- Home

- »

- Petrochemicals

- »

-

Grease Market Size, Share & Growth, Industry Report, 2030GVR Report cover

![Grease Market Size, Share & Trends Report]()

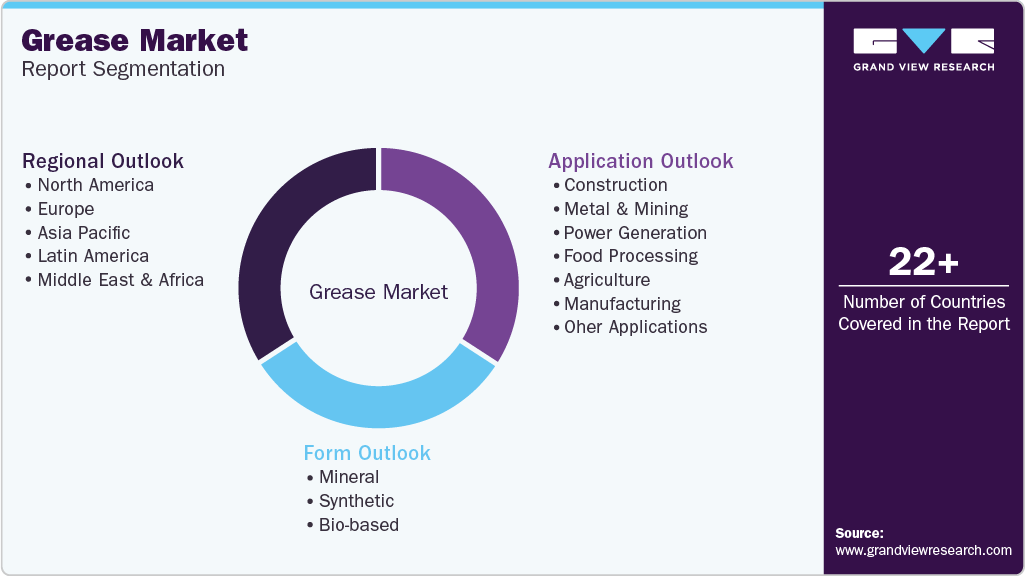

Grease Market (2025 - 2030) Size, Share & Trends Analysis Report By Form (Mineral, Synthetic), By Application (Construction, Metal & Mining), By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68040-302-4

