- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Germany Nutraceuticals Market Size, Industry Report, 2033GVR Report cover

![Germany Nutraceuticals Market Size, Share & Trends Report]()

Germany Nutraceuticals Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Dietary Supplements, Functional Food, Functional Beverages, Infant Formula), By Application (Allergy & Intolerance, Healthy Ageing), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-651-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Germany Nutraceuticals Market Summary

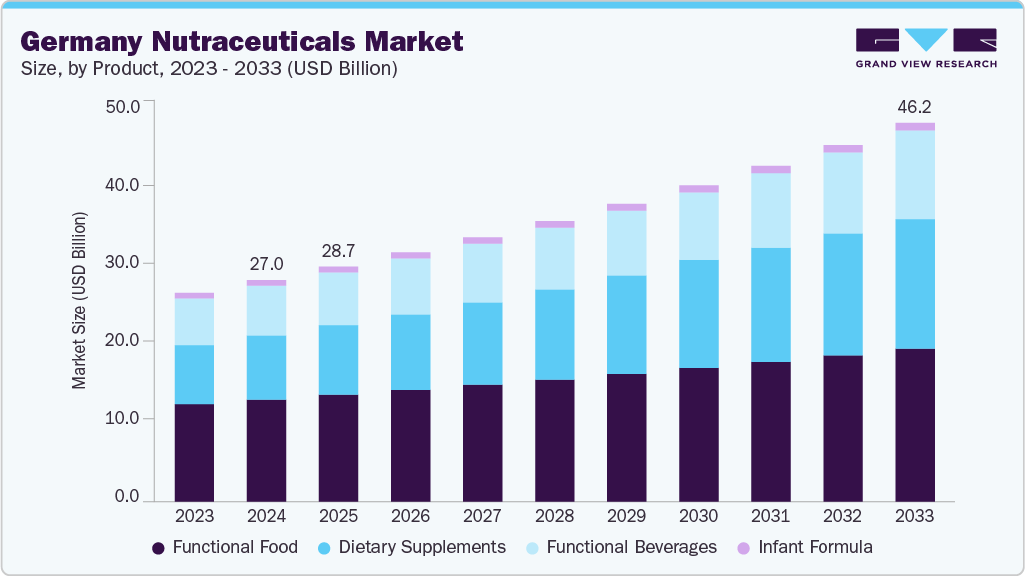

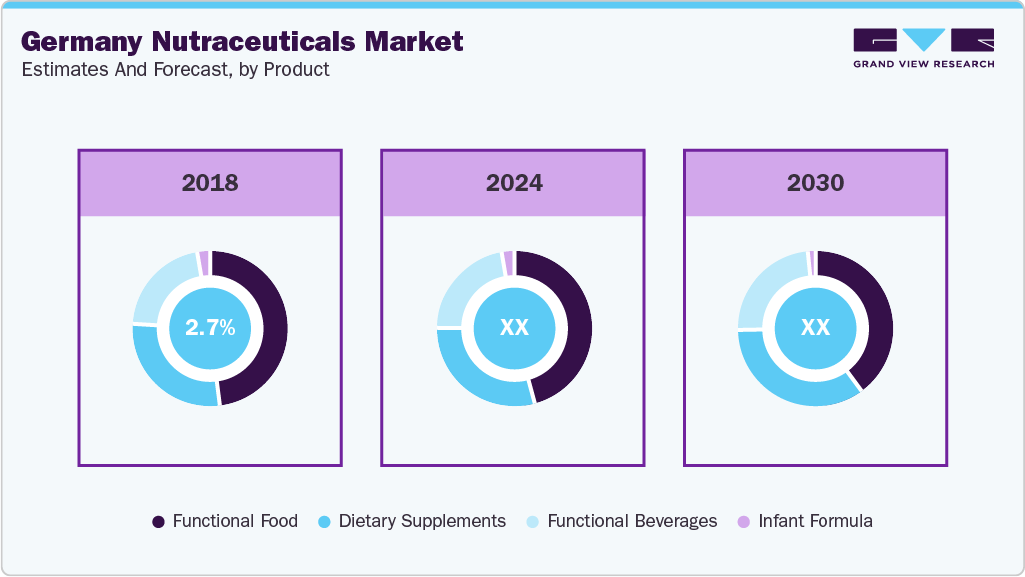

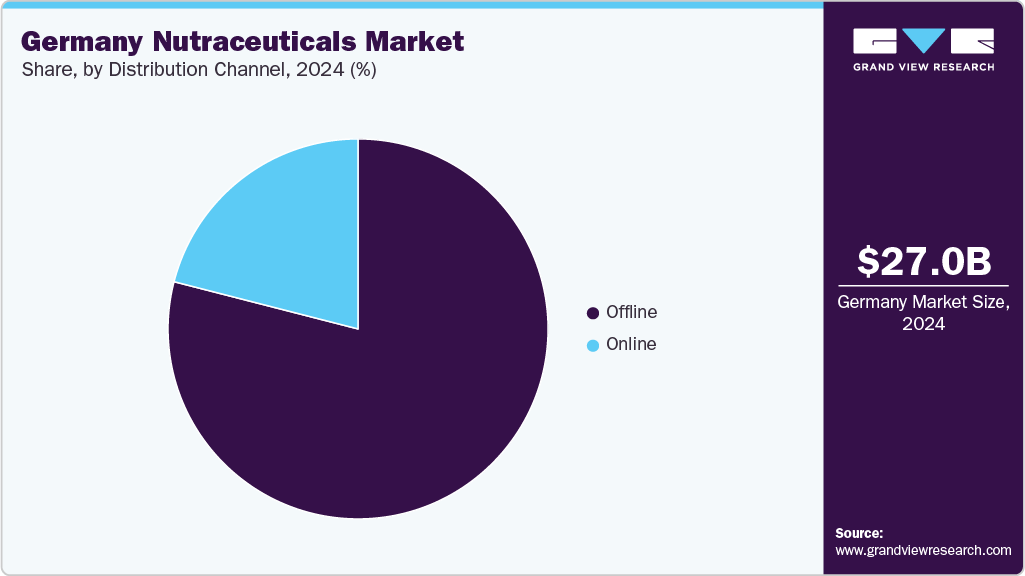

The Germany nutraceuticals market size was estimated at USD 27.04 billion in 2024 and is projected to reach USD 46.25 billion by 2033, growing at a CAGR of 6.1% from 2025 to 2033. This market is primarily driven by the increasing use of functional beverages by sports professionals, rising consumption of supplements such as immunity boosters by young urban consumers, and the growing inclusion of nutraceuticals in ongoing treatments of various health issues.

Key Market Trends & Insights

- By product, the functional food segment held the highest market share of 46.1% in 2024.

- Based on application, the weight management & satiety segment held the highest market share in 2024.

- By distribution channel, the offline segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 27.04 Billion

- 2033 Projected Market Size: USD 46.25 Billion

- CAGR (2025-2033): 6.1%

Germany, one of the key economies in the European Union (EU), accounts for nearly 24.2% of the EU's total GDP. With a diverse population, Germany has experienced significant changes in consumer trends and lifestyle preferences across urban areas in recent years. In 2024, individuals aged 15 to 29 accounted for 15.9% of the total population. This consumer group is expected to contribute to the growing demand for nutraceuticals in Germany.Strong administrative support and various government initiatives are likely to facilitate the growth of this market. For instance, in January 2024, Germany adopted newly developed Food and Nutrition Strategy - Good Food for Germany strategy, which aims to achieve numerous objectives, including promoting plant-based diets. Such initiatives are expected to result in increased awareness and inclusion of functional foods in regular diets in the coming years.

