- Home

- »

- Distribution & Utilities

- »

-

Grid Analytics Market Size & Share, Industry Report, 2033GVR Report cover

![Grid Analytics Market Size, Share & Trends Report]()

Grid Analytics Market (2025 - 2033) Size, Share & Trends Analysis Report By Component Type (Software, Services, Hardware), By Application (Asset Management, Grid Operations & Reliability), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-830-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Grid Analytics Market Summary

The global grid analytics market size was estimated at approximately USD 6.67 billion in 2024 and is projected to reach USD 17.48 billion by 2033, growing at a CAGR of 11.18% from 2025 to 2033. The market expansion is driven by the accelerating digital transformation of power utilities, increasing deployment of smart grids, and the growing need to enhance grid reliability, resilience, and operational efficiency.

Key Market Trends & Insights

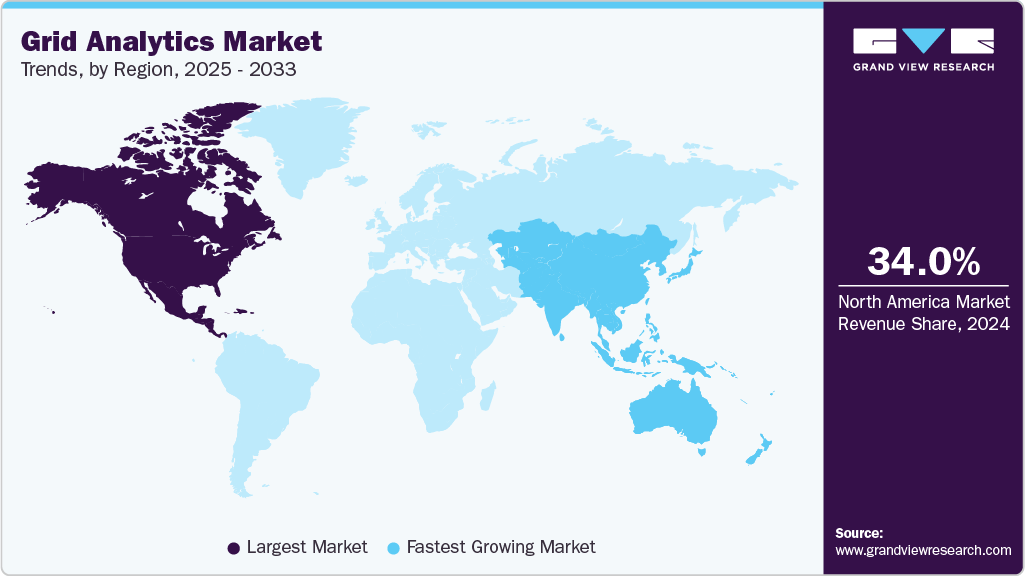

- The North America grid analytics market held the largest share of 34% of the global market in 2024.

- The grid analytics market in the U.S. is expected to grow significantly over the forecast period.

- By component type, software held the highest market share of 52% in 2024.

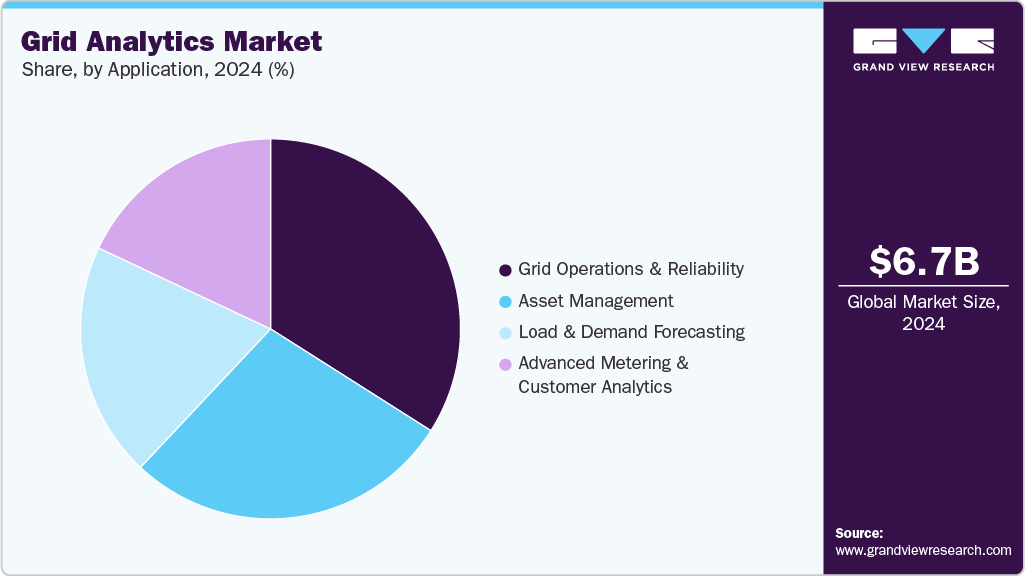

- By application, the grid operations & reliability segment held the highest market share of over 34% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.67 Billion

