- Home

- »

- Smart Textiles

- »

-

Healthcare Personal Protective Equipment Market Report 2030GVR Report cover

![Healthcare Personal Protective Equipment Market Size, Share & Trends Report]()

Healthcare Personal Protective Equipment Market Size, Share & Trends Analysis Report By Product (Respiratory Protection, Hand Protection), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-423-9

- Number of Report Pages: 109

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Market Size & Trends

The global healthcare personal protective equipment market size was valued at USD 14.96 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.9% from 2023 to 2030. The rising product demand, especially from the healthcare industry, due to the global Covid-19 pandemic, coupled with rising awareness about Healthcare-Associated Infections (HAIs), is likely to drive the market growth. Personal protective equipment (PPE) acts as a barrier between infectious viruses and the eyes, nose, mouth, and skin of the person using it. Thus, healthcare personnel use PPE to minimize their exposure to infectious microorganisms in the clinical environment. Products, such as gowns and gloves, are used to interrupt the transmission of pathogens when treating patients with communicable diseases.

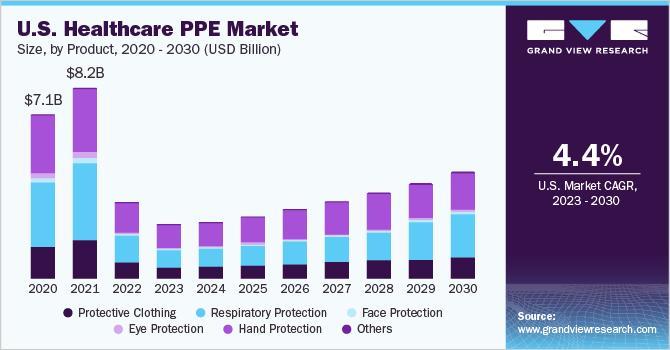

The rising cases of Covid-19 in the U.S. coupled with the presence of stringent regulations regarding the safety of healthcare personnel are anticipated to bolster the product demand over the coming years. Moreover, several small- and large-scale manufacturers in the country have either launched new production lines or have re-engineered the existing ones to boost the availability of critical supplies, including PPE, during the pandemic.

Factors including developing healthcare systems, improving economic conditions, and population growth are anticipated to fuel healthcare spending globally. Rising cases of chronic diseases and increasing investments in medical technology & healthcare infrastructure are also likely to spur the healthcare expenditure across the globe, thereby augmenting the PPE market growth.

The global pandemic has forced first respondents and healthcare workers to adapt to new safety protocols and utilize large amounts of PPE, such as gloves, masks, and gowns. However, the supply chain of PPE was strained to a large extent, resulting in its insufficient supply. Although the supply chain has improved over the past few months, few healthcare facilities and businesses are still facing difficulty in procuring products, such as gloves and respirators.

One of the key reasons responsible for supply chain disruptions was that almost half of the world’s masks were produced in China before the pandemic. As the pandemic began, China cut down its exports of masks to other countries. Moreover, several key components of N95 and surgical masks were also sourced from China, due to which manufacturers based in other countries faced difficulty in procuring these supplies to continue their production.

Product Insights

The hand protection segment led the healthcare PPE market in 2022 and accounted for 43.4% of the global revenue share. The segment is further bifurcated into durable and disposable gloves. Disposable gloves are used to a larger extent than durable ones. Disposable gloves are intended for single-use, which lowers the risk of contamination. Face shields are used for facial protection from splashes, sprays, and spatter of blood and other body fluids. Face shields are usually used in conjunction with other PPE, such as surgical masks and goggles.

The respiratory protection product segment is anticipated to register the fastest CAGR over the forecast period. Respiratory protective equipment (RPE) has become extremely critical amidst the pandemic. Although Covid-19 vaccines are likely to reduce the intensity of the pandemic, the demand for RPE, such as respirators and surgical masks, remained strong throughout 2021, thereby driving the segment growth. Goggles and safety glasses are some of the commonly used eye protection equipment.

