- Home

- »

- Advanced Interior Materials

- »

-

High-Temperature Composite Resins Market Report, 2030GVR Report cover

![High-Temperature Composite Resins Market Size, Share & Trends Report]()

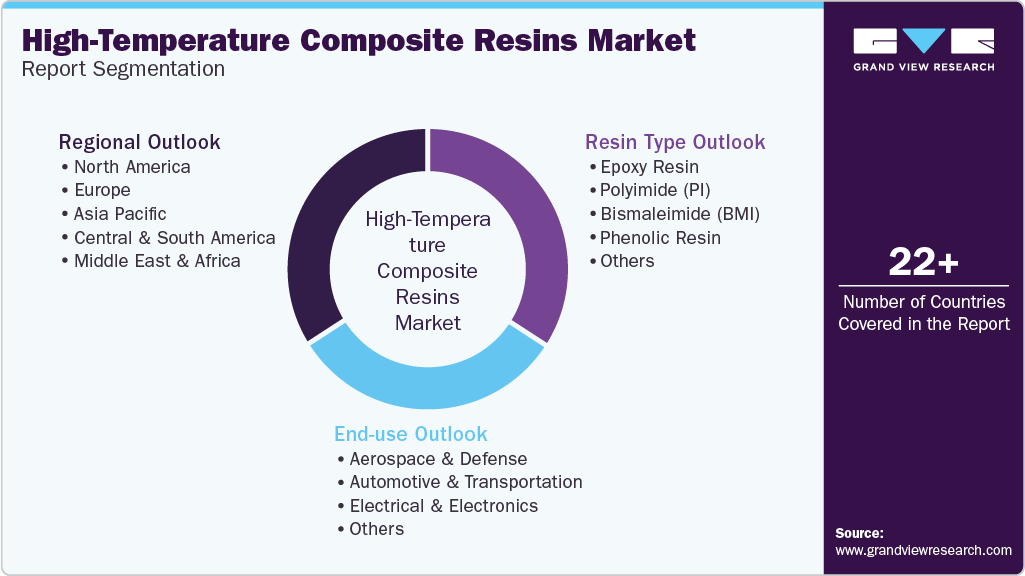

High-Temperature Composite Resins Market (2025 - 2030) Size, Share & Trends Analysis Report By Resin Type (Epoxy Resin, Polyimide (PI), Bismaleimide (BMI), Phenolic Resin), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-591-6

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

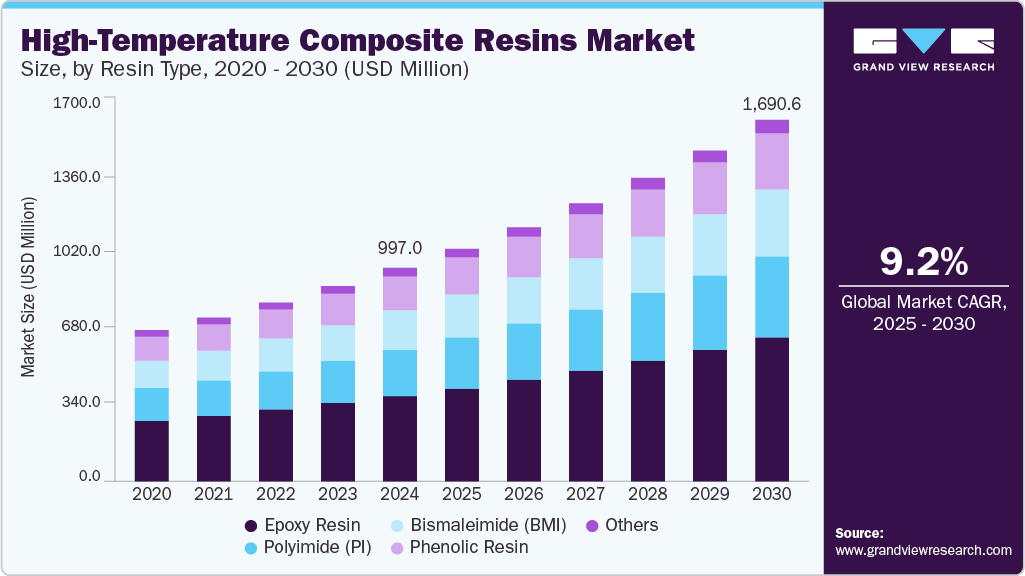

The global high-temperature composite resins market size was estimated at USD 997.0 million in 2024 and is projected to grow at a CAGR of 9.2% from 2025 to 2030, driven by the rising demand for lightweight, durable, and heat-resistant materials across various industries. Composite resins that can withstand high temperatures are essential in applications where conventional materials like metal or plastic fall short, particularly in extreme environments.