- 2033 Projected Market Size: USD 17.48 Billion

- CAGR (2025-2033): 11.18%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Governments and regulatory bodies are also encouraging grid modernization initiatives and data-driven decision-making to optimize energy distribution, reduce transmission losses, and ensure grid stability, further fueling market growth.The market in North America is growing steadily, driven by the rapid modernization of aging grid infrastructure, strong investments in smart grid technologies, and the widespread adoption of advanced metering infrastructure (AMI). Utilities across the U.S. and Canada are increasingly leveraging data-driven platforms to improve outage management, enhance load forecasting, reduce transmission losses, and integrate distributed energy resources such as solar, wind, and EV charging networks. Supportive regulatory frameworks, cybersecurity mandates, and federal funding programs for grid resilience are accelerating the adoption of analytics solutions.

The APAC market is experiencing robust growth due to rapid urbanization, increasing electricity demand, and large-scale initiatives focused on grid digitization and renewable energy integration. Countries such as China, India, Japan, South Korea, and Australia are prioritizing smart grid development to improve grid reliability, reduce power outages, and manage fluctuating loads caused by the fast adoption of solar energy and distributed generation.

Drivers, Opportunities & Restraints

The grid analytics industry is primarily driven by the accelerating modernization of power infrastructure and the growing need to enhance grid reliability, efficiency, and resilience. The increasing deployment of smart meters, IoT-enabled grid sensors, and distributed energy resources (DERs) such as renewable power and electric vehicle charging stations is generating vast volumes of data that utilities must analyze in real time to optimize operations. The rising focus on reducing transmission and distribution losses, minimizing outage durations, automating demand response, and improving asset life cycles further strengthens the demand for advanced analytics platforms.

Significant opportunities exist in the integration of artificial intelligence, machine learning, and cloud computing to create advanced predictive and prescriptive analytics solutions for grid operations. Utilities are increasingly adopting digital twins, grid simulation tools, and DER management systems (DERMS) to improve forecasting, planning, and risk mitigation, opening new avenues for vendors offering integrated analytics platforms.

Despite strong growth potential, the grid analytics industry faces challenges related to high implementation costs, complex system integration, and limited analytics expertise within many utilities. Legacy grid infrastructure, data silos, and interoperability issues between equipment from different vendors can significantly delay analytics deployment and reduce data accuracy. Concerns around data privacy, cybersecurity vulnerabilities, and the lack of unified regulatory standards across regions also create barriers to adoption.

Component Type Insights

The software segment accounted for the largest market share of approximately 52% in 2024, driven by the increasing demand for advanced data analytics, real-time monitoring, and predictive decision-making capabilities across power utilities. Software solutions enable utilities to optimize load management, improve outage detection, enhance asset performance, and integrate distributed energy resources effectively.

Services is expected to witness significant growth, registering a robust CAGR of 12.42% from 2025 to 2033, driven by the increasing demand for consultancy, system integration, maintenance, and managed analytics services among utilities. As power grids become more complex with the integration of distributed energy resources, renewable energy, and IoT-enabled devices, utilities are relying on expert service providers to implement, operate, and optimize grid analytics solutions.

Application Insights

The grid operations & reliability segment accounted for the largest market share of approximately 34% in 2024, driven by the increasing need for utilities to maintain a stable and uninterrupted power supply while optimizing operational efficiency. Rising electricity demand, integration of distributed energy resources, and aging grid infrastructure have made real-time monitoring, predictive maintenance, and fault detection critical for preventing outages and minimizing downtime.

The advanced metering & customer analytics segment is anticipated to experience significant growth, with a CAGR of 12.46% from 2025 to 2033, driven by the increasing adoption of smart meters, IoT-enabled devices, and digital platforms that enable utilities to collect and analyze vast amounts of customer energy data. These analytics solutions help utilities understand consumption patterns, optimize demand response, improve billing accuracy, and offer personalized energy management services.

Regional Insights

North America grid analytics market accounted for the largest share of 34% in 2024, driven by strong investments in smart grid modernization, widespread deployment of advanced metering infrastructure (AMI), growing emphasis on grid reliability and outage management, and supportive government initiatives to upgrade aging transmission and distribution networks.

U.S. Grid Analytics Market Trends

The grid analytics market in the U.S. continues to dominate in 2024, supported by rapid modernization of transmission and distribution infrastructure, large-scale rollout of smart meters and IoT-enabled grid sensors, and strong regulatory emphasis on improving grid reliability and resilience.

