- Home

- »

- Advanced Interior Materials

- »

-

GM Cryocoolers Market Size, Share & Trends Report, 2030GVR Report cover

![GM Cryocoolers Market Size, Share & Trends Report]()

GM Cryocoolers Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Superconducting Devices, Infrared Detectors), By End-use (Medical & Healthcare, Aerospace & Defense), By Cooling Capacity, By Heating Load, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-277-8

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

GM Cryocoolers Market Size & Trends

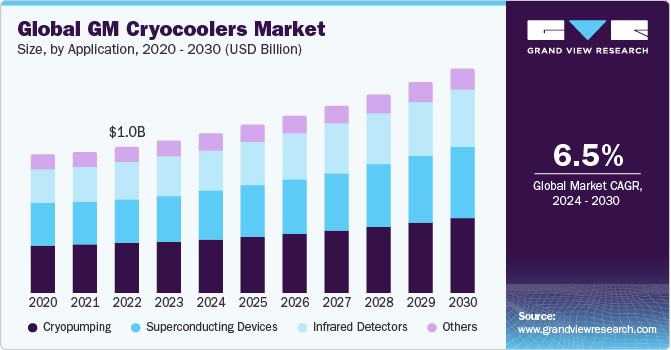

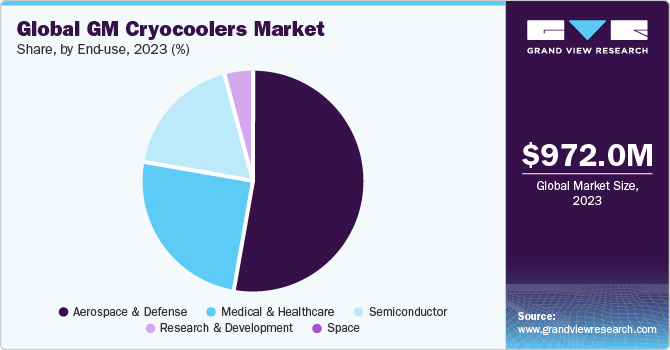

The global GM cryocoolers market size was estimated at USD 972.0 million in 2023 and is anticipated to grow at a CAGR of 6.6% from 2024 to 2030. The market has seen a significant uptick in demand, driven by various factors such as efficient refrigeration capabilities, making them valuable in various industries such as space, aerospace, and defense. The aerospace and defense sectors also contributes to the rising demand, where Gifford-McMahon (GM) cryocoolers are essential for satellite technology and military applications requiring advanced cooling solutions. Additionally, the healthcare industry, with its growing need for MRI systems, which rely on cryocoolers for their superconducting magnets, further bolsters the market growth.

Single-stage GM cryocoolers are used across various industries where precise and reliable cooling is essential. One notable application is in scientific research, particularly in nuclear magnetic resonance (NMR) spectroscopy. These cryocoolers cool the magnets within NMR spectrometers, enabling the accurate analysis of molecular structures. Oxford Instruments offers a range of single-stage GM cryocoolers suitable for scientific research and industrial applications. Their GM cryostats are widely used in laboratories for cooling samples in NMR experiments and other scientific studies.

The Coolstar single-stage coldheads encompass the 0/12 and 0/40 models, delivering cooling capacities of 12 and 40 W, respectively, at 77 Kelvin. These compact variants offer a significant advantage as some of the smallest and most efficient GM heads, making them suitable for installation in systems where space is a premium. Operating independently of orientation, these coldheads can be paired with the K450 helium compressor. Moreover, SHI Cryogenics Group's RD-Series and RDK cryocoolers are known for their reliability and adaptability, catering to specialized research needs. These cryocoolers find utility in liquefiers, laboratory cryostats, superconducting magnets, and high-temperature superconducting applications. Additionally, SHI Cryogenics Group's CH-Series Cryocoolers are versatile, closed-cycle systems incorporated with Displex technology.

Moreover, cryocoolers play a critical role in semiconductor metrology and testing applications, where temperature stability and uniformity are essential for accurate measurements and analysis. Cryogenic cooling ensures the integrity of test setups and minimizes thermal noise, enabling precise characterization of the electrical and thermal properties of semiconductor devices. For instance, in November 2023, CryoSpectra GmbH announced the expansion of the Crycooler K100 Series portfolio with the introduction of the K100015W and K100040W systems. These systems are used in various applications, such as semiconductor inspection, sensor technology, and radiation detection.

