- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Halloysite Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Halloysite Market Size, Share & Trends Report]()

Halloysite Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Medical, Ceramics, Cosmetics, Paints, Cement, Polymers), By Region (APAC, Europe, North America, CSA, MEA), And Segment Forecasts

- Report ID: GVR-2-68038-430-7

- Number of Report Pages: 79

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Halloysite Market Size & Trends

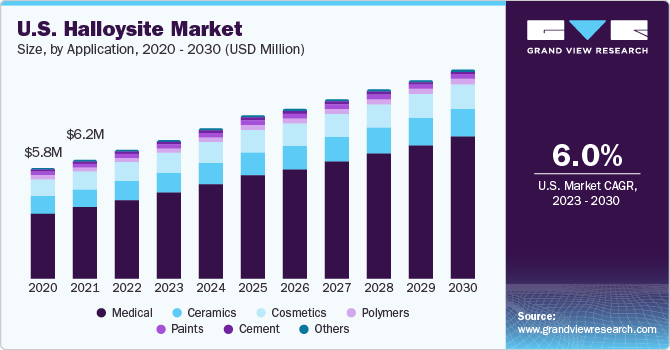

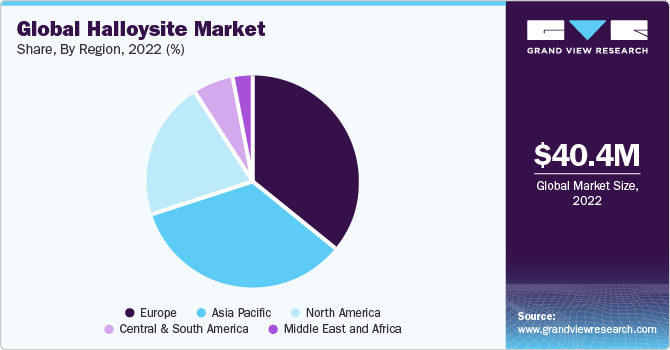

The global halloysite market size was valued at USD 40.4 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.5% from 2023 to 2030. Surging demand for halloysite in novel applications in the medical, cosmetics, and paints industries is projected to drive the market over the forecast period. In addition, manufacturers are increasingly acknowledging the use of the product in the production of tissue engineering scaffolds, which in turn is poised to spur the growth of the market.

Production of raw material varies annually with manufacturers changing trends to meet the annual projected demand for halloysite material. Extensive integration of manufacturers to the raw material supply leads to its abundance, which in turn benefits the overall market growth. Besides this, rising raw material extraction due to spiraling product demand is anticipated to work in favor of the market.

The U.S. accounted for approximately three-quarters of the overall consumption of ceramics in North America in 2017, in terms of volume. The market in the U.S. is likely to remain at the forefront of North America throughout the forecast horizon owing to the increasing production of ceramic ware and other ceramic-based products in the country driven by the booming building & construction industry.

The substance is recognized as safe to use in critical and niche applications by agencies such as the European Commission. The presence of a limited regulatory framework for use of products across various end-use industries is estimated to fuel the demand for halloysite over the forecast period.

The market exhibits a significant threat of external substitution by kaolin and other clays, primarily in the ceramics industry. In addition, the high consumption of the product by the ceramic industry coupled with limited availability increases the substitution threat. However, the product is expected to substitute a number of nanomaterials currently used in applications such as medical and cosmetics.

Growing investments in the production of advanced halloysite products for use in medical, cosmetic, and filtration applications are projected to fuel growth prospects and augment production levels. In addition, rising monetary investments in R&D activities for the incorporation of nanomaterials in medical applications are poised to stimulate market growth.

The global halloysite market is anticipated to be driven by growing demand from the ceramic industry, where the halloysite is used as an additive to improve the performance characteristics of the end products. Halloysite is a crucial component in ceramics, where it is used with kaolin on account of having the same molecular structure. Thus, rising demand for ceramics is likely to aid halloysite demand over the coming years. The use of ceramic tiles in restaurants, offices, malls, and resorts, particularly in developing countries such as India, China, and Brazil, is projected to augment market growth over the forecast period.

