- Home

- »

- Advanced Interior Materials

- »

-

Heat Exchangers Market Size, Share & Growth Report, 2030GVR Report cover

![Heat Exchangers Market Size, Share & Trends Report]()

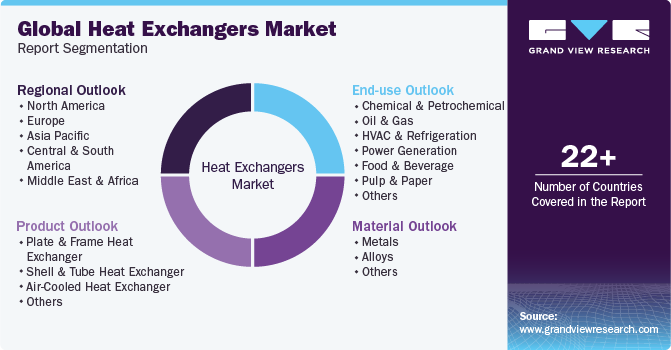

Heat Exchangers Market Size, Share & Trends Analysis Report By Product (Plate & Frame (Brazed, Gasketed, Welded), By End-use (Chemical & Petrochemical, Oil & Gas, Power Generation), By Material, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-718-6

- Number of Pages: 133

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Advanced Materials

Heat Exchangers Market Size & Trends

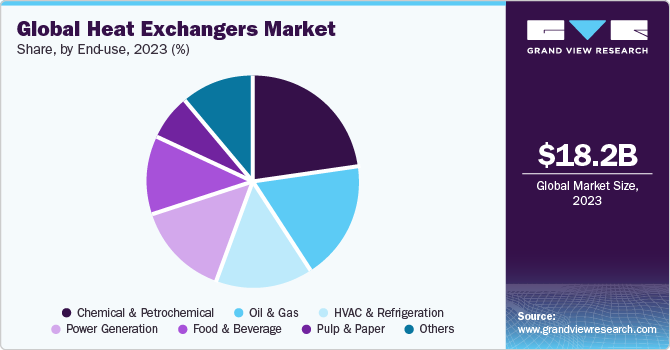

The global heat exchangers market size was estimated at USD 18.19 billion in 2023 and is expected to expand at a compounded annual growth rate (CAGR) of 5.4% from 2024 to 2030. Rising focus on efficient thermal management in various industries, including oil & gas, power generation, chemical & petrochemical, food & beverage, and HVAC & refrigeration, is expected to drive the demand for heat exchangers over the forecast period. Rising demand from chemical industry coupled with increasing technological advancements and a growing focus on improving efficiency standards is expected to drive heat exchangers market growth. Most processes in petrochemical facilities involve high pressure and temperature, thus, necessitating the optimization of heat transfer and enhancement of energy savings, which, in turn, is likely to boost the demand for energy-efficient heat exchangers.

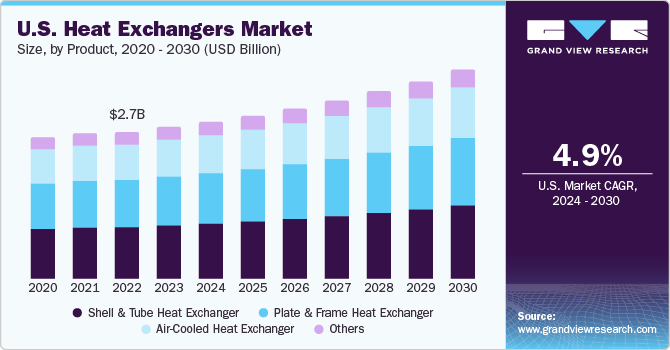

U.S. dominated the North America heat exchanger market in 2023, owing to high electricity demand, industrialization, and investments in renewable power generation. Rising investments by oil & gas companies in exploration & production activities in the U.S. are expected to boost the demand for these products in oil & gas industry.

Significant power markets such as China, U.S., India, Russia, and Japan are restructuring their operating models to adopt the structure of renewable energy and efficient utilization of energy by installing heat exchangers and shifting from traditional energy use. This is expected to drive the demand for heat exchangers.

Technological advancements such as tube inserts in heat exchangers are expected to complement the market growth. Furthermore, ongoing technological improvements to improve energy efficiency, total life cycle cost, durability, and compactness of heat exchangers are expected to drive industry growth.

Manufacturers of these products face a long list of difficult supply chain challenges, including increasing demand variability, intense global competition, more environmental compliance regulations, increasing human- and nature-based risks, and inventory proliferation. COVID-19 pandemic has created new challenges, which are compelling manufacturers to innovate their supply chains at a faster speed.

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. Heat exchangers market is characterized by a high degree of innovation owing to the rapid technological advancements. Moreover, the companies are further adopting various organic and inorganic growth strategies, such as product launches, geographical expansions, mergers & acquisitions, and collaborations, to strengthen their position in the global market.

The heat exchangers market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. Notable mergers and acquisitions in the heat exchangers market have often focused on technological advancements, such as incorporating smart and sustainable solutions. This concentration is driven by the growing demand for energy-efficient systems and environmentally friendly technologies. As companies consolidate, they aim to capitalize on shared R&D capabilities, streamline operations, and meet the evolving needs of diverse industries relying on heat exchange solutions. The resulting landscape is marked by a strategic reshaping of the industry to address emerging challenges and opportunities in the field of thermal management.