Cryocoolers ensure the temperature control and stability of cryogenic propellants, facilitating successful deployment and operation of space missions. Additionally, emerging trends, such as the development of small satellite constellations, lunar resource utilization, and interplanetary exploration missions, are likely to drive further innovation and adoption of cryocooler technologies, positioning cryocoolers as essential enablers of future space exploration endeavors.

Market Concentration & Characteristics

The GM (Gifford-McMahon) cryocoolers market exhibits a level of market concentration that reflects the specialized nature of this technology and its applications. The industry is characterized by a relatively small number of key players that dominate the market, attributing to the high barriers to entry, including the need for specialized knowledge, significant research, and development (R&D) investment, and the establishment of trusted relationships with industries that require cryogenic cooling solutions.

Companies such as Sumitomo Heavy Industries, Cryomech, and Janis Research Company are examples of leading firms in the GM cryocoolers market. Sumitomo Heavy Industries, through its acquisition of the Cryogenics business of Thermo Fisher Scientific, has become a dominant force in the market, offering a wide range of cryogenic systems that cater to various applications, from medical systems to quantum computing. Cryomech is another key player, known for its innovative solutions and a strong focus on R&D, allowing it to cater to the bespoke needs of its clients in both industrial and research settings. Janis Research Company, with its extensive experience in the field, offers highly customized solutions that serve the specific requirements of research institutions and industries engaged in cutting-edge scientific endeavors.

The market concentration is further influenced by the specific demands of the industries it serves. For instance, in the medical sector, particularly in MRI machines, the requirement for reliable and efficient cryogenic cooling is paramount, leading to long-term contracts and relationships with established providers. Similarly, in aerospace and defense, where the performance and reliability of cooling systems can be mission-critical, customers tend to rely on proven suppliers with a track record of delivering high-quality solutions.

However, this concentration also has implications for innovation and competition. The significant investment in R&D required to compete in this market acts as a barrier to new entrants, potentially limiting the pace of innovation. On the other hand, the specialized nature of the market means that customer needs can be very specific, encouraging deep technical collaborations between cryocooler manufacturers and their clients. This can drive forward technological advancements and custom solutions that might not be as prevalent in a more fragmented market.

Regulatory aspects also play a role in shaping the market. The use of cryocoolers in sensitive applications, such as in space missions or military equipment, means that companies often need to comply with strict regulations and quality standards, further raising the barriers to entry for new competitors. Moreover, environmental regulations aim to minimize the impact of cryocooler operation on the environment and ensure compliance with relevant environmental laws and regulations. This may include restrictions on the use of certain refrigerants or cryogenic fluids deemed harmful to the ozone layer or contributing to global warming. Cryocooler manufacturers and users may need to adhere to regulations governing the handling, storage, and disposal of cryogenic fluids and refrigerants to prevent environmental contamination and comply with sustainability goals.

Application Insights

The superconducting devices application segment led the market and accounted for over 29.7% of the global revenue share in 2023. Many research facilities use cryocoolers in conjunction with superconducting devices for various experimental setups, including particle accelerators and fusion reactors. These applications often require precise temperature control to explore the properties of materials and particles at near-zero temperatures. Superconducting materials exhibit perfect diamagnetism in the presence of strong magnetic fields, allowing stable levitation of objects. These aforementioned factors are expected to propel the demand for superconducting device applications in the coming years.

Cryopumping is a process used to achieve high vacuum levels by trapping and removing gases through cryogenic adsorption or condensation onto a cold surface. Cryocoolers play a crucial role in this process by providing the necessary cooling to maintain surfaces at cryogenic temperatures. Moreover, cryopumping is widely used in semiconductor manufacturing to create and maintain high vacuum environments essential for precise deposition and etching of semiconductor materials. Cryocoolers integrated into vacuum systems cool surfaces, such as cold traps, to cryogenic temperatures, effectively capturing and removing residual gases. This ensures that the semiconductor fabrication environment remains contaminant-free, improving device performance and yield.

