- Home

- »

- Consumer F&B

- »

-

Gluten-Free Bread Market Size, Share, Industry Report 2030GVR Report cover

![Gluten-Free Bread Market Size, Share & Trends Report]()

Gluten-Free Bread Market (2025 - 2030) Size, Share & Trends Analysis Report By Distribution Channel (Hypermarkets & Supermarkets, Convenience Stores, Speciality stores, Online), By Region (North America, APAC, Europe), And Segment Forecasts

- Report ID: GVR-4-68040-376-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Gluten-Free Bread Market Summary

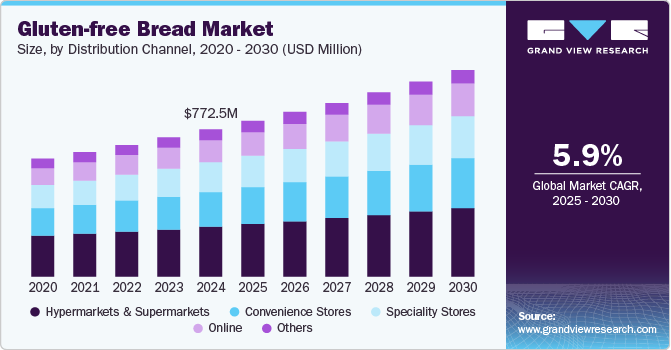

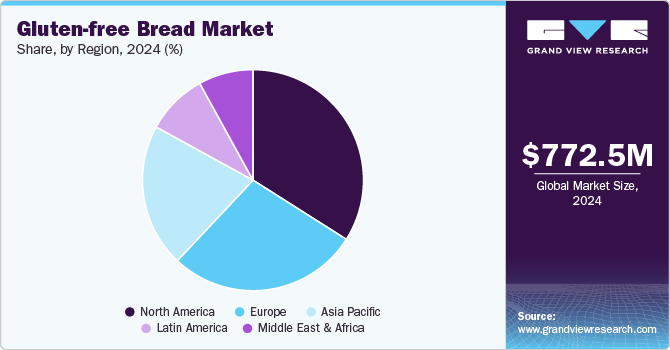

The global gluten-free bread market size was estimated at USD 772.5 million in 2024 and is projected to reach USD 1.09 billion by 2030, growing at a CAGR of 5.9% from 2025 to 2030. The major driving factor for the market growth is the increasing demand for healthy and nutritional food products due to rising health concerns worldwide.

Key Market Trends & Insights

- The North American gluten-free bread market dominated the global market, with a revenue share of 34.1% in 2024.

- The gluten-free bread market in the U.S. led the North American market and held the largest revenue share in 2024.

- Based on distribution channel, The hypermarkets & supermarkets segment led the global gluten-free bread industry, with the largest revenue share of 34.1% in 2024.

- In terms of distribution channel, The online segment is expected to grow at the fastest CAGR of 6.8% from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 772.5 million

- 2030 Projected Market Size: USD 1.09 billion

- CAGR (2025-2030): 5.9%

- North America: Largest market in 2024

In addition, the growing demand for gluten-free options to prevent health problems such as celiac disease, gluten intolerance, heart disease, diabetes, obesity, and metabolic syndrome is likely to drive industry growth. Furthermore, new product releases by manufacturers are contributing significantly to the industry's expansion.

Gluten-free bread is a type of bread made without gluten, a protein found in wheat, barley, and rye. It is designed for individuals with gluten intolerance or sensitivity, such as those with celiac disease. Gluten-free bread often uses alternative flours like rice, almond, coconut, or quinoa, and may include additional ingredients to enhance texture and structure. These breads can vary in taste and texture compared to traditional bread, but they provide a safe option for those who need to avoid gluten.

The increasing awareness of health and wellness among consumers is a significant market driver. The market is experiencing substantial growth due to various health, lifestyle, and innovation factors. Consumers are increasingly shifting to gluten-free products due to health concerns, such as celiac disease, gluten sensitivity, and wheat allergies, as well as the perceived health benefits of gluten-free diets. Popular dietary trends such as Paleo and Keto, alongside greater awareness and education about gluten-related disorders, further drive this shift. Rising diagnosis rates, celebrity and influencer endorsements, and the improved availability and accessibility of gluten-free products in mainstream and specialty stores contribute significantly to market growth.

