- Home

- »

- Consumer F&B

- »

-

Gluten-free Products Market Size And Share Report, 2030GVR Report cover

![Gluten-free Products Market Size, Share & Trend Report]()

Gluten-free Products Market Size, Share & Trend Analysis Report By Product (Bakery Products, Dairy/Dairy Alternatives, Convenience Stores), By Distribution Channel (Online, Specialty Stores), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-834-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The global gluten-free products market size was estimated at USD 6.45 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.8% from 2023 to 2030. The rising prevalence of celiac and other diseases owing to unhealthy lifestyles is expected to drive product demand. Prevention of health disorders, such as heart disease, diabetes, obesity, chronic pulmonary disease, and metabolic syndrome, is expected to drive market growth. The advent of the COVID-19 pandemic saw an exponential increase in the consumption of gluten-free products. This surge can be attributed to the increased health and wellness concerns among consumers during this period. Consumer interest in the nutritional functioning of foods has increased owing to the pandemic.

As consumers' definition of "wellness" has grown to include their emotional and mental well-being, food plays an important part in reaching these goals. Along with changing consumer mindset, the closing down of restaurants, cafés, and hotels resulted in increased consumption of home-cooked food and thereby, augmented the usage of gluten-free products including bread, cookies, cakes, and scones. The rising prevalence of irritable bowel syndrome (IBS) and celiac disease is anticipated to boost product demand in both developed and developing countries. Individuals with IBS experience sensitivity to gluten, and the consumption of gluten exacerbates their symptoms. The rising prevalence of these diseases in developed countries from North America and Europe, including the U.S., Canada, Germany, and France, is expected to drive the market demand.

Many consumers have embraced the diet of individuals for whom eating these products is a mandatory medical necessity inspired by those encouraging gluten-free diets for better health. As more people try new diets, such as the paleo or keto diets, individuals needing a gluten-free diet due to their existing medical conditions, as well as those who wish to lead a gluten-free life, are becoming the key drivers of market growth. As the world is witnessing a shift in consumer adoption of healthier food, consumers can now personalize their shopping experience to fit their unique nutritional demands through technological advancements. In-store nutritionists and color-coded shelf tags indicating nutritional properties of certain products, such as heart-healthy and gluten-free, have long been made available to customers by the retailers.

However, these efforts are relying heavily on more sophisticated technology that allows for greater personalization and customization of the consumer experience to fulfill individual nutritional demands. This has played a significant role in promoting the use of dairy-free products in customers’ diets. Technology trends including product innovations make these products more palatable. In addition, manufacturing processes are undergoing technological advancements to reduce product prices. The new manufacturing processes include extrusion cooking and annealing, which help in increasing the firmness of the product and decreasing the cooking loss. The product demand is also driven by the increasing obese population. Hence, pulses have become a major ingredient replacing wheat in gluten-free products. Some of the brands offering pulses in gluten-free foods are Tilda, Manna, Swasth, Dr. Gluten, and others.

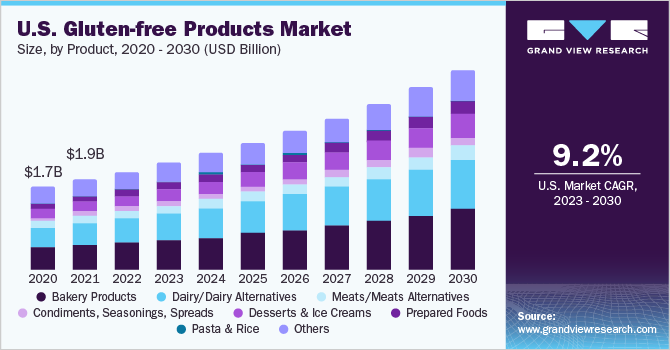

Product Insights

The bakery products segment held the largest share of 28.5% of the overall revenue in 2022 and is expected to maintain its dominance over the forecast period. The increasing awareness about healthy eating, which encompasses natural, organic, and gluten-free foods, is projected to drive the growth of this segment. In addition, the presence of a diverse product portfolio with ongoing innovations is expected to positively influence market growth in the coming years. Increasing demand for gluten-free bread is the primary growth factor driving the bakery product segment growth. To meet this increased demand, packaged bread producers, notably the UK's main player, Warburtons, are developing free-from sub-brands of their flagship brands, which are becoming popular with consumers of all economic strata.