Innovation achieved through extensive R&D efforts and collaborations among organizations shape the further growth of this industry. Discovery and availability of novel ingredients play a pivotal role in the growth potential of nutraceuticals. For instance, in May 2025, BENEO, one of the key ingredients providers for the functional food industry, and WACKERS, a biotechnology company, announced the launch of human milk oligosaccharide (HMO) 2’-Fucosyllactose X(2’-FL), which is crucial in the development of infant formulas for large scale manufacturers and SMEs operating in this sector.

Consumer Insights

Consumer behavior is largely influenced by the diverse preferences of local consumers, goodwill established by major market participants, availability of extensive product portfolios, and current trends such as veganism. Germany has approximately 90,000 sports clubs, with nearly 28 million participating in sports and outdoor activities. The presence of many sports and fitness enthusiasts in Germany, a significant share of the young population aged 15 to 29, and growing awareness regarding health and wellness are expected to influence consumer trends in this market.

The growing demand for improved prenatal health products and the rising use of infant formulas in urban areas also influence this market. Urban consumers in Germany are more inclined towards online shopping, stimulating the increasing entry of brands on e-commerce websites and online platforms. Ease of accessibility, display of reviews shared by previous buyers, availability of detailed product information, and additional services such as delivery is likely to attract more consumers towards online purchase of nutraceuticals.

Product Insights

On the basis of product, the functional food segment dominated the market with a revenue share of 46.1% in 2024. Growth of this segment is primarily driven by increasing demand for products that provide benefits beyond basic nutrition levels and rising awareness regarding the role of food intake in preventing gut health issues and other major illnesses. Modern technologies in diagnostics have enabled easy detection of health problems such as nutrient deficiencies, leading to a growing demand for functional foods. The increasing inclusion of functional ingredients in processed food products such as confectioneries, breakfast cereals, baked goods, and others is also expected to fuel market growth. The strong manufacturing sector in Germany also facilitates market expansion. For instance, BellRing Brands, Inc. (BRBR), a global nutrition solutions provider, operates a manufacturing facility in Voerde, Germany, which mainly supplies nutrition bars, nutrition gels, and other products to EU markets, the UK, and Switzerland. The presence of such production facilities in the country is likely to develop lucrative growth opportunities for this industry.

The dietary supplements segment is projected to experience the fastest CAGR of 8.1% from 2025 to 2033. The significant presence of the young population in the country, the availability of multiple dietary supplements such as immunity boosters, prenatal health supplements, and others in the market, and easy accessibility through online portals are some of the key growth drivers for this segment. Many consumers adopt dietary supplements comprising vitamins, botanicals, minerals, omega-3, and others to address nutritional gaps. Numerous ingredient providers in Germany facilitate new product developments and innovation in the dietary supplements industry.

