- Home

- »

- Healthcare IT

- »

-

Germany Medical Kiosk Market Size & Share Report, 2030GVR Report cover

![Germany Medical Kiosk Market Size, Share & Trends Report]()

Germany Medical Kiosk Market Size, Share & Trends Analysis Report By Type (Check-In Kiosk, Payment Kiosk, Way Finding Kiosk, Telemedicine Kiosk, Self-service Kiosk), By Location (Hospitals, Specialty Clinics), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-070-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

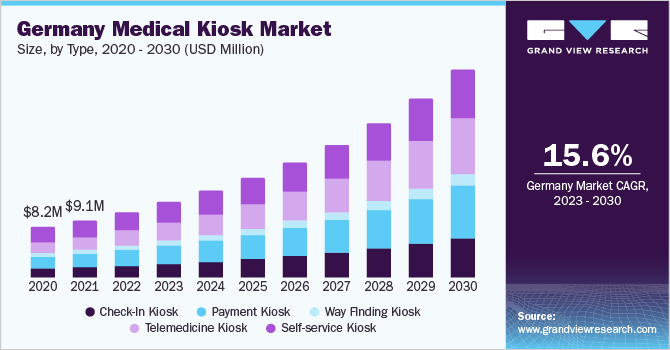

The Germany medical kiosk market size was valued at USD 36.4 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 15.6% from 2023 to 2030. Medical kiosks, also known as healthcare kiosks, are self-service machines that allow patients to perform various healthcare tasks without the need for direct interaction with medical staff. Medical kiosks can help improve patient experience by reducing waiting time and providing quick & efficient access to healthcare services. For instance, in July 2021, the Army medical treatment facilities started upgrading their patient kiosks to improve patient flow, reduce wait times, and standardize healthcare encounters in Europe. They are inducting new medical kiosks in pharmacies & waiting rooms in clinics and upgrading existing ones to improve customer service, recognize areas with long wait times, and drive revenue from third-party insurance companies.

Medical kiosks can help reduce the workload of medical staff, saving time & money. This can particularly be useful in busy healthcare settings. For instance, in July 2021, the German Government announced funding of USD 4.65 million to support digitalization, which involved improving healthcare facilities. Approximately 15% of this funding will be used to enhance the security of Information Technology (IT). Therefore, the German Government introduced biometric technology to streamline the administrative process in the hospital and ensure information security. This reduces the related time and cost of maintaining complete regulatory compliance.

A combination of technological advancements, government initiatives, increased demand for telemedicine, and cost-effectiveness drives digitalization across healthcare organizations in Germany. This trend is expected to continue as healthcare organizations in the country look to leverage digital tools and platforms to improve patient outcomes and reduce costs. For instance, the Federal Ministry of Health passed the “Digital Healthcare Act (DVG)” in 2019 to promote the use of digital health applications and facilitate better collaboration between healthcare providers.

Germany is facing a shortage of healthcare staff, particularly in nursing and geriatric care. The aging population and increased demand for healthcare services have exacerbated the problem. The government is implementing measures to attract and retain healthcare workers, such as offering financial incentives and expanding training programs. For instance, according to the Federal Ministry of Health, there was approximately 5.7 million healthcare personnel available in Germany, as of 2021, including physicians, nurses, therapists, & other healthcare professionals. However, there is still a shortage of healthcare workers, particularly in nursing and geriatric care, which is expected to worsen as the population ages.

Customers today expect quick and personalized services from their providers, which has increased the need for easy, fast, and continuous ways to meet customer expectations. However, cyberattacks are becoming more common, and kiosks are increasingly becoming a target of these attacks. Most kiosk software platforms only provide a way to configure the kiosk device, while traditional devices such as laptops have more defense tools and are regularly patched & updated. This leaves kiosk platforms vulnerable to cyberthreats, limiting their adoption in healthcare settings.

The COVID-19 pandemic has moderately impacted the use of medical kiosks in Germany. In the early days of the pandemic, the production of medical kiosks was slowed due to a shortage of raw materials required to manufacture finished products. This can be attributed to the disruption of the global supply chain. However, postpandemic, the opening of the economy and the stabilization of the supply chain re-started the production of medical kiosks. These kiosks are self-service machines that provide various medical services, such as measuring blood pressure, blood sugar levels, and body weight, without human interaction. With social distancing measures in place to prevent the spread of COVID-19, medical kiosks have become an attractive option for people who want to avoid contact with others in medical facilities. As a result, despite the decrease in the use of medical kiosks in Germany during the early pandemic days, it significantly increased post-pandemic.

Type Insights

On the basis of type, self-service kiosks held the largest market share in 2022 with 28.0% share. Self-service kiosks are increasingly being used in hospitals, as they can help reduce operational costs and provide a unique patient experience. As their adoption rate grows, it is becoming more important to analyze their cost-effectiveness for multispecialty hospitals in Germany. These kiosks are gaining popularity in Germany as they are designed to provide patients with convenient and quick access to healthcare services without the need for a physical visit to a doctor's office or clinic.