End-use Insights

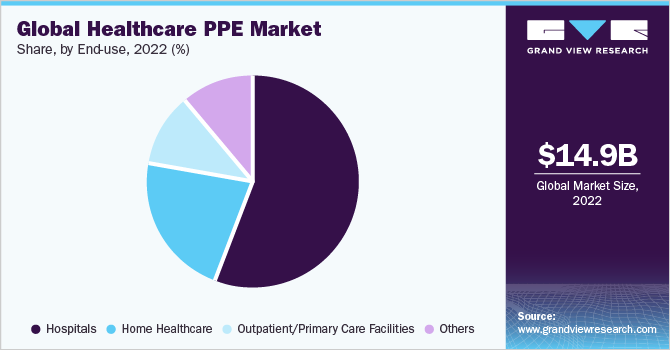

The hospitals end-use segment led the healthcare PPE market and accounted for 56.2% of the global revenue share in 2022. The increasing geriatric population, particularly in developed economies, coupled with rising awareness about HAIs is likely to spur the product demand in hospitals. Moreover, at the onset of the Covid-19 pandemic, healthcare systems experienced a shortage of critical medical supplies, including PPE, owing to overseas supply constraints.

Home healthcare services refer to professional services, including aid in daily activities, private-duty nursing care, rehabilitative therapy, and others offered at the patient’s home by healthcare professionals. Factors including a rising aging population and increased patient preference for value-based healthcare are likely to drive the demand for home healthcare services, which, in turn, will drive the segment growth.

The outpatient/primary care facilities end-use segment is likely to register a CAGR of 9.7% over the forecast period. Primary care physicians act as the first contact and examine patients having undiagnosed health concerns or symptoms. Thus, PPE plays an important role in such cases to avoid cross-contamination. The increasing number of patients visiting primary care services for consultation is likely to augment the product demand in this segment over the forecast period.

The others end-use segment includes dental offices, mental institutes, and emergency care. Dentists often use PPE, such as gloves, masks, face shields, and protective clothing, as they are often exposed to infectious materials, such as blood and saliva, during dental procedures. Moreover, PPE has become extremely crucial for dentists, especially during the Covid-19 pandemic, as the disease primarily spreads through person-to-person contact.

Regional Insights

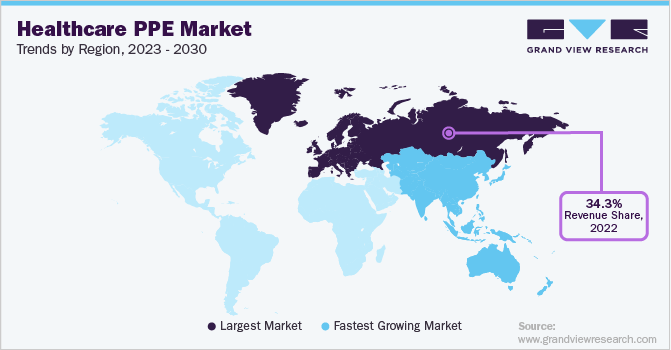

Europe led the global healthcare personal protective equipment (PPE) market and accounted for 34.3% of the revenue share in 2022. The Covid-19 pandemic has drastically increased the product demand in the region. The European Commission has urged manufacturers to convert their existing facilities to produce PPE to increase the production of gowns, coveralls, face masks, gloves, and googles. Moreover, it is working with EU countries to ensure the free flow of PPE within the internal market.

The German Health Ministry has requested the German multinationals, such as BASF and their network of contacts abroad, especially in China, to procure protective equipment and clothing. The product shortage had become apparent at many clinics and hospitals in Germany, owing to which, the government has started an open process for PPE tenders to speed up the process and bypass administrative hurdles.

Asia Pacific is estimated to be the fastest-growing regional market from 2023 to 2030 due to factors, such as developing healthcare infrastructure, rising medical tourism, and increasing demand for home care facilities. Improving hygiene and safety standards across several healthcare settings, especially in developing countries, is further likely to drive the regional market over the forecast period.

