- Home

- »

- Advanced Interior Materials

- »

-

Hot Runner Systems Market Size, Industry Report, 2030GVR Report cover

![Hot Runner Systems Market Size, Share & Trends Report]()

Hot Runner Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Process (Valve Gate Hot Runner, Open Gate Hot Runner), By Application (Automotive & Transportation, Consumer Electronics), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68040-321-7

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hot Runner Systems Market Summary

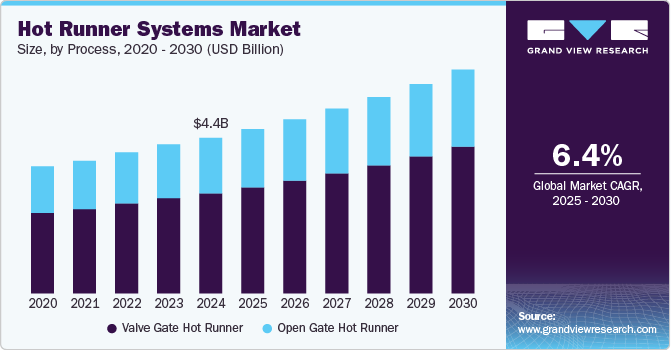

The global hot runner systems market size was estimated at USD 4.43 billion in 2024 and is projected to reach USD 6.37 billion by 2030, growing at a CAGR of 6.4% from 2025 to 2030. The industry is experiencing substantial growth, driven by the rising demand for high-efficiency and cost-effective plastic injection molding solutions.

Key Market Trends & Insights

- The hot runner systems market in Asia Pacific led the global industry and accounted for a 54.9% share in 2024.

- The hot runner systems market in India is expected to grow at a CAGR of 8.1% from 2025 to 2030.

- By process, the valve gate process segment dominated the market in 2024 accounting for a share of 64.3%.

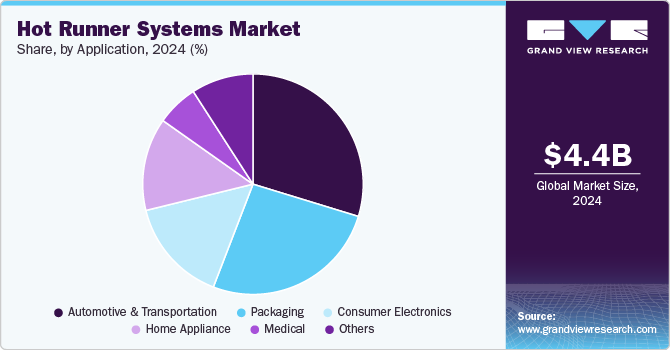

- By application, the automotive & transportation application segment dominated and accounted for 33.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.43 Billion

- 2030 Projected Market Size: USD 6.37 Billion

- CAGR (2025-2030): 6.4%

- Asia Pacific: Largest market in 2024

These systems optimize manufacturing by minimizing material waste, accelerating cycle times, and enhancing product quality. Their ability to support high-precision molding and complex part designs makes them indispensable across industries such as automotive, home appliances, packaging, medical, and electronics, where precision, consistency, and production efficiency are critical.

Hot runner systems have revolutionized the plastic injection molding industry by providing significant economic and technological advantages. Despite their higher upfront costs and maintenance requirements, they offer benefits such as material savings, faster cycle times, and improved part quality, making them an invaluable choice for manufacturers. As technology continues to advance, hot runner systems are expected to become even more efficient and adaptable, further solidifying their importance in modern manufacturing. These systems are essential for ensuring that molten plastic is delivered efficiently and uniformly to mold cavities, resulting in high-quality products.

Market Concentration & Characteristics

The market growth stage is medium, and the pace is accelerating. The market is characterized by a high degree of innovation, which is attributable to the rapid technological advancements. Moreover, market players are adopting organic and inorganic growth strategies, such as product launches, geographical expansions, mergers & acquisitions, and collaborations, to strengthen their position in the global market.

