- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyimide Market Size And Share, Industry Report, 2030GVR Report cover

![Polyimide Market Size, Share & Trends Report]()

Polyimide Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Polyimide Resin, Polyimide Film, Polyimide Coatings, Polyimide Varnish), By Application (Medical, Energy & Power), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-536-5

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2026 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyimide Market Summary

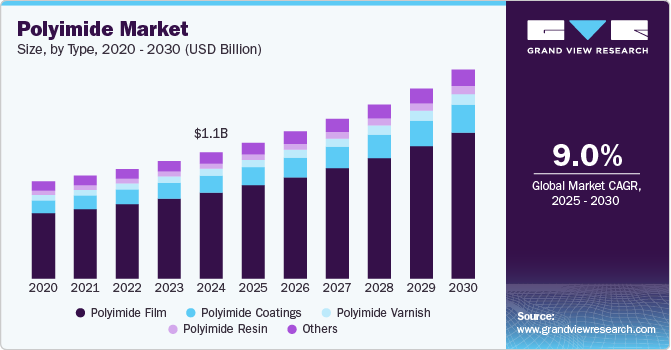

The global polyimide market size was estimated at USD 1,106.7 million in 2024 and is projected to reach USD 1,833.7 million by 2030, growing at a CAGR of 9.0% from 2025 to 2030. The rising demand for lightweight and high-performance materials in the electronics and aerospace industries is a significant driver of the global market.

Key Market Trends & Insights

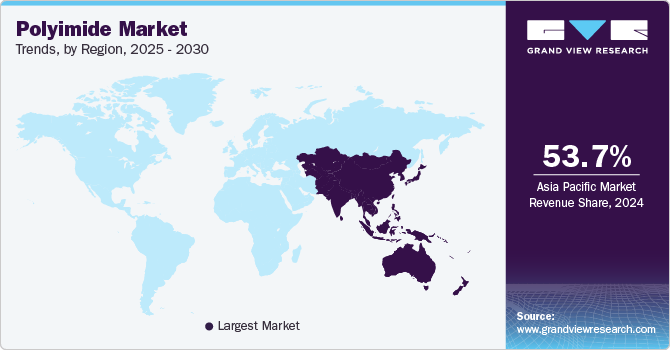

- Asia Pacific polyimide market dominated with the largest revenue share of 53.68% in 2024

- The polyimide market in China is experiencing robust growth primarily due to its robust electronics manufacturing ecosystem.

- Based on type, the polyimide film segment led the market with the largest revenue share of 68.24% in 2024.

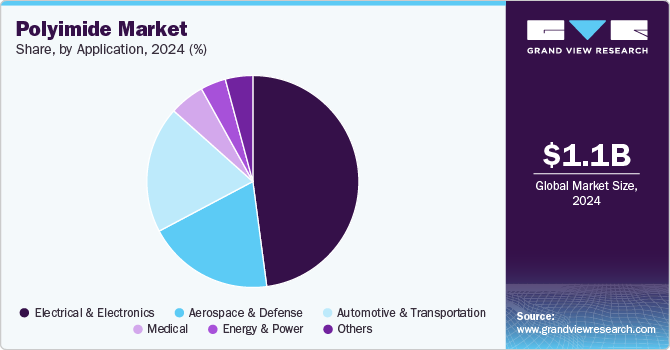

- Based on application, the electrical & electronics segment recorded the largest market share of 47.90% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,106.7 Million

- 2030 Projected Market Size: USD 1,833.7 Million

- CAGR (2025-2030): 9.0%

- Asia Pacific: Largest market in 2024

Polyimides exhibit excellent thermal stability, mechanical strength, and chemical resistance, making them ideal for applications in flexible printed circuit boards (FPCBs), semiconductor manufacturing, and aerospace components.

The increasing miniaturization of electronic devices, such as smartphones, laptops, and wearables, has led to a higher demand for flexible and durable materials. Similarly, in aerospace, polyimide composites replace traditional metal components in aircraft interiors and structural parts due to their lightweight nature, which contributes to improved fuel efficiency.

Another crucial factor fueling market growth is the expansion of the automotive industry, particularly in electric vehicles (EVs). With the global push toward sustainability and the adoption of EVs, manufacturers are focusing on lightweight and heat-resistant materials to enhance vehicle efficiency and safety. Polyimides are increasingly being used in EV battery insulation, motor components, and high-voltage cables due to their ability to withstand extreme temperatures and electrical stress. In addition, polyimide coatings and films are used in sensors and wiring systems to ensure the reliability of autonomous and connected vehicle technologies.