The infrared detectors application segment is expected to witness a significant CAGR from 2024 to 2030. Infrared detectors are crucial components in various applications ranging from astronomy to military operations due to their ability to detect infrared radiation, which is invisible to the human eye. These applications often require the detectors to operate at temperatures significantly below room temperature, to improve their sensitivity and reduce noise. This is where cryocoolers provide the necessary cooling to achieve and maintain low temperatures efficiently.

Cooling Capacity Insights

The 25K to 40K cooling capacity segment led the market with a share of 33.87% in 2023. These cryocoolers provide refrigeration at moderate temperatures. These devices utilize various cooling technologies such as Gifford-McMahon, pulse tube, or Stirling cycles to achieve efficient cooling. They utilize advanced cooling technologies to provide efficient refrigeration for applications requiring moderate temperatures. Cryocoolers operating in this temperature range are used in space exploration equipment, such as cryogenic detectors and cooling systems for infrared telescopes and spectrometers. NASA's James Webb Space Telescope (JWST) utilizes cryocoolers to cool its infrared detectors to temperatures around 40 K for observing distant celestial objects.

GM cryocoolers operating in the 40 to 60 K range are commonly used to cool infrared sensors and detectors in thermal imaging, surveillance, and environmental monitoring applications. For instance, the AIM-9X Sidewinder missile system utilizes cryocoolers to cool its infrared seeker to temperatures around 50 K for target detection and tracking. GM Cryocoolers in this temperature range are utilized in materials characterization experiments, such as X-ray diffraction and neutron scattering studies. These cryocoolers are used to cool sample stages and cryostats to temperatures suitable for investigating material properties at low temperatures. Oxford Instruments offers cryocoolers for cooling sample stages in materials research applications.

Heating Load Insights

The 2.0 to 10.0 W heating load segment led the market in 2023. Cryocoolers with a heating load capacity ranging from 2.0 to 10.0 W are highly sought after owing to their versatility and efficiency in cooling applications that require moderate to high cooling power. These cryocoolers are particularly suited for use in quantum computing applications, superconducting magnets, low-temperature scientific experiments, and infrared sensors wherein precise temperature control and stability are crucial.

Cryocoolers with up to 1.0 W heating load offer a multitude of benefits. They are used in various applications. The ability of these cryocoolers to reach and maintain extremely low temperatures efficiently makes them invaluable for space exploration. Moreover, in medical imaging, notably in MRI machines, cryocoolers with this heating load play a critical role in superconducting magnet systems for improving image quality and reducing noise.

End-use Insights

The aerospace & defense end-use segment led the GM cryocoolers market in 2023. Cryocoolers are used for various applications, such as cooling infrared (IR) sensors for surveillance and targeting. These sensors require extremely low temperatures to operate effectively, and cryocoolers provide a reliable and efficient means of achieving these temperatures. Cryocoolers are also used to cool the onboard electronic systems, such as radar and electronic warfare equipment. These systems generate a lot of heat, and cryocoolers are used to dissipate this heat and maintain optimal operating temperatures.

The space segment is likely to grow at a significant CAGR over the forecast period. GM cryocoolers are utilized to cool infrared detectors, spectrometers, and other sensors onboard satellites and space probes, enabling remote sensing, astronomical observations, and planetary exploration missions. Cryogenic cooling ensures the stability and sensitivity of these instruments, allowing for high-resolution imaging and data collection in space environments. For instance, in April 2023, Thales introduced the LPT6510 pulse-tube cryocooler, which was designed to operate in the TRISHNA earth observation satellite.

Moreover, cryocoolers play a critical role in space telescopes and observatories, where precise temperature control is essential for capturing clear and detailed images of celestial objects. Cryocoolers are integral components of cryogenic propulsion systems used in space missions and satellite launches. Cryogenic fuels, such as liquid hydrogen and liquid oxygen, require cryogenic cooling to remain in their liquid state, enabling efficient propulsion and maneuvering of spacecraft and launch vehicles.

