- Home

- »

- Next Generation Technologies

- »

-

Grow Light Market Size And Share, Industry Report, 2030GVR Report cover

![Grow Light Market Size, Share & Trends Report]()

Grow Light Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (< 300 Watt, > 300 Watt), By System, By Technology (High Intensity Discharge, LED, Fluorescent, Plasma), By Installation, By Spectrum, By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-891-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Grow Light Market Summary

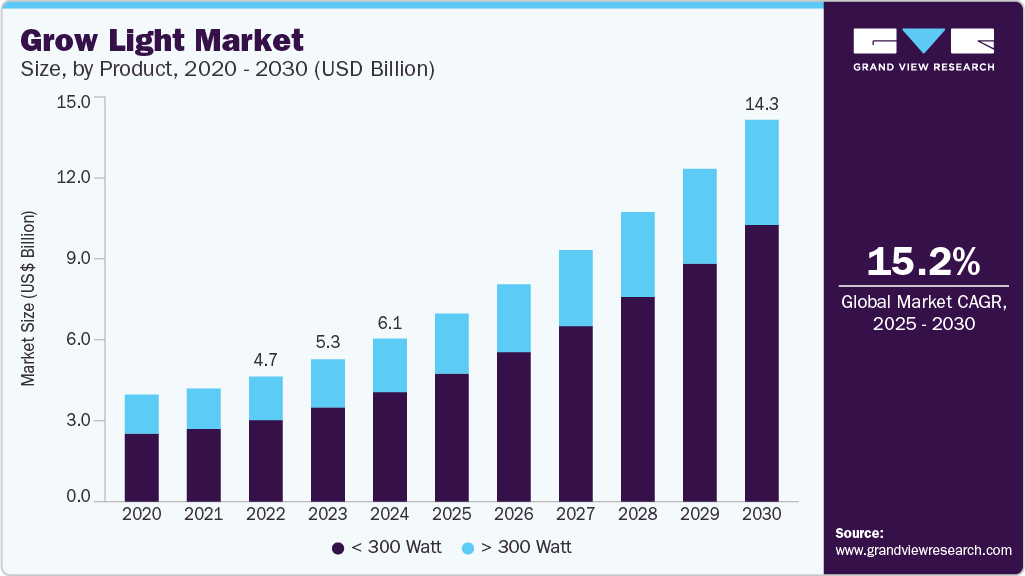

The global grow light market size was estimated at USD 6.11 billion in 2024 and is projected to reach USD 14.31 billion by 2030, growing at a CAGR of 15.2% from 2025 to 2030. Growing urban cultivation, vertical farming, and the growing adoption of environment-friendly production of fruits and vegetables are boosting market growth.

Key Market Trends & Insights

- The North America grow lights market is growing significantly, with a CAGR of nearly 7.2% from 2025 to 2030.

- Europe held the major share of over 31.0% of the grow lights industry in 2024.

- The grow light market in Asia Pacific is expected to witness the highest CAGR of 16.7% from 2025 to 2030.

- In terms of spectrum, the full spectrum segment dominated the market and accounted for a revenue share of 62.0% in 2024.