Key Highlights:

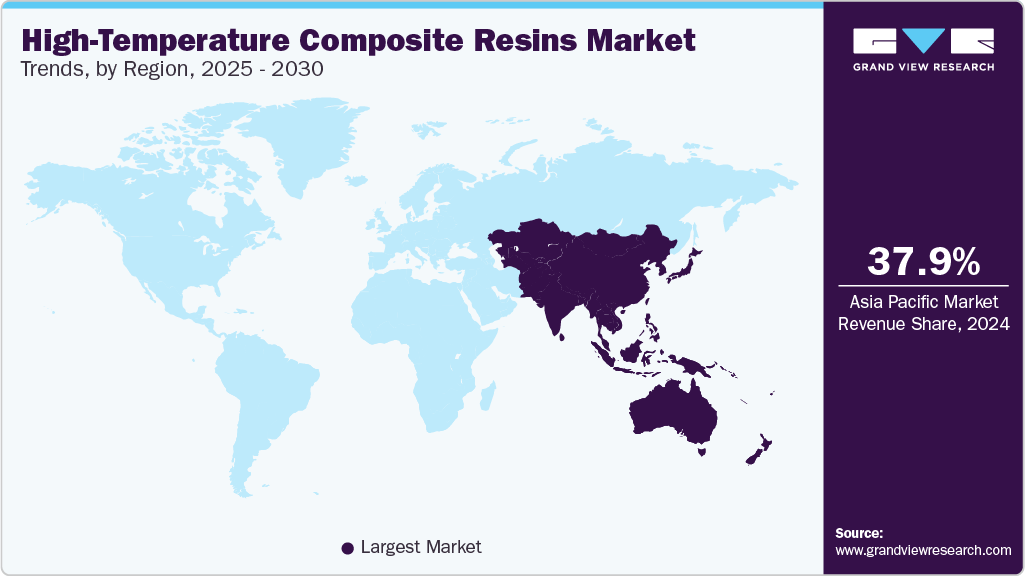

- Asia Pacific high-temperature composite resins market dominated the market and accounted for the largest revenue share of about 37.9% in 2024

- High-temperature composite resins market in China is growing, and China plays a pivotal role in the Asia Pacific market

- In terms of segment, the epoxy resin segment led the market and accounted for the largest revenue share of 40.0% in 2024

- In terms of segment, the aerospace and defense segment dominated the market and accounted for the largest revenue share of 57.3% in 2024

This demand is strongly driven by the aerospace and defense sectors, which use these resins in engine components, aircraft interiors, and structural parts to reduce weight while maintaining strength and thermal stability. Innovations in resin technology have also significantly contributed to the market's growth. Advances in polymer chemistry have led to the development of resins with improved thermal resistance, mechanical strength, and chemical stability. Companies are investing in research and development to create next-generation phenolic, epoxy, and polyimide resins that can perform under even more demanding conditions. Additionally, the integration of nanotechnology into resin systems is improving their thermal and structural performance, further expanding their range of applications.

High-temperature composite resins are used extensively in automotive, electrical and electronics, and energy industries. In the automotive sector, they are used for manufacturing under-the-hood components and structural parts that require high heat resistance to improve fuel efficiency and performance. In electronics, these resins are essential for printed circuit boards and insulation materials that can tolerate high operating temperatures. The renewable energy industry also utilizes these resins in wind turbine blades and other components that demand long-term durability and resistance to extreme conditions. This broad application scope ensures continued growth in demand across global markets.

