- Home

- »

- Next Generation Technologies

- »

-

Geospatial Imagery Analytics Market, Industry Report, 2033GVR Report cover

![Geospatial Imagery Analytics Market Size, Share & Trends Report]()

Geospatial Imagery Analytics Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Software, Services), By Imagery Type, By Analytics Type, By Deployment Mode, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-854-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Geospatial Imagery Analytics Market Summary

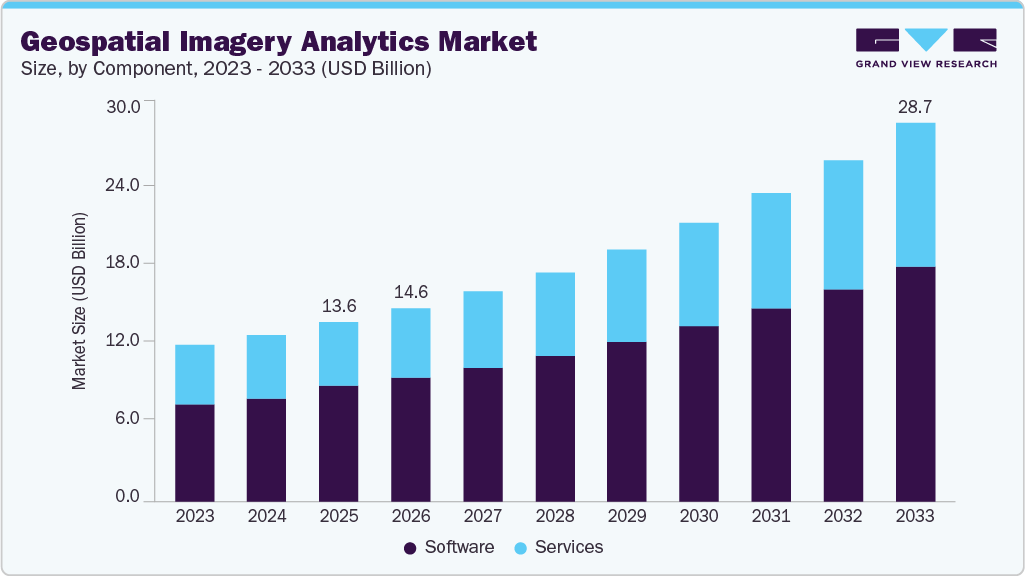

The global geospatial imagery analytics market size was estimated at USD 13.56 billion in 2025 and is projected to reach USD 28.73 billion by 2033, growing at a CAGR of 10.2% from 2026 to 2033. The market growth is primarily driven by the increasing adoption of location-based intelligence across multiple industries, including defense, agriculture, urban planning, environmental monitoring, and disaster management.

Key Market Trends & Insights

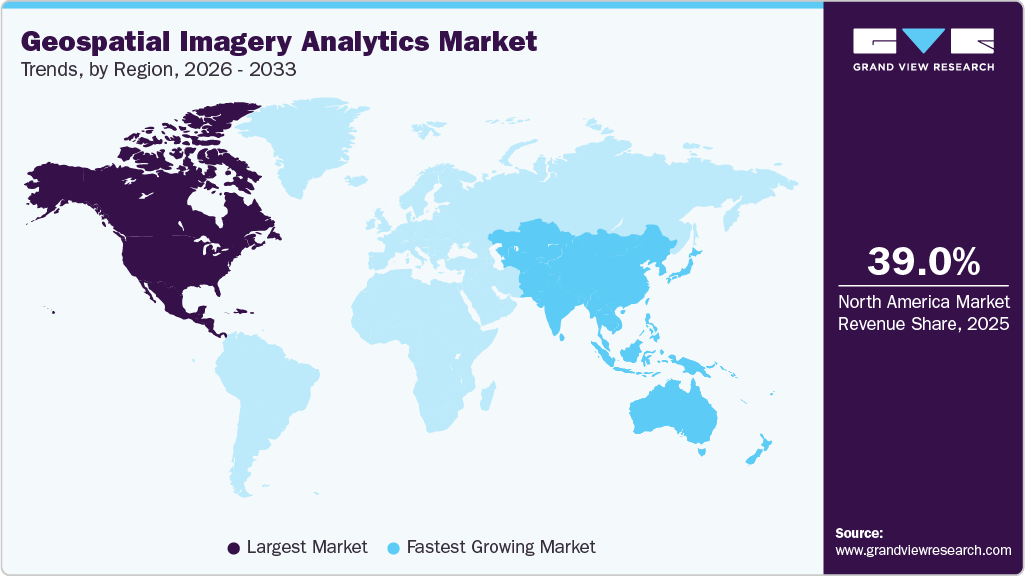

- The North America geospatial imagery analytics market held the major share of over 39.0% in 2025.