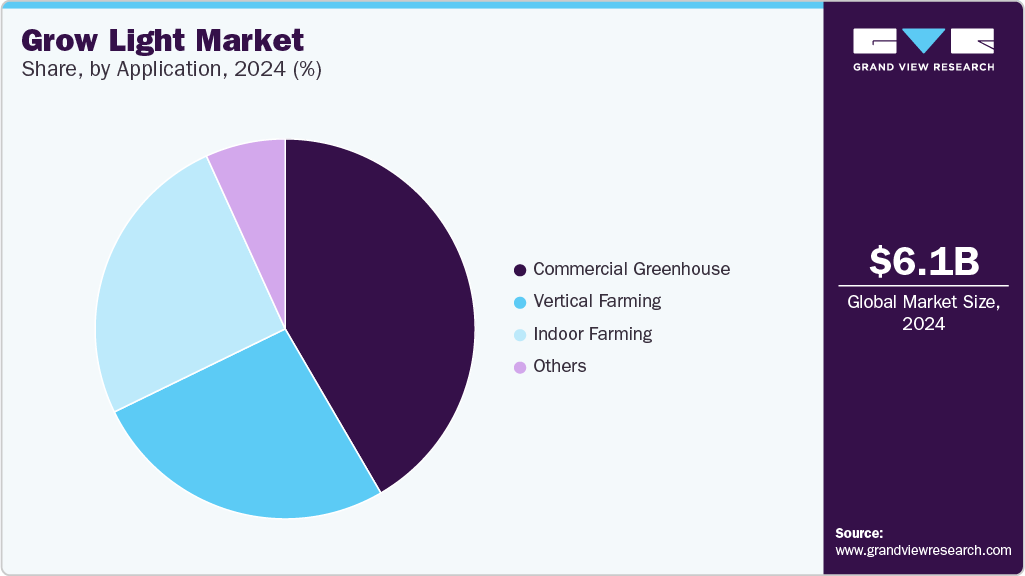

- Based on application, the commercial greenhouse segment accounted for the largest market share of over 41.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.11 Billion

- 2030 Projected Market Size: USD 14.31 Billion

- CAGR (2025-2030): 15.2%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

The unprecedented growth of the global population has also increased the demand for urban agriculture. Furthermore, vertical farming for producing food in a vertically stacked layer, such as a used warehouse, skyscraper, or shipping container, boosts market growth. Grow light helps extend the hours of natural daylight, which further increases the plants' health, growth rate, and yield. Artificial lighting, such as high-pressure sodium lighting, LED lighting, and plasma lighting, can extend the availability of crops (throughout a season).

Growing awareness regarding the importance of alternative farming, owing to the limited availability of fertile agricultural land and increasing population, is the key factor anticipated to spur the industry demand. Unlike traditional farming, indoor farming can produce crops yearly, increasing productivity. Furthermore, indoor farming can protect crops from extreme weather conditions through techniques such as controlled environment agriculture technology, where the facilities use artificial environmental control, control of light, and fertigation.

The growing demand for locally produced, organic, and pesticide-free food has further fueled market adoption. These operations rely entirely on artificial lighting to grow crops in controlled environments such as warehouses and shipping containers. Consumer preferences for traceable and sustainable food sources encourage more investment in these systems, thereby driving demand for high-quality grow lighting technologies. As global demand continues prioritizing innovation and sustainability in agriculture, the market is poised for sustained and dynamic growth.

Product Insights

The < 300 watt segment accounted for the largest market share of over 67.0% in 2024. Increasing demand for high-intensity lighting solutions in large-scale commercial horticulture and vertical farming operations drives market growth. These high-wattage grow lights offer greater light intensity and broader coverage, making them ideal for expansive indoor cultivation facilities that require uniform illumination to support the healthy growth of plants, especially during the flowering and fruiting stages. As commercial growers aim to maximize crop yield and quality, the demand for high-performance lighting systems with superior photon flux density (PPFD) is pushing the adoption of < 300 watt grow lights.

The > 300 watt segment is anticipated to grow at a CAGR of 8.9% during the forecast period due to the expanding use of grow light systems in the residential sector. LED lamps provide advantages, including increased energy efficiency and greater stability over substitutes like incandescent bulbs and CFLs. They also come in a wide range of forms. Another factor projected to support the growth of LED lamps is the government's policy for raising public awareness of LEDs and their potential to help reduce and manage energy usage.

System Insights

The hardware segment dominated the market and accounted for a revenue share of over 73.0% in 2024. The hardware segment includes various grow lights such as LEDs, plasma lights, high-intensity discharge (HID) lights, and ballasts. This growth is attributed to the increasing penetration of controlled-environment agriculture (CEA), which controls various environmental factors using software.

