- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Germany Liquid Dietary Supplements Market Report, 2030GVR Report cover

![Germany Liquid Dietary Supplements Market Size, Share & Trends Report]()

Germany Liquid Dietary Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Ingredients (Vitamins, Botanicals, Minerals), By Type, By Application, By End-use, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-647-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

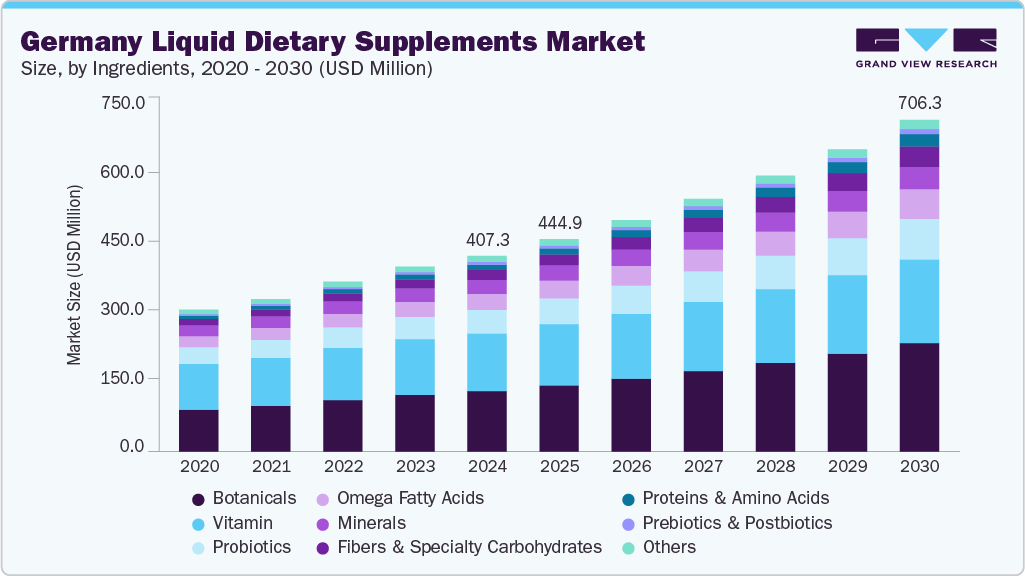

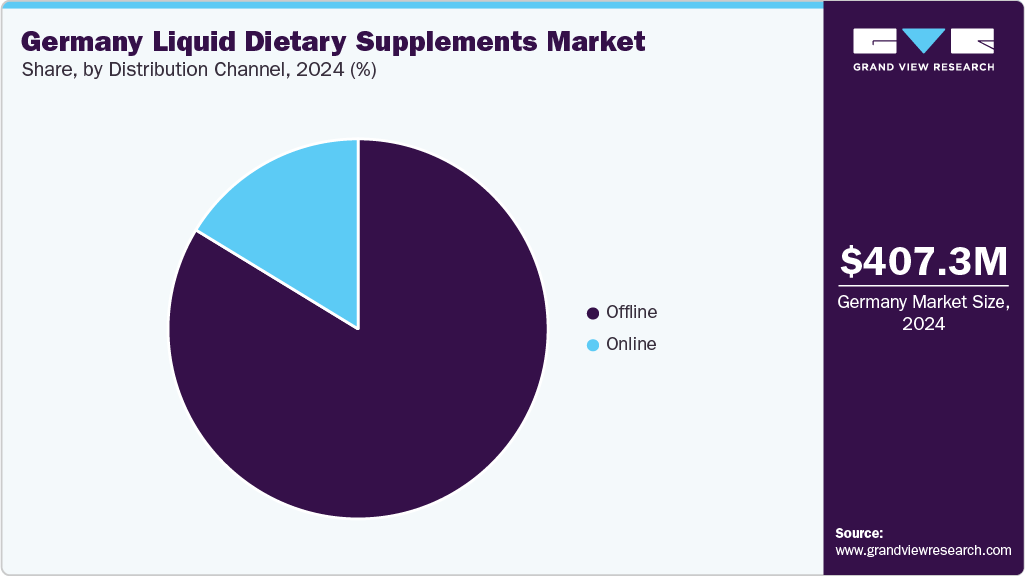

The Germany liquid dietary supplements market size was estimated at USD 407.6 million in 2024 and is projected to grow at a CAGR of 9.7% from 2025 to 2030. Rising number of health-conscious individuals in Germany, increasing incidence rate of lifestyle-related diseases, growing participation in sports and fitness activities, and easy accessibility facilitated by e-commerce are some of the key growth drivers for this market.

