- Home

- »

- Healthcare IT

- »

-

Healthcare Command Centers Market, Industry Report, 2033GVR Report cover

![Healthcare Command Centers Market Size, Share & Trends Report]()

Healthcare Command Centers Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Software, Hardware, Services), By Deployment Mode, By Command Center Type, By Functional Modules, By End-use, By Organization Size/Hospital Size, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-753-4

- Number of Report Pages: 190

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Healthcare Command Centers Market Summary

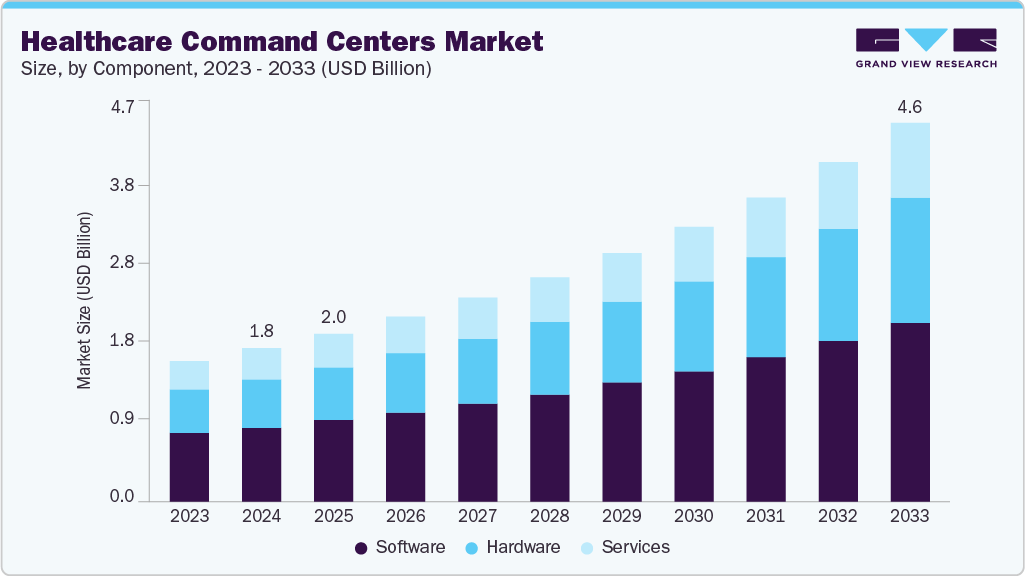

The global healthcare command centers market size was estimated at USD 1.84 billion in 2024 and is projected to reach USD 4.55 billion by 2033, growing at a CAGR of 10.7% from 2025 to 2033. Growing adoption of virtual care and hospital-at-home programs is one of the factors driving the market growth.

Key Market Trends & Insights

- North America dominated the market with the largest revenue share of 40.0% in 2024.

- The healthcare command centers market in the U.S. accounted for the largest market revenue share in North America in 2024.

- By component, the software segment led the market with the largest revenue share of 48.6% in 2024.

- By deployment mode, the cloud-based segment accounted for the largest market revenue share in 2024.

- By command center type, the capacity & bed management/care progression centers segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.84 Billion

- 2033 Projected Market Size: USD 4.55 Billion

- CAGR (2025-2033): 10.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As healthcare systems shift toward decentralized care, the need for centralized coordination is rising. Command centers are becoming essential for managing hospital-at-home initiatives, where patients receive acute-level care at home supported by remote monitoring and on-demand clinical interventions. These centers act as the “nerve center,” coordinating between virtual clinicians, home health providers, and logistics teams, ensuring safety while scaling care beyond hospital walls.

For instance, in August 2024, the Mayo Clinic expanded its Advanced Care at Home program with a dedicated command center in Jacksonville, Florida. From this hub, physicians and nurses provide 24/7 virtual monitoring, coordinate diagnostics, and dispatch in-home clinical teams when needed. The command center has been pivotal in reducing inpatient admissions for patients who can be safely treated at home, while still maintaining hospital-grade oversight and safety standards.