Regional Insights

North America dominated the GM cryocoolers market and accounted for over 42.0% share of global revenue in 2023. The region has been witnessing a rising number of patients with chronic diseases, such as cardiovascular diseases, brain disorders, and cancer. Non-invasive medical techniques, such as Magnetic Resonance Imaging (MRI), Nuclear Magnetic Resonance (NMR), and Particle Therapy (PT) machines, are used to diagnose and treat such diseases. According to the report published by the National Cancer Institute in February 2024, around 623,405 individuals currently have metastatic breast, prostate, lung, colorectal, or bladder cancer. The report further observed that this figure is expected to rise to approximately 693,452 by 2025 in the U.S.

U.S. GM Cryocoolers Market Trends

The GM cryocoolers market in U.S. held over 80% share of North America owing to the growing end-use industries such as semiconductors, medical and healthcare, and aerospace and defense. According to the U.S. Department of Defense (DoD), the U.S. defense budget has been increasing continuously. In 2022 and 2023, the government allotted USD 777.0 billion and 852.0 billion, respectively, to the defense budget.The infrared electronic systems used in these fighter planes and advanced equipment are required to cool down from time to time. Hence, with the growth in the defense budget of advanced equipment, the demand for GM cryocoolers is likely to grow over the forecast period.

The Canada GM cryocoolers market held over 16% share of North America in 2023, owing to the increasing prevalence of diseases in Canada. According to the report published by Statistics Canada and Canadian Cancer Statistics in 2023, 2,39,100 Canadians are likely to be diagnosed with cancer, and 86,700 are anticipated to die from it in 2023 alone. These aforementioned factors are expected to drive the demand for the GM cryocoolers over the forecast period.

Europe GM Cryocoolers Market Trends

The GM cryocoolers market in Europe is driven by the growing driven by increasing demand across various sectors such as medical, space, and cryopreservation. These cryocoolers are prized for their reliability and efficiency in reaching cryogenic temperatures, crucial for applications like MRI systems, semiconductor fabrication, and space satellite sensors. Europe's emphasis on technological innovation, coupled with stringent regulations regarding environmental sustainability, has further propelled the adoption of GM cryocoolers.

The GM cryocoolers market in Germany held over 20.0% share of Europe owing to the increasing investment in research and development to enhance cryocooler performance and energy efficiency. Further, the growing healthcare industry is expected to further drive the demand for GM cryocoolers. For instance, according to the International Trade Administration (ITA) in December 2023, Germany has a strong healthcare system and healthcare infrastructure in Europe. The healthcare industry of the country contributes around 12% to its GDP in 2022.

The UK GM cryocoolers market held over 12.0% share of Europe which is driven by the rising number of patients with cardiovascular, neurological, and cancer disorders in the UK, the demand for early and accurate diagnosis of these health conditions is increasing in the country. To cater to this rising demand for fast and affordable disease diagnosis, under the National Health Service (NHS), the Community Diagnostic Center (CDC) was established in the UK in 2021.

Asia Pacific GM Cryocoolers Market Trends

The GM cryocoolers market in Asia Pacific is driven by the surge in demand for healthcare equipment, primarily due to the increasing population and a growing and aging demographic. Economic growth in many countries has led to higher incomes, and urbanization has contributed to changes in lifestyle, leading to chronic illnesses such as cardiovascular disease, respiratory illness, and various cancers. As a result of higher disposable incomes, people are willing to spend on accurate & prompt disease diagnosis and treatments, thereby driving the market expansion.

The GM cryocoolers market in China held over 41% share of the Asia Pacific market owing to high growing semiconductor and medical industries.According to the Semiconductor Industry Association (SIA), the government of China has taken measures to promote the development of the semiconductor industry. These measures include offering income tax exemptions for advanced technology process nodes, and import duty exemptions for IC manufacturers. GM cryocoolers are used to control the thermal stress being generated during the fabrication of semiconductor chips and remove unwanted gases from the chamber.

Japan GM cryocoolers market held over 19.0% share in the Asia Pacific market owing to the growing prevalence of chronic diseases, such as cancer, and higher government spending to maintain healthcare facilities, the demand for timely diagnosis and treatment is high. MRI and NMR machines are used in the diagnosis of early stages of cancer. GM cryocoolers are used to remove the excess heat generated in these machines. Hence with the rising demand for non-invasive diagnosis, the demand for GM cryocoolers is anticipated to remain high in Japan.

