- Home

- »

- Medical Devices

- »

-

General Surgery Devices Market Size & Share Report, 2030GVR Report cover

![General Surgery Devices Market Size, Share & Trends Report]()

General Surgery Devices Market Size, Share & Trends Analysis Report By Application (Orthopedic, Plastic Surgery, Cardiology, Ophthalmology), By End-use (Hospitals, ASCs), By Type, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-214-3

- Number of Pages: 170

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Healthcare

General Surgery Devices Market Trends

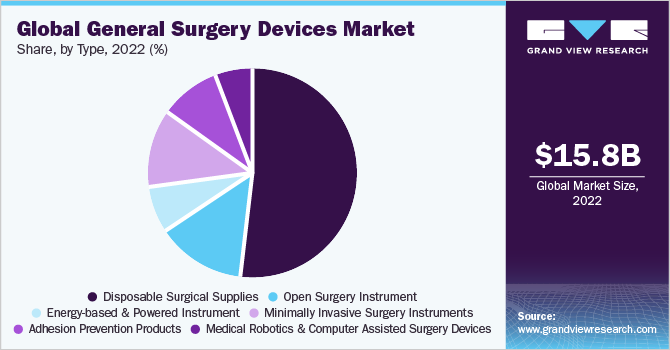

The global general surgery devices market size was valued at USD 15.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.39% from 2023 to 2030. Increasing awareness of patients and high incidence of cardiac related diseases, gastrointestinal diseases and prevalence of osteoporosis would increase the number of surgeries performed during the forecast period. Adding to that, technological development, and adoption of advanced surgeries by the emerging countries are likely to drive the general surgery devices market. The robotic and computer-assisted sector has been in its infancy and is steadily gaining traction. Presently, robotics has applications in various general surgeries such as cholecystectomy, fundoplication, and Heller Myotomy.

Furthermore, increasing acceptance of minimally invasive and robotic & computer assisted surgery is likely to drive the general surgery devices market. For instance, around 310 million major surgeries are carried out year throughout the world, according to the article "Trauma of Major Surgery" published in the National Center for Biotechnology Information (NCBI) in July 2020. Almost 30 million kids and teenagers participate in youth sports nationwide each year, according to Weinstein Legal research that was released in March 2020. This may result in surgical emergencies, which may increase demand for general surgery devices.

Health disorders affecting the worldwide population are transitioning from conditions brought on by infections and plagues to diseases related to lifestyle, as a result of industrialization and significant lifestyle changes. In developed, developing, and less developed countries, the condition has contributed to a marked increase in health conditions such cardiovascular diseases, cancers, cerebro-vascular diseases, and bone abnormalities. As the number of vehicles and other highly advanced gadgets on the road has expanded worldwide, so too has the number of casualties caused by accidents. These trends are anticipated to continue, resulting in a sharp increase in demand for general surgeries in the near future. The circumstance is also anticipated to cause a significant rise in the demand for general surgical equipment globally. A significant number of small and major general surgery device manufacturing companies have entered the global market due to the general surgery devices market's great growth potential, and new players are constantly entering the market.

Rising geriatric population, the introduction of RFID and block chain technologies, expanding demand from emerging nations, rising awareness of surgical facilities, and rising health burden are just a few of the key drivers affecting the global market for general surgery devices. The adoption of portable surgical instruments is becoming more widespread. the population's increased risk of chronic diseases. Healthcare in hospitals is more expensive. As a result, more and more people are choosing to receive their medical care at home and using portable surgical equipment. This factor is accelerating market expansion in developed markets. However, one major barrier is the high price of surgical equipment. The expensive surgical devices are a result of the significant investments made to keep up with technical improvements in surgical equipment. Advanced surgical equipment has a very high acquisition cost, and it also has a significant maintenance cost. This limits market expansion, particularly in emerging and undeveloped regions.

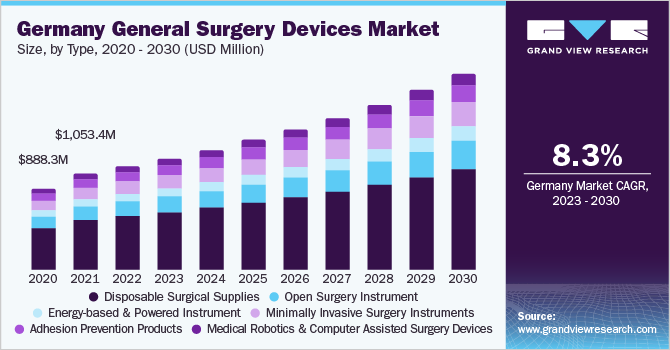

Type Insights

The general surgery devices market is segmented based on type into disposable surgical supplies, open surgery instrument, energy-based & powered instrument, minimally invasive surgery instruments, adhesion prevention products, and medical robotics & computer assisted surgery devices. The disposable surgical supplies segment accounted for the largest revenue share of 51.8% in 2022 owing to the high demand for disposable supplies such as needles, syringes, and catheters. Furthermore, increasing awareness about diseases transmitted through surgical devices coupled with government regulations ensuring safety in surgical procedures is likely to cause a surge in the market demand for disposable products.