The increasing pressure to optimize patient flow drives the market growth. Hospitals worldwide are dealing with overcrowded emergency departments, delayed discharges, and shortages of critical care beds. Command centers directly address this challenge by acting as a central hub where clinical and operational staff monitor admissions, transfers, and discharges in real time. Using advanced dashboards, hospitals can anticipate bottlenecks and proactively reallocate resources to maintain steady patient flow.

For instance, in October 2024, the Cleveland Clinic unveiled an expanded Command Center at its main campus in Ohio. The facility integrates live feeds from electronic health records, bed-tracking systems, and patient transfer data to reduce emergency department boarding times and ensure ICU capacity is managed efficiently. The system allowed care teams to identify delays in discharges earlier in the day, leading to smoother patient transitions and faster bed turnover.

Case: Providence Puget Sound is an 8-hospital, 2,400-bed system in the Pacific Northwest (USA). The system had uneven capacity: hospitals in some regions (Central) were consistently over-burdened, while others (North/South) had excess capacity. There was limited visibility across the hospitals, causing transfer delays, ED boarding, and inefficient utilization of beds. Published in November 2024.

Implementation Details

-

They created a regional command center called STOC (Staffing, Transfer, and Operations Center) using GE HealthCare’s Command Center software.

-

STOC gives enterprise-wide visibility into capacity (beds, staffing), transfers, and operations across all 8 hospitals. Decision-makers from different sites are able to coordinate.

Outcomes / Results

-

15% increase in admissions system-wide.

-

Ability to handle ~19,000 additional patients per year thanks to better utilization of capacity.

-

46% reduction in ED boarding hours, meaning patients wait less in the emergency department after being admitted.

-

48.6% drop in number of patients leaving without being seen (LWBS).

-

Up to 103% increase in external hospital transfers, depending on region, because the command center better matches need and capacity.

-

36% decrease in blocked bed hours due to staffing constraints (i.e. beds that exist but can’t be used because of lack of staff).

Category

Quick Review

Market Impact

Implementation

STOC (Staffing, Transfer & Operations Center) launched across 8 hospitals using GE HealthCare Command Center platform.

Demonstrates scalable adoption of centralized command centers across large systems.

Primary Outcomes

- 15% rise in admissions

- 46% reduction in ED boarding

- 36% fewer blocked bed hours

Highlights efficiency gains and patient flow optimization as a market growth driver.

Healthcare Impact

- Ability to treat ~19,000 more patients annually

- Up to 103% increase in transfers

- 48.6% fewer LWBS (Left Without Being Seen) cases

Strengthens demand for integrated, real-time data solutions in hospital operations.

Key Takeaways

-

Regional coordination & visibility can unlock latent capacity in a hospital system (i.e. using beds that were available but under-used).

-

Managing staffing, transfers, and patient placement with a centralized control mechanism reduces delays (ED boarding, transfers) and improves patient access.

-

Software platforms that give real-time data across many hospitals (not just one facility) can make a big difference in throughput and system efficiency.

