- Home

- »

- Communication Services

- »

-

Roaming Tariff Market Size & Share Analysis Report, 2030GVR Report cover

![Roaming Tariff Market Size, Share & Trends Report]()

Roaming Tariff Market (2023 - 2030) Size, Share & Trends Analysis Report By Roaming Type (National, International), By Distribution Channel, By Service (Voice, Data), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-711-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Roaming Tariff Market Summary

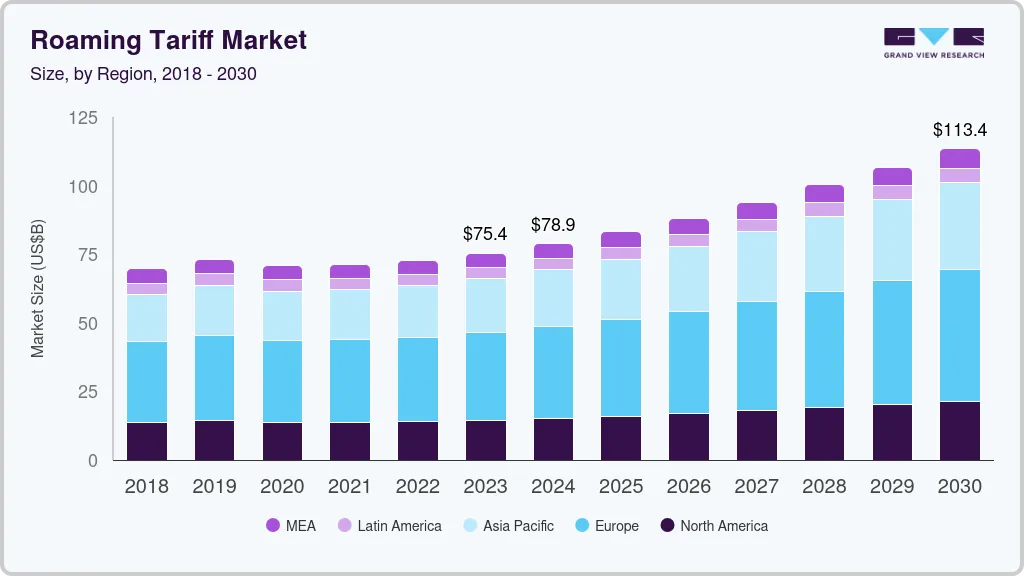

The global roaming tariff market size was estimated at USD 72,652.2 million in 2022 and is projected to reach USD 113,405.9 million by 2030, growing at a CAGR of 6% from 2023 to 2030. Some major factors driving the growth of the roaming tariff industry include the adoption of 3G, 4G, and 5G networking, increasing smartphone adoption, and rising international tourism, among others.

Key Market Trends & Insights

- Europe dominated the market and accounted for a 42.29% share of global revenue in 2022.

- Country-wise, Mexico is expected to register the highest CAGR from 2023 to 2030.

- By roaming type, the international roaming segment is expected to witness the highest CAGR during the forecast period.

- By distribution channel, the wholesale segment is expected to occupy the largest share and is expected to register the highest CAGR during the forecast period

Market Size & Forecast

- 2022 Market Size: USD 75,354.9 Million

- 2030 Projected Market Size: USD 113,405.9 Million

- CAGR (2023-2030): 6%

- Europe: Largest market in 2022

Furthermore, increasing adoption of high-end mobile devices enabled with 3G, and 4G networking capabilities are also expected to drive market growth. Similarly, the emergence of 5G roaming services is also anticipated to power the development of the roaming tariff industry. Additionally, owing to intense competition among key players, companies are engaged in introducing international roaming packages to maintain their customer base since customers switch from one service provider to the other due to price differentiation. These factors are expected to fuel market growth.Roaming enables users to use their mobile devices outside the geographical coverage that home network operators provide. Roaming tariffs are the extra charges roamers pay when entering a foreign network. The additional charges are paid for various roaming services, such as SMS, data, and voice. Multiple factors are anticipated to fuel the growth of the roaming tariff industry. The rising development of mobile phone users, the growing popularity of 3G and 4G-enabled smartphones increasing unique subscribers, and mobile internet penetration are anticipated to positively impact the market growth over the forecast period.

Although international tourism has been a major contributor to the growth of the roaming tariff industry, a free trade agreement between various countries across the globe is expected to decelerate the growth of the roaming tariff industry. For instance, in January 2023, Brazil announced the scrapping of roaming charges for visitors to Chile by end of January 2023. This move comes as promised by a free trade agreement between the 2 countries. The mobile operators and MVNOs which offer international roaming services to users who are passing through Chile will be compelled to supply with the same tariff price as offered in Brazil.

Faster modes of transportation, which are also cost-effective, have paved the way for an increase in tourism, especially internationally. According to the United Nations World Tourism Organization (UNWTO), international tourist arrivals had tripled from January to July 2022, by 172%, compared to the same period in 2021. Increased tourism is a direct fuel to accelerating the growth of the market.

