- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Glass Flake Coatings Market Size & Share Report, 2030GVR Report cover

![Glass Flake Coatings Market Size, Share & Trends Report]()

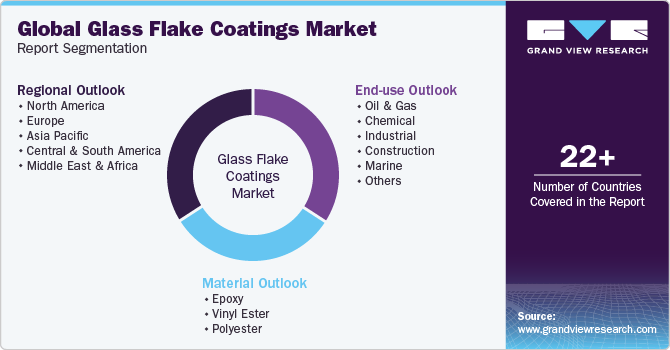

Glass Flake Coatings Market (2023 - 2030) Size, Share & Trends Analysis Report By Material (Epoxy, Vinyl Ester, Polyester), By End-use (Oil & Gas, Chemical, Industrial, Construction, Marine), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-142-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Glass Flake Coatings Size & Trends

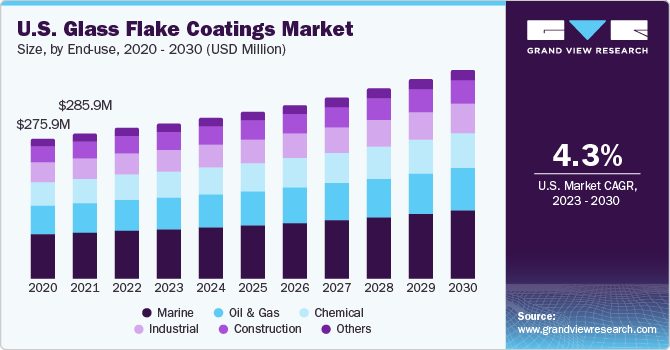

The global glass flake coatings market size was estimated at USD 1.75 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 4.45% from 2023 to 2030. The rapid growth of the petrochemical, construction, and marine industries is driving the growth of the glass flake coatings industry. The U.S. market has experienced strong growth in recent years, with several factors driving this expansion. The rise in demand for glass flake coatings in various industries such as oil and gas, construction, marine, and automotive in the country is expected to drive market growth during the projection period. These coatings offer high corrosion and chemical resistance to the product, as well as durability, making it suitable for several applications.

Glass flake coatings are used to decrease moisture, oil, and vapor. Epoxy coatings are used for a variety of purposes, ranging from strong adhesive to long-lasting paint and coating for floors and metals. The country is predicted to drive demand for glass flake coatings, which is expected to propel the growth of the market over the forecast period.

The increasing R&D projects and industrialization in the country, are projected to fuel the growth of the market in the U.S. over the forecast period. Moreover, the rise in continued research, development, demonstration, and deployment of technologies to eliminate impediments to the widespread usage of coatings in the country is likely to drive market growth in the forecast period.

End-use Insights

Based on end-use, the marine industry segment held the largest market revenue share of over 31.50% in 2022. The rise of global trade and offshore energy production has developed marine infrastructure such as offshore drilling rigs, ports, and wind farms. These factors are likely to drive the growing use of glass flake coatings in several kinds of marine applications, thus propelling market growth in the coming years.

The glass flake coatings industry is expanding due to its capacity to provide corrosion protection, cost savings, durability, and environmental compliance. Owing to their characteristics including high tensile strength, and high resistance to water and temperatures, these coating solutions offer protection to maritime vessels and structures against erosion, fouling, abrasion, salinity, air, and UV damage.

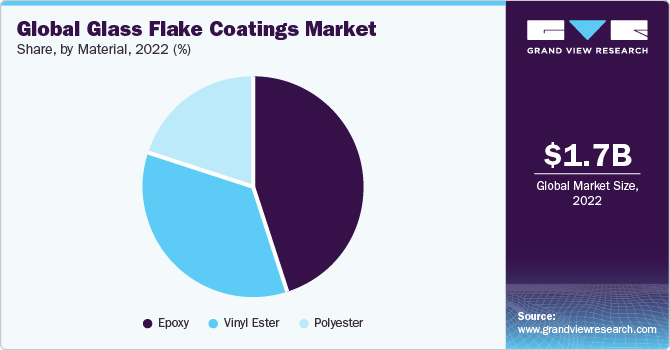

Material Insights

Based on material, the epoxy segment held the largest revenue share of over 44% in 2022. The rise in the development and maintenance of infrastructure projects such as bridges, pipelines, and storage tanks is expected to boost the demand for epoxy in the glass flake coatings industry.