Market Concentration & Characteristics

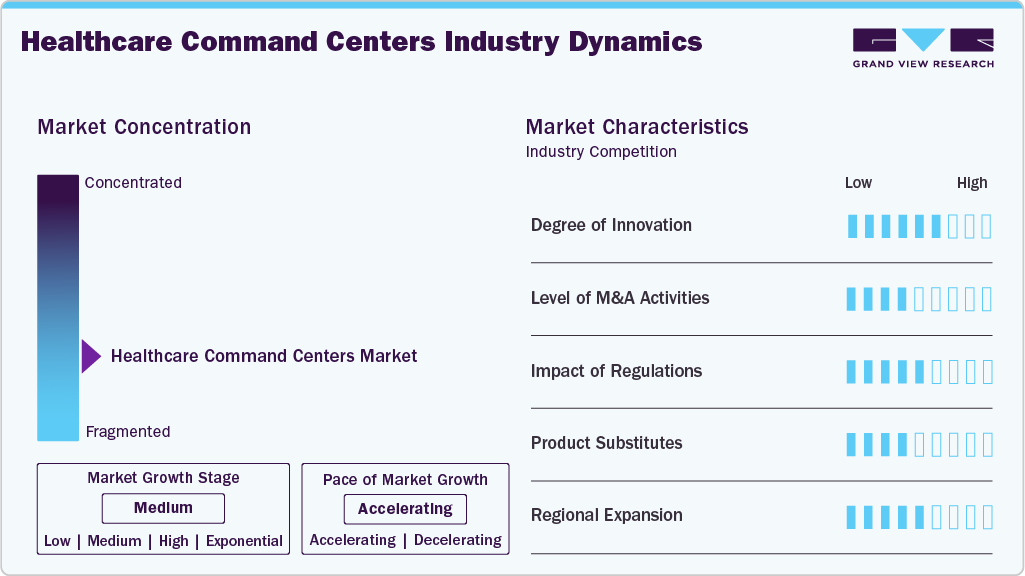

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the healthcare command centers industryis moderately concentrated, driven by major IT providers, tech innovators, and hospitals. Innovation and partnerships are very high, with strong adoption of AI, real-time data tools, and cross-industry collaborations. Regulatory impact is significant, focusing on data privacy, interoperability, and safety. Regional expansion is rising, led by North America and Europe, with growing adoption in Asia-Pacific and the Middle East.

The hospital command centers industryis advancing as providers adopt integrated digital platforms to strengthen operational efficiency, patient flow, and care coordination. For instance, in October 2024, GE HealthCare has introduced “Hospital Pulse,” a new feature within its Command Center Software. The dashboard brings together live data from multiple hospital departments, giving leaders a quick snapshot of key operational metrics. It can be customized to track areas such as daily emergency admissions against historical averages or post-anesthesia boarding times. The goal is to help hospitals respond faster and improve efficiency for both staff and patients. Duke Health will be the first to adopt the tool, with broader U.S. rollout planned next year.

The healthcare command centers industryis expected to witness significant growth driven by strategic partnerships and acquisitions that accelerate digital transformation, enhance compliance, and optimize asset and operational management across healthcare organizations. For instance, in April 2024, ABOUT Healthcare acquired Edgility, an AI and analytics platform company. This acquisition aims to augment ABOUT's care orchestration technology, creating a next-generation system-wide patient flow model from admission to discharge, thereby improving decision-making across the patient journey.

Regulations play a key role in the hospital command centers industry by guiding how hospitals and healthcare systems manage, integrate, and utilize operational and clinical data. Compliance with standards set by agencies such as the FDA, EMA, and The Joint Commission ensures patient safety, data security, and interoperability across hospital systems. Adherence to evolving guidelines on data governance, digital health record integration, and real-time monitoring is crucial for providers and technology vendors to maintain accreditation, optimize workflow efficiency, and support evidence-based decision-making.

The healthcare command centers industry is experiencing robust regional growth, driven by the rising demand for real-time operational visibility, patient flow optimization, and data-driven decision-making. Strategic partnerships and technology deployments further accelerate market expansion by enhancing regional presence and improving system-wide coordination. For instance, in June 2025, Siemens Healthineers partnered with Massachusetts General Hospital (MGH) to launch a Therapy Command Center. This collaboration aims to integrate patient imaging and laboratory data with population-based information to enhance personalized medicine and improve patient outcomes.