- The geospatial imagery analytics industry in the U.S. is expected to grow significantly over the forecast period.

- By component, the software segment accounted for the largest revenue share of 64.5% in 2025.

- By imagery type, the satellite imagery segment accounted for the largest share in 2025.

- By analytics type, the image-based analytics segment accounted for the largest share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 13.56 Billion

- 2033 Projected Market Size: USD 28.73 Billion

- CAGR (2026 – 2033): 10.2%

- North America: Largest Market in 2025

- Asia Pacific: Fastest Growing Market in 2025

Increasing reliance on high-resolution satellite imagery, drone-based data collection, and advanced mapping technologies is significantly enhancing the ability of organizations to extract actionable insights, improve operational efficiency, and support data-driven decision-making processes.The growing integration of artificial intelligence (AI), machine learning (ML), and big data analytics with geospatial imagery solutions is a key factor accelerating market expansion. These advanced technologies enable automated image interpretation, object detection, predictive analysis, and real-time monitoring capabilities. Governments and commercial enterprises are increasingly leveraging AI-powered geospatial analytics to strengthen national security, monitor infrastructure development, optimize agricultural productivity, and enhance surveillance operations. The ability of analytics platforms to process vast volumes of imagery data with improved accuracy and speed is further fueling market demand.

Another significant growth factor is the increasing deployment of geospatial imagery analytics in environmental monitoring and climate change assessment. Rising concerns regarding natural disasters, deforestation, coastal erosion, and resource management are driving organizations to adopt satellite and aerial imagery analytics solutions for continuous environmental tracking and risk mitigation. Governments and international agencies are heavily investing in geospatial technologies to improve disaster preparedness, emergency response planning, and sustainable development initiatives, thereby supporting long-term market growth.

In addition, the rapid expansion of smart city projects and infrastructure development activities worldwide is contributing substantially to market growth. Urban planners and municipal authorities are utilizing geospatial imagery analytics to support traffic management, land-use planning, public safety monitoring, and infrastructure maintenance. The increasing demand for cloud-based deployment models, which provide scalable and cost-effective analytics capabilities, is further encouraging adoption among small and medium enterprises, thereby broadening the market scope across diverse end-use sectors.

Component Insights

The software segment dominated the market in 2025. The segment’s growth is primarily driven by the increasing demand for advanced analytics platforms that enable automated image processing, data visualization, and real-time spatial intelligence across industries. Organizations are widely adopting geospatial software solutions integrated with artificial intelligence, machine learning, and cloud computing technologies to improve decision-making, predictive analysis, and operational efficiency. Rising deployment of geographic information systems (GIS), remote sensing analytics, and 3D mapping tools across sectors such as defense, agriculture, urban planning, and environmental monitoring is further supporting segment expansion. In addition, the growing need for scalable, cost-effective, and user-friendly analytics platforms, along with the increasing availability of high-resolution satellite and drone imagery data, is accelerating the adoption of geospatial imagery analytics software solutions globally.

The services segment is expected to grow at the fastest CAGR from 2026 to 2033. The segment growth is driven by the increasing demand for consulting, integration, maintenance, and managed services that support the implementation and optimization of geospatial imagery analytics solutions. Organizations are increasingly relying on specialized service providers to handle complex data processing, system customization, and workflow integration due to the technical expertise required for advanced spatial analytics. The rising adoption of cloud-based geospatial platforms and AI-powered analytics tools is further fueling demand for professional and managed services to ensure seamless deployment and efficient data management. In addition, the growing need for real-time monitoring, continuous system upgrades, and training services across industries such as defense, agriculture, infrastructure, and environmental monitoring is significantly contributing to the expansion of the geospatial imagery analytics services segment.

