- Home

- »

- Plastics, Polymers & Resins

- »

-

Holographic Labels Market Size, Industry Report, 2033GVR Report cover

![Holographic Labels Market Size, Share & Trends Report]()

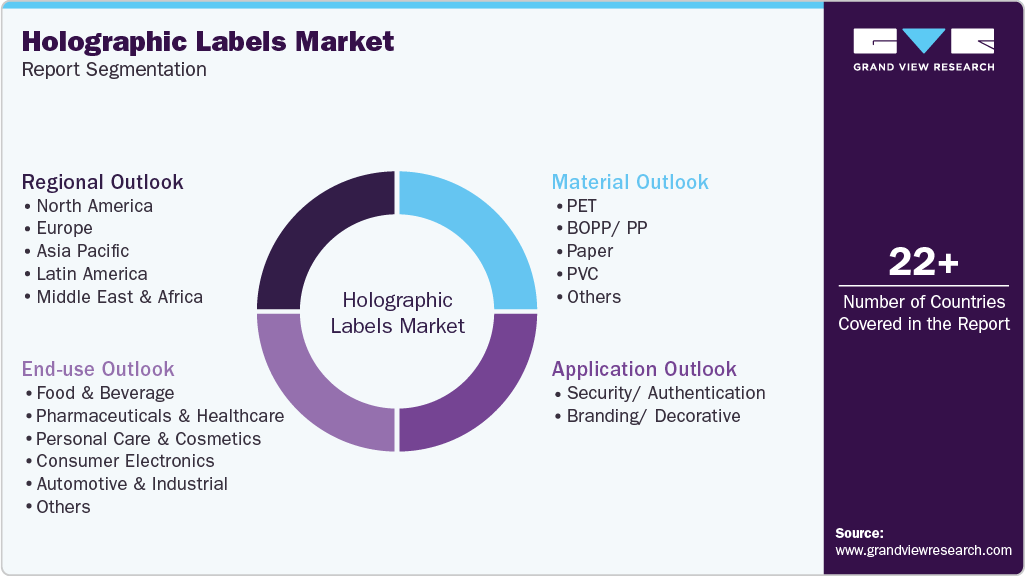

Holographic Labels Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (PET, BOPP/ PP, Paper, PVC), By Application (Security/ Authentication, Branding/ Decorative), By End-use (Food & Beverage, Pharmaceuticals & Healthcare), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-734-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Holographic Labels Market Summary

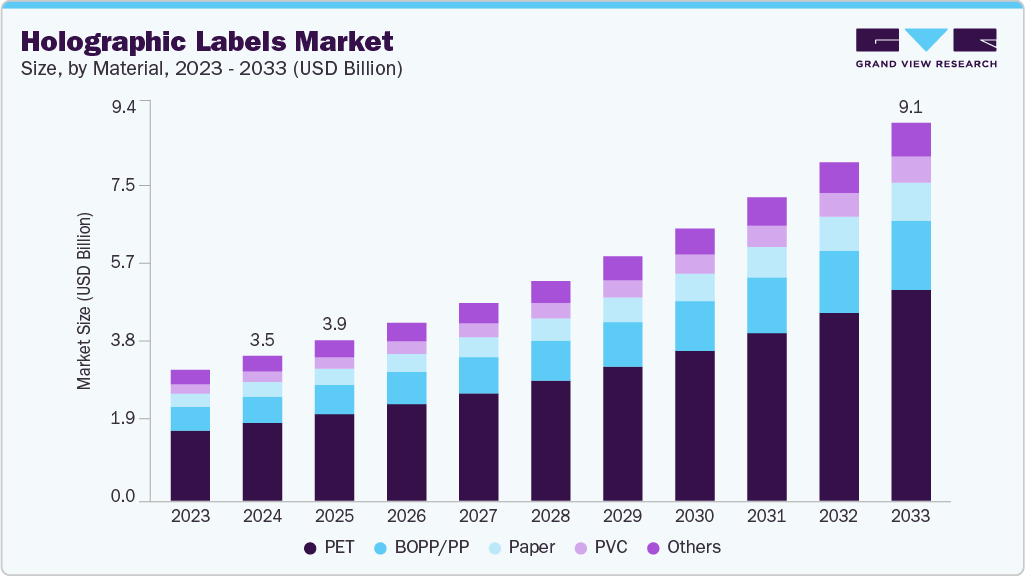

The global holographic labels market size was estimated at USD 3.48 billion in 2024 and is projected to reach USD 9.10 billion by 2033, growing at a CAGR of 11.3% from 2025 to 2033. The market is driven by rising demand for anti-counterfeiting solutions across industries such as pharmaceuticals, FMCG, and electronics.