The heat exchangers market is subject to a high concentration of regulations that significantly influence industry dynamics. Governmental standards related to energy efficiency, environmental impact, and safety standards have become pivotal in shaping the market landscape. The regulatory landscape often encourages technological advancements to meet stringent criteria, fostering a competitive environment among industry players. Companies are strategically aligning their operations with these regulations, leading to a concentration of efforts on compliance, innovation, and sustainable practices. This regulatory focus not only ensures product quality and safety but also shapes the market by promoting advancements that align with broader societal and environmental goals.

Market Dynamics

Rapid industrialization in the developing nations of Asia Pacific coupled with increasing investments in manufacturing, industrial, and commercial projects has contributed to the overall growth of the exchangers market in the region. Another factor driving the market is the increased product penetration in various end-use industries including power generation, chemical, HVAC & refrigeration, petrochemical, and food & beverage.

A significant shift in demand for plate & frame heat exchangers is being observed from mature markets including Europe and North America as well as developing nations of Asia Pacific including India and China. The success of plate & frame heat exchangers in chemical industries of China can be attributed to the high industry fragmentation, strong government influence, tightening of environmental regulations, and growing importance of specialty chemicals.

Product Insights

Shell & tube segment led the industry and accounted for 35.6% of the global revenue demand in 2023. Shell & tube products are built from a bundle of tubes placed in a cylindrical shell with the tube axis parallel to that of shell. Three most common types of shell & tube products are floating-head type, U-tube design, and fixed tube sheet design.

Shell & tube products are used in applications that require a wide temperature and pressure range as well as transfer between two liquids, between liquids & gases, or between two gases. These exchangers have a simple structure and are ideal for heat transfer from steam to water. However, they require large spaces, which is anticipated to hinder the segment’s growth over the forecast period.

Plate & frame product segment is expected to grow at a CAGR of 6.1% over the forecast period. Plate-type exchangers are built of plates either having some form of corrugation or smoothness. These products are classified as brazed, welded, or gasketed depending on the leak tightness required. Plate & frame products are typically used for liquid-liquid exchange at low to medium pressures.

Air-cooled products, also known as air coolers, comprise various components such as a tube bundle, an air-pumping device such as a blower or an axial flow fan, and a support structure. These products are used in petrochemical plants, refineries, compressor stations, gas-treating plants, power plants, and other facilities. Air-cooled products can be installed either vertically, horizontally, or at a sloped angle.

Material Insights

Metals material segment showed lucrative growth from 2024-2030. Metal materials are crucial in heat exchangers due to their inherent properties. High thermal conductivity, exemplified by copper and aluminum, ensures efficient heat transfer. Corrosion-resistant metals like stainless steel enhance durability, guarding against deterioration. Mechanical strength becomes paramount to withstand varying conditions. The judicious selection of these materials strikes a balance between thermal efficiency, resilience, and cost-effectiveness, underscoring their pivotal role in optimizing heat exchange systems.

Alloy materials play a pivotal role in heat exchangers due to their unique combination of properties. The importance lies in achieving a delicate balance between factors such as corrosion resistance, thermal conductivity, and mechanical strength. Alloys like stainless steel provide robust protection against corrosion, while still offering high thermal efficiency and durability, making them essential for optimizing heat transfer processes in a variety of applications.

End-use Insights

Chemical & petrochemical led the market and accounted for 22.6% of the global revenue demand in 2023. Heat exchangers are used in chemical processing industry (CPI) on account of their properties, such as design flexibility and high corrosion resistance. Their properties provide them with ability to handle fluids having varying levels of solids.

Rising demand for fertilizers, plastics, packaging, digital devices, medical equipment, and clothing is likely to boost petrochemical industry's growth. Furthermore, penetration of petrochemical products in modern energy systems, such as wind turbine blades, solar panels, and electric vehicle parts, is anticipated to drive the industry’s growth. Thus, the above factors are, in turn, likely to drive the demand for these products in chemical & petrochemical industry.

Heat exchanger demand in oil & gas end-use industry is anticipated to witness growth at a CAGR of 5.0% over the forecast period. Increasing utilization of shale gas in energy and manufacturing industries, along with growing shale gas exploration activities due to technological advancements in exploration, is expected to boost the demand for heat exchangers. Furthermore, rising number of oil & gas projects across various economies is likely to drive industrial growth.

Heat exchangers form an essential part of HVAC systems. Increasing awareness regarding energy conservation and reducing energy bills is expected to augment the demand for heat exchangers in HVAC industry. The products are used in heat recovery process involving steam, water, air, and refrigerants. Surging demand for efficient heat recovery systems offering high corrosion resistance is anticipated to propel the product demand.

Regional Insights

Europe led the market and accounted for 31.7% of the global revenue share in 2023. Rising public and private infrastructure investments are anticipated to drive the demand for these products in HVAC & refrigeration industry. Moreover, increasing demand from several end-use industries for heat exchangers that offer greater durability, enhanced efficiency, and less fouling is expected to drive growth over the forecast period.

Rising oil & gas exploration activities in the U.S. and Canada are expected to drive the demand for these products in North America. Moreover, increasing energy demand in various industrial and commercial sectors is likely to boost the power and energy sectors, thereby positively impacting the overall market for heat exchangers.

Asia Pacific heat exchanger demand is likely to grow at a CAGR of 6.8% over the forecast period. Rapid industrialization in the developing economies of Asia Pacific coupled with rising investments in manufacturing, commercial, and industrial projects has contributed to the overall growth of the regional market.