Component Insights

The software segment led the market with the largest revenue share of 48.6 % in 2024. The healthcare organizations seek to enhance operational efficiency, patient care, and system-wide coordination. These software solutions are increasingly integrating artificial intelligence (AI), predictive analytics, and real-time data visualization to support decision-making and streamline hospital operations. For instance, in June 2025, GE HealthCare's MIM Software introduced LesionID Pro, an AI-powered innovation designed to automate zero-click preprocessing. This software aims to assist physicians in minimizing manual segmentation, providing whole-body imaging analysis to support theranostics and personalized treatment planning.

The services segment is expected to register at the fastest CAGR during the forecast period. This segment encompasses a range of services, including consulting, system integration, managed services, and training, all aimed at enhancing the operational efficiency and effectiveness of healthcare facilities. The increasing complexity of operations and the need for real-time decision-making have driven the demand for comprehensive service solutions that support the implementation and optimization of command center technologies. For instance, in July 2025, GE HealthCare and Ascension launched a strategic collaboration to advance technology efficiency and comprehensive care across Ascension's national network. This partnership focuses on integrating GE HealthCare's command center technologies with Ascension's services to enhance clinical and operational outcomes. The collaboration aims to improve patient care by providing real-time insights and streamlined operations through advanced technology solutions.

Deployment Mode Insights

The cloud-based segment led the market with largest revenue share of 48.6% in 2024, driven by the need for scalable, flexible, and cost-effective solutions to manage complex healthcare operations. Cloud platforms enable real-time data access, seamless collaboration, and integration of advanced technologies like AI and machine learning, enhancing decision-making and patient care. For instance, in August 2025, the University of Texas at Austin's Dell Medical School partnered with Rackspace Technology to host and manage its healthcare data systems, including the Epic Electronic Health Record platform. This move eliminates the need for a physical data center, leveraging Rackspace's private cloud infrastructure to provide dedicated and secure hardware, supporting the medical school's efforts to develop an academic medical center using cloud-based infrastructure.

The hybrid deployment mode is expected to witness at the fastest CAGR during the forecast period, offering a balanced approach that combines the scalability and flexibility of cloud solutions with the control and security of on-premises infrastructure. This model enables organizations to optimize their operations, enhance patient care, and maintain compliance with regulatory standards. For instance, in January 2025, T-Systems launched its Health Hybrid Cloud (HHC) solution, designed to help healthcare providers optimize their IT operations by hosting their entire electronic health record (EHR) infrastructure and related applications.

Command Center Type Insights

The capacity & bed management/care progression centers segment led the market with the largest revenue share of 38.2% in 2024. The integration of capacity and bed management with care progression in HCC is transforming hospital operations. Leveraging real-time data and predictive analytics, these centers enable providers to proactively manage patient flow, optimize resource utilization, and enhance patient care. While the healthcare industry continues to embrace digital transformation, the adoption of such integrated command centers is expected to increase, leading to improved operational efficiency and better patient outcomes. For instance, in May 2025, AdventHealth's Mission Control operates as a central hub using real-time data and artificial intelligence to monitor capacity and patient flow across the health system. This includes tracking which hospitals have open beds, managing patient transfers, and even helping reroute ambulances if an emergency room is full, thereby improving patient placement and care delivery.

The centralized clinical command centers segment is expected to register at the fastest CAGR during the forecast period. The adoption of centralized clinical command centers is expected to accelerate as healthcare organizations seek to enhance operational efficiency, improve patient care coordination, and reduce costs. Centralizing clinical decision-making and integrating real-time data analytics, these centers enable healthcare providers to proactively manage patient flow, optimize resource utilization, and improve clinical outcomes across multiple facilities. While the industry continues to embrace digital transformation, the role of CCCs in reshaping care delivery models is becoming increasingly vital.

