- Home

- »

- Electronic & Electrical

- »

-

Germany Retail Vending Machine Market Size Report, 2033GVR Report cover

![Germany Retail Vending Machine Market Size, Share & Trends Report]()

Germany Retail Vending Machine Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Beverages Vending Machines, Snack Vending Machines, Food Vending Machines), By Location, By Mode Of Payment (Cash, Cashless), And Segment Forecasts

- Report ID: GVR-4-68040-672-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Germany Retail Vending Machine Market Summary

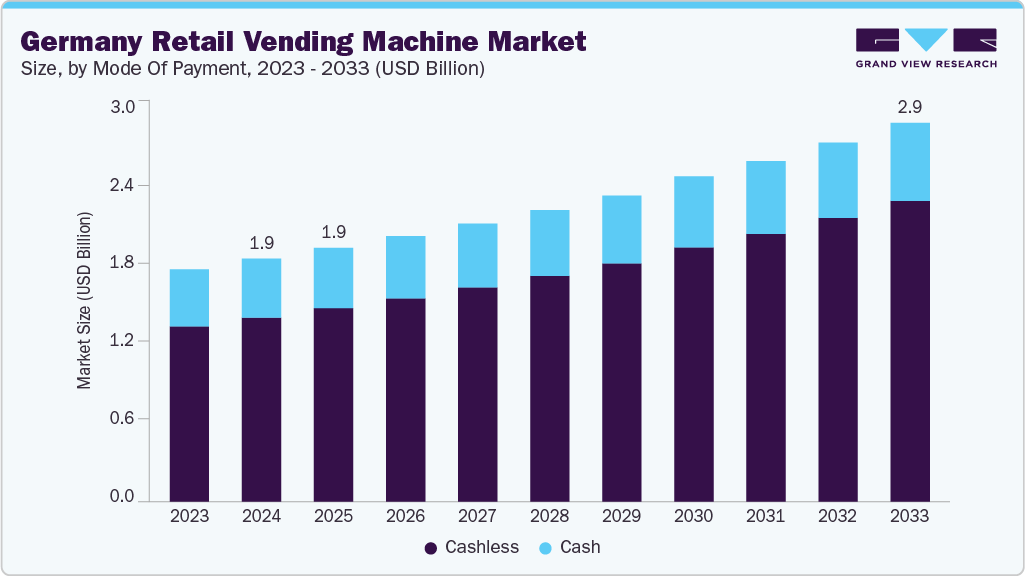

The Germany retail vending machine market size was estimated at USD 1.86 billion in 2024 and is projected to reach USD 2.90 billion by 2033, growing at a CAGR of 5.1% from 2025 to 2033. The market is witnessing steady growth driven by increasing consumer demand for contactless and convenient retail solutions.

Key Market Trends & Insights

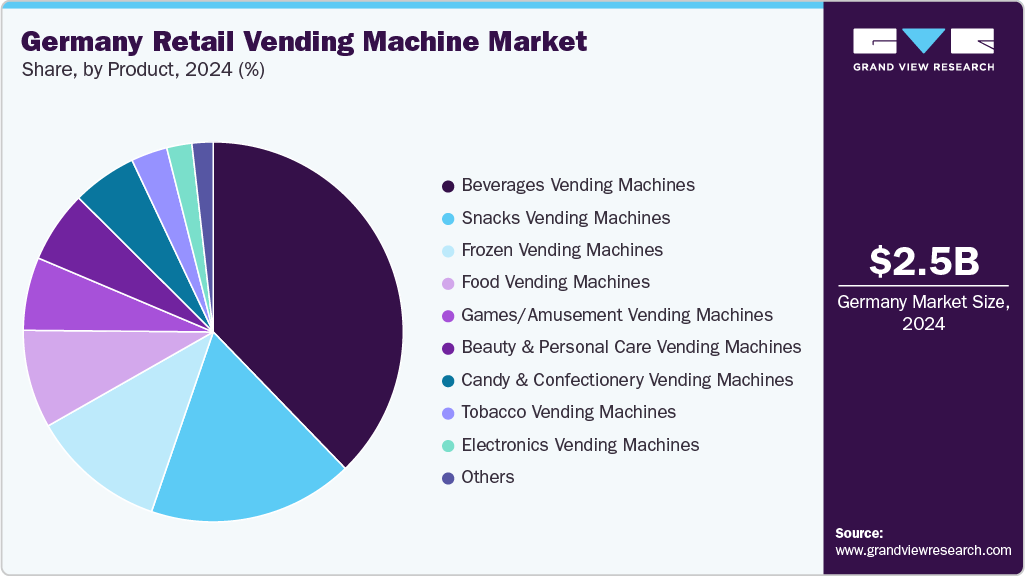

- By product, beverage vending machines accounted for a market share of 37.77% in 2024.