- Number of Report Pages: 137

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Greases Market Summary

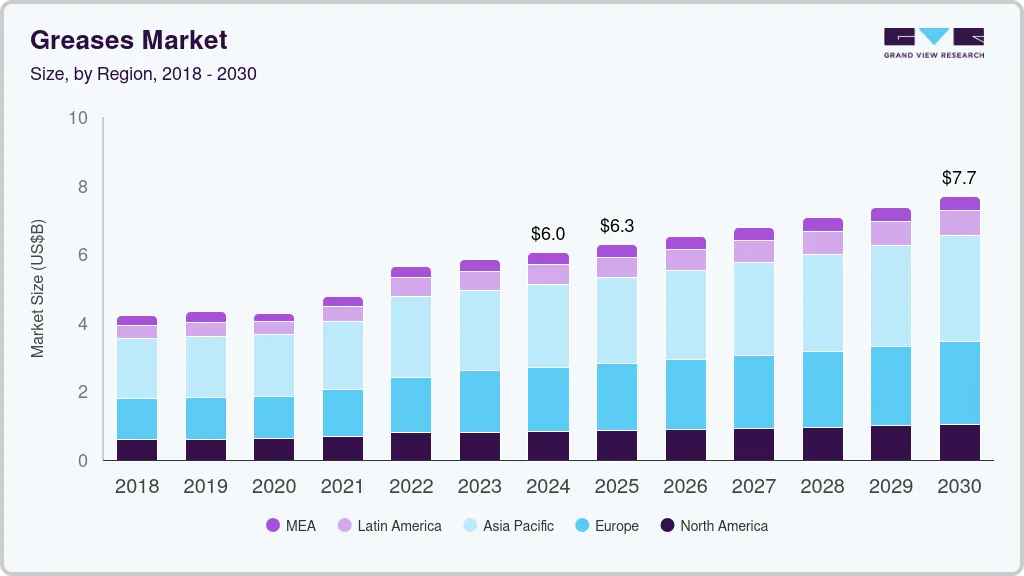

The global greases market size was estimated at USD 6.0 billion in 2024 and is projected to reach USD 7.68 billion by 2030, growing at a CAGR of 4.1% from 2025 to 2030. Due to the surging demand for vehicles and spare parts, the increasing demand for automotive grease worldwide is expected to contribute to market growth in the coming years.

Key Market Trends & Insights

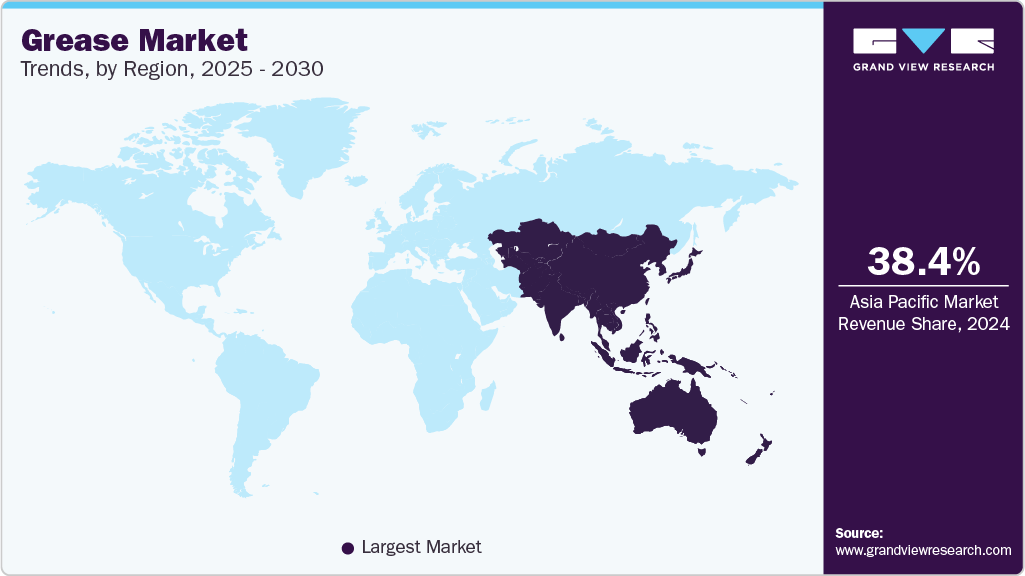

- The grease market in Asia Pacific dominated with a revenue share of 38.4% in 2024.

- China grease market is expected to be one of the promising product markets in the region.

- Based on form, mineral-based product segment dominated the market with a revenue share of 60.3% in 2024.