Application Insights

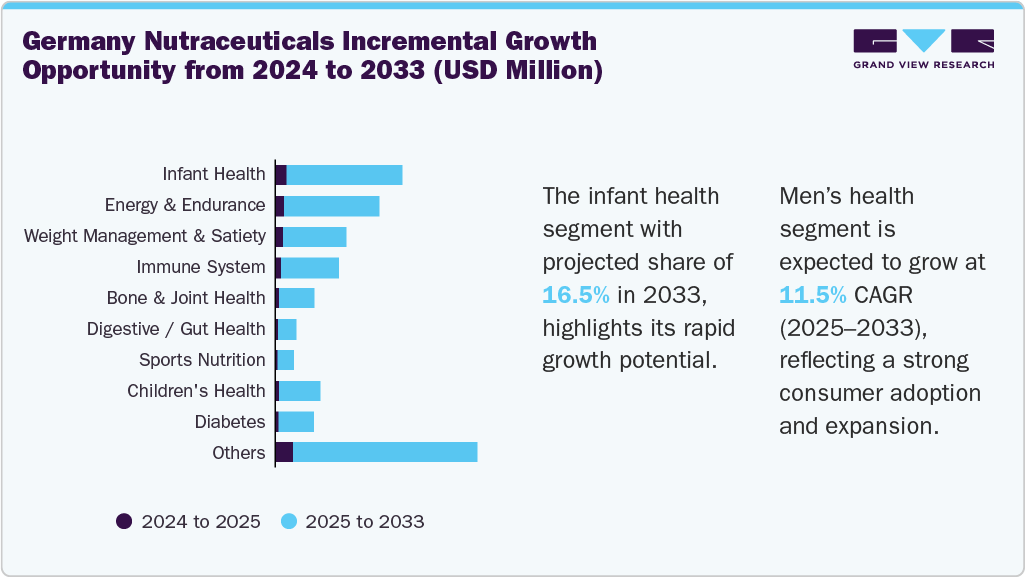

The weight management & satiety segment held the largest revenue share of the German nutraceuticals market in 2024. Factors such as lack of physical activity, excess consumption of sugary soft drinks, confectionery, and processed meat, prevalence of mental health issues, and presence of comorbidities such as esophageal cancer, thyroid cancer, and others are anticipated to develop a growing demand for nutraceuticals designed for weight management & satiety. Changed lifestyles in urban areas, pollution, and increasing exposure to stress and anxiety also contribute to significant growth in these products' consumption.

The men’s health segment is projected to experience the fastest CAGR from 2025 to 2033. This is attributed to increasing awareness regarding the physical and mental well-being of men in Germany, growing demand for reproductive and sexual health supplements, and rising inclination among men toward the consumption of supplements to address health issues originating from stress, lack of exercise, history of substance abuse, and mental health problems.

Distribution Channel Insights

The offline distribution segment dominated the German nutraceuticals market in 2024. Manufacturers rely on efficient offline distribution networks to enhance their market share and improve brand visibility. Trends such as veganism and the growing demand for plant-based products also contribute to market dynamics. Increasing demand for plant-based products has stimulated product developments, innovation, fundamental changes in distribution strategies, and more. In April 2024, REWE Group, one of the market participants in the German retail industry, opened its first-of-a-kind fully plant-based supermarket, dedicated to the product category, in Berlin, featuring nearly 2,700 vegan products. This includes plant-based foods, health and wellness products, and beauty offerings.

The online segment is anticipated to experience the fastest CAGR of 8.4% from 2025 to 2033. Growing inclination among young consumers to purchase dietary supplements and food products such as cereals, snack bars, and others through online platforms, increasing entry of nutraceutical brands on e-commerce websites, and focus of multiple companies on improving their digital footprint are major growth drivers for this segment. In addition, partnerships and collaborations among key market participants in the online delivery industry are also projected to influence the growth potential of this segment. For instance, in October 2024, Lieferando, which delivers health and personal care products from pharmacies, partnered with healthcare startup CURE to launch a new service in nearly 60 pharmacies across 18 cities, including Berlin, Munich, Cologne, Frankfurt, Hamburg, and others.