Telemedicine kiosk is anticipated to witness the fastest CAGR over the forecast period. The recent increase in demand for telemedicine has paved the way for investments in developing and commercializing new telemedicine kiosks in the country. For instance, in June 2020, the German Grand Coalition in Berlin agreed to create a financial aid package for the German industry, worth billions of Euros in funding.

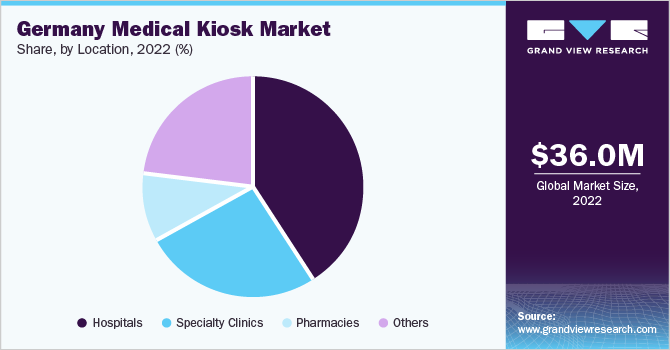

Location Insights

Hospitals segment dominated the Germany medical kiosk market with a revenue share of 40.6% in 2022. Hospitals are the primary users of medical kiosks, and this market can be classified into three categories: public hospitals, private hospitals, and university hospitals. Kiosks can help streamline various tasks, such as patient registration, appointment scheduling, telehealth, and video conferencing & bill payments. It also helps reduce waiting times and administrative workload, enabling hospital staff to focus on providing better care.

Others segment is projected to showcase the fastest growth rate during the forecast period. It includes retail stores, offices, railway & metro stations, colleges, diagnostic centers, rehabilitation centers, and others. These facilities are gradually adopting medical kiosks to improve patient engagement, streamline workflows, and enhance the quality of care. Placing medical kiosks in high-traffic areas, such as retail stores, offices, and railway & metro stations has become a popular solution for improving access to healthcare services.

Key Companies & Market Share Insights

Key players are involved in the launch of new products, acquisitions, and collaborations & partnerships to gain a competitive edge. For instance, in October 2022, Kiosk Embedded Systems partnered with Fielddrive, a leading company in data integration, live badging, and track & trace capabilities. This collaboration enabled Kiosk to expand its product portfolio. In December 2022, Axiomtek launched the SSK515, an all-in-one self-service kiosk equipped with a 15.6-inch Full HD LCD. The display features a 10-point PCAP touchscreen with 300 nits of brightness. Some key players in the Germany medical kiosk market are:

-

KIOSK Embedded Systems GmbH

-

Pyramid Computer GmbH

-

Distec GmbH (FORTEC Elektronik AG)

-

OptiMedis AG

-

XIPHIAS Software Technologies

-

Infotronik Touchscreen Systeme GmbH

-

AXIOMTEK DEUTSCHLAND GmbH

Germany Medical Kiosk Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 41.8 million

Revenue forecast in 2030

USD 115.4 million

Growth Rate

CAGR of 15.6% from 2023 to 2030

The base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segment Covered

Type, location

Key companies profiled

KIOSK Embedded Systems GmbH; Pyramid Computer GmbH; Distec GmbH (FORTEC Elektronik AG); OptiMedis AG; XIPHIAS Software Technologies; Infotronik Touchscreen Systeme GmbH; AXIOMTEK DEUTSCHLAND GmbH

15% free customization scope (equivalent to 5-analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Germany Medical Kiosk Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the Germany medical kiosk market report based on type, and location:

-

Type Outlook (Revenue, USD Million, 2018-2030)

-

Check-In Kiosk

-

Payment Kiosk

-

Way Finding Kiosk

-

Telemedicine Kiosk

-

Self-service Kiosk

-

-

Location Outlook (Revenue, USD Million, 2018-2030)

-

Hospitals

-

Specialty Clinics

-

Pharmacies

-

Others

-

Frequently Asked Questions About This Report

b. The Germany Medical Kiosk market size was estimated at USD 36.4 million in 2022 and is expected to reach USD 41.78 million in 2023.

b. The Germany Medical Kiosk market is expected to grow at a compound annual growth rate of 15.6% from 2023 to 2030 to reach USD 115.4 million by 2030.

b. The hospital segment dominated the market with a revenue share of 40.6% in 2022. Hospitals with the highest number of footfall are the primary users of medical kiosks.

b. Some key players operating in the Germany Medical Kiosk market are KIOSK Embedded Systems GmbH; Pyramid, Computer GmbH; Distec GmbH (FORTEC Elektronik AG); OptiMedis AG; XIPHIAS Software Technologies; Infotronik, Touchscreen Systeme GmbH; AXIOMTEK, DEUTSCHLAND GmbH

b. Increasing demand for quick and personalized services from providers is leading to the need for easy, fast, and continuous ways to meet customer expectations, which in turn is anticipated to increase the demand for medical kiosks.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."