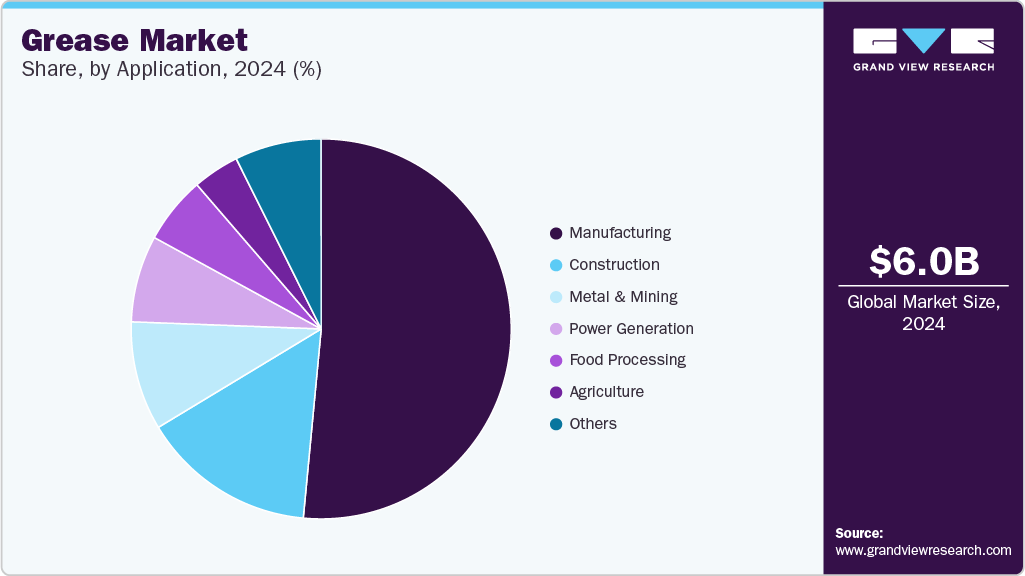

- Based on application, manufacturing segment dominated the market with a revenue share of 49.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.0 Billion

- 2030 Projected Market Size: USD 7.68 Billion

- CAGR (2025-2030): 4.1%

- Asia Pacific: Largest market in 2024

The construction industry is one of the major consumers of the product across the world. This industry uses the product to lubricate and protect the moving parts of heavy construction equipment and machinery, including excavators, bulldozers, cranes, loaders, and dump trucks.

It reduces friction, wear, and corrosion in components such as bearings, gears, bushings, pins, and hydraulic cylinders, thereby extending the lifespan of different equipment and improving their performance. There are three major forms: bio-based, mineral, and synthetic. The product is mainly classified based on the raw material used in manufacturing. Bio-based products include raw materials such as vegetable oil. Vegetable oils such as soybean, rapeseed, sunflower, and palm oil are among the most commonly used feedstocks for bio-based products. Among these, soybean oil is widely utilized for its availability, low cost, and suitable viscosity characteristics for lubricant applications.

Formulation development involves designing the product composition by blending synthetic base oils, thickeners, and additives in specific proportions. The formulation is optimized to achieve the desired viscosity, temperature stability, load-carrying capacity, corrosion protection, and other performance attributes required for the intended application.

The global market is changing in terms of raw materials owing to the rising demand for bio-based products. APAC has emerged as one of the largest product consumers due to the region's rapidly growing manufacturing, construction, metal & mining industries, and industrial development. The Asia Pacific product market has started mirroring the American and European regulatory systems, and thus, countries like Japan and South Korea are emphasizing eco-labeled products.

The global greases and lubricants industry is governed by stringent regulations, ranging from their production to use & disposal. Furthermore, the additives used in manufacturing grease are checked for their toxicity and potential to harm the environment. Some of the regulatory bodies that influence market dynamics include the Occupational Safety & Health Administration (OSHA), Environmental Protection Agency (EPA), and Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) standards.