One of the developed economies in the region, Germany, has recorded increasing per capita expenditure on health in recent years. In 2023, per capita health expenditure in Germany was recorded at approximately USD 6,950, which marked significant growth from USD 6,482.65 in 2020. Dietary supplements, formulated with blends of multiple ingredients such as vitamins, proteins, and fibers, have experienced rising demand in this market. Young adults seeking supplement products to address nutritional gaps and deficiencies, including dietary supplements in the treatment of chronic diseases, the growing use of nutrition solutions during pregnancy, and the rising availability of supplements designed for older adults contribute to the growth experienced by this market.

To address the growing demand for gut health solutions, immunity boosters, and products that can facilitate healthy aging, numerous manufacturers have been introducing products and solutions equipped with innovative formulations. For instance, Symrise, one of the global companies operating in the taste, nutrition, and health industry, showcased multiple novel offerings in Vitafoods Europe 2024, an annual exhibition designed to facilitate long-term collaborations and unveil new opportunities in the nutrition sector, hosted in Geneva, Switzerland. This included concepts such as a HydraBoost sports drink and a dietary powder drink, GlucoZen.

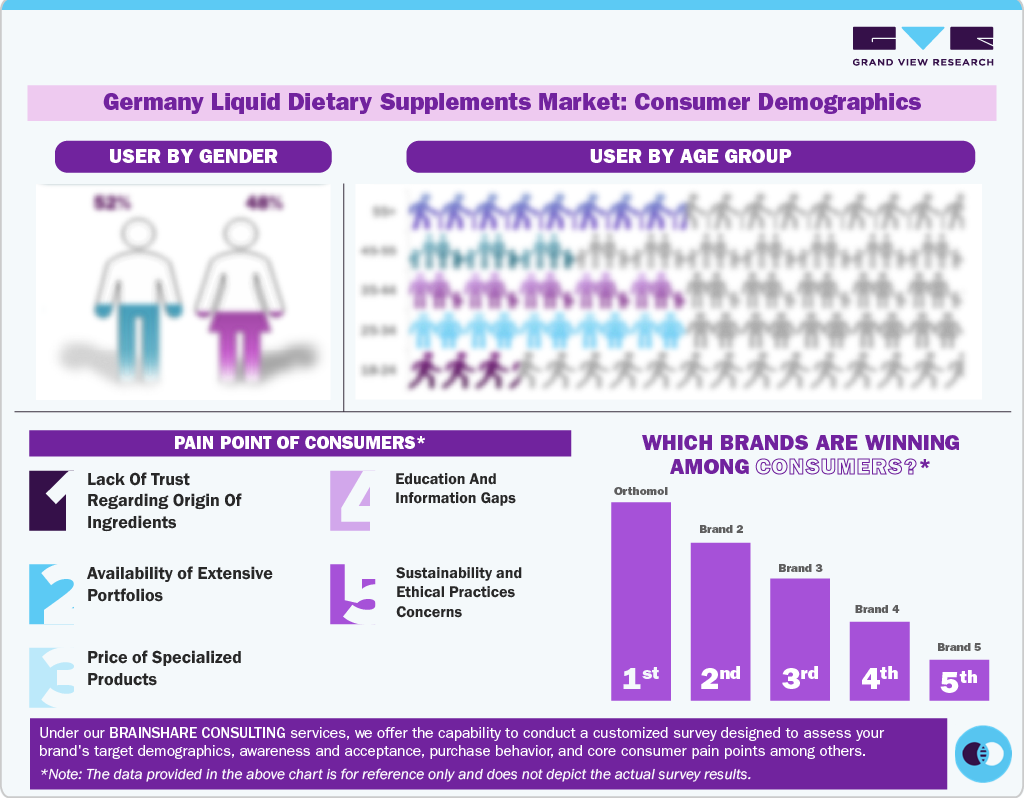

Consumer Insights

The diverse nature of Germany's population drives consumer trends. In 2023, the German population in urban or densely populated areas was 37.2%, contributing to the increasing demand for nutrient-rich food solutions and dietary supplements. In addition, the demography of Germany is largely influenced by the number of foreign nationals present in the country. In 2024, nearly 13.9 million foreign nationals lived in Germany. The age distribution of the German population is also expected to shape trends in this market.