Functional Modules Insights

The data aggregation & interoperability centers segment accounted for the largest market revenue share in 2024. The emphasis on data aggregation and interoperability in HCC is expected to grow as healthcare organizations strive for more integrated and efficient care delivery models. Advancements in data standards, such as HL7 FHIR, and the adoption of cloud-native architectures are paving the way for more seamless data exchange across the healthcare continuum. These developments are anticipated to lead to improved patient outcomes, reduced operational costs, and enhanced compliance with regulatory requirements. For instance, in February 2025, GE HealthCare's Command Center platform continues to advance in data aggregation and interoperability. The platform integrates data from over 300 hospitals worldwide, providing a unified view of clinical and operational metrics. This integration supports predictive analytics, enabling systems to anticipate and address bottlenecks in patient care.

The performance & KPI reporting/BI segment is expected to register at the fastest CAGR during the forecast period. The integration of Performance & KPI Reporting and Business Intelligence into hospital command centers is transforming healthcare operations. Providing real-time, actionable insights, these tools enable organizations to proactively manage performance, optimize resource utilization, and improve patient outcomes. While the healthcare industry continues to embrace digital transformation, the adoption of advanced BI solutions is expected to increase, leading to more efficient and effective healthcare delivery. For instance, in October 2024, GE HealthCare introduced the Hospital Pulse Tile, a dynamic dashboard feature designed to provide real-time insights into hospital performance metrics. The tile allows healthcare providers to monitor various KPIs, such as emergency department admissions and post-anesthesia recovery times, against historical benchmarks. This tool aids in identifying performance gaps and facilitating timely interventions.

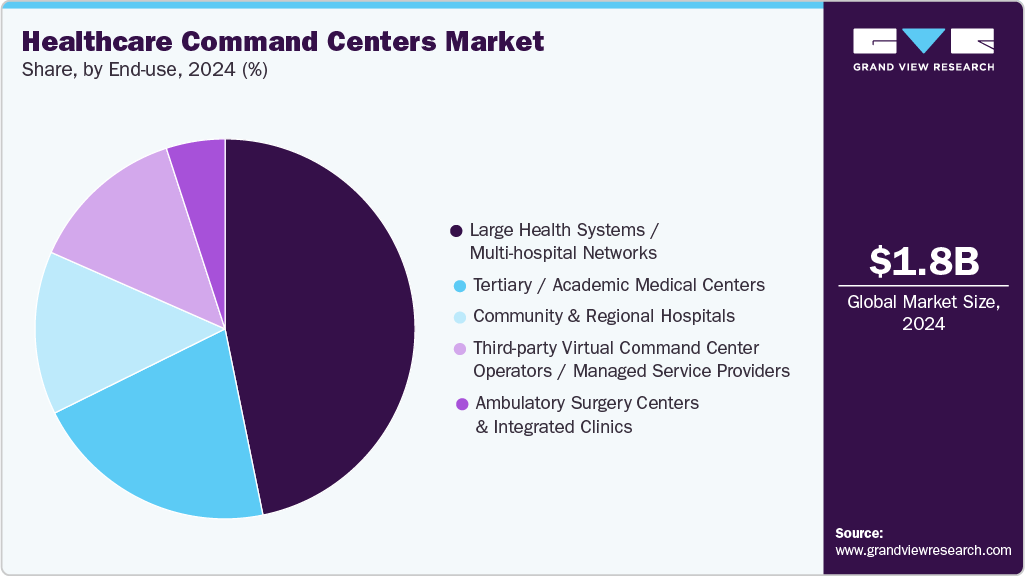

End Use Insights

The large health systems/multi-hospital networks segment accounted for the largest market revenue share in 2024. Large health systems and multi-hospital networks are increasingly adopting Healthcare Command Centers (HCCs) to enhance operational efficiency, improve patient care, and optimize resource utilization across their facilities. These centralized hubs leverage real-time data analytics, predictive modeling, and AI-driven insights to support decision-making and streamline hospital operations. For instance, in June 2025, GE HealthCare's Command Center software is being utilized by several large health systems to manage patient flow, streamline operations, and reduce costs. For instance, Duke Health reported a USD 40 million reduction in labor expenses by reducing reliance on temporary travel labor through the use of GE HealthCare's Command Center software.