The software segment is expected to register the highest CAGR during the forecast period. Software solutions are used in grow lights to improve plant quality. Every plant has different requirements regarding optimal lighting duration and lighting intensity, which can maximize the production output from the plants. Designing specialized software based on the specifics of each plant can enable maximum production with the optimal utilization of the grow lights. Many companies in the market also offer services such as maintenance and repair of the grow lights and software services for the provided solutions.

Technology Insights

The LED segment accounted for the largest market share of over 35.0% in 2024 in the grow lights industry. Increasing urban cultivation and government initiatives to adopt energy-efficient LEDs are expected to drive the LED segment. LED lamps are most efficient at a higher price point. LEDs produce the exact wavelength of desired light. It can produce dual-band spectrum (red & blue) simultaneously. LEDs are good for all growth phases. LEDs are more expensive at the initial stage, but get cheaper over time.

The plasma segment is anticipated to register significant growth during the forecast period. Plasma lights offer a full-spectrum light similar to sunlight. These lights have a longer service period and produce less heat. Plasma lights also consume very little energy compared to other technology types, even though they produce light with comparable intensity to that of HID and LED. Plasma lights have high initial costs but get cheaper over the long run. Plasma lights are useful in vegetative growth as well as flowering.

Installation Insights

The retrofit segment accounted for the largest market share of over 56.0% in 2024. The expansion of urban and vertical farming is driving the segment's growth. These operations often involve repurposing existing industrial or commercial buildings where electrical systems and structural constraints make installing entirely new lighting infrastructure impractical. Retrofit grow light solutions offer a flexible and scalable approach, allowing operators to enhance lighting quality and intensity tailored to specific crop needs without extensive renovation. This adaptability makes retrofitting a highly attractive option for small and medium-sized enterprises entering the controlled-environment agriculture space.

The new installation segment is anticipated to grow during the forecast period. The increasing legalization and commercialization of cannabis cultivation across multiple regions drive the segment's growth. These high-value crops demand precise light intensity and spectrum control to optimize growth stages, which new installations can deliver effectively. The profitability of cannabis and similar specialty crops justifies the upfront capital investment in state-of-the-art lighting systems, encouraging growers to adopt comprehensive new lighting solutions rather than modifying older setups. This trend continues to drive market innovation and demand.

Spectrum Insights

The full spectrum segment dominated the market and accounted for a revenue share of 62.0% in 2024. Full spectrum lamps emit light similar to sunlight. These lamps are useful at every growth stage of a plant. Full spectrum light provides light across the 400 nm to 700 nm wavelengths. It is referred to as Photosynthetic Active Radiation (PAR). Full spectrum light can serve a dual purpose as it provides comfortable lighting for the space and plants. It may allow growers to reduce or remove additional light sources in the growing space.

The partial spectrum segment is anticipated to grow at the highest CAGR during the forecast period. The partial spectrum grow lights emit light of a specific spectrum, such as yellow, blue, or green. These light spectrums are useful at various plant growth stages. These are targeted to specific stages of plant growth, considerably reducing plants' growth time and improving yields. Red and blue wavelengths are conducive for the vegetative growth stage, while red and far-red wavelengths promote better growth for the flowering stage.

Application Insights

The commercial greenhouse segment accounted for the largest market share of over 41.0% in 2024. The increasing global demand for fresh fruits and vegetables drives the segment's growth. In addition, the legalization and commercialization of cannabis in various countries have significantly boosted the adoption of advanced grow lighting systems. Technological innovations, falling prices of LED grow lights, and government incentives for sustainable agriculture practices also contribute to market expansion. As growers continue to seek ways to optimize output while reducing operational costs, the role of advanced grow lighting solutions in modern greenhouse farming is becoming increasingly indispensable.

The vertical farming segment is anticipated to register the highest CAGR during the forecast period. The rising consumer preference for pesticide-free and organic produce is driving segment growth. Vertical farms, operating in enclosed environments, have better control over contamination and pests, reducing or eliminating the need for chemical pesticides. Grow lights are critical in ensuring plants receive optimal light exposure without relying on external environmental factors. This capability supports the consistent production of cleaner, higher-quality crops, which aligns with the growing health consciousness among consumers globally.