Imagery Type Insights

The satellite imagery segment accounted for the largest revenue share in 2025. Satellite imagery helps governments and organizations track environmental changes, monitor natural disasters, support defense and border surveillance, and manage agriculture and natural resources. The availability of high-resolution images and frequent satellite launches has improved data accuracy and accessibility, which is encouraging wider adoption across industries. In addition, the growing demand for real-time earth observation, climate monitoring, and infrastructure planning, along with increasing investments in satellite constellations by governments and private companies, is driving the growth of the satellite imagery segment in the market.

The drone/UAV imagery segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by the increasing adoption of drones for capturing high-resolution and real-time images at lower operational costs. Drones are widely used for applications such as infrastructure inspection, precision agriculture, construction site monitoring, disaster assessment, and land surveying, as they provide detailed and flexible data collection compared to traditional imaging methods. The growing demand for quick and accurate site analysis, along with improvements in drone technology, sensor capabilities, and automated flight systems, is supporting segment growth. In addition, increasing government support for drone-based mapping, growing use of UAVs in defense and surveillance operations, and expanding adoption of AI-powered image analytics tools are further driving the demand for drone/UAV imagery in the market.

Analytics Type Insights

The image-based analytics segment dominated the market in 2025. The segment growth is mainly driven by the increasing use of satellite, aerial, and drone images to extract useful information for monitoring and decision-making. Image-based analytics helps organizations identify objects, detect changes, and analyze patterns in areas such as defense surveillance, urban planning, agriculture monitoring, and environmental assessment. The growing availability of high-resolution imagery and the integration of artificial intelligence and machine learning technologies are making image analysis faster and more accurate.

The multimodal analytics segment is expected to grow at the fastest CAGR from 2026 to 2033. The segment growth is driven by the increasing need to combine multiple data sources, such as satellite imagery, drone images, sensor data, geographic information system (GIS) data, and real-time location data, to gain more accurate and detailed insights. Multimodal analytics helps organizations improve decision-making by providing a more complete view of geographic and environmental conditions. It is widely used in defense, disaster management, smart city planning, transportation monitoring, and environmental analysis. The growing adoption of artificial intelligence and cloud-based platforms that can process large and complex datasets is further supporting segment growth.

Deployment Mode Insights

The cloud-based segment held the largest revenue share in 2025, driven by the growing demand for scalable, flexible, and cost-effective geospatial imagery analytics solutions. Cloud platforms allow organizations to store, process, and analyze large volumes of satellite, aerial, and drone imagery data without requiring heavy on-premise infrastructure. The increasing adoption of cloud computing enables faster data access, real-time analytics, and easier integration with artificial intelligence and machine learning tools, which improves decision-making and operational efficiency. In addition, the increasing need for remote collaboration, secure data sharing, and continuous software updates across industries such as defense, agriculture, urban planning, and environmental monitoring is further supporting the growth of cloud-based deployment in the market.

The on-premises segment is expected to grow at a significant CAGR over the forecast period. The segment growth is mainly driven by organizations that require high data security, regulatory compliance, and complete control over sensitive geospatial information. Government agencies, defense organizations, and critical infrastructure operators often prefer on-premises deployment to manage confidential satellite and surveillance data within their internal networks. On-premises solutions also allow customization of analytics tools and better integration with existing IT infrastructure. In addition, increasing concerns regarding data privacy, cybersecurity risks, and strict government regulations related to data storage and processing are supporting the continued adoption of on-premises geospatial imagery analytics solutions.

Application Insights

The urban planning & smart cities segment held the largest revenue share in 2025, driven by the increasing use of geospatial imagery analytics for efficient city development and infrastructure management. Governments and municipal authorities are using satellite and drone imagery to monitor land use, manage traffic flow, plan transportation networks, and improve public safety. Geospatial analytics helps city planners make better decisions by providing accurate data on population growth, construction activities, and environmental conditions. The rapid expansion of smart city projects, rising investments in digital infrastructure, and growing demand for real-time monitoring of urban assets such as roads, utilities, and public facilities are key factors driving the adoption of geospatial imagery analytics in urban planning and smart city applications.

The supply chain and logistics monitoring segment is expected to grow at the fastest CAGR over the forecast period. The segment is growing due to the increasing need to track and monitor goods, transport routes, and logistics infrastructure in real time. Geospatial imagery analytics helps companies follow shipment movement, monitor ports and warehouses, and detect possible disruptions such as bad weather, traffic delays, or infrastructure issues. The growth of global trade, rising demand for faster and more reliable deliveries, and increasing use of satellite and drone imagery for route planning and asset tracking are supporting this segment’s expansion. In addition, combining geospatial analytics with AI and cloud-based logistics platforms helps businesses improve supply chain visibility, reduce risks, and increase overall operational efficiency.