In addition, innovations in the gluten-free sector, such as the use of alternative flours like almonds, coconut, rice, and quinoa and the inclusion of superfoods, have enhanced the nutritional profile and taste of these products. Furthermore, advances in baking techniques have improved the texture, flavor, and shelf-life of gluten-free items. In contrast, the introduction of gluten-free options across various categories, like frozen meals and snacks, has expanded consumer choices. Moreover, the focus on sustainable practices, ethical sourcing, and customizable bakery items tailored to specific dietary needs, such as vegan and low-sugar options, appeal to a broader consumer base.

Distribution Channel Insights

The hypermarkets & supermarkets segment led the global gluten-free bread industry, with the largest revenue share of 34.1% in 2024. People buy gluten-free bread from supermarkets and hypermarkets primarily for convenience and accessibility. These large retail chains are widely accessible, making it easy for consumers to purchase gluten-free bread during their regular shopping trips. The ability to complete all their grocery shopping, including specialty items like gluten-free bread, in one place adds to the appeal. The variety and quality of products available in supermarkets and hypermarkets also play a significant role. These stores often carry a diverse selection of gluten-free bread brands and types, catering to different tastes and dietary needs. Larger retail chains typically have stringent quality control measures, ensuring that the gluten-free products they stock are safe and meet regulatory standards, which builds consumer trust.

The online segment is expected to grow at the fastest CAGR of 6.8% from 2025 to 2030. People buy gluten-free bread from online channels primarily for the convenience and accessibility it offers. Shopping online allows consumers to purchase gluten-free bread from the comfort of their homes, avoiding the need to visit physical stores. The wide variety of gluten-free products available online often surpasses that found in brick-and-mortar stores, providing consumers with more options to suit their preferences and dietary needs. In addition, many online retailers offer competitive pricing, discounts, and subscription services, making it easier and more affordable to maintain a gluten-free diet.

Regional Insights

The North American gluten-free bread market dominated the global market, with a revenue share of 34.1% in 2024. Increasing health consciousness among consumers plays a pivotal role, with many opting for gluten-free options due to perceived health benefits, including improved digestive health and management of conditions like celiac disease. In addition, increased awareness about gluten sensitivity and celiac disease through media and health professionals has increased demand, alongside lifestyle preferences that align with gluten-free diets as part of overall wellness choices.

U.S. Gluten-free Bread Market Trends

The gluten-free bread market in the U.S. led the North American market and held the largest revenue share in 2024. The popularity of gluten-free bread and bakery items derives from a combination of health awareness and specific dietary needs. The increased availability and improved taste of gluten-free products have also contributed significantly, making it easier and more appealing for people to choose these alternatives. Moreover, endorsements from health influencers and celebrities have helped normalize and popularize gluten-free diets, influencing consumer behavior and driving demand for gluten-free bread and bakery items across the country.

Asia Pacific Gluten-free Bread Market Trends

APAC gluten-free bread market is expected to grow at the fastest CAGR of 6.8% over the forecast period. Cultural and social influences, such as celebrity endorsements, media coverage, and the impact of social media influencers, further drive the demand for gluten-free options. Economic factors like rising disposable incomes and urbanization contribute to the growing middle-class population willing to spend on premium and specialty foods. Enhanced labeling, certification, and government initiatives promoting awareness about food intolerances also provide consumers with greater confidence in their choices. Moreover, global trends towards gluten-free diets influence consumer behavior in the Asia-Pacific region, as international food trends often permeate local markets.

The growth of the gluten-free bread market in Australia and New Zealand is driven by increasing awareness of gluten-related health issues and a rising demand for healthier dietary options. In Australia, the prevalence of celiac disease and gluten intolerance supports the demand for gluten-free products, with the market expected to grow significantly due to changing consumer preferences and advancements in gluten-free offerings. In New Zealand, the market benefits from consumers seeking healthier options and the prevalence of coeliac disease, which affects about one in 70 people in both countries

Europe Gluten-free Bread Market Trends

The Europe gluten-free bread market is expected to grow at a significant CAGR during the forecast period. Europeans have a longstanding cultural attachment to bread, which holds a pivotal role in their culinary traditions and daily diets. There has been a notable increase in the consumption of gluten-free products across the region. This trend is driven by a combination of factors, including rising awareness of gluten intolerance and celiac disease among consumers. Health-conscious individuals are opting for gluten-free alternatives, believing they offer digestive benefits and contribute to overall well-being. Advances in food technology have also played a crucial role in improving the taste and texture of gluten-free bread and bakery items, thereby appealing to a broader audience.