Several new bakery start-ups have emerged, offering gluten-free bread alternatives, such as NUCO's Coconut Wraps, introduced in the U.S., which is not only gluten-free but also checks all the other health terms like raw, paleo, organic, and vegan. The bakery products segment is also projected to register the fastest CAGR of 11.0% from 2023 to 2030 owing to the combination of affordable pricing and a diverse range of products. In addition, the convenience of ready-to-eat foods is expected to contribute to this positive impact on the segment's growth. Furthermore, the increasing recognition of the health advantages associated with baked goods, combined with the rapid pace of urbanization, is expected to propel growth.

Increased consumer awareness about the overall well-being and benefits of consuming natural products contributes to the development of new launches in this segment. Furthermore, the market growth is driven by increased demand from millennials, enhanced marketing efforts, and improvements in distribution channels. Bakery aisles are witnessing this trend going beyond bread to products, such as cakes, biscuits, pastries, pasta, and breakfast cereals. Gluten-free breakfast cereals are gaining immense popularity, and General Mills Inc. is making nearly 90% of its Cheerios breakfast cereals range gluten-free. Moreover, the migrating trend of consuming gluten-free from the West to the East has led to an exponential rise in demand for baked products in recent years.

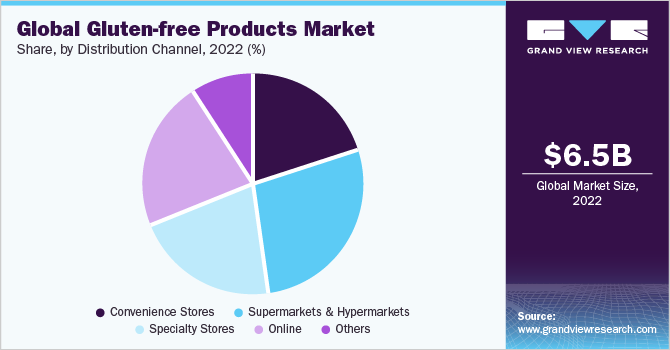

Distribution channel Insights

The supermarkets and hypermarkets segment accounted for the largest revenue share of 28.3% in 2022. As supermarkets & hypermarkets provide easy accessibility to a range of items under one roof, consumers find it easy to choose products from a variety of options. Seasonally driven displays, which include gluten-free products, play a role in promoting new goods and ultimately boosting segment growth. Supermarkets offer the advantage of catering to a single large consumer base, simplifying the operations compared to dealing with numerous smaller independent customers. With access to a substantial consumer base, supermarkets & hypermarkets have significant sales volumes.

Moreover, products that have national distribution benefit from increased brand recognition, resulting in higher sales volumes. Along with this, the supplier benefits from having a contract with big supermarkets, while they seek financial assistance for product development. Hence, manufacturers of these foods prefer selling through supermarkets and hypermarkets, thereby leading to higher penetration. The online segment is anticipated to witness the fastest CAGR of 11.9% from 2023 to 2030. The online channel provides various benefits that are particularly appealing to millennials and the younger generation, such as the convenience of shopping from home, doorstep delivery, free shipping, and discounts.

These advantages serve as key factors driving the preference for online shopping among these demographics. Furthermore, during the COVID-19 pandemic, online channels became a critical avenue for retailers despite a drop in overall retail spending. In addition, newer delivery models are making strides in the retail industry. For instance, customers and retailers equally prefer to click and collect (also known as BOPIS, buying online and picking up in-store) and curbside pickup. Customers may find pickup more convenient than home delivery as it allows them to retrieve their items whenever they choose, rather than having to wait for a delivery to arrive at their home. All these innovations in services are expected to boost segment growth over the forecast period.

Regional Insights

North America dominated the market in 2022 with a maximum revenue share of 36.7% and is expected to maintain its dominance over the forecast period. Gluten-free foods are perceived to ease digestive ailments, lower cholesterol levels, and be less fattening. These factors are anticipated to boost demand over the forecast period. Furthermore, their easy availability at nearly every grocery store is projected to boost the demand further, most notably in the U.S. The growth of the U.S. market is likely to be in line with the rising public awareness about celiac disease. Asia Pacific is expected to register the fastest CAGR of 12.1% from 2023 to 2030. The regional market exhibits promising conditions driven by factors, such as a growing internet penetration rate, a thriving e-commerce market, and favorable demographics.

Consumers in the region include not only individuals suffering from celiac disease or gluten intolerance/sensitivity but also those who are health-conscious and require these products for weight management. This region holds a potential growth opportunity owing to the increasing consumption of healthy diet foods and the unique marketing strategies adopted by key manufacturers to capture a substantial market share. Another emerging trend in the Asia Pacific regional market is the rise of health and wellness tourism, which is directly promoting the adoption of healthier foods. People are traveling in larger numbers to achieve greater well-being in their life. According to the Global Wellness Institute's recent research, Asia Pacific has the highest number of spas and is the fastest-growing market for wellness visits, and wellness tourism expenditure.