The rising adoption of polyimide membranes in filtration and medical applications is also triggering market growth. Polyimide-based membranes are highly resistant to harsh chemicals and offer superior filtration efficiency, making them ideal for gas separation, water purification, and biomedical applications. The healthcare industry has witnessed increased use of polyimide tubing and catheters in minimally invasive surgeries due to their flexibility and biocompatibility. Moreover, polyimide films are widely utilized in wearable medical devices such as glucose monitors and biosensors, which are experiencing growing demand due to the rising prevalence of chronic diseases such as diabetes.

Type Insights

Based on type, the polyimide film segment led the market with the largest revenue share of 68.24% in 2024 and is projected to grow at the fastest CAGR of 9.4% during the forecast period. Polyimide resins are high-performance polymers known for their excellent thermal stability, chemical resistance, and mechanical strength. These resins are widely used in high-temperature applications, including aerospace components, electronics, and automotive parts. Due to their exceptional heat resistance, they are commonly used in advanced composites and adhesives.

Polyimide coatings offer excellent protection against extreme temperatures, chemical exposure, and mechanical wear. These coatings are applied to metal, plastic, and electronic components to enhance durability and performance in harsh environments. They are extensively used in aerospace, industrial machinery, and medical devices. In addition, the growing demand for corrosion-resistant coatings in industrial machinery and the rising use of polyimide coatings in medical applications, such as catheters and surgical instruments, are further supporting market growth.

Application Insights

Based on application, the electrical & electronics segment recorded the largest market share of 47.90% in 2024. Polyimides play a crucial role in the electrical & electronics sector, where they are used in flexible printed circuit boards (PCBs), semiconductors, wire insulation, and displays. Their excellent dielectric properties, high-temperature resistance, and flexibility make them ideal for microelectronic and consumer electronics applications. The growing adoption of 5G technology, IoT devices, and wearable electronics further supports the increasing usage of polyimides in this industry.

The automotive & transportation segment is projected to grow at the fastest CAGR of 9.6% during the forecast period. In the automotive & transportation industry, polyimides are used in components such as bearings, seals, gaskets, and electrical insulation for wiring systems. Their high mechanical strength, resistance to wear, and excellent thermal stability make them suitable for demanding automotive applications, including electric vehicles (EVs) and hybrid systems. The shift toward electric and autonomous vehicles is a major driver, as polyimides are essential in EV battery insulation and electronic control units.

The aerospace & defense sector is a key consumer of polyimides due to their exceptional thermal stability, lightweight nature, and resistance to harsh environmental conditions. Polyimide composites, coatings, and films are widely used in aircraft interiors, jet engine components, and insulation materials for spacecraft and satellites. The material’s ability to withstand extreme temperatures and its flame-retardant properties make it ideal for applications in high-performance military and commercial aviation.

Region Insights

The North America polyimide market is growing due to its robust aerospace and defense sectors, which are primary consumers of these high-performance polymers. The U.S. houses major aerospace manufacturers such as Boeing, Lockheed Martin, and Northrop Grumman, all of which utilize polyimide components in aircraft construction, satellite systems, and military applications due to the material's exceptional thermal stability and mechanical strength.

U.S. Polyimide Market Trends

The polyimide market in U.S. growth is majorly driven by its well-established semiconductor and microelectronics sector, where polyimides are crucial components. Companies such as Intel, Micron, and Texas Instruments utilize polyimide films as insulating layers in chips, flexible printed circuit boards, and other electronic components. The continuous miniaturization trend in electronics has increased the demand for high-quality polyimide materials that can withstand the thermal and mechanical stresses of modern manufacturing processes.

Asia Pacific Polyimide Market Trends

Asia Pacific polyimide market dominated with the largest revenue share of 53.68% in 2024 and is anticipated to grow at the fastest CAGR of 9.4% over the forecast period. This positive outlook is due to its robust manufacturing base, especially in the electronics and semiconductor industries. Countries such as China, Japan, South Korea, and Taiwan have established themselves as manufacturing powerhouses for electronic components, smartphones, and computers, all of which require polyimide films, resins, and coatings.

The polyimide market in China is experiencing robust growth primarily due to its robust electronics manufacturing ecosystem. As the world's largest producer of electronics and electrical equipment, China requires substantial volumes of polyimide materials, which are essential for high-performance insulation in circuit boards, flexible displays, and semiconductor packaging. The country's massive production capacity in these sectors creates unparalleled demand for polyimide films, resins, and composites. The Chinese government's strategic focus on high-technology industries has further accelerated this dominance.

Europe Polyimide Market Trends

The polyimide market in Europe’s growth is primarily due to its robust aerospace and automotive industries. European aerospace giants such as Airbus utilize polyimide films in aircraft components, while premium automotive manufacturers such as BMW and Mercedes-Benz incorporate polyimide-based parts in their engine components and electronic systems. In additional, Europe's advanced electronics and semiconductor industries contribute substantially to polyimide demand.