China Heat Exchangers Market

Heat exchangers market in China is anticipated to be driven by growing investments in chemical, petrochemical, and HVAC sectors. Factors such as burgeoning population and the government's efforts to enhance country's infrastructure are expected to favor the growth of power generation and HVAC & refrigeration sectors, thereby driving the demand for these products over the forecast period.

Key Companies & Market Share Insights

Global heat exchangers industry is characterized by presence of multinational as well as regional players that are engaged in designing, manufacturing, and distributing these products. Product manufacturers strive to obtain a competitive edge over their competitors by increasing application scope of their products.

Strategies adopted by manufacturers include new product development, diversification, mergers & acquisitions, and geographical expansion. These strategies aid the companies in expanding their market penetration and catering to changing technological demand across various end-use industries.

Key Heat Exchangers Companies:

- Alfa Laval

- Danfoss

- Kelvion Holding GmbH

- Güntner Group GmbH

- Xylem Inc

- API Heat Transfer

- Mersen

- Hisaka Works, Ltd.

- Chart Industries, Inc

- Johnson Controls International

- HRS Heat Exchangers

- SPX FLOW, Inc.

- Funke Wärmeaustauscher Apparantebau GmbH

- Koch Heat Transfer Company

- Southern Heat Exchanger Corporation

Recent Developments:

-

For instance, in April 2023, Kelvion launched dedicated air cooler series for natural refrigerants. The CDF & CDH ranges are dual discharge air coolers highlighting a similar proficient tube system.

-

In May 2023, Alfa Laval is enhancing its brazed plate heat exchanger capacity to bolster the global energy transition. The establishment of new facilities in Italy, China, Sweden, and the U.S. signifies significant progress in their initiative to advance manufacturing intelligence and efficiency throughout the entire supply chain.

-

In January 2021, Alfa Laval, opened a new facility for the production of brazed heat exchangers in San Bonifacio, Italy. The new facility will have more capacity to fulfill the increasing customer demand.

Heat Exchangers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 18.90 billion

Revenue forecast in 2030

USD 26.26 billion

Growth Rate

CAGR of 5.4% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, material region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Spain, UK, China; Japan; India; South Korea, Australia, Brazil; Argentina, Saudi Arabia; UAE, South Africa

Key companies profiled

Alfa Laval; Danfoss; Kelvion Holding GmbH; Güntner Group GmbH; Xylem Inc.; API Heat Transfer; Mersen; Hisaka Works, Ltd.; Chart Industries, Inc.; Johnson Controls International; HRS Heat Exchangers; SPX FLOW, Inc.; Funke Wärmeaustauscher Apparantebau GmbH; Koch Heat Transfer Company; Southern Heat Exchanger Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Heat Exchangers Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global heat exchangers market report based on product, end-use, material and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Plate & Frame Heat Exchanger

-

Brazed Plate & Frame Heat Exchanger

-

Gasketed Plate & Frame Heat Exchanger

-

Welded Plate & Frame Heat Exchanger

-

Others

-

Shell & Tube Heat Exchanger

-

Air-Cooled Heat Exchanger

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Chemical & Petrochemical

-

Oil & Gas

-

HVAC & Refrigeration

-

Power GenerationFood & Beverage

-

Pulp & Paper

-

Others

-

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Metals

-

Alloys

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global heat exchangers market size was estimated at USD 18.2 billion in 2023 and is expected to reach USD 18.9 billion in 2024.

b. The global heat exchangers market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.4% from 2024 to 2030 to reach USD 26.3 billion by 2030.

b. Europe dominated the heat exchangers market with a share of 31.7% in 2023, owing to the rising consumption of chemicals in various end-use industries coupled with growing demand for heat exchangers that offer greater durability, enhanced efficiency, and less fouling.

b. Some of the key players operating in the heat exchangers market include Alfa Laval, Danfoss, Kelvion Holding GmbH, Güntner Group GmbH, API Heat Transfer, Xylem Inc.; Mersen, Hisaka Works, Ltd.; SPX FLOW, Inc.; and Koch Heat Transfer Company

b. Key factors that are driving heat exchanger market growth include rising trend for efficient thermal management in chemical, oil & gas, and power generation, and a rising focus on improving efficiency standards.

Table of Contents

Chapter 1. Heat Exchangers Market: Methodology and Scope

1.1. Research Methodology

1.2. Research Scope & Assumption

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Heat Exchangers Market: Executive Summary

