- Home

- »

- Organic Chemicals

- »

-

Hexamethylenediamine Market Size And Share Report, 2030GVR Report cover

![Hexamethylenediamine Market Size, Share & Trends Report]()

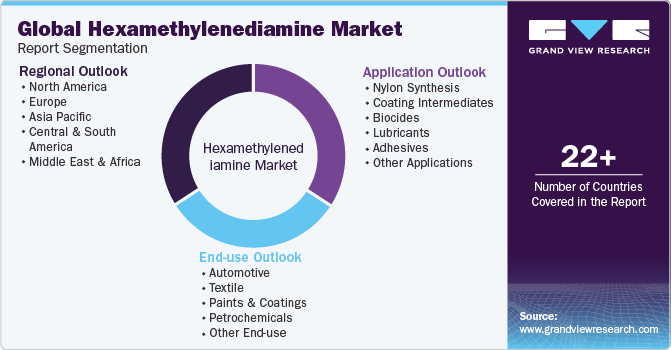

Hexamethylenediamine Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Nylon Synthesis, Biocides), By End-use (Automotive, Textile), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-242-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hexamethylenediamine Market Trends

The global hexamethylenediamine market size was estimated at USD 8,473.20 million in 2023 and is projected to grow at a CAGR of 5.9% from 2024 to 2030. The market is experiencing growth due to increased demand from various industries such as textile, water treatment, and automotive. The market is expected to continue growing shortly, primarily due to the rising demand for the production of nylon 6-6.

There is an increasing preference for nylon materials over metal due to their lighter weight, driving the demand for hexamethylenediamine (HMDA). HMDA is used to produce curing agents, paints, and coatings. In the petrochemical sector, polyamides are produced for 3D printing. The unique properties of HMDA make it a popular choice for lubricant production, as it is compatible with a wide range of additives.

Hexamethylenediamine (HMDA) is a chemical compound widely used in the chemical industry for producing various products, including corrosion inhibitors for water treatment chemicals. It is created through the production of adiponitrile. HMDA plays a vital role as a building block for producing high-performance materials in various industries. Its exceptional chemical and physical properties and versatility make it an essential ingredient in synthesizing polymers, resins, and other specialty chemicals.

Another method to produce HMDA is through the hydrogenation of adiponitrile. This involves mixing adiponitrile with ammonia and hydrogen and passing the mixture through a copper, nickel, or cobalt catalyst bed. The process is conducted continuously under pressure and at high temperatures. The reaction mixture can be separated into gas and liquid phases after leaving the hydrogenation zone while maintaining temperature and pressure to make the process more efficient. The gaseous mixture of hydrogen and ammonia can then be recirculated back to the hydrogenation zone.

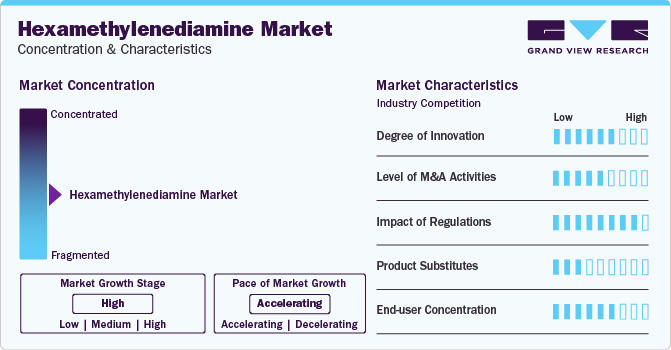

Market Concentration & Characteristics

The market is fragmented with the presence of number of manufacturers. Multinational corporations in the market have established a global supply chain through in-house supply channels or third-party distributors. For instance, companies such as BASF SE, Evonik Industries AG, Asahi Kasei Corporation, have appointed third-party distributors to supply their products in the market.

Given the competitive nature of the market, continuous research and development efforts are necessary for companies to stay ahead. Company often invests in research and innovation to develop new applications, improve product performance, enhance manufacturing process, and alternative sustainable options to traditional steam cracking process HMDA. For instance, in January 2022, Covestro and Genomatica have announced a significant breakthrough in their partnership. They have successfully produced a considerable amount of plant-based HMDA, becoming the first to do so. This will pave the way for renewable feedstocks that are more sustainable.