Market Concentration & Characteristics

The global high-temperature composite resins market exhibits moderate to high market concentration, with a few dominant players holding a significant share due to their strong R&D capabilities, advanced manufacturing technologies, and established distribution networks. Companies like Huntsman Corporation, Hexcel Corporation, and Toray Industries lead the market, often setting trends in innovation and pricing. These players benefit from long-term contracts with aerospace, automotive, and defense industries, creating high entry barriers for new competitors. However, regional players are gradually emerging, especially in Asia-Pacific, driven by increasing industrialization and government support for advanced materials research.

In terms of product substitutes, high-temperature composite resins face competition from traditional materials such as metals (like aluminum and titanium alloys) and ceramics, which are also known for their thermal resistance and structural integrity. However, these alternatives are often heavier and less versatile, making them less desirable in industries focused on lightweight, high-performance materials. Additionally, advancements in polymer blends and thermoplastics that offer comparable thermal and mechanical properties at lower costs pose a growing threat. Despite this, the superior weight-to-strength ratio and design flexibility of high-temperature resins continue to give them a competitive edge in most high-performance applications.

Resin Type Insights

The epoxy resin segment led the market and accounted for the largest revenue share of 40.0% in 2024, driven by its superior mechanical properties, excellent thermal stability, and strong adhesion characteristics. It offers an ideal balance of strength, durability, and resistance to heat and chemicals, making it the preferred choice for high-performance applications, especially in aerospace, automotive, and electrical sectors. Epoxy resins also exhibit low shrinkage during curing, which ensures dimensional stability in complex composite structures. The ease of processing and cost-effectiveness of epoxy systems compared to other high-temperature resins like polyimides or cyanate esters has further cemented their widespread adoption across industries.

Polyimide (PI) resins are growing at a CAGR of 9.7%, driven by their exceptional thermal stability, mechanical strength, and chemical resistance, making them ideal for demanding aerospace, electronics, and automotive applications. Capable of withstanding continuous use up to 315°C (600°F) and intermittent exposure up to 480°C (900°F), polyimide resins are well-suited for components exposed to extreme heat and stress. In the aerospace sector, they are utilized in engine parts, insulation, and structural components, contributing to weight reduction and enhanced fuel efficiency. The electronics industry benefits from polyimide's excellent electrical insulation and thermal stability, employing it in flexible circuits and insulating films.

End Use Insights

The aerospace and defense segment dominated the market and accounted for the largest revenue share of 57.3% in 2024, due to its stringent performance requirements and high reliance on advanced materials that can withstand extreme conditions. Aircraft and spacecraft components must endure intense heat, pressure, and mechanical stress while maintaining lightweight structures for fuel efficiency and operational performance. High-temperature resins particularly polyimides, epoxies, and bismaleimides are essential in manufacturing engine parts, fuselage components, and insulation systems, offering excellent thermal stability, mechanical strength, and chemical resistance. Additionally, defense applications such as missile systems, radar domes, and protective gear also require materials that can perform in high-heat and high-impact environments.

The automotive and transportation sector is the fastest-growing segment in the high-temperature composite resins market, propelled by the industry's pursuit of lightweight, fuel-efficient, and high-performance vehicles. High-temperature composite resins, such as epoxy and polyimide, offer superior strength-to-weight ratios and thermal stability, making them ideal for engine parts, battery enclosures, and structural elements. The shift towards electric vehicles (EVs) further amplifies this demand, as reducing vehicle weight directly enhances battery efficiency and driving range.

Regional Insights

Asia Pacific high-temperature composite resins market dominated the market and accounted for the largest revenue share of about 37.9% in 2024, driven by rapid industrialization, expanding aerospace and automotive industries, and increased government investments in defense and infrastructure. Countries like China, Japan, and South Korea are major consumers, driven by strong manufacturing bases and the rising adoption of advanced materials. The region also benefits from lower production costs and high R&D activity, making it a hub for both global and local resin manufacturers. The surge in electric vehicle production and growing demand for lightweight, fuel-efficient transport systems further amplify market growth in this region.