Middle East & Africa GM Cryocoolers Market Trends

The Middle East & Africa GM cryocoolers market is robust growth driven by several factors such as rising domestic defense production to reduce their defense imports. For instance, at the International Defense Exhibition and Conference (IDEX) that took place in Abu Dhabi in 2023, the UAE procured most of its military equipment from domestic companies. In defense equipment, infrared detectors measure infrared radiation emitted by objects. Cryocoolers are used to cool infrared devices. Therefore, with the growing production of advanced defense equipment, the demand for cryocoolers is anticipated to grow over the forecast period.

The GM cryocoolers market in Saudi Arabia held over 39.0% share in the Middle East & Africa market. This is driven by increasing demand across various sectors such as medical, space, and defense.The country's government allocated USD 50.4 billion in 2023 to healthcare and social development, which accounted for 16.9% of the total government spending for that year, including the construction of new hospitals and clinics. This is expected to drive the demand for medical equipment, such as MRI machines and blood storage units, which require cryogenic cooling.

Central & South America GM Cryocoolers Market Trends

The GM cryocoolers market in Central & South America is experiencing dynamic growth fueled by growing population growth, the prevalence of chronic diseases, and growing healthcare spending due to rising disposable income. Additionally, different governments have been incurring heavy capital expenditure in the region to strengthen the healthcare infrastructure and make healthcare services affordable for the mass population.

The GM cryocoolers market in Brazil held a 58.0% share of Central & South America owing to rapid industrial growth. In 2024, Brazil launched a new industrial policy to boost investment, innovation, and sustainability in strategic areas up to 2033. The defense sector aims to attain self-sufficiency in producing 50% of crucial technologies. GM cryocoolers are used as heat sinks for IR sensors and superconducting devices used in defense equipment and fighter aircraft. Hence, with the growing defense manufacturing, the demand for cryocoolers is anticipated to increase over the forecast period.

Key GM Cryocoolers Company Insights

Some key players operating in the market include Oerlikon Group, Sumitomo Heavy Industries, Ltd., and RIX Industries.

-

Sumitomo Heavy Industries, Ltd. is a comprehensive manufacturer specializing in industrial machinery, automatic weaponry, ships, bridges, steel structures, and environmental protection equipment. Its product range includes mechatronics, industrial machinery, logistics, construction, energy, and more. The company manufactures cryocoolers for use in medical devices like MRI machines, advanced scientific fields such as physics and chemistry, and cryopumps for creating ultra-high vacuum environments for semiconductor production. With a global presence across Europe, East Asia, Japan, North America, Southeast Asia, Oceania, and Latin America, the company serves diverse markets worldwide.

-

RIX Industries specializes in manufacturing a diverse range of products, including gas generation systems, precision compressor solutions, and cryogenic cooling technologies. Its comprehensive capabilities involve production, design, engineering, assembly, and testing. The company's offerings are extensive, serving multiple markets such as marine, aerospace, industrial, medical, energy, and critical infrastructure. The company's thermoacoustic-Stirling (pulse tube) cryocoolers offer a unique combination of mechanical simplicity, high performance, and efficiency while utilizing environmentally friendly refrigerants. Additionally, the company's commitment to excellence is underscored by its AS9100:D-certified Quality Management System, demonstrating its ongoing dedication to quality assurance.

RICOR;ULVAC CRYOGENICS INC.; and AMETEK, Inc. are some of the emerging participants in the market.

-

The company specializes in providing innovative cryocooler technology for infrared detectors and scientific instrumentation. With expertise in developing, manufacturing, and marketing advanced miniature cryocoolers, it serves a diverse range of applications in space, military and defense, semiconductor, homeland security, commercial, and scientific equipment industries., The company's technologies offer exceptional flexibility in cooling power requirements ranging from fractions of a Watt up to 15W, temperatures spanning from 55K to 180K, and input power consumption as low as 1W.