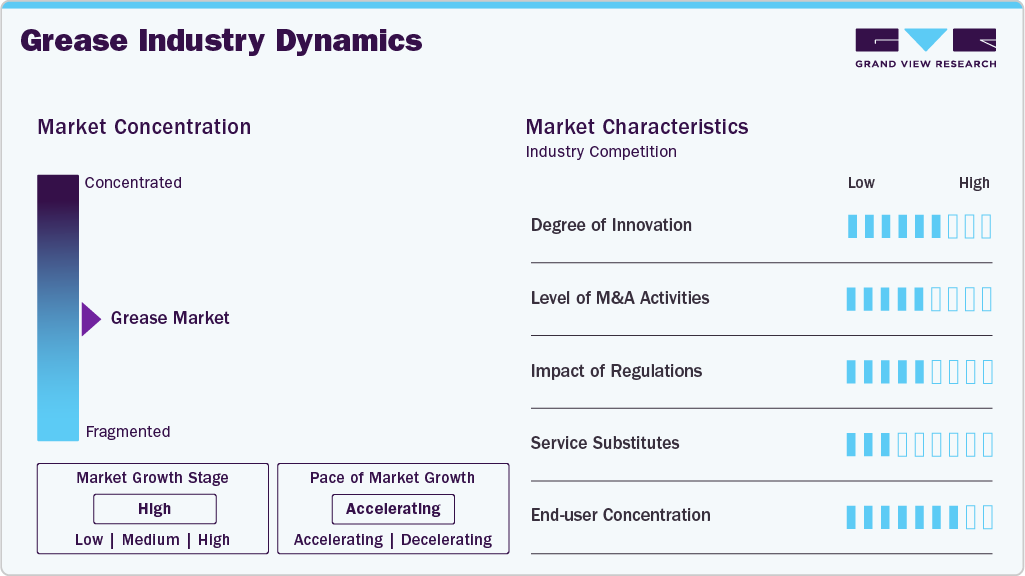

Market Concentration & Characteristics

The market is moderately fragmented, and players aim to achieve optimum business growth and strong market positioning through production capacity expansions, new product development, and research & development. For instance, in 2024, Shell Lubricants (a subsidiary of Shell plc) finalized the acquisition of MIDEL and MIVOLT, both United Kingdom-based companies, from Manchester's M&I Materials Ltd. This acquisition marks Shell's commitment to produce, distribute, and promote the MIDEL and MIVOLT product ranges, enhancing its worldwide lubricants portfolio.

Manufacturers have anticipated a huge gap in product and technology development; thus, they are investing in research & development to add new products to their portfolios and develop better technology for various end-use industries of the product. For instance, in 2024, GB Lubricants introduced its latest innovation, GB Super Universal Tractor Oil 15W-30. This multifunctional oil, designed for farm machinery, is formulated with top-grade virgin mineral base oils and advanced additive systems. It ensures optimal lubrication for various tractor components. In addition, Canoil Canada Ltd. launched different products in 2022-23, including lubricants, greases, and metalworking oils.

Shell plc, Exxon Mobil Corporation, Chevron Corporation, FUCHS, and TotalEnergies, among others, are the key manufacturers operating in the product market. These companies have a stronghold in emerging markets and export their products to various end use applications. Manufacturers are mainly adopting strategies such as partnerships to increase their market footprint. For instance, in 2022, NYCO declared the renewal of its partnership agreement with easyJet, ensuring the continued provision of TURBONYCOIL 600 for the airline's Airbus A320 CEO and NEO family aircraft fleet.

Form Insights

Mineral-based product dominated the market with a revenue share of 60.3% in 2024, owing to their better solubility with additives and cost-effectiveness. Mineral-based products are considered inherently biodegradable (degrading > 20 percent to < 60 percent within 28 days) if exposed to the natural environment. A mineral-based product is a lubricating grease that utilizes mineral oil as its fluid component. These products are widely used in various industrial applications due to their satisfactory performance and versatility. Mineral-based products consist of three main components: a base oil, a thickener, and additives. The base oil in mineral-based products is typically a mineral oil, which provides lubrication and reduces friction between moving parts.

Synthetic products consist of synthetic oils containing a mixture of synthetic thickeners, or bases, in petroleum oils. Synthetic products are available in water-soluble and water-resistant forms and may be used over a wide temperature range. For example, AMSOIL INC., a grease manufacturer, offers water-resistant synthetic greases for various end use industries, including manufacturing and mining. Compared with mineral-oil-based lubricants, synthetic lubricants provide better resistance to extreme temperatures and environments. They tend to resist oxidation better, allowing for a longer shelf life.

Bio-based products are formulated using biodegradable and renewable feedstock or base stock. To be termed bio-based, the products don’t have to be entirely composed of unadulterated vegetable oil; rather, only the base materials need to be renewable. Different companies manufacturing bio-based products use different feedstocks; for instance, BIOBLEND SUATAINABLE PERFORMANCE, a U.S.-based manufacturer of bio-based greases, uses natural plant esters as their base oils, which makes them readily biodegradable.