The companies in the roaming tariff industry are also coming up with initiatives targeting the tourist audience, which has also been able to drive the growth of the market. For instance, in December 2022, Bharti Airtel Ltd. Launched a new international roaming plan as part of the service caller, “World Pass” for both prepaid and postpaid users. The plan will be valid in 184 countries, with several international roaming plans.

An increase in purchasing power of the general public, especially in growing economies, has enabled the adoption of smartphones and other services. For instance, according to World Bank, the GDP per capita in Mexico in 2021 was USD 9,926.4, which increased from USD 8,431.7 in 2020. With the increase in purchasing power, the public will adopt new/better services, enabling the growth of all markets in general. Increased purchasing power, combined with increased smartphone availability and a wide variety of network services, will drive the development of the market during the forecast period.

The large number of companies in the roaming tariff industry, which operate in multiple countries, enables the adoption of network services even in countries located in remote parts of the world. For instance, Telefonica SA offers network services to countries such as Spain, Germany, and the U.K. among others. Additionally, the company has maintained strategic partnership agreements with service providers across more than 170 countries.

Similarly, Vodafone Group Plc. has business across 21 operating countries, moreover, the company has a partnership agreement with local operators in 47 countries, and 168 countries with 4G roaming services. Companies in the market operating across a large number of countries have also been fueling the growth of the market during the forecast period.

Roaming Type Insights

The market is expected to witness growth in developed and developing countries during the forecast period. For instance, in the U.S., national and international roaming shares are growing owing to the presence of key players such as T‑Mobile USA, Inc. and Verizon Communications, Inc. These key players must sign national roaming agreements to offer international roaming services globally.

Several Middle Eastern countries have many foreign nationals, resulting in a large percentage of calls roaming. Moreover, countries that witness a high number of tourists, such as UAE and other Middle Eastern countries, are more likely to invest highly in enhancing roaming services and network capacity, resulting in market growth.

The international roaming segment is expected to witness the highest CAGR during the forecast period. The growth of the international roaming segment can be attributed to the presence of major companies, which have been coming up with several packages targeting tourists/International travelers.

For instance, in December 2022, Vodafone Idea launched a new international roaming pack, which does not have speed throttling issues. The international roaming pack for postpaid users offers 24-hour to 28-day validity, with no data limit for popular travel destinations. Such initiatives have been on the rise, which has been a major contributor to the growth of the international roaming type segment during the forecast period.

Distribution Channel Insights

The companies have been cutting down wholesale roaming charges, especially for the invasion of Ukraine in February 2022. This has enabled wider adoption of network services provided by such companies, which has paved the way for market growth in the coming years.

For instance, in April 2022, Deutsche Telekom AG along with other European telecom companies announced the cutting down of wholesale roaming charges for 3 months levied on Ukrainian peers. This move is aimed at helping Ukrainian refugees to get in touch with their families. From a marketing standpoint, this would help in attracting much more customers to the respective telecom network, which would help in the growth of the wholesale segment of the roaming charges market by distribution channel during the forecast period.

The wholesale segment is expected to occupy the largest share and is expected to register the highest CAGR during the forecast period. The wholesale roaming process has been evolving through advancement in the latest technologies such as blockchain helps in improving network efficiency, and reducing roaming costs among others, contributing to the growth of the wholesale segment during the forecast period.

In June 2021, GSMA announced the commercial availability of a blockchain network for roaming and settlement, “GSMA eBusiness Network” The blockchain network is capable of supporting a wide range of operator business requirements. This blockchain network was made available through collaborative research between GSMA and 6 major mobile operators.

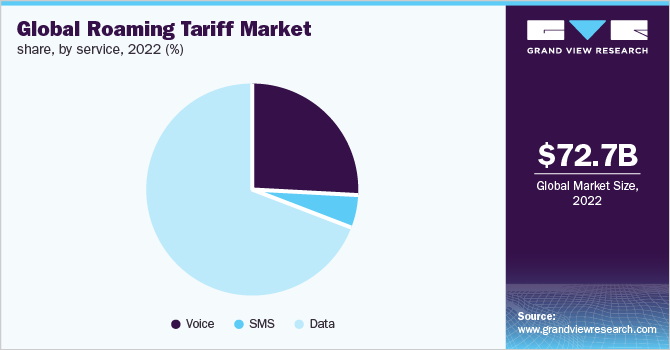

Service Insights

The data segment is projected to occupy the largest share by 2030. The growth of the data segment can be attributed to the presence of a large number of companies that are offering data roaming services, across several countries. For instance, in April 2022, SWAN (Slovakian telecommunication operators) launched 5G roaming services across 7 European Union countries.

According to the company, the 4G users will be able to use faster data in the 5G network in EU countries which are Poland, Greece, Ireland, Malta, Romania, Italy, and Austria. Already major market players offer 4G data roaming services across several countries, however, companies coming up with 5G data roaming services have further accelerated the growth of the data segment during the forecast period.

The voice segment is expected to occupy a significant share of the market by 2030. Many companies have been coming up with roaming charge waiver schemes targeting both voice and SMS segments, which could decelerate the growth of the market. However, some of these schemes have been successful in attracting customers to the respective network service.