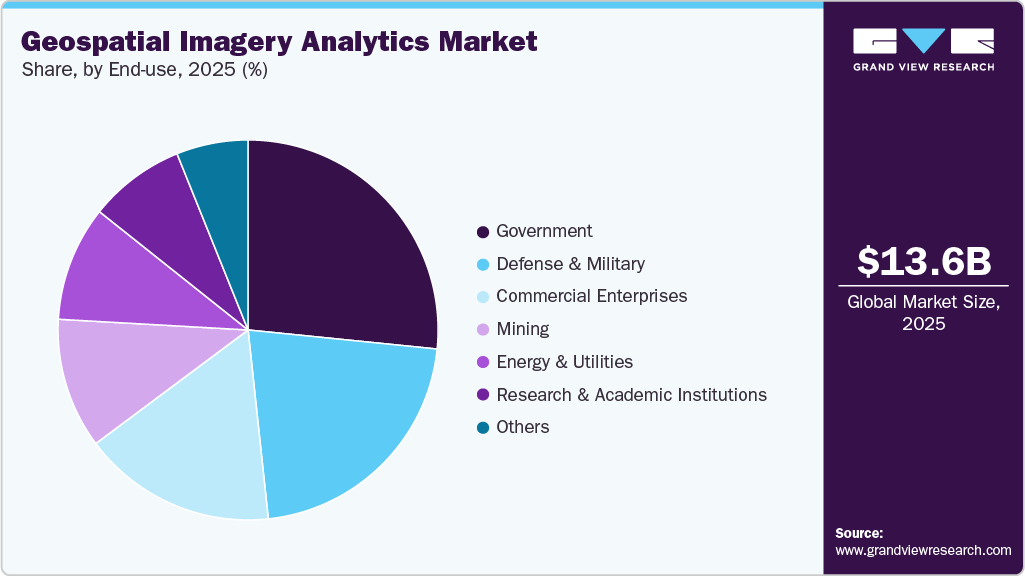

End-use Insights

The government segment accounted for the largest revenue share in 2025. The segment growth is driven by the extensive use of geospatial imagery analytics for national security, disaster management, urban planning, environmental monitoring, and infrastructure development. Government agencies use satellite and aerial imagery to monitor borders, manage natural disasters, track environmental changes, and support public safety operations. The increasing need for accurate and real-time geographic data to support policy planning and emergency response is encouraging governments to invest in advanced geospatial technologies. In addition, increasing investments in smart city projects, defense surveillance programs, and land management systems are further driving the adoption of geospatial imagery analytics solutions across government organizations.

The commercial enterprises segment is expected to grow at the highest CAGR during the forecast period. The segment growth is driven by the increasing adoption of geospatial imagery analytics by businesses to improve operational efficiency, asset monitoring, and decision-making. Companies across industries such as agriculture, construction, logistics, energy, and retail are using satellite and drone imagery to monitor sites, optimize routes, manage resources, and analyze market trends. The growing demand for real-time data insights, along with the growing use of AI and cloud-based analytics platforms, is encouraging businesses to adopt geospatial solutions. In addition, increasing competition, the need to reduce operational costs, and the growing focus on data-driven business strategies are further supporting the adoption of geospatial imagery analytics among commercial enterprises.

Regional Insights

North America geospatial imagery analytics market held the largest share of the geospatial imagery analytics industry in 20Strong government investments in defense, homeland security, environmental monitoring, and infrastructure development largely drive the regional market growth. Increasing adoption of satellite imagery, drone-based mapping, and advanced analytics platforms across sectors such as agriculture, energy, and transportation is supporting market expansion. The presence of well-established technology providers, growing integration of AI and cloud computing with geospatial platforms, and rising demand for real-time situational awareness are further strengthening the adoption of geospatial imagery analytics solutions across North America.