Application Insights

Manufacturing dominated the market with a revenue share of 49.6% in 2024. Grease plays a crucial role in manufacturing heavy machinery by providing lubrication to moving parts, reducing friction, preventing wear and tear, and ensuring smooth operation. Proper lubrication with grease prevents heavy machinery components from grinding against each other, which can cause damage and release harmful contaminants into the system.

Greases form a protective film between moving parts, reducing friction and minimizing wear and tear. High-quality products can lubricate isolated or relatively inaccessible components for extended periods without frequent replenishment. This is especially beneficial in heavy machinery that operates under extreme conditions such as high temperatures, pressures, shock loads, or slow speeds under heavy loads.

Greases play a crucial role in the construction industry, providing lubrication and protection to various mechanical components and equipment. They are extensively used to maintain construction equipment, such as excavators, cranes, bulldozers, and loaders. These heavy machines require regular lubrication to ensure smooth operation and prevent wear and tear. The products are applied to the moving parts, such as bearings, gears, and joints, to reduce friction and extend the lifespan of the equipment.

Regional Insights

The North American market for grease is primarily driven by growing product usage in key end use sectors such as construction, food processing, and power generation. Construction is one of the key end users in the region, which mainly depends on grease products for heavy equipment like bulldozers, excavators, and cranes, which require robust lubrication in high-load, high-speed applications. In addition, the "Affordable Healthcare Act" in 2023 is expected to stimulate the construction of a greater number of healthcare units and hospitals, which, in turn, is expected to boost the demand for products in the region over the forecast period.

National policies promoting the housing sector's recovery are expected to positively impact future construction trends. Reconstruction activities in the U.S., coupled with infrastructure development in Canada and Mexico due to rapid industrialization, are expected to provide immense market potential in North America over the forecast period, thus increasing the demand for the product in the region.

U.S. Grease Market Trends

The U.S construction industry is growing rapidly due to positive commercial real estate market fundamentals and the country’s strong economy. The government provides more funding for building schools, hospitals, and other public projects. A fewupcoming projects in the U.S. include the South San Francisco Civic Center campus construction, the Second Avenue Subway Construction Project, the O’Hare Airport Construction Project, and the LaGuardia Airport Construction Project. These projects are expected to further propel construction working hours, leading to an increase in the operation time of the machinery used in construction activities and, therefore, increasing product consumption in the coming years.

Asia Pacific Grease Market Trends

The grease market in Asia Pacific dominated with a revenue share of 38.4% in 2024, owing to construction activities and growing demand for products from the automotive sector in emerging countries such as India, Japan, and South Korea. These factors are expected to drive the market over the forecast period. According to the data published by the International Organization of Motor Vehicle Manufacturers, Asia Pacific is the largest transportation market in the world, with numerous automobile manufacturers, thus ensuring a steady growth in automobile production in the region. Asia Pacific witnessed a growth of 10% in vehicle production in 2023 compared to 2022, and the region’s automotive production reached 55.1 million units in 2023, establishing it as a major driver for the product market in the region.

China grease market is expected to be one of the promising product markets in the region on account of the government’s support to promote investments in the manufacturing sector. Several companies are expanding or setting up new manufacturing facilities due to low labor costs and the country's ease of raw material procurement. The growing manufacturing sector is expected to propel the demand for products in automotive, construction, electrical & electronics, and other industries.

The grease market in India is expected to witness a substantial growth rate. According to India Brand Equity Foundation, the country is one of the prominent automotive manufacturers globally, with a total production of three-wheelers, passenger vehicles, quadricycles, and two-wheelers accounting for 38,59,030 units in 2023. The country's automotive sector received a cumulative equity FDI inflow of around USD 33.77 billion between April 2000 and September 2022. This positive outlook for the automotive industry in the country is likely to propel product demand in the coming years.

Europe Grease Market Trends

The grease market in Europe is expected to grow significantly as Europe is a major hub for automotive production. Therefore, the demand for automotive greases is expected to be substantial. Grease is mainly used as a lubricant for machinery used in automotive manufacturing. Surging automobile production in Germany, Hungary, Romania, Austria, and the UK, along with strong OEM automotive manufacturing bases in the region, is expected to drive the demand for grease. A few top European OEMs include Mercedes-Benz Group AG, Volkswagen AG, Stellantis NV, Bayerische Motoren Werke AG, and Renault SA.