Consumer Demographics

Increasing awareness regarding the role of nutrition in overall well-being and the effects of nutrient deficiencies has led to the growing adoption of various solutions. Product launches and new formulations introduced by the key market participants also increase engagement in German consumer groups. Rising accessibility to convenient online shopping and a vast range of products offered through e-commerce websites also contribute to increasing demand for supplements in the country.

Ingredient Insights

The botanicals segment dominated the German liquid dietary supplements market with a revenue share of 31.5% in 2024. Botanical liquid nutritional supplements are formulated with plant-based ingredients to support healthy nutrition. The increasing inclination towards natural and organic products and growing awareness regarding the benefits of liquid supplements, such as quicker absorption and convenience, are driving segment growth. Multiple strategic advancements initiated by the key market participants are likely to facilitate segment growth. For instance, in May 2024, Refresco Holding announced entry into a new beverage category, oat drinks, and established a new production line in Calvörde, Germany. Furthermore, in November 2024, Refresco Holding announced the acquisition of a plant-based beverage brand from Spain, Frías Nutrición.

The proteins & amino acids segment is expected to experience the fastest CAGR of 14.9% from 2025 to 2030. This is attributed to increasing consumption of pre-workout protein shakes, growing availability of protein-based powder drinks in the market, and easy accessibility through online portals. In recent years, awareness regarding the role of protein in weight management, muscle gains, immunity, and overall well-being has grown significantly, leading to segment growth.

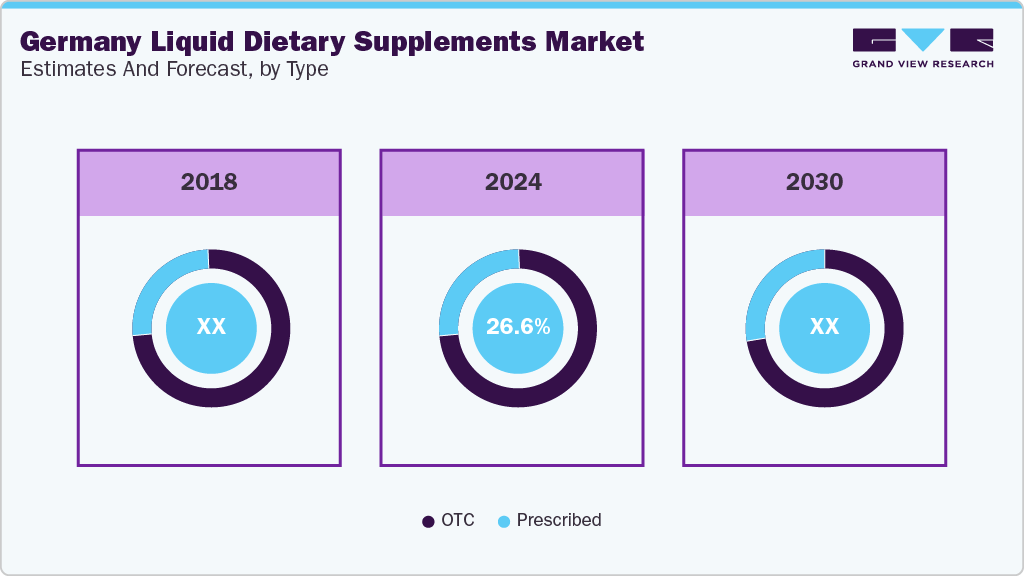

Type Insights

The OTC segment dominated the German liquid dietary supplements market with a revenue share of 73.4% in 2024. Factors such as increasing demand for self-care products and growing consumption of protein drinks, vitamin and mineral-infused beverages, and specialized liquid supplements mainly drive this segment's growth. Ease of availability and growing inclination among consumers toward including liquid-based supplements specifically formulated with nutrient-rich ingredients also contribute to the segment's growth.