The gluten-free bread market in Germany is propelled by consumer preferences for healthier and more sustainable food options. The market benefits from strict labeling regulations, which enhance consumer trust in gluten-free products. Furthermore, advancements in gluten-free technology have improved product quality, making it more appealing to consumers. As a result, the demand for gluten-free bread continues to grow steadily, driven by consumer awareness of health benefits and the availability of high-quality products.

Key Gluten-Free Bread Company Insights

Key companies in the global gluten-free bred industry include General Mills Inc., Amy's Kitchen Inc., Dawn Food Products, and others. The market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products. Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the ingredients used while strictly adhering to international regulatory standards.

-

Amy's Kitchen Inc. manufactures a wide range of gluten-free products, including burritos, pizzas, soups, and entrees, catering to consumers with dietary restrictions. Operating within the organic and natural foods segment, Amy's Kitchen focuses on providing nutritious options that align with health-conscious lifestyles, making it a trusted brand for those seeking gluten-free alternatives.

-

Valeo Foods Ltd. produces various food items, such as sauces, snacks, and ready meals, with a commitment to quality and innovation. Operating in the packaged foods segment, Valeo Foods caters to the growing demand for gluten-free products by developing offerings that meet dietary needs while maintaining taste and quality.

Key Gluten-Free Bread Companies:

The following are the leading companies in the gluten-free bread market. These companies collectively hold the largest market share and dictate industry trends.

- General Mills Inc.

- Amy's Kitchen Inc.

- Bob's Red Mill Natural Foods, Inc.

- Dawn Food Products

- The Hain Celestial Group

- Conagra Brands

- Valeo Foods Ltd.

- Dr. Schar AG

- WGF Bakery Products

- Kelkin

Recent Developments

-

In April 2024, Franz Bakery expanded its gluten-free bread lineup with new selections to celebrate Celiac Awareness Month in May. The additions include sourdough, brioche, and rye-flavored gluten-free bread. These new offerings are also vegan and free from nuts, soy, dairy, eggs, and high-fructose corn syrup. Franz responded to customer feedback by providing longer, generously sliced deli-style loaves ideal for various uses, from avocado toast to deli sandwiches.

-

In February 2024, Base Culture launched a new line of shelf-stable gluten-free bread called "Simply Breads," challenging the conventional bread aisle. These gluten-free bread products aim to offer a healthier, convenient option without compromising taste or texture. Base Culture's expansion into shelf-stable offerings reflects a commitment to providing accessible, better-for-you alternatives. The new line targets consumers seeking nutritious, gluten-free bread that fits their on-the-go lifestyles, marking a significant step in the company's mission to revolutionize the bread market with innovative, health-conscious choices.

-

In April 2023, Krusteaz introduced new additions to its product line, including a Cinnamon a Vanilla Pound Cake Mix and Churro Belgian Waffle Mix. The brand also launched two new gluten-free offerings to cater to a wider range of dietary preferences. This move signifies company’s expansion toward its gluten-free options, which could potentially include gluten-free bread mixes or other baked goods alternatives, aiming to meet the growing demand for gluten-free products.

-

In October 2023, Brazi Bites, a leading brand of Brazilian cheese bread, introduced a new "Everything" flavor of its signature cheese bread product. The new "Everything" Brazilian Cheese Bread features a blend of sesame seeds, garlic, onion, and poppy seeds in addition to the brand's traditional cheese-based recipe. The new offering is gluten-free, grain-free, and made with simple, clean ingredients, with no artificial preservatives, colors, or flavors

-

In March 2023, Rudi's Bakery, a leading organic and gluten-free bread brand, launched its new Texas Toast at Whole Foods Market stores nationwide. The Texas Toast is part of Rudi's Gluten-Free Bakery line and is made with simple, high-quality ingredients. The Texas Toast is made with a blend of gluten-free flour, including brown rice flour, tapioca starch, and potato starch. It is free from artificial preservatives, colors, and flavors, aligning with Rudi's commitment to providing clean-label products. The launch of the Texas Toast expands Rudi's gluten-free bread offerings and provides consumers with a larger variety of gluten-free bread options

Gluten-Free Bread Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 816.4 million

Revenue forecast in 2030

USD 1.09 billion

Growth rate

CAGR of 5.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, Australia & New Zealand, South Korea, Brazil, South Africa

Key companies profiled

General Mills Inc.; Amy's Kitchen Inc.; Bob's Red Mill Natural Foods, Inc.; Dawn Food Products; The Hain Celestial Group; Conagra Brands; Valeo Foods Ltd.; Dr. Schar AG; WGF Bakery Products; Kelkin

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gluten-Free Bread Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gluten-free bread market report based on distribution channel, and region:

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience stores

-

Speciality stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.