- Home

- »

- Semiconductors

- »

-

Glass-reinforced Substrate Market, Industry Report, 2033GVR Report cover

![Glass-reinforced Substrate Market Size, Share & Trends Report]()

Glass-reinforced Substrate Market (2025 - 2033) Size, Share & Trends Analysis Report By Substrate Type (Glass-reinforced Polyimide, Glass-reinforced Cyanate Ester), By Application, By Thickness, By End-use Industry, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-668-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Glass-reinforced Substrate Market Summary

The global glass-reinforced substrate market size was estimated at USD 1.12 billion in 2024, and is projected to reach USD 1.55 billion by 2033, growing at a CAGR of 3.8% from 2025 to 2033. This steady growth is attributed to the increasing adoption of high-performance substrates in automotive electronics, 5G infrastructure, and advanced consumer electronics.

Key Market Trends & Insights

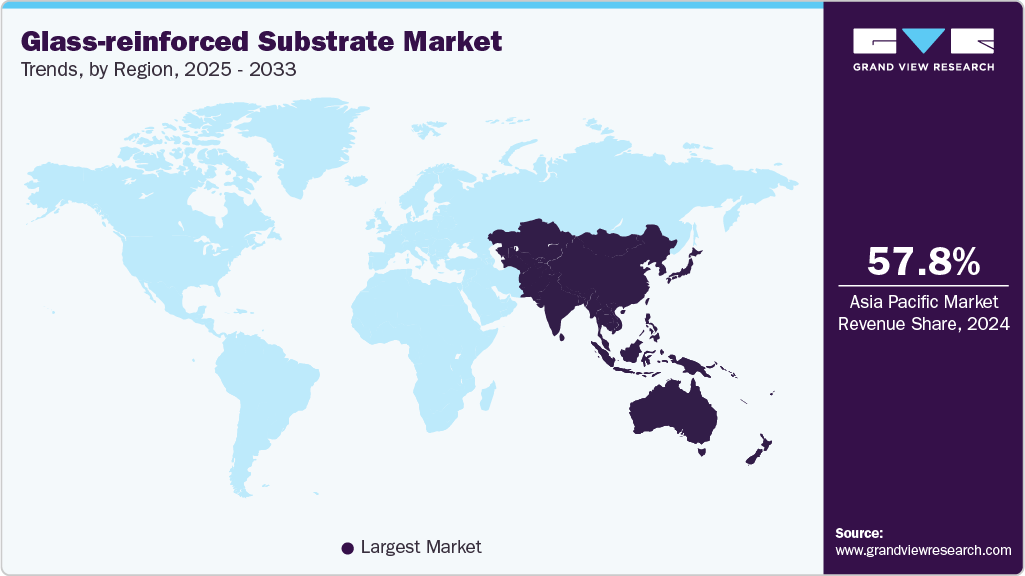

- Asia Pacific accounted for a 57.8% share of the overall global market in 2024.

- The glass-reinforced substrate industry in China held a dominant position in 2024.

- By substrate type, the glass-reinforced epoxy laminates segment accounted for the largest share of 44.7% in 2024.

- By application, the printed circuit boards (PCBs) segment held the largest market share in 2024.

- By thickness, the 0.1 mm - 0.5 mm segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.12 Billion

- 2033 Projected Market Size: USD 1.55 Billion

- CAGR (2025-2033): 3.8%

- Asia Pacific: Largest market in 2024

Glass-reinforced substrates offer superior mechanical strength, thermal stability, and dimensional reliability, making them ideal for miniaturized and high-frequency electronic devices. Moreover, as manufacturers transition toward lightweight and durable materials, the demand for glass-reinforced substrates is expected to expand across both emerging and developed economies.The growing need for low-loss materials in 5G and future 6G infrastructure has led to the increasing adoption of glass-reinforced substrate in high-frequency electronic packages. According to the National Institute of Standards and Technology (NIST), these substrates offer exceptional performance in millimeter-wave applications due to their dielectric stability and thermal endurance. As global telecom OEMs develop higher-bandwidth modules, the material’s superior signal integrity is boosting the market, especially for radar, defense, and wireless base station technologies.

As electronic devices shrink and operating temperatures rise, maintaining thermal and mechanical stability has become critical. The International Electronics Manufacturing Initiative (iNEMI), supported by federal programs, identifies glass-reinforced substrate as a key enabler for advanced PCBs requiring low coefficients of thermal expansion (CTE) and high glass transition temperatures (Tg). Its ability to resist warpage under high-density integration is propelling the market growth, especially in automotive electronics and aerospace systems.