Germany grease market is experiencing lucrative demand growth. The German automotive industry is one of the largest in the world. According to the KBA federal transport authority, new car sales in Germany accounted for a 7.3% share in 2023 and reached a total of 2.8 million vehicles. Germany sold over 524,000 full-electric cars in 2023. According to Trading Economics, car production in Germany increased to 312,100 units in January from 258,254 units in December 2023. Thus, the rising automotive production, import, and export of vehicles positively impact the automotive manufacturing industry in Germany, propelling the demand for greases and related products. This is expected to significantly contribute to the demand for greases in the country over the forecast period.

The grease market in the UK is influenced by various factors, including its application in tire manufacturing. Greases are widely used as a curing agent in tire manufacturing. Factors such as the increasing number of on-road vehicles globally and the need for tire replacements are expected to drive the UK’s demand for greases.

Latin America Grease Market Trends

The grease market in Latin America is expected to grow substantially over the forecast period due to the region’s high economic growth in the past few years. Increasing consumer disposable income has surged the demand for automobiles, which is expected to augment the demand for automotive parts and their manufacturing, further leading to a positive impact on the product over the forecast period. Significant new investments in housing and public works are expected to boost infrastructure growth in Colombia, thereby augmenting the product demand over the next seven years. Thus, the increasing number of infrastructure development projects is expected to drive the demand for greases, which are heavily used in the small and large machinery operating on construction sites.

Brazil grease market growth is projected to surge in the upcoming years. Brazil is the leading producer of automobiles in Central & South America and has emerged as the ninth-largest automobile producer in the world. According to the International Organization of Motor Vehicle Manufacturers, automotive production in Brazil witnessed an increase of 3.27% in 2023 compared to 2021. Thus, the rising production of vehicles is further expected to increase the demand for more manufacturing facilities, further leading to a high demand for greases in the country.

Middle East & Africa Grease Market Trends

The grease market in the Middle East and Africa is expected to grow substantially over the forecast period, owing to the improvement in oil pricing, as per the IMF. The market is likely to be driven by the expanding oil and gas industry and increasing construction expenditures in the region. Greases are used in heavy machinery used in metal mining, gas exploration, and oil extraction activities. Thus, the growing demand for oil and gas is expected to increase the consumption of greases in the Middle East.

Saudi Arabia grease market is experiencing a significant rise in product demand. The country's construction sector has grown substantially, driven by mega projects such as the Red Sea Project and the Qiddiya entertainment city. These developments have increased the need for greases used in construction machinery. Mega construction projects and oil refining facilities are major end-users of greases in the country. Several infrastructure projects have been sanctioned by the Saudi government, further developing the country's infrastructure sector.

Key Grease Company Insights

Some key players operating in the market include Shell plc, Exxon Mobil Corporation, Chevron Corporation, FUCHS, and TotalEnergies.

-

Established players compete and outplay the regional players by strategically integrating across the value chain to ensure seamless supply chain activities and reduce production and operating costs. In addition, companies involved in manufacturing greases develop new products and production technologies. Companies are also backwardly integrating to save the operationalcostsof raw material procurement.

-

For instance, companies such as Chevron Corporation, ExxonMobil Corporation, INEOS, and Shell Plc are backward integrated in the market's value chain and, hence, are involved in manufacturing different raw materials.

Key Grease Companies:

The following are the leading companies in the grease market. These companies collectively hold the largest market share and dictate industry trends.

- NYCO

- Battenfeld-Grease & Oil Corporation of New York

- RichardsApex, Inc.

- Lubriplate Lubricants Company

- GB Lubricants

- Canoil Canada Ltd.

- Eastern Oil Company

- JAX Incorporated

- Daubert Chemical Company

- D-A Lubricant Company

- Xaerus Performance Fluids, Inc.