Halloysite’s tubular molecular shape enables its use in the manufacturing of fine China and porcelain, as it has low iron and titanium content, which aids in producing ceramic products with exceptional whiteness and translucency. In addition, the fineness of halloysite clay particles aids its use in glazing applications, driving its demand in sanitary ware applications. The ceramic materials fulfill demanding hygiene specifications along with chemical and mechanical resistance requirements in bathrooms. The growth of the sanitary ware sector is expected to augment the demand for ceramics over the forecast period, thereby driving the market.

The demand for halloysite is expected to witness growth owing to its increasing demand in novel applications as well, such as polymer nanocomposites, paints, cement, etc. Halloysite nanotubes have recently become the subject of interest and research attention for being used in polymer nanotubes and polymers in general, as a new type of additive enhancing the mechanical, thermal, and fire-retardant performance of polymers.

Halloysite is mainly composed of aluminosilicate and has a predominantly hollow tubular structure with the chemical composition Al2(OH)4Si2O5(2H2O), which aids in providing superior performance to polymers in terms of flame retardancy, among other benefits. This is likely to have a positive impact on the demand for the product over the forecast period. In addition, halloysite nanotubes are considered an ideal material for preparing polymer composites as halloysites are rigid materials. Also, in terms of aspect ratio, the crystal structure of halloysite nanotubes is similar to that of carbon nanotubes.

According to Applied Mineral Inc., the global production of halloysite in 2016 was around 25,000 tons, in stark contrast to kaolinite, which recorded a production volume of approximately 6.1 million tons in the U.S. in the same year. Halloysite is expected to have limited reserves, with very few companies mining the product in the U.S. and New Zealand. The overall reserves are very low as compared to its substitutes or similar products such as kaolinite. As a result, the adoption of clay is relatively low.

Companies such as Applied Minerals, Inc. and Imerys are investing in exploration activities in search of new reserves. However, no new mines or reserves for halloysite have been reported as of now. Hence, depleting halloysite reserves and decreasing the production of the clay are expected to restrain the market growth. Furthermore, the major use of the product in ceramics applications is expected to limit its availability in other applications with high commercial potential.

Application Insights

The medical segment held the largest revenue share of 48.7% in 2022 and is expected to grow at the fastest CAGR of 6.8% over the forecast period. This is due to the usage of halloysite nanotubes in various applications, such as gene delivery, tissue engineering, drug delivery, bioimaging, cancer, and stem cells isolation. The porous nature of halloysite allows for efficient drug loading and sustained release, improving the effectiveness of treatments. There is a high demand for the product for use as a carrier for manufacturing various cosmetic products such as creams, gels, and lotions. Halloysite offers immobilization of a solid-phase ingredient and sustained release of liquid ingredients in cosmetics. The aforementioned factors are likely to boost the growth of the cosmetics segment.

Polymer manufacturers are increasingly employing the product as an additive for their offerings as it helps improve physical properties such as melting point and strength. Currently, the product is widely utilized as a filler in polyvinyl chloride, polystyrene, high-density polyethylene, and polyethylene terephthalate.

The growth of the ceramic ware industry, thanks to rising demand by the HORECA sector coupled with high consumer expenditure on home décor, is anticipated to register a noteworthy CAGR of 6.7% in terms of revenue over the forecast period.

Halloysite nanotubes have a high aspect ratio and unique crystal shape, which enhances the adhesion and strength of paints and coatings. The usage of halloysite-based coatings and paints helps eliminate fungal growth on wallboards and the accumulation of barnacles on ships. As a result, the demand for the product as a suspension agent in the industry is estimated to grow over the forecast years.

Regional Insights

Europe dominated the market and accounted for the largest revenue share of 35.6% in 2022. A shift in the manufacturing bases from European to Asian countries on account of low production costs is expected to affect the ceramics demand, which, in turn, is anticipated to limit the growth of the market in Europe. Growing demand for specialized clays in the Asia Pacific region is further anticipated to impact Europe’s share in the market. The demand for halloysite in Germany is expected to be primarily driven by its increasing application scope in the medical and ceramics industries. I-Minerals’ Ultra Hallopure Halloysite, a product manufactured by one of the major companies, was tested as a new wound treatment material. The companies in the economy have invested significantly in R&D pertaining to the development of advanced products, which, in turn, is expected to drive the market growth over the forecast period.

