- Home

- »

- Communications Infrastructure

- »

-

High-speed Data Converter Market Size, Share Report, 2030GVR Report cover

![High-speed Data Converter Market Size, Share & Trends Report]()

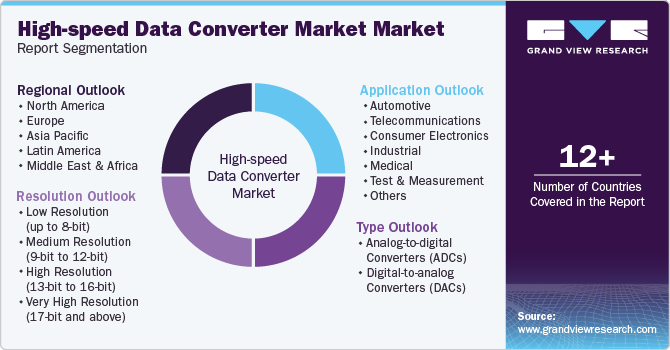

High-speed Data Converter Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Analog-to-digital converters, Digital-to-analog converters), By Resolution (Low Resolution, Medium Resolution), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-432-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

High-speed Data Converter Market Summary

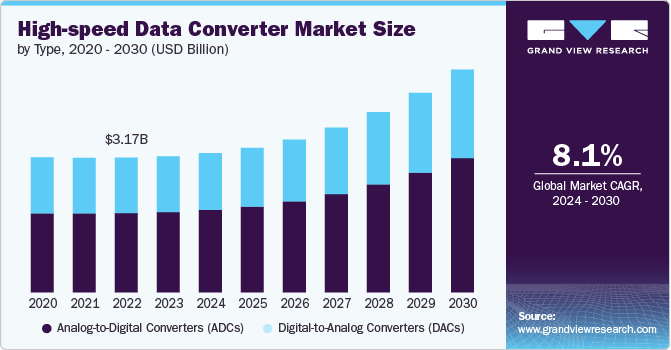

The global high-speed data converter market size was valued at USD 3.20 billion in 2023 and is projected to reach USD 5.24 billion by 2030, growing at a CAGR of 8.1% from 2024 to 2030. The global market is experiencing robust growth, driven by the escalating demand for rapid data processing and superior signal integrity across various sectors, including telecommunications, consumer electronics, automotive, and industrial automation.

Key Market Trends & Insights

- North America high-speed data converter market held a revenue share of 28.1% of the global industry in 2023.

- The high-speed data converter market in the U.S. is expected to grow significantly from 2024 to 2030.

- By type, the analog-to-digital converters (ADCs) segment accounted for the largest market share of 59.0% in 2023.

- By resolution, the high resolution (13-bit to 16-bit) segment accounted for the largest market share of over 35.0% in 2023.

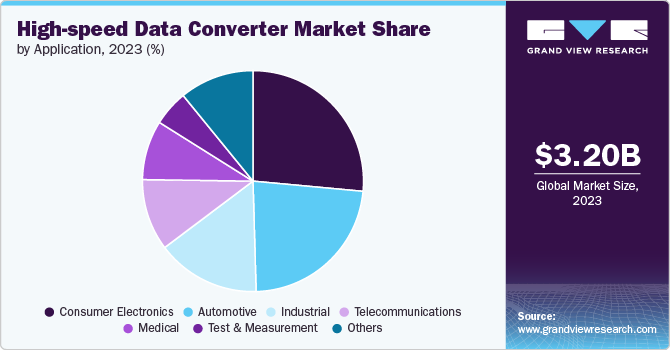

- By application, the consumer electronics segment accounted for the largest market share of 26.5% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.20 Billion

- 2030 Projected Market Size: USD 5.24 Billion

- CAGR (2024-2030): 8.1%

- Asia Pacific: Largest market in 2023

Technological advancements such as 5G networks, the proliferation of the Internet of Things (IoT), and the increasing complexity of electronic systems are fueling the need for high-performance data conversion solutions. These solutions are crucial for ensuring accurate analog-to-digital (A/D) and digital-to-analog (D/A) transformations.

The deployment of 5G networks necessitates high-speed data converters capable of handling the increased data throughput and improved signal fidelity required for advanced telecommunications infrastructure. High-speed data converters are essential for managing the rapid conversion of signals, ensuring optimal performance and reliability in 5G systems. The expansion of smart devices, including smartphones, wearables, and smart home devices, significantly drives the market. These devices integrate sensors and communication modules that demand efficient and high-speed data conversion to process analog signals from sensors into digital data swiftly and accurately. For instance, high-resolution imaging sensors in smartphones and cameras rely on high-speed data converters to ensure precise image signal processing, thereby enhancing photo quality and video resolution.