- MorOil Technologies

- Royal High Performance Oil & Greases

- Industrial Oils Unlimited

- Primrose Oil Company, Inc.

- Environmental Lubricants Manufacturing, Inc. (ELM)

- Cadillac Oil

- CONDAT

- LUBRITA Europe B.V.

- COGELSA Efficient Lubrication

- Interflon

Recent Developments

-

In March 2025, D-A Lubricant Company announced the acquisition of Crystal Packaging, a contract blending company based in Henderson, Colorado. This strategic move aims to expand D-A Lubricant's blending capabilities and strengthen its presence in the western U.S. market.

-

In February 2025, GB Lubricants introduced a new Scania P 280 truck to its fleet, enhancing delivery efficiency across the UK. This initiative aligns with the company's sustainability goals, as the truck uses green energy sourced from the Gateshead District Energy Scheme.

-

In May 2024, GB Lubricants introduced its latest innovation, GB Super Universal Tractor Oil 15W-30. This multifunctional oil, designed for farm machinery, is formulated with top-grade virgin mineral base oils and advanced additive systems. It ensures optimal lubrication for various tractor components.

-

In November 2023, NYCO revealed that Pegasus Airlines, a prominent low-cost carrier in Turkey, opted for TURBONYCOIL 600 to provide engine lubrication across its entire fleet. Pegasus, recognized as one of the rapidly expanding airlines in the region, now boasts a fleet of 100+ aircraft.

-

In January 2024, Shell Lubricants (a subsidiary of Shell plc) finalized the acquisition of MIDEL and MIVOLT, both United Kingdom-based companies, from Manchester's M&I Materials Ltd. This acquisition marked Shell's commitment to produce, distribute, and promote the MIDEL and MIVOLT product ranges, enhancing its worldwide lubricants portfolio.

Grease Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6,269.2 million

Revenue forecast in 2030

USD 7.68 billion

Growth rate

CAGR of 4.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Form, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

NYCO; Battenfeld-Grease & Oil Corporation of New York; RichardsApex; Inc.; Lubriplate Lubricants Company; GB Lubricants; Canoil Canada Ltd.; Eastern Oil Company; JAX Incorporated; Daubert Chemical Company; D-A Lubricant Company; Xaerus Performance Fluids; Inc.; MorOil Technologies; Royal High-Performance Oil & Greases; Industrial Oils Unlimited; Primrose Oil Company, Inc.; Environmental Lubricants Manufacturing, Inc. (ELM); Cadillac Oil; CONDAT; LUBRITA Europe B.V.; COGELSA Efficient Lubrication; Interflon

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Grease Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global grease market report based on product, application, and region:

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Mineral

-

Synthetic

-

Bio-based

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Metal & Mining

-

Power Generation

-

Food Processing

-

Agriculture

-

Manufacturing

-

Oher Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global grease market size was estimated at USD 6,045.6 million in 2024 and is expected to reach USD 6,269.2 million in 2025.

b. The global grease market is expected to grow at a compound annual growth rate of 4.1% from 2025 to 2030 to reach USD 7,678.6 million by 2030.

b. Asia Pacific dominated the market segment with a revenue share of 38.4% in 2024 owing to construction activities and growing demand for products from automotive sector in emerging countries, such as India, Japan, and South Korea, are expected to drive the market over the forecast period.

b. Some key players operating in the greases market include NYCO, Battenfeld-Grease & Oil Corporation of New York, RichardsApex, Inc., Lubriplate Lubricants Company, GB Lubricants, Canoil Canada Ltd., Eastern Oil Company, JAX Incorporated, Daubert Chemical Company, D-A Lubricant Company, Xaerus Performance Fluids, Inc., MorOil Technologies, Royal High- Performance Oil & Greases, Industrial Oils Unlimited, Primrose Oil Company, Inc., Environmental Lubricants Manufacturing, Inc. (ELM), Cadillac Oil, CONDAT, LUBRITA Europe B.V., COGELSA Efficient Lubrication, Interflon

b. Key factors that are driving the greases market growth include surging growth of vehicles and their spare parts.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.