End-use Insights

Based on end-use, the automotive segment dominated the global market with a revenue share in 2023. The growth is attributed to the increased demand for nylon-based product such as Nylon 6-6. Nylon 6-6 is used to manufacture automotive parts and components such as radiator end tanks, air intake manifolds, rocker covers, oil pans, and airbags, among others.

The Textile segment is expected to grow at the significant CAGR over the forecast period. The growth is attributed to the rising usage of hexamethylenediamine is used in the textile industry for making apparel and carpets. Nylon 6-6 is a highly durable material with excellent temperature resistance, which makes it a popular choice across various industries. HMDA plays a vital role in manufacturing nylon fibers, which are widely used in various textile applications to provide excellent strength, durability, and abrasion resistance. Due to urbanization, growing disposable incomes, and changing consumer preferences towards high-quality textiles, the demand for nylon-based textiles in clothing, home furnishings, carpets, and technical textiles is expected to increase.

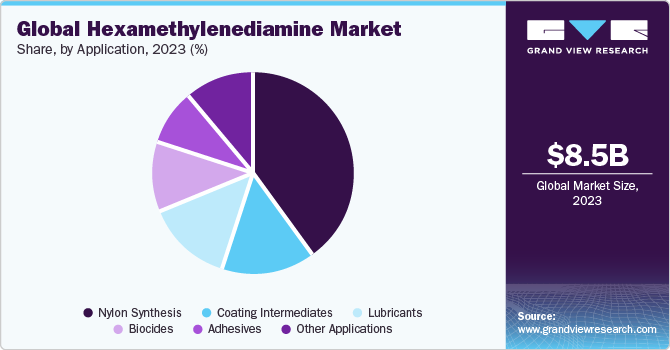

Application Insights

Based on application, the nylon synthesis segment led the market with a largest revenue share of over 40.44% in 2023. This growth is attributed due to rising demand for nylon 6-6 from various end-use industries such as automotive, textile and pharmaceuticals. Nylon 6-6 is used in the manufacture of automotive products. The growth is also due to nylon’s synthesis superior properties such as strength, durability, and chemical resistance.

The lubricants segment is anticipated to grow at a significant CAGR over the forecast period. HMDA is used in lubricants as a corrosion inhibitors and as a component of synthetic lubricant additives. It helps improve lubricating properties of the oil and protects metal surfaces from corrosion. This forms a protective film on the metal surfaces reducing friction and wear between moving parts. It also helps expand the lifespan of the lubricants by preventing oxidative degradation.

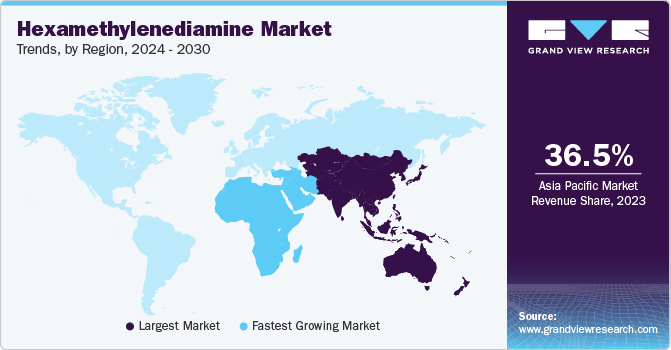

Regional Insights

The hexamethylenediamine market in North America accounted the market with the revenue share in 2023. This is attributed to the rising use of hexamethylenediamine in the automotive industry as U.S. is one of the main manufacturing hub for North America. The growth of automotive industry and textile industry in the region is one of the reasons for the growth market in the particular region.

U.S. Hexamethylenediamine Market Trends

The hexamethylenediamine market in U.S. is the largest market in North America and is driven by the increase in demand of automotive industry, corrosion inhibitors. The rising automotive production and sale in the region is also one of the reasons for the market growth. According to CNBC, in December 2023, the production and sales of new cars is expected to increase slightly from 1-4% to roughly 15.6 million to 16.1 million vehicles sold. This is expected to grow the HMDA market in the U.S.

Europe Hexamethylenediamine Market Trends

The hexamethylenediamine market in Europe is expected to grow at the significant CAGR over the forecast period. This growth is attributed to increase investment in research and development of HMDA and increase in production of automotive industry.