In the realm of audio, high-speed data converters are vital for achieving high-fidelity sound by converting analog audio signals into digital format without compromising quality. This is crucial for applications ranging from streaming services to high-end audio equipment, where clear and accurate sound reproduction is paramount. The industrial automation sector is a significant contributor to the demand for high-speed data converters. These converters play a critical role in translating analog signals from sensors and actuators into digital data for processing by control systems. This capability is essential for real-time monitoring and automation, supporting advanced technologies such as robotics, predictive maintenance, and smart manufacturing.

As industries embrace Industry 4.0 and integrate IoT devices, the need for high-speed data converters that can handle complex data streams and enhance operational efficiency continues to rise. For instance, In November 2023, Renesas Electronics Corporation, a Japanese semiconductor manufacturer, expanded its 32-bit microcontroller (MCU) lineup by introducing the RX23E-B. This advanced 32-bit MCU is designed for high-end industrial sensor applications. It features a precise analog front end (AFE) that ensures accurate and fast analog signal measurements, meeting the needs of systems with performance requirements.

Type Insights

The analog-to-digital converters (ADCs) segment accounted for the largest market share of 59.0% in 2023 due to the increasing demand for high-resolution and high-speed data conversion in consumer electronics. As devices such as smartphones, digital cameras, and wearable technology continue to evolve, there is a growing need for ADCs that can convert analog signals into digital data with greater precision and speed. For instance, in July 2024, Microchip Technology Inc. U.S.-based manufacturer of microcontroller, mixed-signal, analog integrated circuits, unveiled a new addition to its dsPIC range of digital signal controllers: the dsPIC33A. This new line features a 32-bit CPU that can operate at speeds of up to 200MHz, coupled with an integrated floating-point unit (FPU) that supports both single- and double-precision. The controller includes ECC-protected RAM and flash memory, along with various peripherals such as a 12-bit analog-to-digital converter (ADC) capable of 40 mega-samples per second (MSps).

The digital-to-analog converters (DACs) segment is anticipated to grow at a significant CAGR over the forecast period. The telecommunications sector's evolution, driven by the rollout of 5G networks and the expansion of data centers, has increased the need for high-speed data processing. DACs are crucial for converting digital signals into analog ones that can be transmitted over various communication channels. As data traffic continues to grow, the demand for efficient and high-speed DACs will increase.

Resolution Insights

The high resolution (13-bit to 16-bit) segment accounted for the largest market share of over 35.0% in 2023 due to the growing demand for advanced data conversion capabilities across various high-performance applications. High-resolution data converters are increasingly favored due to their superior performance in handling complex and high-speed data processing requirements. These converters provide greater precision and accuracy, which are essential for applications in telecommunications, industrial automation, and consumer electronics.

The very high resolution (17-bit and above) segment is anticipated to grow at a significant CAGR over the forecast period. The demand for enhanced image quality in applications such as medical imaging, industrial inspection, and scientific research is propelling advancements in high-resolution imaging. In medical imaging, for instance, high-resolution images enable more accurate diagnoses, leading to improved patient outcomes.

Application Insights

The consumer electronics segment accounted for the largest market share of 26.5% in 2023. The proliferation of high-speed internet and advancements in wireless technology have made it easier for consumers to access and utilize a wide range of electronic devices. The growth of smart homes, where devices communicate with each other to improve efficiency and convenience, has fueled demand for connected consumer electronics.

The medical segment is anticipated to grow at a significant CAGR over the forecast period. The increasing deployment of advanced data acquisition systems and the shift from traditional methods to computer-based solutions are major factors propelling market growth. This trend is particularly evident in medical applications, where high-resolution imaging and data processing are critical

Regional Insights

North America high-speed data converter market held a revenue share of 28.1% of the global industry in 2023. The increasing use of data converters in consumer electronics, such as smartphones, tablets, and wearables, is driving market growth as these devices require efficient analog-to-digital and digital-to-analog conversions.

U.S. High-speed Data Converter Market Trends

The high-speed data converter market in the U.S. is expected to grow significantly from 2024 to 2030. The increasing adoption of IoT devices across various industries, such as healthcare, automotive, and smart homes, is boosting the demand for data converters to facilitate seamless data exchange between digital and analog systems.

Europe High-speed Data Converter Market Trends

The high-speed data converter market in Europe is expected to grow at a CAGR of 6.2% from 2024 to 2030 due to the growth automotive industry, which is increasingly incorporating advanced electronics and autonomous driving technologies. Modern vehicles require advanced data converters for various applications, such as in-vehicle communication, infotainment systems, and advanced driver-assistance systems (ADAS). The shift toward electric vehicles (EVs) and hybrid vehicles also necessitates high-precision data conversion to manage battery systems and energy efficiency, contributing to the market's growth.