Key Market Trends & Insights

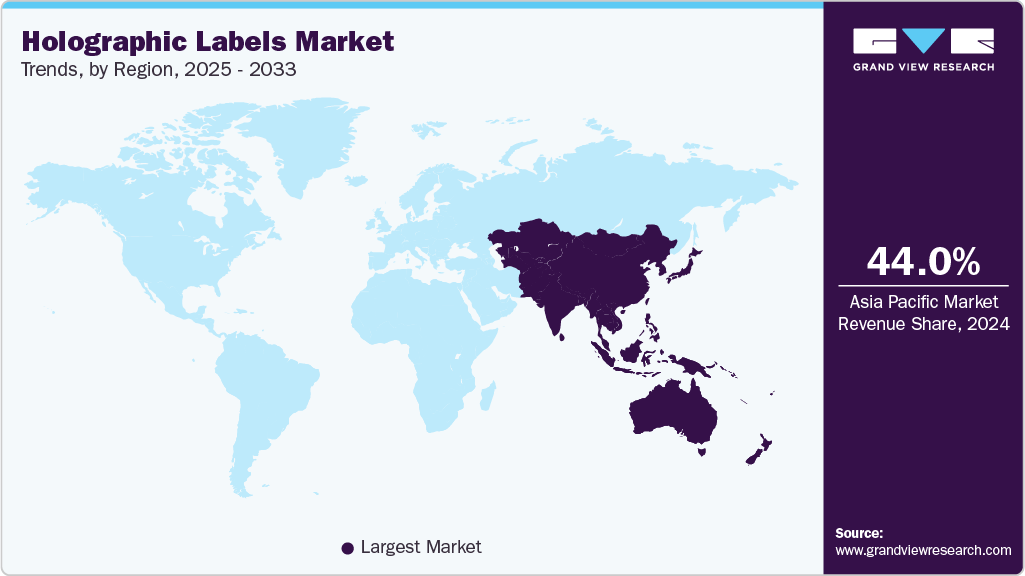

- Asia Pacific dominated the holographic labels market with the largest revenue share of over 44.0% in 2024.

- The holographic labels market in China is expected to grow at a substantial CAGR of 12.0% from 2025 to 2033.

- By material, the PET segment is expected to grow at a considerable CAGR of 11.8% from 2025 to 2033 in terms of revenue.

- By application, the security/authentication segment is expected to grow at a considerable CAGR of 11.9% from 2025 to 2033 in terms of revenue.

- By end use, the pharmaceuticals & healthcare segment is expected to grow at a considerable CAGR of 12.0% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 3.48 Billion

- 2033 Projected Market Size: USD 9.10 Billion

- CAGR (2025-2033): 11.3%

- Asia Pacific: Largest market in 2024

In addition, growing brand differentiation strategies and premium packaging trends fuel market growth. Counterfeit products in pharmaceuticals, cosmetics, automotive parts, and consumer electronics cause significant financial losses and safety risks. Holographic labels provide advanced security features, such as 2D/3D imagery, color-shifting patterns, and hidden identifiers that are difficult to replicate. For example, pharmaceutical companies increasingly use holographic seals to ensure product authenticity and prevent counterfeit drugs from reaching consumers. Similarly, luxury brands in the fashion and cosmetics industry are adopting holographic packaging elements to safeguard brand reputation. This trend is expected to intensify as regulatory bodies worldwide push for stricter product authentication and traceability measures.