The market in North America is anticipated to register the second-highest CAGR over the forecast period. North America is one of the most severely affected regions in the world by Covid-19. To avoid product shortages during the pandemic, federal organizations, such as the U.S. Food and Drug Administration (FDA), have used Emergency Use Authorizations (EUAs) to conclude that certain imported PPE that is not NIOSH-approved are appropriate for use by healthcare workers.

Key Companies & Market Share Insights

The market players focus on integration across the value chain to gain a competitive advantage in the market. Other strategies adopted by the companies usually include new product development, partnerships, mergers & acquisitions, and expansion of product portfolio & distribution network. Several manufacturers have ramped up their production capacities to cater to the increased demand due to the Covid-19 pandemic. Manufacturers are also collaborating with government authorities and industry partners to supply critical PPE required during the pandemic. Some prominent players in the global healthcare personal protective equipment market include:

-

3M

-

DuPont

-

Honeywell International, Inc.

-

Medline Industries, Inc.

-

Cardinal Health

-

Ansell Ltd.

-

Kimberly-Clark Corporation

-

O&M Halyard, Inc.

Healthcare Personal Protective Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 11.34 billion

Revenue forecast in 2030

USD 21.85 billion

Growth Rate

CAGR of 4.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; U.K.; Italy; Spain; Russia; China; Japan; India; South Korea; Indonesia; Australia; Thailand; Malaysia; Brazil; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

3M; DuPont; Honeywell International, Inc.; Medline Industries, Inc.; Cardinal Health; Ansell Ltd.; Kimberly-Clark Corp.; O&M Halyard, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Personal Protective Equipment Market Report Segmentation

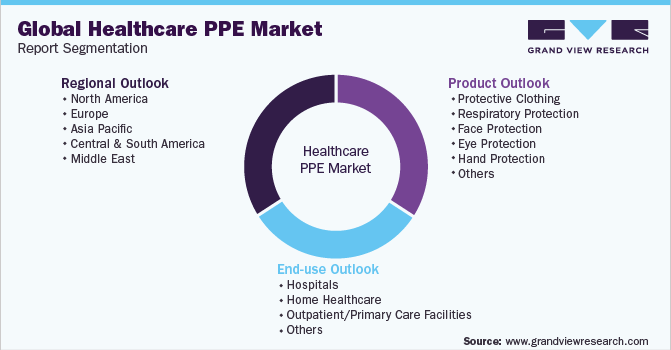

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global healthcare personal protective equipment market report on the basis of product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Protective Clothing

-

Coveralls

-

Gowns

-

Others

-

-

Respiratory Protection

-

Surgical Masks

-

Respirator Masks

-

Others

-

-

Face Protection

-

Eye Protection

-

Hand Protection

-

Disposable Gloves

-

Durable Gloves

-

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Home Healthcare

-

Outpatient/Primary Care Facilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

Russia

-

Spain

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Australia

-

Thailand

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East

-

Saudi Arabia

-

United Arab Emirates

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global healthcare personal protective equipment (PPE) market size was estimated at USD 14.96 Billion in 2022 and is expected to reach USD 11.34 Billion in 2023.

b. The healthcare personal protective equipment (PPE) market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.9% from 2023 to 2030 to reach USD 21.85 Billion by 2030

b. Europe dominated the healthcare personal protective equipment (PPE) market with a revenue share of 34.3% in 2022.

b. Some of the key players operating in the healthcare personal protective equipment (PPE) market include 3M; DuPont; Honeywell International, Inc.; Medline Industries, Inc.; Cardinal Health; Ansell Ltd.; Kimberly-Clark Corp.; O&M Halyard, Inc.

b. The key factors that are driving the healthcare personal protective equipment (PPE) market include The rising product demand, especially from the healthcare industry, due to the global Covid-19 pandemic, coupled with rising awareness about Healthcare-Associated Infections (HAIs), is likely to drive the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."