2.1. Market Outlook

2.2. Segmental Outlook

2.3. Competitive Insights

Chapter 3. Heat Exchanger Market: Variables, Trends & Scope

3.1. Market Lineage Outlook

3.2. Market Segmentation & Scope

3.3. Penetration & Growth Prospect Mapping

3.4. Industry Value Chain Analysis

3.4.1. Raw Material Outlook

3.4.2. Manufacturing Outlook

3.4.3. End-user Outlook

3.5. Regulatory Framework

3.6. Technology Framework

3.7. Impact of Free Trade Agreements

3.8. Market Dynamics

3.8.1. Market Driver Analysis

3.8.2. Market Restraint Analysis

3.8.3. Industry Challenges

3.8.4. Market Opportunity Analysis

3.9. Business Environment Analysis

3.9.1. Industry Analysis - Porter’s

3.9.1.1. Supplier Power

3.9.1.2. Buyer Power

3.9.1.3. Threat of Substitutes

3.9.1.4. Threat of New Entrant

3.9.1.5. Competitive Rivalry

3.9.2. PESTEL Analysis

3.9.2.1. Political Landscape

3.9.2.2. Environmental Landscape

3.9.2.3. Social Landscape

3.9.2.4. Technology Landscape

3.9.2.5. Economic Landscape

3.9.2.6. Legal Landscape

3.10. Economic Mega Trend Analysis

Chapter 4. Heat Exchanger Market - Product Estimates & Trend Analysis

4.1. Heat Exchanger Market: Product Movement Analysis & Market Share, 2023 & 2030

4.2. Plate & Frame Heat Exchanger

4.2.1. Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

4.2.2. Brazed Plate & Frame Heat Exchanger

4.2.2.1. Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

4.2.3. Gasketed Plate & Frame Heat Exchanger

4.2.3.1. Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

4.2.4. Welded Plate & Frame Heat Exchanger

4.2.4.1. Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

4.2.5. Others

4.2.5.1. Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

4.3. Shell & Tube Heat Exchanger

4.3.1. Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

4.4. Air-Cooled Heat Exchanger

4.4.1. Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

4.5. Others

4.5.1. Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Chapter 5. Heat Exchanger Market - End-Use Estimates & Trend Analysis

5.1. Heat Exchanger Market: End-Use Movement Analysis & Market Share, 2023 & 2030

5.2. Chemical & Petrochemical

5.2.1. Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

5.3. Oil & Gas

5.3.1. Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

5.4. HVAC & Refrigeration

5.4.1. Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

5.5. Power Generation

5.5.1. Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

5.6. Food & Beverage

5.6.1. Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

5.7. Pulp & Paper

5.7.1. Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

5.8. Others

5.8.1. Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Chapter 6. Heat Exchanger Market - Material Estimates & Trend Analysis

6.1. Heat Exchanger Market: Material Movement Analysis & Market Share, 2023 & 2030

6.2. Metals

6.2.1. Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

6.3. Alloys

6.3.1. Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

6.4. Others

6.4.1. Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Chapter 7. Heat Exchanger Market - Regional Estimates & Trend Analysis

7.1. Heat Exchanger Market: Regional Movement Analysis, 2023 & 2030

7.2. North America

7.2.1. North America heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.2. North America heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.2.2.1. North America plate & frame heat exchanger market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.2.2.1.1. North America brazed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.2.1.2. North America gasketed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.2.1.3. North America welded plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.2.1.4. North America others product type market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.2.2. North America shell & tube heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.2.3. North America air-cooled heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.2.4. North America other product heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.3. North America heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

7.2.4. North America heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

7.2.5. U.S.

7.2.5.1. U.S. heat exchangers Market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.5.2. U.S. heat exchangers Market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.2.5.2.1. U.S. plate & frame heat exchanger market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.2.5.2.1.1. U.S. brazed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.5.2.1.2. U.S. gasketed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.5.2.1.3. U.S. welded plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.5.2.1.4. U.S. others product type market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.2.5.2.2. U.S. shell & tube heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.5.2.3. U.S. air-cooled heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.5.2.4. U.S. other product heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.5.3. U.S. heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

7.2.5.4. U.S. heat exchangers Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

7.2.6. Canada

7.2.6.1. Canada heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.6.2. Canada heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.2.6.2.1. Canada plate & frame heat exchanger market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.2.6.2.1.1. Canada brazed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.6.2.1.2. Canada gasketed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.6.2.1.3. Canada welded plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.6.2.1.4. Canada others product type market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.6.2.2. Canada shell & tube heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.6.2.3. Canada air-cooled heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.6.2.4. Canada other product heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.6.3. Canada heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

7.2.6.4. Canada heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

7.2.7. Mexico

7.2.7.1. Mexico heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.7.2. Mexico heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.2.7.2.1. Mexico plate & frame heat exchanger market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.2.7.2.1.1. Mexico brazed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.7.2.1.2. Mexico gasketed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.7.2.1.3. Mexico welded plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.7.2.1.4. Mexico others product type market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.7.2.2. Mexico shell & tube heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.7.2.3. Mexico air-cooled heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.7.2.4. Mexico other product heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.2.7.3. Mexico heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

7.2.7.4. Mexico heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

7.3. Europe

7.3.1. Europe heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.2. Europe heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.3.2.1. Europe plate & frame heat exchanger market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.3.2.1.1. Europe brazed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.2.1.2. Europe gasketed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.2.1.3. Europe welded plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.2.1.4. Europe others product type market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.2.2. Europe shell & tube heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.2.3. Europe air-cooled heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.2.4. Europe a other product heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.3. Europe heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

7.3.4. Europe heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

7.3.5. Germany

7.3.5.1. Germany heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.5.2. Germany heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.3.5.2.1. Germany plate & frame heat exchanger market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.3.5.2.1.1. Germany brazed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.5.2.1.2. Germany gasketed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.5.2.1.3. Germany welded plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.5.2.1.4. Germany others product type market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.5.2.2. Germany shell & tube heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.5.2.3. Germany air-cooled heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.5.2.4. Germany other product heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.5.3. Germany heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

7.3.5.4. Germany heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

7.3.6. France

7.3.6.1. France heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.6.2. France heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.3.6.2.1. France plate & frame heat exchanger market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.3.6.2.1.1. France brazed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.6.2.1.2. France gasketed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.6.2.1.3. France welded plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.6.2.1.4. France others product type market estimates and forecasts2018 - 2030 (USD Billion)

7.3.6.2.2. France shell & tube heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.6.2.3. France air-cooled heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.6.2.4. France other product heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.6.3. France heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