Europe Grid Analytics Market Trends

The grid analytics market in Europe is witnessing strong growth driven by increasing integration of renewable energy sources, rising investments in smart grid infrastructure, stringent regulatory mandates for energy efficiency and decarbonization, and growing adoption of advanced metering and predictive analytics to enhance grid reliability and reduce operational costs.

Asia Pacific Grid Analytics Market Trends

The grid analytics market in the Asia Pacific is growing with fastest CAGR of 13.60% globally, driven by rapid urbanization and industrialization, large-scale investments in smart grid and digital utility infrastructure, increasing deployment of smart meters and IoT-enabled grid devices, and strong government initiatives to modernize power distribution and integrate renewable energy and distributed energy resources (DERs) across emerging economies such as China, India, and Southeast Asian nations.

Latin America Grid Analytics Market Trends

The grid analytics market in Latin America is emerging steadily, supported by growing investments in smart grid development, increasing deployment of advanced metering infrastructure (AMI), rising focus on reducing transmission and distribution losses, and government-led initiatives to modernize aging power infrastructure and enhance grid reliability across countries such as Brazil, Mexico, and Chile.

Middle East & Africa Grid Analytics Market Trends

The grid analytics market in the Middle East & Africa is gaining momentum as utilities accelerate digital transformation initiatives, expand smart grid and AMI deployments, and invest in analytics-driven outage management and asset monitoring to enhance grid reliability, support renewable energy integration, and address rising electricity demand across the region.

Key Grid Analytics Company Insights

Some of the key players operating in the global market include Siemens AG, IBM Corporation, GE Vernova (General Electric), and Oracle Corporation.

-

Siemens AG is a global leader in the market, providing end-to-end smart-grid solutions that combine power infrastructure, automation, and advanced analytics. Its platforms, including the EnergyIP Analytics Suite, enable real-time monitoring, predictive maintenance, and outage management, helping utilities optimize operations, integrate renewables, and modernize their grids worldwide.

-

IBM Corporation is a leading component type and consulting company that provides advanced grid analytics solutions to utilities worldwide. Leveraging its AI, cloud, and data analytics capabilities, IBM offers platforms such as IBM Maximo Asset Performance Management (APM) and IBM Utility Analytics to enable predictive maintenance, outage management, and real-time monitoring of grid operations. By combining IT expertise with energy-domain knowledge, IBM helps utilities optimize asset performance, enhance grid reliability, integrate distributed energy resources, and support smart-grid modernization globally.

Key Grid Analytics Companies:

The following are the leading companies in the grid analytics market. These companies collectively hold the largest Market share and dictate industry trends.

- Siemens AG

- IBM Corporation

- GE Vernova (General Electric)

- Oracle Corporation

- Schneider Electric SE

- ABB Ltd.

- Itron, Inc.

- SAS Institute Inc.

- Honeywell International Inc.

- Capgemini SE

Recent Developments

- In February 2024, GE Vernova launched its GridOS Data Fabric in the U.S., enabling utilities to unify distributed grid data, enhance real-time analytics, and improve resilience amid growing renewable integration.

Grid Analytics Market Report Scope

Report Attribute

Details

Market Definition

The market size represents the total investment and operational expenditure involved in manufacturing, installing, and maintaining grid analytics systems, including residential, commercial, and industrial rooftop installations, as well as associated energy storage and grid-integration solutions.

Market size value in 2025

USD 7.49 billion

Revenue forecast in 2033

USD 17.48 billion

Growth rate

CAGR of 11.18% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Component type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

Siemens AG; IBM Corporation; GE Vernova (General Electric); Oracle Corporation; Schneider Electric SE; ABB Ltd.; Itron, Inc.; SAS Institute Inc.; Honeywell International Inc.; Capgemini SE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Grid Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global grid analytics market report based on component type, application, and region:

-

Component Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Services

-

Hardware

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Asset Management

-

Grid Operations & Reliability

-

Load & Demand Forecasting

-

Advanced Metering & Customer Analytics

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global grid analytics market size was estimated at USD 6.67 billion in 2024 and is expected to reach USD 17.48 billion in 2025.

b. The global grid analytics market is expected to grow at a compound annual growth rate of 11.18% from 2025 to 2033 to reach USD 17.48 billion by 2033.

b. Based on the component type segment, software held the largest revenue share of more than 52% in 2024.

b. Some of the key players operating in the global grid analytics market include Siemens AG, IBM Corporation, GE Vernova (General Electric), Oracle Corporation, Schneider Electric SE, ABB Ltd., Itron, Inc., SAS Institute Inc., Honeywell International Inc. and Capgemini SE.

b. The grid analytics market is primarily driven by the growing adoption of smart grids, integration of renewable energy, increasing deployment of IoT-enabled devices, and the need for real-time monitoring and predictive maintenance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.