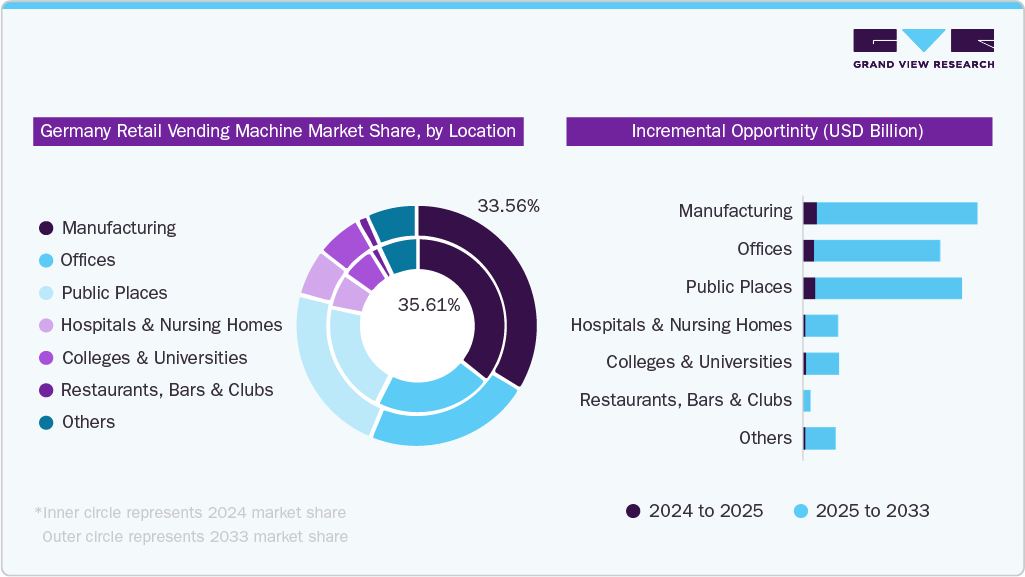

- By location, beverage machines for manufacturing accounted for a market share of 35.61% in 2024.

- By mode of payment, the cashless vending machines held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.86 Billion

- 2033 Projected Market Size: USD 2.90 Billion

- CAGR (2025-2033): 5.1%

Technological integration, such as smart payment systems, is further enhancing user engagement and operational efficiency. The growth of Germany’s retail vending machine industry is primarily driven by rising consumer preference for quick, contactless purchasing experiences, particularly in urban areas and high-traffic zones like airports and train stations. The increasing adoption of cashless payment technologies, along with advancements in AI, IoT, and real-time inventory tracking, is enhancing vending machine efficiency and appeal. Additionally, demand for 24/7 access to snacks, beverages, and essential goods, coupled with labor shortages in traditional retail formats, is prompting businesses to invest in automated retail solutions.

Germany's retail vending machine market is expanding due to the increasing demand for fast, contactless shopping options. Urbanization and changing consumer behavior, especially among younger demographics, have made vending machines a practical choice for on-the-go consumption. Consumers are drawn to the 24/7 availability and convenience of vending machines for products such as snacks, beverages, and personal care items, particularly in transit hubs, office complexes, and educational institutions. This trend was further accelerated by the COVID-19 pandemic, which heightened awareness around hygiene and reduced interpersonal contact.

Technological advancements are a major catalyst for growth. Modern vending machines in Germany are equipped with touchless interfaces, digital screens, and mobile payment options such as Apple Pay, Google Pay, and NFC-enabled cards. These features not only enhance user experience but also streamline inventory management and restocking through IoT integration. For example, refrigerated vending units offering fresh food and ready-to-eat meals are becoming increasingly common in co-working spaces and residential buildings, reducing reliance on traditional retail.