National-level investments such as the U.S. CHIPS and Science Act have allocated billions to rebuild domestic capabilities in semiconductor packaging. NIST highlights the importance of supporting pilot manufacturing lines specifically for advanced materials like glass-reinforced substrate. These funding efforts are directly boosting the market by encouraging substrate innovation, reducing reliance on imports, and supporting scalable production infrastructure in North America.

The rising adoption of 3D chiplet architectures in AI processors and cloud infrastructure has led to the widespread use of Glass-Reinforced Substrate for its dimensional stability and fine-line routing capabilities. Supported by the Semiconductor Research Corporation (SRC), research shows that glass-based substrates outperform traditional organic materials in co-packaged optics and heterogeneous integration. Their enhanced alignment accuracy and thermal control are propelling the market growth, particularly for cutting-edge data centers and defense-grade processors.

The development of Through-Glass Via (TGV) technology has unlocked new applications in RF communication, photonics, and sensor packaging. According to the U.S. Department of Energy (DOE), TGV-enabled glass-reinforced substrate offers a cost-effective alternative to silicon interposers, with reduced warpage and improved electrical performance. These process innovations are boosting the market by enabling compact and efficient systems for 5G antenna arrays, LiDAR modules, and optical sensors.

Substrate Type Insights

The glass-reinforced epoxy laminates segment accounted for the largest share of 44.7% in 2024. Glass-reinforced epoxy laminates, especially FR-4 grade, remain the dominant substrate type due to their cost efficiency and wide availability. Their balance of mechanical strength and electrical insulation is increasingly leveraged in consumer and industrial electronics. The trend toward miniaturization of devices in emerging markets has pushed OEMs to standardize on epoxy-based substrates, boosting the market as new product designs in wearables, IoT modules, and handheld tools continue to rely on this mature technology.

The glass-reinforced cyanate ester segment is expected to grow at the fastest CAGR during the forecast period. The high glass transition temperature and low dielectric constant of glass-reinforced cyanate ester substrates make them ideal for mission-critical applications such as aerospace navigation systems and supercomputing. These substrates resist moisture absorption and thermal cycling far better than traditional materials. With increasing investments in advanced defense electronics and quantum computing across North America and Europe, cyanate ester-based glass substrates are propelling the market growth, despite their relatively higher cost.

Application Insights

The printed circuit boards (PCBs) segment held the largest share in 2024. The proliferation of multi-layer PCBs in smart devices, EVs, and industrial automation is fueling sustained demand for Glass-Reinforced Substrate. As PCBs now require higher heat resistance and dimensional stability, glass-reinforced variants have become the go-to solution. Particularly in mobile and wearable electronics, these substrates are boosting the market by supporting thin, compact, and energy-efficient device architectures.

The IC packaging substrates segment is expected to grow at the fastest CAGR during the forecast period. The rise of chiplet-based SoCs and high-performance computing has spotlighted IC packaging substrates that can handle finer pitch and thermal gradients. Glass-Reinforced Substrate materials are increasingly adopted in advanced IC packages due to their low CTE, high rigidity, and compatibility with Through-Glass Via (TGV) structures. This segment is propelling the market growth as foundries and OSAT players shift toward next-gen 2.5D/3D integration formats.

Thickness Insights

The 0.1 mm - 0.5 mm segment dominated the market in 2024. The 0.1 mm - 0.5 mm thickness range offers the best trade-off between flexibility and mechanical stability. These glass-reinforced substrate types dominate mid-range smartphone PCBs, EV control boards, and industrial automation modules. Their compatibility with multilayer constructions and reflow soldering processes makes them indispensable in volume manufacturing, propelling the market growth across Asia-Pacific's manufacturing hubs.

The ≤ 0.1 mm segment is projected to grow at the fastest CAGR over the forecast period. Thin glass-reinforced substrate sheets ≤ 0.1 mm-are enabling the development of ultra-slim products, especially in foldable smartphones, compact sensors, and medical electronics. Manufacturers favor these ultra-thin formats for their flexibility and light weight. As the trend of reducing device footprint continues across Asia-Pacific and North America, these substrates are boosting the market with niche yet high-value applications.