Stringent environmental regulations are driving manufacturers to adopt more sustainable production processes. Hot runner systems, which eliminate the need for plastic runners and thereby reduce material waste, align well with these regulations. By minimizing plastic waste and improving energy efficiency, hot runner systems help manufacturers comply with environmental standards, reducing their ecological footprint and avoiding potential fines or penalties associated with non-compliance. This push for sustainability encourages more companies to invest in hot runner technology, thus driving market growth.

The degree of innovation in the industry is notably high, driven by continuous advancements in technology and evolving industry demands. One significant innovation area is the design and materials used for hot runner components. Manufacturers are developing more robust and durable materials that can withstand higher temperatures and pressures, leading to longer-lasting systems with reduced maintenance requirements. Innovations in nozzle design, such as the introduction of compound nozzles and heated nozzle flanges, have enhanced the precision and efficiency of the injection molding process, allowing for more complex and high-quality part production.

The concentration of end-users in the industry is notably diverse, reflecting the wide range of industries that benefit from this technology. Key end-user segments include the automotive, packaging, home appliances, electronics, and healthcare industries. Each of these sectors has specific requirements and benefits from hot runner systems' enhanced efficiency, precision, and cost savings. The automotive industry is one of the largest end-users of hot runner systems. This sector demands high precision and quality for plastic components used in various applications, from interior parts to under-the-hood components. Hot runner systems are essential for meeting the automotive industry's stringent durability, aesthetics, and performance standards. The ability to produce complex parts with minimal defects and material waste is particularly valued, driving significant adoption of hot runner technology in this sector.

Several alternatives and substitutes exist in the industry, each with its own advantages and limitations. These alternatives cater to specific needs and preferences of manufacturers, depending on the application, complexity, and volume of production. One substitute for hot runner systems is the cold runner system. In this traditional method, molten plastic is injected into a mold through runners (channels), which solidify and are subsequently ejected as waste material. While cold runner systems are simpler and less expensive upfront, they generate more material waste than hot runners. This increased waste affects material costs and requires additional resources for recycling or disposal. Cold runners are suitable for applications where cost is the primary concern and material waste can be managed effectively.

Drivers, Opportunities & Restraints

The primary driver for hot runner systems is the need for increased efficiency and quality in injection molding processes. Hot runner systems maintain a consistent temperature in the mold, preventing material solidification in the runner channels. This results in faster cycle times, reduced material waste, and improved part quality, making it particularly valuable in high-volume production. As manufacturers demand more precise and consistent molding processes, hot runner systems offer a solution that enhances productivity and lowers overall production costs.

One key restraint for hot runner systems is the higher initial investment and maintenance costs. The complexity of the system requires sophisticated technology and skilled labor for setup and maintenance. This increased cost can deter smaller manufacturers or those with tight budgets from adopting hot runner systems. Additionally, if the system malfunctions or requires repair, it may cause extended downtime and potential production delays, further increasing operational expenses.

The growing demand for complex, high-quality plastic parts across industries like automotive, medical, and electronics presents a significant opportunity for hot runner systems. As product designs become more intricate and manufacturers seek to reduce material waste and energy consumption, hot runner systems provide an ideal solution. Advancements in technology, such as better temperature control and more energy-efficient systems, open new opportunities for even broader adoption, offering manufacturers enhanced capabilities and cost savings over time.

Process Insights

The valve gate process segment dominated the market in 2024 accounting for a share of 64.3%. Valve gate hot runner systems are ideal for applications that demand high precision, consistent quality, and minimal waste. Common industries using valve gate systems include automotive, medical devices, consumer electronics, and packaging. For instance, in automotive applications, valve gate systems are used to produce parts such as dashboards, panels, and connectors where appearance, material flow, and dimensional accuracy are critical.

Open gate hot runner systems are widely used in applications where speed, simplicity, and cost efficiency are the primary drivers. Commonly found in industries such as packaging, home appliances, and basic automotive components, these systems excel in high-throughput environments. For instance, open gate systems are frequently used to mold plastic containers, caps, and small automotive parts where aesthetic appearance and complex part geometries are less of a concern.