Furthermore, minimally invasive surgery instruments are expected to grow at a significant CAGR during the forecast period. Minimally invasive procedures are gaining surgical demand due to their shorter hospital stays, increased accuracy, reduced scarring and pain, and smaller incisions. Medical displays guarantee improved visibility of diagnostic images, showing even the smallest variation in tissues and cells, ensuring accurate and speedier procedures. Higher-quality tools are made available by the field's ongoing technical improvements, enabling surgeons to carry out surgical procedures quickly without compromising patient safety.

Application Insights

The global general surgery devices market is segmented based on applications into orthopedic surgery, cardiology, ophthalmology, wound care, audiology, thoracic surgery, urology and gynecology surgery, plastic surgery, neurosurgery, and others. Orthopedic surgery held the largest share of 17.5% in 2022 and will maintain its dominance throughout the forecast years due to rising cases of bone diseases and growing geriatric population across the globe. Product innovations, favorable reimbursement, and improving diagnosis methods and imaging technology in orthopedic surgery are also likely to drive the segment.

The cardiology segment has secured the second position over the forecast period owing to rising cases of cardiovascular disorders. According to WHO, 17.9 million deaths worldwide in 2019 were attributable to CVDs, or 32% of all fatalities. Heart attack and stroke deaths accounted for 85% of these fatalities. Furthermore, instances of heart attacks were certainly increasing in 2022 due to genetics and lifestyle changes contribute to a variety of issues, including hypertension, cholesterol, diabetes, and obesity, which can result in fatal heart attacks, cardiac arrests, and strokes. During these uncertain times, people have also faced a great deal of stress. Due to excessive stress, various unhealthy habits developed, such insufficient sleep, excessive alcohol intake, smoking, abusing drugs, taking cheap supplements, and over-exercising.

End-use Insights

Based on end use, the global general surgery deices market is classified into hospitals, ambulatory surgical centers, and specialty clinics. In 2022, the hospitals segment held a revenue share of more than 58.9% of the market. A report indicates that many hospitals and healthcare facilities are in Asia Pacific, which is fueling industry expansion. Additionally, rising healthcare costs in developed and developing nations may lead to an increase in hospitals, which is predicted to raise demand for general surgical instruments and fuel the segment's expansion.

The ambulatory surgical centers are expected to witness a fastest CAGR during the forecast period. Growing public awareness for one-day procedures is a key driver of the segment's expansion. People in many regions are preferring ASCs since they are less expensive than hospitals for treatment due to the rising expense of medical operations. People are being driven to seek medical care at ASCs due to the growing usage of cutting-edge surgical equipment there. It is also projected that the segment will be driven by expanding types of procedures with potential for reimbursement. These elements are anticipated to encourage the use of general surgical devices in ASCs, accelerating the segment's growth over the anticipated time frame.

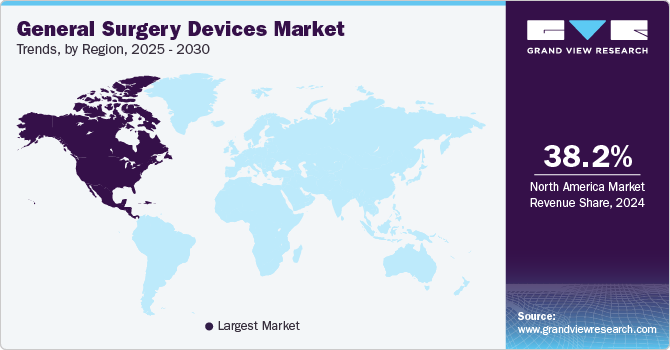

Regional Insights

North America dominated the general surgery devices market in 2022 with around 40.0% share and is expected to maintain its position during the forecast period. Major factors contributing to its growth include favorable reimbursement policies, local presence of key market players, and government initiatives that enable provide access to advanced devices for general surgery & training sessions for physicians.