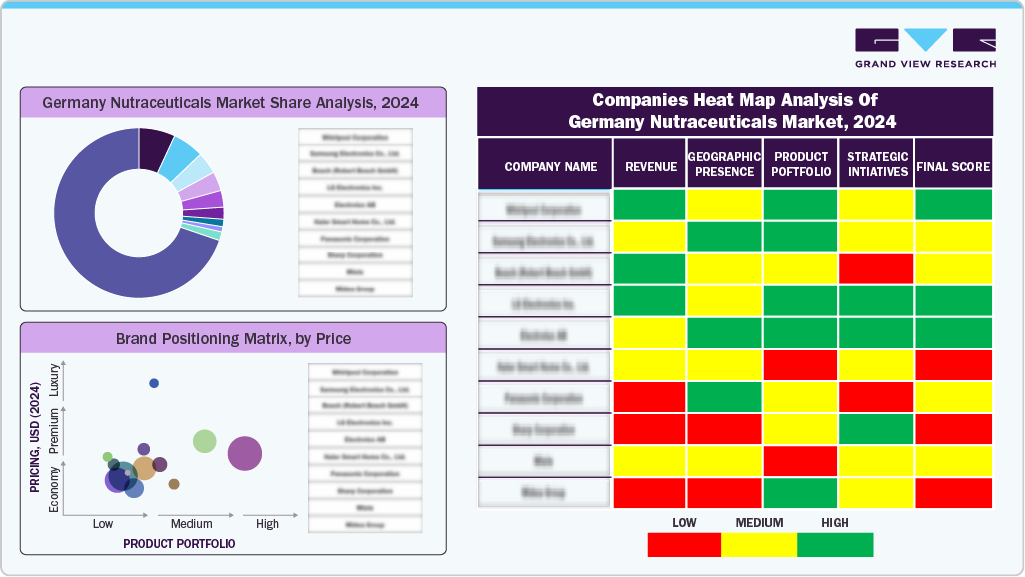

Key Germany Nutraceuticals Company Insights

Some of the key players in the Germany nutraceuticals market include Amway Corp., orthomol, Danone, Yakult Deutschland GmbH, General Mills Inc., and others. Major players embrace innovative strategies, new product development, distribution partnerships, and more to address changing consumer preferences and growing demand for extensive product portfolios by diverse consumer groups.

-

orthomol provides comprehensive portfolio of nutrition solutions including dietary supplements associated with various categories, such as gut health, brain & energy metabolism, eye health, heart and immune system, children’s health, men’s health, women’s health, sleep, tiredness & exhaustion, and sports.

-

Amway Corp. is a global organization that offers numerous products associated with nutrition, home, personal care, and beauty. Its nutrition category offerings include various products such as foundational food supplements, targeted food supplements, sports nutrition products, targeted food supplements, and more.

Key Germany Nutraceuticals Companies:

- Amway Corp.

- orthomol

- Danone

- Yakult Deutschland GmbH

- General Mills Inc.

- Nestlé Deutschland AG (Nestlé)

- The Kraft Heinz Company

- The Hain Celestial Group, Inc.

- Herbalife International Deutschland GmbH

- Tyson Foods, Inc.

- Haleon Group of Companies

- GSK plc

Recent Developments

-

In October 2024, Sirio Europe GmbH Co KG, a nutraceutical contract development and manufacturing organization (CDMO), announced an investment of nearly USD 18.45 million to develop a purpose-built packaging facility equipped with automated packaging lines.

Germany Nutraceuticals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 28.7 billion

Revenue forecast in 2033

USD 46.25 billion

Growth rate

CAGR of 6.1% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, distribution channel

Key companies profiled

Amway Corp.; orthomol; Danone; Yakult Deutschland GmbH; General Mills Inc.; Nestlé Deutschland AG (Nestlé); The Kraft Heinz Company; The Hain Celestial Group, Inc.; Herbalife International Deutschland GmbH; Tyson Foods, Inc.; Haleon Group of Companies; GSK plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Germany Nutraceuticals Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Germany nutraceuticals market report based on product, application, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Dietary Supplements

-

Tablets

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Capsules

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Soft Gels

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Powders

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Gummies

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Liquid

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Others

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

-

Functional Food

-

Vegetable and Seed Oil

-

Sweet Biscuits, Snack Bars and Fruit Snacks

-

Dairy

-

Baby Food

-

Breakfast Cereals

-

Others

-

-

Functional Beverages

-

Energy drink

-

Sports drink

-

Others (Functional dairy based beverages, kombucha, kefir, probiotic drinks, and functional water)

-

-

Infant Formula

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Allergy & Intolerance

-

Healthy Ageing

-

Bone & Joint health

-

Cancer Prevention

-

Children's Health

-

Cognitive Health

-

Diabetes

-

Digestive / Gut Health

-

Energy & Endurance

-

Eye Health

-

Heart Health

-

Immune System

-

Infant Health

-

Inflammation

-

Maternal Health

-

Men's Health

-

Nutricosmetics

-

Oral care

-

Personalized Nutrition

-

Post Pregnancy Health

-

Sexual Health

-

Skin Health

-

Sports Nutrition

-

Weight Management & Satiety

-

Women's Health

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Supermarkets & Hypermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Grocery Stores

-

Others

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.