For instance, in May 2023, BettaF!sh and Foodji partnered to launch BettaF!sh TU-NAH, a plant-based tuna alternative, across Germany, coinciding with World Tuna Day on May 2, 2023. The collaboration introduces ready-to-eat sandwiches and salad bowls featuring TU-NAH in Foodji’s vending machines, which are located in offices, airports, train stations, hospitals, and production sites. Emphasizing sustainability, BettaF!sh uses regeneratively cultivated European seaweed, while Foodji leverages AI to reduce food waste. This partnership offers consumers a convenient and eco-friendly meal option throughout Germany.

Retailers and brands are also using vending machines for product sampling and brand visibility. Companies have launched machines that dispense not just food and drinks but also electronics, cosmetics, and even pharmaceuticals. This diversification is helping attract broader demographics. As Germany faces labor shortages in the retail sector, automated vending also serves as a cost-effective solution that ensures consistent service delivery without the need for staffing, supporting its long-term growth trajectory.

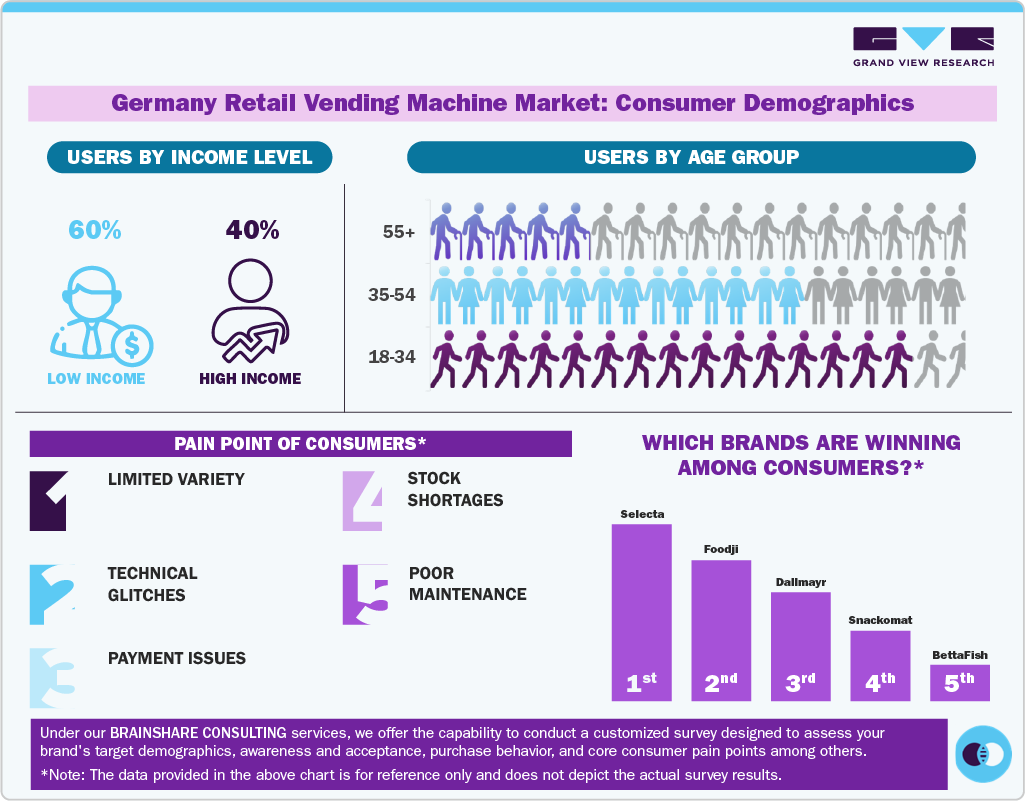

Consumer Insights

Germany’s retail vending machine market shows distinct usage patterns based on income levels. Low-income consumers tend to rely on vending machines for their accessibility and affordability, using them in public transit areas, hospitals, and workplaces. High-income users, while fewer in number, prefer premium and health-oriented offerings often found in smart vending machines located in offices, airports, and urban business districts. Their focus is more on quality, convenience, and sustainability than price.