Asia Pacific High-speed Data Converter Market Trends

The high-speed data converter market in Asia Pacific is expected to grow at a CAGR of 9.5% from 2024 to 2030 due to the rapid expansion of the consumer electronics industry, particularly in countries such as China, Japan, South Korea, and India. The increasing adoption of smartphones, tablets, smart TVs, and other connected devices requires advanced data converters for efficient signal processing, contributing to the market's expansion.

Key High-speed Data Converter Company Insights

The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In June 2024, Asahi Kasei Microdevices introduced a new lineup of integrated circuits (ICs) that provide enhanced features in a smaller form factor than earlier offerings. This new series includes an integrated Delta-Sigma modulator, which allows the IC to serve the function of conventional shunt resistors and isolated analog-to-digital converters (ADCs) within a single unit.

-

In April 2024, ROHM Co., LTD. introduced four innovative compact DC-DC step-down converter integrated circuits that are ideal for both consumer and industrial use, such as in refrigerators, washing machines, programmable logic controllers (PLCs), and inverters. These newly launched converter ICs are capable of providing an output current ranging from 1A to 3A and are housed in the small TSOT23 package (2.8mm x 2.9mm), offering a reduction in component footprint by as much as 72% compared to the more common SOP-J8 package.

Key High-speed Data Converter Companies:

The following are the leading companies in the high-speed data converter market. These companies collectively hold the largest market share and dictate industry trends.

- Analog Devices, Inc.

- Asahi Kasei Microdevices Corporation

- Caelus Technology Limited

- Cirrus Logic, Inc.

- DigiKey

- Faraday Technology Corporation

- GlobalSpec

- Infineon Technologies AG

- Microchip Technology Inc.

- Omni Design Technologies, Inc.

- Renesas Electronics Corporation.

- ROHM Co., Ltd.

- STMicroelectronics

- Synopsys, Inc.

- Teledyne Technologies Incorporated

- Texas Instruments Incorporated

High-speed Data Converter Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.28 billion

Revenue forecast in 2030

USD 5.24 billion

Growth rate

CAGR of 8.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, resolution, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico U.K., Germany, France, China, India, Japan, Australia, South Korea, Brazil, UAE, Kingdom of Saudi Arabia, South Africa

Key companies profiled

Analog Devices, Inc.; Asahi Kasei Microdevices Corporation; Caelus Technology Limited; Cirrus Logic, Inc.; DigiKey; Faraday Technology Corporation; GlobalSpec; Infineon Technologies AG; Microchip Technology Inc.; Omni Design Technologies, Inc.; Renesas Electronics Corporation.; ROHM Co., Ltd.; STMicroelectronics; Synopsys, Inc.; Teledyne Technologies Incorporated; Texas Instruments Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global High-speed Data Converter Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the high-speed data converter market report based ontype, resolution, application, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Analog-to-digital converters (ADCs)

-

Digital-to-analog converters (DACs)

-

-

Resolution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Low Resolution (up to 8-bit)

-

Medium Resolution (9-bit to 12-bit)

-

High Resolution (13-bit to 16-bit)

-

Very High Resolution (17-bit and above)

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automotive

-

Telecommunications

-

Consumer Electronics

-

Industrial

-

Medical

-

Test & Measurement

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global high-speed data converter market size was estimated at USD 3.20 billion in 2023 and is expected to reach USD 3.28 billion in 2024.

b. The global high-speed data converter market is expected to grow at a compound annual growth rate of 8.1% from 2024 to 2030 to reach USD 5.24 billion by 2030.

b. Asia Pacific dominated the high-speed data converter market with a market share of 35.94% in 2023 due to the rapid expansion of the consumer electronics industry, particularly in countries such as China, Japan, South Korea, and India. The increasing adoption of smartphones, tablets, smart TVs, and other connected devices requires advanced data converters for efficient signal processing, contributing to the market's expansion.

b. Some key players operating in the high-speed data converter market include Analog Devices, Inc., Asahi Kasei Microdevices Corporation, Caelus Technology Limited, Cirrus Logic, Inc., DigiKey, Faraday Technology Corporation, GlobalSpec, Infineon Technologies AG, Microchip Technology Inc., Omni Design Technologies, Inc., Renesas Electronics Corporation., ROHM Co., Ltd., STMicroelectronics, Synopsys, Inc., Teledyne Technologies Incorporated, and Texas Instruments Incorporated.

b. Several key factors drive the growth of the high-speed data converter market. Escalating demand for rapid data processing and superior signal integrity across various sectors, including telecommunications, consumer electronics, automotive, and industrial automation. Technological advancements such as 5G networks, the proliferation of the Internet of Things (IoT), and the increasing complexity of electronic systems are fueling the need for high-performance data conversion solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.