7.3.6.4. France heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

7.3.7. Italy

7.3.7.1. Italy heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.7.2. Italy heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.3.7.2.1. Italy plate & frame heat exchanger market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.3.7.2.1.1. Italy brazed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.7.2.1.2. Italy gasketed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.7.2.1.3. Italy welded plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.7.2.1.4. Italy others product type market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.7.2.2. Italy shell & tube heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.7.2.3. Italy air-cooled heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.7.2.4. Italy other product heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.7.3. Italy heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

7.3.7.4. Italy heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

7.3.8. Spain

7.3.8.1. Spain heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.8.2. Spain heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.3.8.2.1. Spain plate & frame heat exchanger market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.3.8.2.1.1. Spain brazed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.8.2.1.2. Spain gasketed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.8.2.1.3. Spain welded plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.8.2.1.4. Spain others product type market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.8.2.2. Spain shell & tube heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.8.2.3. Spain air-cooled heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.8.2.4. Spain other product heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.8.3. Spain heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

7.3.8.4. Spain heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

7.3.9. UK

7.3.9.1. UK heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.9.2. UK heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.3.9.2.1. UK plate & frame heat exchanger market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.3.9.2.1.1. UK brazed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.9.2.1.2. UK gasketed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.9.2.1.3. UK welded plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.9.2.1.4. UK others product type market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.9.2.2. UK shell & tube heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.9.2.3. UK air-cooled heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.9.2.4. UK other product heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.3.9.3. UK heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

7.3.9.4. UK heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

7.4. Asia Pacific

7.4.1. Asia Pacific heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.2. Asia Pacific heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.4.2.1. Asia Pacific plate & frame heat exchanger market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.4.2.1.1. Asia Pacific brazed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.2.1.2. Asia Pacific gasketed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.2.1.3. Asia Pacific welded plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.2.1.4. Asia Pacific others product type market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.2.2. Asia Pacific shell & tube heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.2.3. Asia Pacific air-cooled heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.2.4. Asia Pacific other product heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.3. Asia Pacific heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

7.4.4. Asia Pacific heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

7.4.5. China

7.4.5.1. China heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.5.2. China heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.4.5.2.1. China plate & frame heat exchanger market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.4.5.2.1.1. China brazed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.5.2.1.2. China gasketed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.5.2.1.3. China welded plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.5.2.1.4. China others product type market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.5.2.2. China shell & tube heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.5.2.3. China air-cooled heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.5.2.4. China other product heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.5.3. China heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

7.4.5.4. China heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

7.4.6. Japan

7.4.6.1. Japan heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.6.2. Japan heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.4.6.2.1. Japan plate & frame heat exchanger market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.4.6.2.1.1. Japan brazed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.6.2.1.2. Japan gasketed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.6.2.1.3. Japan welded plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.6.2.1.4. Japan others product type market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.6.2.2. Japan shell & tube heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.6.2.3. Japan air-cooled heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.6.2.4. Japan other product heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.6.3. Japan heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

7.4.6.4. Japan heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

7.4.7. India

7.4.7.1. India heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.7.2. India heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.4.7.2.1. India plate & frame heat exchanger market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.4.7.2.1.1. India brazed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.7.2.1.2. India gasketed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.7.2.1.3. India welded plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.7.2.1.4. India others product type market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.7.2.2. India shell & tube heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.7.2.3. India air-cooled heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.7.2.4. India other product heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.7.3. India heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

7.4.7.4. India heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

7.4.8. Australia

7.4.8.1. Market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.8.2. Market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.4.8.2.1. Plate & frame heat exchanger market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.4.8.2.1.1. Brazed plate & frame heat exchanger market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.4.8.2.1.2. Gasketed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.8.2.1.3. Welded plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.8.2.1.4. Others market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.4.8.3. Market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

7.4.8.4. Market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

7.4.9. South Korea

7.4.9.1. South Korea heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.9.2. South Korea heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.4.9.2.1. South Korea plate & frame heat exchanger market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.4.9.2.1.1. South Korea brazed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.9.2.1.2. South Korea gasketed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.9.2.1.3. South Korea welded plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.9.2.1.4. South Korea others product type market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.9.2.2. South Korea shell & tube heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.9.2.3. South Korea air-cooled heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.9.2.4. South Korea other product heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.4.9.3. South Korea heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

7.4.9.4. South Korea heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

7.5. Central & South America

7.5.1. Central & South America heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.5.2. Central & South America heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.5.2.1. Central & South America plate & frame heat exchanger market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.5.2.1.1. Central & South America brazed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.5.2.1.2. Central & South America gasketed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.5.2.1.3. Central & South America welded plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.5.2.1.4. Central & South America others product type market estimates and forecasts, 2018 - 2030 (USD Billion)

7.5.2.2. Central & South America shell & tube heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.5.2.3. Central & South America air-cooled heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.5.2.4. Central & South America other product heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.5.3. Central & South America heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

7.5.4. Central & South America heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

7.5.5. Brazil

7.5.5.1. Brazil heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.5.5.2. Brazil heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.5.5.2.1. Brazil plate & frame heat exchanger market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.5.5.2.1.1. Brazil brazed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.5.5.2.1.2. Brazil gasketed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.5.5.2.1.3. Brazil welded plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.5.5.2.1.4. Brazil others product type market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.5.5.2.2. Brazil shell & tube heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.5.5.2.3. Brazil air-cooled heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.5.5.2.4. Brazil other product heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.5.5.3. Brazil heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