In terms of age groups, younger consumers are the most frequent users of vending machines, drawn by convenience, speed, and digital-friendly interfaces. They are particularly responsive to machines offering healthier and trend-driven products. Middle-aged professionals also represent a significant user group, especially in work environments, where vending serves as a quick lunch or snack solution. Older consumers show lower engagement, often preferring traditional retail formats or requiring simpler machine interfaces for ease of use.

Despite their growing popularity, vending machines face key consumer pain points. Limited product variety remains a challenge, especially in locations with high footfall. Users also report technical issues, such as touchscreen failures or system lag. Payment-related problems, like non-functional card readers, can hinder purchases. Frequent stockouts and poor machine maintenance further diminish the user experience, affecting satisfaction and repeat usage.

Popular brands in Germany’s vending ecosystem are those that combine strong distribution with innovation. Selecta and Foodji stand out as leaders, with the latter gaining attention for integrating fresh food and AI technology. Other emerging brands include Dallmayr, known for premium coffee, Snackomat, which offers a broad range of snacks and drinks, and BettaF!sh, which promotes sustainable, plant-based alternatives in partnership with smart vending platforms.

Location Insights

Vending machines for manufacturing accounted for a share of 35.61% in 2024. Vending machines in Germany’s manufacturing sector hold a significant share of the Germany vending machine market, due to their role in supporting round-the-clock operations and shift-based work environments. These machines provide quick access to snacks, beverages, and essential items for workers in factories and production sites, minimizing downtime and increasing efficiency. For example, machines stocked with bottled drinks from Gerolsteiner or snacks from brands like Knoppers help meet the needs of workers during breaks, especially in remote or large-scale industrial zones where traditional food service options are limited.

Vending machines for offices is expected to grow at a CAGR of 5.2% from 2025 to 2033. The rise in demand for vending machines in German offices is fueled by increasing demand for convenient, healthy, and time-efficient food and beverage options among employees. As more workplaces prioritize employee well-being and hybrid work models, vending machines offering fresh meals, snacks, and premium coffee, such as those from Foodji or Dallmayr, are becoming standard in office environments. Their ability to operate 24/7 without staffing, digital payment integration, and customizable product offerings makes them an attractive solution for modern, productivity-focused workplaces.

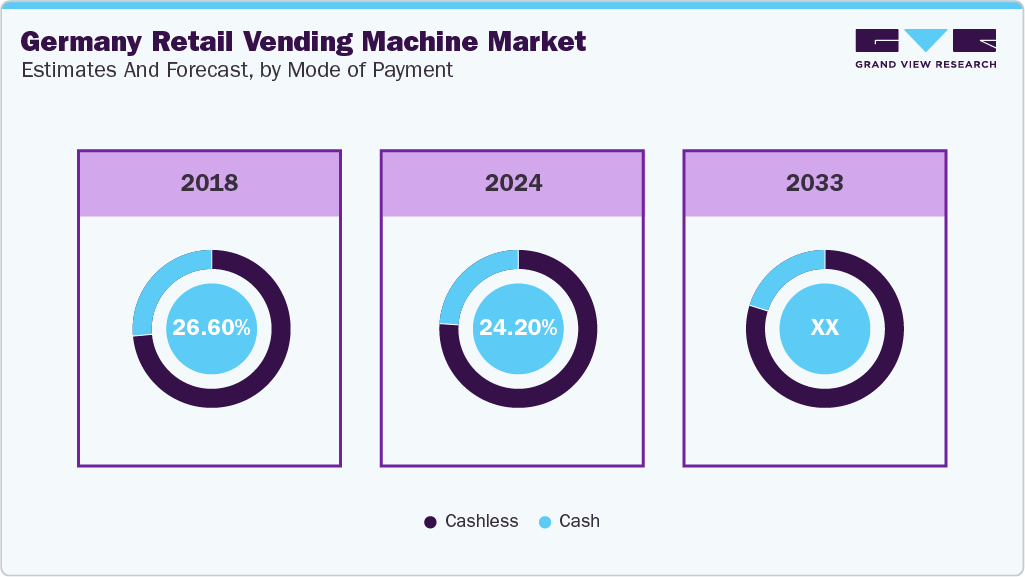

Mode of Payment Insights

Cashless vending machines accounted for a 75.80% market share in 2024, due to the widespread adoption of digital payment methods and consumer preference for speed, hygiene, and convenience. With the rise of contactless payments via debit cards, smartphones, and apps like Apple Pay and Google Pay, users increasingly expect seamless, tap-and-go transactions. This trend accelerated post-pandemic, as hygiene-conscious consumers moved away from cash handling. Operators also benefit from reduced cash-handling costs and improved tracking, making cashless systems the preferred standard across urban offices, transport hubs, and public venues.