-

ULVAC CRYOGENICS INC. provides a range of cryopumps, turbo molecular pumps, cryogenic equipment, and dry pumps, primarily serving the semiconductor and electronics industries. Ulvac Cryogenics Incorporated was established as a joint venture between ULVAC, Inc. in Japan and Helix Technology Corporation (CTI), now known as Edwards Vacuum LLC, based in the U.S. With a substantial market share of 40% in Japan, the company designs, manufactures, and sells cryopumps, in addition to offering maintenance services.

Key GM Cryocoolers Companies:

The following are the leading companies in the gm cryocoolers market. These companies collectively hold the largest market share and dictate industry trends.

- Sumitomo Heavy Industries, Ltd.

- RIX Industries

- Northrop Grumman

- Bluefors Oy

- RICOR

- AMETEK, Inc.

- ULVAC CRYOGENICS, INC.

- CryoSpectra GmbH

- Lihan Cryogenics Co., Ltd.

- CSSC Pride (Nanjing) Cryogenic Technology Co., Ltd

- Edwards Vacuum

Recent Developments

-

In March 2023, Bluefors Oy acquired Cryomech, a leading cryocooler technology company based in Syracuse, New York, U.S. This strategic move unites nearly 600 experts across multiple countries, enabling Bluefors Oy to enhance its service to customers in quantum technology, physics research, and industrial applications. The acquisition aligns with Bluefors Oy' growth strategy to advance ultra-low temperature cooling technology in R&D and industrial sectors.

-

In May 2023, Bluefors Oy completed the acquisition of Rockgate, a distributor of cryogenic equipment located in Tokyo, Japan. This strategic move allows Bluefors Oy to establish a direct sales & service presence in the Japanese cryogenics technology market, thereby expanding its global footprint beyond its existing presence in Finland, Germany, the Netherlands, and the U.S.

GM Cryocoolers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.02 billion

Revenue forecast in 2030

USD 1.50 billion

Growth rate

CAGR of 6.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Application, cooling capacity, heating load, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; Japan; India; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Sumitomo Heavy Industries, Ltd.; RIX Industries; Northrop Grumman; Bluefors Oy; RICOR; AMETEK, Inc.; ULVAC CRYOGENICS, INC.; CryoSpectra GmbH; Lihan Cryogenics Co.; Ltd.; CSSC Pride (Nanjing) Cryogenic Technology Co., Ltd; Edwards Vacuum

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global GM Cryocoolers Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the GM cryocoolers market report based on application, cooling capacity, heating load, end-use, and region:

-

Application Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Infrared Detectors

-

Superconducting Devices

-

Cryopumping

-

Other

-

-

End-use Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Semiconductor

-

Medical & Healthcare

-

Research & Development

-

Aerospace & Defense

-

Space

-

-

Cooling Capacity Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Up to 4 K

-

Up to 4 to 10 K

-

10 to 25 K

-

25 to 40 K

-

40 to 60 K

-

Above 60 K

-

-

Heating Load Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Up to 1.0 W

-

1.0 to 2.0 W

-

2.0 to 10.0 W

-

Above 10.0 W

-

-

Regional Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Superconducting devices application segment led the market and accounted for over 28% of the global revenue share in 2023. Many research facilities use cryocoolers in conjunction with superconducting devices for various experimental setups, including particle accelerators and fusion reactors. These applications often require precise temperature control to explore the properties of materials and particles at near-zero temperatures.

b. Some of the key players operating in the GM cryocoolers market include Sumitomo Heavy Industries, Ltd., RIX Industries, Northrop Grumman, Bluefors Oy, RICOR, AMETEK, Inc., ULVAC CRYOGENICS, INC., CryoSpectra GmbH, Lihan Cryogenics Co., Ltd., CSSC Pride (Nanjing) Cryogenic Technology Co., Ltd, and Edwards Vacuum among others

b. The GM cryocoolers market has seen a significant uptick in demand, driven by various factors such as efficient refrigeration capabilities, making them valuable in various industries such as space, aerospace, and defense. For instance, GM cryocoolers are essential for satellite technology and military applications requiring advanced cooling solutions.

b. The global GM cryocoolers market size was estimated at USD 972.0 million in 2023 and is expected to reach USD 1.02 billion in 2024.

b. The global GM cryocoolers market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030 to reach USD 1.50 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.