Moreover, the growing use of holographic labels as a branding and marketing tool is benefiting market growth. Beyond security, holographic labels add visual appeal and create a premium look that enhances shelf product differentiation. This is particularly relevant in the highly competitive food & beverage and consumer goods markets, where packaging aesthetics significantly influence consumer purchasing decisions. For example, beverage brands incorporate holographic foils on bottle labels to attract consumer attention in crowded retail environments. The eye-catching 3D effects of holographic labels not only improve shelf visibility but also contribute to brand identity and customer loyalty. As companies continue to invest in premium packaging solutions, the adoption of holographic labels is anticipated to expand further.

Expanding e-commerce and online retail also fuel the demand for holographic labels. With the increasing volume of products being shipped directly to consumers, the need for secure packaging solutions has become more pressing. Holographic labels serve as tamper-evident seals, assuring customers that the product they receive is genuine and unopened. For instance, electronics companies selling through e-commerce platforms often use holographic seals on packaging to protect against product substitution during transit. Moreover, governments in markets such as India and China are introducing policies to strengthen supply chain security, encouraging wider adoption of holographic labels in local and international trade.

Moreover, technological advancements in holography and printing techniques are driving market innovation. Modern holographic labels are no longer limited to simple optical effects; they can now integrate QR codes, serial numbers, and blockchain-enabled authentication for advanced traceability. Furthermore, the cost of producing holographic labels has decreased due to improvements in embossing, laser, and film lamination technologies, making them more accessible for small and medium-sized enterprises (SMEs). This convergence of security, branding, and digital verification technologies positions holographic labels as a critical component in the future of secure and intelligent packaging solutions.

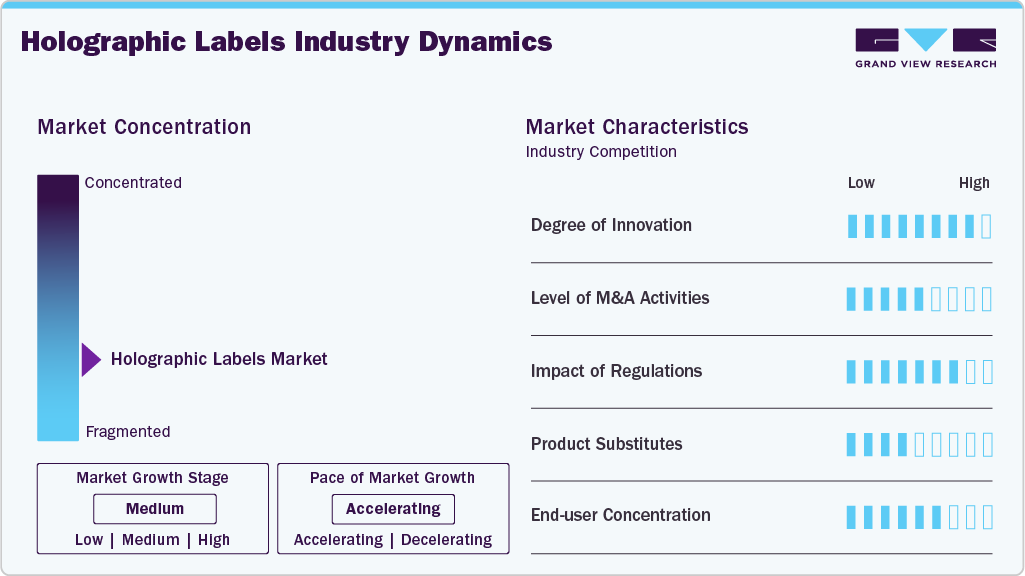

Market Concentration & Characteristics

The holographic labels industry is characterized by its dual functionality, security, and aesthetics, which position it uniquely within the broader packaging and labeling industry. Unlike conventional labels, holographic labels combine tamper-evident and anti-counterfeiting features with visually striking designs, making them essential for industries such as pharmaceuticals, cosmetics, food and beverages, and consumer electronics. This dual role enhances both product safety and brand visibility, giving holographic labels a competitive edge in high-value and fast-moving consumer goods markets.

Another key industry characteristic is its strong reliance on innovation and technological advancements. Continuous improvements in holography, microtext, nanostructures, and digital integration (such as QR codes and blockchain-enabled holographic seals) are shaping the market. This innovation-driven nature makes the sector highly dynamic, with manufacturers investing heavily in R&D to differentiate their products. The shift toward smart packaging and traceability further strengthens the role of holographic labels as part of integrated supply chain security solutions.