For instance, in December 2022, T‑Mobile USA, Inc. (U.S.-based telecommunication provider) announced the extension of the waving international and long-distance roaming charges for SMS and calls which are being made to/from Ukraine and the U.S. till January 31, 2023. This waiver would be applicable only for Sprint, and T-Mobile postpaid businesses and consumers, along with T-Mobile prepaid customers.

Although such a move would decelerate the market growth for a short while, however, the companies are attracting a high number of customers, moreover, the companies will be forced to pull out of such schemes at some point in time, which would eventually result in a high number of customers, who would be charged for roaming services later.

Regional Insights

Asia Pacific region is expected to register the highest CAGR during the forecast period. The growth can be attributed to multiple factors such as a rise in the number of international tourists, cheaper roaming charges, presence of global companies among others. However, some underlying factors have pushed the growth of the Asia Pacific region in the market such as the expansion of network coverage by local telecommunication providers.

For instance, in October 2021, Maxis Berhad (a Malaysian telecommunication operator) announced its expansion of 5G roaming services across 29 countries, which enables travelers to enjoy high-speed connectivity in foreign countries. The company first expanded the 5G roaming services to countries such as Singapore, Thailand, and Indonesia. Such strategic initiatives would aid in increasing international tourism in the respective country, which would benefit the development of the market.

Europe dominated the market and accounted for a 42.29% share of global revenue in 2022. The Europe region is expected to have significant growth in the roaming tariff industry owing to the market-friendly regulation coming from European Union. The'Roam-like-at-home' relegation which was announced in 2017 by the European Commission has helped reduce the trend of switching off mobile while traveling, by reducing the roaming charges for the public periodically traveling in the European Union.

Moreover, the European Commission in July 2022, announced the extension of the 'Roam-like-at-home' regulations for telecom operators until 2032, enabling travelers in the EU to call, surf, and text abroad without extra charges. This new move will be much beneficial for businesses and citizens in the EU. Additionally, the new regulation also improves access to emergency communication across European Union without any extra charges. This new regulation is expected to boost the growth of the Europe region during the forecast period.

Key Companies & Market Share Insights

The key market players engage in several inorganic growth strategies, such as mergers & acquisitions, partnerships, and geographical expansion, to stay afloat in the competitive market. For instance, in August 2022, T‑Mobile USA, Inc. partnered with SpaceX, aimed at using the company’s Starlink satellite for providing mobile networks for users in remote areas.

Reduced prices of roaming tariffs have resulted in increased price competition among key operating players. To provide an improved customer experience, companies offer digital solutions that provide bundled solutions to their customers.

Moreover, the companies have also been involved in partnerships for offering 5G services. For instance, in December 2022, Advanced Micro Devices, Inc announced a collaboration with VIETTEL for 5G mobile network expansion. VIETTEL had been using AMD radio technology with 4G deployments, but the new collaboration is aimed at accelerating new networks via 5G remote radio heads. Some prominent players in the global roaming tariff market include:

-

America Movil

-

AT&T Inc.

-

Bharti Airtel Ltd.

-

China Mobile Ltd.

-

Deutsche Telekom AG

-

Digicel Group

-

T-Mobile (Sprint Corporation)

-

Telefonica SA

-

Verizon Communications Inc.

-

Vodafone Group plc

Roaming Tariff Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 75,354.9 million

Revenue forecast in 2030

USD 113,405.9 million

Growth Rate

CAGR of 6.0 % from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Roaming type, distribution channel, service, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; Brazil; Mexico

Key companies profiled

America Movil; AT&T, Inc.; Bharti Airtel Ltd.; China Mobile Ltd.; Deutsche Telekom AG; Digicel Group; T-Mobile (Sprint Corporation); Telefonica SA; Verizon Communications, Inc.; Vodafone Group plc

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Roaming Tariff Market Segmentation

The report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global roaming tariff market report based on roaming type, distribution channel, service, and region:

-

Roaming Type Outlook (Revenue, USD Million, 2018 - 2030)

-

National

-

International

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail Roaming

-

Wholesale Roaming

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Voice

-

SMS

-

Data

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Rest of Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Rest of Latin America

-

-

Middle East & Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global roaming tariff market is expected to grow at a compound annual growth rate of 6.0% from 2023 to 2030 to reach USD 113,405.9 million by 2030.

b. Europe dominated the roaming tariff market with a share of 42.24% in 2022. This is attributable to the rising disposable income of the upper- & middle-class population and the ‘Roam like at Home’ policy introduced by the European Commission to prevent additional tariffs.

b. Some key players operating in the roaming tariff market include America Movil, AT&T Inc., Bharti Airtel Ltd., China Mobile Ltd., Deutsche Telekom AG, Digicel Group, Sprint Corporation, Telefonica SA, Verizon Communications Inc., and Vodafone Group plc.

b. Key factors that are driving the roaming tariff market growth include the rising number of smartphones, the rising number of unique mobile subscribers, and the proliferation of the Internet worldwide.

b. The global roaming tariff market size was estimated at USD 72,652.2 million in 2022 and is expected to reach USD 75,354.9 billion in 2022.

b. The international roaming segment held the largest roaming tariff market share of over 75% in 2022 and is expected to grow at the fastest CAGR during the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.