Application Insights

The automotive & transportation application segment dominated and accounted for 33.1% in 2024. Hot runner systems play a crucial role in the automotive & transportation industries, where precision, speed, and cost-efficiency are critical in manufacturing high-performance parts. These systems are primarily used to inject plastic materials into complex mold cavities, ensuring consistent part quality and reducing material waste. In the automotive industry, hot runner systems are commonly used to produce components such as bumpers, dashboards, interior trim parts, connectors, and engine components.

Hot runner systems are becoming increasingly important in the medical industry, where precision, cleanliness, and consistency are critical in the production of medical components. These systems are commonly used to produce a wide variety of medical products, such as syringes, vials, surgical instruments, and diagnostic devices. Hot runner systems ensure uniform melt distribution, allowing for high-quality parts with minimal defects. The ability to control temperature and material flow precisely is particularly valuable when manufacturing components that must meet strict regulatory standards, such as biocompatibility and sterility requirements.

Regional Insights

North America hot runner systems market is driven by industries like automotive, home appliances, and packaging, where precision molding and reduced waste are critical. Manufacturers are increasingly focusing on automation and cost-efficiency, leading to higher adoption of advanced hot runner technology. The region also benefits from robust research and development efforts, improving system efficiency and versatility.

U.S. Hot Runner Systems Market Trends

The U.S. hot runner systems market is expected to grow at a CAGR of 5.6% from 2025 to 2030. In the U.S., the automotive sector is a key driver for hot runner system adoption, where high-volume production of complex parts demands fast cycle times and high-quality molds. Increased focus on sustainability has led to higher demand for systems that minimize waste and energy consumption. Technological advancements in the U.S. also contribute to improvements in hot runner system capabilities, making them more cost-effective and reliable.

The hot runner systems market in Canada is expected to grow at a CAGR of 6.2% from 2025 to 2030. Canada’s demand for hot runner systems is heavily influenced by the country’s strong manufacturing base in automotive and consumer products. The need for faster production times and higher-quality molded parts has led to more manufacturers investing in hot runner technology. Canada’s stringent environmental regulations are pushing companies to adopt systems that reduce waste and energy consumption.

Europe Hot Runner Systems Market Trends

The hot runner systems market in Europe is driven by industries such as automotive, medical devices, and packaging, where precision and sustainability are paramount. The region's push towards reducing carbon footprints and enhancing production efficiency fosters the adoption of hot runner systems, as they help reduce material waste and energy use. Technological innovation in mold design and automation is also spurring growth.

Germany hot runner systems market held a 33.0% share in the European market. Germany’s demand for hot runner systems is fueled by its industrial leadership in automotive manufacturing, where high-precision components and faster production times are essential. The country's strong focus on innovation and sustainability supports the adoption of advanced technologies like hot runner systems. German manufacturers are also responding to increasing demand for high-quality, low-waste production methods in the medical and consumer electronics sectors.

The hot runner systems market in the UK is driven by its robust automotive, medical, and electronics industries, all of which require high precision and quick turnaround times. The rise of sustainable production practices is driving manufacturers to adopt energy-efficient and waste-reducing technologies. The UK’s manufacturing sector is increasingly embracing automation, and hot runner systems align well with these advancements.

Asia Pacific Hot Runner Systems Market Trends

The hot runner systems market in Asia Pacific led the global industry and accounted for a 54.9% share in 2024. In Asia Pacific, the demand for hot runner systems is increasing rapidly, particularly in countries like China and India, driven by their booming manufacturing sectors. High-volume production needs in industries such as automotive, electronics, and home appliances are propelling the adoption of hot runner systems. The region’s competitive manufacturing landscape requires technologies that improve efficiency and reduce production costs.

China hot runner systems market held a significant share of the Asia Pacific market. China's strong demand for hot runner systems is primarily driven by the rapid growth in the automotive, electronics, and home appliances industries, where high precision and fast cycle times are essential. The country's large-scale manufacturing operations need cost-effective solutions to increase production efficiency and reduce waste. China is also witnessing a growing interest in environmentally sustainable production, which encourages the adoption of hot runner systems.