U.S. Geospatial Imagery Analytics Market Trends

The geospatial imagery analytics market in the U.S. is expected to grow significantly from 2026 to 2033. The growth is primarily supported by extensive use of geospatial technologies in national defense, disaster management, smart infrastructure development, and environmental monitoring programs. Federal agencies and local authorities are increasingly deploying satellite and aerial imagery analytics to improve emergency response, urban planning, and resource management initiatives. For instance, the Federal Geographic Data Committee (FGDC) introduced the National Spatial Data Infrastructure (NSDI) Strategic Plan 2025–2035, which emphasizes the adoption of advanced geospatial technologies, remote sensing, and spatial data integration to strengthen disaster response, environmental monitoring, and infrastructure planning across government agencies. In addition, rapid technological advancements in AI-driven image analysis, increasing use of unmanned aerial vehicles (UAVs), and expanding adoption of cloud-based geospatial platforms among commercial enterprises are contributing to the sustained growth of the market in the U.S.

Asia Pacific Geospatial Imagery Analytics Market Trends

The geospatial imagery analytics market in the Asia Pacific is growing significantly at a CAGR of 12.4% from 2026 to 2033. The regional market growth is driven by increasing government investments in satellite programs, disaster management systems, agricultural monitoring, and urban infrastructure development. Rapid expansion of smart city initiatives, rising adoption of drone-based mapping technologies, and increasing use of geospatial analytics for climate monitoring and resource management are supporting market expansion. Countries across the region are actively strengthening their geospatial data infrastructure and encouraging public-private collaborations to enhance spatial intelligence capabilities. For instance, in February 2025, the Singapore Land Authority (SLA), through the Office for Space Technology and Industry, announced new partnerships under its Earth Observation Initiative to leverage space-based technologies and geospatial data for addressing climate challenges, environmental monitoring, and sustainability planning across the Asia Pacific region. In addition, growing adoption of cloud-based geospatial platforms and AI-powered image analysis solutions across industries such as transportation, mining, energy, and agriculture is further accelerating market growth.

China geospatial imagery analytics market held a significant share in 2025. Chinese authorities are promoting policies that support commercial remote sensing satellite development and incentivize government-enterprise cooperation to provide expanded imaging data services for diverse applications, supporting the country’s spatial intelligence infrastructure and driving demand for geospatial analytics solutions. Furthermore, the rising implementation of geospatial analytics in urban planning, disaster preparedness, precision agriculture, and smart transportation systems is supporting the continued market expansion in China.

Europe Geospatial Imagery Analytics Market Trends

The geospatial imagery analytics market in Europe is growing at a significant CAGR from 2026 to 2033, supported by strategic government initiatives and expanding public sector use of spatial information. Regional programs such as the Copernicus Programme, the European Union’s flagship earth observation system, provide high-quality, open-access satellite data that fuel applications in environmental monitoring, urban planning, agriculture, and civil protection across member states. In addition, the EU’s Destination Earth (DestinE) initiative aims to build a high-resolution digital twin of the planet to improve climate impact modeling and disaster response capabilities, reflecting government-backed demand for advanced geospatial analytics in policy and resilience planning. National governments, especially in Germany and France, are also enhancing their spatial data infrastructures and aligning satellite remote sensing investments with economic and sustainability objectives, further strengthening Europe’s geospatial analytics ecosystem.

The UK geospatial imagery analytics marketis expected to grow rapidly in the coming years, driven by focused government strategies to position the country as a leader in location technologies. The UK Geospatial Strategy 2030 outlines a commitment to harnessing satellite imaging, real-time data integration, AI, and cloud-based analytics to support public services, infrastructure planning, and economic innovation across sectors. These initiatives reflect a growing policy focus on using geospatial intelligence to drive efficiency, sustainability, and economic growth across the UK’s public and private sectors.

Key Geospatial Imagery Analytics Company Insights

Some of the key companies operating in the market include BAE Systems, BlackSky, EOS Data Analytics, Inc., esri, and Google, among others.

-

BAE Systems is a global defense, security, and aerospace company that provides a wide range of products and services to military and government organizations, as well as select commercial sectors. The company develops and delivers advanced electronics, information technology solutions, and geospatial intelligence software that help customers with mission planning, situational awareness, and operational decision-making. In the market, BAE Systems is known for its Geospatial eXploitation Products (GXP) software suite, which enables rapid discovery, exploitation, and dissemination of geospatial and temporal data from satellite, aerial, and other sensor sources to support mapping, image analysis, and intelligence workflows.