Regional Insights

The North America grow lights market is growing significantly, with a CAGR of nearly 7.2% from 2025 to 2030. The legalization and commercialization of cannabis in many U.S. states and across Canada have created a strong demand for advanced indoor cultivation systems, where grow lights are critical for optimizing plant growth. The cannabis sector requires precise light control to influence different growth stages, and LED systems provide the tunable spectrums and energy efficiency needed to maximize output and reduce operational costs. This has led to significant investment in research and development of high-performance grow lights tailored specifically for cannabis cultivation.

U.S. Grow Lights Market Trends

The U.S. grow lights industry is expected to grow significantly from 2025 to 2030. The increasing adoption of controlled-environment agriculture (CEA), including greenhouses, indoor farms, and vertical farming systems, is driving market adoption. With a rising demand for fresh, locally grown produce and heightened interest in sustainable food production, U.S. growers invest in artificial lighting to ensure consistent yields and high-quality crops throughout the year. Grow lights, particularly energy-efficient LED systems, have become essential for these operations, especially in regions with seasonal limitations on natural sunlight.

Europe Grow Lights Market Trends

Europe held the major share of over 31.0% of the grow lights industry in 2024. The growth of the horticulture sector, particularly in countries like the Netherlands, Germany, and France, is another significant market driver. The Netherlands, a global leader in greenhouse technology and horticultural exports, continues to invest in advanced lighting systems to increase crop yields while maintaining energy efficiency. In Northern and Eastern Europe, where sunlight can be extremely limited in colder months, artificial lighting becomes even more critical for year-round cultivation. This geographic necessity further fuels the demand for reliable growing lighting solutions.

The grow light market in the UK is expected to grow significantly from 2025 to 2030. Urban agriculture and vertical farming are also emerging as influential sectors in the UK, particularly in densely populated cities like London, Manchester, and Birmingham. The rise of urban farms and agritech startups has spurred demand for high-performance grow lights that can be integrated into compact, indoor systems. These ventures aim to produce fresh, pesticide-free food within city limits, reducing food miles and enhancing urban food resilience. As vertical farms rely entirely on artificial lighting, the expansion of this segment directly supports market growth.

Asia Pacific Grow Lights Market Trends

The grow light market in Asia Pacific is expected to witness the highest CAGR of 16.7% from 2025 to 2030. The growing investment in smart agriculture and agritech innovation drives regional market growth. Governments and private companies across the region are promoting advanced farming methods to address agricultural inefficiencies and climate-related challenges. Japan and South Korea, in particular, have invested heavily in vertical farming initiatives, where grow lights are critical for plant development in entirely indoor environments. LED grow lights are favored for their ability to provide customizable light spectrums and improve energy efficiency, key concerns in high-tech indoor farms operating in urban centers.

China grow light market is projected to grow during the forecast period. China’s strong manufacturing base and technological capabilities support rapid innovation and scaling in the grow light industry. Domestic companies are developing high-performance, cost-effective LED grow lights, often integrated with IoT and AI systems for precise control over light intensity and spectral output. This vertical integration from production to application gives China a competitive advantage in domestic deployment and export of grow light technologies. As the country balances population growth, urbanization, and environmental concerns, the market is expected to expand steadily, becoming essential to China’s future farming infrastructure.

Key Grow Light Company Insights

Some leading market participants include AeroFarms, Signify Holding, and Osram Licht AG.

- AeroFarms is a pioneering indoor agriculture company specializing in vertical farming through aeroponic technology. Central to AeroFarms' cultivation process is the use of custom LED grow lights. These lights are tailored to emit specific wavelengths that optimize photosynthesis and promote healthy plant growth. By precisely controlling the light spectrum, intensity, and duration, AeroFarms creates an ideal environment for plants to thrive year-round, regardless of external weather conditions.

EVERLIGHT ELECTRONICS CO., LTD. and GAVITA Holland BV are some of the emerging market participants.