The tertiary/academic medical centers segment is expected to register at the fastest CAGR during the forecast period. The integration of Hospital Command Centers in tertiary and academic medical centers is expected to grow, driven by the need for improved operational efficiency, enhanced patient care, and better resource management. These centers enable institutions to leverage real-time data and advanced analytics to make informed decisions, streamline processes, and respond effectively to challenges.

Organization size/hospital size Insights

The major (>500 beds) segment accounted for the largest market revenue share in 2024. Large hospitals with over 500 beds are increasingly adopting Hospital Command Centers (HCCs) to enhance operational efficiency, improve patient care, and streamline resource management. These centralized hubs leverage real-time data analytics, predictive modeling, and AI-driven insights to support decision-making and optimize hospital operations. For instance, in April 2025, Children’s Mercy Kansas City opened a 6,000-square-foot Patient Progression Hub in May 2023. This command center co-locates key clinical and operational staff, enabling data-driven decision-making to enhance patient care and operational efficiency.

The mid (150-500 beds) segment is projected to register at the fastest CAGR during the forecast period. Mid-sized hospitals, typically ranging from 150 to 500 beds, are increasingly adopting Healthcare Command Centers (HCCs) to enhance operational efficiency, improve patient care, and streamline resource management. These centralized hubs leverage real-time data analytics, predictive modeling, and AI-driven insights to support decision-making and optimize hospital operations. For instance, in June 2025, Children’s Mercy Kansas City, a 367-bed pediatric hospital, opened a 6,000-square-foot Patient Progression Hub in May 2023. This command center co-locates key clinical and operational staff, enabling data-driven decision-making to enhance patient care and operational efficiency. The hospital reported a USD 40 million reduction in labor expenses by reducing reliance on temporary travel labor through the use of GE HealthCare's Command Center software.

Regional Insights

North America dominated the global healthcare command centers market with the largest revenue share of 40.0% in 2024. Healthcare Command Centers (HCCs) are transforming hospital operations across North America, enabling real-time coordination, predictive analytics, and improved patient care. These centralized hubs integrate data from various departments to enhance efficiency and streamline resource management. Increasing implementations and expansions of HCCs in the region drive the market growth.

U.S. Healthcare Command Centers Market Trends

The healthcare command centers market in the U.S. is witnessing strong growth, fueled by the increasing adoption of digital hospital operations platforms, advanced healthcare IT infrastructure, and AI-driven decision support systems. Rising reliance on connected medical devices and real-time data analytics is driving the need for integrated command centers to optimize patient flow, staff allocation, and equipment utilization.

In addition, healthcare providers are prioritizing operational efficiency, regulatory compliance, and asset lifecycle management, further accelerating market penetration across large health systems, academic medical centers, and multi-hospital networks. For instance, in October 2024, Memorial Healthcare System launched its Care Coordination Center (CCC), a 24/7 clinical command center located in Pembroke Pines. Utilizing virtual operations and technology, the CCC aims to improve patient safety and care times across all of Memorial’s healthcare facilities. The center facilitates accelerated patient transfers and real-time adjustment of staffing needs, enhancing overall operational efficiency.

Europe Healthcare Command Centers Market Trends

The healthcare command centers market in Europe is witnessing consistent growth, driven by Europe's commitment to advancing healthcare through the integration of technology and collaborative frameworks. The establishment of command centers and data-sharing initiatives reflects a strategic approach to addressing the complexities of modern healthcare delivery. For instance, in April 2024, the European Parliament and the Council reached a provisional agreement on the European Health Data Space Regulation. This initiative aims to facilitate the secure exchange and access to health data across EU member states, promoting innovation in healthcare and enhancing the efficiency of health systems.