China High-Temperature Composite Resins Market Trends

High-temperature composite resins market in China is growing, and China plays a pivotal role in the Asia Pacific market, driven by its massive automotive manufacturing industry and growing focus on aerospace development. The country’s "Made in China 2025" initiative has emphasized advanced materials, supporting the domestic production of high-temperature composite resins. The expansion of electric vehicle infrastructure and domestic aircraft programs like COMAC is increasing the use of these resins in high-performance applications. Additionally, China's cost-effective manufacturing capabilities and growing export potential contribute to its leadership in regional market growth.

North America High-Temperature Composite Resins Market Trends

North America is a significant player in the high-temperature composite resins market, primarily driven by its well-established aerospace, defense, and automotive sectors. The U.S. leads the region with high investments in advanced materials, supported by companies like Boeing and Lockheed Martin that require high-performance composites for aircraft and defense systems. The demand is also rising from the electric vehicle sector, which values thermal-resistant resins for battery protection and lightweight structural components. North America's strong regulatory focus on emissions and fuel efficiency further accelerates the shift to composite materials.

The United States dominates the North American market due to its leadership in aerospace and defense technologies. Home to major aerospace OEMs and a robust military sector, the U.S. consistently demands cutting-edge high-temperature composite resins for engine parts, insulation, and structural aircraft components. Additionally, innovations in automotive manufacturing and government support for clean energy vehicles have pushed the adoption of these resins. The presence of leading chemical companies and sustained investment in R&D ensures the U.S. remains a core contributor to global market advancements.

Europe High-Temperature Composite Resins Market Trends

Europe holds a strong position in the high-temperature composite resins market, fueled by its advanced automotive, aerospace, and wind energy industries. The EU's stringent environmental regulations and sustainability goals are pushing manufacturers toward lightweight, heat-resistant materials that enhance fuel efficiency and reduce emissions. Countries like France, the UK, and Germany are investing heavily in green mobility and advanced aerospace engineering, which drives demand for high-performance resins. Europe's focus on circular economy principles also encourages innovations in recyclable and eco-friendly composites.

Germany high-temperature composite resins market is a key contributor to the European high-temperature composite resins market due to its leadership in automotive engineering and aerospace technology. As home to major automakers and suppliers, the country is at the forefront of adopting lightweight materials for improving vehicle efficiency and meeting emission targets. Additionally, Germany's involvement in aerospace collaborations like Airbus drives continuous demand for high-temperature resins in aircraft structures and engine components. Strong emphasis on quality, innovation, and sustainable manufacturing practices further boosts Germany's market influence.

Central & South America High-Temperature Composite Resins Market Trends

Central & South America represents a growing market for high-temperature composite resins, primarily driven by industrial development in countries like Brazil and Mexico. While the region is still in the early stages compared to global leaders, increasing investments in automotive manufacturing and aerospace partnerships are creating new opportunities. Infrastructure growth and regional OEM expansions are also encouraging the adoption of composite materials in construction and transport systems. However, limited local production and high import dependency currently constrain faster market expansion.

Middle East & Africa High-Temperature Composite Resins Market Trends

The Middle East & Africa market for high-temperature composite resins is emerging, with demand largely supported by investments in aerospace, energy, and defense sectors. The UAE and Saudi Arabia are leading regional adopters due to their increasing focus on diversifying economies and developing local aerospace capabilities. In Africa, growing infrastructure needs and investments in transportation and renewable energy are slowly opening doors for composite applications. However, the market faces challenges such as limited industrial base, technical expertise, and high material costs, which restrain rapid adoption.

Key High-Temperature Composite Resins Company Insights

Some of the key players operating in market include Hexion Inc., Huntsman Corporation

-

Hexion Inc. is a leading global manufacturer of thermoset resins and specialty chemicals, with a strong focus on epoxy and phenolic resin systems used in high-temperature composite applications. Their products are integral to aerospace, automotive, wind energy, and industrial sectors, offering excellent thermal stability, chemical resistance, and mechanical performance. Hexion’s continuous innovation in resin formulations and processing technologies supports lightweight and durable composite materials that meet stringent industry standards for heat and stress resistance.