Material Insights

The PET segment recorded the largest market revenue share of over 53.0% in 2024 and is expected to grow at the fastest CAGR of 11.8% during the forecast period. PET is one of the most widely used materials in holographic labels due to its excellent clarity, strength, and dimensional stability. It offers a smooth surface that enhances the visibility of holographic patterns and provides durability against moisture, chemicals, and wear. PET-based holographic labels are commonly used in industries such as food & beverages, pharmaceuticals, and cosmetics, requiring long-lasting visual appeal and protection. The demand for PET holographic labels is driven by their durability, high resistance to tearing, and superior optical clarity, which make them ideal for premium packaging.

BOPP/ PP materials are lightweight, cost-effective, and highly versatile for holographic label applications. They are preferred for products requiring resistance to moisture, oil, and chemicals. These labels maintain printability and can be designed with vibrant holographic effects, making them popular in food packaging, FMCG, and logistics industries. The growth of BOPP/PP holographic labels is mainly driven by their cost-effectiveness and wide applicability in mass-market consumer goods. Their moisture-resistant property makes them ideal for food packaging, while their lightweight nature reduces transportation costs. Increasing usage in high-volume packaged goods and e-commerce shipments further supports demand.

Application Insights

The security/authentication segment recorded the largest market revenue share of over 71.0% in 2024 and is expected to grow at the fastest CAGR of 11.9% during the forecast period. The increasing prevalence of counterfeiting across industries is the key driver for security-related holographic label adoption. According to international trade bodies, counterfeit goods account for a significant portion of global trade, creating a pressing need for advanced authentication solutions. Regulatory pressures in industries such as pharmaceuticals (compliance with serialization and track-and-trace regulations) and consumer electronics (to protect brand reputation) further boost demand. Rising consumer awareness about product authenticity and safety also plays a critical role, as buyers increasingly look for visible trust marks before purchase.

In branding and decorative applications, holographic labels serve as visually appealing tools that enhance packaging aesthetics and reinforce brand identity. The growing demand for attractive, premium, and innovative packaging solutions is driving the use of holographic labels for branding and decorative purposes. Packaging has become a key differentiator influencing buying decisions with rising competition among consumer goods brands. The e-commerce boom also amplifies this need, as brands seek packaging that stands out in digital marketplaces and enhances unboxing experiences.