The cash vending machine market segment is expected to grow at a CAGR of 7.3% from 2025 to 2033, driven by consumer demand for unique, high-quality, and locally produced beers. Craft breweries offer diverse styles, bold flavors, and creative branding that appeal to younger and more experimental drinkers seeking alternatives to mainstream options. The emphasis on authenticity, small-batch production, and community connection also resonates with modern values around sustainability and supporting local businesses.

Vending machines today operate in both cash and cashless formats, with payment modes often aligning with the type of product offered and the location. Cash vending machines remain common for low-cost items like candy, snacks, and beverages, especially in public places and manufacturing sites. In contrast, cashless machines-accepting cards, mobile payments, or QR codes-are increasingly preferred for higher-value or tech-driven products like electronics, beauty items, pharmaceuticals, and books, typically found in offices, colleges, and airports. The shift toward cashless vending is especially prominent in urban and high-security locations, where convenience and hygiene are key.

Product Insights

Beverage vending machines in Germany accounted for a revenue share of 37.77% in 2024, due to their high demand in transit hubs, workplaces, and public areas where quick, on-the-go refreshment is essential. Consumers frequently purchase bottled water, soft drinks, energy beverages like Red Bull, and ready-to-drink coffees such as Dallmayr or Coca-Cola-owned brands. The ease of access, 24/7 availability, and increasing preference for contactless drink purchases contribute to their consistent performance.

Snacks vending machines in Germany are expected to grow at a CAGR of 5.5% from 2025 to 2033, driven by rising consumer demand for convenient, on-the-go snacking options in workplaces, universities, and transit locations. With changing lifestyles and longer work hours, there’s increased reliance on vending machines for quick access to items like granola bars, nuts, and packaged baked goods. Brands such as Lorenz, Leibniz, and Milka are commonly found in these machines, catering to both traditional tastes and healthier snacking preferences. Additionally, the integration of smart vending technology and expanding product variety are making these machines more appealing across urban and semi-urban regions.

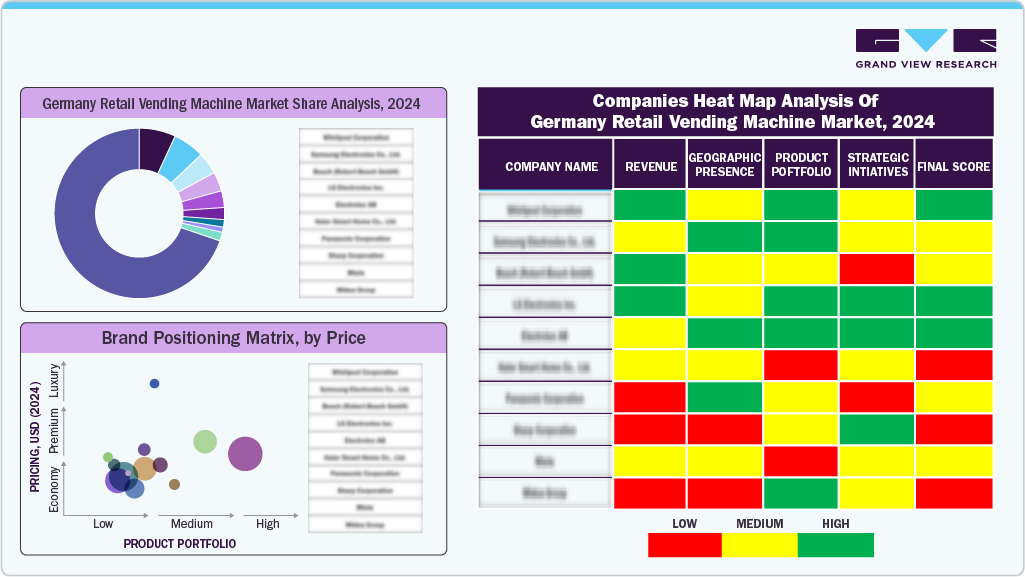

Key Germany Retail Vending Machine Company Insights

The Germany retail vending machine market features a strong presence of established players that benefit from widespread brand recognition, long-standing industry experience, and strategic placement across high-traffic areas. These companies operate vast machine networks in offices, airports, train stations, hospitals, and industrial zones, allowing them to maintain consistent visibility and consumer reach. Their partnerships with local and international food and beverage brands further enhance product variety and appeal.