The hot runner systems market in India is expected to grow at a CAGR of 8.1% from 2025 to 2030. India's demand for hot runner systems is growing due to the expanding automotive, medical device, and home appliances industries, which require efficient and precise molding technologies. The country’s shift toward automation and the adoption of advanced manufacturing technologies is pushing companies to adopt hot runner systems to meet quality and production standards. India is also focusing on improving its manufacturing sustainability, further boosting the demand for systems that reduce material waste and energy consumption.

Middle East & Africa Hot Runner Systems Market Trends

The hot runner systems market in the Middle East & Africa is driven by rapid industrialization and the expansion of sectors such as automotive, packaging, and construction. Countries in the region are focusing on technological advancements to enhance production capabilities, making hot runner systems an appealing solution for efficient and high-quality molding. The region’s push for sustainability in manufacturing also supports the growth of these systems, as they reduce material waste and energy use.

Saudi Arabia hot runner systems market is driven by its expanding petrochemical, automotive, and construction industries, where efficient molding processes are essential. The country’s Vision 2030 initiative, which emphasizes technological advancement and sustainable development, has spurred the adoption of advanced manufacturing technologies. Hot runner systems align well with these objectives by improving production efficiency and reducing material waste. As Saudi Arabia continues to diversify its economy and boost industrial output, the need for precision molding solutions like hot runner systems is on the rise.

Central & South America Hot Runner Systems Market Trends

The hot runner systems market in Central & South America is rising, particularly in countries like Brazil, as manufacturers seek to increase production efficiency and reduce costs in the automotive, packaging, and home appliances sectors. The region’s growing focus on sustainable production practices is also driving the adoption of hot runner systems, as they help reduce material waste and energy consumption. Latin American manufacturers are increasingly adopting advanced molding technologies to meet the rising demand for high-quality plastic products.

Brazil hot runner systems market is largely driven by its strong automotive and home appliances sectors, where precision and efficiency are crucial for meeting the high production demands. The need for high-quality molded parts in industries like electronics and packaging further fuels the market. Brazil is also placing greater emphasis on sustainable manufacturing practices, which aligns with the environmental benefits of hot runner systems.

Key Hot Runner Systems Company Insights

Some of the key players operating in the market include hot runner systems, Husky Injection Molding Systems Ltd., Mold-Masters, and HASCO Hasenclever GmbH + Co KG.

-

Husky Injection Molding Systems Ltd. designs and manufactures a comprehensive range of hot runner systems for various industries, including automotive, packaging, medical, and consumer goods. Their hot runner systems are renowned for their precision, reliability, and innovative design, which help customers achieve high-quality injection-molded parts with reduced cycle times and minimal material waste.

-

Mold-Masters specializes in developing and producing hot runner systems and related technologies. The company has a rich history of innovation and industry expertise, catering to the injection molding needs of customers across the globe. Mold-Masters operates as a part of Milacron Holdings Corp., a leading industrial technology company serving the plastics processing industry.

Fast Heat, Inc., Polyshot Corporation, Inc., Synventive Molding Solutions are some of the emerging market participants in the hot runner systems market.

-

Fast Heat, Inc. specializes in the design, manufacture, and support of hot runner systems and temperature control units. The company has a strong reputation for delivering high-quality products that cater to a wide range of industries, including automotive, packaging, medical, and consumer goods. Fast Heat has been serving the injection molding industry for several decades, focusing on providing innovative solutions and excellent customer service.

-

Polyshot Corporation, Inc. is a renowned manufacturer of hot runner systems, providing innovative solutions that cater to the needs of various industries. The company focuses on delivering high-quality, reliable, and cost-effective products to enhance the efficiency and performance of injection molding processes.

Key Hot Runner Systems Companies:

The following are the leading companies in the hot runner systems market. These companies collectively hold the largest market share and dictate industry trends.

- Polimold Industrial S/A

- Husky Injection Molding Systems Ltd.

- Synventive Molding Solutions

- INCOE Corporation

- Mold-Masters

- HASCO Hasenclever GmbH + Co KG

- EWIKON Heißkanalsysteme GmbH

- Anole Hot Runner System Technology

- GÜNTHER Heisskanaltechnik GmbH

- Seiki Corporation

- Fast Heat, Inc.