The Germany polyimide market is primarily driven by its robust automotive and aerospace industries. German engineering firms such as BMW, Mercedes-Benz, and Airbus have integrated polyimide components into their designs for applications requiring resistance to extreme temperatures and harsh operating conditions. This industrial demand has catalyzed significant investment in polyimide research and production facilities throughout the country, thus market growth.

Key Polyimide Company Insights

The global polyimide industry is characterized by intense competition among established multinational companies, each leveraging significant R&D capabilities to enhance product performance and innovation. These companies invest heavily in developing polyimides with superior thermal stability, mechanical strength, and chemical resistance to meet the stringent demands of sectors such as aerospace, electronics, automotive, and industrial manufacturing.

Market players pursue strategic partnerships, mergers, acquisitions, and geographic expansions to secure a competitive edge, while also adapting to evolving regulatory standards and a growing emphasis on sustainable manufacturing practices. This competitive drive, combined with rapid technological advancements and diversified applications, creates a dynamic and challenging market environment.

Key Polyimide Companies:

The following are the leading companies in the polyimide market. These companies collectively hold the largest market share and dictate industry trends.

- DuPont de Nemours, Inc.

- SABIC

- Ube Industries Ltd.

- Kaneka Corporation

- Taimide Tech. Inc.

- PI Advanced Materials Co., Ltd.

- Mitsui Chemicals

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- Asahi Kasei Corporation

- Huangshan Juxin New Material Co., Ltd.

Recent Developments

-

In November 2024, PI Advanced Materials announced the development of a 4-micrometer thick, casting ultra-thin polyimide (PI) film. This new film was intended for use in smartphones, tablets, and wearables. The company claims the film is expected to improve the slimness, heat resistance, and durability of these devices.

-

In January 2024, Ventec Group announced that its VT-901 polyimide material received full and exclusive qualification from the European Space Agency (ESA) for use in ACB Belgium's high-density interconnect (HDI) printed circuit board manufacturing. This qualification made ACB the only PCB manufacturer with ESA approval for HDI technology. Ventec's VT-901 material was chosen for its reliability and performance, featuring a high decomposition temperature, glass transition temperature, and low CTE.

Polyimide Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,193.1 million

Revenue forecast in 2030

USD 1,833.7 million

Growth rate

CAGR of 9.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in tons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

DuPont de Nemours, Inc.; SABIC; Ube Industries Ltd.; Kaneka Corporation; Taimide Tech. Inc.; PI Advanced Materials Co., Ltd.; Mitsui Chemicals; MITSUBISHI GAS CHEMICAL COMPANY, INC.; Asahi Kasei Corporation; Huangshan Juxin New Material Co., Ltd.

Customization scope

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

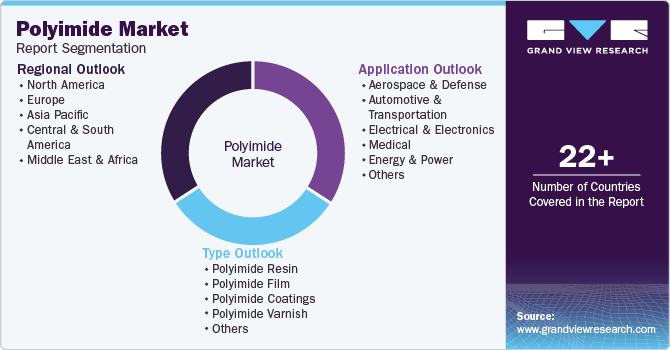

Global Polyimide Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polyimide market report based on type, application, and region:

-

Type Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Polyimide Resin

-

Polyimide Film

-

Polyimide Coatings

-

Polyimide Varnish

-

Others

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Aerospace & Defense

-

Automotive & Transportation

-

Electrical & Electronics

-

Medical

-

Energy & Power

-

Others

-

-

Region Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global polyimide market was estimated at around USD 1,106.7 million in the year 2024 and is expected to reach around USD 1,193.1 million in 2025.

b. The global polyimide market is expected to grow at a compound annual growth rate of 9.0% from 2025 to 2030 to reach around USD 1,833.7 million by 2030.

b. Electrical & electronics emerged as the dominant application in the polyimide market, capturing approximately 47.0% of the market share in 2024, primarily due to the material’s exceptional thermal stability, electrical insulation properties, and mechanical strength.

b. The key players in the polyimide market include DuPont de Nemours, Inc., SABIC, Ube Industries Ltd., Kaneka Corporation, Taimide Tech. Inc., PI Advanced Materials Co., Ltd., Mitsui Chemicals, MITSUBISHI GAS CHEMICAL COMPANY, INC., Asahi Kasei Corporation, and Huangshan Juxin New Material Co., Ltd.

b. The polyimide market is driven by increasing demand for high-performance materials in aerospace, electronics, and automotive industries due to its superior thermal stability, chemical resistance, and mechanical strength. Additionally, the rising adoption of flexible electronics and miniaturized devices boosts market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.