-

EVERLIGHT ELECTRONICS CO., LTD., is a prominent global player in the LED industry. Specializing in the design, manufacturing, and sale of light-emitting diodes (LEDs), Everlight offers a diverse product portfolio encompassing high-power LEDs, surface-mount device (SMD) LEDs, lamps, lighting components, LED modules, digital displays, optocouplers, and infrared components. The company's products cater to a wide range of applications, including general lighting, automotive lighting, consumer electronics, and industrial uses.

-

GAVITA Holland BV is a Dutch company specializing in advanced horticultural lighting solutions. Gavita's product portfolio is centered around providing efficient and reliable lighting systems that support optimal plant growth. The company offers a range of products, including high-pressure sodium (HPS) lamps, ceramic metal halide (CMH) lamps, light-emitting plasma (LEP) systems, and LED-based fixtures. These products are designed to meet the specific needs of different plant species and growth stages, ensuring maximum yield and quality.

Key Grow Light Companies:

The following are the leading companies in the grow light market. These companies collectively hold the largest market share and dictate industry trends.

- AeroFarms

- EVERLIGHT ELECTRONICS CO., LTD.

- GAVITA Holland BV

- Heliospectra AB

- Hortilux Schréder

- Illumitex

- LumiGrow Inc

- Osram Licht AG

- Signify Holding

- Sunlight Supply, Inc.

Recent Developments

-

In December 2024, Heliospectra AB launched the Dynamic MITRA X multi-channel LED lights, seamlessly integrating with the company’s HelioCORE Software to optimize light management for professional growers and researchers. These new multi-channel solutions are designed to complement Heliospectra’s fixed and Flex spectrum options, meeting the increasing demand from commercial growers for greater operational adaptability and flexibility.

-

In June 2024, Signify Holding launched the Philips GreenPower LED Toplighting Force 2.0 (TLF 2.0), featuring enhanced high light output options of up to 5150 µmol/s. More light in the optimal setting enables higher yields and improved business performance. The newly engineered Quadro beam lens ensures consistent light distribution in all directions, even at elevated light outputs. This results in fewer fixtures needed for the same area, reducing installation expenses and maximizing light efficiency.

Grow Lights Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.04 billion

Revenue forecast in 2030

USD 14.31 billion

Growth rate

CAGR of 15.2% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, system, technology, installation, spectrum, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

AeroFarms; EVERLIGHT ELECTRONICS CO., LTD.; GAVITA Holland BV; Heliospectra AB; Hortilux Schréder; Illumitex; LumiGrow Inc.; Osram Licht AG; Signify Holding; Sunlight Supply, Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Light Market Report Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global grow light market report based on product, system, technology, installation, spectrum, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

< 300 Watt

-

> 300 Watt

-

-

System Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

High Intensity Discharge

-

LED

-

Fluorescent

-

Plasma

-

-

Installation Outlook (Revenue, USD Million, 2018 - 2030)

-

New Installation

-

Retrofit

-

-

Spectrum Outlook (Revenue, USD Million, 2018 - 2030)

-

Partial Spectrum

-

Full Spectrum

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Indoor Farming

-

Vertical Farming

-

Commercial Greenhouse

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global grow light market size was estimated at USD 6.11 billion in 2024 and is expected to reach USD 7.04 billion in 2025.

b. The global grow light market is expected to grow at a compound annual growth rate of 16.5% from 2025 to 2030 to reach USD 14.31 billion by 2030.

b. The < 300 watt segment accounted for the largest market share of over 67.0% in 2024 in the grow light market. Increasing demand for high-intensity lighting solutions in large-scale commercial horticulture and vertical farming operations is driving market growth.

b. Some key players operating in the grow light market include AeroFarms, EVERLIGHT ELECTRONICS CO., LTD., GAVITA Holland BV, Heliospectra AB, Hortilux Schréder, Illumitex, LumiGrow Inc, Osram Licht AG, Signify Holding, Sunlight Supply, Inc.

b. Key factors that are driving the grow light market growth include growing urban cultivation & vertical farming and growing adoption of environment-friendly and organic production of fruits and vegetables.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.