End-use Industry Insights

The consumer electronics segment dominated the market in 2024 and is projected to grow at a significant CAGR over the forecast period. In smartphones, smartwatches, and AR/VR headsets, the demand for thinner, lighter, and more durable circuits is leading to widespread adoption of Glass-Reinforced Substrate. Their role in enabling compact PCB stacking, thermal control, and signal integrity is boosting the market, particularly as major OEMs release multiple product lines annually.

The telecommunications segment is projected to grow at the fastest CAGR over the forecast period. As telecom infrastructure modernizes for 5G and beyond, the industry’s preference for substrates that can handle mmWave frequencies and large thermal loads is accelerating. Glass-reinforced substrate is critical for base stations, RF modules, and antennas due to its signal integrity and mechanical reliability. The global push for network densification and edge computing is propelling the market growth through massive investments in telecom hardware.

Regional Insights

North America glass-reinforced substrate market accounted for a 19.2% share of the overall market in 2024 and is projected to grow at a significant CAGR over the forecast period. Across North America, particularly in the U.S., a wave of infrastructure rehabilitation is driving demand for glass-reinforced substrate materials. Federal agencies like the U.S. Army Corps of Engineers and the Federal Highway Administration are increasingly turning to these composites for bridge reinforcements and wastewater treatment systems, citing their excellent corrosion resistance and long-term durability. As older infrastructure undergoes modernization, the use of glass-reinforced components in structural applications is steadily boosting the market throughout the region.

U.S. Glass-reinforced Substrate Market Trends

The glass-reinforced substrate industry in the U.S. held a dominant position in 2024.The U.S. is witnessing a significant transformation in semiconductor supply chain localization. Under the CHIPS and Science Act, the federal government has allocated over USD 50 billion to revive domestic semiconductor manufacturing and packaging. As noted in NIST’s 2023 Packaging R&D Gap report, Glass-Reinforced Substrate is identified as a critical material for next-generation IC packaging and 2.5D/3D interposers, particularly in applications requiring low CTE and high thermal stability. With pilot lines being funded across the country, the integration of these substrates into high-frequency chiplet designs is propelling the market growth in the U.S. semiconductor ecosystem.

Europe Glass-reinforced Substrate Market Trends

The glass-reinforced substrate market in Europe is growing as the region’s Important Project of Common European Interest (IPCEI) on microelectronics has accelerated funding for R&D in advanced substrates, packaging materials, and interconnects. The EU Chips Act, introduced to enhance regional self-sufficiency, places emphasis on substrates compatible with fan-out and chiplet packaging. In this environment, Glass-Reinforced Substrate is gaining traction due to its thermal uniformity and suitability for precision etching, especially in advanced RF, radar, and 5G chip modules. These regulatory and industrial collaborations are actively boosting the market across EU member states.

Germany glass-reinforced substrate market is driven by firms like Infineon and Bosch, creating a fertile landscape for substrate innovation. The Federal Ministry for Economic Affairs and Climate Action (BMWK) is investing in localized packaging capabilities, with a strong focus on high-reliability IC substrates. Glass-Reinforced Substrate is emerging as a material of choice for use in power modules, radar systems, and advanced driver-assistance systems (ADAS), where mechanical stability under thermal load is critical. These applications are propelling the market growth in the German semiconductor backend segment.

The glass-reinforced substrate market in the UK is growing as government-funded R&D hubs such as UKRI and Innovate U.K. are exploring packaging materials for AI processors and quantum computing chips. Several collaborative efforts, supported by the Department for Science, Innovation and Technology (DSIT), are testing Glass-Reinforced Substrate for quantum-safe IC interconnects and cryogenic environments. Its high dielectric stability and compatibility with through-glass via (TGV) processes are boosting the market, particularly within university spinouts and deep-tech fabs.

Asia Pacific Glass-reinforced Substrate Market Trends

The glass-reinforced substrate market in Asia Pacific dominated the global market and is expected to grow at the fastest CAGR from 2025 to 2030. Asia-Pacific remains the global hub for semiconductor manufacturing, with Taiwan, South Korea, China, and Japan dominating front- and back-end processes. Across APAC, demand for Glass-Reinforced Substrate is rising sharply in IC packaging and high-frequency RF modules, as device miniaturization and power efficiency become priorities. Regional packaging powerhouses are expanding fan-out and panel-level packaging capacities, which require thermally stable, high-density substrates. These trends are collectively propelling the market growth throughout APAC.