7.5.5.4. Brazil heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

7.5.6. Argentina

7.5.6.1. Argentina heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.5.6.2. Argentina heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.5.6.2.1. Argentina plate & frame heat exchanger market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.5.6.2.1.1. Argentina brazed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.5.6.2.1.2. Argentina gasketed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.5.6.2.1.3. Argentina welded plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.5.6.2.1.4. Argentina others product type market estimates and forecasts, 2018 - 2030 (USD Billion)

7.5.6.2.2. Argentina shell & tube heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.5.6.2.3. Argentina air-cooled heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.5.6.2.4. Argentina other product heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.5.6.3. Argentina heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

7.5.6.4. Argentina heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

7.6. Middle East & Africa

7.6.1. Middle East & Africa heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.2. Middle East & Africa heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.6.2.1. Middle East & Africa plate & frame heat exchanger market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.6.2.1.1. Middle East & Africa brazed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.2.1.2. Middle East & Africa gasketed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.2.1.3. Middle East & Africa welded plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.2.1.4. Middle East & Africa others product type market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.2.2. Middle East & Africa shell & tube heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.2.3. Middle East & Africa air-cooled heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.2.4. Middle East & Africa other product heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.3. Middle East & Africa heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

7.6.4. Middle East & Africa heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

7.6.5. Saudi Arabia

7.6.5.1. Saudi Arabia heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.5.2. Saudi Arabia heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.6.5.2.1. Saudi Arabia plate & frame heat exchanger market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.6.5.2.1.1. Saudi Arabia brazed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.5.2.1.2. Saudi Arabia gasketed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.5.2.1.3. Saudi Arabia welded plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.5.2.1.4. Saudi Arabia others product type market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.5.2.2. Saudi Arabia shell & tube heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.5.2.3. Saudi Arabia air-cooled heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.5.2.4. Saudi Arabia other product heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.5.3. Saudi Arabia heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

7.6.5.4. Saudi Arabia heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

7.6.6. UAE

7.6.6.1. UAE heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.6.2. UAE heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.6.6.2.1. UAE plate & frame heat exchanger market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.6.6.2.1.1. UAE brazed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.6.2.1.2. UAE gasketed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.6.2.1.3. UAE welded plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.6.2.1.4. UAE others product type market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.6.2.2. UAE shell & tube heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.6.2.3. UAE air-cooled heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.6.2.4. UAE other product heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.6.3. UAE heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

7.6.6.4. UAE heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

7.6.7. South Africa

7.6.7.1. South Africa heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.7.2. South Africa heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.6.7.2.1. South Africa plate & frame heat exchanger market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

7.6.7.2.1.1. South Africa brazed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.7.2.1.2. South Africa gasketed plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.7.2.1.3. South Africa welded plate & frame heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.7.2.1.4. South Africa others product type market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.7.2.2. South Africa shell & tube heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.7.2.3. South Africa air-cooled heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.7.2.4. South Africa other product heat exchanger market estimates and forecasts, 2018 - 2030 (USD Billion)