The UK healthcare command centers market is growing quickly, fueled by increasing adoption of command centers to enhance operational efficiency, patient care, and resource management. These centralized hubs integrate real-time data analytics, AI-driven insights, and collaborative workflows to support decision-making across healthcare facilities. For instance, in June 2024, Bradford Teaching Hospitals NHS Foundation Trust launched an AI-powered command center, marking a significant advancement in hospital operations. This center utilizes artificial intelligence to optimize patient flow, improve staff coordination, and enhance overall care delivery. The implementation of this command center is expected to alleviate pressure on staff and streamline patient care processes.

The healthcare command centers market in France is expanding steadily, fueled by strong regulatory frameworks, advanced hospital infrastructure, and strategic initiatives for digital health. For instance, in March 2024, Montpellier University Hospital Center, in collaboration with Dedalus and the University of Montpellier, initiated the ERIOS project to develop dynamic temporal visualization tools within the Electronic Health Record (EHR). This initiative aims to enhance data visualization capabilities, supporting improved clinical decision-making and patient outcomes.

Asia Pacific Healthcare Command Centers Market Trends

The healthcare command centers market in the Asia Pacific is expanding rapidly. This growth is driven by the increasing adoption of digital health solutions, the need for real-time data integration, and the emphasis on operational efficiency and patient care. Healthcare providers across the region are investing in command center technologies to enhance coordination, optimize resource utilization, and improve patient outcomes. For instance, in October 2023, Singapore's National Healthcare Group (NHG) launched a Command, Control, and Communications (C3) system at its flagship Tan Tock Seng Hospital (TTSH). This system integrates real-time data from various departments to streamline care delivery, reduce administrative workload, and enhance patient care. The implementation of the C3 system has significantly improved operational efficiency and staff coordination.

Latin America Healthcare Command Centers Market Trends

The healthcare command centers market in Latin America is gaining momentum, driven by increased investments in hospital modernization, the adoption of digital health technologies, and the rising demand for streamlined medical device management. Brazil, in particular, is emerging as a regional leader, with expanding healthcare infrastructure, government programs aimed at improving digital connectivity, and wider deployment of electronic health records. Hospitals, diagnostic centers, and public health institutions are adopting command center solutions to enhance equipment uptime, ensure regulatory compliance, and optimize operational costs.

Middle East & Africa Healthcare Command Centers Market Trends

The healthcare command centers market in the Middle East & Africa is growing rapidly, fueled by expanding healthcare infrastructure, the adoption of smart hospital initiatives, and government-backed digital health programs. In the Gulf region, countries such as Saudi Arabia and the UAE are at the forefront, driven by strategic frameworks like Saudi Vision 2030 and the UAE’s National Strategy for Artificial Intelligence. These initiatives emphasize medical device digitalization, predictive maintenance, and interoperability across healthcare facilities.

Key Healthcare Command Centers Company Insights

The global healthcare command centers industry is highly fragmented, with many small and large players operating in this space. This leads to intense competition between smaller players to sustain their position. Strategies such as new product launches and partnerships are playing a key role in propelling the market growth.

Key Healthcare Command Centers Companies:

The following are the leading companies in the healthcare command centers market. These companies collectively hold the largest market share and dictate industry trends.

- GE HealthCare

- Koninklijke Philips N.V.

- Siemens Healthineers

- TeleTracking Technologies, Inc.

- Qventus

- Epic Systems

- Oracle (Cerner)

- LeanTaaS

- Dedalus

- ABOUT Healthcare, Inc.

- Care Logistics

- care.ai

Recent Developments

-

In April 2025, GE HealthCare and FPT Software expanded their strategic partnership to accelerate the adoption of AI-driven healthcare solutions. The collaboration includes the establishment of an FPT Competency Center in Vietnam, aiming to enhance operational efficiency and improve patient care through advanced digital solutions.