China’s 14th Five-Year Plan and “Made in China 2025” initiative have prioritized semiconductor independence, including backend packaging. State-supported facilities are now integrating Glass-Reinforced Substrate in RF front-end modules and chiplet-based processors for telecom and AI applications. With national subsidies encouraging domestic alternatives to imported substrate tech, localized production and use of glass-reinforced materials are steadily boosting the market.

Japan’s Ministry of Economy, Trade and Industry (METI) supports advanced IC packaging through strategic R&D grants. Institutions such as AIST and the University of Tokyo are advancing Glass-Reinforced Substrate research for use in 3D ICs, co-packaged optics, and photonic interposers. These technologies require fine-line signal integrity and thermal uniformity, both of which are strengths of glass-reinforced materials, thus propelling the market growth in Japan’s semiconductor innovation clusters.

Key Glass-reinforced Substrate Companies Insights

Key players operating in the glass-reinforced substrate market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Glass-reinforced Substrate Companies:

The following are the leading companies in the glass-reinforced substrate market. These companies collectively hold the largest market share and dictate industry trends.

- AGC Inc.

- Corning Incorporated

- Dai Nippon Printing Co., Ltd.

- Nippon Electric Glass Co., Ltd.

- Ohara Inc.

- PLANOPTIK AG

- Samtec

- Schott AG

- Shin-Etsu Chemical Co., Ltd.

- SKC

Recent Developments

-

On August 30, 2024, SCHOTT AG launched low-loss glass tailored for high-frequency semiconductor Applications, featuring a dielectric constant (εᵣ = 4.0) and ultra-low loss tangent (tan δ = 0.0021 at 10 GHz). Demonstrated at SEMICON Taiwan, this breakthrough targets advanced packaging in 5G/6G, RF, and high-speed digital domains where signal integrity is critical.

-

In January 2025, AGC Inc. introduced an ultra-thin, 30 μm glass substrate with embedded passive components, designed to streamline fan-out wafer-level and chiplet packaging. The innovation improves form factor, signal performance, and thermal management for next-gen AR/MR and consumer devices.

Glass-reinforced Substrate Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.15 billion

Revenue forecast in 2033

USD 1.55 billion

Growth rate

CAGR of 3.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Substrate type, application, thickness, end-use industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

AGC Inc.; Corning Incorporated; Dai Nippon Printing Co., Ltd.; Nippon Electric Glass Co., Ltd.; Ohara Inc.; PLANOPTIK AG; Samtec; Schott AG; Shin-Etsu Chemical Co., Ltd.; SKC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Glass-reinforced Substrate Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global glass-reinforced substrate market report based on substrate type, application, thickness, end-use industry, and region.

-

Substrate Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Glass-Reinforced Epoxy Laminates

-

Glass-Reinforced BT (Bismaleimide Triazine) Resin

-

Glass-Reinforced Polyimide

-

Glass-Reinforced Cyanate Ester

-

Glass-Reinforced PTFE

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Printed Circuit Boards (PCBs)

-

IC Packaging Substrates

-

RF & Microwave Components

-

Automotive Electronic Modules

-

Display Panels

-

Others

-

-

Thickness Outlook (Revenue, USD Million, 2021 - 2033)

-

≤ 0.1 mm

-

0.1 mm - 0.5 mm

-

0.5 mm - 1 mm

-

1 mm

-

-

End-use Industry Outlook (Revenue, USD Million, 2021 - 2033)

-

Consumer Electronics

-

Automotive

-

Telecommunications

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global glass-reinforced substrate market size was estimated at USD 1.12 billion in 2024 and is expected to reach USD 1.15 billion in 2025.

b. The global glass-reinforced substrate market size is expected to grow at a significant CAGR of 3.8% to reach USD 1.55 billion in 2033.

b. Asia Pacific held the largest market share of 57.8% in 2024. Asia-Pacific remains the global hub for semiconductor manufacturing, with Taiwan, South Korea, China, and Japan dominating front- and back-end processes. Across APAC, demand for Glass-Reinforced Substrate is rising sharply in IC packaging and high-frequency RF modules, as device miniaturization and power efficiency become priorities.

b. Some of the players in the glass-reinforced substrate market are AGC Inc., Corning Incorporated, Dai Nippon Printing Co., Ltd., Nippon Electric Glass Co., Ltd., Ohara Inc., PLANOPTIK AG, Samtec, Schott AG, Shin-Etsu Chemical Co., Ltd., and SKC.

b. The key driving trend in the glass-reinforced substrate market is the growing integration of electronic functionality into structural materials, particularly through smart composite development and embedded electronics in sectors like consumer electronics and automotive.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.