-

Huntsman Corporation is a major player in the advanced materials industry, renowned for its high-performance Araldite® epoxy resins and other specialized resin systems tailored for high-temperature applications. The company serves critical markets such as aerospace, defense, automotive, and electronics, where materials must withstand extreme thermal and mechanical conditions. Huntsman’s investment in R&D enables the development of composite resins that deliver superior adhesion, low shrinkage, and enhanced durability, facilitating the production of lightweight, fuel-efficient components.

Solvay S.A., Toray Industries Inc. are some of the emerging market participants in high-temperature composite resins market.

-

Solvay S.A. is a global chemical and advanced materials company that specializes in high-performance polymers and composite materials, including polyimide, cyanate ester, and bismaleimide resins. These resin systems are engineered for high-temperature resistance and are widely used in aerospace, automotive, and energy sectors. Solvay’s solutions focus on improving the thermal, mechanical, and chemical properties of composites, enabling applications such as engine components, insulation systems, and structural parts that require exceptional durability under harsh operating conditions.

-

Toray Industries Inc. is a leading multinational corporation specializing in carbon fiber, advanced composites, and high-temperature resin systems. Their product portfolio includes thermoset resins used extensively in aerospace, automotive, and industrial applications to create lightweight yet thermally stable composite materials. Toray’s expertise in combining high-performance fibers with innovative resin chemistries helps meet the growing demand for composites that offer superior heat resistance, mechanical strength, and corrosion resistance, essential for next-generation aircraft, electric vehicles, and industrial equipment.

Key High-Temperature Composite Resins Companies:

The following are the leading companies in the high-temperature composite resins market. These companies collectively hold the largest market share and dictate industry trends.

- Hexion Inc.

- Huntsman Corporation

- Solvay S.A.

- Toray Industries Inc.

- SABIC (Saudi Basic Industries Corporation)

- DIC Corporation

- UBE Industries Ltd.

- BASF SE

- Mitsubishi Chemical Corporation

- Henkel AG & Co. KGAA

Recent Developments

-

In May 2023, Huntsman announced new epoxy materials designed to enhance electric vehicle battery integration, offering quick curing, high strength, and reduced weight. These epoxy resins enable faster production up to 30% quicker of high-performance battery protection components, improving durability and design flexibility.

-

In April 2022, Hexcel launched HiFlow HF610F-2, an innovative resin transfer molding (RTM) resin tailored for high-rate manufacturing of small to medium-sized aerospace parts.

High-Temperature Composite Resins Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,088.7 million

Revenue forecast in 2030

USD 1,690.6 million

Growth rate

CAGR of 9.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Resin type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

Hexion Inc.; Huntsman Corporation; Solvay S.A.; Toray Industries Inc.; SABIC (Saudi Basic Industries Corporation); DIC Corporation; UBE Industries Ltd.; BASF SE; Mitsubishi Chemical Corporation; and Henkel AG & Co. KGAA

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global High-Temperature Composite Resins Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global high-temperature composite resins market report based on resin type, end use and region.

-

Resin Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Epoxy Resin

-

Polyimide (PI)

-

Bismaleimide (BMI)

-

Phenolic Resin

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerospace & Defense

-

Automotive & Transportation

-

Electrical & Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global market for high-temperature composite resins was estimated at USD 997.0 million in 2024 and is expected to reach USD 1,088.7 million in 2025.

b. The global high-temperature composite resins market is expected to grow at a compound annual growth rate of 9.2% from 2025 to 2030 to reach USD 1,690.6 million by 2030.

b. The epoxy resin segment led the market and accounted for the largest revenue share of 40.0% in 2024, due to its excellent thermal stability, mechanical strength, and widespread use across aerospace, automotive, and electronics applications.

b. Hexion Inc., Huntsman Corporation, Solvay S.A., Toray Industries Inc., SABIC (Saudi Basic Industries Corporation), DIC Corporation , UBE Industries Ltd., BASF SE Mitsubishi Chemical Corporation, and Henkel AG & Co. KGAA are prominent companies in the High-Temperature Composite Resins Market.

b. Key factors affecting the high-temperature composite resins market include rising demand for lightweight, heat-resistant materials, stringent environmental regulations, technological advancements, high production costs, and dependence on aerospace and automotive industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.