The prescribed liquid dietary supplements market is expected to experience the fastest CAGR of 9.9% from 2025 to 2030. Increasing involvement of liquid dietary supplements in treating chronic diseases and growing recommendations by health professionals. Prescribed liquid dietary supplements are primarily included in dietary recommendations for immunity boosting, pain relief, and more.

Application Insights

The bone & joint health segment accounted for the largest revenue share of the German liquid dietary supplements market in 2024. Based on the 2021 Census, 18.4 million individuals aged 65 and above lived in Germany. According to A retrospective health claims data analysis published by Science Direct, nearly 5 million adult patients with osteoarthritis of the knee are identified in Germany annually.

The prenatal health segment is anticipated to experience the fastest CAGR from 2025 to 2030. This is attributed to the growing adoption of liquid dietary supplements by pregnant women, increasing recommendations of supplements given by health professionals, and the launch of specially formulated product lines for prenatal health. Changed lifestyles and dietary preferences have led to rising nutrient deficiencies and gaps in necessary nutrition. Liquid dietary supplements that are easy to consume provide convenient and safe solutions to such health issues.

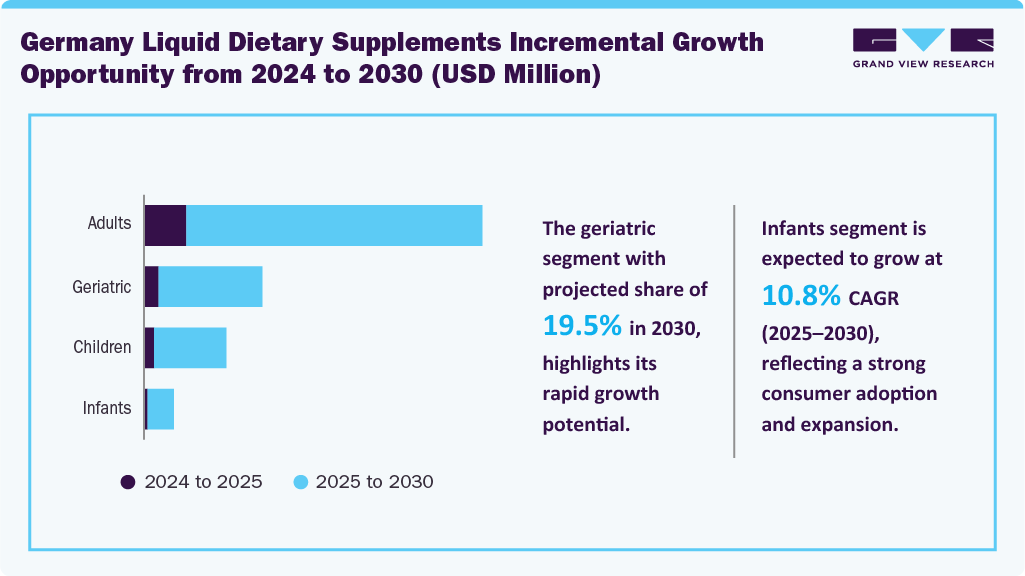

End-use Insights

On the basis of end use, the adults segment accounted for the largest revenue share of the market. Several factors contribute to this dominance, such as the significant growth in adoption by urban consumers from various groups, including millennials, Gen X, and Gen Z, the increasing demand for immunity boosters and multivitamins by work professionals, and the notable consumption of proteins and vitamins by sports and fitness enthusiasts. Young adults seeking convenient nutrition solutions also prefer supplements such as protein shakes, vitamin drinks, and ready-to-drink offerings.

The infant segment is projected to experience the fastest CAGR from 2025 to 2030. Early-stage development is significant for infants, and nutrition plays a pivotal role. Due to their ease of consumption, liquid dietary supplements are increasingly preferred for infants. Parents adopt specialized infant formulas and nutritional supplements to address nutrient deficiencies and gaps. Convenient packaging and the availability of safe products for infants contribute to the segment’s growth.

Distribution Channel Insights

The offline distribution segment dominated the Germany liquid supplement market in 2024. Manufacturers and marketers leverage vast offline distribution networks to improve the market reach of their portfolios. This includes distributing products through hypermarkets and supermarkets, specialty stores, and pharmacies. The major market players also distribute their products to practitioners, who further recommend them to users according to requirements and identified health issues. Brands focus more on offline distribution as it directly influences brand visibility across markets.