- Barnes Group Inc.

- CACO PACIFIC Corporation

- Meusburger Georg GmbH & Co KG

- Polyshot Corporation, Inc.

Recent Developments

-

In March 2024, Mold-Masters updated its EcoONE Series hot runner system to include thermal gated options with hot half plates. The system now comes with a complete package including the EcoONE Series hot runner, final assembly, leader pins, nozzle plate, clamp plate, insulator plate, assembly bolts, wiring, and electrical test. It's designed for cost-sensitive applications in consumer goods, small home appliances, automotive components, and electronic peripherals, with manifold configurations ranging from 1-16 drops and custom pitches.

-

In September 2023, EFI Ltd introduced their latest innovations: the CM9 hot runner controller and a new water flow manifold. The CM9, a product of extensive development over many years, enhances EFI’s well-regarded CM8 controller with a host of new features. It boasts a modern, intuitive interface that improves user-friendliness and allows for the strategic placement of manifolds between cavities. Additionally, the CM9 offers an advanced temperature control system, surpassing the previous model to provide industry-leading temperature regulation.

-

In November 2022, Mold-Masters launched a specialized PET-series hot runner system designed for producing high-quality PET preforms. This innovative system enables customers to produce thinner preforms (light weighting), saving resin through improved hot runner balance and reduced variation in preform weight. Additionally, the PET-Series hot runner system shortens cycle times due to faster fill times, offers a wider process window, and lowers AA content, enhancing overall efficiency and product quality.

Hot Runner Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.68 billion

Revenue forecast in 2030

USD 6.37 billion

Growth rate

CAGR of 6.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Process, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, South Korea, Taiwan, Brazil, Argentina, Saudi Arabia, UAE

Key companies profiled

Polimold Industrial S/A; Husky Injection Molding Systems Ltd.; Synventive Molding Solutions; INCOE Corporation; Mold-Masters; HASCO Hasenclever GmbH + Co KG; EWIKON Heißkanalsysteme GmbH; Anole Hot Runner System Technology; GÜNTHER Heisskanaltechnik Gmbh; Seiki Corporation; Fast Heat, Inc.; Barnes Group Inc.; CACO PACIFIC Corporation; Meusburger Georg GmbH & Co KG; Polyshot Corporation, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hot Runner Systems Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hot runner systems market report on the basis of process, application, and region:

-

Process Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Valve Gate Hot Runner

-

Open Gate Hot Runner

-

-

Application Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Automotive & Transportation

-

High Tier

-

Mid Tier

-

Low Tier

-

-

Consumer Electronics

-

High Tier

-

Mid Tier

-

Low Tier

-

-

Packaging

-

High Tier

-

Mid Tier

-

Low Tier

-

-

Home Appliance

-

High Tier

-

Mid Tier

-

Low Tier

-

-

Medical

-

High Tier

-

Mid Tier

-

Low Tier

-

-

Others

-

High Tier

-

Mid Tier

-

Low Tier

-

-

-

Region Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Taiwan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global hot runner systems market size was estimated at USD 4.43 billion in 2024 and is expected to reach USD 4.68 billion in 2025.

b. The hot runner systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.4% from 2025 to 2030 to reach USD 6.37 billion by 2030.

b. The automotive & transportation application segment dominated and accounted for 33.1% in 2024. Hot runner systems play a crucial role in the automotive & transportation industries, where precision, speed, and cost-efficiency are critical in manufacturing high-performance parts.

b. Some of the key players operating in the hot runner systems market include Polimold Industrial S/A, Husky Injection Molding Systems Ltd., Synventive Molding Solutions, INCOE Corporation, Mold-Masters, HASCO Hasenclever GmbH + Co KG, EWIKON Heißkanalsysteme GmbH, Anole Hot Runner System Technology, GÜNTHER Heisskanaltechnik Gmbhamong others.

b. The hot runner systems market is experiencing significant growth, driven primarily by the increasing demand for high-quality, efficient, and cost-effective injection molding solutions across various industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.