“As a digital transformation enabler, FPT can co-develop cutting-edge healthcare solutions with GE HealthCare. With nearly two decades of experience delivering solutions to healthcare providers, we see immense opportunities to harness AI to transform the industry, enhance efficiency, and drive smarter decision-making. The establishment of the FPT Competency Center will further accelerate the development of AI-powered solutions, supporting GE HealthCare’s mission of creating a healthier future for all.”

-Pham Minh Tuan, FPT Software Chief Executive Officer and Executive Vice President, FPT Corporation.

-

In July 2025, GE HealthCare's Command Center introduced advanced census forecasting and staffing solutions. Hospitals using this AI-powered platform, such as Duke Health, have achieved 95% accuracy in predicting staffing needs up to 14 days in advance, leading to significant reductions in temporary labor costs.

-

In November 2024, Medically Home partnered with SCP Health to staff a new command center in Dallas, Texas. This facility will support health system partners by providing centralized staffing for hospital-at-home programs, offering a cost-effective alternative to establishing individual hubs.

“Implementing the hospital-from-home program would have been difficult if we had to create and staff our own command center would have also taken longer to implement the program from the time we entered into a contractual relationship with Medically Home, as well”.

- Dawn Jacobson, senior vice president for home care at Hackensack Meridian Health.

Healthcare Command Centers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.02 billion

Revenue forecast in 2033

USD 4.55 billion

Growth rate

CAGR of 10.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment mode, command center type, functional modules, organization size/hospital size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

GE HealthCare; Koninklijke Philips N.V.; Siemens Healthineers; TeleTracking; Qventus; Epic Systems; Oracle (Cerner); LeanTaaS; Dedalus; ABOUT Healthcare Inc.; KenSci; Care Logistics; care.ai

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Command Centers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global healthcare command centersmarket report based on component, deployment mode, command center type, functional modules, organization size/hospital size, end use, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Real-time Dashboards & Visualization

-

Predictive Analytics & Forecasting

-

Scheduling & OR/Procedure Optimization

-

Event / Alarm & Incident Management

-

Integrations & Middleware

-

Collaboration / Communication Workspace

-

-

Hardware

-

Display Walls & Visualization Hardware

-

Networking & Edge Appliances

-

On-site Monitoring Stations / Consoles

-

-

Services

-

Implementation & Integration Services

-

Managed Services / Virtual Command Center Operations

-

Consulting

-

Training & Continuous Optimization

-

Data Science / Model Tuning

-

-

-

Deployment Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud-based

-

On-premise

-

Hybrid

-

-

Command Center Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Capacity & Bed Management / Care Progression Centers

-

Operations & Resource Orchestration Centers

-

Centralized Clinical Command Centers

-

Incident Response / Emergency Operations Centers

-

Security / Facilities Operations Centers

-

-

Functional Modules Outlook (Revenue, USD Million, 2021 - 2033)

-

Data Aggregation & Interoperability

-

Real-time Operational Intelligence / Dashboards

-

Predictive Forecasting & Machine Learning

-

Alerting, Escalation & Workflow Automation

-

Simulation & Digital Twin

-

Performance & KPI Reporting / BI

-

RTLS / IoT Integration

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Health Systems / Multi-hospital Networks

-

Tertiary / Academic Medical Centers

-

Community & Regional Hospitals

-

Ambulatory Surgery Centers & Integrated Clinics

-

Third-party Virtual Command Center Operators / Managed Service Providers

-

-

Organization size/hospital size Outlook (Revenue, USD Million, 2021 - 2033)

-

Major (>500 beds)

-

Mid (150-500 beds)

-

Small (<150 beds)

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare command center market size was estimated at USD 1.84 billion in 2024 and is expected to reach USD 2.02 billion in 2025

b. The global healthcare command center market is expected to grow at a compound annual growth rate of 10.7% from 2025 to 2033 to reach USD 4.55 billion by 2033.

b. North America dominated the healthcare command centers market

b. Some key players operating in the healthcare command centers market include

b. Key factors that are driving the market growth include

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.