North America is expected to grow at the fastest CAGR of 5.9% during the forecast period. The growing healthcare industry and the demand for advanced medical technologies and therapies are fueling the need for halloysite in North America. In addition, increasing demand for sustainable and environmentally responsible materials is expected to drive the demand for halloysite in this region.

In terms of volume, Asia Pacific is expected to grow at the second-fastest CAGR of 5.8% over the forecast period. Increasing spending in the medical sector in the region is expected to have a positive impact on the demand for halloysite-based products such as implants. The rising demand for advanced ceramics in medical applications is likely to increase the demand for halloysite as it enhances the performance of advanced ceramics.

China is anticipated to dominate the product demand in Asia Pacific over the forecast period. Major brands such as P&G and Unilever have their manufacturing facilities established in China owing to the low manufacturing cost, and consequently, the country has become a major manufacturing hub for the majority of the cosmetics manufacturers. The product demand is likely to increase in China’s cosmetics industry over the forecast period as halloysite is used as a filler in moisturizers and other personal care products.

Key Companies & Market Share Insights

The industry is characterized by the presence of a limited number of players. Small-scale companies majorly compete on the basis of product quality as the type of product manufactured depends on the mine from where the material is sourced. The demand for halloysite is high in major ceramic product manufacturing companies.

Halloysite production is volatile in nature as the process has not yet been fully commercialized. Halloysite clay available in the market has been assigned several grades depending on its purity level. Key market players are resorting to the production of advanced grades of halloysite to cater to the demands of a niche market. The following are some of the major participants in the halloysite market:

-

Applied Minerals, Inc.

-

Imerys

-

I-Minerals

-

Northstar Clay Mines LLC

Recent Development

-

In September 2022, Ionic Mineral Technologies, a U.S.-based company specializing in advanced battery materials, introduced a new product called Ionisil. Ionisil is a nano-silicon material derived from halloysite, and it serves as a direct alternative to graphite in lithium-based batteries. By using nano-silicon in batteries, electric vehicles (EVs) can achieve longer driving ranges and faster charging capabilities. This innovation has the potential to revolutionize the EV market by enhancing the performance and efficiency of lithium-based batteries.

Halloysite Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 43.4 million

Revenue forecast in 2030

USD 63.0 million

Growth Rate

CAGR of 5.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD thousand, volume in tons and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; &MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia; Indonesia; Thailand; Malaysia; Brazil

Key companies profiled

Applied Minerals, Inc.; Imerys; I-Minerals; Northstar Clay Mines LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Halloysite Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global halloysite market on the basis of application, and region:

-

Application Outlook (Volume, Tons; Revenue in USD thousand, 2018 - 2030)

-

Medical

-

Cosmetics

-

Ceramics

-

Polymers

-

Cement

-

Paints

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue in USD thousand, Volume in Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa

-

Frequently Asked Questions About This Report

b. Europe dominated the halloysite market with a share of 35.6% in 2022. The demand for halloysite in Germany is expected to be primarily driven by its increasing application scope in the medical and ceramics industries.

b. Some key players operating in the halloysite market include Applied Minerals, Inc., Imerys, I-Minerals, and Northstar Clay Mines LLC.

b. Surging demand for halloysite in novel applications in the medical, cosmetics, and paints industries is projected to drive the market over the forecast period. In addition, manufacturers are increasingly acknowledging the use of the product in the production of tissue engineering scaffolds, which in turn is poised to spur the growth of the market.

b. The global halloysite market is expected to grow at a compound annual growth rate of 5.5% from 2023 to 2030 to reach USD 62.99 billion by 2030.

b. The global halloysite market size was estimated at USD 40.4 billion in 2022 and is expected to reach USD 43.40 billion in 2023.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.