Competition in the market is fueled by innovation, with companies increasingly adopting smart technologies such as AI-powered inventory tracking, real-time analytics, and digital payment integration.

Companies are aligning their marketing and product development efforts accordingly as consumer expectations evolve, particularly around convenience, nutrition, and sustainability. Investments in targeted promotions, data-driven product curation, and regional customization help brands stay relevant. The market’s competitive dynamics are shaped not only by pricing and scale but also by how well players adapt to changing consumer behaviors and workplace needs.

Key Germany Retail Vending Machine Companies:

- Selecta

- Foodji

- Dallmayr Automatenservice

- Wurlitzer

- Automaten Seitz

- Stüwer GmbH

- Sielaff GmbH

- Rheavendors Servomat

- SandenVendo

- BettaF!sh

Recent Developments

-

In March 2024, DIGGI24 partnered with Invenda, a manufacturer and software company specializing in automated retail devices, to deploy smart vending machines across Germany. These machines, which are fully digitized and equipped with interactive touchscreens and Internet of Things (IoT) technology, are strategically placed in locations such as hotels, universities, and shopping centers. The IoT integration allows for centralized management and automated identification of maintenance needs, leading to efficient maintenance intervals. This collaboration aims to enhance consumer experiences through innovative retail solutions.

Germany Retail Vending Machine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.95 billion

Revenue forecast in 2033

USD 2.90 billion

Growth rate

CAGR of 5.1% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, location, mode of payment

Key companies profiled

Selecta; Foodji; Dallmayr Automatenservice; Wurlitzer; Automaten Seitz; Stüwer GmbH; Sielaff GmbH; Rheavendors Servomat; SandenVendo; BettaF!sh

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Germany Retail Vending Machine Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the Germany retail vending machine market report on the basis of product, location, mode of payment:

-

Product Market Outlook (Revenue, USD Million, 2021 - 2033)

-

Beverages Vending Machines

-

Hot Beverage Vending Machines

-

Cold Beverage Vending Machines

-

-

Snack Vending Machines

-

Food Vending Machines

-

Frozen Vending Machines

-

Tobacco Vending Machines

-

Games/Amusement Vending Machines

-

Beauty & Personal Care Vending Machines

-

Candy & Confectionery Vending Machines

-

Pharmaceuticals Vending Machines

-

Electronics Vending Machines

-

Book & Magazine Vending Machines

-

-

Location Market Outlook (Revenue, USD Million, 2021 - 2033)

-

Manufacturing

-

Offices

-

Colleges & Universities

-

Hospitals & Nursing Homes

-

Restaurants, Bars & Clubs

-

Public Places

-

Others

-

-

Mode of Payment Market Outlook (Revenue, USD Million, 2021 - 2033)

-

Cash

-

Cashless

-

Frequently Asked Questions About This Report

b. The Germany retail vending machine market size was estimated at USD 1.86 billion in 2024 and is expected to reach USD 1.95 billion in 2025.

b. The Germany retail vending machine market is expected to grow at a compound annual growth rate (CAGR) of 5.1% from 2025 to 2033 to reach USD 2.90 billion by 2033.

b. Beverage vending machine accounted for a revenue share of 37.77% in 2024, due to their high demand in transit hubs, workplaces, and public areas where quick, on-the-go refreshment is essential.

b. Some key players operating in the Germany retail vending machine market include Selecta; Foodji; Dallmayr Automatenservice; Wurlitzer; Automaten Seitz; Stüwer GmbH; Sielaff GmbH; Rheavendors Servomat; SandenVendo; BettaF!sh

b. The growth of Germany’s retail vending machine market is primarily driven by rising consumer preference for quick, contactless purchasing experiences, particularly in urban areas and high-traffic zones like airports and train stations. The increasing adoption of cashless payment technologies, along with advancements in AI, IoT, and real-time inventory tracking, is enhancing vending machine efficiency and appeal.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.