7.6.7.3. South Africa heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

7.6.7.4. South Africa heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

Chapter 8. Competitive Analysis

8.1. Recent Developments & Impact Analysis, By Key Market Participants

8.2. Company Categorization

8.3. Company Market Share Analysis, 2023

8.4. Company Market Positioning

8.5. Competitive Dashboard Analysis

8.6. Company Heat Map Analysis, 2023

8.7. Strategy Mapping

8.8. Expansion

8.8.1. Mergers & Acquisition

8.8.2. Partnerships & Collaborations

8.8.3. New Product Launches

8.8.4. Research And Development

8.9. Company Profiles

8.9.1. Alfa Laval

8.9.1.1. Company Overview

8.9.1.2. Financial Performance

8.9.1.3. Product Benchmarking

8.9.1.4. Strategic Initiatives

8.9.2. Danfoss

8.9.2.1. Company Overview

8.9.2.2. Financial Performance

8.9.2.3. Product Benchmarking

8.9.2.4. Strategic Initiatives

8.9.3. Kelvion Holding GmbH

8.9.3.1. Company Overview

8.9.3.2. Financial Performance

8.9.3.3. Product Benchmarking

8.9.3.4. Strategic Initiatives

8.9.4. Güntner Group GmbH

8.9.4.1. Company Overview

8.9.4.2. Financial Performance

8.9.4.3. Product Benchmarking

8.9.4.4. Strategic Initiatives

8.9.5. Xylem Inc.

8.9.5.1. Company Overview

8.9.5.2. Financial Performance

8.9.5.3. Product Benchmarking

8.9.5.4. Strategic Initiatives

8.9.6. API Heat Transfer

8.9.6.1. Company Overview

8.9.6.2. Financial Performance

8.9.6.3. Product Benchmarking

8.9.6.4. Strategic Initiatives

8.9.7. Mersen

8.9.7.1. Company Overview

8.9.7.2. Financial Performance

8.9.7.3. Product Benchmarking

8.9.7.4. Strategic Initiatives

8.9.8. Hisaka Works, Ltd.

8.9.8.1. Company Overview

8.9.8.2. Financial Performance

8.9.8.3. Product Benchmarking

8.9.8.4. Strategic Initiatives

8.9.9. Chart Industries, Inc.

8.9.9.1. Company Overview

8.9.9.2. Financial Performance

8.9.9.3. Product Benchmarking

8.9.9.4. Strategic Initiatives

8.9.10. Johnson Controls International

8.9.10.1. Company Overview

8.9.10.2. Financial Performance

8.9.10.3. Product Benchmarking

8.9.10.4. Strategic Initiatives

8.9.11. HRS Heat Exchangers

8.9.11.1. Company Overview

8.9.11.2. Financial Performance

8.9.11.3. Product Benchmarking

8.9.11.4. Strategic Initiatives

8.9.12. SPX FLOW, Inc.

8.9.12.1. Company Overview

8.9.12.2. Financial Performance

8.9.12.3. Product Benchmarking

8.9.12.4. Strategic Initiatives

8.9.13. Funke Wärmeaustauscher Apparantebau GmbH

8.9.13.1. Company Overview

8.9.13.2. Financial Performance

8.9.13.3. Product Benchmarking

8.9.13.4. Strategic Initiatives

8.9.14. Koch Heat Transfer Company

8.9.14.1. Company Overview

8.9.14.2. Financial Performance

8.9.14.3. Product Benchmarking

8.9.14.4. Strategic Initiatives

8.9.15. Southern Heat Exchanger Corporation

8.9.15.1. Company Overview

8.9.15.2. Financial Performance

8.9.15.3. Product Benchmarking

8.9.15.4. Strategic Initiatives

List of Tables

Table 1 Heat exchangers market 2018 - 2030 (USD Billion)

Table 2 Global heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 3 Global heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 4 Global plate & frame heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 5 Global shell & tube heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 6 Global heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

Table 7 Global heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

Table 8 Global heat exchangers market estimates and forecasts, by region, 2018 - 2030 (USD Billion)

Table 9 North America heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 10 North America heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 11 North America plate & frame heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 12 North America shell & tube heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 13 North America heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

Table 14 North America heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

Table 15 U.S. heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 16 U.S. heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 17 U.S. plate & frame heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 18 U.S. shell & tube heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 19 U.S. heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

Table 20 U.S. heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

Table 21 Canada heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 22 Canada heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 23 Canada plate & frame heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 24 Canada shell & tube heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 25 Canada heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

Table 26 Canada heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

Table 27 Mexico heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 28 Mexico heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 29 Mexico plate & frame heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 30 Mexico shell & tube heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 31 Mexico heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

Table 32 Mexico heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

Table 33 Europe heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 34 Europe heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 35 Europe plate & frame heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 36 Europe shell & tube heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 37 Europe heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

Table 38 Europe heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

Table 39 Germany heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 40 Germany heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 41 Germany plate & frame heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 42 Germany shell & tube heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 43 Germany heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

Table 44 Germany heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

Table 45 France heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 46 France heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 47 France plate & frame heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 48 France shell & tube heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 49 France heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

Table 50 France heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

Table 51 Italy heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 52 Italy heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 53 Italy plate & frame heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 54 Italy shell & tube heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 55 Italy heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

Table 56 Italy heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

Table 57 Spain heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 58 Spain heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 59 Spain plate & frame heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 60 Spain shell & tube heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 61 Spain heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

Table 62 Spain heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

Table 63 UK heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 64 UK heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 65 UK plate & frame heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 66 UK shell & tube heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 67 UK heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

Table 68 UK heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

Table 69 Asia Pacific heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 70 Asia Pacific heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 71 Asia Pacific plate & frame heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 72 Asia Pacific shell & tube heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 73 Asia Pacific heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

Table 74 Asia Pacific heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

Table 75 China heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 76 China heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 77 China plate & frame heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 78 China shell & tube heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 79 China heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

Table 80 China heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

Table 81 India heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 82 India heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 83 India plate & frame heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 84 India shell & tube heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 85 India heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

Table 86 India heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

Table 87 Japan heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 88 Japan heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 89 Japan plate & frame heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 90 Japan shell & tube heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 91 Japan heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

Table 92 Japan heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

Table 93 South Korea heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 94 South Korea heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 95 South Korea plate & frame heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 96 South Korea shell & tube heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 97 South Korea heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

Table 98 South Korea heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

Table 99 Australia heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 100 Australia heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 101 Australia plate & frame heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 102 Australia shell & tube heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 103 Australia heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

Table 104 Australia heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

Table 105 Central & South America heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 106 Central & South America heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 107 Central & South America plate & frame heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 108 Central & South America shell & tube heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 109 Central & South America heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

Table 110 Central & South America heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

Table 111 Brazil heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 112 Brazil heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 113 Brazil plate & frame heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 114 Brazil shell & tube heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 115 Brazil heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

Table 116 Brazil heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

Table 117 Argentina heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 118 Argentina heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 119 Argentina plate & frame heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 120 Argentina shell & tube heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 121 Argentina heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

Table 122 Argentina heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

Table 123 Middle East & Africa heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 124 Middle East & Africa heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 125 Middle East & Africa plate & frame heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 126 Middle East & Africa shell & tube heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 127 Middle East & Africa heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

Table 128 Middle East & Africa heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

Table 129 Saudi Arabia heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 130 Saudi Arabia heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 131 Saudi Arabia plate & frame heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 132 Saudi Arabia shell & tube heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 133 Saudi Arabia heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

Table 134 Saudi Arabia heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

Table 135 South Africa heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 136 South Africa heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 137 South Africa plate & frame heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 138 South Africa shell & tube heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 139 South Africa heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

Table 140 South Africa heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

Table 141 UAE heat exchangers market estimates and forecasts, 2018 - 2030 (USD Billion)

Table 142 UAE heat exchangers market estimates and forecasts, by product, 2018 - 2030 (USD Billion)

Table 143 UAE plate & frame heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 144 UAE shell & tube heat exchangers market estimates and forecasts, by type, 2018 - 2030 (USD Billion)

