Accenture); IBM; L7 Informatics Inc.; TrakCel; IDBS; Novartis; SAP SE; DEEP GENOMICS; ElevateBio; Sarepta Therapeutics Inc.; CRISPR Therapeutics; Precision BioSciences; AstraZeneca; Andelyn Biosciences; Renova Therapeutics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gene Therapy Platform Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gene therapy platform market report based on platform type, application, delivery method, end use, and region.

-

Platform Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Viral Vector Platforms

-

Adeno-associated Virus (AAV)

-

Lentivirus

-

Retrovirus

-

Adenovirus

-

Herpes Simplex Virus (HSV)

-

-

Non-Viral Vector Platforms

-

Lipid Nanoparticles (LNPs)

-

Electroporation & Microinjection Platforms

-

Polymer-based Delivery Systems

-

Naked DNA/RNA Delivery

-

-

Gene Editing Platforms

-

CRISPR-Cas Systems

-

TALENs

-

ZFNs

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Rare Genetic Disorders

-

Cardiovascular Diseases

-

Neurological Disorders

-

Ophthalmic Diseases

-

Hematological Disorders (e.g., Hemophilia, Sickle Cell)

-

Musculoskeletal Disorders

-

Infectious Diseases (e.g., HIV, COVID-19 adjunct therapies)

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

In Vivo Gene Therapy

-

Ex Vivo Gene Therapy

-

Autologous Cell-Based Gene Therapy

-

Allogeneic Cell-Based Gene Therapy

-

-

Others (In-situ Gene therapy)

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

Academic & Research Institutions

-

Contract Development & Manufacturing Organizations (CDMOs)

-

Hospitals & Gene Therapy Centers

-

-

Regional Outlook (Revenue, USD Million, 2018-2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global gene therapy platform market size was valued at USD 2.14 billion in 2024 and is expected to reach USD 2.43 billion in 2025.

b. The global gene therapy platform market is expected to grow at a compound annual growth rate of 15.22% from 2025 to 2030 to reach USD 4.93 billion by 2030.

b. The North America region dominated the market in 2024 with a revenue share of 35.96%. The region continues to dominate global gene therapy advancements, with a flourishing biotech ecosystem driving the development of advanced technologies such as viral vectors and CRISPR gene editing.

b. Some key players operating in the Healthcare gamification market are Lonza, BioIT, Autolomous Ltd, Hypertrust Patient Data Care (Part of Accenture), IBM, L7 Informatics, Inc., TrakCel, IDBS, Novartis, SAP SE, DEEP GENOMICS, ElevateBio, Sarepta Therapeutics, Inc., CRISPR Therapeutics, Precision BioSciences, AstraZeneca, Andelyn Biosciences, Renova Therapeutics

b. The growth is driven by several key drivers, including rapid technological advancements, increasing prevalence of genetic and chronic diseases, growing investments and funding in biopharmaceutical research, and supportive regulatory frameworks facilitating faster approvals. Innovations in viral vector technologies, gene editing tools including CRISPR, and integration of AI and automation in manufacturing are enhancing therapy precision and production efficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.