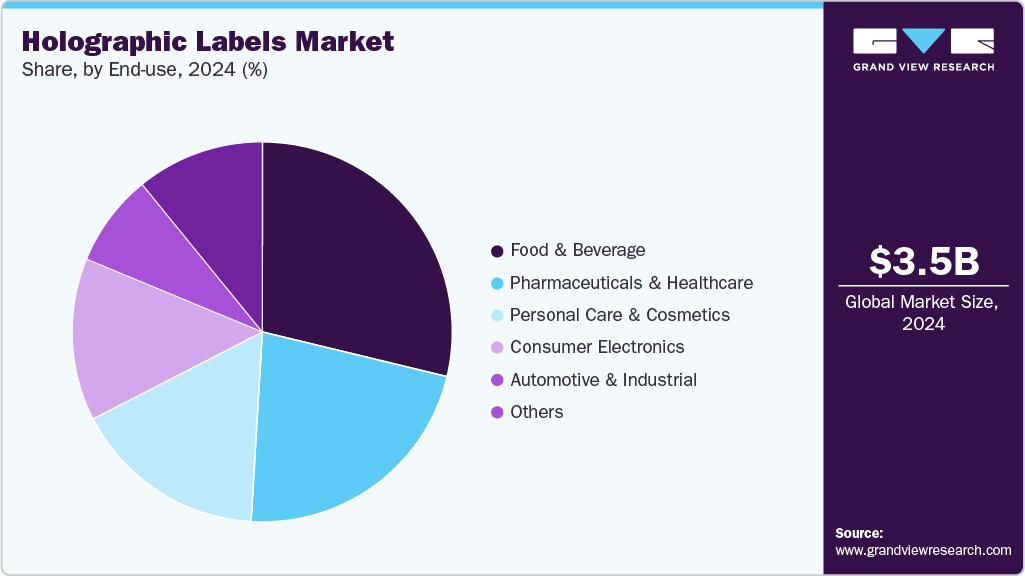

End-use Insights

The food & beverage segment recorded the largest market share of over 28.0% in 2024. Liquid dairy products such as milk, flavored milk, yogurt drinks, and cream are the dominant end-use category for Holographic Labels. These products are often packaged in aseptic or gable-top cartons, offering long shelf life without refrigeration and preserving nutritional content. Major brands such as Amul, Lactalis, and Nestlé rely heavily on carton packaging for ambient and chilled dairy distribution. The increasing demand for safe, shelf-stable dairy products in both developed and emerging economies drives this segment.

The pharmaceuticals & healthcare segment is projected to grow at the fastest CAGR of 12.0% during the forecast period. Holographic labels play a vital role in the pharmaceuticals & healthcare sector, where authenticity and safety are critical. They are widely used on medicine packaging, diagnostic kits, and medical devices to ensure traceability, prevent counterfeiting, and build consumer trust. The primary drivers are increasing incidences of counterfeit drugs and strict regulatory norms mandating secure labeling in pharmaceuticals. The need for serialization, authentication, and traceability systems in global pharma supply chains significantly enhances demand for holographic labels.

Region Insights

The North America holographic labels market is a mature yet highly innovative market, driven by stringent regulatory requirements, a strong focus on brand protection, and high consumer awareness. Due to the immense financial and safety risks, the U.S. and Canada's well-established pharmaceutical, automotive, and luxury goods sectors have a zero-tolerance policy towards counterfeiting. This makes advanced, multi-layered holographic security features a standard requirement.

U.S. Holographic Labels Market Trends

The U.S. holographic labels market is expected to grow significantly over the forecast period. The U.S. Food and Drug Administration (FDA) has guidelines promoting track-and-trace technologies, leading pharmaceutical giants such as Pfizer to use holographic serialization on medicine bottles, combining overt (visible hologram) and covert (hidden, machine-readable) features. In the retail sector, a company such as Nike uses custom holographic labels on its high-end sneakers and apparel as a key authentication feature for consumers and resellers, directly combating a sophisticated counterfeit market.

Asia Pacific Holographic Labels Market Trends

Asia Pacific dominated the market and accounted for the largest revenue share of over 44.0% in 2024 and is expected to grow at the fastest CAGR of 11.9% over the forecast period. This positive outlook is due to its massive manufacturing base, rapid economic expansion, and increasing adoption of anti-counterfeiting technologies. The region is a global hub for consumer goods, pharmaceuticals, and electronics, all major end-use industries for holographic labels. Furthermore, governments in the region, particularly in China and India, are implementing stricter regulations to combat rampant counterfeiting in sectors like pharmaceuticals and FMCG (Fast-Moving Consumer Goods), making security holograms a critical tool for brand protection.

The China holographic labels market is primarily known as the world's largest manufacturing center and as a country grappling with a severe internal counterfeiting problem. Its massive output of electronics, toys, apparel, and pharmaceuticals creates an enormous addressable market for both branding and security labels. Also, Chinese electronics manufacturers like Xiaomi or Huawei use sophisticated holographic labels on product packaging and components for brand enhancement and supply chain security, ensuring genuine parts are used in manufacturing and repair processes. The cost-effectiveness of manufacturing these labels within the region further accelerates adoption.

Europe Holographic Labels Market Trends

The holographic labels market in Europe is a significant market characterized by its robust regulatory framework, high standard of consumer protection, and a sophisticated luxury goods industry. The European Union has some of the world's strictest laws regarding product authenticity, safety, and traceability, particularly for tobacco, alcohol, and pharmaceuticals. The EU's Falsified Medicines Directive, for instance, mandates safety features including tamper-evident seals, many of which incorporate holography. In addition, Europe is home to the world's leading luxury brands, in France, Italy, and Switzerland, for whom holographic labels are indispensable for protecting brand integrity and exclusivity against forgery.