The online segment is expected to experience the fastest CAGR from 2024 to 2030. This is attributed to factors such as the increasing ubiquity of smartphones, growing market penetration of e-commerce platforms, and rising availability of dietary supplements through online shopping. Consumers increasingly choose online shopping over offline for convenience, ease of use, and additional services e-commerce businesses provide, such as doorstep delivery, display of reviews posted by previous buyers, and improved customer assistance.

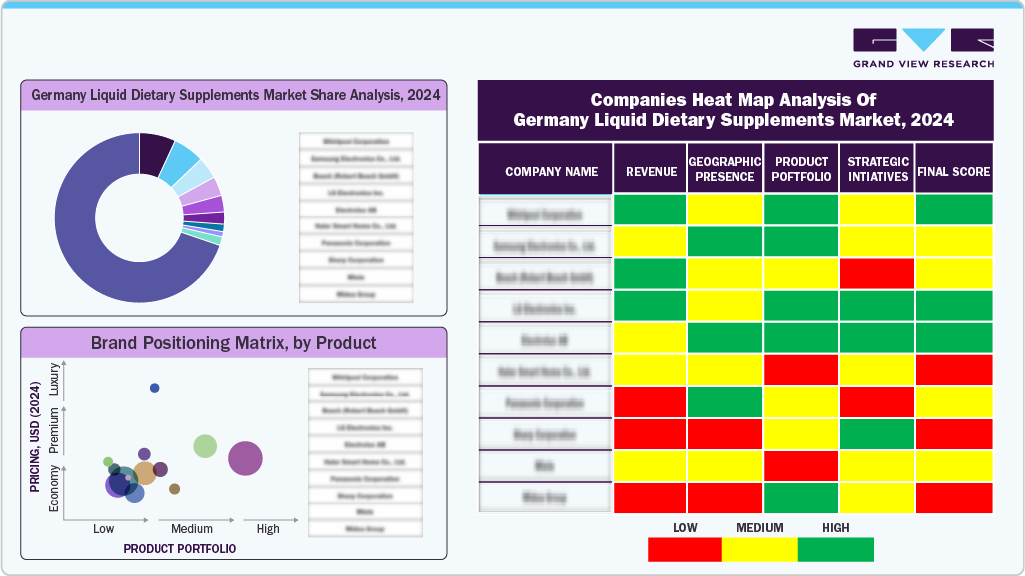

Key Germany Liquid Dietary Supplements Company Insights

Some of the key companies operating in the Germany liquid dietary supplements market include orthomol, Bayer AG, Abbott, Nestlé Health Science, and others.

-

orthomol offers an extensive portfolio of dietary supplements associated with various categories, including brain & energy metabolism, children’s health, gut health, eye health, heart and immune system, men’s health, sleep, tiredness & exhaustion, women’s health, vegan nutrition, and sports.

-

Bayer AG, a global health and nutrition company, provides a variety of vitamins and supplements that support nutrition enhancements. These include products designed for categories such as prenatal care, mental and physical energy, and immunity systems.

Key Germany Liquid Dietary Supplements Companies:

- orthomol

- Bayer AG

- Abbott

- Nestlé Health Science

- Glanbia plc

- Amway

Recent Developments

-

In April 2024, Volvic, one of Danone's mineral water brands, launched Volvic Vitamin+, a functional natural mineral water offering, in three variations: Recharge with raspberry flavor, Awake with lemon flavor, and Active with peach flavor.

Germany Liquid Dietary Supplements Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 706.3 million

Growth rate

CAGR of 9.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Ingredients, type, application, end-use, distribution channel, country

Key companies profiled

orthomol; Bayer AG; Abbott; Nestlé Health Science; Glanbia plc; Amway

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Germany Liquid Dietary Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Germany liquid dietary supplements market report based on ingredients, type, application, end-use, and distribution channel:

-

Ingredients Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (Selenium, Chromium, Copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Prescribed

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

-

-

Geriatric

-

Children

-

Infants

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others (Direct to Consumer, MLM)

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.