Table 145 UAE heat exchangers market estimates and forecasts, by end-use, 2018 - 2030 (USD Billion)

Table 146 UAE heat exchangers market estimates and forecasts, by material, 2018 - 2030 (USD Billion)

Table 147 Key Companies Undergoing Mergers & Acquisitions

Table 148 Key Companies Undergoing Product Launches

Table 149 Key Companies Undergoing Partnerships & Collaborations

Table 150 Key Companies Making Investments

Table 151 Key Companies Undergoing Expansions

Table 152 Key Companies Undergoing Agreements

Table 153 Key Companies Undergoing Disinvestment

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 QFD modeling for market share assessment

Fig. 6 Information Procurement

Fig. 7 Market Formulation and Validation

Fig. 8 Data Validating & Publishing

Fig. 9 Market Segmentation & Scope

Fig. 10 Heat Exchangers Market Snapshot

Fig. 11 Product Segment Snapshot

Fig. 12 End-use Segment Snapshot

Fig. 13 Material Segment Snapshot

Fig. 14 Competitive Landscape Snapshot

Fig. 15 Heat Exchangers Market Value, 2023 (USD Billion)

Fig. 16 Heat Exchangers Market - Value Chain Analysis

Fig. 17 Heat Exchangers Market - Market Dynamics

Fig. 18 Heat Exchangers Market - PORTER’s Analysis

Fig. 19 Heat Exchangers Market - PESTEL Analysis

Fig. 20 Heat Exchangers Market Estimates & Forecasts, By Product: Key Takeaways

Fig. 21 Heat Exchangers Market Share, By Product, 2023 & 2030

Fig. 22 Plate & Frame Heat Exchangers Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 23 Plate & Frame Heat Exchangers Market Estimates & Forecasts, By Type, 2018 - 2030 (USD Billion)

Fig. 24 Brazed Plate & Frame Heat Exchanger Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 25 Gasketed Plate & Frame Heat Exchanger Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 26 Welded Plate & Frame Heat Exchanger Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 27 Other Product Type Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 28 Shell & Tube Heat Exchangers Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 29 Air Cooled Heat Exchangers Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 30 Other Product Heat Exchangers Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 31 Heat Exchangers Market Estimates & Forecasts, By End-use: Key Takeaways

Fig. 32 Heat Exchangers Market Share, By End-use, 2023 & 2030

Fig. 33 Heat Exchangers Market Estimates & Forecasts, In Chemical & Petrochemical, 2018 - 2030 (USD Billion)

Fig. 34 Heat Exchangers Market Estimates & Forecasts, In Oil & Gas, 2018 - 2030 (USD Billion)

Fig. 35 Heat Exchangers Market Estimates & Forecasts, In HVAC & Refrigeration, 2018 - 2030 (USD Billion)

Fig. 36 Heat Exchangers Market Estimates & Forecasts, In Power Generation, 2018 - 2030 (USD Billion)

Fig. 37 Heat Exchangers Market Estimates & Forecasts, In Food & Beverage, 2018 - 2030 (USD Billion)

Fig. 38 Heat Exchangers Market Estimates & Forecasts, In Pulp & Paper, 2018 - 2030 (USD Billion)

Fig. 39 Heat Exchangers Market Estimates & Forecasts, In Other End-use, 2018 - 2030 (USD Billion)

Fig. 40 Heat Exchangers Market Estimates & Forecasts, By Material: Key Takeaways

Fig. 41 Heat Exchangers Market Share, By Material, 2023 & 2030

Fig. 42 Heat Exchangers Market Estimates & Forecasts, By Metals, 2018 - 2030 (USD Billion)

Fig. 43 Heat Exchangers Market Estimates & Forecasts, By Alloys, 2018 - 2030 (USD Billion)

Fig. 44 Heat Exchangers Market Estimates & Forecasts, By Others, 2018 - 2030 (USD Billion)

Fig. 45 North America Heat Exchangers Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 46 U.S. Heat Exchangers Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 47 Canada Heat Exchangers Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 48 Mexico Heat Exchangers Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 49 Europe Heat Exchangers Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 50 Germany Heat Exchangers Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 51 France Heat Exchangers Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 52 UK Heat Exchangers Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 53 Italy Heat Exchangers Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 54 Spain Heat Exchangers Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 55 Asia Pacific Heat Exchangers Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 56 China Heat Exchangers Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 57 India Heat Exchangers Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 58 Japan Heat Exchangers Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 59 South Korea Heat Exchangers Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 60 Australia Heat Exchangers Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 61 Central & South America Heat Exchangers Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 62 Brazil Heat Exchangers Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 63 Argentina Heat Exchangers Market Estimates & Forecasts, By Product, 2018 - 2030 (USD Billion)

Fig. 64 Middle East & Africa Heat Exchangers Market Estimates & Forecasts, By Product, 2018 - 2030 (USD Billion)

Fig. 65 UAE Heat Exchangers Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 66 South Africa Heat Exchangers Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 67 Saudi Arabia Heat Exchangers Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

Fig. 68 Key Company Categorization

Fig. 69 Competitive Dashboard Analysis

Fig. 70 Company Market Positioning

Fig. 71 Key Company Market Share Analysis, 2023

Fig. 72 Strategy MappingWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Heat Exchanger Product Outlook (Revenue, USD Million, 2018 - 2030)

- Plate & Frame Heat Exchanger

- Brazed Plate & Frame Heat Exchanger

- Gasketed Plate & Frame Heat Exchanger

- Welded Plate & Frame Heat Exchanger

- Others

- Shell & Tube Heat Exchanger