Key Holographic Labels Company Insights

The competitive environment of the holographic labels industry is moderately fragmented, with a mix of global players and regional manufacturers competing on innovation, product differentiation, and customization capabilities. Leading companies focus on advanced holographic printing technologies, security features, and sustainable label materials to meet the rising demand from industries such as food & beverage, pharmaceuticals, personal care, and electronics.

Strategic partnerships, acquisitions, and R&D investments are common, as firms aim to strengthen their market presence and offer cost-effective, high-quality solutions. Moreover, increasing counterfeiting concerns drive companies to develop high-security holograms, further intensifying competition and encouraging continuous technological advancements.

Key Holographic Labels Companies:

The following are the leading companies in the holographic labels market. These companies collectively hold the largest market share and dictate industry trends.

- Avery Dennison Corporation

- UFlex Limited

- 3M

- Huhtamaki

- CCL Industries

- Creative Labels Inc.

- Matrix Technologies

- NovaVision, LLC

- Jinya New Materials Co., Ltd

- Suzhou Image Technology Co., Ltd

- Skunkworx Packaging

- Intertronix

- Hira Holovision

Recent Developments

-

In May 2025, Holosafe Security Labels upgraded its production with the Jetsci KolorSmart+ UV Inkjet Label Press from Monotech, enabling high-quality, secure labels with variable data like serial numbers and QR codes. Targeting FMCG, pharmaceuticals, and alcohol sectors, the system supports short, customizable runs and smart packaging with anti-counterfeiting features, with future RFID integration planned. Holosafe’s 35+ machine facility and 130 employees serve both domestic and international markets.

-

In April 2025, Toppan Digital introduced a color version of its Illumigram hologram, showing 3D text and images in fixed colors for stronger visual impact and easier authenticity verification. Compatible with other hologram technologies and smartphone ID services, it targets industries like pharmaceuticals, luxury goods, and machinery to combat counterfeiting.

-

In May 2024, UFlex’s holography business launched customized holographic security labels for the pyrotechnics industry to combat counterfeiting and enhance product authenticity, brand protection, and consumer trust. Featuring strong overt security elements, the labels have been well-received by the market and mark UFlex’s strategic expansion into a new sector, reinforcing its leadership in packaging and security solutions.

Holographic Labels Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.86 billion

Revenue forecast in 2033

USD 9.10 billion

Growth rate

CAGR of 11.3% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, application, end-use, region

States scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Key companies profiled

Avery Dennison Corporation; UFlex Limited; 3M; Huhtamaki; CCL Industries; Creative Labels Inc.; Matrix Technologies; NovaVision, LLC; Jinya New Materials Co., Ltd; Suzhou Image Technology Co., Ltd; Skunkworx Packaging; Intertronix; Hira Holovision

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Holographic Labels Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global holographic labels market report based on material, application, end-use, and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

PET

-

BOPP/ PP

-

Paper

-

PVC

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Security/ Authentication

-

Branding/ Decorative

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Food & Beverage

-

Pharmaceuticals & Healthcare

-

Personal Care & Cosmetics

-

Consumer Electronics

-

Automotive & Industrial

-

Others

-

-

Region Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global holographic labels market was estimated at around USD 3.48 billion in the year 2024 and is expected to reach around USD 3.86 billion in 2025.

b. The global holographic labels market is expected to grow at a compound annual growth rate of 11.3% from 2025 to 2033 to reach around USD 9.10 billion by 2033.

b. Food & beverage segment emerged as the dominating end use segment in the holographic labels market due to stringent anti-counterfeiting regulations and the critical need for brand protection in a high-volume, consumer-driven industry.

b. The key players in the holographic labels market include Avery Dennison Corporation; UFlex Limited; 3M; Huhtamaki; CCL Industries; Creative Labels Inc.; Matrix Technologies; NovaVision, LLC; Jinya New Materials Co., Ltd; Suzhou Image Technology Co., Ltd; Skunkworx Packaging; Intertronix; and Hira Holovision

b. The global holographic labels market is driven by rising demand for anti-counterfeiting solutions across industries such as pharmaceuticals, FMCG, and electronics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.