The Germany hexamethylenediamine market is the dominating in Europe. This is because the country is the market leader in the automotive industry and has presence of market major players of HMDA, such as Covestro, BASF SE, EVONIK. For instance, in January 2022, Covestro and Genomatica have announced a significant breakthrough in their partnership. They have successfully produced a considerable amount of plant-based HMDA. This will pave the way for renewable feedstocks that are more sustainable. These feedstocks will be able to produce a wide range of products, such as Nylon 6-6 and coatings. This marks a significant step towards embracing the circular economy fully. As HMDA is more environmentally sustainable, it will lead to a rise in demand for it.

The hexamethylenediamine market in UK is expected to grow at the fastest CAGR over the forecast period. This growth is attributed to rise in demand for light weight automotive parts which are manufactured with the help of HMDA.

Asia Pacific Hexamethylenediamine Market Trends

Asia Pacific dominated the hexamethylenediamine market with a revenue share of over 36.52% in 2023. This growth is attributed to the rising industrial growth and development in sectors such as automotive, textile and pharmaceuticals are the one of the primary reasons for the rise in HMDA demand as it is widely used in the industries in production of various products.

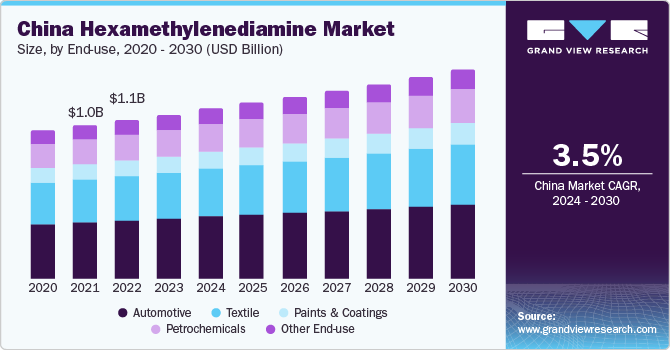

The China hexamethylenediamine market is anticipated to grow at the fastest CAGR over the forecast period. China is the world's largest automotive production country in the world. This has led to rise in demand for HMDA, as it can be used in the production of lightweight automotive parts. The automotive industry is focusing on reducing vehicle weight to increase fuel efficiency and reduce emissions, which will drive demand for lightweight composite nylon resins for under-the-hood components. According to the International Organization of Motor Vehicle Manufacturers (OICA), China is the biggest automotive manufacturer in the region and globally, with 27.02 million units produced in 2022, a 3% increase from the previous year.

Central & South America Hexamethylenediamine Market Trends

The hexamethylenediamine market in Central and South America market is estimated to grow at the fastest CAGR over the forecast period, owing to increase in infrastructure and production facilities in Brazil, Argentina, Chile and other countries. The region growth is textile industry is expected to grow, leading to rise in demand for HMDA.

The Brazil hexamethylenediamine market is expected to dominate the Central and South America market. This growth is attributed to the rising production of automotive in the country. According to International Organization of Motor Vehicles Manufacturers (OICA) Brazil has witnessed the growth in automotive production with a increase in production by 5% and the total production of automotive vehicles with 2.36 million unit produced in 2022. This has led to rise in demand for raw materials such as HMDA, which are used in the manufacturing of automobile parts.

Middle East & Africa Hexamethylenediamine Market Trends

The hexamethylenediamine market in Middle East & Africa is anticipated to grow at the fastest CAGR over the forecast period, growing demand for HMDA in the region is driven by factors such as growth of automotive industry, rising textile sales & production. The region’s oil and gas projects also plays a role in rising demand for HMDA in the coating and adhesive industry.

Saudi Arabia hexamethylenediamine market is expected to grow at the significant CAGR over the forecast period. Saudi Arabia market is expected to grow due to rise in automotive manufacturing plant in the region. Many major automotive players are setting up their plants in the region which will give them a presence in the Middle East region and will be able to cater the demand of the consumer. For instance, in December 2022, Saudi Arabia's Crown Prince, Mohammad bin Salman bin Abdulaziz, has recently launched Ceer, Saudi Arabia's first-ever electric vehicle brand. The cars will be both designed and manufactured within the country itself. The project is expected to contribute a direct USD 8 billion to Saudi Arabia's GDP by 2034 and attract over USD 150 million in foreign direct investment. These local and international investments will be vital in establishing a thriving ecosystem and creating job opportunities and investment avenues through various growth industries.