For instance, Bali has become renowned for modern gluten-free dishes, whereas Vietnam is the most popular destination for these foods in Asia. Europe held the second-largest market share of 29.0% in 2022 and is anticipated to show a similar trend during the forecast period. This is owing to changes in consumer demographics and a rise in disposable income levels. Countries, such as Germany, Italy, and the UK, have emerged as potential markets for the region’s growth, as consumers seek healthier food options. Europe has witnessed a significant rise in cases of food allergies and intolerances, including gluten intolerance. Thus, many individuals are opting for dairy-free diets to manage their symptoms and improve their overall well-being. This trend is driving the product demand in the region.

The European market has seen a notable expansion in the availability and variety of gluten-free products. Major food manufacturers and retailers are responding to the growing demand by offering a wider range of gluten-free options across various categories, including baked goods, pasta, snacks, and ready-to-eat meals. This increased accessibility and choice contribute to market growth.

Key Companies & Market Share Insights

The market is highly competitive with the presence of numerous multinational companies across major economies. The majority of the companies are vertically integrated for manufacturing gluten-free foods. This provides them with a much-improved product portfolio, with the launch of new products and brands. Key initiatives undertaken by market participants include new product launches, M&As, partnerships, geographical expansions, etc. For instance:

-

Recently, Dr. Schar USA Inc., a subsidiary of Dr. Schar AG based in Burgstall, Italy, announced to undertake an expansion of its manufacturing capacity in the United States and venture into new product categories. The company's investments are driven by a strategic goal to diversify its offerings and increase its market presence in North America within the gluten-free baked foods sector

-

In November 2021, Hy-Vee, Inc., a supermarket chain, introduced Good Graces, a new private brand featuring a full range of gluten-free products. Good Graces currently includes 30 gluten-free products with an additional 60 items in development

-

In September 2021, Rudi’s launched 15 new products in its organic and gluten-free domain with a new fermentation process and new packaging that includes bread

-

In July 2021, Feel Good Foods, a gluten-free frozen snack & appetizers brand launched gluten-free square pan pizza. Available in Margherita, Truffle Mushroom, and Four Cheese, each includes a baking tray

Some of the key players in the global gluten-free products market include:

-

Conagra Brands, Inc.

-

The Hain Celestial Group

-

General Mills Inc.

-

Kellogg Co.

-

The Kraft Heinz Company

-

Hero Group

-

Barilla G. e R. Fratelli S.p.A

-

Seitz glutenfrei

-

Freedom Foods Group Limited

-

Ecotone

Gluten-Free Products Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.07 billion

Revenue forecast in 2030

USD 13.67 billion

Growth rate

CAGR of 9.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; France; Germany; Italy; UK; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Conagra Brands, Inc.; The Hain Celestial Group; General Mills Inc.; Kellogg Co.; The Kraft Heinz Company; Hero Group; Barilla G. e R. Fratelli S.p.A; Seitz glutenfrei; Freedom Foods Group Ltd.; Ecotone

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gluten-Free Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the gluten-free products market report based on the basis of product, distribution channel, and region.:

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Bakery Products

-

Dairy/ Dairy Alternatives

-

Meats/ Meats Alternatives

-

Condiments, Seasonings, Spreads

-

Desserts & Ice Creams

-

Prepared Foods

-

Pasta and Rice

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Convenience Stores

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global gluten-free products Market market size was estimated at USD 6.45 billion in 2022 and is expected to reach USD 7.07 billion in 2023.

b. The global gluten-free products Market market is expected to grow at a compounded growth rate of 9.8% from 2023 to 2030 to reach USD 13.67 billion by 2030.

b. Bakery products dominated the global gluten-free products Market market with a share of 28.84% in 2022. This is attributed to increasing awareness of healthy eating, which encompasses natural, organic, and gluten-free foods.

b. Some key players operating in the gluten-free products market include Conagra Brands, Inc., The Hain Celestial Group, General Mills Inc., Kellogg Co., The Kraft Heinz Company, Hero Group, Barilla G. e R. Fratelli S.p.A, Seitz glutenfrei, Freedom Foods Group Limited, Ecotone.

b. Key factors that are driving the gluten-free products market growth include the rising prevalence of celiac disease and other diseases owing to unhealthy lifestyles.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."