The Asia Pacific is anticipated to grow at the maximum pace during the forecast period due to rising investment in the region. Japan, China, India, Australia, and Singapore are the major contributing countries in the Asia Pacific region. Government initiatives to incorporate improvements in reimbursement policies and growing awareness about reconstructive or plastic surgeries are the other factors anticipated to support market expansion during the forecast period.

Key Companies & Market Share Insights

Some of the key companies are Covidien Plc (Medtronic), Boston Scientific Corporation, B. Braun Melsungen AG, Conmed Corporation, Erbe Elektromedizin GmbH, Johnson & Johnson Service, Inc Integra LifeSciences, Smith & Nephew, 3M Healthcare, and CareFusion Corporation. Due to the presence of significant opportunities in the developing countries, market players in the general surgery devices sector are undertaking strategic initiatives such as product development, geographical expansion, launches, mergers, and acquisitions to increase market share.

Olympus introduced POWER SEAL enhanced bipolar surgical energy devices in September 2021 to expand its surgical offering. Similar to this, the New Delhi-based SS Innovations company declared in February 2021 that it would commercially release India's first general robotic surgery equipment in the following 4-6 months. Additionally, in February 2017, Medrobotics Corporation received funding of USD 20 million for expanding in novel surgical applications and for developing next-generation Flex Robotic System. Some of the prominent players in the global general surgery devices market include:

-

Medtronic Plc

-

Johnson & Johnson Service, Inc.

-

Conmed Corporation

-

Integra LifeSciences

-

Smith & Nephew

-

Becton, Dickinson and Company (Bd)

-

B. Braun Melsungen Ag

-

Cadence Inc

-

Integer Holdings Corporation

-

Olympus Corporation

-

Stryker

-

Boston Scientific Corporation

-

Erbe Elektromedizin Gmbh

-

3M Healthcare

General Surgery Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 17.0 billion

Revenue forecast in 2030

USD 29.9 billion

Growth rate

CAGR of 8.39% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; India; China; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic Plc; Johnson & Johnson Service; Inc.; Conmed Corporation; Integra LifeSciences; Smith & Nephew; Becton; Dickinson and Company (Bd); B. Braun Melsungen Ag; Cadence Inc; Integer Holdings Corporation; Olympus Corporation; Stryker; Boston Scientific Corporation; Erbe Elektromedizin Gmbh; 3M Healthcare

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global General Surgery Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global general surgery devices market report on the basis of type, application, end-use, and region:

-

Type Outlook (Revenue in USD Million; 2017 - 2030)

-

Disposable Surgical Supplies

-

Surgical Non-woven

-

Disposable Surgical Masks

-

Surgical Drapes

-

Surgical Caps

-

Surgical Gowns

-

-

Examination & Surgical Gloves

-

General Surgery General Surgery Procedural Kits

-

Needles and Syringes

-

Venous Access Catheters

-

-

Open Surgery Instrument

-

Retractor

-

Dilator

-

Catheters

-

-

Energy-based & Powered Instrument

-

Powered Staplers

-

Drill System

-

-

Minimally Invasive Surgery Instruments

-

Laparoscope

-

Organ Retractor

-

-

Medical Robotics & Computer Assisted Surgery Devices

-

Adhesion Prevention Products

-

-

Application Outlook (Revenue in USD Million; 2017 - 2030)

-

Orthopedic Surgery

-

Cardiology

-

Ophthalmology

-

Wound Care

-

Audiology

-

Thoracic Surgery

-

Urology and Gynecology Surgery

-

Plastic Surgery

-

Neurosurgery

-

Others

-

-

End-use Outlook (Revenue in USD Million; 2017 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Specialty Clinics

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global general surgery devices market is expected to grow at a compound annual growth rate of 8.39% from 2023 to 2030 to reach USD 29.96 billion by 2030.

b. North America dominated the general surgery devices market with a share of 39.95% in 2022 This is attributable to favorable reimbursement policies, the presence of key companies, and supportive government initiatives.

b. Some key players operating in the general surgery devices market include Covidien Plc (Medtronic); Boston Scientific Corp.; B. Braun Melsungen AG; Conmed Corp.; Erbe Elektromedizin GmbH; Johnson & Johnson Service, Inc.; Integra LifeSciences; Smith & Nephew; 3M Healthcare; and CareFusion Corp.

b. Key factors that are driving the market growth include technological advancements, an increase in surgical procedures, and an increase in government initiatives across the world.

b. The global general surgery devices market size was estimated at USD 15.8 billion in 2022 and is expected to reach USD 17.0 billion in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."