Key Hexamethylenediamine Company Insights

Some of the key players operating in the market include BASF SE, EVONIK Industries AG, Asahi Kasei Corporation, TORAY INDUSTRIES Inc., and INVISTA among others.

-

BASF SE is a chemical manufacturing company. The company operates through five business segments, namely performance products, chemicals, agricultural solutions, functional materials & solutions, and oil & gas. It caters its products to several end-use industries, such as pharmaceuticals, automotive & transportation, agriculture, construction, electronics & electric, personal care & hygiene, energy & resources, furniture & wood, home care and industrial & institutional cleaning solutions, nutrition, packaging & print, paints & coatings, pulp & paper, textile, plastics & rubber, leather & footwear, among others

-

EVONIK Industries AG is a chemical manufacturing company. The company operates through five different segments: Nutrition and Care, Resource Efficiency, Performance Materials, Services, and Other Operations. The Resource Efficiency segment supplies materials and specialty additives across multiple industries, such as paints, coatings, adhesives, automotive, construction, and others

Ascend Performance Materials., Genomatica, Rennovia, Solvay, and Ashland among others, are some of the emerging market participants in the global market.

-

Genomatica, Inc. is a private company specializing in developing bio-manufacturing processes for producing various industrial chemicals. The company has established itself as a leading developer of bio-based process technologies by forging partnerships with top chemical manufacturers. Genomatica provides a bioprocess engineering platform and a complete suite of computational and experimental technologies to design, create, and optimize microorganisms

-

Ascend Performance Materials Holdings Inc. is a global chemical company that produces intermediate chemicals, specialty chemicals, resins, fibers, and compounds for the automotive, consumer, industrial, electrical, and textile industries

Key Hexamethylenediamine Companies:

The following are the leading companies in the hexamethylenediamine market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- DuPont

- Asahi Kasei Corporation

- Evonik Industries AG

- Toray Industries Inc.

- INVISTA

- Rennovia Inc.,

- Ashland

- Solvay

- Genomatica

- Ascend Performance Materials

Recent Developments

-

In March 2022, Asahi Kasei Corporation has partnered with Genomatica Inc. to commercialize renewable nylon 6.6 made from bio-based hexamethylenediamine building blocks. The partnership aims to strengthen Asahi Kasei Corporation's market further

-

In January 2022, BASF SE has recently announced its plan to construct a new plant for hexamethylene diamine in Chlaampe, France. This new plant will significantly enhance BASF's annual production capacity of hexamethylenediamine to 260,000 metric tons. The production of hexamethylenediamine is expected to commence in 2024

-

Ascend Performance Materials has signed an investment agreement to construct a new hexamethylenediamine and specialty chemicals plant at Xuwei New Area Park in Lianyungang, China. This will be Ascend's first chemical production facility and its most significant investment outside the U.S. The plant will produce hexamethylenediamine and specialty chemicals to support Ascend's global polyamide production and regional customers

Hexamethylenediamine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8,854.49 million

Revenue forecast in 2030

USD 12,489.34 million

Growth rate

CAGR of 5.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume inn kilo tons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

BASF SE; DuPont; Asahi Kasei Corporation; Evonik Industries AG; Toray Industries Inc.; INVISTA, Rennovia Inc.; Ashland; Solvay; Genomatica; Ascend Performance Materials.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hexamethylenediamine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hexamethylenediamine market report based on application, end-use, and region.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Nylon Synthesis

-

Coating Intermediates

-

Biocides

-

Lubricants

-

Adhesives

-

Other Applications

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Textile

-

Paints & Coatings

-

Petrochemicals

-

Other End-use

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hexamethylenediamine mark is estimated to reach USD 8,473.20 million in 2023 and is expected to reach USD 8,854.49 million in 2024.

b. The global hexamethylenediamine market is expected to grow at a compound annual growth rate of 5.9% from 2024 to 2030 to reach USD 12,489.34 million by 2030.

b. Asia Pacific dominated the hexamethylenediamine market with a share of 36.52% in 2022. This is attributable to the growth of the automotive and textile sectors, along with the increasing demand for engineering plastics

b. Some key players operating in the hexamethylenediamine market include Evonik Industries AG, BASF SE, INVISTA, TORAY INDUSTRIES INC., DuPont, Asahi Kasei Corporation

b. Key factors that are driving the market growth are the growing awareness of the importance of hygiene and the increasing use of biocides in various sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.