Moreover, the increased usage of epoxy-based glass flake coatings in pipe coating, tank lining, and ballast tank coating has contributed to the expansion of this industry. Glass flake epoxy is extensively used in the offshore oil and gas sector, particularly in high-aggressive splash zones. During the assessment period, the expanding offshore oil & gas industry due to rapidly growing energy consumption is expected to drive strong demand for glass flake coatings in projects.

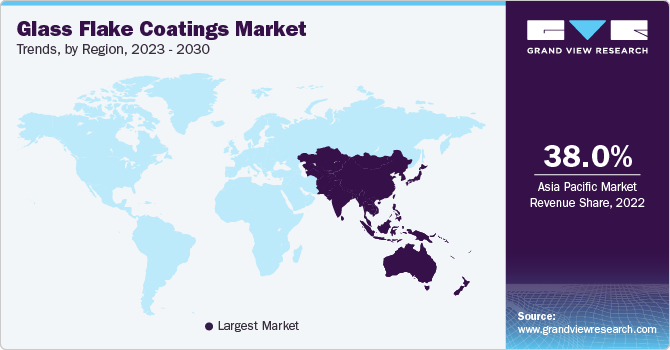

Regional Insights

Asia Pacific led with the highest regional share of over 38% in 2022 in the market. Rapid urbanization and infrastructural progress in economies such as China and India are fueling the demand for coatings. Furthermore, the region has a substantial maritime industry, which is expected to create demand for coatings that offer strong corrosion protection in saltwater environments.

The growth in the automotive industry across the region is likely to boost the market. Glass flake coatings are widely used in the automotive sector, mainly for corrosion prevention and increased durability. Glass flake coatings are extremely resistant to corrosion, making them an excellent choice for underbody protection and other exposed vehicle components.

Moreover, Europe is expected to grow at a significant rate in the coming years. The European government has a strong commitment to infrastructure development, with plans for significant investments in sectors such as transportation, electricity, and water management. The increased number of infrastructure projects and the rehabilitation of existing structures are likely to increase demand for protective coatings, such as glass flake coatings, to improve durability and extend the lifespan of these assets.

Key Companies & Market Share Insights

The global market is highly competitive due to the presence of major industries across the region as these companies are comparatively concentrated and fiercely competitive along with acquisitions, mergers, and collaborations.For Instance, in July 2023, Akzo Nobel N.V. announced the establishment of a new Research and Development Center in High Point, North Carolina. The company is developing the new R&D center's capabilities to combine research for solvent-based and aqueous products and accelerate innovation in the performance coatings sector.

Key Glass Flake Coatings Companies:

- Akzo Nobel N.V.

- Hempel A/S

- PPG Industries, Inc.

- KCC Corporation

- Kansai Paint Co., Ltd.

- Berger Paints India Limited

- The Sherwin-Williams Company

- Jotun A/S

- Deccan Mechanical & Chemical Industries Pvt. Ltd

Glass Flake Coatings Market Report Scope

Report Attribute

Details

Market size volume in 2023

USD 1.80 billion

Volume forecast in 2030

USD 2.44 billion

Growth rate

CAGR of 4.45% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, end-use, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain, Netherlands; China; India; Japan; South Korea; Australia; Malaysia; Singapore; Thailand; Vietnam; Brazil; Argentina; Saudi Arabia, UAE, South Africa

Key companies profiled

Akzo Nobel N.V.; Hempel A/S; PPG Industries Inc.; KCC Corporation; Kansai Paint Co., Ltd.; Winn & Coales (Denso) Ltd; Berger Paints India Limited; The Sherwin-Williams Company; Jotun A/S; Deccan Mechanical & Chemical Industries Pvt. Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Glass Flake Coatings Market Report Segmentation

This report forecasts revenue & volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. Forthis study, Grand View Research has segmented the global glass flake coatings market report based on material, end-use, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Epoxy

-

Vinyl Ester

-

Polyester

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Chemical

-

Industrial

-

Construction

-

Marine

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Malaysia

-

Singapore

-

Thailand

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global glass flake coatings market size was estimated at USD 1.75 billion in 2022 and is expected to reach USD 1.80 billion in 2023.

b. The global glass flake coatings market is anticipated to propel at a growth rate of 4.45% from 2023 to 2030 to reach USD 2.44 billion by 2030.

b. Epoxy, under material type segmentation, accounted for the highest market share across the glass flake coatings market. The rise in development and maintenance of infrastructure projects such as bridges, pipelines, and storage tanks is expected to boost the demand for epoxy in glass flake coatings market.

b. The key global players across the glass flake coatings market include Akzo Nobel N.V. , Hempel A/S , PPG Industries, Inc. , KCC Corporation, Kansai Paint Co.,Ltd., Winn & Coales (Denso) Ltd, Berger Paints India Limited, The Sherwin-Williams Company, Jotun A/S, Deccan Mechanical & Chemical Industries Pvt. Ltd

b. The rapid expansion of the construction, petrochemical, marine, and shipbuilding industries is fueling the growth of the glass flake coatings market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.