-

esri (Environmental Systems Research Institute) is a global company in geographic information systems (GIS) software and location intelligence solutions, headquartered in California, U.S. The company is best known for its ArcGIS platform, which helps organizations collect, analyze, and visualize spatial and imagery data. In the market, Esri provides tools for processing satellite, aerial, and drone imagery, supporting applications such as urban planning, environmental monitoring, disaster management, and infrastructure mapping. The company serves government agencies, commercial enterprises, and research organizations worldwide.

Key Moringa Ingredients Companies:

The following key companies have been profiled for this study on the geospatial imagery analytics market.

- BAE Systems

- Bentley Systems, incorporated

- BlackSky

- EOS Data Analytics, Inc.

- esri

- Hexagon AB

- L3Harris Technologies, Inc.

- Nearmap

- Planet Labs PBC

- SkyWatch

- Trimble Inc.

- UP42 GmbH

- Ursa Space Systems Inc.

- Vantor

Recent Developments

-

In October 2025, Esri signed a strategic collaboration agreement with Amazon Web Services (AWS) to integrate generative AI capabilities into its ArcGIS platform, enabling enhanced cloud-based geospatial AI solutions. This partnership aims to help organizations scale spatial analytics more efficiently, improve predictive insights, and accelerate workflows by combining Esri’s geospatial technology with AWS’s cloud infrastructure.

-

In August 2025, HEO and Satellogic expanded their agreement to provide exclusive access to non-Earth imagery for space domain awareness. This collaboration enhances capabilities to monitor objects and activities beyond Earth using advanced satellite imaging and analytics, supporting improved space tracking and intelligence services for commercial and government users.

-

In February 2025, Pixxel announced a strategic partnership with geospatial analytics firm Geospatial Insight to integrate hyperspectral data from its 5 m resolution Firefly satellite constellation into advanced climate intelligence and environmental monitoring solutions. Under this collaboration, Geospatial Insight will incorporate Pixxel’s hyperspectral imagery into its climate analytics stack, including the GHGWatch platform, to enhance risk monitoring, greenhouse gas tracking, carbon sequestration measurement, and air quality assessment, expanding the use of geospatial imagery analytics for climate action and sustainability applications.

Geospatial Imagery Analytics Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 14.64 billion

Revenue forecast in 2033

USD 28.73 billion

Growth rate

CAGR of 10.2% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, imagery type, analytics type, deployment mode, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

BAE Systems; Bentley Systems, Inc.; BlackSky; EOS Data Analytics, Inc.; esri; Google; Hexagon AB; L3Harris Technologies, Inc.; Nearmap; Planet Labs PBC; SkyWatch; Trimble Inc.; UP42 GmbH; Ursa Space Systems Inc.; Vantor

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Geospatial Imagery Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global geospatial imagery analytics market report based on component, imagery type, analytics type, deployment mode, application, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Software

-

Services

-

-

Imagery Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Satellite Imagery

-

Aerial Imagery

-

Drone/UAV Imagery

-

Radar (SAR) Imagery

-

-

Analytics Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Image-Based Analytics

-

Video-Based Analytics

-

Multimodal Analytics

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

On-Premises

-

Cloud-Based

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Urban Planning & Smart Cities

-

Environmental Monitoring

-

Agriculture & Forestry

-

Disaster Management

-

Supply Chain and Logistics Monitoring

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Government

-

Defense & Military

-

Commercial Enterprises

-

Research & Academic Institutions

-

Energy & Utilities

-

Mining

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global geospatial imagery analytics market size was estimated at USD 13.56 billion in 2025 and is expected to reach USD 14.64 billion in 2026.

b. The market growth is primarily driven by the increasing adoption of location-based intelligence across multiple industries, including defense, agriculture, urban planning, environmental monitoring, and disaster management.

b. The geospatial imagery analytics market in North America held a share of nearly 39.6% in 2025. The regional market growth is largely driven by strong government investments in defense, homeland security, environmental monitoring, and infrastructure development.

b. Some prominent players in the market include BAE Systems; Bentley systems, incorporated; BlackSky; EOS Data Analytics,Inc.; esri; Google; Hexagon AB; L3Harris Technologies, Inc.; Nearmap; Planet Labs PBC; SkyWatch; Trimble Inc.; UP42 GmbH; Ursa Space Systems Inc.; Vantor

b. The global geospatial imagery analytics market is expected to grow at a compound annual growth rate of 10.2% from 2026 to 2033 to reach USD 28.73 billion by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.